Analysis of The Proposed 2015 Budget and Program of Expenditures Revenue, Borrowing and Expenditure Programs

Diunggah oleh

BlogWatch0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

422 tayangan26 halaman(Via Social Watch) Given the macro- and socio-economic context, the budget is a powerful tool by the government to address challenges brought about by macroeconomic and social realities. The following slides analyses the approved 2014 budget, looking at the patterns of resource allocation since the incumbency of the Aquino administration.

Judul Asli

Analysis of the Proposed 2015 Budget and Program of Expenditures Revenue, Borrowing and Expenditure Programs

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini(Via Social Watch) Given the macro- and socio-economic context, the budget is a powerful tool by the government to address challenges brought about by macroeconomic and social realities. The following slides analyses the approved 2014 budget, looking at the patterns of resource allocation since the incumbency of the Aquino administration.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

422 tayangan26 halamanAnalysis of The Proposed 2015 Budget and Program of Expenditures Revenue, Borrowing and Expenditure Programs

Diunggah oleh

BlogWatch(Via Social Watch) Given the macro- and socio-economic context, the budget is a powerful tool by the government to address challenges brought about by macroeconomic and social realities. The following slides analyses the approved 2014 budget, looking at the patterns of resource allocation since the incumbency of the Aquino administration.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 26

Professor Emeritus Leonor Magtolis Briones

Former National Treasurer

Lead Convenor, Social Watch Philippines

October 11, 2014, 2014

Scrap Pork/Abolish Pork Networks

Dela Salle University

No improvement in poverty for the

past seven years

Source: 2012 Full Year Official Poverty Statistics; 2013 First Semester Official Poverty Statistics, PSA-NSCB

Poverty Incidence (PI) and Subsistence Incidence among Population (%),

2006, 2009, 2012 and 2013 1

st

sem

Fiscal Program

PARTICULARS

2013

Adjusted

Program

2014

Program

2015

Proposed

2016

Proposed

Levels in Billion Pesos

Revenues

Disbursements

Surplus/(Deficit)

Obligation Budget

Per cent of GDP

Revenues

Disbursements

Surplus/(Deficit)

Obligation Budget

Growth Rate

Revenues

Disbursements

Surplus/(Deficit)*

Obligation Budget

1,745.9

1,983.9

(238.0)

2,005.9

14.7

16.7

(2.0)

16.8

13.7

11.6

2.0

9.7

2,018.1

2.284.3

(266.2)

2,264.6

15.5

17.5

(2.0)

17.4

15.6

15.1

(11.9)

12.9

2,337.3

2,622.6

(285.3)

2,605.9

16.2

18.2

(2.0)

18.0

15.8

14.8

(7.1)

15.1

2,760.8

3,082.8

(322.0)

3,077.9

17.1

19.1

(2.0)

19.0

18.1

17.5

(12.9)

18.1

GDP

Gross Financing Mix (%)

Foreign

Domestic

11,914.5

8.0

92.0

12,990.3

15.0

85.0

14,463.5

11.0

89.0

16,179.0

9.0

91.0

Notes: *A positive growth rate indicates an improvement in the fiscal balance

Source: DBM NBM 119 based on DBM, DOF, and NEDA data

Sources of Revenue

Sources of Tax Revenues, FY 2015

*Includes incremental revenues for BIR from Republic Act No. 10351 (Sin Tax Reform Law of 2012)

Source: FY 2015 BESF, primarily from the Department of Finance

Revenue Program

Amount (in million pesos)

Net Income Taxes and Profits

1,032,120

Tax on Property

5,017

Taxes on Domestic Goods and Services

700,821

Taxes in International Trade and Transactions

456,468

Total

2,337,333

Amount (in million pesos) Growth rate (%)

2013 2014 2015 2013-2014 2014-2015

Tax Revenues 1,535,698 1,879,918 2,194,427 22.41 16.73

Non-tax Revenues 177,459 136,133 140,906 (23.29) 3.51

Privatization 2,936 2,000 2,000 (31.88) 0.0

Total 1,716,093 2,018,051 2,337,333 17.6 15.82

National Government Financing

FY 2013 to FY 2015 (in million pesos)

Particulars 2013

a/

2014 2015

GROSS FOREIGN BORROWINGS 33,767 130,500 95,700

Net Foreign Borrowings (83,821) 4,236 20,898

GROSS DOMESTIC BORROWINGS 520,934 620,011 605,122

Net Domestic Borrowings 402,939 279,734 289,537

NET FINANCING 319,118 283,969 310,436

CHANGE IN CASH 65,933 16,002 24,978

TOTAL NET FINANCING REQUIREMENT 164,062 266,247 283,687

a/ Based on actual data reported in the Cash Operations Report (COR)

Source: FY 2015 BESF, primarily from the Bureau of the Treasury

Debt trap. While government is planning to borrow a total of

P700.822 Billion, it will only receive P310.435 Billion for both

peso and foreign borrowings due to costs of borrowing and

other charges.

Debt Servicing in the P2.606 T budget

does not reflect Principal Amortization

NG Debt Service Expenditures

(in million pesos)

2013 2014 2015

Interest Payments 323,434 352,652 372,863

Domestic 222,317 255,970 277,565

Foreign 101,117 96,682 95,298

Principal Amortization 235,583 466,542 390,386

Domestic 117,995 340,277 315,585

Foreign 117,588 126,264 74,802

GRAND TOTAL 559,017 819,194 763,250

Source: FY 2015 BESF, primarily from the Bureau of the Treasury

Source: FY 2015 Budget of Expenditure and Sources of Financing: DBM

Note: Net Lending amounts to PhP16.626B in 2013, PhP24.95Bin 2014 and PhP26.5B for

2015. This is equivalent to percentage distribution of 0.83%, 1.1% and 1.02% in

expenditure program by sector respectively.

Allocation by Sector

I

n

B

i

l

l

i

o

n

s

o

f

P

e

s

o

s

I

n

B

i

l

l

i

o

n

s

o

f

P

e

s

o

s

*Are Personal Services understated?

Source: FY 2015 Budget of Expenditure and Sources of Financing: DBM

Allocation By General Expense Class

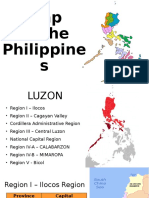

Allocation by Region

Source: FY 2015 Budget of Expenditure and Sources of Financing: DBM

In Billion Pesos

Where are the poor?

The 16 poorest provinces

Province 2012

Poverty

Inciden

ce (%)

Island

Region

Lanao del

Sur

67.3 Mindanao

Eastern

Samar

55.4 Visayas

Apayao 54.7 Luzon

Maguindanao 54.5 Mindanao

Zamboanga

del Norte

48.0 Mindanao

Sarangani 46.0 Mindanao

North

Cotabato

44.8 Mindanao

Negros

Oriental

43.9 Visayas

Northern

Samar

43.5 Visayas

Source: 2012 Full Year Official Poverty Statistics, National Statistical Coordination Board

*10 of the 16 poorest provinces are

situated in Mindanao; 3 out of 4 in

Visayas from the Samar provinces

Province 2012

Poverty

Inciden

ce (%)

Island

Region

Western

Samar

43.5 Visayas

Bukidnon 41.5 Mindanao

Lanao del

Norte

41.4 Mindanao

Camiguin 41.0 Mindanao

Masbate 40.6 Luzon

Sultan

Kudarat

40.4 Mindanao

Sulu 40.2 Mindanao

WHAT THE 2015 NATIONAL BUDGET

LOOKS LIKE

The Budget is like a huge, huge box.

When it is opened, there are smaller

boxes.

National

Expenditure

Program

Ph2.606 trillion

draft

General

Appropriations Act

Ph1.74 trillion

Automatic

Appropriations

Ph866.2 billion

The first smaller box is composed

of two even smaller boxes: the

budgets of agencies and the

special purpose funds. in the first

of the two smaller boxes are the

agencies with the ten highest

budgets

General

Appropriations

Act

PhP 1.74 trillion

Special Purpose

Funds

PhP 378.5 billion

Agency

Budgets

PhP 1.361

trillion

There are still items which

are not listed in the

expenditure program.

still another box with a

different color. Inside this

box are two boxes: off

budget items and direct

remittances. the other box

contains the

unprogrammed

expenditures.

Not in the

Expenditures/ Not in

the Gen.

Appropriations Act

Unprogrammed

Funds

Ph 123 billion

Off Budget items

and Direct

Remittances

Ph 40.6 billion

OUTSIDE THE EXPENDITURES

BOX

Out of the proposed

expenditures of PhP 2.606

trillion, Congress will only

debate in detail PhP 1.361

trillion of government agency

budgets, out of which PhP

761.231 billion are Personnel

Expenditures. This leaves P

599.769 billion for detailed

Congressional scrutiny.

Proposed Expenditures

PhP 2.606 trillion

Agency Budgets

PhP 1.361 trillion

Personnel

Expenditures

PhP 761.231

billion

Congressional

Scrutiny

599. 769

billion

Top 12 Agencies, FY 2013-2015

Dept. FY 2013 GAA

(000)

R

a

n

k

FY 2014 GAA

(000)

R

a

n

k

FY 2015 NEP

(000)

R

a

n

k

DepEd 232,595,221 1 281,774,247 1 318,896,319 1

DPWH 155,517,533 2 206,634,047 2 287,825,956 2

DSWD 56,333,858 6 83,304,463 5 108,880,894 3

DILG 91,164,442 3 100,295,430 3 104,571,005 4

DND 80,420,311 4 82,265,071 6 99,469,167 5

DOH 51,074,586 5 84,356,933 4 87,209,479 6

DOTC 34,185,121 8 45,461,306 8 52,874,342 7

DA 64,474,099 5 68,596,751 7 48,435,703 8

SUCs 32,770,703 9 35,934,625 9 41,224,509 9

ARMM 13,172,022 13 19,615,029 12 24,299,773 10

DENR 23,135,850 10 23,345,621 10 20,849,411 11

The

Judiciary

17,006,107 12 18,559,816 13 19,499,422 12

Source: GAA, 2013-2014; NEP: DBM, 2015

Proposed Special Purpose Funds for 2015

SPECIAL PURPOSE FUNDS

(in 000)

GAA 2013

GAA 2014

NEP 2015

Budgetary Support to

Government Corporations

44,664,500

46,255,210

61,319,392

Allocation to Local

Government Units

17,529,452

19,588,843

33,131,405

National Disaster Risk

Reduction Management Fund

7,500,000

13,000,000

14,000,000

Contingent Fund 1,000,000 1,000,000

2,000,000

DepEd School Building

Program

1,000,000

1,000,000

-

E-Government Fund 1,000,000 2,478,900

1,000,000

International Commitments

Fund

2,636,723

4,815,644

7,443,963

Miscellaneous Personnel

Benefits Fund

69,089,206

53,535,086

118,142,443

Pension and Gratuity Fund

(formerly Retirement

Benefits Fund)

98,715,143

120,495,952

140,566,386

Source: GAA 2013-2014: DBM; FY 2015 National Expenditure Program

Proposed Special Purpose Funds for 2015

1

The PhP22.4 Billion Priority Social and Economic Projects Fund proposed in the 2013 National

Expenditure Program was later realigned to concerned agencies as a result of the campaign of

ABI for the 2013 Budget.

SPECIAL

PURPOSE FUNDS

(in 000)

GAA 2013 GAA 2014 NEP 2015

Priority

Development

Assistance Fund

24,790,000

-

-

Priority Social and

Economic Projects

Fund

1

-

Feasibility Studies

Fund -

400,000

-

Rehabilitation &

Reconstruction

Program

20,000,000

1,000,000

TOTAL (in 000)

267,925,024 282,569,635 378,603,589

Source: GAA 2013-2014: DBM; FY 2015 National Expenditure Program

UNPROGRAMMED

FUNDS (in 000)

GAA 2013 GAA 2014 NEP 2015

Budgetary Support to GOCCs

16,826,406

3,036,268

5,060,762

Support to Foreign-Assisted

Projects

2,226,655

6,124,491

3,095,319

General Fund Adjustments (for

the Share of the ARMM

pursuant to R.A.9054; NEP

2015)

1,000,000

1,000,000

800,000

Support for Infrastructure

Projects and Social Programs

23,000,000

20,000,000

20,000,000

Disaster Relief & Mitigation

Fund

-

3,000,000

-

Debt Management Program

60,363,130 1,000,000 -

Proposed Unprogrammed Funds for 2015

Source: GAA 2013-2014: DBM; FY 2015 National Expenditure Program

UNPROGRAMMED

FUNDS (in 000)

GAA 2013 GAA 2014

NEP 2015

AFP Modernization

Program

10,632,180

5,000,000

10,000,000

Risk Management

Program -

20,000,000

30,000,000

Payment of Total

Administrative Disability

Pension

3,000,000

243,000 -

Reconstruction and

Rehabilitation Program

-

80,000,000 -

Peoples Survival Fund

500,000

500,000

-

Equity Value Buy-out of

the Metro Rail Transit

Corporation 0

0

53,900,000

TOTAL (in 000)

117,548,371

139,903,759

123,056,081

Proposed Unprogrammed Funds for 2015

Source: GAA 2013-2014: DBM; FY 2015 National Expenditure Program

AUTOMATIC

APPROPRIATIONS

(in 000)

GAA 2013 GAA 2014 NEP 2015

Interest Payments for Debt

Service

333,902,000

352,652,000,000

372,863,000

Internal Revenue Allotment 302,304,001 341,544,726,000

389,860,429

Tax Refunds

15,518,556 -

Pension under RA 2087 &

5059

331,000

331,000

331,000

Grant Proceeds 545,844 6,450

140,902

Custom duties and taxes,

including Tax expenditures

26,900,000

26,900,000

25,475,000

Net Lending 26,500,000 24,950,000 26,500,000

Employees retirement and

life insurance premiums

28,125,611

28,859,006

30,149,491

Rewards and Incentives

Fund

2,182,808 - -

Special accounts in the

general fund

19,240,064

21,116,662

21,242,275

TOTAL

755,219,215

796,029,175

866,231,428

Proposed Automatic Appropriations for 2015

Source: GAA 2013-2014: DBM; FY 2015 National Expenditure Program

Issues on Special Purpose Funds, Automatic

Appropriations and Unprogrammed Funds

Lump sum appropriations have always been

problematic

since these are not as detailed as regular appropriations,

they tend to be vulnerable to abuse.

accountability is sometimes difficult to establish and

documentation difficult

in the Philippines, lump sum appropriations include

special purpose funds, overall savings and

unprogrammed funds

To Summarize

Total projected National Expenditures-Ph2.758 trillion

General Appropriations - Ph1.740 trillion

Unprogrammed Expenditures- 123 billion

Off Budget Remittances- 29 billion

Automatic appropriations- 866 billion

General Appropriations Act to be

passed by Congress - Ph1.740 trillion

Special Purpose Funds- 379 billion

Agency Budgets to be examined 1.361 trillion, of which

are Personnel Expenditures 761 billion

free for detailed examination by

Congress 600 billion

WHO HAS THE REAL POWER OF

THE PURSE?

For the next four months, Congress will work on

the budget and approve it by December.

If the Evardone bill will be passed the President

can declare savings by January or any other time

of the year.

Even now, the DBM has written to Malacanang

changing the definition of savings and

proposing a bill for approval by Congress.

WHO HAS THE POWER OF THE

COIN PURSE?

Congressmen and Senators are anxious to

ensure their re-election. They are now

under pressure to approve either of the

proposed bills.

Will they regain their lost Power of the

Purse?

Anda mungkin juga menyukai

- A Collective Call - 13 October 2021 - 329pmDokumen22 halamanA Collective Call - 13 October 2021 - 329pmBlogWatchBelum ada peringkat

- A Collective Call - 12 October 2021 - 1050pmDokumen22 halamanA Collective Call - 12 October 2021 - 1050pmBlogWatchBelum ada peringkat

- A Collective Expression of Indignation and A Call To ActionDokumen15 halamanA Collective Expression of Indignation and A Call To ActionRapplerBelum ada peringkat

- UNFPA State of World Population 2018 - English-WebDokumen156 halamanUNFPA State of World Population 2018 - English-WebBlogWatchBelum ada peringkat

- Draft PCOO Memo On Social Media PolicyDokumen10 halamanDraft PCOO Memo On Social Media PolicyTonyo CruzBelum ada peringkat

- A Collective Expression of Indignation and A Call To ActionDokumen7 halamanA Collective Expression of Indignation and A Call To ActionBlogWatchBelum ada peringkat

- (Vote Pilipinas) - Launch of Voter Registration Service Test and 2021 Information CampaignDokumen18 halaman(Vote Pilipinas) - Launch of Voter Registration Service Test and 2021 Information CampaignBlogWatchBelum ada peringkat

- Speech of Retired Ombudsman Conchita Carpio-Morales at The 2nd Democracy and Disinformation Conference (22 April 2019)Dokumen14 halamanSpeech of Retired Ombudsman Conchita Carpio-Morales at The 2nd Democracy and Disinformation Conference (22 April 2019)BlogWatchBelum ada peringkat

- Position Paper On Internet Transactions Act - As of 12 Feb 2021 (v3)Dokumen26 halamanPosition Paper On Internet Transactions Act - As of 12 Feb 2021 (v3)BlogWatchBelum ada peringkat

- Disinformation in The South China Sea Dispute by SC Justice Antonio CarpioDokumen56 halamanDisinformation in The South China Sea Dispute by SC Justice Antonio CarpioBlogWatchBelum ada peringkat

- Kontra Daya Voter's Guide For The 2019 Party-List ElectionDokumen39 halamanKontra Daya Voter's Guide For The 2019 Party-List ElectionBlogWatch100% (2)

- Draft - National Broadband PlanDokumen49 halamanDraft - National Broadband PlanBlogWatchBelum ada peringkat

- The PMTL Gabay English For 2016 ElectionsDokumen2 halamanThe PMTL Gabay English For 2016 ElectionsJun Gula100% (1)

- IRR-Data Privacy Act (Aug 25, 2016)Dokumen49 halamanIRR-Data Privacy Act (Aug 25, 2016)BlogWatch100% (1)

- The First Philippine Telecoms Summit 2017 ProgramDokumen5 halamanThe First Philippine Telecoms Summit 2017 ProgramBlogWatchBelum ada peringkat

- TRANSCRIPT: 6th Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDokumen172 halamanTRANSCRIPT: 6th Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchBelum ada peringkat

- EO Resolution and Position Paper On TelecommutingDokumen20 halamanEO Resolution and Position Paper On TelecommutingBlogWatchBelum ada peringkat

- South China Sea RulingDokumen501 halamanSouth China Sea RulingAnonymous zBCMh8j100% (1)

- #VoteReportPH A Guide To The 2016 Election MonitoringDokumen32 halaman#VoteReportPH A Guide To The 2016 Election MonitoringBlogWatchBelum ada peringkat

- Short Primer On The PH-China ArbitrationDokumen13 halamanShort Primer On The PH-China ArbitrationBlogWatchBelum ada peringkat

- (English) 2016 Precinct Election Monitoring GuideDokumen1 halaman(English) 2016 Precinct Election Monitoring GuideBlogWatchBelum ada peringkat

- PH CN 20160712 Press Release No 11 EnglishDokumen11 halamanPH CN 20160712 Press Release No 11 EnglishJojo Malig100% (5)

- (Tagalog) 2016 Precinct Election Monitoring GuideDokumen1 halaman(Tagalog) 2016 Precinct Election Monitoring GuideBlogWatchBelum ada peringkat

- Consolidated Matrix On The Presidentiables' and Vice-Presidentiables' Platforms and Positions On Public Finance and Social DevelopmentDokumen21 halamanConsolidated Matrix On The Presidentiables' and Vice-Presidentiables' Platforms and Positions On Public Finance and Social DevelopmentBlogWatchBelum ada peringkat

- Mayor Rodrigo R. Duterte, 2015 SALNDokumen7 halamanMayor Rodrigo R. Duterte, 2015 SALNBlogWatchBelum ada peringkat

- Philippines: Elections 2016 Namfrel PEAM Report, Aka Pre-Election AssessmentDokumen13 halamanPhilippines: Elections 2016 Namfrel PEAM Report, Aka Pre-Election AssessmentLorna DietzBelum ada peringkat

- Call On COMELEC, Voters, Poll Watchers: Gear For Poll Disaster Preparedness and Mitigation On May 9Dokumen5 halamanCall On COMELEC, Voters, Poll Watchers: Gear For Poll Disaster Preparedness and Mitigation On May 9BlogWatchBelum ada peringkat

- TRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDokumen302 halamanTRANSCRIPT: 3rd Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchBelum ada peringkat

- TRANSCRIPT: 4th Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseDokumen213 halamanTRANSCRIPT: 4th Public Hearing of The Senate Blue Ribbon Committee On The $81-M Money Laundering CaseBlogWatchBelum ada peringkat

- "Urgent Appeal" of The Filipino Fisher Folks of Scarborough Shoal Versus ChinaDokumen28 halaman"Urgent Appeal" of The Filipino Fisher Folks of Scarborough Shoal Versus ChinaBlogWatchBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Non-Islamic Music of Mindanao: Figure 3 Palakpak Figure 2 Takumbo Figure 1 KudlongDokumen2 halamanNon-Islamic Music of Mindanao: Figure 3 Palakpak Figure 2 Takumbo Figure 1 KudlongJANEL BRIÑOSA100% (2)

- Conflict Analysis of The Philippines by Sian Herbert 2019Dokumen16 halamanConflict Analysis of The Philippines by Sian Herbert 2019miguel riveraBelum ada peringkat

- History and Development of English in The PhilippinesDokumen12 halamanHistory and Development of English in The Philippinesfrenzvincentvillasis26Belum ada peringkat

- Barmm Mindanao or BARMM (Filipino: Rehiyong Awtonomo NG Bangsamoro Sa MuslimDokumen8 halamanBarmm Mindanao or BARMM (Filipino: Rehiyong Awtonomo NG Bangsamoro Sa MuslimMylaCambriBelum ada peringkat

- Table 5.4.1. Water Borne Diseases Cases and Deaths (Typhoid and Paratyphoid Fever 2010-2019) - 0Dokumen9 halamanTable 5.4.1. Water Borne Diseases Cases and Deaths (Typhoid and Paratyphoid Fever 2010-2019) - 0Alifer GloriaBelum ada peringkat

- May 2022 Civil Engineer Licensure Examination: Seq. NODokumen9 halamanMay 2022 Civil Engineer Licensure Examination: Seq. NORapplerBelum ada peringkat

- Republic of The PhilippinesDokumen11 halamanRepublic of The PhilippinesNiel Ivan Alliosada QuimboBelum ada peringkat

- MDPZ3RDokumen168 halamanMDPZ3Rmmabee75% (4)

- 3 - SR - Q1 2022 Chicken Egg Situation Report - v2 - ONS-signedDokumen6 halaman3 - SR - Q1 2022 Chicken Egg Situation Report - v2 - ONS-signedMonette De CastroBelum ada peringkat

- Philippine MapDokumen21 halamanPhilippine Mapj l100% (1)

- Proposal: Islamic StudiesDokumen6 halamanProposal: Islamic StudiesMussolini22Belum ada peringkat

- Lesson OutlineDokumen8 halamanLesson OutlineMYKO DIONGSONBelum ada peringkat

- ITTM-PPT-Week 4 Regions and Provinces of The Philippines (ASYNCHRONOUS) .OdpDokumen18 halamanITTM-PPT-Week 4 Regions and Provinces of The Philippines (ASYNCHRONOUS) .OdpAlmira BatuBelum ada peringkat

- Post Test in Crop Science PDFDokumen11 halamanPost Test in Crop Science PDFshakiraBelum ada peringkat

- 1M 1S 2013Dokumen4 halaman1M 1S 2013Rezinna SebongbongBelum ada peringkat

- History of Muslims in The PhilippinesDokumen3 halamanHistory of Muslims in The PhilippinesLaud, Aina Erika G.Belum ada peringkat

- Bylaws of the United Architects of the Philippines Student AuxiliaryDokumen15 halamanBylaws of the United Architects of the Philippines Student AuxiliaryCharls Maligaya100% (1)

- The Mountain and River Systems in The PhilippinesDokumen7 halamanThe Mountain and River Systems in The PhilippinesRose Sauler ServidaBelum ada peringkat

- The Philippine Tourism Master Plan 1991-2010Dokumen7 halamanThe Philippine Tourism Master Plan 1991-2010Zcephra MalsiBelum ada peringkat

- Philippine Literature Course OverviewDokumen69 halamanPhilippine Literature Course OverviewKristal Mae SangcapBelum ada peringkat

- Untitled DocumentDokumen7 halamanUntitled DocumentMae NedrodaBelum ada peringkat

- Pol Sci NotesDokumen13 halamanPol Sci Notesred gynBelum ada peringkat

- Maayong Adlaw! Tara Na Sa Hilagang Kamindanawan!!Dokumen41 halamanMaayong Adlaw! Tara Na Sa Hilagang Kamindanawan!!Mariane Louise BatacBelum ada peringkat

- ALS A&E Secondary Level Test PassersDokumen1.097 halamanALS A&E Secondary Level Test PassersAlejandro Reymundo BainganBelum ada peringkat

- Our Lady of Perpetual Succor CollegeDokumen2 halamanOur Lady of Perpetual Succor CollegeLord SequenaBelum ada peringkat

- Activity Sheet in ART Quarter 1Dokumen2 halamanActivity Sheet in ART Quarter 1Liza Dalisay100% (2)

- ESC Participating Schools 20mar2018 PDFDokumen68 halamanESC Participating Schools 20mar2018 PDFRosjyum LoveblissBelum ada peringkat

- The Lumad in Early Colonial Mindanao by Oona ParedesDokumen5 halamanThe Lumad in Early Colonial Mindanao by Oona ParedesBrecht Agnila TampusBelum ada peringkat

- Annex A DICT Towers and Real EstateDokumen10 halamanAnnex A DICT Towers and Real EstateWendel Jonn L. AbaraBelum ada peringkat

- Philippine Political GeographyDokumen4 halamanPhilippine Political GeographyJames Bond100% (2)