PP For Chapter 3 Completing The Accounting Cycle - Final

Diunggah oleh

Sozia Tan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

64 tayangan54 halamanAccounting: a Malaysian perspective, 4 th ed (Adapted from Accounting 22 nd ed) Warren, Reeve and Duchac Completing the Accounting Cycle 3 2 Click to edit Master title style 2 2 The Matching Concept 2. Nature of the Adjusting Process 3. Recording Adjusting Entries 4. Summary of Adjustment Process 5. Prepare the Financial Statement 6. Prepare the Closing entries

Deskripsi Asli:

Judul Asli

PP for Chapter 3 Completing the Accounting Cycle - Final

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAccounting: a Malaysian perspective, 4 th ed (Adapted from Accounting 22 nd ed) Warren, Reeve and Duchac Completing the Accounting Cycle 3 2 Click to edit Master title style 2 2 The Matching Concept 2. Nature of the Adjusting Process 3. Recording Adjusting Entries 4. Summary of Adjustment Process 5. Prepare the Financial Statement 6. Prepare the Closing entries

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

64 tayangan54 halamanPP For Chapter 3 Completing The Accounting Cycle - Final

Diunggah oleh

Sozia TanAccounting: a Malaysian perspective, 4 th ed (Adapted from Accounting 22 nd ed) Warren, Reeve and Duchac Completing the Accounting Cycle 3 2 Click to edit Master title style 2 2 The Matching Concept 2. Nature of the Adjusting Process 3. Recording Adjusting Entries 4. Summary of Adjustment Process 5. Prepare the Financial Statement 6. Prepare the Closing entries

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 54

1

Click to edit Master title style

1

1

Accounting: A Malaysian Perspective, 4

th

ed

(Adapted from Accounting 22

nd

ed)

Warren, Reeve and Duchac

Completing the

Accounting Cycle

3

2

Click to edit Master title style

2

2

1. The Matching Concept

2. Nature of the Adjusting Process

3. Recording Adjusting Entries

4. Summary of Adjustment Process

5. Prepare the Financial Statement

6. Prepare the Closing Entries

After completing this chapter, you should be able to:

3

Click to edit Master title style

3

3

TWO METHODS

Reporting Revenue and Expense

Cash Basis of Accounting

Accrual Basis of Accounting

3-1

4

Click to edit Master title style

4

4

Cash Basis of Accounting

Revenue reported when cash is received

Expense reported when cash is paid

Does not properly match revenues and

expenses

3-1

5

Click to edit Master title style

5

5

Accrual Basis of Accounting

Revenue reported when earned

Expense reported when incurred

Properly matches revenues and expenses

in determining net income

Requires adjusting entries at end of period

It just sounds mean it really isnt

3-1

6

Click to edit Master title style

6

6

The Matching Concept

Assets

Liabilities

Owners

Equity

Debits = Credits

Expenses Revenues

3-1

7

Click to edit Master title style

7

7

The Matching Concept

Assets

Liabilities

Owners

Equity

Debits = Credits

Expenses Revenues

Net

Income

3-1

8

Click to edit Master title style

8

8

The Matching Concept

Assets

Liabilities

Owners

Equity

Debits = Credits

Net income is determined by properly

matching expenses and revenues.

Expenses Revenues

Net

Income

matching

3-1

9

Click to edit Master title style

9

9

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

Assets

3-1

10

Click to edit Master title style

10

10

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

21 Accounts Payable 900

23 Unearned Rent 360

Liabilities

3-1

11

Click to edit Master title style

11

11

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

21 Accounts Payable 900

23 Unearned Rent 360

31 Chris Clark, Capital 25,000

32 Chris Clark, Drawing 4,000

Owners

Equity

3-1

12

Click to edit Master title style

12

12

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

21 Accounts Payable 900

23 Unearned Rent 360

31 Chris Clark, Capital 25,000

32 Chris Clark, Drawing 4,000

41 Fees Earned 16,340

Revenue

3-1

13

Click to edit Master title style

13

13

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

21 Accounts Payable 900

23 Unearned Rent 360

31 Chris Clark, Capital 25,000

32 Chris Clark, Drawing 4,000

41 Fees Earned 16,340

51 Wages Expense 4,275

52 Rent Expense 1,600

54 Utilities Expense 985

55 Supplies Expense 800

59 Miscellaneous Expense 455

42,600 42,600

Expenses

3-1

14

Click to edit Master title style

14

14

NetSolutions

Unadjusted Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,220

14 Supplies 2,000

15 Prepaid Insurance 2,400

17 Land 20,000

18 Office Equipment 1,800

21 Accounts Payable 900

23 Unearned Rent 360

31 Chris Clark, Capital 25,000

32 Chris Clark, Drawing 4,000

41 Fees Earned 16,340

51 Wages Expense 4,275

52 Rent Expense 1,600

54 Utilities Expense 985

55 Supplies Expense 800

59 Miscellaneous Expense 455

42,600 42,600

3-1

15

Click to edit Master title style

15

15

NetSolutions

Expanded Chart of Accounts

Balance Sheet Income Statement

1. Assets

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Insurance

17 Land

18 Office Equipment

19 Accumulated Depreciation

2. Liabilities

21 Accounts Payable

22 Wages Payable

23 Unearned Rent

3. Owners Equity

31 Chris Clark, Capital

32 Chris Clark, Drawing

4. Revenue

41 Fees Earned

42 Rent Revenue

5. Expenses

51 Wages Expense

52 Rent Expense

53 Depreciation Expense

54 Utilities Expense

55 Supplies Expense

56 Insurance Expense

59 Miscellaneous Expense

3-1

16

Click to edit Master title style

16

16

NetSolutions

Expanded Chart of Accounts

Balance Sheet Income Statement

1. Assets

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Insurance

17 Land

18 Office Equipment

19 Accumulated Depreciation

2. Liabilities

21 Accounts Payable

22 Wages Payable

23 Unearned Rent

3. Owners Equity

31 Chris Clark, Capital

32 Chris Clark, Drawing

4. Revenue

41 Fees Earned

42 Rent Revenue

5. Expenses

51 Wages Expense

52 Rent Expense

53 Depreciation Expense

54 Utilities Expense

55 Supplies Expense

56 Insurance Expense

59 Miscellaneous Expense

3-1

17

Click to edit Master title style

17

17

NetSolutions

Expanded Chart of Accounts

Balance Sheet Income Statement

1. Assets

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Insurance

17 Land

18 Office Equipment

19 Accumulated Depreciation

2. Liabilities

21 Accounts Payable

22 Wages Payable

23 Unearned Rent

3. Owners Equity

31 Chris Clark, Capital

32 Chris Clark, Drawing

4. Revenue

41 Fees Earned

42 Rent Revenue

5. Expenses

51 Wages Expense

52 Rent Expense

53 Depreciation Expense

54 Utilities Expense

55 Supplies Expense

56 Insurance Expense

59 Miscellaneous Expense

3-1

18

Click to edit Master title style

18

18

NetSolutions

Expanded Chart of Accounts

Balance Sheet Income Statement

1. Assets

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Insurance

17 Land

18 Office Equipment

19 Accumulated Depreciation

2. Liabilities

21 Accounts Payable

22 Wages Payable

23 Unearned Rent

3. Owners Equity

31 Chris Clark, Capital

32 Chris Clark, Drawing

4. Revenue

41 Fees Earned

42 Rent Revenue

5. Expenses

51 Wages Expense

52 Rent Expense

53 Depreciation Expense

54 Utilities Expense

55 Supplies Expense

56 Insurance Expense

59 Miscellaneous Expense

3-1

19

Click to edit Master title style

19

19

NetSolutions

Expanded Chart of Accounts

Balance Sheet Income Statement

1. Assets

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Insurance

17 Land

18 Office Equipment

19 Accumulated Depreciation

2. Liabilities

21 Accounts Payable

22 Wages Payable

23 Unearned Rent

3. Owners Equity

31 Chris Clark, Capital

32 Chris Clark, Drawing

4. Revenue

41 Fees Earned

42 Rent Revenue

5. Expenses

51 Wages Expense

52 Rent Expense

53 Depreciation Expense

54 Utilities Expense

55 Supplies Expense

56 Insurance Expense

59 Miscellaneous Expense

3-1

20

Click to edit Master title style

20

20

Adjustments Deferrals and Accruals

Current Period Future Period

Cash Received Revenue Recorded Deferrals Cash Received

Revenues

3-1

21

Click to edit Master title style

21

21

Adjustments Deferrals and Accruals

Current Period Future Period

Cash Received Revenue Recorded Deferrals Cash Received

Accruals Revenue Recorded Cash Received

Revenues

3-1

22

Click to edit Master title style

22

22

Adjustments Deferrals and Accruals

Current Period Future Period

Cash Received Revenue Recorded Deferrals Cash Received

Current Period Future Period

Cash Paid Expense Recorded

Expenses

Cash Paid

Accruals Revenue Recorded Cash Received

Revenues

Deferrals

3-1

23

Click to edit Master title style

23

23

Adjustments Deferrals and Accruals

Current Period Future Period

Cash Received Revenue Recorded Deferrals Cash Received

Current Period Future Period

Expense Recorded Cash Paid

Cash Paid Expense Recorded

Expenses

Cash Paid

Accruals Revenue Recorded Cash Received

Revenues

Deferrals

Accruals

3-1

24

Click to edit Master title style

24

24

Adjustments Deferred Expense

P1..... 2,400

Cash

Prepaid Insurance

Insurance Expense

P1..... 2,400

On December 1, NetSolutions purchased insurance

for 24 months at a cost of $2,400.

Adjustment A1 Record

insurance used for

December, $100.

Expenses

Assets

Example P1 Purchase initially recorded as an asset.

3-1

25

Click to edit Master title style

25

25

Adjustments Deferred Expense

P1..... 2,400

Cash

Prepaid Insurance

Insurance Expense

P1..... 2,400

On December 1, NetSolutions purchased insurance

for 24 months at a cost of $2,400.

Adjustment A1 Record

insurance used for

December, $100.

A1..... 100

A1.....100

Expenses

Assets

A1

Example P1 Purchase initially recorded as an asset.

A1

3-1

26

Click to edit Master title style

26

26

Adjustments Deferred Expense

P2..... 2,400

Cash

Prepaid Insurance

Insurance Expense

P2..... 2,400

On December 1, NetSolutions purchased insurance

for 24 months at a cost of $2,400.

Adjustment A2 Record

insurance unused as of

December 31.

Expenses

Assets

Example P2 Purchase initially recorded as an expense.

3-1

27

Click to edit Master title style

27

27

Adjustments Deferred Expense

P2..... 2,400

Cash

Prepaid Insurance

Insurance Expense

P2..... 2,400

On December 1, NetSolutions purchased insurance

for 24 months at a cost of $2,400.

Adjustment A2 Record

insurance unused as of

December 31.

A2..... 2,300

A2.....2,300

Expenses

Assets

A2

Example P2 Purchase initially recorded as an expense.

A2

3-1

28

Click to edit Master title style

28

28

Adjustments Deferred Revenue

Cash

Unearned Rent

Rent Revenue

S1..... 360

On December 1, NetSolutions received cash of $360 for

three months rent beginning December 1.

Adjustment A3 Record rent

earned for December.

S1..... 360

Revenues

Liabilities

Example S1 Sale initially recorded as a liability.

3-1

29

Click to edit Master title style

29

29

Adjustments Deferred Revenue

A3..... 120

Cash

Unearned Rent

Rent Revenue

S1..... 360

On December 1, NetSolutions received cash of $360 for

three months rent beginning December 1.

Adjustment A3 Record rent

earned for December.

S1..... 360

A3.....120

Revenues

Liabilities

A3

Example S1 Sale initially recorded as a liability.

A3

3-1

30

Click to edit Master title style

30

30

Adjustments Deferred Revenue

Cash

Unearned Rent

Rent Revenue

S2..... 360

On December 1, NetSolutions received cash of $360 for

three months rent beginning December 1.

Adjustment A4 Record rent

unearned as of December 31.

S2.....360 Revenues

Liabilities

Example S2 Sale initially recorded as revenue.

3-1

31

Click to edit Master title style

31

31

Adjustments Deferred Revenue

A4..... 240

Cash

Unearned Rent

Rent Revenue

S2..... 360

On December 1, NetSolutions received cash of $360 for

three months rent beginning December 1.

Adjustment A4 Record rent

unearned as of December 31.

A4..... 240

S2.....360 Revenues

Liabilities

A4

Example S2 Sale initially recorded as revenue.

A4

3-1

32

Click to edit Master title style

32

32

Adjustments Accrued Expense

Wages Payable

Wages Expense

NetSolutions received employee services for the last two

days of December amounting to $250, to be paid later.

Adjustment A5 Record accrued wages of $250.

Bal.....4,275

Expenses

Liabilities

3-1

33

Click to edit Master title style

33

33

Adjustments Accrued Expense

Wages Payable

Wages Expense

NetSolutions received employee services for the last two

days of December amounting to $250, to be paid later.

Adjustment A5 Record accrued wages of $250.

A5..... 250

Bal.....4,275

Expenses

Liabilities

A5

A5

A5.....250

3-1

34

Click to edit Master title style

34

34

Adjustments Accrued Revenue

Accounts Receivable

Fees Earned

As of December 31, NetSolutions provided 25 hours of

services at $20 per hour to be billed next month.

Adjustment A6 Record accrued fees earned of $500.

Bal....16,340

Revenues

Assets

Bal.....2,220

35

Click to edit Master title style

35

35

Adjustments Accrued Revenue

Accounts Receivable

Fees Earned

As of December 31, NetSolutions provided 25 hours of

services at $20 per hour to be billed next month.

Adjustment A6 Record accrued fees earned of $500.

A6..... 500

Bal....16,340

Revenues

Assets

A6

A6

A6.....500

Bal.....2,220

3-1

36

Click to edit Master title style

36

36

Summary of Adjustments

Deferred

Expenses

Expenses

Assets

A1 A2

Buying Side

Rearranging

the Debits

3-1

37

Click to edit Master title style

37

37

Summary of Adjustments

Deferred

Expenses

Expenses

Assets

A1 A2

Deferred

Revenues

Revenues

Liabilities

A3 A4

Buying Side Selling Side

Rearranging

the Debits

Rearranging

the Credits

3-1

38

Click to edit Master title style

38

38

Summary of Adjustments

Expenses

Liabilities

A5

Accrued

Expenses

Buying Side Selling Side

Adding a New

Transaction

3-1

39

Click to edit Master title style

39

39

Summary of Adjustments

Expenses

Liabilities

A5

Revenues

Assets

A6

Accrued

Expenses

Buying Side Selling Side

Adding a New

Transaction

Adding a New

Transaction

Accrued

Revenues

3-1

40

Click to edit Master title style

40

40

Summary of Adjustments

Deferred

Expenses

Expenses

Assets

A1 A2

Expenses

Liabilities

A5

Deferred

Revenues

Revenues

Liabilities

A3 A4

Revenues

Assets

A6

Accrued

Expenses

Buying Side Selling Side

Rearranging

the Debits

Adding a New

Transaction

Rearranging

the Credits

Adding a New

Transaction

Accrued

Revenues

3-1

41

Click to edit Master title style

41

41

NetSolutions

Income Statement

For Two Months Ended December 31, 2002

Fees earned $16,840

Rent revenue 120

Total revenues $16,960

Expenses:

Wages expense $ 4,525

Supplies expense 2,040

Rent expense 1,600

Utilities expense 985

Insurance expense 100

Depreciation expense 50

Miscellaneous expense 455

Total expenses 9,755

Net income $ 7,205

3-1

42

Click to edit Master title style

42

42

NetSolutions

Statement of Owners Equity

For Two Months Ended December 31, 2002

Chris Clark, capital, November 1, 2002 $ 0

Investment on November 1, 2002 $15,000

Net income for November and December 7,205

$22,205

Less withdrawals 4,000

Increase in owners equity 18,205

Chris Clark, capital, December 31, 2002 $18,205

3-1

43

Click to edit Master title style

43

43

NetSolutions

Balance Sheet

December 31, 2002

ASSETS

Current assets:

Cash $ 2,065

Accounts receivable 2,720

Supplies 760

Prepaid insurance 2,300

Total current assets $ 7,845

Property, plant, and

equipment:

Land $20,000

Office equipment 1,800

Less accum. depr. (50)

Total property, plant,

and equipment 11,750

Total assets $29,595

3-1

44

Click to edit Master title style

44

44

NetSolutions

Balance Sheet

December 31, 2002

LIABILITIES

Current liabilities:

Accounts payable $ 900

Wages payable 250

Unearned rent 240

Total liabilities $ 1,390

OWNERS EQUITY

Chris Clark, capital 28,205

Total liabilities and

owners equity $29,595

3-1

45

Click to edit Master title style

45

45

Wages Expense

Bal. 4,525

Rent Expense

Bal. 1,600

Depreciation Expense

Bal. 50

Utilities Expense

Bal. 985

Supplies Expense

Bal. 2,040

Insurance Expense

Bal. 100

Miscellaneous Expense

Bal. 455

Fees Earned

Bal. 16,840

Rent Revenue

Bal. 120

Chris Clark, Capital

Bal. 15,000

Chris Clark, Drawing

Bal. 4,000

Income Summary

Note: The balances

shown are adjusted

balances before closing.

The following sequence

demonstrates the closing

process.

The Closing Process

3-1

46

Click to edit Master title style

46

46

Wages Expense

Bal. 4,525

Rent Expense

Bal. 1,600

Depreciation Expense

Bal. 50

Utilities Expense

Bal. 985

Supplies Expense

Bal. 2,040

Insurance Expense

Bal. 100

Miscellaneous Expense

Bal. 455

Fees Earned

Bal. 16,840

Rent Revenue

Bal. 120

16,840

120

Income Summary

16,960

Chris Clark, Capital

Close Revenues

Bal. 25,000

Chris Clark, Drawing

Bal. 4,000

Total

Revenues

The Closing Process

3-1

47

Click to edit Master title style

47

47

Wages Expense

Bal. 4,525

Rent Expense

Bal. 1,600

Depreciation Expense

Bal. 50

Utilities Expense

Bal. 985

Supplies Expense

Bal. 2,040

Insurance Expense

Bal. 100

Miscellaneous Expense

Bal. 455

4,525

1,600

50

985

2,040

100

455

Fees Earned

Bal. 16,840

Rent Revenue

Bal. 120

16,840

120

Income Summary

16,960 9,755

Chris Clark, Capital

Close Revenues

Bal. 25,000

Chris Clark, Drawing

Bal. 4,000

Close Expenses

Total

Expenses

Total

Revenues

The Closing Process

3-1

48

Click to edit Master title style

48

48

Wages Expense

Bal. 4,525

Rent Expense

Bal. 1,600

Depreciation Expense

Bal. 50

Utilities Expense

Bal. 985

Supplies Expense

Bal. 2,040

Insurance Expense

Bal. 100

Miscellaneous Expense

Bal. 455

4,525

1,600

50

985

2,040

100

455

Fees Earned

Bal. 16,840

Rent Income

Bal. 120

16,840

120

Income Summary

16,960 9,755

Chris Clark, Capital

Close Revenues

Bal. 15,000

Chris Clark, Drawing

Bal. 4,000

Close Expenses

The Closing Process

7,205

7,205

Close Income Summary

Net Income

Closed

3-1

49

Click to edit Master title style

49

49

Wages Expense

Bal. 4,525

Rent Expense

Bal. 1,600

Depreciation Expense

Bal. 50

Utilities Expense

Bal. 985

Supplies Expense

Bal. 2,040

Insurance Expense

Bal. 100

Miscellaneous Expense

Bal. 455

4,525

1,600

50

985

2,040

100

455

Fees Earned

Bal. 16,840

Rent Income

Bal. 120

16,840

120

Income Summary

16,960 9,755

Chris Clark, Capital

Close Revenues

Bal. 15,000

Chris Clark, Drawing

Bal. 4,000

Close Expenses

The Closing Process

7,205

7,205

Close Income Summary

Net Income

4,000

4,000

Close Drawing

Drawing

Closed

Closed

3-1

50

Click to edit Master title style

50

50

Wages Expense

Rent Expense

Depreciation Expense

Utilities Expense

Supplies Expense

Insurance Expense

Miscellaneous Expense

Fees Earned

Rent Income

Income Summary

Chris Clark, Capital

Bal. 15,000

Chris Clark, Drawing

Net Income

Drawing

Bal. 18,205

All temporary accounts

now have zero balances

and are ready for the

next accounting period.

7,205

4,000

The Closing Process

3-1

51

Click to edit Master title style

51

51

NetSolutions

Post-Closing Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,720

14 Supplies 760

15 Prepaid Insurance 2,300

17 Land 20,000

18 Office Equipment 1,800

19 Accum. Depreciation 50

21 Accounts Payable 900

22 Wages Payable 250

23 Unearned Rent 240

31 Chris Clark, Capital 28,205

29,645 29,645

Assets

3-1

52

Click to edit Master title style

52

52

NetSolutions

Post-Closing Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,720

14 Supplies 760

15 Prepaid Insurance 2,300

17 Land 20,000

18 Office Equipment 1,800

19 Accum. Depreciation 50

21 Accounts Payable 900

22 Wages Payable 250

23 Unearned Rent 240

31 Chris Clark, Capital 28,205

29,645 19,645

Liabilities

3-1

53

Click to edit Master title style

53

53

NetSolutions

Post-Closing Trial Balance

December 31, 2002

11 Cash 2,065

12 Accounts Receivable 2,720

14 Supplies 760

15 Prepaid Insurance 2,300

17 Land 20,000

18 Office Equipment 1,800

19 Accum. Depreciation 50

21 Accounts Payable 900

22 Wages Payable 250

23 Unearned Rent 240

31 Chris Clark, Capital 28,205

29,645 29,645

Owners

Equity

3-1

54

Click to edit Master title style

54

54

This is the last slide in Chapter 3.

Power Notes

Analyzing Transactions

Chapter 3

3-1

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- History of Microfinance in NigeriaDokumen9 halamanHistory of Microfinance in Nigeriahardmanperson100% (1)

- THE DOSE, Issue 1 (Tokyo)Dokumen142 halamanTHE DOSE, Issue 1 (Tokyo)Damage85% (20)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Chapter 5 - Acc. OperationsDokumen42 halamanChapter 5 - Acc. OperationsSozia TanBelum ada peringkat

- Chapter 1 - Acc - in BusinessDokumen54 halamanChapter 1 - Acc - in BusinessSozia TanBelum ada peringkat

- Chapter 3 - Adj - Ncial StateDokumen34 halamanChapter 3 - Adj - Ncial StateSozia TanBelum ada peringkat

- PP For Chapter 8 - Cost Volume Profit - FinalDokumen91 halamanPP For Chapter 8 - Cost Volume Profit - FinalSozia TanBelum ada peringkat

- PP For Chapter 7 - Introduction To Managerial Accounting - FinalDokumen40 halamanPP For Chapter 7 - Introduction To Managerial Accounting - FinalSozia TanBelum ada peringkat

- UUM Business Accounting Course OverviewDokumen5 halamanUUM Business Accounting Course OverviewSozia TanBelum ada peringkat

- Chapter 4 - Com - Nting CycleDokumen44 halamanChapter 4 - Com - Nting CycleSozia TanBelum ada peringkat

- Budgeting Tools for Merchandising BusinessesDokumen55 halamanBudgeting Tools for Merchandising BusinessesSozia TanBelum ada peringkat

- Chapter 3 - Adj - Ncial StateDokumen34 halamanChapter 3 - Adj - Ncial StateSozia TanBelum ada peringkat

- Chapter 2 - Ana - RansactionsDokumen35 halamanChapter 2 - Ana - RansactionsSozia TanBelum ada peringkat

- PP For Chapter 10 - Variance Analysis - FinalDokumen52 halamanPP For Chapter 10 - Variance Analysis - FinalSozia TanBelum ada peringkat

- Chapter 3 - Adj - Ncial StateDokumen34 halamanChapter 3 - Adj - Ncial StateSozia TanBelum ada peringkat

- Click To Edit Master Title Style: Completing The Accounting CycleDokumen54 halamanClick To Edit Master Title Style: Completing The Accounting CycleSozia TanBelum ada peringkat

- PP For Chapter 6 - Financial Statement Analysis - FinalDokumen67 halamanPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanBelum ada peringkat

- PP For Chapter 2 - Analyzing Transactions - FinalDokumen49 halamanPP For Chapter 2 - Analyzing Transactions - FinalSozia TanBelum ada peringkat

- Chapter 6 - Acc. OperationsDokumen44 halamanChapter 6 - Acc. OperationsSozia TanBelum ada peringkat

- Chapter 13 - Fi - NT AnalysisDokumen64 halamanChapter 13 - Fi - NT AnalysisSozia TanBelum ada peringkat

- Budgeting As A Tool For Planning and Controlling: Budget????Dokumen73 halamanBudgeting As A Tool For Planning and Controlling: Budget????Sozia TanBelum ada peringkat

- Chapter 14 - Co - It AnalysisDokumen68 halamanChapter 14 - Co - It AnalysisSozia TanBelum ada peringkat

- PP For Chapter 1 - Introduction To Accounting - FinalDokumen97 halamanPP For Chapter 1 - Introduction To Accounting - FinalSozia TanBelum ada peringkat

- Chapter 8Dokumen30 halamanChapter 8Sozia TanBelum ada peringkat

- Power Notes: Company Annual ReportDokumen14 halamanPower Notes: Company Annual ReportSozia TanBelum ada peringkat

- Financial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andDokumen43 halamanFinancial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andVivek Roy100% (1)

- Chapter 7Dokumen24 halamanChapter 7Sozia TanBelum ada peringkat

- Chapter 6Dokumen24 halamanChapter 6Sozia TanBelum ada peringkat

- Chapter 6Dokumen63 halamanChapter 6Sozia TanBelum ada peringkat

- Topic 12Dokumen19 halamanTopic 12Sozia TanBelum ada peringkat

- Chapter 6Dokumen63 halamanChapter 6Sozia TanBelum ada peringkat

- Chapter 4Dokumen26 halamanChapter 4Sozia TanBelum ada peringkat

- Chapter 5 ContDokumen55 halamanChapter 5 ContSozia TanBelum ada peringkat

- Unr Ece R046Dokumen74 halamanUnr Ece R046rianteri1125Belum ada peringkat

- Mounting InstructionDokumen1 halamanMounting InstructionAkshay GargBelum ada peringkat

- Anti Jamming of CdmaDokumen10 halamanAnti Jamming of CdmaVishnupriya_Ma_4804Belum ada peringkat

- ArDokumen26 halamanArSegunda ManoBelum ada peringkat

- USDA Guide To CanningDokumen7 halamanUSDA Guide To CanningWindage and Elevation0% (1)

- 1st SemDokumen3 halaman1st SemARUPARNA MAITYBelum ada peringkat

- Template WFP-Expenditure Form 2024Dokumen22 halamanTemplate WFP-Expenditure Form 2024Joey Simba Jr.Belum ada peringkat

- Kaydon Dry Gas SealDokumen12 halamanKaydon Dry Gas Sealxsi666Belum ada peringkat

- Brochure en 2014 Web Canyon Bikes How ToDokumen36 halamanBrochure en 2014 Web Canyon Bikes How ToRadivizija PortalBelum ada peringkat

- Unit 14 Ergonomics Design: AND ProductDokumen24 halamanUnit 14 Ergonomics Design: AND ProductRämêşh KątúřiBelum ada peringkat

- Propoxur PMRADokumen2 halamanPropoxur PMRAuncleadolphBelum ada peringkat

- N4 Electrotechnics August 2021 MemorandumDokumen8 halamanN4 Electrotechnics August 2021 MemorandumPetro Susan BarnardBelum ada peringkat

- An Introduction To Ecology and The BiosphereDokumen54 halamanAn Introduction To Ecology and The BiosphereAndrei VerdeanuBelum ada peringkat

- Developing the cycle of maslahah based performance management system implementationDokumen27 halamanDeveloping the cycle of maslahah based performance management system implementationM Audito AlfansyahBelum ada peringkat

- HP HP3-X11 Exam: A Composite Solution With Just One ClickDokumen17 halamanHP HP3-X11 Exam: A Composite Solution With Just One ClicksunnyBelum ada peringkat

- 100 Training Games - Kroehnert, GaryDokumen180 halaman100 Training Games - Kroehnert, GarywindsorccBelum ada peringkat

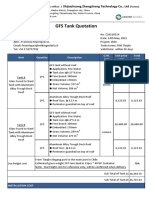

- GFS Tank Quotation C20210514Dokumen4 halamanGFS Tank Quotation C20210514Francisco ManriquezBelum ada peringkat

- Marshall Stability Test AnalysisDokumen5 halamanMarshall Stability Test AnalysisZick Zickry50% (2)

- Checklist of Requirements For OIC-EW Licensure ExamDokumen2 halamanChecklist of Requirements For OIC-EW Licensure Examjonesalvarezcastro60% (5)

- Revit 2010 ESPAÑOLDokumen380 halamanRevit 2010 ESPAÑOLEmilio Castañon50% (2)

- Training Customer CareDokumen6 halamanTraining Customer Careyahya sabilBelum ada peringkat

- SDS OU1060 IPeptideDokumen6 halamanSDS OU1060 IPeptideSaowalak PhonseeBelum ada peringkat

- Mrs. Universe PH - Empowering Women, Inspiring ChildrenDokumen2 halamanMrs. Universe PH - Empowering Women, Inspiring ChildrenKate PestanasBelum ada peringkat

- PowerPointHub Student Planner B2hqY8Dokumen25 halamanPowerPointHub Student Planner B2hqY8jersey10kBelum ada peringkat

- Assignment Gen PsyDokumen3 halamanAssignment Gen PsyHelenBelum ada peringkat

- WWW - Commonsensemedia - OrgDokumen3 halamanWWW - Commonsensemedia - Orgkbeik001Belum ada peringkat

- Technical specifications for JR3 multi-axis force-torque sensor modelsDokumen1 halamanTechnical specifications for JR3 multi-axis force-torque sensor modelsSAN JUAN BAUTISTABelum ada peringkat