Morning View 12feb2010

Diunggah oleh

AndysTechnicalsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Morning View 12feb2010

Diunggah oleh

AndysTechnicalsHak Cipta:

Format Tersedia

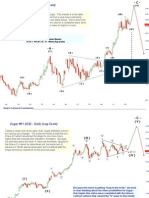

Dollar Index (180 minute) ~ “Unorthodox model” y?

-g-

81.10

-e-

Reprinted from 2/10/2010

-c-

79.25?

x?

-a- -f-

-d-

-b-

The “unorthodox” model is so far serving us well. The weekend report suggested 4-5 days of correction,

and that’s what we’ve been getting. This move lower should finish within the next 24-48 hours. An ideal

target might be 79.25 for 161.8% of -d-=-f-. When -f- wave completes, we should get one more move higher

76.94 to the 81 zone.

x

Andy’s Technical Commentary__________________________________________________________________________________________________

y?

-g-

Dollar Index (180 minute) ~ “Unorthodox model” 81.20s

-e-

-c-

-f-

x?

-a-

-d-

-b-

It’ll be interesting to see if this “unorthodox” model proves to be correct. It would mark the first time

I’ve assumed this type of pattern to predict market behavior. According to this model, we’re in the

final g-wave of a “diametric.” If the -efg-waves are “fractal” to the -abc-, then this -g- should complete

76.94 near 78.6% of -e-, or in the 81.20s. Under no circumstances should this g-wave break above 82.

x Because the -c- wave was shorter than -a-, the -g- should be shorter than -e-.

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z)

“c”

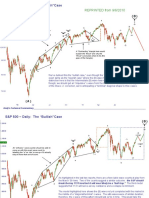

1050 S&P 500 (180 min.) - A Triangle Forming off the Lows?

[b] I’m sort of warming up to the idea of this triangle model for various reasons:

1) The move from 1071.61104.7 had the look of an “initial” wave that was NOT an impulse;

2) The (b) wave looks like an “elongated flat,” a pattern one sees contained within a triangle;

3) The (c) wave here looks “corrective” and the line break has seemed “uneventful,” typically a triangle signal.

[a]

If this is the model, the market should continue to “meander” and

(x) chop sideways. There should also be a Fibonacci relationship

between the (c) and (a) wave, which means a “reversal” at one of

(a) the targets cited.

[c]

1104.7

(w) [b]

(x) [b] So far, this line break seems “non-eventful.” If this

[b] was a ‘real’ break of trendline, shouldn’t we have

seen an acceleration?

(c)?

[a]

[a]

-b- or -x-

[c] (e)?

(y) [a]

1071.6

[c]

(z)

-a- or -w- (d)?

Targets for the (c) wave:

1077 = 100.0% of (a)

1090 = 138.2% of (a)

1098 = 161.8% of (a)

1044.5

[c]

(b) CRASH

Andy’s Technical Commentary__________________________________________________________________________________________________

(Z)

“c”

1050

S&P 500 (180 min.) - A “Double”?

[b]

This is a variation on previous similar models. This calls for one more leg down, but not necessarily a “crash.”

It would just be another leg down that would take the S&P to the 1130’s, before another bear market rally. The

(b) wave in the model could certainly test 1104.7 before resuming the next wave down. The 61.8% retrace of

the last wave down, around 1078, as been presenting plenty of resistance, but this market is not really showing

[a] any immediate sings of reversing, yet.

(x)

[c] -x-

(w) 1104.7

[b]

(x) [b]

[b]

(b)

[a]

[a]

[c]

(y) [a]

1071.6

[c]

(z)

-w-

1044.5

(a)

NON-

CRASH

Andy’s Technical Commentary__________________________________________________________________________________________________

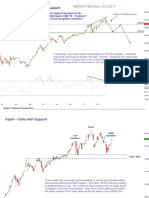

(A) Smith and Wesson [SWHC] ~ Daily

“c”

$7.52

“b”

“d”

“a”

“c” “e”

Interesting how its finding support at an EXACT 61.8% (B)

“a”

$3.29

b

d

I’ll periodically post on Smith and Wesson because, quite frankly, I love the look of this entire

pattern. It’s entirely possible that this (B)-wave takes longer to complete, but the whole pattern from

the $7.52 highs looks VERY corrective in nature--meaning, we should get another big leg up at

e some point. So, either SWHC will prove the point that Wave Analysis does not work well on stocks,

and this equity will break my heart, or SWHC will launch very powerfully higher in the not distant

“b” future.

c

a

Andy’s Technical Commentary__________________________________________________________________________________________________

“d” Smith and Wesson [SWHC] ~ 60 min.

The worrisome factor for SWHC bulls is the clear triangular nature of this pattern on the recent lows. A

break of new lows should send this market to the $3.40s, which should be the final low for the Smith and

Wesson. As we have seen, sometimes triangles END major patterns, so a thrust higher would not

surprise. The Bottom Line: A decision moment is coming for the Smith and Wesson and this stock should

get “volatile” very soon. I’ve liked the stock near $4.00 and would probably buy more at $3.50, if we got

another move lower. Remember to “keep your powder dry.”

$3.29

Andy’s Technical Commentary__________________________________________________________________________________________________

Smith and Wesson [SWHC] ~ Daily

(A)

$7.52

Reprinted from 1/27/2010

(B)

Double Bottom at $3.83?

$3.29

My first look at SWHC was back on 9/25/09 at $5.21. At that time I thought it was a triangle that had

a lot of upside. The stop loss was at $5.00 while the low $3.00’s was identified as better long term

support. At this point, it’s very difficult to peg the exact kind of correction this might be, but one thing

is certain: the move down from $7.52 was only corrective in nature. This suggests that once

played out, SWHC has a pretty strong ( C ) wave coming. Perhaps it’s time to think about bullish

strategies on this stock?

Andy’s Technical Commentary__________________________________________________________________________________________________

DISCLAIMER WARNING DISCLAIMER WARNING DISCLAIMER

This report should not be interpreted as investment advice of any kind. This report is technical

commentary only. The author is NOT representing himself as a CTA or CFA or Investment/Trading

Advisor of any kind. This merely reflects the author’s interpretation of technical analysis. The

author may or may not trade in the markets discussed. The author may hold positions opposite of

what may by inferred by this report. The information contained in this commentary is taken from

sources the author believes to be reliable, but it is not guaranteed by the author as to the accuracy

or completeness thereof and is sent to you for information purposes only. Commodity trading

involves risk and is not for everyone.

Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading:

Trading commodity futures and options is not for everyone. IT IS A VOLATILE, COMPLEX AND

RISKY BUSINESS. Before you invest any money in futures or options contracts, you should

consider your financial experience, goals and financial resources, and know how much you can

afford to lose above and beyond your initial payment to a broker. You should understand commodity

futures and options contracts and your obligations in entering into those contracts. You should

understand your exposure to risk and other aspects of trading by thoroughly reviewing the risk

disclosure documents your broker is required to give you.

Anda mungkin juga menyukai

- Distressed Debt Investing Strategies and TechniquesDokumen10 halamanDistressed Debt Investing Strategies and Techniques233344554545100% (1)

- Investthesis 160425213014Dokumen32 halamanInvestthesis 160425213014OblackBelum ada peringkat

- Market Commentary 5aug12Dokumen7 halamanMarket Commentary 5aug12AndysTechnicalsBelum ada peringkat

- Capital Structure Slides Plus QuestionsDokumen22 halamanCapital Structure Slides Plus QuestionsDishAnt PaTelBelum ada peringkat

- How To Use Bar Patterns To Spot Trade SetupsDokumen16 halamanHow To Use Bar Patterns To Spot Trade Setupstonmdn100% (4)

- Goldman Sachs Letter To ClientsDokumen2 halamanGoldman Sachs Letter To ClientsDealBookBelum ada peringkat

- Book Value Per Share Problem 1Dokumen3 halamanBook Value Per Share Problem 1XXXXXXXXXXXXXXXXXXBelum ada peringkat

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDokumen8 halamanUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Quiz Associates and Joint Arrangements UpdatedDokumen22 halamanQuiz Associates and Joint Arrangements UpdatedMarlon Solano100% (1)

- Dollar Index (180 Minute) "Unorthodox Model"Dokumen6 halamanDollar Index (180 Minute) "Unorthodox Model"AndysTechnicalsBelum ada peringkat

- S&P 500 Update 9 Nov 09Dokumen6 halamanS&P 500 Update 9 Nov 09AndysTechnicalsBelum ada peringkat

- Dollar Index 15 Feb 2010Dokumen4 halamanDollar Index 15 Feb 2010AndysTechnicalsBelum ada peringkat

- S&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100Dokumen7 halamanS&P 500 (180 Min.) : Key Resistance Points Remain 1078 and 1100AndysTechnicalsBelum ada peringkat

- Morning View 18 Feb 10Dokumen6 halamanMorning View 18 Feb 10AndysTechnicalsBelum ada peringkat

- Wednesday Update 10 March 2010Dokumen6 halamanWednesday Update 10 March 2010AndysTechnicalsBelum ada peringkat

- Morning View 19 Feb 10Dokumen4 halamanMorning View 19 Feb 10AndysTechnicalsBelum ada peringkat

- Morning View 10feb2010Dokumen8 halamanMorning View 10feb2010AndysTechnicalsBelum ada peringkat

- S& P 500 Update 2 May 10Dokumen9 halamanS& P 500 Update 2 May 10AndysTechnicalsBelum ada peringkat

- REPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseDokumen7 halamanREPRINTED From 9/7/2010:: S&P 500 Daily: The "Bullish"CaseAndysTechnicalsBelum ada peringkat

- Market Update 11 July 10Dokumen13 halamanMarket Update 11 July 10AndysTechnicalsBelum ada peringkat

- Morning View 17 Feb 10Dokumen10 halamanMorning View 17 Feb 10AndysTechnicalsBelum ada peringkat

- Market Discussion 19 Dec 10Dokumen6 halamanMarket Discussion 19 Dec 10AndysTechnicalsBelum ada peringkat

- Market Commentary 13mar11Dokumen8 halamanMarket Commentary 13mar11AndysTechnicalsBelum ada peringkat

- Gold Report 30 May 2010Dokumen7 halamanGold Report 30 May 2010AndysTechnicalsBelum ada peringkat

- Morning Update 2 Mar 10Dokumen4 halamanMorning Update 2 Mar 10AndysTechnicalsBelum ada peringkat

- Sugar Report Nov 06 2009Dokumen6 halamanSugar Report Nov 06 2009AndysTechnicalsBelum ada peringkat

- Market Update 28 Nov 10Dokumen8 halamanMarket Update 28 Nov 10AndysTechnicalsBelum ada peringkat

- REPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseDokumen8 halamanREPRINTED From 9/12/2010: S&P 500 Daily: The "Bearish"CaseAndysTechnicalsBelum ada peringkat

- Morning Update 3 Mar 10Dokumen5 halamanMorning Update 3 Mar 10AndysTechnicalsBelum ada peringkat

- Market Discussion 5 Dec 10Dokumen9 halamanMarket Discussion 5 Dec 10AndysTechnicalsBelum ada peringkat

- Morning View 5mar2010Dokumen7 halamanMorning View 5mar2010AndysTechnicalsBelum ada peringkat

- SP500 Update 13 June 10Dokumen9 halamanSP500 Update 13 June 10AndysTechnicalsBelum ada peringkat

- Morning View 27jan2010Dokumen6 halamanMorning View 27jan2010AndysTechnicals100% (1)

- Sunday Evening Views 21 March 10Dokumen6 halamanSunday Evening Views 21 March 10AndysTechnicalsBelum ada peringkat

- Gold Report 7 Nov 2010Dokumen8 halamanGold Report 7 Nov 2010AndysTechnicalsBelum ada peringkat

- SP500 Update 2 Jan 11Dokumen9 halamanSP500 Update 2 Jan 11AndysTechnicalsBelum ada peringkat

- S&P 500 Update 4 Apr 10Dokumen10 halamanS&P 500 Update 4 Apr 10AndysTechnicalsBelum ada peringkat

- Market Update 18 July 10Dokumen10 halamanMarket Update 18 July 10AndysTechnicalsBelum ada peringkat

- SP500 Update 24apr11Dokumen7 halamanSP500 Update 24apr11AndysTechnicalsBelum ada peringkat

- Gold Report 12 Sep 2010Dokumen16 halamanGold Report 12 Sep 2010AndysTechnicalsBelum ada peringkat

- S&P 500 Update 23 Jan 10Dokumen7 halamanS&P 500 Update 23 Jan 10AndysTechnicalsBelum ada peringkat

- Market Update 29 Aug 10Dokumen13 halamanMarket Update 29 Aug 10AndysTechnicalsBelum ada peringkat

- S&P 500 Update 19 Mar 10Dokumen8 halamanS&P 500 Update 19 Mar 10AndysTechnicalsBelum ada peringkat

- Sugar Nov 28 2009Dokumen9 halamanSugar Nov 28 2009AndysTechnicalsBelum ada peringkat

- S&P 500 Update 15 Feb 10Dokumen9 halamanS&P 500 Update 15 Feb 10AndysTechnicalsBelum ada peringkat

- SP500 Update 31 May 10Dokumen13 halamanSP500 Update 31 May 10AndysTechnicalsBelum ada peringkat

- SP500 Update 22 Aug 10Dokumen7 halamanSP500 Update 22 Aug 10AndysTechnicalsBelum ada peringkat

- S&P 500 Daily: The "Double Top Count"Dokumen7 halamanS&P 500 Daily: The "Double Top Count"AndysTechnicalsBelum ada peringkat

- DXY Report 11 April 2010Dokumen8 halamanDXY Report 11 April 2010AndysTechnicalsBelum ada peringkat

- S&P 500 (Daily) - Sniffed Out Some Support .Dokumen4 halamanS&P 500 (Daily) - Sniffed Out Some Support .AndysTechnicalsBelum ada peringkat

- REPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartDokumen8 halamanREPRINTED From 10/31/2010: S&P 500 120 Min. Cash ChartAndysTechnicalsBelum ada peringkat

- S&P 500 Update 4 Nov 09Dokumen6 halamanS&P 500 Update 4 Nov 09AndysTechnicalsBelum ada peringkat

- S&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010Dokumen10 halamanS&P 500 Daily: The "Bullish"Case: REPRINTED From 9/6/2010AndysTechnicalsBelum ada peringkat

- Sample Paper Maths Icse 10th GradeDokumen10 halamanSample Paper Maths Icse 10th GradeAkshita MaityBelum ada peringkat

- Iep "Santo Domingo de Guzmán" Geometría: CuadriláterosDokumen4 halamanIep "Santo Domingo de Guzmán" Geometría: CuadriláterosDaniel TorresBelum ada peringkat

- Market Commentary 27mar11Dokumen10 halamanMarket Commentary 27mar11AndysTechnicalsBelum ada peringkat

- Market Update 25 July 10Dokumen13 halamanMarket Update 25 July 10AndysTechnicalsBelum ada peringkat

- Iep "Lobachevsky" Geometría: CuadriláterosDokumen4 halamanIep "Lobachevsky" Geometría: CuadriláterosDaniel TorresBelum ada peringkat

- 202002-SW02L2 Y10 Transformations Practice WorksheetDokumen8 halaman202002-SW02L2 Y10 Transformations Practice WorksheetSarah TseungBelum ada peringkat

- Market Update 21 Nov 10Dokumen10 halamanMarket Update 21 Nov 10AndysTechnicalsBelum ada peringkat

- Tutorial Sheet (2) : Kingdom of Saudi Arabia Ministry of Education - Higher Education Computer Sciences DepartmentDokumen5 halamanTutorial Sheet (2) : Kingdom of Saudi Arabia Ministry of Education - Higher Education Computer Sciences DepartmentFatimah TurkiBelum ada peringkat

- Crude Oil 31 October 2010Dokumen8 halamanCrude Oil 31 October 2010AndysTechnicalsBelum ada peringkat

- Sugar Dec 11 2009Dokumen6 halamanSugar Dec 11 2009AndysTechnicalsBelum ada peringkat

- S&P 500 Update 1 Nov 09Dokumen7 halamanS&P 500 Update 1 Nov 09AndysTechnicalsBelum ada peringkat

- S&P Futures 3 March 10 EveningDokumen2 halamanS&P Futures 3 March 10 EveningAndysTechnicalsBelum ada peringkat

- S&P 500 Update 25 Apr 10Dokumen7 halamanS&P 500 Update 25 Apr 10AndysTechnicalsBelum ada peringkat

- Market Commentary 1may11Dokumen12 halamanMarket Commentary 1may11AndysTechnicalsBelum ada peringkat

- Productivity Now: Social Administration, Training, Economics and Production DivisionDari EverandProductivity Now: Social Administration, Training, Economics and Production DivisionBelum ada peringkat

- Market Commentary 22JUL12Dokumen6 halamanMarket Commentary 22JUL12AndysTechnicalsBelum ada peringkat

- Market Commentary 29apr12Dokumen6 halamanMarket Commentary 29apr12AndysTechnicalsBelum ada peringkat

- Market Commentary 25mar12Dokumen8 halamanMarket Commentary 25mar12AndysTechnicalsBelum ada peringkat

- Market Commentary 10JUN12Dokumen7 halamanMarket Commentary 10JUN12AndysTechnicalsBelum ada peringkat

- Market Commentary 11mar12Dokumen7 halamanMarket Commentary 11mar12AndysTechnicalsBelum ada peringkat

- Market Commentary 20may12Dokumen7 halamanMarket Commentary 20may12AndysTechnicalsBelum ada peringkat

- Market Commentary 1JUL12Dokumen8 halamanMarket Commentary 1JUL12AndysTechnicalsBelum ada peringkat

- Market Commentary 17JUN12Dokumen7 halamanMarket Commentary 17JUN12AndysTechnicalsBelum ada peringkat

- S&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportDokumen6 halamanS&P 500 Weekly Bull Trap?: Previous Resistance Zone Should've Been SupportAndysTechnicals100% (1)

- Market Commentary 1apr12Dokumen8 halamanMarket Commentary 1apr12AndysTechnicalsBelum ada peringkat

- S&P500 Report 22apr12Dokumen12 halamanS&P500 Report 22apr12AndysTechnicalsBelum ada peringkat

- Dollar Index (DXY) Daily ContinuationDokumen6 halamanDollar Index (DXY) Daily ContinuationAndysTechnicalsBelum ada peringkat

- Market Commentary 18mar12Dokumen8 halamanMarket Commentary 18mar12AndysTechnicalsBelum ada peringkat

- S&P 500 Commentary 12feb12Dokumen6 halamanS&P 500 Commentary 12feb12AndysTechnicalsBelum ada peringkat

- S& P 500 Commentary 20feb12Dokumen9 halamanS& P 500 Commentary 20feb12AndysTechnicalsBelum ada peringkat

- Market Commentary 29jan12Dokumen6 halamanMarket Commentary 29jan12AndysTechnicalsBelum ada peringkat

- Market Commentary 26feb12Dokumen6 halamanMarket Commentary 26feb12AndysTechnicalsBelum ada peringkat

- Market Commentary 22jan12Dokumen8 halamanMarket Commentary 22jan12AndysTechnicalsBelum ada peringkat

- Market Commentary 16jan12Dokumen7 halamanMarket Commentary 16jan12AndysTechnicalsBelum ada peringkat

- Copper Commentary 11dec11Dokumen6 halamanCopper Commentary 11dec11AndysTechnicalsBelum ada peringkat

- Market Commentary 8jan12Dokumen8 halamanMarket Commentary 8jan12AndysTechnicalsBelum ada peringkat

- Market Commentary 6NOVT11Dokumen4 halamanMarket Commentary 6NOVT11AndysTechnicalsBelum ada peringkat

- Market Commentary 2jan12Dokumen7 halamanMarket Commentary 2jan12AndysTechnicalsBelum ada peringkat

- Market Commentary 27NOV11Dokumen5 halamanMarket Commentary 27NOV11AndysTechnicalsBelum ada peringkat

- Copper Commentary 2OCT11Dokumen8 halamanCopper Commentary 2OCT11AndysTechnicalsBelum ada peringkat

- Market Commentary 19DEC11Dokumen9 halamanMarket Commentary 19DEC11AndysTechnicals100% (1)

- Market Commentary 20NOV11Dokumen7 halamanMarket Commentary 20NOV11AndysTechnicalsBelum ada peringkat

- Market Commentary 30OCT11Dokumen6 halamanMarket Commentary 30OCT11AndysTechnicalsBelum ada peringkat

- Sp500 Update 23oct11Dokumen7 halamanSp500 Update 23oct11AndysTechnicalsBelum ada peringkat

- Private Equity in MENA RegionDokumen109 halamanPrivate Equity in MENA RegionkmghazaliBelum ada peringkat

- Bearish Harami Candlestick PatternDokumen5 halamanBearish Harami Candlestick PatternbabscribdBelum ada peringkat

- Brand Valuation Final-2Dokumen8 halamanBrand Valuation Final-2ChimzMughoghoBelum ada peringkat

- Example 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDokumen8 halamanExample 8: Appendix - Answers To Examples and End-Of-Chapter QuestionsDewan Mahid Raza ChowdhuryBelum ada peringkat

- Debtors Turnover RatioDokumen7 halamanDebtors Turnover RatiorachitdedhiaBelum ada peringkat

- FM-financial Statement AnalysisDokumen29 halamanFM-financial Statement AnalysisParamjit Sharma97% (32)

- Sebi TocDokumen33 halamanSebi Tocapi-3712367Belum ada peringkat

- Upstox Discount BrokerDokumen5 halamanUpstox Discount BrokerAbhishek JainBelum ada peringkat

- MCQ Law Ca InterDokumen71 halamanMCQ Law Ca InterGaurav PatelBelum ada peringkat

- Company Accounts Issue of Shares Par Premium DiscountDokumen20 halamanCompany Accounts Issue of Shares Par Premium DiscountDilwar Hussain100% (1)

- Article On Investors Awareness in Stock Market-1Dokumen10 halamanArticle On Investors Awareness in Stock Market-1archerselevatorsBelum ada peringkat

- Sources of finance for business - Lease financing, public deposits, commercial paper, equity shares, preference sharesDokumen4 halamanSources of finance for business - Lease financing, public deposits, commercial paper, equity shares, preference sharesAmrit KaurBelum ada peringkat

- This Study Resource WasDokumen7 halamanThis Study Resource WasBilly Vince AlquinoBelum ada peringkat

- Pershing Square's Q1 Letter To InvestorsDokumen10 halamanPershing Square's Q1 Letter To InvestorsDealBook100% (22)

- W2 WCorporateDokumen14 halamanW2 WCorporateWay2 WealthBelum ada peringkat

- Bata Learning Center Financial PositionDokumen10 halamanBata Learning Center Financial PositionMaria Denise Belen SaclutiBelum ada peringkat

- Beijing Cuts Interest Rates in Bid To Revive Economy: Three Headaches Sleeping Beauty The Big RetreatDokumen26 halamanBeijing Cuts Interest Rates in Bid To Revive Economy: Three Headaches Sleeping Beauty The Big RetreatstefanoBelum ada peringkat

- Jayson Sabado resume for accounting positionDokumen3 halamanJayson Sabado resume for accounting positionrobertoBelum ada peringkat

- 11modelos de Valorización de AccionesDokumen46 halaman11modelos de Valorización de AccionesMario Zambrano CéspedesBelum ada peringkat

- Mahindra and Mahindra Financial Limited SHIVANK DANTREDokumen9 halamanMahindra and Mahindra Financial Limited SHIVANK DANTREmadhu sudhanBelum ada peringkat

- 8-Behavoral Finance and Technical AnalysisDokumen36 halaman8-Behavoral Finance and Technical AnalysisHenry TianBelum ada peringkat

- Tax Equity Financing and Asset RotationDokumen38 halamanTax Equity Financing and Asset RotationShofiul HasanBelum ada peringkat