Ranbaxy

Diunggah oleh

dnyanni100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

2K tayangan24 halamanDaiichi - benefit from low-cost production Increase in sales / revenues (e.g. Procter & Gamble takeover of gillette) Increase market share Reduction of overcapacity in the industry Enlarge brand portfolio (e. G. L'oreal's takeover of bodyshop) Likelihood of job cuts Cultural integration / conflict with new management Hidden liabilities of target entity the monetary cost to the company.

Deskripsi Asli:

Judul Asli

Ranbaxy Ppt

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniDaiichi - benefit from low-cost production Increase in sales / revenues (e.g. Procter & Gamble takeover of gillette) Increase market share Reduction of overcapacity in the industry Enlarge brand portfolio (e. G. L'oreal's takeover of bodyshop) Likelihood of job cuts Cultural integration / conflict with new management Hidden liabilities of target entity the monetary cost to the company.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

100%(1)100% menganggap dokumen ini bermanfaat (1 suara)

2K tayangan24 halamanRanbaxy

Diunggah oleh

dnyanniDaiichi - benefit from low-cost production Increase in sales / revenues (e.g. Procter & Gamble takeover of gillette) Increase market share Reduction of overcapacity in the industry Enlarge brand portfolio (e. G. L'oreal's takeover of bodyshop) Likelihood of job cuts Cultural integration / conflict with new management Hidden liabilities of target entity the monetary cost to the company.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 24

• Ranbaxy - access to Daiichi’s expertise in

research

• Daiichi - benefit from low-cost production

• Increase in sales/revenues (e.g. Procter &

Gamble takeover of Gillette)

•Profitability of target company

• Increase market share

•Reduction of overcapacity in the industry

• Enlarge brand portfolio (e.g. L'Oréal's takeover

of Bodyshop)

• Increase in economies of scale

• Reduced competition and choice for

consumers in oligopoly markets (Bad for

consumers, although this is good for the

companies involved in the takeover)

• Likelihood of job cuts

• Cultural integration/conflict with new

management

• Hidden liabilities of target entity

• The monetary cost to the company

• Integrated, research based, international

pharmaceutical company producing a wide

range of quality, affordable generic medicines

• Serving in over 125 countries and has an

expanding international portfolio of affiliates,

joint ventures and alliances, ground operations

in 49 countries and manufacturing operations in

11 countries

• Ranbaxy Laboratories Limited is an Indian

company incorporated in 196. Ranbaxy went

• In 1998, Ranbaxy entered Us the world's

largest pharmaceuticals market and now the

biggest market for Ranbaxy, accounting for

28% of Ranbaxy's sales in 2005

• September 1999 - Ranbaxy out-licensed its

first once-a-day formulation to a

multinational company

• June 23, 2006 received from the U.S. Food

and Drug Administration a 180-day

exclusivity period to sell simvastatin (Zocor)

• Daiichi - Sankyo Company, Ltd was

established in 2005 through the merger of

two leading Japanese pharmaceutical

companies

• Discovery of new medicines in the areas

of infectious diseases, cancer, bone and

joint diseases, and immune disorders

• Continuous development of novel drugs

• 1970s, In Basle a Sankyo office was opened to

keep contact with the big Swiss pharma

companies

• 1985, Sankyo Europe was established in

Duesseldorf

• 1988, Daiichi Pharmaceutical Europe

• 1993, established Daiichi Pharmaceutical UK,

Ltd. in London

• 1990, Acquisition of Luitpold Werke, by

• Production plants in Pfaffenhofen (Germany)

and Altkirch (France)

• 25 million packs and 1.2 billion tablets were

dispatched from Pfaffenhofen to over 50

countries worldwide

• Termination and official opening of the

extended production plant in Pfaffenhofen this

year

• Gradual rise in the production volume to more

• Ranbaxy is a well known name

in pharmaceutical company in India, with large

amount of shares both in Bombay and National

stock exchange has now sold major amount of

shares to the Japanese company Daiichi

• Daiichi Sankyo bought out the entire

promoter stake of 35 per cent in Ranbaxy

Laboratories at Rs 737 per share costing $3.4

billion to $4.6 billion

• Daiichi Sankyo will hold a majority stake in

• All management and people structures

across Ranbaxy will continue as they are

at present

• Mr. Malvinder Singh will be appointed

Chairman of the Board of Directors

&member of the Senior Global

Management of Daiichi Sankyo ,in

addition to his existing responsibilities as

CEO & MD, Ranbaxy

• Ranbaxy has thrived on selling off-patent drugs

in the U.S. Much more expensive proposition

because of litigation

• Growing competition in generics at home and

abroad

• Though Ranbaxy did well this yr it missed its

2007 target of becoming a $2-billion company

• Its sight on generating revenues of $5 billion by

2012, this target too appeared to be difficult.

• Ranbaxy’s share price has gone up by just 5%,

• The R&D pipeline was not delivering

enough products, the generic market was

not generating adequate returns

• Ranbaxy had three choices,It could have

spent lots of money in acquiring a big

generic company to grow inorganically,

merge with a global player, or sell-out.

• The sell-out option was the most profitable,

both for the promoters as well as

shareholder

• The investing company shall then be

amongst the largest generic manufacturers

globally in terms of market share.

• The sale would create a new powerhouse

spanning the entire pharmaceutical spectrum

• Part of the problem, state officials say, is

that generic drug companies in Japan are

small and doctors do not trust them, by

effectively rebranding Ranbaxy generics

• A complementary business combination

that provides sustainable growth by

diversification that spans the full spectrum

of the pharmaceutical business

• An expanded global reach that enables

leading market positions in both mature and

emerging markets with proprietary and non-

proprietary products

• Strong growth potential by effectively

• Competitiveness by optimizing usage of

R&D and manufacturing facilities of both

companies

• The combination of the two companies

will give Ranbaxy access to Daiichi 's

expertise in research while the Japanese

company will benefit from low-cost

production on the sub-continent, amid a

deepening profits crisis in Japan’s drugs

• Big threat to the survival of the domestic

generic industry

• May just dampen the motivation of other Indian

aspirants who want to emulate Ranbaxy's success

in global Pharma

• The acquisition will help Daiichi Sankyo to jump

from number 22 in the global pharmaceutical

sector to number 15

• Ranbaxy will gain easier access to the much-

coveted Japanese market by operating from

• The share price of Ranbaxy rose 3.86% to Rs

526.40 on June 9, two days before the company

announced its buyout by Daiichi Sankyo.

• The benchmark Sensex plunged 506 points the

same day

• June 10, a day before the deal was announced,

the Ranbaxy scrip surged 6.52% to Rs 560.75 and

the Sensex fell 177 points. The stock ended

almost flat at Rs 560.80 on June 11

• June 11 The reason as to why the Ranbaxy stock

It was not just Ranbaxy that had a run up , but

the companies that are promoted by Ranbaxy’s

promoter family also rallied. Zenotech surged

20 per cent, Religare (8.53 per cent), Fortis

Financial Services (10 per cent), Fortis

Healthcare (18.87 per cent), Krebs

• The deal is a win-win for both Ranbaxy and

Daiichi. Ranbaxy couldn’t have grown much on

the basis of first to file. It has actually left out

the NCE pipeline which Teva has done. It

actually left out the bio-similar plant which they

were desperately trying to do through

Zenotech. So, Ranbaxy’s opportunities seem to

have exhausted.

• Daiichi, on the other hand, is a small company

with 2-3 big brands like Olmesartin and Avista

• For Daiichi, it was important to have some

kind of generic play that Novartis has with

Sandoz, which is the second largest generic

company in the world. Novartis is a USD 30-

35 billion company. Maybe Daiichi at the

very start of that graph is trying to do

exactly that. They have a great play in

Ranbaxy, which has a manufacturing and

research base. It will also benefit from the

Anda mungkin juga menyukai

- Ranbaxy Acquisition By Daiichi Sankyo DealDokumen32 halamanRanbaxy Acquisition By Daiichi Sankyo DealShally GuptaBelum ada peringkat

- Ranbaxy CaseDokumen16 halamanRanbaxy Casepthukral_1Belum ada peringkat

- RanbaxyDokumen18 halamanRanbaxyDipankar PandeyBelum ada peringkat

- Ranbaxy - Daiichi Sankyo DealDokumen19 halamanRanbaxy - Daiichi Sankyo DealAkansha JainBelum ada peringkat

- Ranbaxy+ +Daiichi+Sankyo+DealDokumen19 halamanRanbaxy+ +Daiichi+Sankyo+DealNeha Dhar KoulBelum ada peringkat

- Daiichi and RanbaxyDokumen7 halamanDaiichi and RanbaxytruptiBelum ada peringkat

- Ranbaxy Daiichi Sankyo FinalDokumen42 halamanRanbaxy Daiichi Sankyo Finalarunrathore_28Belum ada peringkat

- Ranbaxy Daiichi SankyoDokumen28 halamanRanbaxy Daiichi SankyoRehanBelum ada peringkat

- Ranbaxy Acquisition by Daiichi Sankya: Click To Edit Master Subtitle StyleDokumen21 halamanRanbaxy Acquisition by Daiichi Sankya: Click To Edit Master Subtitle StyleRaul JainBelum ada peringkat

- Valuation of RanbaxyDokumen11 halamanValuation of RanbaxyMeghna SutharBelum ada peringkat

- Implementation of 7s Srategy in DR Reddy'sDokumen10 halamanImplementation of 7s Srategy in DR Reddy'schaithanyaBelum ada peringkat

- Punit Sahu PPT On RanbaxyDokumen24 halamanPunit Sahu PPT On Ranbaxypunitsahu5Belum ada peringkat

- Supply Chain Solutions For RanbaxyDokumen10 halamanSupply Chain Solutions For RanbaxyMesajalBelum ada peringkat

- Ranbaxy Laboratories LimitedDokumen11 halamanRanbaxy Laboratories LimitedRohitBelum ada peringkat

- Case Study of Ranbaxy For Mergers and AcquisitionsDokumen18 halamanCase Study of Ranbaxy For Mergers and AcquisitionsjitendrabiharBelum ada peringkat

- Pharma Industry Pakistan and Herbion Pharma Company Swot AnalysisDokumen20 halamanPharma Industry Pakistan and Herbion Pharma Company Swot Analysiscooladeel23383% (6)

- Daicho Pharma Case Study: Business Growth and Ethics IssuesDokumen45 halamanDaicho Pharma Case Study: Business Growth and Ethics IssuesRahul DeepBelum ada peringkat

- Dr. Reddy's Group-14 MACR AssignmentDokumen11 halamanDr. Reddy's Group-14 MACR AssignmentSahil GuptaBelum ada peringkat

- Daiichi Sankyo RanbaxyDokumen2 halamanDaiichi Sankyo RanbaxyPramod kBelum ada peringkat

- Johnson & Johnson Global Healthcare Giant ProfiledDokumen11 halamanJohnson & Johnson Global Healthcare Giant ProfiledkevinBelum ada peringkat

- OSD RanbaxyDokumen26 halamanOSD RanbaxyUmair Khalid SiddiquiBelum ada peringkat

- Case Study on Merging of Ranbaxy and Daiichi SankyoDokumen13 halamanCase Study on Merging of Ranbaxy and Daiichi SankyoLavanya PrabhakaranBelum ada peringkat

- FADMDokumen27 halamanFADMManju TripathiBelum ada peringkat

- Ranbaxy: "Trusted Medicines For Better Lives,"Dokumen8 halamanRanbaxy: "Trusted Medicines For Better Lives,"deepakBelum ada peringkat

- Japanese Pharma MarketDokumen2 halamanJapanese Pharma Markettusharp89Belum ada peringkat

- Project Report On M & A of Ranbaxy Ltd. and Daiichi SankyoDokumen14 halamanProject Report On M & A of Ranbaxy Ltd. and Daiichi SankyoNikita AgarwalBelum ada peringkat

- Assignment ON Strategies of Ranbaxy: Company ProfileDokumen9 halamanAssignment ON Strategies of Ranbaxy: Company Profilelovy07Belum ada peringkat

- Ranbaxy Project Main2Dokumen27 halamanRanbaxy Project Main2rohitmitra060% (1)

- Ranbaxy Acquisition By Daiichi Sankyo ResearchDokumen9 halamanRanbaxy Acquisition By Daiichi Sankyo Researchrupe59Belum ada peringkat

- Your Partners in CareDokumen70 halamanYour Partners in CareNabinSundar NayakBelum ada peringkat

- Synopsis: Ranbaxy Laboratories Limited (BSE: 500359)Dokumen4 halamanSynopsis: Ranbaxy Laboratories Limited (BSE: 500359)HimanshiBelum ada peringkat

- Kevin Kato Fischer Swot Analysis 2Dokumen19 halamanKevin Kato Fischer Swot Analysis 2Kevin Kato Fischer100% (1)

- Issues and Growth of Ranbaxy PharmaDokumen16 halamanIssues and Growth of Ranbaxy Pharmaanjali_jain_37Belum ada peringkat

- The Saga of Globalization of Indian Brand: IM Project OnDokumen14 halamanThe Saga of Globalization of Indian Brand: IM Project OnAshish Chatrath100% (2)

- Project MBA Ranbaxy Laboratories Ltd.Dokumen5 halamanProject MBA Ranbaxy Laboratories Ltd.neelamverma1970Belum ada peringkat

- Dr. Reddy's Corporate PresentationDokumen35 halamanDr. Reddy's Corporate Presentationbiswajitd100% (2)

- Sun Pharma Swot Analysis 1Dokumen12 halamanSun Pharma Swot Analysis 1vishalBelum ada peringkat

- Teva PharmaceuticalDokumen17 halamanTeva PharmaceuticalGanesh VedhachalamBelum ada peringkat

- Daicii RanbaxyDokumen27 halamanDaicii RanbaxydimpledsmilesBelum ada peringkat

- Marketing Strategy of RanbaxyDokumen9 halamanMarketing Strategy of Ranbaxytasneem890% (1)

- Name Chaithanya Reddy Sadu IUD 08PMP03528 Enrollment No. 08BS0002864 SUBJECT: Business Strategy FACULTY NAME: Prof. A. Lakshmi NarasimhaDokumen8 halamanName Chaithanya Reddy Sadu IUD 08PMP03528 Enrollment No. 08BS0002864 SUBJECT: Business Strategy FACULTY NAME: Prof. A. Lakshmi NarasimhaVrinda SinghalBelum ada peringkat

- Healthcare in BDDokumen20 halamanHealthcare in BDAl AminBelum ada peringkat

- Report RanbaxyDokumen2 halamanReport RanbaxythokachiBelum ada peringkat

- RANBAXYDokumen5 halamanRANBAXYRanjith KumarBelum ada peringkat

- Prestige Institute of Management & Research Gwalior: Case Folio - 2010Dokumen18 halamanPrestige Institute of Management & Research Gwalior: Case Folio - 2010Satya Kam JawalBelum ada peringkat

- Eli Lilly Ranbaxy Joint Venture Case StudyDokumen21 halamanEli Lilly Ranbaxy Joint Venture Case StudyAnil Jadli100% (2)

- Daiichi Ranbaxy FinalDokumen21 halamanDaiichi Ranbaxy Finaltusharp89Belum ada peringkat

- Sic PharmaDokumen36 halamanSic PharmaPrakash JeswaniBelum ada peringkat

- 18miles eDokumen13 halaman18miles eMarieBashBelum ada peringkat

- Project On RanbaxyDokumen8 halamanProject On RanbaxyManish VermaBelum ada peringkat

- Project On Sale of Cephalosporins Class Antibiotic.Dokumen56 halamanProject On Sale of Cephalosporins Class Antibiotic.Rahul GurjarBelum ada peringkat

- Cracking the Generics Code: Your Single-Source Success Manual for Winning in Multi-Source Product Markets!Dari EverandCracking the Generics Code: Your Single-Source Success Manual for Winning in Multi-Source Product Markets!Penilaian: 5 dari 5 bintang5/5 (1)

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)Dari EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Belum ada peringkat

- Supply Chain Management in the Drug Industry: Delivering Patient Value for Pharmaceuticals and BiologicsDari EverandSupply Chain Management in the Drug Industry: Delivering Patient Value for Pharmaceuticals and BiologicsBelum ada peringkat

- Dealing with Darwin (Review and Analysis of Moore's Book)Dari EverandDealing with Darwin (Review and Analysis of Moore's Book)Belum ada peringkat

- Good Laboratory Practices and Compliance MonitoringDari EverandGood Laboratory Practices and Compliance MonitoringBelum ada peringkat

- Outthink the Competition (Review and Analysis of Krippendorff's Book)Dari EverandOutthink the Competition (Review and Analysis of Krippendorff's Book)Belum ada peringkat

- Summary of The Goal: by Eliyahu M. Goldratt and Jeff Cox | Includes AnalysisDari EverandSummary of The Goal: by Eliyahu M. Goldratt and Jeff Cox | Includes AnalysisPenilaian: 4.5 dari 5 bintang4.5/5 (2)

- Midterm Exam 2Dokumen8 halamanMidterm Exam 2Nhi Nguyễn HoàngBelum ada peringkat

- Who Owns The Ice House Eight Life-1Dokumen131 halamanWho Owns The Ice House Eight Life-1Justin ElijahBelum ada peringkat

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDokumen3 halamanIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- Nike: The world's leading sportswear brandDokumen20 halamanNike: The world's leading sportswear brandMohit ManaktalaBelum ada peringkat

- Module 6 - Applied Economics MODULE 6: Contemporary Economic Issues Faced by Filipino EntrepreneursDokumen4 halamanModule 6 - Applied Economics MODULE 6: Contemporary Economic Issues Faced by Filipino EntrepreneursRuby CocalBelum ada peringkat

- North South University Assignment on Ceramic Tiles IndustryDokumen14 halamanNorth South University Assignment on Ceramic Tiles IndustryTanzil Tahseen 1620052630Belum ada peringkat

- What Causes Small Businesses To FailDokumen11 halamanWhat Causes Small Businesses To Failmounirs719883Belum ada peringkat

- Fundamental Analysis On Stock MarketDokumen6 halamanFundamental Analysis On Stock Marketapi-3755813Belum ada peringkat

- Value Stream Mapping Process - Supply Chain ManagementDokumen21 halamanValue Stream Mapping Process - Supply Chain ManagementMANTECH Publications100% (1)

- Profile of The Indian Consumers 1Dokumen2 halamanProfile of The Indian Consumers 1mvsrikrishna100% (1)

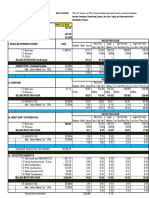

- FMV of Equity Shares As On 31st January 2018Dokumen57 halamanFMV of Equity Shares As On 31st January 2018Manish Maheshwari100% (2)

- Syllabus CFA Level 1Dokumen2 halamanSyllabus CFA Level 1Phi AnhBelum ada peringkat

- QuestionsDokumen3 halamanQuestionsLayla RamirezBelum ada peringkat

- 15 Golden Tips 2 Bluid ResumeDokumen3 halaman15 Golden Tips 2 Bluid ResumeDeepak KumarBelum ada peringkat

- Case Study GuidelinesDokumen4 halamanCase Study GuidelinesKhothi BhosBelum ada peringkat

- Master of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramDokumen20 halamanMaster of Business Administration: The Report On Summer-Internship at Suguna Foods Limited in VaratharajapuramThilli KaniBelum ada peringkat

- 10 Types of Entrepreneurial BMsDokumen36 halaman10 Types of Entrepreneurial BMsroshnisoni_sBelum ada peringkat

- Account StatementDokumen3 halamanAccount StatementRonald MyersBelum ada peringkat

- PhonePe Statement Mar2023 Mar2024Dokumen59 halamanPhonePe Statement Mar2023 Mar2024Navneet ChettiBelum ada peringkat

- Management Development ProgrammeDokumen4 halamanManagement Development ProgrammeDebi GhoshBelum ada peringkat

- Security agency cost report for NCRDokumen25 halamanSecurity agency cost report for NCRRicardo DelacruzBelum ada peringkat

- 300+ TOP Central Civil Services (Conduct) Rules MCQs and Answers 2022Dokumen1 halaman300+ TOP Central Civil Services (Conduct) Rules MCQs and Answers 2022Indhunesan Packirisamy100% (2)

- Schneider EnglishDokumen134 halamanSchneider EnglishpepitoBelum ada peringkat

- Capital Reduction MergedDokumen33 halamanCapital Reduction MergedWhalienBelum ada peringkat

- Samsung Care Plus Terms and Conditions PDFDokumen10 halamanSamsung Care Plus Terms and Conditions PDFav86Belum ada peringkat

- Convince Converts What Great Brands Do in Content Marketing Ebook PDFDokumen8 halamanConvince Converts What Great Brands Do in Content Marketing Ebook PDFA100% (1)

- Policy On Prohibition of Child LaborDokumen2 halamanPolicy On Prohibition of Child LaborkkyuvarajBelum ada peringkat

- Concept Methods Analysis InterpretationDokumen13 halamanConcept Methods Analysis InterpretationnikskagalwalaBelum ada peringkat

- 3.time Value of Money..F.MDokumen21 halaman3.time Value of Money..F.MMarl MwegiBelum ada peringkat

- PD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016Dokumen36 halamanPD Mitra Jurnal Penerimaan Kas: Bulan: Desember 2016DaraBelum ada peringkat