Basic Management Accounting Concepts

Diunggah oleh

lita2703Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

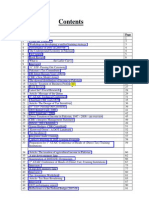

Basic Management Accounting Concepts

Diunggah oleh

lita2703Hak Cipta:

Format Tersedia

2 -1

Basic

Management

Accounting

Concepts

CHAPTER

2 -2

1. Describe the cost assignment process.

2. Define tangible and intangible products and

explain why there are different product cost

definitions.

3. Prepare income statements for manufacturing

and service organizations.

4. Outline the differences between functional-

based and activity-based management

accounting systems.

Objectives

After studying this

chapter, you should

be able to:

2 -3

Exactly what is

meant by cost?

Cost is the cash or cash-equivalent value

sacrificed for goods and services that is

expected to bring a current or future

benefit to the organization.

I see Its a dollar

measure of the

resources used to

achieve a given

benefit.

2 -4

A cost object is any item such as products,

customers, departments, projects, activities, and

so on, for which costs are measured and assigned.

Example: A bicycle is a cost object when you are

determining the cost to produce a bicycle.

An activity is a basic unit of work performed

within an organization.

Example: Setting up equipment, moving materials,

maintaining equipment, designing products,

etc.

2 -5

Traceability is the ability to assign a cost to a

cost object in an economically feasible way by

means of a cause-and-effect relationship.

Direct costs are those costs that can be easily

and accurately traced to a cost object.

Example: I f a hospital is the cost object,

the cost of heating and

cooling the hospital is

a direct cost.

2 -6

I ndirect costs are those costs that cannot be

easily and accurately traced to a cost object.

Example: The salary of a plant manager, where

departments within the plant are defined

as the cost objects.

2 -7

Tracing is the actual assignment of costs to a cost

object using an observable measure of the resources

consumed by the cost object. Tracing costs to cost

objects can occur in the following two ways:

Direct tracing is the process of identifying and assigning

costs that are exclusively and physically associated with a

cost object to that cost object.

Driver tracing is the use of drivers to assign costs to cost

objects. Drivers are observable causal factors that

measure a cost objects resource consumption.

2 -8

Cost Assignment Methods

Cost of Resources

Direct

Tracing

Driver

Tracing

Allocation

Physical

Observation

Causal

Relationship

Assumed

Relationship

Cost Objects

2 -9 I nterface of Services with

Management Accounting

1. Intangibility

2. Perishability

3. Inseparability

4. Heterogeneity

Services cannot be stored.

No patent protection.

Cannot display or

communicate services.

Price difficult to set.

Derived Properties

Services benefits expire

quickly.

Services may be repeated

often for one customer.

Customer directly

involved with

production of service.

Centralized mass

production of services

difficult.

Wide variation in service

products possible.

2 -10 I nterface of Services with

Management Accounting

No inventories.

Strong ethical code.

Price difficult to set.

Demand for more accurate

cost assignments.

Impact on Management

Accounting

No inventories.

Need for standards and

consistent high quality.

Costs often accounted

for by customer type.

Demand for measure-

ment and control of

quality to maintain

consistency.

Productivity and quality

measurement and

control must be

ongoing.

Total quality manage-

ment critical.

1. Intangibility

2. Perishability

3. Inseparability

4. Heterogeneity

2 -11

Product cost is a cost assignment that

supports a well-specified managerial

object. Thus, what product cost means

depends on the managerial objective

being served.

2 -12

Design

Produce

Market

Distribute

Service Develop

2 -13

Product Costing Definitions

Pricing Decisions

Product-Mix Decisions

Strategic Profitability

Analysis

Strategic Design Decisions

Tactical Profitability

Analysis

External Financial

Reporting

Research and

Development

Production

Marketing

Customer

Service

Value-Chain

Product Costs

Production

Marketing

Customer

Service

Operating Product

Costs

Traditional Product

Costs

Production

2 -14

Direct materials are those materials that are directly

traceable to the goods or services being produced.

Steel in an automobile

Wood in furniture

Alcohol in cologne

Denim in jeans

Braces for correcting teeth

2 -15

Direct labor is the labor that is directly traceable to

the goods or services being produced.

Workers on an assembly

line at Chrysler

A chef in a restaurant

A surgical nurse attending

an open heart operation

Airline pilot

2 -16

Overhead are all other production costs.

Depreciation on building

and equipment

Maintenance

Supplies

Supervision

Power

Property taxes

2 -17

Noninventoriable (period) costs

are expensed in the period in

which they are incurred.

Salaries and commissions of

sales personnel (marketing)

Advertising (marketing)

Legal fees (administrative)

Printing the annual report

(administrative)

2 -18

Prime Cost :

Direct Materials Costs + Direct Labor Costs

Conversion Cost:

Direct Labor Costs + Overhead Costs

2 -19

External

Financial

Statements

2 -20

Manufacturing Organization

Income Statement

For the Year Ended December 31, 2004

Sales $2,800,000

Less cost of goods sold:

Beginning finished goods inventory $ 500,000

Add: Cost of goods manufactured 1,200,000

Cost of goods available for sale $1,700,000

Less: Ending finished goods inventory 300,000 1,400,000

Gross margin $1,400,000

Less operating expenses:

Selling expenses $ 600,000

Administrative expenses 300,000 900,000

Income before taxes $ 500,000

2-20

2 -21

Direct materials:

Beginning inventory $200,000

Add: Purchases 450,000

Materials available $650,000

Less: Ending inventory 50,000

Direct materials used $ 600,000

Direct labor 350,000

Manufacturing overhead:

Indirect labor $122,500

Depreciation 177,500

Rent 50,000

Utilities 37,500

Property taxes 12,500

Maintenance 50,000 450,000

Total manufacturing costs added $1,400,000

Statement of Cost of Goods Manufactured

For the Year Ended December 31, 2004

2-21

continued on next slide

2 -22

Total manufacturing costs added $1,400,000

Add: Beginning work in process 200,000

Total manufacturing costs $1,600,000

Less: Ending work in process 400,000

Cost of goods manufactured $1,200,000

Work in process consists of all

partially completed units found in

production at a given point in time.

2 -23

Service Organization

Income Statement

For the Year Ended December 31, 2004

Sales $300,000

Less expenses:

Cost of services sold:

Beginning work in process $ 5,000

Service costs added:

Direct materials $ 40,000

Direct labor 80,000

Overhead 100,000 220,000

Total $225,000

Less: Ending work in process 10,000 215,000

Gross margin $ 85,000

Less operating expenses:

Selling expenses $ 8,000

Administrative expenses 22,000 30,000

Income before income taxes $ 55,000

2-23

2 -24

Functional-Based

Management Model

Efficiency

Analysis

Performance

Analysis

Operational View

Resources

Functions

Products

Cost View

2 -25

Activity-Based

Management Model

Resources

Activities

Products and

Customers

Cost View

Driver

Analysis

Performance

Analysis

Process View

Why? What? How Well?

2 -26

1. Unit-based drivers

2. Allocation-intensive

3. Narrow and rigid product

costing

4. Focus on managing cost

5. Sparse activity information

6. Maximization of individual

unit performance

7. Use of financial measures of

performance

1. Unit- and nonunit-based

drivers

2. Tracing intensive

3. Broad, flexible product

costing

4. Focus on managing

activities

5. Detailed activity

information

6. Systematic performance

maximization

7. Use of both financial and

nonfinancial measures of

performance

Functional-Based Activity-Based

2 -27

The End

Chapter Two

2 -28

Anda mungkin juga menyukai

- Ch02, MGMT Acct, HansenDokumen28 halamanCh02, MGMT Acct, HansenIlham DoankBelum ada peringkat

- Basic Management Accounting ConceptsDokumen28 halamanBasic Management Accounting ConceptsDhani SardonoBelum ada peringkat

- Basic Management Accounting ConceptsDokumen33 halamanBasic Management Accounting ConceptsNur Ravita HanunBelum ada peringkat

- Basic Cost Management Concepts: Douglas CloudDokumen32 halamanBasic Cost Management Concepts: Douglas Cloudmanuel2811Belum ada peringkat

- Cost Management: Hansen & MowenDokumen27 halamanCost Management: Hansen & Mowensnobar1282Belum ada peringkat

- Ch02 - Basic Cost Management ConceptsDokumen32 halamanCh02 - Basic Cost Management ConceptsFauziahBelum ada peringkat

- Basic Cost Management ConceptsDokumen15 halamanBasic Cost Management ConceptsKatCaldwell100% (1)

- Chap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokumen15 halamanChap 2 Basic Cost Management Concepts and Accounting For Mass Customization OperationsMarklorenz SumpayBelum ada peringkat

- Basic Cost Management Concepts: Mcgraw-Hill/IrwinDokumen52 halamanBasic Cost Management Concepts: Mcgraw-Hill/IrwinDaMin ZhouBelum ada peringkat

- Cost Terms, Concepts, and ClassificationsDokumen33 halamanCost Terms, Concepts, and ClassificationsKlub Matematika SMABelum ada peringkat

- Managerial Accounting - Week 1 Lecture 02/27/12Dokumen4 halamanManagerial Accounting - Week 1 Lecture 02/27/12Moxa PatelBelum ada peringkat

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokumen44 halamanBasic Cost Management Concepts and Accounting For Mass Customization OperationsRoberto De JesusBelum ada peringkat

- Chap002 Cost TermsDokumen41 halamanChap002 Cost TermsNgái Ngủ100% (1)

- Cost AccountingDokumen38 halamanCost AccountingAayush ShahBelum ada peringkat

- Lesson 2 Basic Cost ConceptsDokumen32 halamanLesson 2 Basic Cost ConceptsMELODY MAE TIONGSONBelum ada peringkat

- CHAPTER 2 Cost Terms and PurposeDokumen31 halamanCHAPTER 2 Cost Terms and PurposeRose McMahonBelum ada peringkat

- Chap 002Dokumen15 halamanChap 002Mindori YashaBelum ada peringkat

- Cost Concepts and Behavior: Mcgraw-Hill/IrwinDokumen17 halamanCost Concepts and Behavior: Mcgraw-Hill/Irwinimran_chaudhryBelum ada peringkat

- CFS and Cost Concepts ExplainedDokumen3 halamanCFS and Cost Concepts ExplainedRagh KrishhBelum ada peringkat

- Lecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaDokumen30 halamanLecturer: Diana Weekes-Marshall Bsc. (Hons), Fcca, FcaKarenBelum ada peringkat

- CH-4 Chapter ManufDokumen14 halamanCH-4 Chapter Manufጌታ እኮ ነውBelum ada peringkat

- Basic Cost Management Concepts and Accounting For Mass Customization OperationsDokumen43 halamanBasic Cost Management Concepts and Accounting For Mass Customization OperationsSoumik NagBelum ada peringkat

- Cost ConceptsDokumen43 halamanCost ConceptsProfessorAsim Kumar MishraBelum ada peringkat

- PP For Chapter 7 - Introduction To Managerial Accounting - FinalDokumen40 halamanPP For Chapter 7 - Introduction To Managerial Accounting - FinalSozia TanBelum ada peringkat

- Assignment 1Dokumen7 halamanAssignment 1Ahmed SuhailBelum ada peringkat

- Job Costing at Law Firm and University PressDokumen22 halamanJob Costing at Law Firm and University PressAlmirBelum ada peringkat

- Cost Terminology and Cost FlowsDokumen60 halamanCost Terminology and Cost FlowsInney SildalatifaBelum ada peringkat

- Cost Accounting Concepts ExplainedDokumen53 halamanCost Accounting Concepts ExplainedHassham YousufBelum ada peringkat

- Review ch.1 2Dokumen21 halamanReview ch.1 2Nguyễn Thị Hồng YếnBelum ada peringkat

- Kinney 8e - IM - CH 02Dokumen16 halamanKinney 8e - IM - CH 02Nonito C. Arizaleta Jr.Belum ada peringkat

- Cost Acctg CH 2Dokumen16 halamanCost Acctg CH 2NicoleBelum ada peringkat

- Kinney 8e - CH 02Dokumen16 halamanKinney 8e - CH 02Ashik Uz ZamanBelum ada peringkat

- Managerial Accounting:: An Introduction To Concepts, Methods, and UsesDokumen22 halamanManagerial Accounting:: An Introduction To Concepts, Methods, and UsesamitbaggausBelum ada peringkat

- Ankita ProjectDokumen17 halamanAnkita ProjectRaman NehraBelum ada peringkat

- Cost Concepts and Classifications: Fixed Vs Direct Vs Variable Indirect Functional Vs BehavioralDokumen35 halamanCost Concepts and Classifications: Fixed Vs Direct Vs Variable Indirect Functional Vs BehavioralshonithjosephBelum ada peringkat

- Cheat SheetDokumen28 halamanCheat SheetDailenneaBelum ada peringkat

- 53 Activity Based CostingDokumen19 halaman53 Activity Based CostingUmar SulemanBelum ada peringkat

- MAF251 Chapter 1Dokumen19 halamanMAF251 Chapter 1Hasrul Daud100% (1)

- Prepared by Debby Bloom-Hill Cma, CFMDokumen55 halamanPrepared by Debby Bloom-Hill Cma, CFMAlondra SerranoBelum ada peringkat

- Basic Management Accounting ConceptsDokumen17 halamanBasic Management Accounting ConceptsAsa SeptaBelum ada peringkat

- Activity Based Costing, ABC AnalysisDokumen19 halamanActivity Based Costing, ABC AnalysisLuis NashBelum ada peringkat

- Cost Terms, Concepts, and ClassificationsDokumen45 halamanCost Terms, Concepts, and ClassificationsMountaha0% (1)

- CIMA C1 Unit 1 2012Dokumen50 halamanCIMA C1 Unit 1 2012Mir Fida NadeemBelum ada peringkat

- CH 2 - Cost Terms, Concepts, and ClassificationsDokumen78 halamanCH 2 - Cost Terms, Concepts, and ClassificationsLimChanpatiya67% (3)

- Cost Accounting: Swiss Business SchoolDokumen149 halamanCost Accounting: Swiss Business SchoolMyriam Elaoun100% (1)

- Slide of Chapter 1Dokumen29 halamanSlide of Chapter 1Uyen ThuBelum ada peringkat

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 2Dokumen28 halamanSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 2jasperkennedy082% (22)

- Costacctg13 SM ch02Dokumen26 halamanCostacctg13 SM ch02Yenny TorroBelum ada peringkat

- Cost Concepts and Cost AllocationDokumen28 halamanCost Concepts and Cost Allocationpvsk17072005Belum ada peringkat

- Chapter 1 - StudentsDokumen8 halamanChapter 1 - StudentsLynn NguyenBelum ada peringkat

- Kinney CH 02Dokumen19 halamanKinney CH 02sweetmangoshakeBelum ada peringkat

- Mid-Term Revision - Cost AccountingDokumen32 halamanMid-Term Revision - Cost AccountingAhmed Rabea50% (2)

- Cost Accounting ActivitiesDokumen5 halamanCost Accounting ActivitiesTrisha Lorraine RodriguezBelum ada peringkat

- POM (406) IntroductionDokumen2 halamanPOM (406) IntroductionFaryal MasoodBelum ada peringkat

- Maher, Stickney and Weil: Fundamental ConceptsDokumen9 halamanMaher, Stickney and Weil: Fundamental ConceptsRachel NicoleBelum ada peringkat

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Dari EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Belum ada peringkat

- Impact of The Global Economic Crisis On The Agricultural Sector in Saint Lucia by Rufus LeandreDokumen15 halamanImpact of The Global Economic Crisis On The Agricultural Sector in Saint Lucia by Rufus LeandreRufus LeandreBelum ada peringkat

- Sales Case DigestDokumen7 halamanSales Case Digestrian5852Belum ada peringkat

- Reliable Exports Lease DeedDokumen27 halamanReliable Exports Lease DeedOkkishoreBelum ada peringkat

- Property Arts. 484 490Dokumen7 halamanProperty Arts. 484 490Nhaz PasandalanBelum ada peringkat

- Forbes 12 Best Stocks To Buy For 2024Dokumen29 halamanForbes 12 Best Stocks To Buy For 2024amosph777Belum ada peringkat

- Risk Aversion, Neutrality, and PreferencesDokumen2 halamanRisk Aversion, Neutrality, and PreferencesAryaman JunejaBelum ada peringkat

- Protect Against Rising Rates With CapsDokumen13 halamanProtect Against Rising Rates With Capsz_k_j_vBelum ada peringkat

- Avarta WhitepaperDokumen33 halamanAvarta WhitepaperTrần Đỗ Trung MỹBelum ada peringkat

- Numericals On Financial ManagementDokumen4 halamanNumericals On Financial ManagementDhruv100% (1)

- Apsee 327Dokumen2 halamanApsee 327manikanta2235789Belum ada peringkat

- Case Studies On HR Best PracticesDokumen50 halamanCase Studies On HR Best PracticesAnkur SharmaBelum ada peringkat

- DOTgazette - Aug06 - July08.Dokumen196 halamanDOTgazette - Aug06 - July08.M Munir Qureishi100% (1)

- Cost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockDokumen18 halamanCost of Debt Cost of Preferred Stock Cost of Retained Earnings Cost of New Common StockFadhila HanifBelum ada peringkat

- Man Acc Qs 1Dokumen6 halamanMan Acc Qs 1Tehniat Zafar0% (1)

- The Optimal Timing of Investment Decisions. DraftDokumen36 halamanThe Optimal Timing of Investment Decisions. DraftpostscriptBelum ada peringkat

- HomeworkDokumen3 halamanHomeworkJo Kristianti100% (1)

- The Role of Public Sectors in Developing INDIADokumen8 halamanThe Role of Public Sectors in Developing INDIAL. Lawliet.Belum ada peringkat

- Reclassification AdjustmentsDokumen3 halamanReclassification AdjustmentsRanilo HeyanganBelum ada peringkat

- Course List - Minor From Other Kulliyyahs-CentresDokumen5 halamanCourse List - Minor From Other Kulliyyahs-CentresAzrin SaediBelum ada peringkat

- Intro To Banking M3 BankBusinessAndOperatingModels FINALDokumen17 halamanIntro To Banking M3 BankBusinessAndOperatingModels FINALanuj guptaBelum ada peringkat

- 2021.11.13 - BTG PACTUAL Research - Nutresa - An Unexpected Tender Offer For Nutresa Was Submitted To The RegulatorDokumen6 halaman2021.11.13 - BTG PACTUAL Research - Nutresa - An Unexpected Tender Offer For Nutresa Was Submitted To The RegulatorSemanaBelum ada peringkat

- Judgement Day Algorithmic Trading Around The Swiss Franc Cap RemovalDokumen30 halamanJudgement Day Algorithmic Trading Around The Swiss Franc Cap RemovalTorVikBelum ada peringkat

- EPF Nomination FormDokumen3 halamanEPF Nomination Formjhaji24Belum ada peringkat

- Open Banking Api Service FactsheetDokumen2 halamanOpen Banking Api Service FactsheetswiftcenterBelum ada peringkat

- Financial Management - Capital Budgeting Answer KeyDokumen5 halamanFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Meet Your Strawman: Let's Have A Little QuizDokumen50 halamanMeet Your Strawman: Let's Have A Little Quizwereld2all100% (3)

- Hoboken-United Water Agreement (1994)Dokumen69 halamanHoboken-United Water Agreement (1994)GrafixAvengerBelum ada peringkat

- Partnership Liquidation: Answers To Questions 1Dokumen28 halamanPartnership Liquidation: Answers To Questions 1El Carl Sontellinosa0% (1)

- Southerland - ClipbookDokumen25 halamanSoutherland - ClipbookDCCCSouthDeskBelum ada peringkat

- Samriddhi 11 4 The Potion of WealthDokumen28 halamanSamriddhi 11 4 The Potion of WealthBarun SinghBelum ada peringkat