Health Insurance

Diunggah oleh

Vidya OrugantiHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Health Insurance

Diunggah oleh

Vidya OrugantiHak Cipta:

Format Tersedia

Health Insurance Module: why people

buy health insurance?

Presentation is organized in the following

manner:

Traditional Demand theory

concepts of risk and uncertainty

Methods for measuring risk and analyzing

individuals attitude towards risk

Health insurance: supply and demand

Choice Under Uncertainty

Traditional demand theory assumed a riskless

world

But People mostly make choices under uncertainty

Most economic decisions are made in the face of risk or

uncertainty (e.g., choosing an occupation, financing large

purchases)

Extension of traditional economic theory

Consumer choices are made under conditions of

certainty, risk or uncertainty

Uncertainty and Consumer Behavior

To examine the ways that people can compare and

choose among risky alternatives, we take the

following steps:

1. In order to compare the riskiness of alternative

choices, we need to quantify risk.

2. We will examine peoples preferences toward risk.

3. We will see how people can sometimes reduce or

eliminate risk.

4. In some situations, people must choose the amount

of risk they wish to bear. Such investments involve

trade-off between monetary gains and the

riskiness of that gain.

Risk and uncertainty in demand

choices

Certainty

One possible outcome to a decision

Risk

More than one possible outcome and the prob.

of each outcome is known or can be estimated

Uncertainty

More than one possible outcome and prob. of

each outcome occurring is not known (e.g.,

drilling for oil in an unproven field)

In the analysis of choices involving risk, we

utilize the following concepts

Strategy

States of nature

Pay-off matrix

QUANTIFYING RISK

Probability

The probability of an event is the chance that the event will occur. By listing all the

possible outcomes of an event and the probability attached to each, we get a

probability distribution. The concept of P.D is essential in evaluating and

comparing different outcomes.

expected value associated with an uncertain situation is a weighted average of all

possible values with all possible outcomes. The probabilities of each outcome

are used as weights.

The expected value measures the central tendencythe value that we would

expect on average.

Expected value = Pr(success)($40/share) + Pr(failure)($20/share)

= (1/4)($40/share) + (3/4)($20/share) = $25/share

E(X) = Pr

1

X

1

+ Pr

2

X

2

E(X) = Pr

1

X

1

+ Pr

2

X

2

+ . . . + Pr

n

X

n

DESCRIBING RISK

Variability

variability is the extent to which possible outcomes of an

uncertain situation differ.

deviation Difference between expected payoff and actual payoff.

OUTCOME 1 OUTCOME 2

Probability Income ($) Probability Income ($)

Expected

Income ($)

Job 1: Commission

Job 2: Fixed Salary

.5

.99

2000

1510

1000

510

.5

.01

1500

1500

TABLE 1 Income from Sales Jobs

TABLE 2 Deviations from Expected Income ($)

Outcome 1 Deviation Outcome 2 Deviation

Job 1

Job 2

2000

1510

500

10

1000

510

-500

-990

DESCRIBING RISK

Variability

Outcome 1

Deviation

Squared

Deviation

Squared Outcome 2

Deviation

Squared

Weighted Average

Standard

Deviation

Job 1

Job 2

2000

1510

250,000

100

1000

510

250,000

980,100

250,000

9900

500

99.5

Table 3 Calculating Variance ($)

standard deviation Square root of the weighted average of the squares

of the deviations of the payoffs associated with each outcome from their

expected values.

PREFERENCES TOWARD RISK

expected utility Sum of the utilities associated with all possible outcomes,

weighted by the probability that each outcome will occur.

PREFERENCES TOWARD RISK

In (b), the consumer is risk

loving and she prefers an

uncertain income to a certain

one, even if the expected value

of the uncertain income is less

than that of the certain income.

She would prefer the same

gamble (with expected utility

of 10.5) to the certain income

(with a utility of 8).

In (c), the consumer is risk

neutral, and indifferent

between certain and uncertain

events with the same expected

income. Marginal utility of

income is constant for a risk

neutral person.

PREFERENCES TOWARD RISK

r

i

s

k

a

v

e

r

s

e

A

n

i

n

d

i

v

i

d

u

a

l

w

h

o

i

s

r

i

s

k

-

a

v

e

r

s

e

p

r

e

f

e

r

s

a

c

e

r

t

a

i

n

g

i

v

e

n

i

n

c

o

m

e

t

o

a

r

i

s

k

y

i

n

c

o

m

e

w

i

t

h

t

h

e

s

a

m

e

e

x

p

e

c

t

e

d

v

a

l

u

e

.

risk neutral A person who is risk neutral is indifferent between

a certain income and an uncertain income with the same

expected value.

risk loving An individual who is risk loving prefers a risky

income to a certain income, even if the expected value of the

uncertain income is less than that of the certain income.

People differ in their willingness to bear risk. Some are risk averse,

some risk loving and some risk neutral.

Demand for Health Insurance

What is insurance?

The incidence of illness seems to be random and so,

health care expenses are uncertain. Since health care

expenses are unpredictable, they can be financially

catastrophic for the households.

Insurance reduces the variability of incomes (or

losses) of those insured by pooling a large number of

people and operating on the principle of the law of

large numbers.

Consumers actually purchase a pooling

arrangement when they buy a policy from an

insurance company. Pooling arrangements

help mitigate some of the risk associated with

potential losses.

Suppose, two individuals, Joe and Lee face

the same distribution of losses. Both of them

face a 20% prob. of losing $20 and an 80%

prob. of losing nothing. So, the expected

value of this distribution of losses:

0.2*$20+0.8*$0=$4.

Joe can expect to lose $4. We are more concerned

about the variability of the expected loss.

Variance=0.2($20-$4), S.D.=$8

Both the expected loss of $4 and its s.d. can be

thought of as measures of risk.

Lets now show how Joe and Lee might mutually

gain from entering into an pooling arrangement.

Entering into a pooling arrangement essentially

replaces each persons individual loss distribution

with the average loss distribution of the group.

16

Why People demand for health insurance?

The conventional theory or standard gamble

model, assumes that people purchase health

insurance to avoid or transfer risk. In this case,

insurance serves as a pooling arrangement to

replace the high risk or variability of individual

losses with the reduced risk or variability

associated with aggregated losses.

Logic

The consumer pays insurer a premium to

cover medical expenses in coming year

For any one consumer, the premium will be higher

or lower than medical expenses

But the insurer can pool or spread risk among

many insurees so that

The sum of premiums will exceed the sum of

medical expenses

Characterizing Risk Aversion

Recall the consumer maximizes utility, with

prices and income given

Utility = U (health, other goods)

health = h (medical care)

Insurance doesnt guarantee health, but

provides $ to purchase health care

We assumed diminishing marginal utility of

health and other goods

In addition, lets assume diminishing

marginal utility of income

Utility

Income

Assume that we can assign a numerical

utility value to each income level

Also, assume that a healthy individual

earns $40,000 per year, but only $20,000

when ill

$20,000

$40,000

70

90

Income Utility

Sick

Healthy

Utility

Income $20,000 $40,000

90

70

Utility when

healthy

Utility when sick

A

B

Individual doesnt know whether she will

be sick or healthy

But she has a subjective probability of

each event

She has an expected value of her utility in the

coming year

Define: P

0

= prob. of being healthy

P

1

= prob. of being sick

P

0

+ P

1

= 1

An individuals subjective probability of

illness (P

1

) will depend on her health stock,

age, lifestyle, etc.

Then without insurance, the individuals

expected utility for next year is:

E(U) = P

0

U($40,000) + P

1

U($20,000)

= P

0

90 + P

1

70

For any given values of P

0

and P

1

, E(U) will

be a point on the chord between A and B

Utility

Income $20,000 $40,000

70

90

A

B

Assume the consumer sets P

1

=.20

Then if she does not purchase insurance:

E(U) = .8090 + .2070 = 86

E(Y) = .8040,000 + .2020,000 = $36,000

Without insurance, the consumer has an

expected loss of $4,000

Utility

Income $20,000 $40,000

90

70

A

B

$36,000

C

86

The consumers expected utility for next

year without insurance = 86 utils

Suppose that 86 utils also represents

utility from a certain income of $35,000

Then the consumer could pay an insurer

$5,000 to insure against the probability of

getting sick next year

Paying $5,000 to insurer leaves consumer with

86 utils, which equals E(U) without insurance

Utility

Income $20,000 $40,000

90

70

A

B

$36,000

C

86

$35,000

D

At most, the consumer is willing to pay

$5,000 in insurance premiums to cover

$4,000 in expected medical benefits

$1,000 loading fee price of insurance

Covers

profits

administrative expenses

taxes

Determinants of Health Insurance

Demand

1 Price of insurance

In the previous example, the consumer will

forego health insurance if the premium is

greater than $5,000

2 Degree of Risk Aversion

Greater risk aversion increases the demand for

health insurance

Utility

Income $40,000 $20,000

A

B

If there is no risk aversion, utility = expected utility, and

there is no demand for insurance

3 Income

Larger income losses due to illness will

increase the demand for health insurance

4 Probability of ILLNESS

Consumers demand less insurance for events

most likely to occur (e.g. dental visits)

Consumers demand less insurance for events

least likely to occur

Consumers more likely to insure against

random events

Estimates of Price & Income Elasticities

for Demand for Health Ins.

Price elasticities b/w -.03 and -.54

At the individual level

Enrollment or premium expenditure

Elastic or Inelastic demand?

Income elasticities b/w 0.01 and 0.13

Estimates of Price & Income Elasticities

for Demand for Health Ins.

What about when employees are choosing

between the menu of plans offered by their

employer?

Range of choices is more limited

Price elasticites are found to range between -2

and -8.4, depending on age, job tenure, medical

risk category

Dowd and Feldman 1994, Strombom et al. 2002

Assumptions underlying the theoretical model

of health insurance demand

Consumers bear the full cost of their own

health insurance

Insurance companies can appropriately

price policies

Individuals can afford health

insurance/health care

The above 3 assumptions do not always hold

in the real world

The majority of Americans have employer-

provided health insurance

Employer-paid health insurance is exempt

from federal, state, and Social Security taxes

Employee will prefer to purchase insurance

through work, rather than on his own

Example: Insurance and take-home pay

when income is $1,000 per week and

income tax rate is 28%

Employee Purchased

$1,000

28% tax <280>

after tax 720

insurance <50>

net pay 670

Employer Purchased

$1,000

insurance <50>

subtotal 950

28% tax <266>

net pay 684

Employer Health Insurance Coverage of

U.S. Population (percent)

58

59

60

61

62

63

64

65

Total Employment Based

1995

1998

2000

2002

2005

Consequences for costs

Too many services were covered by

insurance

Coverage of more small claims increased

administrative costs

Employers offering more than 1 plan often fully

subsidized the more expensive plans

Insurance Terminology

Coinsurance: A cost-sharing requirement

under a health insurance policy that provides

that the insured will assume a portion or a

percentage of the costs of covered services.

Co-payment: A cost sharing arrangement in

which the insured pays a flat amount for a

specified for a specified service. It does not

vary with the cost of service, unlike the

coinsurance that is based on some percentage

of cost.

Deductibles: Amounts required to be paid

by the insured under a health insurance

contract, before benefits become payable.

In a sense, the insurance does not apply

until the consumer pays the deductible.

Anda mungkin juga menyukai

- Marketing Campaign Management A Clear and Concise ReferenceDari EverandMarketing Campaign Management A Clear and Concise ReferenceBelum ada peringkat

- Executive Summary Auto Saved)Dokumen58 halamanExecutive Summary Auto Saved)Devesh Chauhan0% (1)

- 8 Truths of Marketing To A WomenDokumen14 halaman8 Truths of Marketing To A Womenkaushik samantBelum ada peringkat

- "HDFC Bank" Pimple Saudagar Branch, PuneDokumen36 halaman"HDFC Bank" Pimple Saudagar Branch, PuneMinal PatilBelum ada peringkat

- Institutional Support For EntrepreneuresDokumen27 halamanInstitutional Support For EntrepreneuresMahesh LingayathBelum ada peringkat

- Rural Marketing - InsuranceDokumen106 halamanRural Marketing - InsurancesinghinkingBelum ada peringkat

- Low InvolvementDokumen26 halamanLow InvolvementVivek MishraBelum ada peringkat

- Project of Consumer AwarenessDokumen11 halamanProject of Consumer AwarenessShailesh SharmaBelum ada peringkat

- Business To Business Strategy A Complete Guide - 2020 EditionDari EverandBusiness To Business Strategy A Complete Guide - 2020 EditionBelum ada peringkat

- Mobile BankingDokumen14 halamanMobile Bankingraghvendrapatel75Belum ada peringkat

- Personality & Consumer BehaviourDokumen27 halamanPersonality & Consumer BehaviourArathy Vikram100% (1)

- Factors Influencing Consumer Behavior-Maruthi01Dokumen95 halamanFactors Influencing Consumer Behavior-Maruthi01Vipul RamtekeBelum ada peringkat

- StoxPlus VietnamHealthcareSectorReport 2012 Demo-Version 20140925095905 PDFDokumen113 halamanStoxPlus VietnamHealthcareSectorReport 2012 Demo-Version 20140925095905 PDFToàn PhạmBelum ada peringkat

- Sun Pharma Project FinalDokumen44 halamanSun Pharma Project FinalDoli ChawlaBelum ada peringkat

- Innovation in Banking SectorDokumen6 halamanInnovation in Banking SectorKashishBelum ada peringkat

- Environmental Scan PaperDokumen10 halamanEnvironmental Scan PaperDESMOND42Belum ada peringkat

- Consumer Behavior ModelsDokumen9 halamanConsumer Behavior ModelsShiney RajanBelum ada peringkat

- CB-Unit 03-External Influences PDFDokumen87 halamanCB-Unit 03-External Influences PDFVivek Lal KarnaBelum ada peringkat

- Personal Financial Planning: Presented byDokumen11 halamanPersonal Financial Planning: Presented byNeha Sathaye100% (1)

- Nirmiti PresentationDokumen47 halamanNirmiti Presentationshreyas kulkarniBelum ada peringkat

- IMC FinalDokumen75 halamanIMC FinalRohit Matani0% (1)

- Marketing of Financial ServicesDokumen10 halamanMarketing of Financial ServicesAnonymous ibmeej9Belum ada peringkat

- 009 FICCI E&Y Wellness Knowledge Paper ESDokumen9 halaman009 FICCI E&Y Wellness Knowledge Paper ESsaurabh10627278Belum ada peringkat

- Male Female Married Single Own House Rented House Yes NoDokumen8 halamanMale Female Married Single Own House Rented House Yes NoAbhishek JainBelum ada peringkat

- Piyush Consumer BehaviourDokumen19 halamanPiyush Consumer BehaviourNehal SharmaBelum ada peringkat

- Health Insurance PresentationDokumen31 halamanHealth Insurance PresentationHirak Chatterjee100% (1)

- LifeStyle MarketingDokumen25 halamanLifeStyle MarketingMohit MehraBelum ada peringkat

- Short Term Disability PolicyDokumen4 halamanShort Term Disability Policybabalu tacosBelum ada peringkat

- Surrogate Marketing in The Indian Liquor IndustryDokumen33 halamanSurrogate Marketing in The Indian Liquor IndustryKaran Bhimsaria100% (1)

- Micro and Small Enterprises in Nepal Prospects and ChallengesDokumen12 halamanMicro and Small Enterprises in Nepal Prospects and ChallengesMonish ShresthaBelum ada peringkat

- Marketing Channels For Insurance IndustryDokumen12 halamanMarketing Channels For Insurance Industrygautamcool2002Belum ada peringkat

- MEDP Beacon For Stand Up IndiaDokumen106 halamanMEDP Beacon For Stand Up IndiaKamzalian TomgingBelum ada peringkat

- Mobile App Survey ReportDokumen18 halamanMobile App Survey ReportvictrrocksBelum ada peringkat

- Approach Note For New Beverage BrandDokumen80 halamanApproach Note For New Beverage BrandMrityunjaiBelum ada peringkat

- Health InsuranceDokumen28 halamanHealth InsuranceVikramaditya MuralidharanBelum ada peringkat

- Retail Question Bank Mid TermDokumen2 halamanRetail Question Bank Mid TermAbhishek Shekhar100% (1)

- Funding For StartupsDokumen31 halamanFunding For StartupsJayan PrajapatiBelum ada peringkat

- Investor Presentation Dec 2018 GeneralitatDokumen35 halamanInvestor Presentation Dec 2018 GeneralitatFernando HernandezBelum ada peringkat

- Finding The Future of Care Provision The Role of Smart HospitalDokumen10 halamanFinding The Future of Care Provision The Role of Smart HospitalDian Putri SusantiBelum ada peringkat

- Marketing Strategies of HDFC Standard Life InsuranceDokumen2 halamanMarketing Strategies of HDFC Standard Life InsuranceMehak LIfez TrailingBelum ada peringkat

- Assignment On Medical TourismDokumen8 halamanAssignment On Medical TourismSurbhi SinghBelum ada peringkat

- Starbucks Case StudyDokumen1 halamanStarbucks Case StudyShrikant SanapBelum ada peringkat

- Relationship Marketing in Banking PDFDokumen10 halamanRelationship Marketing in Banking PDFarvind3041990Belum ada peringkat

- Term InsuranceDokumen1 halamanTerm Insurancearundjones1471Belum ada peringkat

- Gujarat Technological UnversityDokumen2 halamanGujarat Technological UnversityKrutika Goyal100% (1)

- Bharat Case StudyDokumen3 halamanBharat Case StudyPooja PandeyBelum ada peringkat

- Consumer Attitude Formation and ChangeDokumen24 halamanConsumer Attitude Formation and ChangeHarsh AnchaliaBelum ada peringkat

- Documentation On Multi Level PDFDokumen38 halamanDocumentation On Multi Level PDFvasanthv0% (3)

- JBorgen - Content Marketing ThesisDokumen20 halamanJBorgen - Content Marketing ThesisDavit KhutsishviliBelum ada peringkat

- Cognitive Model of Consumer Decision MakingDokumen7 halamanCognitive Model of Consumer Decision Makingramji100% (2)

- EDA Case Study - Gramener Case StudyDokumen25 halamanEDA Case Study - Gramener Case Studysanjeebani swainBelum ada peringkat

- Maax Internshipreport FinalDokumen59 halamanMaax Internshipreport FinalashwiniBelum ada peringkat

- Sip Presentation in Idbi FederalDokumen16 halamanSip Presentation in Idbi FederalPratik GuptaBelum ada peringkat

- Consumer Decision Making Model Class XII WEEKDokumen33 halamanConsumer Decision Making Model Class XII WEEKRachit RawalBelum ada peringkat

- ColgateDokumen32 halamanColgategargatworkBelum ada peringkat

- 0chapter 2-1Dokumen30 halaman0chapter 2-1Breket WonberaBelum ada peringkat

- Underatanding Risk & Attitudes Towards Risk Together With A Comparative Perspective Between Expected Utility Maximization & Prospect TheoriesDokumen32 halamanUnderatanding Risk & Attitudes Towards Risk Together With A Comparative Perspective Between Expected Utility Maximization & Prospect TheoriesAbhishek YadavBelum ada peringkat

- CHESS Seville - VidyaDokumen1 halamanCHESS Seville - VidyaVidya OrugantiBelum ada peringkat

- Karl Marx On IndiaDokumen8 halamanKarl Marx On IndiaVidya OrugantiBelum ada peringkat

- Caste in Other CountryDokumen12 halamanCaste in Other CountryVidya OrugantiBelum ada peringkat

- Caste System in IndiaDokumen19 halamanCaste System in IndiaVidya OrugantiBelum ada peringkat

- Int J Qual Health Care 2008 Green Field 172 83Dokumen12 halamanInt J Qual Health Care 2008 Green Field 172 83Vidya OrugantiBelum ada peringkat

- NanotechnologyDokumen5 halamanNanotechnologyVidya OrugantiBelum ada peringkat

- Risk Factors of Oral CancerDokumen12 halamanRisk Factors of Oral CancerNauman ArshadBelum ada peringkat

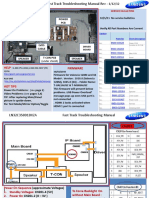

- Samsung LN55C610N1FXZA Fast Track Guide (SM)Dokumen4 halamanSamsung LN55C610N1FXZA Fast Track Guide (SM)Carlos OdilonBelum ada peringkat

- The "Kind Martin" Strategy - Official Olymp Trade BlogDokumen7 halamanThe "Kind Martin" Strategy - Official Olymp Trade BlogGopal NapoleonBelum ada peringkat

- RULE 130 Rules of CourtDokumen141 halamanRULE 130 Rules of CourtalotcepilloBelum ada peringkat

- Free Vibration of SDOFDokumen2 halamanFree Vibration of SDOFjajajajBelum ada peringkat

- Upsa Y5 2023Dokumen8 halamanUpsa Y5 2023Faizal AzrinBelum ada peringkat

- The Effect of Realistic Mathematics Education Approach On Students' Achievement and Attitudes Towards MathematicsDokumen9 halamanThe Effect of Realistic Mathematics Education Approach On Students' Achievement and Attitudes Towards MathematicsyusfazilaBelum ada peringkat

- A Visual Rhetoric StudyDokumen32 halamanA Visual Rhetoric StudylpettenkoferBelum ada peringkat

- "Design, Modeling and Analysis of Steam Turbine Blade": Dayananda Sagar College of EngineeringDokumen66 halaman"Design, Modeling and Analysis of Steam Turbine Blade": Dayananda Sagar College of EngineeringSHREENIVAS MBelum ada peringkat

- Brochure Delegation Training For LeadersDokumen6 halamanBrochure Delegation Training For LeadersSupport ALProgramsBelum ada peringkat

- Gynaecology Thesis TopicsDokumen7 halamanGynaecology Thesis TopicsDawn Cook100% (2)

- How Do I Predict Event Timing Saturn Nakshatra PDFDokumen5 halamanHow Do I Predict Event Timing Saturn Nakshatra PDFpiyushBelum ada peringkat

- Rapid History Taking: 1. Patient ProfileDokumen3 halamanRapid History Taking: 1. Patient ProfileTunio UsamaBelum ada peringkat

- Grade 7 - R & C - Where Tigers Swim - JanDokumen15 halamanGrade 7 - R & C - Where Tigers Swim - JanKritti Vivek100% (3)

- Jeep TJ Torque SpecsDokumen4 halamanJeep TJ Torque SpecsmaulotaurBelum ada peringkat

- Recovering The Snorra Edda On Playing Gods, Loki, and The Importance of HistoryDokumen17 halamanRecovering The Snorra Edda On Playing Gods, Loki, and The Importance of HistoryM SBelum ada peringkat

- Three Moment Equation For BeamsDokumen12 halamanThree Moment Equation For BeamsRico EstevaBelum ada peringkat

- Combustion FundamentalsDokumen30 halamanCombustion FundamentalsPrem SagarBelum ada peringkat

- Ringleman Chart FlareDokumen12 halamanRingleman Chart FlareguhadebasisBelum ada peringkat

- Elaborare Modele de Rating in Conformitate Cu IFRS 9Dokumen8 halamanElaborare Modele de Rating in Conformitate Cu IFRS 9MstefBelum ada peringkat

- University of Dar Es Salaam: Faculty of Commerce and ManagementDokumen37 halamanUniversity of Dar Es Salaam: Faculty of Commerce and ManagementEric MitegoBelum ada peringkat

- Curriculum Vitae ofDokumen4 halamanCurriculum Vitae ofAndrew OlsonBelum ada peringkat

- Tele-Medicine: Presented by Shyam.s.s I Year M.SC NursingDokumen12 halamanTele-Medicine: Presented by Shyam.s.s I Year M.SC NursingShyamBelum ada peringkat

- Text Ranslation and TradicitonDokumen283 halamanText Ranslation and TradicitonSCAF55100% (4)

- Model Questions and Answers Macro EconomicsDokumen14 halamanModel Questions and Answers Macro EconomicsVrkBelum ada peringkat

- State Partnership Program 101 Brief (Jan 2022)Dokumen7 halamanState Partnership Program 101 Brief (Jan 2022)Paulo FranciscoBelum ada peringkat

- 13-Mike Engelbrecht - Methods of Maintenance On High Voltage Fluid FilledDokumen5 halaman13-Mike Engelbrecht - Methods of Maintenance On High Voltage Fluid FilledRomany AllamBelum ada peringkat

- 3.6 A 40Nm Cmos Highly Linear 0.4-To-6Ghz Receiver Resilient To 0Dbm Out-Of-Band BlockersDokumen3 halaman3.6 A 40Nm Cmos Highly Linear 0.4-To-6Ghz Receiver Resilient To 0Dbm Out-Of-Band Blockershaoyue huangBelum ada peringkat

- Installation Manual of FirmwareDokumen6 halamanInstallation Manual of FirmwareOmar Stalin Lucio RonBelum ada peringkat

- E-Catalog 2021 Jan JMI Dan KimDokumen52 halamanE-Catalog 2021 Jan JMI Dan KimbobBelum ada peringkat