Financial Statement Analysis Session 1

Diunggah oleh

Vignan MadanuDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Financial Statement Analysis Session 1

Diunggah oleh

Vignan MadanuHak Cipta:

Format Tersedia

Financial

statement

analysis

Financial Statements Basic Relationships

Financial Statements

Cash Flow Statement

Profit & Loss Account Balance Sheet

Primary

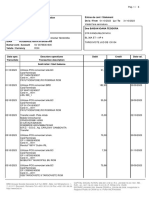

Tools India Ltd.

Profit & Loss Account

For the year ended December 31, 2000

Amount in 000 in Rs.

Sales Net

255

Other income 5

Total Revenue 260

Cost of goods sold 130

Gross profit 130

Operating expenses:

Personnel 49

Depreciation 11

Other expenses 28

Operating profit 42

Interest 12

Profit before taxes 30

Income tax provision 12

Net profit after tax 18

Data used for analysis

Absolute terms (Size issue)

Net profits of Companies X, Y and Z; for

the year ended 31

st

March, 2010 are Rs.

100 each.

Sales of Companies X, Y and Z for the

year ended 31

st

March, 2010 are Rs.

1000, 10,000, 20,000 each

Net profit to sales ratio for X, Y, Z stands

at 10%, 1% and 0.5%

Data in relational form

Analysis within one financial statement??

Common size statements/intra component

analysis

Analysis across financial statements??

Ratio analysis/inter component analysis

Data in comparative form

Comparisons of current performance can

be made:

With Companys past performance (trend

analysis/longitudinal analysis)

With Competing Firms (Cross section analysis)

Comparison of same variable over number of years

and across competing firms (pooled analysis)

With Industry averages

With pre determined standards or budgets (for

internal users)

Financial analysis cont..

Year/Company X Y Z

Industry

average

Y1 10 160 150 106.67

Y2 20 155 135 103.33

Y3 30 150 120 100.00

Y4 40 145 105 96.67

Y5 50 140 90 93.33

Y6 60 135 75 90.00

Y7 70 130 60 86.67

Y8 80 125 45 83.33

Y9 90 120 30 80.00

Y10 100 115 15 76.67

(sales in 000s in Rs.)

Time series analysis

10

20

30

40

50

60

70

80

90

100

0

20

40

60

80

100

120

Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10

X

X

Cross section analysis

10

160

150

0

20

40

60

80

100

120

140

160

180

X Y Z

Y1

Y1

Cross section analysis

0

20

40

60

80

100

120

140

X Y Z

Y10

Y10

Pooled series analysis

10

20

30

40

50

60

70

80

90

100

160

155

150

145

140

135

130

125

120

115

150

135

120

105

90

75

60

45

30

15

0

20

40

60

80

100

120

140

160

180

Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10

X

Y

Z

Industry level comparison

0

20

40

60

80

100

120

140

160

180

Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y8 Y9 Y10

X

Y

Z

Industry average

Industry level comparison

Common size financial statements/

intra-component analysis

Express each item on a particular statement

as a percentage of a single base amount.

Total assets

on the balance

sheet

Net sales

on the income

statement

Common size financial statements/

intra-component analysis

Balance sheet of Vinyl Chemicals Limited as

on 31

st

March..

All figures in Rs. Crores

Liabilities 2002 2001 Assets 2002 2001

Current liabilities 8.18 8.64

Cash and bank

balance 1.01 1

Long term

liabilities 12.32 8.08

Accounts

receivables 16.74 13.01

Owners' equity 53.18 49.55

Loans and

advances 3.76 3.44

Inventories 11.53 11.98

Total current assets 33.04 29.43

Other Assets 3.42 4.41

Fixed assets (net) 37.22 32.43

Total 73.68 66.27 Total 73.68 66.27

Vinyl Chemicals Ltd. is a mid

sized organic chemicals

manufacturer owned by the

Pidilite Parekh group

Common size/Intra component analysis for

balance sheet

Liabilities 2002 2001 Assets 2002 2001

Current liabilities 11.10 13.04

Cash and bank

balance 1.37 1.51

Long term liabilities 16.72 12.19 Accounts receivables 22.72 19.63

Owners' equity 72.18 74.77 Loans and advances 5.10 5.19

Inventories 15.65 18.08

Total current assets 44.84 44.41

Other Assets 4.64 6.65

Fixed assets (net) 50.52 48.94

Total 100 100 Total 100 100

Assets

Industry

average 2002 2001

Cash and bank balance 2.00 1.37 1.51

Accounts receivables 21.00 22.72 19.63

Loans and advances 7.00 5.10 5.19

Inventories 25.00 15.65 18.08

Total current assets 55.00 44.84 44.41

Other Assets 3.4 4.64 6.65

Fixed assets (net) 41.60 50.52 48.94

Total 100 100 100

Assets side

Liabilities side

Liabilities

Industry

average 2002 2001

Current liabilities 12 11.10 13.04

Long term liabilities 22 16.72 12.19

Owners' equity 66 72.18 74.77

Total 100 100 100

Income statement of Vinyl Chemicals

Limited for the year ended 31

st

March..

All figures in Rs. Crores

2002 2001

Net Sales 92.46 88.18

COGS (87.17) (90.04)

Gross Profits 5.29 -1.86

Non -operating incomes 3.18 1.11

Interest expense (0.82) (0.58)

Profits before taxes 7.65 -1.33

Taxes (1.62) 0

Profits after taxes 6.03 -1.33

Dividends 1.83 0

Common size/Intra component

analysis for income statement

2002 2001

Net Sales 100.00 100.00

COGS (94.28) (102.11)

Gross Profits 5.72 -2.11

Non -operating incomes 3.44 1.26

Interest expense (0.89) (0.66)

Profits before taxes 8.27 -1.51

Taxes (1.75) 0.00

Profits after taxes 6.52 -1.51

Dividends 1.98 0.00

Common size/Intra component

analysis for income statement

Industry

average 2002 2001

Net Sales 100 100.00 100.00

COGS (83) (94.28) (102.11)

Gross Profits 17 5.72 -2.11

Non -operating incomes 0.5 3.44 1.26

Interest expense (1.5) (0.89) (0.66)

Profits before taxes 16 8.27 -1.51

Taxes (5) (1.75) 0.00

Profits after taxes 11 6.52 -1.51

Dividends 5 1.98 0.00

Ratio analysis/Inter component

analysis

Financial ratios

Liquidity ratios

Efficiency ratios

Current assets

Long lived assets

Solvency ratios (financial leverage)

Profitability ratios

Margin on sales

Overall profitability/Return on investment

Liquidity ratios

Current Assets

Current Ratio =

Current Liabilities

Factors to be considered:

Composition of current assets

Speed of conversion of current assets

into cash

Speed of maturity of current liabilities

Liquidity ratios cont

Quick (Acid-Test) Ratio (QR)

Current Assets Inventory prepaid expense

QR =

Current Liabilities

Absolute liquid ratio (ALR) =

Absolute liquid assets

ALR = Current Liabilities

Absolute liquid assets = Cash + Bank Balance +

Marketable Securities

Expenses Cover

Expense cover ratio (ECR) =

Cash and cash equivalents

ECR =

Average daily operating expenses

Measured in days

Example

Particulars 20X4 20X3

Cash (Rs Million) 19 11

Average Daily expenses (Rs Million) 0.6027 0.5726

Cash holding

sufficient for a

months

expenses

Cash cover (number of days) 32 19

The balance sheet of Shreyas Ltd. as on 31

st

March, 2006 was follows:

Liabilities Rs. Assets Rs.

Share capital 650000 Goodwill 265500

Capital Reserve 2500 Land 129000

General Reserve 162910 Premises 150000

P&L A/c 18777 Plant 234395

5% Debentures 157500 Furniture 8575

Sundry Creditors 73900 Stock 196770

Proposed Dividends 75000 Debtors 227617

Provision for Taxation 25000 MF Liquid Scheme Units 71400

Cash and Bank 121280

Total 1165587 Total 1165587

From the above information compute:

a) Current Ratio

b) Quick Ratio

c) Absolute liquid ratio

Anda mungkin juga menyukai

- Regions Bank StatementDokumen1 halamanRegions Bank Statementdudu adulBelum ada peringkat

- Cooper Excel FileDokumen17 halamanCooper Excel Filecvelm001Belum ada peringkat

- Marketing Plan For TRACTOR - Group 2Dokumen25 halamanMarketing Plan For TRACTOR - Group 2Vignan Madanu67% (9)

- VPA Cheat SheetDokumen5 halamanVPA Cheat SheetSharma comp71% (7)

- Industrial Marketing - Krishna HavaldarDokumen276 halamanIndustrial Marketing - Krishna HavaldarImtiyaz Qureshi40% (5)

- NISMDokumen167 halamanNISMprashant_agharkar9257Belum ada peringkat

- Topic 03 - Double Entry SystemDokumen37 halamanTopic 03 - Double Entry SystemNorainah Abdul GaniBelum ada peringkat

- 6.4-Case Study APA Paper 15-2 and 16-1 - Document For Financial Accounting TheoryDokumen11 halaman6.4-Case Study APA Paper 15-2 and 16-1 - Document For Financial Accounting TheorySMWBelum ada peringkat

- Tata Motors Annual Report 2007 08Dokumen124 halamanTata Motors Annual Report 2007 08MorningLight97% (31)

- Financial Statements: An OverviewDokumen34 halamanFinancial Statements: An OverviewMUSTAFA KAMAL BIN ABD MUTALIP / BURSAR100% (1)

- Terminology Balance SheetDokumen3 halamanTerminology Balance SheetMarcel Díaz AdriàBelum ada peringkat

- MBATaxDokumen24 halamanMBATaxFilsufGorontaloBelum ada peringkat

- Final Module Public FinanceDokumen7 halamanFinal Module Public FinanceRomel Remolacio AngngasingBelum ada peringkat

- Agreement.: Dissolution IsDokumen4 halamanAgreement.: Dissolution IsClauie BarsBelum ada peringkat

- Advance Accounting TheoryDokumen27 halamanAdvance Accounting TheorykailashdhirwaniBelum ada peringkat

- Income Tax Under Canadian RegulationsDokumen10 halamanIncome Tax Under Canadian Regulationshemayal0% (1)

- CH 17 SolDokumen52 halamanCH 17 SolCarlos J. Cancel AyalaBelum ada peringkat

- Tax PlanningDokumen12 halamanTax PlanningPrince RajputBelum ada peringkat

- CHAP 13 Partnerships and Limited Liability CorporationsDokumen89 halamanCHAP 13 Partnerships and Limited Liability Corporationspriyankagrawal7100% (1)

- Accounting NotesDokumen106 halamanAccounting NotesjayedosBelum ada peringkat

- Basic Financial Statements NotesDokumen6 halamanBasic Financial Statements NotesNBelum ada peringkat

- Statement of Cash Flows: HOSP 2110 (Management Acct) Learning CentreDokumen6 halamanStatement of Cash Flows: HOSP 2110 (Management Acct) Learning CentrePrima Rosita AriniBelum ada peringkat

- Income and Expenditures Account by HM RanaDokumen36 halamanIncome and Expenditures Account by HM RanaIcap FrtwoBelum ada peringkat

- Financial Statement Analysis PDFDokumen16 halamanFinancial Statement Analysis PDFLara CelestialBelum ada peringkat

- TaxACT Form 1120 Facts ABC Inc 2016 Tax ReturnDokumen2 halamanTaxACT Form 1120 Facts ABC Inc 2016 Tax ReturnMD_ARIFUR_RAHMAN0% (2)

- Sample Chart of AccountsDokumen3 halamanSample Chart of Accountsanah ÜBelum ada peringkat

- What Is The Indirect MethodDokumen3 halamanWhat Is The Indirect MethodHsin Wua ChiBelum ada peringkat

- Course: Advanced Auditing: Course Code: Credit HoursDokumen32 halamanCourse: Advanced Auditing: Course Code: Credit HoursEyayaw AshagrieBelum ada peringkat

- PartnershipDokumen41 halamanPartnershipBinex67% (3)

- Capital Gains Tax: © AccaDokumen29 halamanCapital Gains Tax: © AccaRai Ali WafaBelum ada peringkat

- FHV - Inventories PPT (10032020)Dokumen60 halamanFHV - Inventories PPT (10032020)Kristine TiuBelum ada peringkat

- FR17 - Employee Benefits (Stud) .Dokumen45 halamanFR17 - Employee Benefits (Stud) .duong duongBelum ada peringkat

- Basics of Financial Accounting - 1Dokumen40 halamanBasics of Financial Accounting - 1Dr.Ashok Kumar PanigrahiBelum ada peringkat

- Payment Service Provider/ Emi License.: (Global Accreditation)Dokumen4 halamanPayment Service Provider/ Emi License.: (Global Accreditation)PSP LICENCEBelum ada peringkat

- 12 Audit ReportsDokumen16 halaman12 Audit ReportsZindgiKiKhatirBelum ada peringkat

- CSR Theories and ModelsDokumen20 halamanCSR Theories and Modelsgabrielle doBelum ada peringkat

- Income Tax Handbook 2021-22Dokumen66 halamanIncome Tax Handbook 2021-22Shahabuddin LimonBelum ada peringkat

- Full Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloDokumen72 halamanFull Cost Accounting: Dela Cruz, Roma Elaine Aguila, Jean Ira Bucad, RoceloJean Ira Gasgonia Aguila100% (1)

- Chapter 3 AccountingDokumen11 halamanChapter 3 AccountingĐỗ ĐăngBelum ada peringkat

- Funds Flow StatementDokumen3 halamanFunds Flow StatementKalappa LavanyaBelum ada peringkat

- Understanding Financial Statements of Life Insurance Corporation of IndiaDokumen50 halamanUnderstanding Financial Statements of Life Insurance Corporation of IndiaSaurabh TayalBelum ada peringkat

- Accounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceDokumen13 halamanAccounting Information and Value Relevance in An Economy Under Recession: The Nigeria ExperienceInternational Journal of Accounting & Finance ReviewBelum ada peringkat

- Chap 17Dokumen34 halamanChap 17ridaBelum ada peringkat

- No Telephone Fax: Branches in Addis AbabaDokumen35 halamanNo Telephone Fax: Branches in Addis AbabaHay Jirenyaa100% (1)

- Accounting 5 - Closing EntriesDokumen13 halamanAccounting 5 - Closing EntriesOanh NguyenBelum ada peringkat

- Residential StatusDokumen17 halamanResidential Statussaif aliBelum ada peringkat

- Consolidated Financial Statements - IFRS 10Dokumen3 halamanConsolidated Financial Statements - IFRS 10akii ramBelum ada peringkat

- LECTURE 8 - Mergers - AcquisitionDokumen34 halamanLECTURE 8 - Mergers - AcquisitionYvonneBelum ada peringkat

- Money and Banking: Chapter - 8Dokumen36 halamanMoney and Banking: Chapter - 8Nihar NanyamBelum ada peringkat

- Fundamentals of Financial Auditing 1Dokumen24 halamanFundamentals of Financial Auditing 1Raja Ghufran Arif100% (1)

- Tax Calendar 2022 GUIDEDokumen84 halamanTax Calendar 2022 GUIDEETHEL NAGANAGBelum ada peringkat

- FMI Class - Chap 2Dokumen29 halamanFMI Class - Chap 2ruman mahmoodBelum ada peringkat

- Chapter 1Dokumen30 halamanChapter 1Yitera SisayBelum ada peringkat

- Module 2 Capital Budgeting Net Present Value and Other Investment CriteriaDokumen70 halamanModule 2 Capital Budgeting Net Present Value and Other Investment CriteriaJoyal jose100% (1)

- The Profit and Loss Appropriation AccountDokumen4 halamanThe Profit and Loss Appropriation AccountSarthak GuptaBelum ada peringkat

- Accounting As An Information SystemDokumen14 halamanAccounting As An Information SystemAimee SagastumeBelum ada peringkat

- Acountancy 10Dokumen129 halamanAcountancy 10Erfan Bhat0% (1)

- Accounting Exam PART 3Dokumen13 halamanAccounting Exam PART 3Nanya BisnestBelum ada peringkat

- Depreciation: Depreciation Is A Term Used inDokumen10 halamanDepreciation: Depreciation Is A Term Used inalbertBelum ada peringkat

- IAS 1 Presentation of Financial StatementsDokumen33 halamanIAS 1 Presentation of Financial StatementsAbdullah Shaker TahaBelum ada peringkat

- COST - Quizzer No. 1Dokumen10 halamanCOST - Quizzer No. 1Ryan JulapongBelum ada peringkat

- Murphy 2019 SM CH01Dokumen55 halamanMurphy 2019 SM CH01kevin ChenBelum ada peringkat

- ch03 SM Leo 10eDokumen72 halamanch03 SM Leo 10ePyae PhyoBelum ada peringkat

- Profit and Loss AccountDokumen15 halamanProfit and Loss AccountLogesh Waran100% (1)

- Ratio AnalysisDokumen50 halamanRatio AnalysisSweetie Arshad AliBelum ada peringkat

- Session 1 Financial Accounting Infor Manju JaiswallDokumen41 halamanSession 1 Financial Accounting Infor Manju JaiswallpremoshinBelum ada peringkat

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryDari EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- 173995519Dokumen241 halaman173995519Vignan MadanuBelum ada peringkat

- GatecutoffDokumen12 halamanGatecutoffVignan MadanuBelum ada peringkat

- Financial Statement Analysis Session 1Dokumen31 halamanFinancial Statement Analysis Session 1Vignan MadanuBelum ada peringkat

- MAJVCG A Groups PDFDokumen2 halamanMAJVCG A Groups PDFVignan MadanuBelum ada peringkat

- MOS Group2 Ann StarDokumen3 halamanMOS Group2 Ann StarVignan MadanuBelum ada peringkat

- GatecutoffDokumen12 halamanGatecutoffVignan MadanuBelum ada peringkat

- Service Quality Delivery of Reliance FreshDokumen55 halamanService Quality Delivery of Reliance FreshTushar PatelBelum ada peringkat

- TMDokumen124 halamanTMVignan MadanuBelum ada peringkat

- The Impact of Digital Environment: " Nexpensive " ErvasiveDokumen1 halamanThe Impact of Digital Environment: " Nexpensive " ErvasiveVignan MadanuBelum ada peringkat

- Comparative Analysis of Working Capital Management of Agro Tech Foods LTDDokumen4 halamanComparative Analysis of Working Capital Management of Agro Tech Foods LTDVignan MadanuBelum ada peringkat

- QuotesDokumen1 halamanQuotesVignan MadanuBelum ada peringkat

- Successfully Outsourcing Formulation Development: Considerations For Emerging Biopharmaceutical CompaniesDokumen6 halamanSuccessfully Outsourcing Formulation Development: Considerations For Emerging Biopharmaceutical CompaniesVignan MadanuBelum ada peringkat

- Keynotes Copper Report 31jan13Dokumen8 halamanKeynotes Copper Report 31jan13Vignan MadanuBelum ada peringkat

- Enshrine Case Study by Ushr and Tfi4Dokumen4 halamanEnshrine Case Study by Ushr and Tfi4Vignan MadanuBelum ada peringkat

- Excel SolverDokumen8 halamanExcel SolverVignan Madanu100% (1)

- History of BankDokumen12 halamanHistory of BankvanpariyabhumikaBelum ada peringkat

- Kendriya Vidyalaya No.1 Kunjaban, Agartala Tripura: Submitted By: Aboya DebbarmaDokumen12 halamanKendriya Vidyalaya No.1 Kunjaban, Agartala Tripura: Submitted By: Aboya Debbarmaakash debbarmaBelum ada peringkat

- Chapter 6 - Money MarketsDokumen47 halamanChapter 6 - Money MarketsBeah Toni PacundoBelum ada peringkat

- Chapter 3Dokumen8 halamanChapter 3Nigussie BerhanuBelum ada peringkat

- Group 4 - Banking Law Assignment - Forex BureausDokumen24 halamanGroup 4 - Banking Law Assignment - Forex Bureausmoses machiraBelum ada peringkat

- Bond and Stock ValuationDokumen14 halamanBond and Stock ValuationadikopBelum ada peringkat

- Simarleen Kaur 1222Dokumen4 halamanSimarleen Kaur 1222simar leenBelum ada peringkat

- CRANBERRY PLC Scenario Chapter 12Dokumen3 halamanCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngBelum ada peringkat

- Ruchi BlackbookDokumen45 halamanRuchi BlackbookRUCHI PADHIYARBelum ada peringkat

- Receivable FINANCING PDFDokumen30 halamanReceivable FINANCING PDFChristian Blanza LlevaBelum ada peringkat

- Enterprise Risk ManagementDokumen29 halamanEnterprise Risk ManagementSujeewa LakmalBelum ada peringkat

- 2595 5165 1 SMDokumen4 halaman2595 5165 1 SMJatinder KumarBelum ada peringkat

- Audit of Property, Plant & EquipmentDokumen51 halamanAudit of Property, Plant & EquipmentKristina KittyBelum ada peringkat

- Retirement and Dissolution of Firm Class TestDokumen2 halamanRetirement and Dissolution of Firm Class TestHarish RajputBelum ada peringkat

- SV39786361600 2023 10Dokumen6 halamanSV39786361600 2023 10ioanateodorabaisanBelum ada peringkat

- AppendixDokumen30 halamanAppendixLeigh Arrel DivinoBelum ada peringkat

- Personal Finance For Canadians 9th Edition Currie Solutions ManualDokumen9 halamanPersonal Finance For Canadians 9th Edition Currie Solutions ManualLesterBriggssBelum ada peringkat

- Ch3 - test bank: corporate finance (ةقراشلا ةعماج)Dokumen25 halamanCh3 - test bank: corporate finance (ةقراشلا ةعماج)sameerBelum ada peringkat

- KYC Services: You Are KYC Compliant!!! This KYC Confirmation Can Be Used For All Securities Accounts!!!Dokumen1 halamanKYC Services: You Are KYC Compliant!!! This KYC Confirmation Can Be Used For All Securities Accounts!!!Divya UpadhayayBelum ada peringkat

- NorQuant Multi-Asset Fund White Paper 2023Dokumen24 halamanNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikBelum ada peringkat

- BM10 Q4W3 VinalonDokumen4 halamanBM10 Q4W3 VinalonQuaintrell ArtsBelum ada peringkat

- Fiscal Management Report 2016Dokumen123 halamanFiscal Management Report 2016Ada DeranaBelum ada peringkat

- Commercial Bank of EthiopiaDokumen3 halamanCommercial Bank of EthiopiaEmiru ayalew100% (1)

- AramcoGoldCoins FOFOA032210Dokumen15 halamanAramcoGoldCoins FOFOA032210Christien PetrieBelum ada peringkat

- Secured Transactions: UCC Title 9Dokumen17 halamanSecured Transactions: UCC Title 9Rebel X86% (7)

- Responsi Akkeu 2 EquityDokumen36 halamanResponsi Akkeu 2 EquityAngel Valentine TirayoBelum ada peringkat

- Countif Sumif ExercisesDokumen18 halamanCountif Sumif Exerciseskemalll100% (1)