CVP Relationship

Diunggah oleh

Sarith SagarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CVP Relationship

Diunggah oleh

Sarith SagarHak Cipta:

Format Tersedia

Variable and Fixed Cost Behavior

A variable cost

changes in direct

proportion to changes

in the cost-driver level.

A fixed cost is

not immediately

affected by changes

in the cost-driver.

Think of variable

costs on a per-unit basis.

The per-unit variable

cost remains unchanged

regardless of changes in

the cost-driver.

Think of fixed costs

on a total-cost basis.

Total fixed costs remain

unchanged regardless of

changes in the cost-driver.

Relevant Range

The relevant range is the limit

of cost-driver activity level within which a

specific relationship between costs

and the cost driver is valid.

Even within the relevant range, a fixed

cost remains fixed only over a given

period of time Usually the budget period.

Fixed Costs and Relevant Range

20 40 60 80 100

$115,000

100,000

60,000

Total Cost-Driver Activity in Thousands

of Cases per Month

T

o

t

a

l

M

o

n

t

h

l

y

F

i

x

e

d

C

o

s

t

s

Relevant range

$115,000

100,000

60,000

20 40 60 80 100

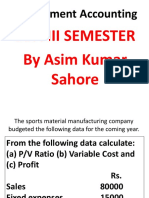

CVP Scenario

Per Unit Percentage of Sales

Selling price $1.50 100%

Variable cost of each item 1.20 80

Selling price less variable cost $ .30 20%

Monthly fixed expenses:

Rent $3,000

Wages for replenishing and

servicing 13,500

Other fixed expenses 1,500

Total fixed expenses per month $ 18,000

Cost-volume-profit (CVP) analysis is the study of the effects of output

volume on revenue (sales), expenses (costs), and net income (net profit).

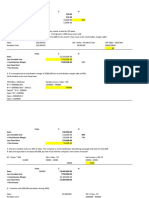

Break-Even Point

The break-even point is the level of sales at which

revenue equals expenses and net income is zero.

Sales

- Variable expenses

- Fixed expenses

Zero net income (break-even point)

Contribution Margin Method

$18,000 fixed costs $.30

= 60,000 units (break even)

Contribution margin

Per Unit

Selling price $1.50

Variable costs 1.20

Contribution margin $ .30

Contribution margin ratio

Per Unit %

Selling price 100

Variable costs .80

Contribution margin .20

Contribution Margin Method

$18,000 fixed costs

20% (contribution-margin percentage)

= $90,000 of sales to break even

60,000 units $1.50 = $90,000

in sales to break even

Equation Method

Sales variable expenses fixed expenses = net income

$1.50N $1.20N $18,000 = 0

$.30N = $18,000

N = $18,000 $.30

N = 60,000 Units

Let N = number of units

to be sold to break even.

Equation Method

S .80S $18,000 = 0

.20S = $18,000

S = $18,000 .20

S = $90,000

Let S = sales in dollars

needed to break even.

Shortcut formulas:

Break-even volume in units = fixed expenses

unit contribution margin

Break-even volume in sales = fixed expenses

contribution margin ratio

Cost-Volume-Profit Graph

18,000

30,000

90,000

120,000

138,000

$150,000

0

10 20 30 40 50 60 70 80 90 100

Units (thousands)

D

o

l

l

a

r

s

60,000

Total

Expenses

Sales

Net Income Area

Break-Even Point

60,000 units

or $90,000

Net Loss

Area

A

C

D

B

Fixed Expenses

Variable

Expenses

Net Income

Target Net Profit

Managers use CVP analysis

to determine the total sales,

in units and dollars, needed

To reach a target net profit.

Target sales

variable expenses

fixed expenses

target net income

$1,440 per month

is the minimum

acceptable net income.

Target sales volume in units =

(Fixed expenses + Target net income)

Contribution margin per unit

($18,000 + $1,440) $.30 = 64,800 units

Target Net Profit

Selling price $1.50

Variable costs 1.20

Contribution margin per unit $ .30

Target sales dollars = sales price X sales volume in units

Target sales dollars = $1.50 X 64,800 units = $97,200.

Sales volume in dollars = 18,000 + $1,440 = $97,200

.20

Target Net Profit

Target sales volume in dollars = Fixed expenses + target net income

contribution margin ratio

Contribution margin ratio

Per Unit %

Selling price 100

Variable costs .80

Contribution margin .20

Anda mungkin juga menyukai

- CVP Analysis: Use Contribution Margin to Determine Impact of Sales ChangesDokumen21 halamanCVP Analysis: Use Contribution Margin to Determine Impact of Sales ChangesAthi SivaBelum ada peringkat

- CVP AnalysisDokumen24 halamanCVP AnalysisAshima shafiqBelum ada peringkat

- Accounting 202 Chapter 7 NotesDokumen15 halamanAccounting 202 Chapter 7 NotesnitinBelum ada peringkat

- Cost-Volume-Profit AnalysisDokumen24 halamanCost-Volume-Profit AnalysisIbrahim ElsayedBelum ada peringkat

- AFM CH 5Dokumen27 halamanAFM CH 5sebsibeboki01Belum ada peringkat

- Cost Behavior and Cost-Volume-Profit AnalysisDokumen56 halamanCost Behavior and Cost-Volume-Profit Analysisjeela1Belum ada peringkat

- CVP1 MarkupsDokumen15 halamanCVP1 MarkupsWaleed J.Belum ada peringkat

- MA CHAPTER 4 Marginal Costing 2Dokumen93 halamanMA CHAPTER 4 Marginal Costing 2Mohd Zubair KhanBelum ada peringkat

- Cost Profit Volume AnalysisDokumen28 halamanCost Profit Volume AnalysisClarice LangitBelum ada peringkat

- Module 3 Practice Problems(2)Dokumen13 halamanModule 3 Practice Problems(2)Liza Mae MirandaBelum ada peringkat

- Managment Science - Final ExaminationDokumen6 halamanManagment Science - Final ExaminationAuroraBelum ada peringkat

- Tugasan 6 Bab 6Dokumen4 halamanTugasan 6 Bab 6azwan88Belum ada peringkat

- Business & Finance Chapter-7 Part-02 PDFDokumen12 halamanBusiness & Finance Chapter-7 Part-02 PDFRafidul IslamBelum ada peringkat

- CVP AnalysisDokumen11 halamanCVP AnalysisPratiksha GaikwadBelum ada peringkat

- CVP Analysis Target Net Profit and Sales MixDokumen19 halamanCVP Analysis Target Net Profit and Sales MixWaleed J.Belum ada peringkat

- Module 4Dokumen42 halamanModule 4Eshael FathimaBelum ada peringkat

- The Contribution Margin Ratio Will DecreaseDokumen7 halamanThe Contribution Margin Ratio Will DecreaseSaeym SegoviaBelum ada peringkat

- CH 14 Var Vs Abs CostingDokumen60 halamanCH 14 Var Vs Abs CostingShannon BánañasBelum ada peringkat

- Chapter 22Dokumen14 halamanChapter 22Nguyên BảoBelum ada peringkat

- Cost Contribution Format vs. Traditional Format of Income StatementDokumen24 halamanCost Contribution Format vs. Traditional Format of Income StatementFaizan Ahmed KiyaniBelum ada peringkat

- Tutorial Chapter 12 Cost Behaviour and Measurement of CostsDokumen54 halamanTutorial Chapter 12 Cost Behaviour and Measurement of CostsNaKib Nahri0% (1)

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDokumen18 halamanPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghBelum ada peringkat

- ACCT3104 - Lecture 5 - Lecture Exercise 2 & Solution RFDokumen7 halamanACCT3104 - Lecture 5 - Lecture Exercise 2 & Solution RFnikkiBelum ada peringkat

- Kinney8e PPT Ch09Dokumen36 halamanKinney8e PPT Ch09Ashraf ZamanBelum ada peringkat

- Presentation of CVP FinalDokumen34 halamanPresentation of CVP FinalMonir HossanBelum ada peringkat

- Cost Management Accounting Assignment Bill French Case StudyDokumen5 halamanCost Management Accounting Assignment Bill French Case Studydeepak boraBelum ada peringkat

- S2 CMA c02 Cost-Volume-Profit AnalysisDokumen25 halamanS2 CMA c02 Cost-Volume-Profit Analysisdiasjoy67Belum ada peringkat

- ACCCOB3Dokumen10 halamanACCCOB3Jenine YamsonBelum ada peringkat

- CVP Analysis Graphical RepresentationsDokumen53 halamanCVP Analysis Graphical RepresentationsRahma Nur AiniBelum ada peringkat

- PRICING EXERCISES ANALYSISDokumen14 halamanPRICING EXERCISES ANALYSISvineel kumarBelum ada peringkat

- Shorya Agarwal Class Text 2Dokumen14 halamanShorya Agarwal Class Text 2vidhantmaanthapaBelum ada peringkat

- Garrison 14e Practice Exam - Chapter 5Dokumen4 halamanGarrison 14e Practice Exam - Chapter 5Đàm Quang Thanh TúBelum ada peringkat

- Lecture 4b Cost Volume Profit EditedDokumen24 halamanLecture 4b Cost Volume Profit EditedJinnie QuebrarBelum ada peringkat

- 2.1 Powerpoint - Slides - To - Chapter - 16Dokumen40 halaman2.1 Powerpoint - Slides - To - Chapter - 16Sarthak PatidarBelum ada peringkat

- Chapter 3Dokumen60 halamanChapter 3Adam AbdullahiBelum ada peringkat

- Cost-Volume-Profit Analysis Planning ToolDokumen39 halamanCost-Volume-Profit Analysis Planning ToolYana MarsiamilaBelum ada peringkat

- CVP Analysis Break-Even PointDokumen20 halamanCVP Analysis Break-Even Pointsolomon adamuBelum ada peringkat

- Module 2 HWDokumen5 halamanModule 2 HWdrgBelum ada peringkat

- Null, 1Dokumen67 halamanNull, 1siddharthsonar9604Belum ada peringkat

- BEP N CVP AnalysisDokumen49 halamanBEP N CVP AnalysisJamaeca Ann MalsiBelum ada peringkat

- Break-Even Point ReportingDokumen30 halamanBreak-Even Point ReportingaikoBelum ada peringkat

- Volume Profit AnalysisDokumen24 halamanVolume Profit AnalysisJean MaltiBelum ada peringkat

- Cost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageDokumen40 halamanCost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageJeejohn Sodusta0% (1)

- Definition of Break Even Point:: ExampleDokumen4 halamanDefinition of Break Even Point:: ExampleAnonymous mzF3JvyTJsBelum ada peringkat

- Definition of Break Even Point:: ExampleDokumen4 halamanDefinition of Break Even Point:: ExampleAnonymous mzF3JvyTJsBelum ada peringkat

- Exercise C2Dokumen13 halamanExercise C2Nhựt AnhBelum ada peringkat

- CVP AnalysisDokumen41 halamanCVP AnalysisRahul Kumar Jain100% (1)

- Break Even PointDokumen29 halamanBreak Even PointDanbryanBelum ada peringkat

- Cost Volume Profit AnalysisDokumen20 halamanCost Volume Profit AnalysisSidharth RayBelum ada peringkat

- Tugas 2 Akmen - Firman A R - 0101161123Dokumen7 halamanTugas 2 Akmen - Firman A R - 0101161123firman abdulBelum ada peringkat

- Costing Methods ComparisonDokumen24 halamanCosting Methods ComparisonJohn BernabeBelum ada peringkat

- CVP Analysis 2 Amp Ratios ExcelDokumen53 halamanCVP Analysis 2 Amp Ratios ExcelSoahBelum ada peringkat

- 1521strategic Cost Management K-3-ADokumen15 halaman1521strategic Cost Management K-3-APratham KochharBelum ada peringkat

- CH 2 Cost-Volume-Profit RelationshipsDokumen24 halamanCH 2 Cost-Volume-Profit RelationshipsMona ElzaherBelum ada peringkat

- Assignment On Management AccountingDokumen17 halamanAssignment On Management AccountingMarysun Tlengr100% (2)

- CVP analysis guideDokumen6 halamanCVP analysis guidetahir abbasBelum ada peringkat

- ACCT202 CVP Analysis ChapterDokumen6 halamanACCT202 CVP Analysis ChapterFådĭ AmjådBelum ada peringkat

- Topic 11 - Cost Volume Profit Analysis - LectureDokumen23 halamanTopic 11 - Cost Volume Profit Analysis - LectureshamimahBelum ada peringkat

- Business Metrics and Tools; Reference for Professionals and StudentsDari EverandBusiness Metrics and Tools; Reference for Professionals and StudentsBelum ada peringkat

- CPA Review Notes 2019 - BEC (Business Environment Concepts)Dari EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Penilaian: 4 dari 5 bintang4/5 (9)

- Porters 5 ForcesDokumen10 halamanPorters 5 ForcesSarith SagarBelum ada peringkat

- CVP RelationshipDokumen14 halamanCVP RelationshipSarith SagarBelum ada peringkat

- MonopolyDokumen6 halamanMonopolySarith SagarBelum ada peringkat

- DistributionDokumen12 halamanDistributionSarith SagarBelum ada peringkat

- Two Means TestDokumen15 halamanTwo Means TestSarith SagarBelum ada peringkat

- Introduction To Cost Systems and BehaviousDokumen46 halamanIntroduction To Cost Systems and BehaviousSarith SagarBelum ada peringkat

- The Red-Bearded BaronDokumen6 halamanThe Red-Bearded BaronSarith Sagar100% (2)

- Financial Statement Analysis Problem SetDokumen7 halamanFinancial Statement Analysis Problem SetSarith SagarBelum ada peringkat

- CVP RelationshipDokumen37 halamanCVP RelationshipSarith SagarBelum ada peringkat

- Confidence Interval Estimates for Production Process Paper LengthDokumen7 halamanConfidence Interval Estimates for Production Process Paper LengthSarith SagarBelum ada peringkat

- Confidence Interval Estimates for Production Process Paper LengthDokumen7 halamanConfidence Interval Estimates for Production Process Paper LengthSarith SagarBelum ada peringkat

- CVP RelationshipDokumen37 halamanCVP RelationshipSarith SagarBelum ada peringkat

- Markov AnalysisDokumen6 halamanMarkov AnalysisSarith SagarBelum ada peringkat

- Accounting Primer Solutions for 4 CompaniesDokumen43 halamanAccounting Primer Solutions for 4 CompaniesSarith SagarBelum ada peringkat

- Broadening The Marketing ConceptDokumen6 halamanBroadening The Marketing ConceptGhani ThapaBelum ada peringkat

- What Business Are We In?: B.V.L.Narayana SPTM112-Apr-09Dokumen11 halamanWhat Business Are We In?: B.V.L.Narayana SPTM112-Apr-09Sarith SagarBelum ada peringkat

- Financial Statement Analysis Problem SetDokumen7 halamanFinancial Statement Analysis Problem SetSarith SagarBelum ada peringkat

- Understanding Financial Statements - A Basic OverviewDokumen49 halamanUnderstanding Financial Statements - A Basic OverviewSarith SagarBelum ada peringkat

- Retail Store Operations Report on Reliance Retail LtdDokumen59 halamanRetail Store Operations Report on Reliance Retail LtdKadali Prasad0% (1)

- Accounting Principles and ConceptsDokumen14 halamanAccounting Principles and ConceptsSarith SagarBelum ada peringkat

- Accounting PrimerDokumen21 halamanAccounting PrimerSarith SagarBelum ada peringkat

- Sample Project 1Dokumen18 halamanSample Project 1Sarith SagarBelum ada peringkat

- Assignment 1Dokumen2 halamanAssignment 1Sarith SagarBelum ada peringkat

- Introduction and Overview of Financial SystemDokumen25 halamanIntroduction and Overview of Financial SystemSarith SagarBelum ada peringkat

- DefinitionsHypothesesPosterior Analytics (Landor)Dokumen12 halamanDefinitionsHypothesesPosterior Analytics (Landor)Daniel Rojas UBelum ada peringkat

- WCB Customized Superior Quality Slewing Ring GearDokumen173 halamanWCB Customized Superior Quality Slewing Ring GearWCB BEARINGBelum ada peringkat

- PFR Lime Kiln Process With Blast Furnace Gas and OxygenDokumen4 halamanPFR Lime Kiln Process With Blast Furnace Gas and OxygenVitor Godoy100% (1)

- Land Based SensorsDokumen40 halamanLand Based SensorsJ.MichaelLooneyBelum ada peringkat

- in 01 en KATALOGDokumen50 halamanin 01 en KATALOGSigma Ragam ManunggalBelum ada peringkat

- Vodafone Bid HBS Case - ExhibitsDokumen13 halamanVodafone Bid HBS Case - ExhibitsNaman PorwalBelum ada peringkat

- Quantitative Reasoning: Factors, HCF & LCM, FactorialsDokumen2 halamanQuantitative Reasoning: Factors, HCF & LCM, FactorialsNaman JainBelum ada peringkat

- Applied Combinatorics, Second Edition by Fred S Roberts, Barry TesmanDokumen889 halamanApplied Combinatorics, Second Edition by Fred S Roberts, Barry TesmanAnil kumarBelum ada peringkat

- Astm-e855 Изгиб МеталлаDokumen8 halamanAstm-e855 Изгиб МеталлаАлесь БуяковBelum ada peringkat

- Timetable Saturday 31 Dec 2022Dokumen1 halamanTimetable Saturday 31 Dec 2022Khan AadiBelum ada peringkat

- Mathematical Induction, Peano Axioms, and Properties of Addition of Non-Negative IntegersDokumen13 halamanMathematical Induction, Peano Axioms, and Properties of Addition of Non-Negative IntegersMarius PaunescuBelum ada peringkat

- 325F Diagrama Electrico CHASIS PDFDokumen8 halaman325F Diagrama Electrico CHASIS PDFRICHARDBelum ada peringkat

- Arc Welding Cracks SolidificationDokumen3 halamanArc Welding Cracks SolidificationShaher YarBelum ada peringkat

- AminesDokumen12 halamanAminesEmelda BanumathyBelum ada peringkat

- Chapter 2 - Exercises - Econometrics2Dokumen2 halamanChapter 2 - Exercises - Econometrics2Mai AnhBelum ada peringkat

- G4pc50ud-Fd IgbtDokumen10 halamanG4pc50ud-Fd IgbtMiguel DuranBelum ada peringkat

- Vendor Information Vishay BLH Handbook TC0013 Solutions For Process Weighing and Force Measurement Electronic Weigh SystemsDokumen59 halamanVendor Information Vishay BLH Handbook TC0013 Solutions For Process Weighing and Force Measurement Electronic Weigh SystemsAndrew JacksonBelum ada peringkat

- Academic Performance of Face-to-Face and Online Students in An Introductory Economics Course and Determinants of Final Course GradesDokumen13 halamanAcademic Performance of Face-to-Face and Online Students in An Introductory Economics Course and Determinants of Final Course GradesLou BaldomarBelum ada peringkat

- GD-1884 Manual PDFDokumen10 halamanGD-1884 Manual PDFAnonymous srwHCpABelum ada peringkat

- 19Ma2Icmat Module 5 - Elementary Numerical MethodsDokumen4 halaman19Ma2Icmat Module 5 - Elementary Numerical Methods1DS19CH011 Jashwanth C RBelum ada peringkat

- DIN-Rail AC Current Transducer 0.25% AccuracyDokumen3 halamanDIN-Rail AC Current Transducer 0.25% AccuracyjoseluisbeitoBelum ada peringkat

- Fiber Optics Unit 3Dokumen82 halamanFiber Optics Unit 3NIKHIL SOLOMON P URK19CS1045Belum ada peringkat

- Sand, Salt, IronDokumen1 halamanSand, Salt, IronKevin ChoyBelum ada peringkat

- Manual ApolloDokumen263 halamanManual ApolloJose Luis CristanchoBelum ada peringkat

- Grade 6 MathDokumen12 halamanGrade 6 Mathapi-264682510Belum ada peringkat

- Preparation Exam API 510:N°01 QuestionsDokumen3 halamanPreparation Exam API 510:N°01 QuestionskorichiBelum ada peringkat

- Supervision Circuito de DisparoDokumen10 halamanSupervision Circuito de DisparoedwinoriaBelum ada peringkat

- 2011 Nov P1 Maths L2Dokumen9 halaman2011 Nov P1 Maths L2nhlanhlamhlambi3Belum ada peringkat

- Problem Set 3 NonparaDokumen3 halamanProblem Set 3 NonparaRhia Mae TeporaBelum ada peringkat

- Tapered Vector Spiral in InkscapeDokumen5 halamanTapered Vector Spiral in InkscapejeanBelum ada peringkat