S3 Corporate Level Strategies

Diunggah oleh

pravit08Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

S3 Corporate Level Strategies

Diunggah oleh

pravit08Hak Cipta:

Format Tersedia

CORPORATE LEVEL

STRATEGIES

Strategic Management Module 2 Session

3

Family tree of strategies

Stability

Retrenchment

Agenda

Corporate level

strategies

Corporate

level

strategies

Stability Retrenchment Expansion

Stability

strategies

Stability

No-change Profit

Proceed

with caution

Retrenchment

strategies

Retrenchment

Turnaround Divestment Liquidation

Expansion

strategies

Expansion

Concentration

Integration

Diversification

Internationalization

Cooperation

Digitalization

Stability Strategy

Stability

strategies

Stability

No-change Profit

Proceed

with caution

Stability strategy implies continuing the current

activities of the firm without any significant change in

direction.

Why do companies pursue a stability strategy?

The firm is doing well or perceives itself as successful

1) It is less risky

2) It is easier and more comfortable

3) The environment is relatively unstable

4) Too much expansion can lead to inefficiencies

Situations where a stability strategy is more

advisable than the growth strategy:

1) If the external environment is highly dynamic and

unpredictable

2) Strategic managers may feel that the cost of

growth may be higher than the potential benefits

3) Excessive expansion may result in violation of anti

trust laws

Stability

strategies

Stability

No-change Profit

Proceed

with caution

A no change strategy is

a decision to do nothing

new i.e continue current

operations and policies

for the foreseeable

future.

Some organizations

pursue stability strategy

for a temporary period of

time until the particular

environmental situation

changes, especially if

they have been growing

too fast in the previous

period.

The profit strategy is an

attempt to artificially

maintain profits by

reducing investments

and short-term

expenditures.

Retrenchment Strategy

Retrenchment

strategies

Retrenchment

Turnaround Divestment Liquidation

A strategy used by corporations to

reduce the diversity or the overall size

of the operations of the company. This

strategy is often used in order to

cut expenses with the goal of becoming

a more financial stable business.

Typically the strategy involves

withdrawing from certain markets or the

discontinuation

of selling certain products or service in

order to make a beneficial turnaround.

Retrenchment

strategies

Retrenchment

Turnaround Divestment Liquidation

Conditions

Persistent negative cash flow

Negative profit

Declining market share

Deterioration in physical facilities

Over manning, high turnover of employees and low morale

Uncompetitive products and services

Mismanagement

Turnaround strategy means to

convert, change or transform a

loss-making company into a profit-

making company.

Retrenchment

strategies

Retrenchment

Turnaround Divestment Liquidation

Conditions

Business is a mismatch and cannot be integrated within the

company

Persistent negative flows

Severity of competition

Not possible to in technology upgradation

Selling off a part of business to survive

May be as part of a merger plan

Divestment is a form of

retrenchment strategy used by

businesses when they downsize

the scope of their business

activities. Divestment usually

involves eliminating a portion of a

business

Retrenchment

strategies

Retrenchment

Turnaround Divestment Liquidation

Lead to serious consequences including loss of employment,

termination of opportunities etc

Compulsory winding-up by court order

Voluntary winding- up

Voluntary winding- up under court supervision

Liquidation is the process by

which a company (or part of a

company) is brought to an end,

and the assets and property of the

company redistributed.

THANK YOU

Anda mungkin juga menyukai

- Strategic MGMT Sess 8 & 9Dokumen13 halamanStrategic MGMT Sess 8 & 9ShwetaBelum ada peringkat

- Strategic PlanningDokumen58 halamanStrategic PlanningAndro AlbertBelum ada peringkat

- Strategic Management: 8 Types of Strategies & 10 Benefits of Clear ObjectivesDokumen4 halamanStrategic Management: 8 Types of Strategies & 10 Benefits of Clear ObjectivesMarie GarpiaBelum ada peringkat

- Formulating Long-Term Objectives and Grand StrategiesDokumen50 halamanFormulating Long-Term Objectives and Grand StrategiesNida_Basheer_206Belum ada peringkat

- Grand Strategies Classification and TypesDokumen55 halamanGrand Strategies Classification and TypeskksavaliyaBelum ada peringkat

- Retrenchment StrategyDokumen12 halamanRetrenchment Strategyvikas3697100% (1)

- Strategy ManagementDokumen106 halamanStrategy ManagementGirish Harsha100% (9)

- EsDokumen94 halamanEsrose llarBelum ada peringkat

- Turnaround StrategyDokumen19 halamanTurnaround StrategyAkash LadhaBelum ada peringkat

- Turnaround Strategies: Actions for Declining CompaniesDokumen19 halamanTurnaround Strategies: Actions for Declining Companiesanshita9shrivastavaBelum ada peringkat

- Unit 2Dokumen15 halamanUnit 2Dr umamaheswari.sBelum ada peringkat

- Strategic Management and Policy: by Iram FatimaDokumen18 halamanStrategic Management and Policy: by Iram FatimaFareena NadeemBelum ada peringkat

- Stability StrategyDokumen22 halamanStability StrategySid GargBelum ada peringkat

- SM CH 4 SM Smu 2023Dokumen39 halamanSM CH 4 SM Smu 2023Ab ParvizeBelum ada peringkat

- Michael Porter's Five Generic StrategiesDokumen64 halamanMichael Porter's Five Generic StrategiesMoses FisherBelum ada peringkat

- What Is Grand Strategy ?Dokumen48 halamanWhat Is Grand Strategy ?Vishwajeet ChavanBelum ada peringkat

- What is Grand Strategy and Types of StrategiesDokumen48 halamanWhat is Grand Strategy and Types of StrategiesReenaAswaneyBelum ada peringkat

- Retrenchment StrategiesDokumen3 halamanRetrenchment StrategiesSABRI AKBAL MOHAMED HASSAN100% (3)

- Types of StrategiesDokumen15 halamanTypes of Strategiesmayaverma123pBelum ada peringkat

- Types of StrategiesDokumen36 halamanTypes of StrategiesSam JunejaBelum ada peringkat

- Competitive Strategy: Lecture 7: Acquisitions and StructureDokumen27 halamanCompetitive Strategy: Lecture 7: Acquisitions and StructurehrleenBelum ada peringkat

- Strategy FormulationDokumen53 halamanStrategy FormulationJoeBelum ada peringkat

- Grand StrategiesDokumen7 halamanGrand StrategiesSeher NazBelum ada peringkat

- Turnaround Strategies and Case StudiesDokumen81 halamanTurnaround Strategies and Case StudiesKanchan GuptaBelum ada peringkat

- Strategic Management and Corporate Governmance: Topic Turnaround StrategyDokumen10 halamanStrategic Management and Corporate Governmance: Topic Turnaround StrategyVyshnav esBelum ada peringkat

- Strategic ManagementDokumen21 halamanStrategic Managementallanrichard025Belum ada peringkat

- Strategic Planning Unit 2Dokumen42 halamanStrategic Planning Unit 2Gaurav Navale100% (2)

- Grand StrategiesDokumen11 halamanGrand StrategiesManmeet Kaur0% (1)

- ABPS Lecture7Dokumen30 halamanABPS Lecture7Marian BucknerBelum ada peringkat

- Ahadkhan - 1683 - 16127 - 1 - eMBA SM - Corporate Strategies - Lecture 6Dokumen28 halamanAhadkhan - 1683 - 16127 - 1 - eMBA SM - Corporate Strategies - Lecture 6Muhammad AfzalBelum ada peringkat

- Ocd 5Dokumen24 halamanOcd 5udayBelum ada peringkat

- SHRP01Dokumen19 halamanSHRP01Arju LubnaBelum ada peringkat

- Chapter 7 Grand StrategiesDokumen73 halamanChapter 7 Grand StrategiesFarhan Badakshani100% (3)

- Strategic ManagementDokumen29 halamanStrategic ManagementN-jay ErnietaBelum ada peringkat

- STD RetenchDokumen35 halamanSTD RetenchManu JohariBelum ada peringkat

- Strategic Management Unit2Dokumen67 halamanStrategic Management Unit2Will RobinsonBelum ada peringkat

- SM Corporate Level Strategies Expansions EtcDokumen5 halamanSM Corporate Level Strategies Expansions EtcRohit R SumbruiBelum ada peringkat

- Earnings ManagementDokumen9 halamanEarnings ManagementyoutinskmBelum ada peringkat

- Unit 9Dokumen19 halamanUnit 9Priya ShindeBelum ada peringkat

- Very Good Types of StrategyDokumen5 halamanVery Good Types of StrategyAnonymous r6U4HTyBelum ada peringkat

- Strategy Formulation Corporate StrategyDokumen48 halamanStrategy Formulation Corporate StrategyKimberly Claire AtienzaBelum ada peringkat

- 3 Identifying Strategy Alternatives - Session ThreeDokumen56 halaman3 Identifying Strategy Alternatives - Session ThreeY. Sajith (Sajja)Belum ada peringkat

- Strategic Management: Business Strategies and Corporate StrategiesDokumen22 halamanStrategic Management: Business Strategies and Corporate StrategiesRajat ShettyBelum ada peringkat

- Grand Strategies N Strategy Selection ModelsDokumen42 halamanGrand Strategies N Strategy Selection ModelsJoshua LaryeaBelum ada peringkat

- Chapter 4 Strategic ChoicesDokumen43 halamanChapter 4 Strategic Choicesgadiyasiddhi0Belum ada peringkat

- Growth StrategiesDokumen14 halamanGrowth StrategiesSarah GatchalianBelum ada peringkat

- Long-Term Objectives and Grand StrategiesDokumen33 halamanLong-Term Objectives and Grand StrategiesAnn MaryBelum ada peringkat

- Strategic ch.3Dokumen14 halamanStrategic ch.3tage008Belum ada peringkat

- Corporate Level Strategies: - Rutika SainiDokumen25 halamanCorporate Level Strategies: - Rutika Sainidivyansh varshneyBelum ada peringkat

- Stability StrategyDokumen4 halamanStability StrategyButtercupBelum ada peringkat

- Formulating Long-Term Objectives and Grand StrategiesDokumen40 halamanFormulating Long-Term Objectives and Grand StrategiesGandhesBelum ada peringkat

- Strategy Formulation and ImplementationDokumen42 halamanStrategy Formulation and ImplementationAgustinVillarealBelum ada peringkat

- Strategies in Action: 40+ Strategic Management ConceptsDokumen36 halamanStrategies in Action: 40+ Strategic Management ConceptsRadha PalachollaBelum ada peringkat

- MCom Types of StrategiesDokumen63 halamanMCom Types of StrategiesViraj BalsaraBelum ada peringkat

- Establish Long-Term Goals and ObjectivesDokumen15 halamanEstablish Long-Term Goals and Objectiveskim cheBelum ada peringkat

- U-2 - Corporate Level Strategy - Creating Value Through DiversificationDokumen18 halamanU-2 - Corporate Level Strategy - Creating Value Through DiversificationGenieBelum ada peringkat

- Types of Strategies SalimDokumen62 halamanTypes of Strategies SalimAshLee0% (1)

- SM PPTs To Students (Module 5 To 12)Dokumen121 halamanSM PPTs To Students (Module 5 To 12)Raj ThakurBelum ada peringkat

- Strategic Analysis of Internal Environment of a Business OrganisationDari EverandStrategic Analysis of Internal Environment of a Business OrganisationBelum ada peringkat

- S5-6 Internal AnalysisDokumen24 halamanS5-6 Internal Analysispravit08Belum ada peringkat

- Lean Manufacturing: Module-5 SIX SIGMADokumen27 halamanLean Manufacturing: Module-5 SIX SIGMApravit08Belum ada peringkat

- TakttimeDokumen1 halamanTakttimepravit08Belum ada peringkat

- Strategic Management Notes: SM Modules 3, 4 & 5Dokumen61 halamanStrategic Management Notes: SM Modules 3, 4 & 5pravit08Belum ada peringkat

- Leanmanufacturing Module2 ContinuationDokumen24 halamanLeanmanufacturing Module2 Continuationpravit08Belum ada peringkat

- Lean Manufacturing Module 2Dokumen20 halamanLean Manufacturing Module 2pravit08Belum ada peringkat

- S1 - 2 Business StrategiesDokumen33 halamanS1 - 2 Business Strategiespravit08Belum ada peringkat

- S4 Corporate Level StrategiesDokumen11 halamanS4 Corporate Level Strategiespravit08Belum ada peringkat

- S4 Competitive EnvironmentDokumen13 halamanS4 Competitive Environmentpravit08Belum ada peringkat

- Lean Manufacturing: Module-1Dokumen36 halamanLean Manufacturing: Module-1pravit08Belum ada peringkat

- CSR, Governance & StrategyDokumen1 halamanCSR, Governance & Strategypravit08Belum ada peringkat

- Introdution To Strategic ManagementDokumen25 halamanIntrodution To Strategic Managementpravit08Belum ada peringkat

- Rolled Through Put YieldDokumen1 halamanRolled Through Put Yieldpravit08Belum ada peringkat

- Lean Manufacturing: Module-2 & Module-3Dokumen17 halamanLean Manufacturing: Module-2 & Module-3pravit08Belum ada peringkat

- Lean Manufacturing: Module-5 SIX SIGMADokumen8 halamanLean Manufacturing: Module-5 SIX SIGMApravit08Belum ada peringkat

- Lean Manufacturing: Module-5 SIX SIGMADokumen23 halamanLean Manufacturing: Module-5 SIX SIGMApravit08Belum ada peringkat

- (Paper) Computer General Knowledge For Bank Examination (For Bank PO Exam)Dokumen12 halaman(Paper) Computer General Knowledge For Bank Examination (For Bank PO Exam)pravit08Belum ada peringkat

- Basic TPS HandbookDokumen33 halamanBasic TPS HandbookSumith KobewattaBelum ada peringkat

- List of Circulating Currencies - Wikipedia, The Free EncyclopediaDokumen11 halamanList of Circulating Currencies - Wikipedia, The Free EncyclopediagdeepthiBelum ada peringkat

- Improve Low Volume Value StreamDokumen9 halamanImprove Low Volume Value Streampravit08Belum ada peringkat

- CC21 - Course Plan - V1Dokumen3 halamanCC21 - Course Plan - V1pravit08Belum ada peringkat

- Non Verbal Reasoning Question TrickDokumen2 halamanNon Verbal Reasoning Question TrickAjay Singh Rathore100% (1)

- Short Cuts.9493532Dokumen1 halamanShort Cuts.9493532Arivarasan JCBelum ada peringkat

- List of Padma Awards 2011 WinnersDokumen7 halamanList of Padma Awards 2011 WinnersRavish MalhotraBelum ada peringkat

- English TipsDokumen3 halamanEnglish Tipsiam027Belum ada peringkat

- Data SuffiiciencyDokumen11 halamanData SuffiiciencylenovojiBelum ada peringkat

- Table, Figure FormatDokumen1 halamanTable, Figure FormatAthira MenonBelum ada peringkat

- Facing SheetsDokumen10 halamanFacing Sheetspravit08Belum ada peringkat

- English Essay On 2007/2008 Financial CrisisDokumen6 halamanEnglish Essay On 2007/2008 Financial CrisisMahmudul HasanBelum ada peringkat

- IFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TDokumen10 halamanIFB Washing Machines Marketing Analysis: N V Jagadeesh Kumar TomprakashBelum ada peringkat

- Annual Review Pitch Deck by SlidesgoDokumen7 halamanAnnual Review Pitch Deck by SlidesgoALJOHARA KHALID HAMAD ALSULIMANBelum ada peringkat

- Foregin Policy IndiaDokumen21 halamanForegin Policy IndiaJeevandeep Singh DulehBelum ada peringkat

- Central Excise - Into & Basic ConceptsDokumen21 halamanCentral Excise - Into & Basic ConceptsMruduta JainBelum ada peringkat

- HNIDokumen5 halamanHNIAmrita MishraBelum ada peringkat

- DR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Dokumen21 halamanDR Winston McCalla, Lessons From The Caribbean Region Experience, Presentation, 2-2012Detlef LoyBelum ada peringkat

- Chad Humphrey ResumeDokumen2 halamanChad Humphrey ResumeSeattleChadBelum ada peringkat

- MTNL Mumbai PlansDokumen3 halamanMTNL Mumbai PlansTravel HelpdeskBelum ada peringkat

- 9731ch04Dokumen44 halaman9731ch04Yuki TakenoBelum ada peringkat

- Impact of Annales School On Ottoman StudiesDokumen16 halamanImpact of Annales School On Ottoman StudiesAlperBalcıBelum ada peringkat

- Eeag 2017Dokumen117 halamanEeag 2017Anonymous Hnv6u54HBelum ada peringkat

- Chevron Attestation PDFDokumen2 halamanChevron Attestation PDFedgarmerchanBelum ada peringkat

- Why Do Famines PersistDokumen9 halamanWhy Do Famines PersistJose Maria CisnerosBelum ada peringkat

- Microeconomics Chapter 1 IntroDokumen28 halamanMicroeconomics Chapter 1 IntroMc NierraBelum ada peringkat

- 2.kristian Agung PrasetyoDokumen32 halaman2.kristian Agung PrasetyoIin Mochamad SolihinBelum ada peringkat

- Keegan02 The Global Economic EnvironmentDokumen17 halamanKeegan02 The Global Economic Environmentaekram faisalBelum ada peringkat

- BELENDokumen22 halamanBELENLuzbe BelenBelum ada peringkat

- Budget Deficit: Some Facts and InformationDokumen3 halamanBudget Deficit: Some Facts and InformationTanvir Ahmed SyedBelum ada peringkat

- Method Statement-Site CleaningDokumen6 halamanMethod Statement-Site Cleaningprisma integrated100% (1)

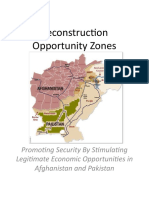

- Reconstruction Opportunity Zones in PakistanDokumen6 halamanReconstruction Opportunity Zones in Pakistantaimoor_qureshiBelum ada peringkat

- López Quispe Alejandro MagnoDokumen91 halamanLópez Quispe Alejandro MagnoAssasin WildBelum ada peringkat

- Bylaws Gulf Shores Association IncDokumen9 halamanBylaws Gulf Shores Association IncTeena Post/LaughtonBelum ada peringkat

- Becker Friedman Institute Annual Report 2013-14Dokumen24 halamanBecker Friedman Institute Annual Report 2013-14bficommBelum ada peringkat

- GMG AirlineDokumen15 halamanGMG AirlineabusufiansBelum ada peringkat

- Tender Document CONCORDokumen109 halamanTender Document CONCORgiri_placid100% (1)

- Honda: Head Office & FactoryDokumen3 halamanHonda: Head Office & FactoryUmendra TewariBelum ada peringkat

- Elasticity of SupplyDokumen11 halamanElasticity of Supply201222070% (1)

- Position Description WWF Serbia Operations ManagerDokumen3 halamanPosition Description WWF Serbia Operations ManagerMilica Lalovic-BozicBelum ada peringkat

- Tax invoice for ceiling fanDokumen1 halamanTax invoice for ceiling fansanjuBelum ada peringkat