Allama Iqbal Open University: Presented To:-Mr: Rizwan Hamid Presented By:-M - Waqas

Diunggah oleh

SyedMohammadHashaamPirzadaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Allama Iqbal Open University: Presented To:-Mr: Rizwan Hamid Presented By:-M - Waqas

Diunggah oleh

SyedMohammadHashaamPirzadaHak Cipta:

Format Tersedia

Allama Iqbal open

university

presented to:- Mr: Rizwan Hamid

presented by:-M- Waqas

Topic: Capital budgeting techniques

Subject: coorporate finance

MBA (B&F)

Roll No: Am 552990

Capital Budgeting

Concepts

Capital Budgeting involves evaluation of (and decision about)

projects. Which projects should be accepted? Here, our goal

is to accept a project which maximizes the shareholder

wealth. Benefits are worth more than the cost.

The Capital Budgeting is based on forecasting.

Estimate future expected cash flows.

Evaluate project based on the evaluation method.

Classification of Projects

Mutually Exclusive - accept ONE project only

Independent - accept ALL profitable projects.

Capital Budgeting

Concepts

Cash flows

Initial Cash Outlay - amount of capital spent to get project

going.

If spend $10 million to build new plant then the Initial Outlay

(IO) = $10 million

Annual Cash Inflows--after-tax CF

Cash inflows from the project

CFn = Sales - Costs

Capital budgeting

techniques

Payback Period (PBP)

Internal Rate of Return (IRR)

Net Present Value (NPV)

Profitability Index (PI)

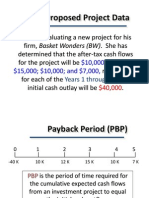

Proposed Project Data

Julie Miller is evaluating a new project for

her firm, Basket Wonders (BW). She has

determined that the after-tax cash flows

for the project will be $10,000; $12,000;

$15,000; $10,000; and $7,000,

respectively, for each of the Years 1

through 5. The initial cash outlay will be

$40,000.

Payback Period (PBP)

PBP is the period of time required

for the cumulative expected cash

flows from an investment project to

equal the initial cash outflow.

0 1 2 3 4 5

-40 K 10 K 12 K 15 K 10 K 7 K

(c) 10 K 22 K 37 K 47 K 54 K

Payback Solution (#1)

PBP = a + ( b - c ) / d

= 3 + (40 - 37) / 10

= 3 + (3) / 10

= 3.3 Years

0 1 2 3 4 5

-40 K 10 K 12 K 15 K 10 K 7 K

Cumulative

Inflows

(a)

(-b)

(d)

PBP Acceptance Criterion

Yes! The firm will receive back the initial

cash outlay in less than 3.5 years. [3.3

Years < 3.5 Year Max.]

The management of Basket Wonders

has set a maximum PBP of 3.5 years

for projects of this type.

Should this project be accepted?

PBP Strengths

and Weaknesses

Strengths:

Easy to use and

understand

Can be used as a

measure of

liquidity

Weaknesses:

Does not account

for TVM

Does not consider

cash flows beyond

the PBP

Internal Rate of Return (IRR)

IRR is the discount rate that equates the

present value of the future net cash flows

from an investment project with the

projects initial cash outflow.

CF

1

CF

2

CF

n

(1+IRR)

1

(1+IRR)

2

(1+IRR)

n

+ . . . + +

ICO =

$15,000 $10,000 $7,000

IRR Solution

Find the interest rate (IRR) that causes the

discounted cash flows to equal $40,000.

$10,000 $12,000

(1+IRR)

1

(1+IRR)

2

+ +

+ +

$40,000 =

(1+IRR)

3

(1+IRR)

4

(1+IRR)

5

IRR Solution (Try 10%)

$40,000 = $10,000(PVIF

10%,1

) + $12,000(PVIF

10%,2

) +

$15,000(PVIF

10%,3

) + $10,000(PVIF

10%,4

) + $

7,000(PVIF

10%,5

)

$40,000 = $10,000(.909) + $12,000(.826) +

$15,000(.751) + $10,000(.683) +

$ 7,000(.621)

$40,000 = $9,090 + $9,912 + $11,265 +

$6,830 + $4,347

= $41,444 [Rate is too low!!]

IRR Solution (Try 15%)

$40,000 = $10,000(PVIF

15%,1

) + $12,000(PVIF

15%,2

) +

$15,000(PVIF

15%,3

) + $10,000(PVIF

15%,4

) + $

7,000(PVIF

15%,5

)

$40,000 = $10,000(.870) + $12,000(.756) +

$15,000(.658) + $10,000(.572) +

$ 7,000(.497)

$40,000 = $8,700 + $9,072 + $9,870 +

$5,720 + $3,479

= $36,841 [Rate is too high!!]

IRR Solution (Interpolate)

.10 $41,444

.05 IRR $40,000 $4,603

.15 $36,841

X $1,444

.05 $4,603

$1,444

X

=

IRR Solution (Interpolate)

.10 $41,444

.05 IRR $40,000 $4,603

.15 $36,841

X $1,444

.05 $4,603

$1,444

X

=

IRR Solution (Interpolate)

.10 $41,444

.05 IRR $40,000 $4,603

.15 $36,841

($1,444)(0.05)

$4,603

$1,444

X

X = X = .0157

IRR = .10 + .0157 = .1157 or 11.57%

IRR Acceptance Criterion

No! The firm will receive 11.57% for

each dollar invested in this project at a

cost of 13%. [ IRR < Hurdle Rate ]

The management of Basket Wonders

has determined that the hurdle rate is

13% for projects of this type.

Should this project be accepted?

IRR Strengths

and Weaknesses

Strengths:

Accounts for

TVM

Considers all

cash flows

Weaknesses:

Assumes all cash

flows reinvested at

the IRR

Net Present Value

(NPV)

NPV is the present value of an

investment projects net cash flows

minus the projects initial cash

outflow.

CF

1

CF

2

CF

n

(1+k)

1

(1+k)

2

(1+k)

n

+ . . . + + - ICO

NPV =

NPV Solution

Basket Wonders has determined that the

appropriate discount rate (k) for this

project is 13%.

$10,000 $7,000

$10,000 $12,000 $15,000

(1.13)

1

(1.13)

2

(1.13)

3

+ +

+

- $40,000

(1.13)

4

(1.13)

5

NPV =

+

NPV Solution

NPV = $10,000(PVIF

13%,1

) + $12,000(PVIF

13%,2

) +

$15,000(PVIF

13%,3

) + $10,000(PVIF

13%,4

) +

$ 7,000(PVIF

13%,5

) - $40,000

NPV = $10,000(.885) + $12,000(.783) +

$15,000(.693) + $10,000(.613) +

$ 7,000(.543) - $40,000

NPV = $8,850 + $9,396 + $10,395 +

$6,130 + $3,801 - $40,000

= - $1,428

NPV Acceptance Criterion

No! The NPV is negative. This means that

the project is reducing shareholder wealth.

[Reject as NPV < 0 ]

The management of Basket Wonders

has determined that the required rate

is 13% for projects of this type.

Should this project be accepted?

NPV Strengths

and Weaknesses

Strengths:

Accounts for TVM.

Considers all

cash flows.

Weaknesses:

Difficult to determine

the discount rate

Profitability Index (PI)

PI is the ratio of the present value of a

projects future net cash flows to the

projects initial cash outflow.

CF

1

CF

2

CF

n

(1+k)

1

(1+k)

2

(1+k)

n

+ . . . + + ICO PI =

PI = 1 + [ NPV / ICO ]

<< OR >>

Method #2:

Method #1:

PI Acceptance Criterion

No! The PI is less than 1.00. This

means that the project is not profitable.

[Reject as PI < 1.00 ]

PI = $38,572 / $40,000

= .9643 (Method #1, 13-34)

Should this project be accepted?

PI Strengths

and Weaknesses

Strengths:

Same as NPV

Allows

comparison of

different scale

projects

Weaknesses:

Same as NPV

Anda mungkin juga menyukai

- Applied Corporate Finance. What is a Company worth?Dari EverandApplied Corporate Finance. What is a Company worth?Penilaian: 3 dari 5 bintang3/5 (2)

- Capital BudgetingDokumen31 halamanCapital BudgetinggulafridiBelum ada peringkat

- FINANCIAL MANAGEMENT MODULE 1 6 Capital BudgetingDokumen49 halamanFINANCIAL MANAGEMENT MODULE 1 6 Capital BudgetingMarriel Fate CullanoBelum ada peringkat

- Capital BudgetingDokumen66 halamanCapital BudgetingAli KhanBelum ada peringkat

- Capital Budgeting TechniquesDokumen24 halamanCapital Budgeting TechniquesMohibullah BarakzaiBelum ada peringkat

- Chapter 5Dokumen62 halamanChapter 5Dereje UrgechaBelum ada peringkat

- Financial Management07,08Dokumen33 halamanFinancial Management07,08tahir khanBelum ada peringkat

- Capital BudgetingDokumen24 halamanCapital BudgetingGokil AjeBelum ada peringkat

- MS 602 - Lec - Capital BudgetingDokumen52 halamanMS 602 - Lec - Capital BudgetingGEORGEBelum ada peringkat

- 2-Capital Budgeting TechniquesDokumen31 halaman2-Capital Budgeting TechniquesSafdar BNC cjk IqbalBelum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen58 halamanCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad ZeeshanBelum ada peringkat

- Project Evaluation: Alternative MethodsDokumen50 halamanProject Evaluation: Alternative MethodsMd SolaimanBelum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen50 halamanCapital Budgeting Techniques Capital Budgeting TechniquesMoqadus SeharBelum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen59 halamanCapital Budgeting Techniques Capital Budgeting TechniquesMuhammad FarooqBelum ada peringkat

- Capital Budgeting Techniques + IRRDokumen20 halamanCapital Budgeting Techniques + IRRHumzaBelum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen32 halamanCapital Budgeting Techniques Capital Budgeting TechniquesMehrab BashirBelum ada peringkat

- Capital Budgeting TechniquesDokumen60 halamanCapital Budgeting Techniquesaxl11Belum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen60 halamanCapital Budgeting Techniques Capital Budgeting Techniquesahmad_ranjhaBelum ada peringkat

- Capital Budgeting Techniques Capital Budgeting TechniquesDokumen31 halamanCapital Budgeting Techniques Capital Budgeting Techniquesharis123pBelum ada peringkat

- Capital Budgeting TechniquesDokumen33 halamanCapital Budgeting TechniqueservinaBelum ada peringkat

- Project Budgeting TechniqueDokumen15 halamanProject Budgeting Techniquesshahriar2001Belum ada peringkat

- Capital BudgetingDokumen67 halamanCapital BudgetingAhmad VohraBelum ada peringkat

- © 2010 Financial Management Prepared By: Amyn WahidDokumen66 halaman© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- Capital BudgetingDokumen60 halamanCapital BudgetingAce DesabilleBelum ada peringkat

- ch13Dokumen60 halamanch13Ains M. BantuasBelum ada peringkat

- CH 13Dokumen59 halamanCH 13Anusha samreenBelum ada peringkat

- Capital BudgetingDokumen48 halamanCapital BudgetingVIVEK JAISWAL100% (1)

- Capital BudgetingDokumen60 halamanCapital BudgetingMujeeb U RahmanBelum ada peringkat

- Chapter 9Dokumen44 halamanChapter 9Phạm Thùy DươngBelum ada peringkat

- Cap BudgetingDokumen58 halamanCap BudgetingKhalid MahmoodBelum ada peringkat

- Tutorial & Computer Lab Solutions - Week 8Dokumen11 halamanTutorial & Computer Lab Solutions - Week 8yida chenBelum ada peringkat

- CF MergedDokumen249 halamanCF MergedDhruv PatelBelum ada peringkat

- Inflows OutflowsDokumen17 halamanInflows OutflowsSaad-Ur-RehmanBelum ada peringkat

- Chapter 13 Capital BudgetingDokumen60 halamanChapter 13 Capital BudgetinggelskBelum ada peringkat

- Capital Budgeting TechniquesDokumen35 halamanCapital Budgeting TechniquesGaurav gusaiBelum ada peringkat

- 3 Capital Budgeting TechniquesDokumen42 halaman3 Capital Budgeting TechniquesfnhshafiraBelum ada peringkat

- Capital Budgeting Capital Budgeting: Financial Markets (Universitas IBA) Financial Markets (Universitas IBA)Dokumen6 halamanCapital Budgeting Capital Budgeting: Financial Markets (Universitas IBA) Financial Markets (Universitas IBA)karthik sBelum ada peringkat

- Chap 11Dokumen45 halamanChap 11SEATQMBelum ada peringkat

- 4-Capital Budgeting TechniquesDokumen20 halaman4-Capital Budgeting TechniquesnoortiaBelum ada peringkat

- Capital Budget Report-FINALDokumen35 halamanCapital Budget Report-FINALMikaBelum ada peringkat

- Unit 5Dokumen26 halamanUnit 5Vidhyamahaasree DBelum ada peringkat

- Chapter-4 (Capital Budgeting)Dokumen26 halamanChapter-4 (Capital Budgeting)Milad AkbariBelum ada peringkat

- The Basics of Capital Budgeting: Should We Build This Plant?Dokumen41 halamanThe Basics of Capital Budgeting: Should We Build This Plant?MoheuddinMayrajBelum ada peringkat

- Lecture 5 502 Example SolutionsDokumen9 halamanLecture 5 502 Example SolutionsJohn SmithBelum ada peringkat

- Cash Flows and Other Topics in Capital BudgetingDokumen63 halamanCash Flows and Other Topics in Capital BudgetingShaina Rosewell M. VillarazoBelum ada peringkat

- Investment Decision RulesDokumen45 halamanInvestment Decision RulesLee ChiaBelum ada peringkat

- Nadeen Ahmed Abdallah 18100863: College: CMT Answer BookDokumen9 halamanNadeen Ahmed Abdallah 18100863: College: CMT Answer BookNouran BakerBelum ada peringkat

- Unit-2 Investment AppraisalDokumen47 halamanUnit-2 Investment AppraisalPrà ShâñtBelum ada peringkat

- Capital Budgeting DecisionsDokumen30 halamanCapital Budgeting Decisionskd231Belum ada peringkat

- Investment Criteria ExDokumen14 halamanInvestment Criteria ExMon ThuBelum ada peringkat

- 2-Capital Budegeting-GMPDokumen26 halaman2-Capital Budegeting-GMPAtul SudhakaranBelum ada peringkat

- Capital Budgeting TechniquesDokumen21 halamanCapital Budgeting TechniquesMishelBelum ada peringkat

- FProyectos-05-Evaluación FinancieraDokumen52 halamanFProyectos-05-Evaluación FinancieraPedro Quimi ReyesBelum ada peringkat

- Capital BudgetingDokumen47 halamanCapital BudgetingmoosanipppBelum ada peringkat

- Capital BudgetingDokumen16 halamanCapital Budgetingrizman2004Belum ada peringkat

- Fin322 Week2 2018Dokumen12 halamanFin322 Week2 2018chi_nguyen_100Belum ada peringkat

- Capital BudgetingDokumen5 halamanCapital Budgetingshafiqul84Belum ada peringkat

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDari EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsBelum ada peringkat

- DCF Budgeting: A Step-By-Step Guide to Financial SuccessDari EverandDCF Budgeting: A Step-By-Step Guide to Financial SuccessBelum ada peringkat

- Training Nomination FormDokumen3 halamanTraining Nomination FormImmanuelohim Charis OtegbayoBelum ada peringkat

- EDP by Gowtham Kumar C.K PDFDokumen84 halamanEDP by Gowtham Kumar C.K PDFDeepthi Gowda100% (3)

- Hotel Asset Management GuidefDokumen12 halamanHotel Asset Management GuidefLaurentiuBelum ada peringkat

- Atm Master Card PDFDokumen1 halamanAtm Master Card PDFAnonymous USezGu2y5dBelum ada peringkat

- Key Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - InvestopediaDokumen3 halamanKey Ratios For Analyzing Oil and Gas Stocks: Measuring Performance - Investopediapolobook3782Belum ada peringkat

- HKUST Canvas - Quiz 2 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionsDokumen10 halamanHKUST Canvas - Quiz 2 - FINA1303 (L1) - Introduction To Financial Markets and InstitutionslauyingsumBelum ada peringkat

- SWOT Analysis of DepositsDokumen3 halamanSWOT Analysis of Depositszahranqv1Belum ada peringkat

- A Handbook On Derivatives PDFDokumen35 halamanA Handbook On Derivatives PDFAccamumbai Acca Coaching50% (2)

- Treasury Direct Account TDADokumen10 halamanTreasury Direct Account TDAVincent J. Cataldi91% (81)

- CH 10Dokumen9 halamanCH 10Paw VerdilloBelum ada peringkat

- P 7-15 Common Stock Value: All Growth ModelsDokumen8 halamanP 7-15 Common Stock Value: All Growth ModelsAlvira FajriBelum ada peringkat

- Financial Analysis and ManagementDokumen19 halamanFinancial Analysis and ManagementMohammad AnisuzzamanBelum ada peringkat

- Cgr660 10 LiquidationDokumen39 halamanCgr660 10 Liquidationr4vemasterBelum ada peringkat

- Fighting InflationDokumen3 halamanFighting InflationGabe FarajollahBelum ada peringkat

- VLIS SelectionOpinion021916Dokumen12 halamanVLIS SelectionOpinion021916Abdullah18Belum ada peringkat

- Introduction To DTCCDokumen11 halamanIntroduction To DTCCefx8x75% (4)

- Case StudyDokumen8 halamanCase StudyManiya JigarBelum ada peringkat

- Hp12c DurationDokumen3 halamanHp12c DurationGabriel La Motta100% (1)

- QuizDokumen13 halamanQuizAnnie Lind0% (3)

- GNFC Ar 2008 Full FinalDokumen44 halamanGNFC Ar 2008 Full FinalNour Saad EdweekBelum ada peringkat

- GoPro Investor SuitDokumen23 halamanGoPro Investor Suitjeff_roberts881Belum ada peringkat

- Religare ProjectDokumen109 halamanReligare Projectjagrutisolanki01Belum ada peringkat

- Marketing QuestionsDokumen3 halamanMarketing QuestionsNAZMUL HAQUEBelum ada peringkat

- Chapter 12-Eneman20Dokumen3 halamanChapter 12-Eneman20Reynald John PastranaBelum ada peringkat

- Chapter 16 Advanced Accounting Solution ManualDokumen119 halamanChapter 16 Advanced Accounting Solution ManualAsuncion BarquerosBelum ada peringkat

- Sampark FinDokumen5 halamanSampark FinAsif HussainBelum ada peringkat

- HSBC AlgosDokumen1 halamanHSBC Algosdoc_oz3298Belum ada peringkat

- Government Accounting and Financial ReportingDokumen91 halamanGovernment Accounting and Financial ReportingMurphy Red100% (1)

- Ceramic Tiles Market in India 2018 - Part-IIDokumen49 halamanCeramic Tiles Market in India 2018 - Part-IIvikasaggarwal01Belum ada peringkat

- Capital Asset Pricing Model SAPMDokumen18 halamanCapital Asset Pricing Model SAPMarmailgmBelum ada peringkat