Tire City Case

Diunggah oleh

XRiloX0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

386 tayangan14 halamanThe document provides information for projecting pro forma income statements and balance sheets for Tire City for 1996 and 1997. It outlines the general methodology for the financial projections, including assumptions around 20% annual sales growth, constant costs of sales and expenses as a percentage of sales, and calculations for balance sheet accounts. Key figures from Tire City's historical financial statements are also provided as inputs for the projections. Students are assigned to complete the financial projections for Tire City as outlined in the document.

Deskripsi Asli:

Tire City Case Power Point

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document provides information for projecting pro forma income statements and balance sheets for Tire City for 1996 and 1997. It outlines the general methodology for the financial projections, including assumptions around 20% annual sales growth, constant costs of sales and expenses as a percentage of sales, and calculations for balance sheet accounts. Key figures from Tire City's historical financial statements are also provided as inputs for the projections. Students are assigned to complete the financial projections for Tire City as outlined in the document.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

386 tayangan14 halamanTire City Case

Diunggah oleh

XRiloXThe document provides information for projecting pro forma income statements and balance sheets for Tire City for 1996 and 1997. It outlines the general methodology for the financial projections, including assumptions around 20% annual sales growth, constant costs of sales and expenses as a percentage of sales, and calculations for balance sheet accounts. Key figures from Tire City's historical financial statements are also provided as inputs for the projections. Students are assigned to complete the financial projections for Tire City as outlined in the document.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 14

Tire City Case

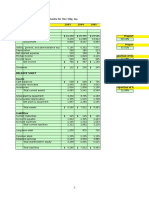

Pro forma income statements and balance sheets for 1996

& 1997

1/2 page

project the need for financing for the warehouse project

determined by the projected cash flows;

assess the financial health of Tire City before and after

the project is completed

General methodology for producing a forecast average

% of sales approach

Sales grow at 20% compounded

Cost of sales, S G & A average for past three years

96, use same for 97

Depreciation 96-213, 97-213+( 5% of 2400)

Net interest expense 96-129, 97-116

Income tax 45%

Dividends 20% of PAT

Cash 3% of sales

A/R 15% of sales

Inventories 96-given, 97-3148

Gross plant and equipment 96-given, 97-given

Accumulated depreciation from income statement

Current liabilities constant

A/P 6% of sales

Bank debt - plug figure to balance

Accrued expenses 7% of sales

Long term debt decline by 125

Common stock constant

Retained earnings beg RE +PAT-dividends

Ratios 95, 96, 97

Profitability

Return on assets

Gross margin

Return on equity

Liquidity

Current ratio

Quick ratio

Leverage

Debt to assets

Debt to equity

Times interest earned

Activity

Sales/assets

Days receivable

Days inventory

Days payable

Financial Statements - Forecast

Systematic projection expected actions of

management budgets, schedules, financial

statements

Working plan statistics, ratios, relationships, funds

flows, conditions, decisions, activities

Coordinated thinking future

Reduces emergency decisions, surprises

Sets standards of performance measure, control

Anticipate upcoming financial needs

Pro Forma statements - future

Pro forma operating statement

Sales

Trend growth in sales

% increase in number of stores

Inflation rate

Sales per square foot

Sales per employee

Assumptions estimates best guess

Historical relationships

Management forecasts

Industry data

Common sense

COGS percentage of sales

Other items less challenge past ratio

Financial Statements - Forecast

Income statement project other items

Classify cost behavior assumptions vary with sales?

Depreciation new assets

Interest new debt

Taxes rates change

Percentage of sales

Test assumptions constant with sales?

Special cases

Interest - % of total financial liabilities

Adding new L/T assets cost per store?

Tax rate projected EBT

Classification of debt current vs. L/T

Net Sales 3,950.00 100%

Less COGS

Direct Labor 948.00 24%

Materials 592.50 15%

Depreciation 130.00 3%

Overhead 743.90 2,414.40 19% 61%

Gross Profit 1,535.60 39%

Selling Expense 392.00 10%

General & admin expense 237.00 629.00 6% 16%

Profit before taxes 906.60 23%

Federal Income taxes 453.30 11%

Net Profit 453.30 11%

Percy-Bowles, Inc.

Pro Forma Operating Statement

For the Fiscal Year Ended August 31, 1961

(Thousands of Dollars)

1.

2.

a. Cash

b. Accounts Receivable

c. Inventories

d. Total current assets

e. Land, buildings, equip., trucks

f. Accumulated depreciation

g. Net fixed assets

h. Other assets

i. Total assets

j. Accounts Payable

k. Note payable- bank

l. Accrued expenses & taxes

m. Total current liabilities

n. Mortgage payable

o. Capital stock

p. Earned surplus

q. Total liabilities & net worth

2.

Hepplefinger & Company

Pro Forma Balance Sheet

June 30, 1961

Cash 40,000 (minimum balance)

Accounts Receivable 103,056 (14/360*2,650,000)

Inventories 258,900 (221,900+2,475,000-2,438,000)

Total current assets 401,956

Land, buildings, equip., trucks 125,400 (111,400+4,000+10,000)

Accumulated depreciation 82,000 (73,700+8,300)

Net fixed assets 43,400

Other assets 5,100

Total assets 450,456

Accounts Payable 171,875 (25/360*2,475,000)

Note payable- bank 141,681 (plug figure)

Accrued expenses & taxes 11,300 (same)

Total current liabilities 324,856

Mortgage payable 22,500 (24,000-1,500)

Capital stock 75,000 (same)

Earned surplus 28,100 (25,300+5,300-2,500)

Total liabilities & net worth 450,456

3.

a. Sales

b. Less: Cost of Goods Sold

c. Direct Labor

d. Materials

e. Depreciation

f. Overhead

g. Total Cost of Goods Sold

h. Gross Margin

i. Sales & administrative expense

j. Earnings before taxes

k. Income tax

l. Net Profit

3b.

a. Cash

b. Accounts receivable

c. Inventories

d. Total current assets

e. Machinery & equipment

f. Accumulated depreciation

g. Net fixed assets

h. Other assets

i. Total assets

j. Accounts payable

k. Accrued wages

l. Accrued taxes

m. Total current liabilities

n. Long Term Debt

o. Capital stock

p. Earned surplus

q. Total liabilities & net worth

3.

IDEAS, INC.

Pro Forma Operating Statement

For the Six Months Ended

(Thousands of dollars)

Sales 600 (100*6)

Less: Cost of Goods Sold

Direct Labor 120 (20*6)

Materials 160 (40*6-80)

Depreciation 12 (2 per month*6)

Overhead 168 (25/month*6+3/month)

Total Cost of Goods Sold 460

Gross Margin 140

Sales & administrative expense 108 (18*6)

Earnings before taxes 32

Income tax 16 (50% of profit)

Net Profit 16

3.

IDEAS, INC.

Pro Forma Balance Sheet

At the end of six months

(Thousands of dollars)

Cash 15 (given)

Accounts receivable 133 (600/180*40)

Inventories 80 (20+60)

Total current assets 228

Machinery & equipment 60 (given)

Accumulated depreciation 12 (2 per month*6)

Net fixed assets 48

Other assets 5 (given)

Total assets 281

Accounts payable 40 ( 240/180*30)

Accrued wages 5 (120/6/4)

Accrued taxes 16 (above)

Total current liabilities 61

Long Term Debt 104

Capital stock 100 (55+45)

Earned surplus 16 (above)

Total liabilities & net worth 281

Read Note on Financial Forecasting;

Read Financial Forecasting Problems;

Assign #10 - Tire City Case (due 3/10, 3/11)

Extra credit cash flows from operations '96 and

'97.

Anda mungkin juga menyukai

- Tire City AnalysisDokumen3 halamanTire City AnalysisKailash HegdeBelum ada peringkat

- Tire City IncDokumen12 halamanTire City Incdownloadsking100% (1)

- Tire CityDokumen3 halamanTire CityenypurwaningsihBelum ada peringkat

- 93-Tire-City 22 22Dokumen26 halaman93-Tire-City 22 22Daniel InfanteBelum ada peringkat

- Tire City Inc.Dokumen6 halamanTire City Inc.Samta Singh YadavBelum ada peringkat

- Tire City SolutionDokumen4 halamanTire City SolutionUmeshKumarBelum ada peringkat

- Tire City AssignmentDokumen7 halamanTire City AssignmentShivam Kanojia100% (1)

- Netscape ProformaDokumen6 halamanNetscape ProformabobscribdBelum ada peringkat

- Tire City IncDokumen12 halamanTire City IncMahesh Kumar Meena100% (1)

- Tire City CaseDokumen12 halamanTire City CaseAngela ThorntonBelum ada peringkat

- Tire City AssignmentDokumen6 halamanTire City AssignmentXRiloXBelum ada peringkat

- Tire - City AnalysisDokumen17 halamanTire - City AnalysisJustin HoBelum ada peringkat

- Tire City Spreadsheet SolutionDokumen6 halamanTire City Spreadsheet Solutionalmasy99100% (1)

- Tire City IncDokumen5 halamanTire City IncAfrin FarhanaBelum ada peringkat

- Tire CityDokumen3 halamanTire Cityrahulchohan2108Belum ada peringkat

- Tire City Inc. Case StudyDokumen8 halamanTire City Inc. Case StudyKyeli TanBelum ada peringkat

- Marriott Solutions WACC LodgingDokumen3 halamanMarriott Solutions WACC LodgingPabloCaicedoArellanoBelum ada peringkat

- Ameritrade Case SolutionDokumen34 halamanAmeritrade Case SolutionAbhishek GargBelum ada peringkat

- Tire City, Inc - Examen FinalDokumen3 halamanTire City, Inc - Examen Finalmacro_jBelum ada peringkat

- Tire City Spreadsheet SolutionDokumen8 halamanTire City Spreadsheet SolutionsuwimolJBelum ada peringkat

- Tire City Spreadsheet SolutionDokumen7 halamanTire City Spreadsheet SolutionSyed Ali MurtuzaBelum ada peringkat

- Clarkson Lumber Analysis - TylerDokumen9 halamanClarkson Lumber Analysis - TylerTyler TreadwayBelum ada peringkat

- Debt Policy at UST Inc.Dokumen47 halamanDebt Policy at UST Inc.karthikk1990100% (2)

- Case Analysis - Toy WorldDokumen11 halamanCase Analysis - Toy Worldvarjin71% (7)

- Tire City Case 1Dokumen28 halamanTire City Case 1Srikanth VasantadaBelum ada peringkat

- Session 19 - Dividend Policy at Linear TechDokumen2 halamanSession 19 - Dividend Policy at Linear TechRichBrook7Belum ada peringkat

- Excel File Exhibits For Marriott CaseDokumen18 halamanExcel File Exhibits For Marriott Caset3ddyme123Belum ada peringkat

- Tire City Case AnalysisDokumen10 halamanTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Belum ada peringkat

- Tire City AnalysisDokumen1 halamanTire City AnalysisNikhil Kangutkar80% (10)

- Nike Case AnalysisDokumen9 halamanNike Case AnalysisFami FamzBelum ada peringkat

- Energy GelDokumen4 halamanEnergy Gelchetan DuaBelum ada peringkat

- Toy World - ExhibitsDokumen9 halamanToy World - Exhibitsakhilkrishnan007Belum ada peringkat

- Tire City SolutionDokumen2 halamanTire City Solutionadityaintouch60% (5)

- Netscape CaseDokumen6 halamanNetscape CaseVikram RathiBelum ada peringkat

- RJR Nabisco ValuationDokumen33 halamanRJR Nabisco ValuationKrishna Chaitanya KothapalliBelum ada peringkat

- Case Study Debt Policy Ust IncDokumen10 halamanCase Study Debt Policy Ust IncIrfan MohdBelum ada peringkat

- Tire City AssignmentDokumen6 halamanTire City AssignmentderronsBelum ada peringkat

- Case StudyDokumen10 halamanCase StudyEvelyn VillafrancaBelum ada peringkat

- Tire CityDokumen5 halamanTire CitySudip BrahmacharyBelum ada peringkat

- Midland Energy Resources Inc SolutionDokumen2 halamanMidland Energy Resources Inc SolutionAashna MehtaBelum ada peringkat

- Assessing Earnings Quality at NuwareDokumen7 halamanAssessing Earnings Quality at Nuwaremyhellonearth0% (1)

- Tire City Case Study SolutionDokumen2 halamanTire City Case Study SolutionPrathap Sankar0% (1)

- Nike Inc. Case StudyDokumen3 halamanNike Inc. Case Studyshikhagupta3288Belum ada peringkat

- Midland Case CalculationsDokumen24 halamanMidland Case CalculationsSharry_xxx60% (5)

- Tire City Case SolutionDokumen6 halamanTire City Case SolutionShivam Bhasin60% (10)

- Case Report FinalDokumen12 halamanCase Report Finalsimplyabeer100% (3)

- FIN RealOptionsDokumen3 halamanFIN RealOptionsveda20Belum ada peringkat

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDokumen11 halamanUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- Midland EnergyDokumen9 halamanMidland EnergyPrashant MishraBelum ada peringkat

- WorldCom Bond IssuanceDokumen9 halamanWorldCom Bond IssuanceAniket DubeyBelum ada peringkat

- Case 51 Palamon Capital Partners Team System SPADokumen10 halamanCase 51 Palamon Capital Partners Team System SPAcrs50% (2)

- Alliance Concrete ForecastingDokumen7 halamanAlliance Concrete ForecastingS r kBelum ada peringkat

- FMG Comsat FCCDokumen18 halamanFMG Comsat FCCMuhammad Rizwan AsimBelum ada peringkat

- Case Submission - Stone Container Corporation (A) ' Group VIIIDokumen5 halamanCase Submission - Stone Container Corporation (A) ' Group VIIIGURNEET KAURBelum ada peringkat

- Corporate Valuation: Group - 2Dokumen6 halamanCorporate Valuation: Group - 2RiturajPaulBelum ada peringkat

- UST Debt Policy SpreadsheetDokumen9 halamanUST Debt Policy Spreadsheetjchodgson0% (2)

- Vocabulary English For AccountingDokumen8 halamanVocabulary English For AccountingMi NhonBelum ada peringkat

- Ch. 12 Financial Planning and Forecasting Financial Statements The Financial PlanDokumen6 halamanCh. 12 Financial Planning and Forecasting Financial Statements The Financial PlanAnis AtmojoBelum ada peringkat

- Exhibit 6.3 Margin Money For Working CapitalDokumen12 halamanExhibit 6.3 Margin Money For Working Capitalanon_285857320Belum ada peringkat

- Solution To Y Guess Jeans:: Item 1. Consolidated Financial StatementsDokumen7 halamanSolution To Y Guess Jeans:: Item 1. Consolidated Financial StatementsAbuBakarSiddiqueBelum ada peringkat

- Salary Certificate FormatDokumen1 halamanSalary Certificate FormatshajahanBelum ada peringkat

- Problem 10Dokumen2 halamanProblem 10novyBelum ada peringkat

- BIR Ruling No. 317-18 (BVI Law)Dokumen3 halamanBIR Ruling No. 317-18 (BVI Law)Liz100% (1)

- Audit Problems CashDokumen18 halamanAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- In The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Dokumen67 halamanIn The United States Bankruptcy Court For The District of Delaware in Re:) Chapter 11 Pacific Energy Resources LTD., Et Al.,') Case No. 09-10785 (KJC) ) (Jointly Administered) Debtor.)Chapter 11 DocketsBelum ada peringkat

- Abella vs. Abella GR No. 195166 July 08, 2015Dokumen6 halamanAbella vs. Abella GR No. 195166 July 08, 2015ErikEspinoBelum ada peringkat

- New BIT Structure For 081 AboveDokumen17 halamanNew BIT Structure For 081 Aboveعلي برادةBelum ada peringkat

- 92611902-KrugmanMacro SM Ch19 PDFDokumen6 halaman92611902-KrugmanMacro SM Ch19 PDFAlejandro Fernandez RodriguezBelum ada peringkat

- Accounting For Income TaxDokumen14 halamanAccounting For Income TaxJasmin Gubalane100% (1)

- TallyPrime Essential Level 2Dokumen26 halamanTallyPrime Essential Level 2Lavanya TBelum ada peringkat

- Indian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianDokumen4 halamanIndian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianVignesh KanagarajBelum ada peringkat

- A Case Study On Moser BaerDokumen13 halamanA Case Study On Moser BaerShubham AgarwalBelum ada peringkat

- 3.kingsun Financial Statement FinalDokumen22 halaman3.kingsun Financial Statement FinalDharamrajBelum ada peringkat

- Brokerage Agreement-ExclusiveDokumen3 halamanBrokerage Agreement-ExclusiveMarvin B. SoteloBelum ada peringkat

- Co Operative SocietyDokumen101 halamanCo Operative SocietyRaghu Ck100% (2)

- Recruitment Selection Process in HDFCDokumen102 halamanRecruitment Selection Process in HDFCaccord123100% (2)

- InvoiceDokumen2 halamanInvoiceTHIMMEGOWDA H MBelum ada peringkat

- Fin Ca2 FinalDokumen6 halamanFin Ca2 FinalVaishali SonareBelum ada peringkat

- IA2 Chapter 20 ActivitiesDokumen13 halamanIA2 Chapter 20 ActivitiesShaina TorraineBelum ada peringkat

- A Study On Claims ManagementDokumen77 halamanA Study On Claims Managementarjunmba119624100% (2)

- Chapter OneDokumen119 halamanChapter Onegary galangBelum ada peringkat

- Ms8-Set A Midterm - With AnswersDokumen5 halamanMs8-Set A Midterm - With AnswersOscar Bocayes Jr.Belum ada peringkat

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDokumen38 halamanAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722Belum ada peringkat

- Ssi FinancingDokumen7 halamanSsi FinancingAnanya ChoudharyBelum ada peringkat

- Sales Invoice: Customer InformationDokumen1 halamanSales Invoice: Customer InformationRaghavendra S DBelum ada peringkat

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDokumen14 halamanUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellBelum ada peringkat

- Mamis Last LetterDokumen10 halamanMamis Last LetterTBP_Think_Tank100% (3)

- India Cements Result UpdatedDokumen12 halamanIndia Cements Result UpdatedAngel BrokingBelum ada peringkat

- Audit of Property, Plant and Equipment: Auditing ProblemsDokumen5 halamanAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanBelum ada peringkat

- Tabel DFDokumen15 halamanTabel DFSexy TofuBelum ada peringkat