Unit 8 - Capital Budgeting

Diunggah oleh

Parul SrivastavDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Unit 8 - Capital Budgeting

Diunggah oleh

Parul SrivastavHak Cipta:

Format Tersedia

1

Subject Name : Financial Management

Unit Title : Capital Budgeting

HOME NEXT

Introduction

2

All such businesses involve investment decisions. These investment

decisions that corporates take are known as capital budgeting

decisions.

Capital budgeting decisions involve evaluation of specific investment

proposals.

Capital budgeting is a blue-print of planned investments in operating

assets.

It is the process of evaluating the profitability of the projects under

consideration and deciding on the proposal to be included in the

capital budget for implementation.

Capital budgeting decisions involve investment of current funds in

anticipation of cash flows occurring over a series of years in future.

Investment of current funds in long-term assets for generation of

cash flows in future over a series of years characterises the nature of

capital budgeting decisions.

3

HOME NEXT PREVIOUS

Session Objectives:

To understand,

The concept of capital budgeting

The importance of capital budgeting

The complexity of capital budgeting procedures

Various techniques of appraisal methods

Evaluation of capital budgeting decision

Importance of Capital Budgeting

Grouping of Decisions

Decision to replace the equipments for maintenance of current level of

business or decisions aiming at cost reductions, known as

replacement decisions

Decisions on expenditure for increasing the present operating level or

expansion through improved network of distribution

Decisions for production of new goods or rendering of new services

Decisions on penetrating into new geographical area

Decisions to comply with the regulatory structure affecting the

operations of the company, like investments in assets to comply with

the conditions imposed by Environmental Protection Act

Decisions on investment to build township for providing residential

accommodation to employees working in a manufacturing plant

4

The reasons that make the capital budgeting decisions most crucial

for finance managers are:

These decisions involve large outlay of funds in anticipation of cash

flows in future.

Long time investments of the funds sometimes may change the risk

profile of the firm.

Capital budgeting decisions involve assessment of market for

companys product and services, deciding on the scale of operations,

selection of relevant technology and finally procurement of costly

equipment.

5

The growth and survival of any firm in todays business environment

demands a firm to be pro-active. Capital budgeting decisions help in

this process.

The social, political, economic and technological forces generate high

level of uncertainty in future cash flow streams associated with capital

budgeting decisions. These factors make these decisions highly

complex.

Capital budgeting decisions are very expensive. To implement these

decisions, firms will have to tap the capital market for funds. The

composition of debt and equity must be optimal keeping in view the

expectations of investors and risk profile of the selected project.

Therefore capital budgeting decisions for growth have become an

essential characteristic of successful firms today.

6

Complexities involved

Capital expenditure decision involves forecasting of future operating

cash flows.

Forecasting the future cash flows demands certain assumptions about

the behaviour of costs and revenues in future.

The following are complexities involved in capital budgeting decisions:

Estimation of future cash flows

Commitment of funds on long-term basis

Problem of irreversibility of decisions

7

Phases of Capital

Expenditure decisions

Identification of investment opportunities.

Evaluation of each investment proposal

Examination of the investments required for each investment proposal

Preparation of the statements of costs and benefits of investment

proposals

Estimation and comparison of the net present values of the

investment proposals that have been cleared by the management on

the basis of screening criteria

Examination of the government policies and regulatory guidelines, for

execution of each investment proposal screened and cleared based on

the criteria stipulated by the management

Budgeting for capital expenditure for approval by the management

Implementation

Post-completion audit

8

Identification of investment

opportunities

A firm is in a position to identify investment proposal only when it is

responsive to the ideas of capital projects emerging from various

levels of the organisation.

The proposal may be to:

Add new products to the companys product line,

Expand capacity to meet the emerging market at demand for

companys products

Add new technology based process of manufacture that will

reduce the cost of production.

Generation of ideas with the feasibility to convert the same into

investment proposals occupies a crucial place in the capital budgeting

decisions.

Proactive organisations encourage a continuous flow of investment

proposals from all levels in the organisation.

9

Important Points for consideration

Analysing the demand and supply conditions of the market for the

companys product could be a fertile source of potential investment

proposals.

Market surveys on customers perception of companys product could

be a potential investment proposal to redefine the companys

products in terms of customers expectations.

Reports emerging from R & D section could be a potential source of

investment proposal.

Economic growth of the country and the emerging middle class

endowed with purchasing power could generate new business

opportunities in existing firms.

Public awareness of their rights compels many firms to initiate

projects from environmental protection angle.

10

Rationale of Capital Budgeting

Proposals

The investors and the stake-holders expect a firm to function

efficiently to satisfy their expectations.

The stake-holders expectation and the performance of the company

may clash among themselves.

The one that touches all these stake-holders expectation could be

visualised in terms of firms obligation to reduce the operating costs

on a continuous basis and increasing its revenues.

Therefore, capital budgeting decisions could be grouped into two

categories:

Decisions on cost reduction programmes

Decisions on revenue generation through expansion of installed

capacity

11

12

Capital Budgeting

Process

The technical aspects of the project are:

Selection of process know-how

Decision on determination of plant capacity

Selection of plant, equipment and scale of operation

Plant design and layout

General layout and material flow

Construction schedule

Economic Appraisal / social cost benefit analysis examines:

The impact of the project on the environment

The impact of the project on the income distribution in the society

The impact of the project on fulfilment of certain social objective like

generation of employment and attainment of self sufficiency

Will the project materially alter the level of savings and investment in

the society?

13

Financial appraisal technique examines:

Cost of the project

Investment outlay

Means of financing and the cost of capital

Expected profitability

Expected incremental cash flows from the project

Break-even point

Cash break-even point

Risk dimensions of the project

Will the project materially alter the risk profile of the company ?

If the project is financed by debt, expected Debt Service Coverage

Ratio

Tax holiday benefits, if any.

14

Investment Evaluation

Steps involved in the evaluation of any investment proposal are:

Estimation of cash flows both inflows and outflows occurring at

different stages of project life cycle

Examination of the risk profile of the project to be taken up and

arriving at the required rate of return

Formulation of the decision criteria

Estimation of cash flows

Capital outlays are estimated by engineering departments after

examining all aspects of production process.

Marketing department on the basis of market survey forecasts the

expected sales revenue during the period of accrual of benefits from

project executions.

Operating costs are estimated by cost accountants and production

engineers.

15

Incremental cash flows and cash out flow statement is prepared by

the cost accountant on the basis of the details generated in the above

steps.

Estimation of incremental cash flows

Incremental cash flows stream of a capital expenditure decision has

three components.

Initial cash outlay (Initial investment)

Operating cash inflows

Terminal cash inflows

16

Basic principles of Cash Flow Estimation*

17

Separation principle : The essence of this principle is the necessity

to treat investment element of the project separately (i.e.

independently) from that of financing element.

The rate of return expected on implementation if the project is arrived

at by the investment profile of the projects.

Interest on debt is ignored while arriving at operating cash inflows.

The following formula is used to calculate profit after tax

Incremental PAT = Incremental EBIT (1-t)

(Incremental) (Incremental)

Where, EBIT = earnings (profit) before interest and taxes, t = tax

rate

18

Incremental principle : This principle states that cash flows of a

project are to be considered in incremental terms.

Following aspects have to be taken into account:

Ignore sunk costs

Consider opportunity costs

Need to take into account all incident effect

Cannibalisation

Post tax principle : All cash flows should be computed on post tax

basis

Consistency principle : Cash flows and discount rates used in

project evaluation need to be consistent with the investor group and

inflation.

19

Appraisal Criteria

Discounted Cash Flow methods

Traditional Methods

Payback Method

Accounting Rate of

Return

Modern Techniques

Net Present Value

Internal Rate of Return

Modified Internal Rate of

Return

Profitability Index

20

Payback period is defined as the length of time required to recover

the initial cash out lay.

(Year Prior to full recovery + Balance of initial out lay to be recovered

of initial out lay at the beginning of the year in which full) / Cash

inflow of the year in which full recovery takes place

Accounting rate of return (ARR) measures the profitability of

investment (project) using information taken from financial

statements:

ARR = Average income / Average investment

ARR = Average of post tax operating profit / Average investment

Average investment = (Book Value of the investment at the beginning

+ Book Value of investment at the end of the life of the project or

investment) / 2

21

Net present value (NPV) method recognises the time value of

money. It correctly admits that cash flows occurring at different time

periods differ in value.

Accept or reject criterion can be summarised as given below:

NPV > Zero = accept

NPV < Zero = reject

Internal rate of return (IRR) is the rate (i.e. discount rate) which

makes the NPV of any project equal to zero.

IRR is the rate of interest which equates the PV of cash inflows with

the PV of cash outflows.

IRR can be determined by solving the following equation:

where t = 1 to n

22

t

t

r

C

CF

) 1 (

0

Modified internal rate of return (MIRR) is a distinct improvement

over the IRR.

Managers find IRR intuitively more appealing than the rupees of NPV

because IRR is expressed on a percentage rate of return. MIRR

modifies IRR.

MIRR is a better indicator of relative profitability of the projects. MIRR

is defined as

PV of Costs = PV of terminal value

cash inflow (1+r)

n-t

cash outflow / (1+r)

n-t

MIRR is obtained on solving the following equation.

PV of costs = TV/ (1 + MIRR)

n

23

Profitability index is also known as benefit cost ratio.

Profitability index is the ratio of the present value of cash inflows to

initial cash outlay.

The discount factor based on the required rate of return is used to

discount the cash inflows.

PI = Present value of cash inflows / initial cash outlay

Accept or reject criteria

Accept the project if PI is greater than 1

Reject the project if PI is less than 1

If PI = 1, then the management may accept the project because the

sum of the present value of cash inflows is equal to the sum of

present value of cash outflows. It neither adds nor reduces the

existing wealth of the company.

24

Summary

You have learnt:

What is Capital Budgeting

Importance of Capital Budgeting

Complexities involved

Capital Budgeting process

Investment Evaluation

Appraisal techniques Traditional and modern methods

25

NEXT PREVIOUS HOME

Anda mungkin juga menyukai

- Capital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToDokumen7 halamanCapital Budgeting Decision Is An Important, Crucial and Critical Business Decision Due ToGaganBelum ada peringkat

- Capital BudgetingDokumen36 halamanCapital BudgetingShweta SaxenaBelum ada peringkat

- Capital Budgeting - THEORYDokumen9 halamanCapital Budgeting - THEORYAarti PandeyBelum ada peringkat

- Capital Budgeting: Unit - 1Dokumen31 halamanCapital Budgeting: Unit - 1RajapriyaBelum ada peringkat

- Capital Budgeting Techniques and StepsDokumen13 halamanCapital Budgeting Techniques and Stepsaon aliBelum ada peringkat

- Identification of Potential Investment Opportunities - The CapitalDokumen4 halamanIdentification of Potential Investment Opportunities - The CapitalAshley_RulzzzzzzzBelum ada peringkat

- 2020 Sem 2 EUP222 CAPITAL BUDGETING NOTES PDFDokumen104 halaman2020 Sem 2 EUP222 CAPITAL BUDGETING NOTES PDFSaiful MunirBelum ada peringkat

- Capitalbudgeting 1227282768304644 8Dokumen27 halamanCapitalbudgeting 1227282768304644 8Sumi LatheefBelum ada peringkat

- For Students Capital BudgetingDokumen3 halamanFor Students Capital Budgetingripplerage0% (1)

- © 2010 Financial Management Prepared By: Amyn WahidDokumen66 halaman© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- Evaluating Project Risks & Capital RationingDokumen53 halamanEvaluating Project Risks & Capital RationingShoniqua JohnsonBelum ada peringkat

- Chapter Three Feasibility AnalysisDokumen82 halamanChapter Three Feasibility AnalysisAbdifatah AhmedBelum ada peringkat

- Capital Budgeting TechniquesDokumen21 halamanCapital Budgeting Techniquesmusa_scorpionBelum ada peringkat

- The Objective in Corporate Finance: Stern School of BusinessDokumen54 halamanThe Objective in Corporate Finance: Stern School of BusinessKhattak MusafirBelum ada peringkat

- MCS Case StudyDokumen17 halamanMCS Case StudyPratik Tambe0% (1)

- Cash Flow AnalysisDokumen26 halamanCash Flow AnalysisSupragy BhatnagarBelum ada peringkat

- Wealth Maximization ObjectiveDokumen8 halamanWealth Maximization ObjectiveNeha SharmaBelum ada peringkat

- LESSON 3 Capital BudgetingDokumen10 halamanLESSON 3 Capital BudgetingNoel Salazar JrBelum ada peringkat

- 2010 Recruitment Day One: Banking Track Case StudyDokumen25 halaman2010 Recruitment Day One: Banking Track Case StudySimar DhillonBelum ada peringkat

- 4 6032630305691534636 PDFDokumen254 halaman4 6032630305691534636 PDFDennisBelum ada peringkat

- Chapter 9 Project Cash FlowsDokumen28 halamanChapter 9 Project Cash FlowsGovinda AgrawalBelum ada peringkat

- Fundamentals of Corporate Finance: Mcgraw Hill/IrwinDokumen31 halamanFundamentals of Corporate Finance: Mcgraw Hill/IrwinjovialleoBelum ada peringkat

- Chapter 2-Project CycleDokumen28 halamanChapter 2-Project CyclemitkuBelum ada peringkat

- Maf5102 Fa Cat 2 2018Dokumen4 halamanMaf5102 Fa Cat 2 2018Muya KihumbaBelum ada peringkat

- Rose Mwaniki CVDokumen10 halamanRose Mwaniki CVHamid RazaBelum ada peringkat

- RR CommunicationsDokumen19 halamanRR CommunicationsMeghanaThummala100% (1)

- Chapter 6 Financial Estimates and ProjectionsDokumen15 halamanChapter 6 Financial Estimates and ProjectionsKusum Bhandari33% (3)

- 2 Risk and Uncertainity in Capital BudgetingDokumen23 halaman2 Risk and Uncertainity in Capital BudgetingAjay RaiBelum ada peringkat

- 5.advanced Performance Management PDFDokumen220 halaman5.advanced Performance Management PDFElena V.Belum ada peringkat

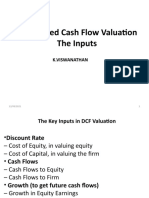

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDokumen47 halamanDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarBelum ada peringkat

- Calculate Capital Budgeting Payback Period & ARRDokumen83 halamanCalculate Capital Budgeting Payback Period & ARRAashutosh MishraBelum ada peringkat

- Flexible Budgets and Variance AnalysisDokumen42 halamanFlexible Budgets and Variance Analysissayed7777Belum ada peringkat

- Project Cost & Risk ManagementDokumen39 halamanProject Cost & Risk ManagementtechnicalvijayBelum ada peringkat

- Financial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFDokumen222 halamanFinancial Cash Flow Determinants of Company Failure in The Construction Industry (PDFDrive) PDFAnonymous 94TBTBRksBelum ada peringkat

- Presentation On: General Electric (GE) MatrixDokumen20 halamanPresentation On: General Electric (GE) Matrix09987508819Belum ada peringkat

- Free Cash Flow Valuation: Wacc FCFF VDokumen6 halamanFree Cash Flow Valuation: Wacc FCFF VRam IyerBelum ada peringkat

- Budgeting Case StudyDokumen1 halamanBudgeting Case Studykisschotu100% (1)

- Code of Ethics Standards Professional ConductDokumen2 halamanCode of Ethics Standards Professional ConductAnurag SharmaBelum ada peringkat

- Ch-5 Financial Cost-Benefit Analysis PDFDokumen130 halamanCh-5 Financial Cost-Benefit Analysis PDFGadaa TubeBelum ada peringkat

- Project Identification TechniquesDokumen80 halamanProject Identification TechniqueshailegebraelBelum ada peringkat

- Assess Project ViabilityDokumen16 halamanAssess Project ViabilityNabila Afrin RiyaBelum ada peringkat

- UNIZIM ACCN Business Accounting Course OutlineDokumen7 halamanUNIZIM ACCN Business Accounting Course OutlineEverjoice Chatora100% (1)

- Financial Decision Making - Sample Suggested AnswersDokumen14 halamanFinancial Decision Making - Sample Suggested AnswersRaymond RayBelum ada peringkat

- Final Book Presentation UnstoppableDokumen17 halamanFinal Book Presentation UnstoppablebigbazaarBelum ada peringkat

- Chapter 04 Working Capital 1ce Lecture 050930Dokumen71 halamanChapter 04 Working Capital 1ce Lecture 050930rthillai72Belum ada peringkat

- Financing - Capital Structure: Chapter Learning ObjectivesDokumen10 halamanFinancing - Capital Structure: Chapter Learning ObjectivesDINEO PRUDENCE NONG100% (1)

- CPM PertDokumen21 halamanCPM Pertkabina goleBelum ada peringkat

- ch01 PenmanDokumen27 halamanch01 PenmansaminbdBelum ada peringkat

- GE MatrixDokumen6 halamanGE MatrixManish JhaBelum ada peringkat

- SBL Exam KitDokumen24 halamanSBL Exam KitSIN NI TANBelum ada peringkat

- Project Planning NotesDokumen13 halamanProject Planning NotesEljah NjoraBelum ada peringkat

- INNOVATIVE BANKINGDokumen6 halamanINNOVATIVE BANKINGRani Sinha KBelum ada peringkat

- Capital Structure Theory PolicyDokumen51 halamanCapital Structure Theory Policyprateek gangwani0% (1)

- Data Mining and Knowledge ManagementDokumen9 halamanData Mining and Knowledge ManagementSyed Arfat AliBelum ada peringkat

- Value Chain Management Capability A Complete Guide - 2020 EditionDari EverandValue Chain Management Capability A Complete Guide - 2020 EditionBelum ada peringkat

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Credit Risk: Pricing, Measurement, and ManagementDari EverandCredit Risk: Pricing, Measurement, and ManagementPenilaian: 1 dari 5 bintang1/5 (2)

- Unit 8 - Capital BudgetingDokumen25 halamanUnit 8 - Capital BudgetingParul SrivastavBelum ada peringkat

- Length of StayDokumen5 halamanLength of StayParul SrivastavBelum ada peringkat

- Rectifying accounting errors under 40 charsDokumen18 halamanRectifying accounting errors under 40 charsluvnica6477Belum ada peringkat

- DBMS File Organization, Indexes: Platters Read/write Head ArmDokumen16 halamanDBMS File Organization, Indexes: Platters Read/write Head ArmMohit VarshneyBelum ada peringkat