Foreign Trade Policy

Diunggah oleh

Nilesh SolankiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Foreign Trade Policy

Diunggah oleh

Nilesh SolankiHak Cipta:

Format Tersedia

NATIONAL

FOREIGN TRADE

POLICY

WHY EXPORTS?

NATIONAL LEVEL

Develope foreign Exchange reserves & Improve

balance of Payment.

Better use of National/Natural Resources.

Technological Development.

Globalisation.

Reduction of Unemployment.

WHY EXPORTS?

COMPANY LEVEL

Use of Surplus Capacity.

Slack season Capacity Utilisation.

Economies of Scale-World is our Market

Globalisation.

Benifities.(Export Incentives).

International Exposure.

EXPORTS ( $ billion)

2009-2010- 182.

2010-2011- 250

2011-2012- 303

2012-2013- 300.60 (360).

2013-2014-325 (Revised from $500).

AGENCIES INVOLVED IN

EXPORT SHIPMENTS.

CUSTOMS. (MINISTRY OF FINANCE)

DGFT (MINISTRY OF COMMERCE).

PORTS. (MINISTRY OF SURFACE TRANSPORT).

CENTRAL EXCISE (MINISTRY OF FINANCE).

RESERVE BANK OF INDIA.

AUTHORISED DEALERS.

COMMERCIAL BANKS.

AGENCIES INVOLVED IN

EXPORT SHIPMENTS.

EXPORT PROMOTION COUNCIL.

CHAMBERS OF COMMERCE.

SALES TAX DEPARTMENT.

INCOME TAX DEPARTMENT

LOCAL AUTHORITIES (OCTROI/ TOT).

CUSTOM HOUSE AGENTS.

SHIPPING COS/AIRWAYS/ROAD TRANSPORT

FREIGHT FORWARDERS.

NVOCCS

EXPORT INSPECTION AGENCY.

AGENCIES INVOLVED IN

EXPORT SHIPMENTS.

PRIVATE INSPECTION AGENCIES.

TRANSPORTERS.

LOGISTICS CO.

ECGC.

MODUS OPERANDI OF SHIPMENTS.

PRESHIPMENT STAGE.

SHIPMENT STAGE.

POSTSHIPMENT STAGE.

PRESHIPMENT STAGE.

RECEIPT OF AN ENQUIRY.

QUOTATION TO CUSTOMER.

RECEIPT OF PURCHASE ORDER.

PROFORMA INVOICE TO CUSTOMER.

RECEIPT OF L/C.

ARRANGEMENT OF PRESHIPMENT

FINANCE.

DESPATCH FROM PLANT.

SHIPMENT STAGE.

PHYSICAL MOVEMNENT OF GOODS.

Dock Stuffing.

Factory Stuffing.

ICD- Dock Stuffing/Factory Stuffing.

PERMISSION FROM CUSTOMS.

PHYSICAL EXAMINATION.

OUT OF CHARGE.

LOADING OF CARGO ON VESSEL.

ADVANTAGES OF DOCK

STUFFING.

CHOICE OF SHIIPING CO.

IMMEDIATE DESPATCH OF

CONSIGNMENT ON TRUCKS/TRAILERS.

DETENTION OF CONT. AVOIDED.

SHORT SHIPMENT POSSIBLE.

SUITABLE FOR LCL CARGO.

DISADVANTAGES OF DOCK

STUFFING.

TIME CONSUMIG-.

MISHANDLING OF CONSIGNMENT.

IMPROPER STUFFING.

DEPENDENT ON CFS.

NON SUITABILITY FOR FRAGILLE

CARGO.

INCREASE IN LOGISTICS COST.

ADVANTAGES OF FACTORY

STUFFING.

TIME SAVING.

PROPER INHOUSE STUFFING AS PER

CUSTOMERS REQUIREMENT.

COST ADVANTAGE.

MINIMUM FORMALITIES AT GATEWAY

PORT.

UNLOADING OF CONT. WITHOUT

PASSING OF DOCUMENTS.

DISADVANTAGES OF FACTORY

STUFFING.

DETENTION OF CONT.IF

CONSIGNMENT DELAYED AT PLANT.

SHORT SHIPMENT NOT POSSIBLE.

DELAY IN DESPATCH DUE TO NON

ARRIVAL OF CONT. AT FACTORY.

WAITING PERIOD AT PORT IN CASE OF

MISSING OF VESSEL.

ADVANTAGES OF ICD.

QUICK PASSING OF DOCS.

MINIMUM FORMALITIES AT GATEWAY PORT.

BACKLOADING AT FACTORY POSSIBLE.

ARRIVAL OF CONT. AT BECK-N-CALL.

RAIL TRANSPORTATION IS CHEAPER THAN ROAD

TRANSPORTATION.

CARRYING CAPACITY IS MORE IN RAIL

TRANSPORTATION COMPARED TO ROAD

TRANSPORTATION.

CONGESTION AT PORT AVOIDED LEADING TO

SAVING IN LOGISTICS COST.

DISADVANTAGES OF ICD.

LIMITED CHOICE OF SHIPPING COS.

DELAY DUE TO TRANSPORT (RAIL/ROAD)

PROBLEM.

FULL CONTAINER LOAD TRAIN.

TRACKING OF CONT. DIFFICULT.

HOLDING OF CONTAINER DIFFICULT.

POSTSHIPMENT STAGE.

INFORM CUSTOMER SHIPMENT DETAILS.

ARRANGE FOR NEGOTIATION OF

DOCUMENTS.

COMPLETE PROOF OF EXPORT ACTIVITY.

CLAIM INCENTIVES FROM GOVT.

INCOTERMS

The Inco terms rules or International Commercial

Terms are a series of pre-defined commercial terms

published by the International Chamber of Commerce

(ICC) that are widely used in International commercial

transactions or procurement processes. A series of

three-letter trade terms related to common contractual

sales practices, the Inco terms rules are intended

primarily to clearly communicate the tasks, costs, and

risks associated with the transportation and delivery of

goods.

18

INCOTERMS

The Inco terms rules are accepted by

governments, legal authorities, and practitioners

worldwide for the interpretation of most

commonly used terms in international trade.

They are intended to reduce or remove

altogether uncertainties arising from different

interpretation of the rules in different countries.

As such they are regularly incorporated into

sales contracts worldwide.

19

INCOTERMS

First published in 1936, the Inco terms rules

have been periodically updated, with the eighth

versionInco terms 2010having been

published on January 1, 2011. "Inco terms" is a

registered trademark of the ICC.

20

INCOTERMS2000

Group E: EXW Ex works (. Named Place of Seller).

Group F: FCA Free Carrier (Named Place).

FAS Free alongside ship ( Named port of Shipment).

FOB Free on Board (. Named port of Shipment.).

Group C: CFR Cost & freight (. Named port of Destination).

CIF Cost, insurance & freight (. Named port of

Destination).

CPT Carriage paid to (. Named place of Destination).

CIP Carriage & Insurance Paid to (. Named place of

Destination).

Group D DAF Delivered at Frontier ( named place of Buyer)

DES Delivered EX Ship (. Named port of Destination)

DEQ Delivered Ex Quay (Duty paid) (. Named port of

Destination)

DDU Delivered Duty Unpaid (. Named place of Destination)

DDP Delivered Duty paid (. Named place of Destination)

INCOTERMS2010

Group E: EXW Ex works (. Named Place of Seller).

Group F: FCA Free Carrier (Named Place).

FAS Free alongside ship ( Named port of Shipment).

FOB Free on Board (. Named port of Shipment).

Group C: CFR Cost & freight (. Named port of Destination).

CIF Cost, insurance & freight (. Named port of

Destination).

CPT Carriage paid to (. Named place of Destination).

CIP Carriage & Insurance Paid to (. Named place of

Destination).

Group D DAT Delivered at Terminal (named terminal at port or

place of Destination)

DAP Delivered at Place (. Named place of Destination)

DDP Delivered Duty paid (. Named place ).

CHOOSING AN APPROPRATE

INCOTERMS.

SMALL EXPORTER EXPORTING TO BIG

CUSTOMER SHOULD OPT FOR EXW.

BIG EXPORTER EXPORTING TO SMALL

CUSTOMER SHOULD OPT FOR DDP.

EXPORTER HAVING GLOBAL TIE UP WITH

SHIPPING CO SHOULD OPT FOR FOB.

SPLIT THE TERMS IN CASE OF DDU & DDP

SHIPMENT.

COMPARE LOGISTICS COST WITH 3 PL &

SELECT AN INCOTERM.

FOREIGN TRADE POLICY

Exim Policy or Foreign Trade Policy is a set of

guidelines & instructions established by the DGFT in

matters related to Imports & Exports of goods in India.

The Foreign Trade policy is guided by the Foreign

Trade Development & Regulation Act , 1992.

In order to liberalize Imports & boost Exports the

Government of India has for the first time introduced

the Indian Exim Policy on April 1, 1992.

FOREIGN TRADE POLICY

1992-1997.

1997-2002.

2002-2004.

2004-2009

2009-2014

FOREIGN TRADE POLICY-2009-14

(KEY OBJECTIVES)

TO ARREST THE DECLINING EXPORT & REVERSE

TREND.

TO PROVIDE ADDITIONAL SUPPORT TO

EMLOYMENT INTENSIVE SECTORS.

TO REACH OUT TO NON TRADITIONAL

DESTINATIONS IN AFRICA, LATIN AMERICA & ASIA.

TO ENCOURAGE TECHNOLOGICAL UPGRADATION

OF EXPORT.

TO SIMPLIFY PROCEDURE FOR REDUCING

TRANSACTION COST.

Promotional Measures in

Department of Commerce. (CH-3)

ASSISTANCE TO STATE FOR INFRASRUCTURE

DEVELOPMENT OF EXPORT. (ASIDE).

MARKET ACCESS INITIATIVE. (MAI).

MARKETING DEVELOMENT ASSISTANCE (MDA).

MEETING EXPENSES FOR STATUTORY COMPLIANCES IN

BUYER COUNTRY FOR TRADE RELATED MATTER.

TOWNS OF EXPORT EXCELLANCE. (TFE).

BRAND PROMOTION & QUALITY.

TEST HOUSES.

EXPORT & TRADING HOUSE.

ELIGIBILITY

MERCHANT AS WELL AS MANUFACTURE EXPORTERS,

SERVICE EXPORTERS,SERVICE PROVIDERS, EOU& UNIT

LOCATED IN SPECIAL ECONOMIC ZONE (SEZ), AGRI

EXPORT ZONE, ELECTRONIC HARDWARE TECHNOLOGY PARK

(EHTPS),SOFTWARE TECHNOLOGY PARK (STPS), AND BIO

TECHNOLOGY PARKKS (BTPS), SHALL BE ELIGIBLE FOR

STATUS.

EXPORT & TRADING HOUSE.

STATUS CATEGORY

APPLICANT SHALL BE

CATEGORISED DEPENDING ON

HIS TOTAL (FOB), (FOR),(DEEMED

EXPORTS) PERFORMANCE DURING

CURRENT PLUS PREVIOUS THREE

YEARS (TAKEN TOGETGER)

UPON EXCEEDING LIMIT BELOW.

FOR (EH) EXPORT PERFORMNCCE

IS NECESSARY IN AT LEAST TWO

OF FOUR YEARS (I.E CURRENT

YEAR PLUS PREVIOUS YEAR).

STATUS

CATEGORY

EXPORT

PERFORMANCE

FOB/FOR VALUE

(RS. IN CRORES )

EXPORT HOUSE

(EH)

20

STAR EXORT

HOUSE (SEH )

100

TRADING

HOUSE (TH)

500

STAR TRADING

HOUSE ( STH)

2500

PREMIER

TRADING

HOUSE (PTH).

7500

EXPORT & TRADING HOUSE.

PREVILAGES OF EXPORT & TRADING HOUSE

HOLDERS.

AUTHORISATION OF CUSTOM CLEARANCE FOR BOTH IMPORT &

EXPORTS ON SELF DECLARATIN BASIS.

FIXATION OF INPUT OUT NORMS ON PRIORITY BASIS WITHIN 60 DAYS.

EXEMPTION FROM COMPULSORY NEGOTIATION OF DOCUMENTS.

100 % RETENTION OF FOREIGN EXCHANGE IF EEFC ACCOUNT.

EXEMPTION FROM FURNISHING OF BG IN SCHEMES UNDER FTP.

SEHS & ABOVE SHALL BE PERMITTED TO ESTABLISH WAREHOUSE.

STATUS HOLDERS OF SPECIFIC SECTORS SALL BE ELIGIBLE FOR

STATUS HOLDER INCENTIVE SCRIP.

STATUS HOLDERS OF AGRI SECTOR SHALL BE ELIGIBLE FOR AGRI

INFRASTRUCTURE INCENTIVE SCRIP. UNDER VKGUY.

SERVICE EXPORT.

SERVICES INCLUSE ALL 116 TRADABLE SERVICES COVERED

UNDER GENERALAGREEMENT ON TRADE IN SERVICES

(GATS) WHERE PAYMENT OF SUCH SERVICES IS RECEIVED IN

FREE FOREIGN EXCHANGE.

REGISTRATION CUM MEMBERSHIP CERTIFICATE (RCMC):

SOFTWARE EXPORTERS SHALL REGISTER THEMSELVES WITH

ELECTRONICS & SOFTWARE EPC. EXPORTERS OF 15 SPECIFIC

SERVICES REGISTER WITH SERVICES EPC. PTHER SERVICES

SHALL REGISTER WITH FIEO.

COMMON FACILITY CENTRES:

GOVERNMET SHALL PROMOTE ESTABLISHMENT OF CFC FOR USE

BY HOME-BASED SERVICE PROVIDERS IN DISTRICT LEVEL

TOWNS.

REWARDS/INCENTIVES SHEMES IN DGFT.

SERVED FROM INDIA SCHEME.(SFIS)-10 %.

VISHESH KRISHI GRAM UDYOG YOJANA

(VKGUY)- 5%.

AGRI INFRASTRUCTIRE INCENTIVE SCRIPS-

10%.

FOCUS MARKET SCHEME- 3%.

FOCUS PRODUCT SCHEME- 2%.

MARKET LINKED FOCUS PRODUCT SCRIPS.-

2%

STATUS HOLDERS INCENTIVE SCRIPS- 1%.

SERVED FROM INDIA

SCHEME.(SFIS).

Objective- To accelerate Growth in Export of

Services.

Eligibility.

Entitlement.- 10 %

Imports Allowed.

Non Transferability.

Procurement from Domestic Sources.

VISHESH KRISHI GRAM UDYOG

YOJANA (VKGUY).

Objective: Duty Credit Scrip benefits are

granted with an Aim to Compensate high

transport Costs, and to offset other

Disadvantages.

Entitlement- 5%. of FOB Value of Exports.

Agri Infrastructure Incentive Scrip- 10%. On

FOB .

Actual User Condition.

AGRI INFRASTRUCTIRE

INCENTIVE SCRIPS-

Status Holders ( having Status recognition for

the current year ) shall be granted Duty Credit

Scrip of 10 % of FOB value of Agricultural

Exports ( including VKGUY) subject to total

benifite does not exceed Rs. 100 Crores.

The following Capital Goods/Equipments

permitted to import.

Cold Storage units, Pack houses , reefer

Van/Containers subject to Actual User

Condition.

FOCUS MARKET SCHEME.

Objective is to offset high cost & other

externalities to select international markets with

a view to enhance Indias Export

competitiveness in these countries.

Entitlement- 3%. of FOB Value of Exports

FOCUS PRODUCT SCHEME.

Objective is to incentivise export of such

products which have high export intensity

/employment potential, so as to offset

infrastructure inefficiencies & other associated

costs involved in marketing of these products.

Entitlement- 2%. of FOB Value of Exports

STATUS HOLDERS INCENTIVE

SCRIPS.

Objective is to promote investment in up

gradation of technology of some specified

sectors.

Entitlement- 1%. of FOB Value of Exports.

Actual User Condition.

Sectors-Leather, Textiles. Handicrafts, Engg.

Sectors-Plastics, Basic Chemicals.

STATUS HOLDERS INCENTIVE

SCRIPS.

Counting of Commision-3% on FOB.

Free Transferability.

DUTY EXEMPTION SCHEME.-CH-4

DUTY EXEMPTION SCHEMES ENABLE DUTY

FREE IMPORT OF INPUTS REQUIRED FOR

EXPORT PRODUCTION.

DUTY EXEMPTION SCHEME CONSIST OF :

ADVANCE AUTHORISATION SCHEME.(AA).

DUTY FREE IMPORT AUTHORISATION.(DFIA).

DUTY REMISSION SCHEME.-CH-4

DUTY REMISSION SCHEME ENABLES POST EXPORT

REPLENISHMENT/REMISSION OF DUTY ON INPUTS

USED IN EXPORT PRODUCT.

DUTY REMISSION SCHEME CONSIST OF :

DUTY ENTITLEMENT PASSBOOK SCHEME(DEPB).

(Discontinued from 30.09.12).

DUTY DRAWBACK.

ADVANCE AUTHORISATION

SCHEME.(AAI)

An Advance Authorization is issued to allow duty free import of

inputs, which are physically incorporated in export product .

Duty free import of mandatory spares up to 10% of CIF value of

Authorization which are required to be exported/supplied with

resultant product.

Advance Authorization can be issued to either Manufacturer

Exporter or Merchant Exporter tied to Supporting

Manufacturers.

Advance Authorization are exempted from payment of basic

Customs duty, additional Customs duty, education cess,

antidumping duty & safeguard duty.

ADVANCE AUTHORISATION

SCHEME.(AAI).

Actual user Condition.

AAI issued for Physical Export, Intermediate Supplies.

Minimum value addition of 15 %.

In case of Authorization for Import of Tea minimum

Value Addition shall be 50%.

Free of Cost Supply by Foreign Buyer.

Export Obligation to be completed within 18 months.

Extension of EO up to 6 months.

Provision for BIFR Units.- EOP- 5 Years.

ADVANCE AUTHORISATION

SCHEME.(AAI).

Advance Authorization for Annual requirement-

up to 300% of the FOB value of Physical

Export and/or FOR value of Deemed Export in

preceding licensing year or Rs. 1 Crore,

whichever is higher.

Advance Release Order & Invalidation letter.

Authorization holder shall submit requisite

evidence of EO within Two months from the

date of Expiry.

44

ADVANCE AUTHORISATION

SCHEME.(AAI).

No export or Import of an item shall be allowed under

AAI/DFIA if the items is prohibited for Exports or

Imports.

Items reserved for import by STEs can not be

imported against AAI/DFIA however those items can

be procured from STEs against ARO or invalidation

letter.

Items reserved for Export by STEs can be Exported

under AAI/DFIA only after obtaining NOC from the

concerned STEs.

45

DUTY FREE IMPORT

AUTHORISATION SCHEME.(DFIA).

DFIA is issued to allow duty free import of inputs, fuel ,oil

,energy sources which are required for production of export

product .

DFIA shall be issued only for products for which SION have

been notified.

Minimum Value addition of 20%.

Pre-Export Authorization shall be issued with Actual user

condition & shall be exempted from payment of basic Customs

duty/excise duty, additional Customs duty, education cess,

antidumping duty & safeguard duty.

In case of post-Export DFIA, a merchant exporter shall be

required to mention only names & addresses of manufacturers of

the Export product.

DUTY FREE IMPORT

AUTHORISATION SCHEME.(DFIA).

Minimum value addition of 20 %.

Export Obligation to be completed within 18

months.

Re-export of goods imported under DFIA

scheme.`

Transferability of the DFIA.

DUTY ENTITLEMENT PASS

BOOK SCHEME.

Objective of DEPB is to neutralize incidence of

customs duty on import content of export

product. Duty credit under the scheme shall be

calculated by taking in to account deemed

import content of said export product as per

SION. Value addition achieved by export of

such product shall also be taken in to account

while determining the rate of duty credit under

the scheme.

DUTY ENTITLEMENT PASS

BOOK SCHEME.

Fixation of DEPB rate.

Provisional DEPB rate.

Port of Registration.

Credit under DEPB & Present Market Value.

Application of DEPB.

Monitoring of Realisation.

Time period.``

DUTY ENTITLEMENT PASS

BOOK SCHEME.

Frequency of Application.

Verification by customs.

Issuence of DEPB & other duty credit

certificates against lost EP copy of the Shipping

Bill.

DUTY DRAWBACK

The Duty Drawback seeks to rebate duty or tax

chargeable on any imported/excisable materials &

input services used in the manufacture of export

goods. The Duties & tax neutralized under the

Scheme are :-

Customs & Union Excise Duties in respect of

inputs.

Service Tax in respect of inputs.

51

DUTY DRAWBACK

DUTY DRAWBACK SCHEME COVERS ABOUT4000

ITEMS.

ALL INDUSTRY RATE.

DBK AMOUNT OR RATE SHOULD NOT EXCEED 1/3 rd

OF THE MARKET PRICE OF PRODUCT.

BRAND RATE WHICH IS VALID FOR ONE YEAR.

NO DRAWBACK IS ADMISSIBLE IF MARKET PRICE OF

THE GOODS IS LESS THAN THE AMOUNT OF

DRAWBACK.

AIR SHIPMENTS DBK SANCTIONED WITHOUT

DEDUCTING FREIGHT. FROM FOB CONTRACTED

FOB VALUE.

DUTY DRAWBACK

DBK AMOUNT DUE IS CREDITED IN OT EXPORTERS ACCOUNT

IN ANY BANK/BRANCH AFTER LEO & EGM FILED BY CARRIER.

DBK AMOUNT IS RECOVERABLE IF SALES PROCEEDS NOT

REALISED WITHIN THE TIME PERMITED BY RBI.

DOCUMENTS REQUIRED ALONGWITH DRAWBACK COPY OF

SHIPPING BILL.

(a) Copy of export contract or L/C.

(b) Copy of Packing List.

ARE-1/2

(d) Insurance Certificate wherever necessary.

(e) Copy of Brand Rate Sanction.

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG] [ 0 % ].-CH-5

ZERO DUTY EPCG SCHEME ALLOWS IMPORT OF CAPITAL GOODS

FOR PEEPRODUCTION, PRODUCTION & POST PRODUCTION

(INCLUDING CKD/SKD THEREOF AS WELL AS COMPUTER

SOFTWARE SYSTEM) AT 0% CUSTOMS DUTY SUBJECT TO

AN EXPORT OBLIGATION EQUIVALENT TO 6 TIMES OF DUTY

SAVED ON CAPITAL GOODS IMPORTED UNDER EPCG SCHEME ,

TO

BE COMPLETED IN 6 YEARS. THE ZERO DUTY EPCG SCHEME

SHALL BE IN OPERATION TILL 31.03.13.

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG] [ 3 % ].

EPCG SCHEME ALLOWS IMPORT OF CAPITAL GOODS

FOR PEEPRODUCTION, PRODUCTION & POST PRODUCTION

(INCLUDING CKD/SKD THEREOF AS WELL AS COMPUTER

SOFTWARE SYSTEM) AT 3 % CUSTOMS DUTY SUBJECT TO

AN EXPORT OBLIGATION EQUIVALENT TO 8 TIMES OF DUTY

SAVED ON CAPITAL GOODS IMPORTED UNDER EPCG SCHEME ,

TO

BE COMPLETED IN 8 YEARS.

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG].

AGRO UNITS, AND UNITS IN COTTAGE & TINY

SECTOR. (6 times duty saved & Eop is 12 years).

SSI UNITS CIF VALUE SHOULD NOT EXCEED Rs.50lakhs

& TOTAL INVESTMENT IN PLANT & MACHINERY

AFTER SUCH IMPORT SHOULD NOT EXCEED SSI

LIMITS. (6 times duty saved & Eop is 8 years).

IN CASE DUTY SAVED AMOUNT OF RS. 100 CRORES

OR MORE , (Eop is 12 years).

SECOND HAND CAPITAL GOODS, WITHOUT ANY

RESTRICTION CAN BE IMPORTED UNDER EPCG.

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG].

IMPORT OF MOTOR CARS,SUV/ALL PURPOSE

VEHICLES SHALL ONLY BE ALLOWED TO HOTELS,

TRAVEL AGENTS, TOUR OPERATOR OR TOUR

TRANSPORT OPERATORS & COMPANIES OWNING/

OPERATING GOLF RESORTS..

EPCG FOR PROJECTS.

EPCG FOR RETAIL SECTOR. ( Minimum Area of 1000 sq

meters) ( EO 8 TIMES IN 8 YEARS).

EPCG FOR ANNUAL REQUIREMENT.

ELIGIBILITY. ( Common Service Providers).

ACTUAL USER CONDITION.

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG].

EXPORT OBLIGATION.

PROVISION FOR BIFR UNITS.( EOP up to 12 Years).

EPCG FOR AGRO UNITS.

INDEGINOUS SOURCING OF CAPITAL GOODS &

BENIFITES TO DOMESTIC SUPPLIER.

TECHNOLOGICAL UPGRATION OF EXISTING EPCG

MACHINERY. ( Minimum period 5 ysars & minimum Export

made must be 40%).).

INCENTIVE FOR FAST TRACK COMPANIES

EXPORT PROMOTION CAPITAL GOODS

SCHEME[EPCG].

FOR UNITS LOCATED IN ARUNACHAL

PRADESH, ASSAM, MANIPUR,

MEGHALAYA,MIZORAM, NAGALAND ,

SIKKIM & TRIPURA, SPECIFIC EO SHALL

BE 25 % OF THE EO, AS STIPULATED

HOWEVER THERE SHALL BE NO

CHANGE IN AVERAGE EO AS

STIPULATED.

EPCG DUTY CALCULATION

EPCG DUTY SAVE & PAID

a ASS. VAL. 100000

b BASIC 10% 10 10000

a+b 110000

c CVD 12% 12 13200

d E. CESS 0% 0 0

e H.E.CESS 0% 0 0

b+c 23200

f = (b+c+d+e X2 %) E. CESS 2% 2 464

g = {b+c+d+e X1 %) H.E.CESS 1% 1 232

h = (a+b+c+d+e+f+g X 4 %) SAD 4% 4 4955.84

I = (b+c+d+e+f+g+h) TOTAL DUTY % 28851.84

j = (a X 3.09 %) EPCG DUTY PAID 3.09% 3.09 3090

k = (i-j) DUTY SAVE 25761.84

EPCG BOND AMOUNT

BOND

JNP , MUMBAI &

AIR

Duty save amt *18% *10 year + Duty save amt= Bond Amt

DUTY SAVE 25761.84

X 18 % 4637.13

X 10 YEARS 46371.31

BOND AMT 72133.15 (Pl take Round up Amt i.e. Rs.72140

EOU, EHTPS, STPS & BTPS-

CH-6

UNITS UNDRTAKING TO EXPORT THEIR ENTIRE

PRODUCTION OF GOODS & SERVICES (EXCEPT

PERMISSIBLE SALES IN DTA), MAY BE SET UP UNDER

THE EOU SCHEME, EHTP SCHEME, STP SCHEME OR BTP

SCHEME FOR MANUFACTURE OF GOODS, INCLUDING

REPAIR, REMAKING, RECONDITIONING, RE-

ENGINEERING & RENDERING OF SERVICES.

TRADING UNITS ARE NOT COVERED UNDER THESE

SCHEMES.

EOU, EHTPS, STPS & BTPS

EXPORT & IMPORT OF GOODS.

Export all kinds of goods & services except items that

are prohibited.

Export of Special chemicals, organisms, materials,

Equipment & Technologies (SCOMET) shall be

subject to fulfillment of the Conditions.

Import &/or procure, from DTA or bonded

warehouses in DTA without payment of Duty, all

types of goods, including Capital goods with Actual

user Condition.

EOU, EHTPS, STPS & BTPS

SECOND HAND CAPITAL GOODS.

Second hand Capital goods, without any age

limit , may also be imported duty free.

LEASING OF CAPITAL GOODS.

Source capital goods from a domestic / foreign

leasing company without payment customs /

excise duty.

Sell capital goods & lease back the same from a

NBFC.

64

EOU, EHTPS, STPS & BTPS

NET FOREIGN EXCHANGE EARNINGS.

Unit shall be a net foreign exchange earner

except for sector specific provision.

NFE earnings shall be calculated cumulatively in

blocks of 5 years, starting from commencement

of production.

BoA may also consider extension of block

period on case to case basis.

65

EOU, EHTPS, STPS & BTPS

LETTER OF PERMISSION/LOI & LEGAL

UUNDERTAKINGS.

LOP/LOI shall be issued by DC/designated

officer shall have initial validity of 3 years by

which time unit should have commenced

production.

Its validity may be further extended by 3 years

by competent authority however extension

beyond six year on exceptional circumstances.

66

EOU, EHTPS, STPS & BTPS

67

NET FOREIGN EXCHANGE EARNINGS.

Unit shall be a net foreign exchange earner except for sector

specific provision.

NFE earnings shall be calculated cumulatively in blocks of 5

years, starting from commencement of production.

BoA may also consider extension of block period on case to case

basis.

LOP/LOI valid for 5 years may be further extended by DC for 5

years at a time.

Unit shall execute an LUT with DC concerned.

EOU, EHTPS, STPS & BTPS

INVESTMENT CRITERIA

Only projects having a minimum investment of

Rs. 1 Cr. in plant & machinery shall be

considered for establishment as EOUs.

68

EOU, EHTPS, STPS & BTPS

APPLICATION & APPROVALS.

Shall be approved or rejected by the units

Approvals Committee within 15 days as per

criteria.

EOU, EHTPS, STPS & BTPS

DTA SALE OF FINISHED

PRODUCTS/REJECTS/WASTE/SCRAP/RE

MNANTS & BY-PRODUCTS.

Units, other than gems & jewellery units, may

sell goods up to 50% of FOB value of export,

subject to fulfillment of positive NFE.

Gems & jewellery units may sell up to 10% of

FOB value of exports of the preceding year in

DTA.

70

EOU, EHTPS, STPS & BTPS

Unless specifically prohibited in LOP, rejects

within an overall limit of 50% may be sold in

DTA on payment of duties as applicable. Sale of

rejects up to 5% of FOB value of exports shall

not be subject to achievement of NFE.

In case of new EOUs , advance DTA sale will

be allowed not exceeding 50% of its exports for

first year, except pharmaceutical units where this

will be based on estimated exports for two years.

71

EOU, EHTPS, STPS & BTPS

OTHER SUPPLIES .

Supplies effected in DTA to holders of Advance

Authorization/Advance Authorization for

annual requirement / DFIA under duty

exemption/remission scheme/ EPCG scheme.

Supplies effected in DTA against foreign

exchange remittances received from overseas.

Supplies to other EOUs.

72

EOU, EHTPS, STPS & BTPS

ENTITLEMENTS FOR SUPPLIES FROM

DTA.

Supplies from DTA to EOU/EHTP/STP/BTO

units will be regarded as Deemed Exports.

Reimbursement of Central Sales Tax (CST) on

goods manufactured in India.

Exemption from payment of Central Excise

Duty on goods procured from DTA on goods

manufactured in India.

73

EOU, EHTPS, STPS & BTPS

OTHER ENTITLEMENTS.

Exemption from Income Tax as per Section

10A & 10B of Income Tax Act.

Exemption for industrial licensing for

manufacture of items reserved for SSI sector.

Export proceeds will be realized within 12

months.

Units allowed to retain 100% of its export

earning in EEFC account.

74

EOU, EHTPS, STPS & BTPS

INTER UNIT TRANSFER.

Transfer of manufactured goods from one EOU

unit to another EOU unit is allowed with prior

intimation to concerned DC.

Capital goods may be transferred or given on

loan to other unit with prior intimation to

concerned DC.

75

EOU, EHTPS, STPS & BTPS

SUB-CONTRACTING.

Sub contract production processes to DTA

through job work which may also involve

change of form or nature of goods, thru job

work by units in DTA.

EOU with annual permission from customs,

undertake job work for Export, on behalf of

DTA exporter provided goods are directly

exported from EOU.

76

EOU, EHTPS, STPS & BTPS

SALE OF UN UNTILSED MATERIAL.

Transfer to another EOU/EHTP/STP/BTP.

Disposed off in DTA with Approval.

Exported .Such Transfer from

EOU/EHTP/STP/BTP unit to another such

unit would be treated as import for receiving

unit.

EOU, EHTPS, STPS & BTPS

RECONDITIONING/REPAIR & RE-

ENGINEERING.

REPLACEMENT/REPAIR OF

IMPORTED/INDIGENOUS GOODS.

EXIT FROM EOU SCHEME.

Unit proposing to exit out of EOU scheme

shall intimate DC & Central Excise authorities

in writing.

EOU, EHTPS, STPS & BTPS

EXIT FROM EOU SCHEME.

With approval of DC, an EOU may opt out of Scheme subject

to payment of Excise & Customs duties & industrial policy in

force.

If unit has not achieved obligations, it shall also be liable to

penalty at the time of exit.

CONVERSION.

Existing DTA units may also apply for Conversion in to an

EOU/EHTP/STP/BTP unit.

Existing EHTP/STP units may also apply for

conversion/merger to EOU unit vice versa.

EOU, EHTPS, STPS & BTPS

MONITORING OF NFE.

Performance of units shall be monitored by

Units Approval Committee.

EXPORT THROUGH

EXHIBITIONS/EXPORT PROMOTION

TOURS/SHOWROOMS ABROAD/DUTY

FREE SHOPS.

PERSONAL CARRIAGE OF

IMPORT/EXPORT PARCELS INCLUDING

THRU FOREIGN BOUND PASSENGERS.

EOU, EHTPS, STPS & BTPS

APPROVAL OF EHTP/STP.

In case of EHTP/STP schemes , necessary

approvals /permission shall be granted by

officer designated by Ministry of

Communication & Information technology,

instead of DC

APPROVAL OF BTP.

Approval by designated officer of department of

Biotechnology.

DEEMED EXPORT

DEEMED EXPORT REFER TO THOSE

TRANSACTIONS IN WHICH GOODS

SUPPLIED DO NOT LEAVE COUNTRY

AND PAYMENT FOR SUCH SUPPLIES IS

RECEIVED IN INDIAN RUPEES OR IN

FREE FOREIGN

DEEMED EXPORT.-CH-8

CATEGORIES OF SUPPLY.

BENIFITE TO DEEMED EXPORTS.

BENIFITE TO THE SUPPLIERS.

ELIGIBILITY FOR REFUND OF

TERMINAL EXCISE/ DUTY DRAWBACK.

SUPPLIES TO BE MADE BY THE

MAIN/SUB CONTRACTOR.

SPECIAL ECONOMIC ZONE

ASIAS FIRST EPZ WAS SET UP IN KANDLA IN

1965.

SEZ POLICY WAS AMENDED IN APRIL2000.

SEZS IN INDIA FUNCTIONED FROM 01.11.2000

TO 09.02.2006 UNDER THE PROVISION OF

FOREIGN TRADE PLOICY.

SEZ ACT 2005 SUPPORTED BY SEZ RULES

CAME IN TO EFFECT FROM 10.02.2006

PROVIDING FOR DRASTIC SIMPLIFICATION

OF PROCEDURES & FOR SINGLE WINDOW

CLEARANCE.

SPECIAL ECONOMIC ZONE

The main objectives of the SEZ Act are:

(a) generation of additional economic activity

(b) promotion of exports of goods and services;

(c) promotion of investment from domestic and

foreign sources;

(d) creation of employment opportunities;

(e) development of infrastructure facilities;

SPECIAL ECONOMIC ZONE

The SEZ Rules provide for:

Simplified procedures for development, operation, and

maintenance of the Special Economic Zones and for

setting up units and conducting business in SEZs;

Single window clearance for setting up of an SEZ;

Single window clearance for setting up a unit in a

Special Economic Zone;

Single Window clearance on matters relating to Central

as well as State Governments;

Simplified compliance procedures and documentation

with an emphasis on self certification

SPECIAL ECONOMIC ZONE

THE MAJOR INCENTIVES & FACILITIES.

Exemption from customs/excise duties for development of

SEZs for authorized operations approved by the BOA.

Income Tax exemption on income derived from the business of

development of the SEZ in a block of 10 years in 15 years under

Section 80-IAB of the Income Tax Act.

Exemption from minimum alternate tax under Section 115 JB of

the Income Tax Act.

Exemption from dividend distribution tax under Section 115O

of the Income Tax Act.

Exemption from Central Sales Tax (CST).

Exemption from Service Tax (Section 7, 26 and Second Schedule

of the SEZ Act).

SPECIAL ECONOMIC ZONE

OTHER BENIFITES

Exemption from Central Sales Tax / VAT (For input material used for

manufacturing for export purposes)

100% FDI through automatic route

Domestic Sales on payment of applicable duties by the buyer

External commercial borrowings by units up to $ 500 million a year allowed

without any maturity restrictions

No requirement for Import License

Freedom to bring in export proceeds without any time limit

Flexibility to keep 100% of export proceeds in EEFC account

Offshore banking unit

On-site custom house

Self-certification

Warehouses/ICD

SPECIAL ECONOMIC ZONE

(EXPORT PERFORMANCE)

Year Value (Rs. Crore) G.R ( over p.year )

2003-2004 13,854 39%

2004-2005 18,314 32%

2005-2006 22 840 25%

2006-2007 34,615 52%

2007-2008 66,638 93%

2008-2009 99,689 50%

2009-2010 2,20,711.39 121.40%

2011-2012 3,64,477.73 65 %

2012-2013 4,76,159.00 31 %

SPECIAL ECONOMIC ZONE

(HOW TO APPLY)

Any individual, co-operative society, company or partnership

firm can file an application for setting up of Special Economic

Zone. The application is to be made in Form-A to the concerned

State Government and the Board of Approval (BOA) in the

Department of Commerce, Government of India. However the

application would be considered by the BOA only when the

State Government recommendation is received.

SPECIAL ECONOMIC ZONE

MINIMUM AREA REQUIREMENT FOR SETTING

UP A SEZ ARE AS FOLLOWS:

MULTI SECTOR SEZ : 1000 HECTARES.

SPECIFIC SECTOR SEZ: 100 HECTARES.

FTWZ : 40 HECTARES.

IT/ITES/HANDICRAFTS 10 HECTARES.

HANDICRAFTS 10 HECTARES.

BIOTECHNOLOGY. 10 HECTARES.

GEMS & JEWELARY 10 HECTARES.

NON CONVENTIONAL ENERGY

10 HECTARES.

SEZ/EOU

EOU is a scheme with an applicable sunset clause whereas

SEZ is an Act. The SEZ scheme has many advantages over

the EOU scheme.

Net Foreign Exchange earnings as a percentage is not

applicable. Only units have to be NFE (net foreign exchange)

positive cumulatively at the end of 5 years.

Predetermined value addition is not compulsory.

No maturity restriction on external commercial borrowings

Duty free material could be utilized in five years time instead

of one year.

Self certification is applicable for imports and exports.

Mandatory period of 180 days for receipt of export proceeds

has been extended to 360 days.

As per Sunset Clause, STPI or EOU's may not be eligible for

any Income tax benefit u/s 10B, for exports affected after

31/03/11.

SEZ/EOU

Trading activity with Zero Value addition is allowed in SEZ.

Customs examination is to the minimum. SEZ units function on

self certification basis. The meaning of Hassle Free Zone clearly

originates from this concept. No Tax, No Duties, No Hurdles.

DTA exports are faster than EOU.

NFE is calculated on a simple formulae i.e. Exports (FOB value

of all exports) Imports (CIF value of all imports) > 0. In

simple words, if a unit is bringing in X amount foreign

exchange i.e. exports and is buying Y amount of foreign

exchange from the Government and if X is > Y even by 1$, it

has achieved a positive NFE.

Registration formalities for

Exports

Obtaining Permanent Account Number (PAN)

Opening bank Account

Registration for Organisation

Obtaining Importer-Exporter Code Number

(IEC No.)

Registration with VAT and Sales Tax Authority

Registration with Export Promotion Council

Registration formalities for Exports

Registration with Export Credit and Guarantee

Corporation of India (ECGC)

Registration with other Authorities

Federation of Indian Export Organisation

(FIEO)

Indian Trade Promotion Organisation (ITPO)

Chambers Of Commerce (COC)

Productivity Councils, etc.

IMPORTANCE OF EXPORT

DOCUMENTS .

NO. OF DOCUMENTS (HEAVY DOCUMENTATION).

INVOLVEMENT OF DIFF. GOVT.

AGENCIES/INSTITUTIONS.

COMPLEX FORMALITIES.

FOREIGN EXCHANGE INVOLVEMENT.

PAYMENT RISK.

RULES & REGULATIONS OF IMPORTING COUNTRY.

MULTIMODAL TRANSPORT.

DELIVERY COMMITMENT.

EXPORT INCENTIVE.

MULTIPLE TRANSFER OF TITLE.

TRANSACTION COST.

ELECTRONIC DATA INTERCHANGE

(EDI)

EDI IS THE COMPUTER TO COMPUTER EXCHANGE OF

BUSINESS DATA IN A PUBLICLY PUBLISHED &

GLOBALLY STANDARDISED FORMAT.

EDI IS THE TRANSFER OF STRUCTURED BUSINESS

DATA, BY AGREED MESSAGE STANDARDS, FROM

ONE COMPUTER APPLICATION TO ANOTHER BY

ELECTRONIC MEANS AND WITH A MINIMUM OF

HUMAN INTERVENTION.

1. PREVENTING CLERICAL ERROR.

2. TIME SAVING

3. REDUCTION IN TRANSACTION COST.

4. QUICK ACCESS TO INFORMATION BY USERS.

5. STRATEGIC INTEGRATION OF DATA.

6. MINIMISATION OF PAPER USE.

ADVANTAGES OF (EDI)

EXPORT DOCUMENTS

COMMERCIAL DOCUMENTS REGULATORY DOCUMENTS

1. Enquiry 1. Invoice (pre-shipment)

2. Purchase Order 2. Packing List (pre-shipment)

3. Proforma Invoice 3. Excise Challan

4. Commercial Invoice 4. ARE 1

5. Packing List 5. Annexure A or B

6. Shipping Instructions 6. Annexure C

7. Intimation for inspection 7. Declaration D

8. Certificate of inspection / Quality

Control.

8. Shipping Bill

9. Insurance Declaration 9. G.R./Statutory Declaration Form.

10. Certificate of Insurance 10. Freight Payment Certificate

11. Shipping Order

12. Mate Receipt

EXPORT DOCUMENTS

COMMERCIAL DOCUMENTS REGULATORY DOCUMENTS

13. Bill of Lading / Combined Transport

Documents.

14. Application for Certificate of Origin.

15. Certificate of Origin / GSP

16. Bill of Exchange / Sight Draft

17. Shipment Advice

18. Letter of Bank for collection /

negotiation of documents.

POST SHIPMENT DOCUMENTS REQUIRED

FOR NEGOTIATION

a) Covering letter to Bank.

b) Original L/C or Purchase Order

c) Bills of Exchange

d) Invoice

e) Consular Invoice

f) Packing List

g) Certificate of Origin or G.S.P.

h) B/L. (3) Originals.

i) Weighment Certificate

j) Test Certificate

k) Ins. Certificate in case of CIF.

l) Fumigation Certificate in case of Australia & USA.

m) Intermodal Certificate.

n) Packing declaration in case of Australia

o) Advance Cargo Declaration (CRF)

p) Third party inspection certificate (CRF)

q) Shipment Advice.

r) SDF Form (Duplicate copy)

s) Any other document as per requirement of L/C.

POST SHIPMENT DOCUMENTS REQUIRED

FOR NEGOTIATION

Certificate from Shipper reg. Sending of N/N documents.

Certificate from Shipper reg. Partial Qty as per P/I is of the same lot.

Certificate from Shipper that the goods are strictly as per Proforma

Invoice and are of Indian origin.

NVOCC B/L not acceptable.

Age certificate from shipping co.

Certificate from shipping co. reg. Non calling at Israeli port

Freight certificate as per requirement of L/C.

To check the quantity of Invoice with ARE-1 and Packing List.

To check whether the P.O. & / or L/C no. is correctly mentioned on

Preshipment documents. If the same are not available with us to send

message to HO/PLANT.

To check the Rate / Size / Value and description as per P.O. / L/C with the

Preshipment Invoice.

To mention commission as per Commission List. & also endorsement for

Incentive Scheme & EPCG Scheme.

To make Pre-shipment Invoice without mentioning commission, GR

Waived in case of FREE Sample Consignment.

To check the quantity as per the Packing List (Net weight / Gross Weight).

CHECK LIST

(FOR PRE-SHIPMENT DOCUMENTS)

To prepare the documents with clear copy of Purchase Order & / or L/C.

To check the Quantity / Rate / Value & Description as per the Pre-shipment central

excise attested Invoice.

To check No. of cases, Gross Weight / Nett Weights as per the Packing List.

B/L is prepared, as per L/C & or P.O. Description of Goods should be strictly as per

L/C & / or P.O. check last Date of Shipment and Expiry date as per the L/C

accordingly B/L date is to be taken. Claused B/L is to be avoided.

To check Shipper, Consignee, Notify party, Second Notify Party, Port of Destination

(via) final destination, Shipping Agents Name and Address and SHIPPED ON

BOARD stamp with date stamp.

CHECK LIST

(FOR POST-SHIPMENT DOCUMENTS)

CHECK LIST

(FOR POST-SHIPMENT DOCUMENTS)

To check the GR form (duplicate) thoroughly since GR cannot be

amended.

Original set of documents to be prepared strictly as per the L/C & /

or P.O.

Freight Certificate is to be attached together with the Original set of

documents.

Commission is not to be mentioned on any of the documents as in

some Countries like IRAN the Commission Payment is totally

banned.

All Certificates and documents are attached strictly as per the Terms

and Conditions of the L/C.

a)Clubbing of documents for big Order although dispatched in different lots.

b)To understand the psychology of people of Importing Country.

c)In case of USA, Intermodal Certificate is must. Due to Wt. Restriction in country.

d)In case of Australia Fumigation Certificate and Packing Declaration is must.

e)Inspection Certificate from Outside Agencies like S.G.S, OMIC & INTEPTECK.

f)Gulf documents to be prepared carefully as they are very strict.

g)Country requirement of inspection by S.G.S. or any other Agency.

h)Legislation.

Points to be noted while preparing

Final Post Shipment documents

107

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Final emDokumen19 halamanFinal emNilesh SolankiBelum ada peringkat

- Introductory PageDokumen20 halamanIntroductory PageNilesh SolankiBelum ada peringkat

- Home GroupDokumen1 halamanHome GroupNilesh SolankiBelum ada peringkat

- Franchising CCDDokumen33 halamanFranchising CCDNilesh SolankiBelum ada peringkat

- Introductory PageDokumen20 halamanIntroductory PageNilesh SolankiBelum ada peringkat

- Sony KodakDokumen54 halamanSony KodakNilesh SolankiBelum ada peringkat

- 3D Vacuum SublimationDokumen7 halaman3D Vacuum SublimationNilesh SolankiBelum ada peringkat

- CCD MarkettingDokumen47 halamanCCD Markettingmack2coolBelum ada peringkat

- Final ObDokumen50 halamanFinal ObNilesh SolankiBelum ada peringkat

- Samplebusinessplan 12711671623324 Phpapp02Dokumen21 halamanSamplebusinessplan 12711671623324 Phpapp02Nilesh SolankiBelum ada peringkat

- Compartive Study of Barista and CCDDokumen92 halamanCompartive Study of Barista and CCDanuvat143100% (2)

- The Promotional MixDokumen11 halamanThe Promotional MixNilesh SolankiBelum ada peringkat

- AsdDokumen16 halamanAsdNilesh SolankiBelum ada peringkat

- Cafe Coffe DayDokumen63 halamanCafe Coffe Dayanikettt67% (3)

- Wedding InvitationDokumen21 halamanWedding InvitationNilesh SolankiBelum ada peringkat

- Final ObDokumen50 halamanFinal ObNilesh SolankiBelum ada peringkat

- Sony KodakDokumen54 halamanSony KodakNilesh SolankiBelum ada peringkat

- Lays Potato ChipsDokumen7 halamanLays Potato ChipsSam RadcliffBelum ada peringkat

- Home GroupDokumen1 halamanHome GroupNilesh SolankiBelum ada peringkat

- Sonyfinalproject 100716092858 Phpapp01Dokumen17 halamanSonyfinalproject 100716092858 Phpapp01Nilesh SolankiBelum ada peringkat

- Shreeji TourismDokumen1 halamanShreeji TourismNilesh SolankiBelum ada peringkat

- Travel Agent Registration FormDokumen1 halamanTravel Agent Registration FormNilesh SolankiBelum ada peringkat

- Jet Airways Retrenchment Case StudyDokumen13 halamanJet Airways Retrenchment Case StudySimone Bandrawala50% (4)

- Organisational-Change Sony and KodakDokumen47 halamanOrganisational-Change Sony and KodakNilesh SolankiBelum ada peringkat

- Flip KartDokumen28 halamanFlip KartNilesh SolankiBelum ada peringkat

- Comparitivestudybetweenunclechipsandlays 140228120538 Phpapp02Dokumen85 halamanComparitivestudybetweenunclechipsandlays 140228120538 Phpapp02Nilesh SolankiBelum ada peringkat

- The Promotional MixDokumen11 halamanThe Promotional MixNilesh SolankiBelum ada peringkat

- Flipkart MarketingDokumen26 halamanFlipkart MarketingNilesh SolankiBelum ada peringkat

- Role of Packaging On Consumer Buying BehaviorDokumen119 halamanRole of Packaging On Consumer Buying BehaviorMuhammad AyazBelum ada peringkat

- Finalaaa Vijay MaliyaDokumen19 halamanFinalaaa Vijay MaliyaNilesh SolankiBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Consumer Behavior Assignment: Stimulus GeneralizationDokumen3 halamanConsumer Behavior Assignment: Stimulus GeneralizationSaurabh SumanBelum ada peringkat

- Coping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesDokumen208 halamanCoping With Institutional Order Flow Zicklin School of Business Financial Markets SeriesRavi Varakala100% (5)

- Ready To Eat Food DM20204Dokumen18 halamanReady To Eat Food DM20204Akai GargBelum ada peringkat

- No Shortchanging ActDokumen11 halamanNo Shortchanging ActDesiree Ann GamboaBelum ada peringkat

- Marketing Management Question Paper 2Dokumen1 halamanMarketing Management Question Paper 2Jeevan PradeepBelum ada peringkat

- One Point LessonsDokumen27 halamanOne Point LessonsgcldesignBelum ada peringkat

- Virata V Wee To DigestDokumen29 halamanVirata V Wee To Digestanime loveBelum ada peringkat

- Easyjet - A Marketing ProfileDokumen28 halamanEasyjet - A Marketing ProfilecharurastogiBelum ada peringkat

- Business Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonDokumen12 halamanBusiness Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonBhavin GhoniyaBelum ada peringkat

- MalluDokumen176 halamanMalluMallappaBelum ada peringkat

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDokumen21 halamanAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriBelum ada peringkat

- Stefan CraciunDokumen9 halamanStefan CraciunRizzy PopBelum ada peringkat

- Solutions ArtLog Edition9Dokumen15 halamanSolutions ArtLog Edition9scottstellBelum ada peringkat

- 1st Quarterly Exam Questions - TLE 9Dokumen28 halaman1st Quarterly Exam Questions - TLE 9Ronald Maxilom AtibagosBelum ada peringkat

- FMEA Training v1.1Dokumen78 halamanFMEA Training v1.1Charles Walton100% (1)

- Ch.4 - Cash and Receivables - MHDokumen75 halamanCh.4 - Cash and Receivables - MHSamZhaoBelum ada peringkat

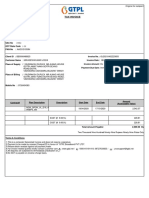

- Tax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJDokumen1 halamanTax Invoice: U64204GJ2008PTC054111 24AADCG1959N1ZA 9984 GJMrugesh Joshi50% (2)

- Mohamed Nada - Learn Pivot Tables in One Hour EbookDokumen37 halamanMohamed Nada - Learn Pivot Tables in One Hour EbookEjlm OtoBelum ada peringkat

- Management Accounting Perspective: © Mcgraw-Hill EducationDokumen12 halamanManagement Accounting Perspective: © Mcgraw-Hill Educationabeer alfalehBelum ada peringkat

- 5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)Dokumen23 halaman5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)sen2natBelum ada peringkat

- Assignment For CB TechniquesDokumen2 halamanAssignment For CB TechniquesRahul TirmaleBelum ada peringkat

- Finacle - CommandsDokumen5 halamanFinacle - CommandsvpsrnthBelum ada peringkat

- Advanced Competitive Position AssignmentDokumen7 halamanAdvanced Competitive Position AssignmentGeraldine Aguilar100% (1)

- Personal Selling in Pharma Marketing: Shilpa GargDokumen17 halamanPersonal Selling in Pharma Marketing: Shilpa GargNikhil MahajanBelum ada peringkat

- Strategic Management Nokia Case AnalysisDokumen10 halamanStrategic Management Nokia Case Analysisbtamilarasan88100% (1)

- Risk Chapter 6Dokumen27 halamanRisk Chapter 6Wonde BiruBelum ada peringkat

- Progress Test 4 KeyDokumen2 halamanProgress Test 4 Keyalesenan100% (1)

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDokumen18 halamanIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaBelum ada peringkat

- Icici BankDokumen99 halamanIcici BankAshutoshSharmaBelum ada peringkat

- Bahan Presentasi - Kelompok 3 - Supply ChainDokumen46 halamanBahan Presentasi - Kelompok 3 - Supply ChainpuutBelum ada peringkat