The Daimler Chrysler Merger

Diunggah oleh

Oumayma BakaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The Daimler Chrysler Merger

Diunggah oleh

Oumayma BakaHak Cipta:

Format Tersedia

By

Abdul Rahim A

S 2, IEM

Guidance by

Dr M S Jayamohan

Mergers

Literature review

Premerger Daimler Chrysler

Premerger Mitsubishi

Towards the merger

The merger

To demerger

The contrast

The failures

Inference

Global vehicle production has more than doubled since1975 , from

33 to nearly 73 mn in 2007

New markets in China and India has helped to drive the pace of

growth

Since the mid 1980s, automobile industry has been shifting from

discrete national industries to a more integrated global industry

On the production side, the dominant trend is towards regional

integration

Major firms searched for a presence not just in all major geographic

markets, but in each market segment

Organic growth or Growth by acquisition and merger

Mergers & Acquisitions are attractive as they create synergies

and economies of scale

A courtship can often assist in clarifying how much investment might

be required to improve a weaker firm as the amount of investment

needed might be underestimated and vitiate any post-merger

strategy (Gomes et al., 2007)

Of the two key phases, post-merger implementation strategy is the

most difficult to operate. No two mergers are alike and so

implementation strategies vary accordingly, but in theory should

reflect the rationale behind the merger (Mitleton-Kelly, 2004)

It could be argued that mergers and acquisitions have become a key

method of firm growth and expansion as it is cheaper and quicker

than organic growth. Mergers differ from acquisitions in so far as

they are the product of mutual consent between the respective firms

and often simply involve an exchange of shares.(Capron 1999)

There are three key stages in a merger process: target identification

and selection; negotiation; and integration. (Howell 1970)

Timeline

Benz & Company, 18831926

Daimler Motoren Gesellschaft AG, 18901926

Daimler-Benz AG, 19261998(Germany)

DaimlerChrysler AG, 19982007

Daimler AG, 2007present

Restructuring

Jurgen Schrempp(Daimler) assumed leadership in 1995

Daimler merged with US based Chrysler in 1998

Third largest automaker(4.4 mn/annum)

In auto industry since 1917 (Mitsubishi ship building Co.)

Formed Mitsubishi motors in 1970

Alliance with Chrysler(1971-1993)

Produced 250000 vehicles/annum

Posted a debt of $14.2 bn by mid 1990s

Initiated restructuring

Daimler chrysler

Had aspirations for expansion into Japan and other Asian

countries

Envisaged sales of $21 bn

Looked for cooperation in technologies leading to new models

and cost reduction(shared assets)

Mitsubishi

Wanted to survive the recession

Seeking new markets abroad

Daimler Chrysler purchased 34% stake($2.1 bn) of MMC in

2000

Rolf Eckrodt (Daimler) appointed as COO at MMC

Cut material cost(15%) and increased capacity utilization(20%)

Shifted from Engg Dominance to market view point

New manufacturing facility at Kolleda in Germany

The global manufacturing alliance(2 mn power train)

GS platform ("Project Global" by Mitsubishi) was a compact car

platform co-developed by MMC and DCX

Small car models(SMART) in western market

Opened a factory in Illinois, Mitsubishi produced vehicles for

itself and for Chrysler, differentiated mostly by name

Mitsubishi embroiled in accusations of covering up defects in their

vehicles

MMCs CEO was forced to resign

Daimler Chrysler renegotiated the financial terms.

Poor performance of the American wing were creating headaches

Less attention to the East

Three year Recovery plan($2.8 bn) by Schrempp failed

Mitsubishis US marketing team failed to properly establish the brand

Profitability remained out of reach for Mitsubishi, and enlarged losses

in 2005 were forecast by the company

Daimler Chrysler

Mercedes had fallen to lower level in JDP reliability survey

Daimler lost $60 bn in stock market value in six years

Finally Daimler Chrysler extricated from its Asian holdings in

November 2005

Production of Smart forfour a JV product ended

Jointly operated engine plant came to Daimler

Daimler-Chrysler split followed

In May 2007, a private equity firm Cerberus Capital

Management LP bought 80.1 percent of Chrysler, for $7.4

billion

Mitsubishi initiated a revitalization plan to return to profitability

by 2006

DCX

Less innovative in

technology

Hierarchical: traditional topdown management

Non-programmed decision

Bureaucratic

Stood for shareholders'

satisfaction

Luxury brand

MMC

Emphasised technological

development

Programmed decision-making

Participative

Secretive culture

Low priority to compliance

and customer satisfaction

Brand for the mass

The post merger integration strategy never worked

Partnership with an ailing Mitsubishi in 2000

MMCs management culture is in sharp contrast to Daimlers

Serious error in judgment in terms of timing

Poor evaluation of MMC before the merger

Focused on growing business than profit maximization

Unequal representation at the executive board

Facing the dual Challenge in the West and East

The ultimate lessons flowing from this case are the

dangers in not having fully thought out post

integration strategies, the importance of timing

and the consequences of stretching resources too

thinly in times of economic crisis, especially when

the very existence of the dominant partner could

be threatened.

Begley J. and Donnelly T.(2011) The DaimlerChrysler Mitsubishi

merger: a study in failure, Int. J. Automotive Technology and

Management, Vol. 11, No. 1

Sturgeon T.J., Memedovic O., Biesebroeck J.V., Gereffi G. (2009)

Globalisation of the automotive industry: main features and trends,

Int. J. Technological Learning, Innovation and Development, Vol. 2, Nos.

Dirk Vaubel, Carsten Herbes,(2007) Mergers and acquisitions in Japan

Mitsubishi Motors (19982004) Internet repository, Consolidated annual

financial results, available at http://media.mitsubishimotors.com

Anda mungkin juga menyukai

- The Daimler Chrysler MergerDokumen18 halamanThe Daimler Chrysler MergerAbdul Rahim100% (1)

- Daimler ChryslerDokumen17 halamanDaimler ChryslerSudeep Khare100% (1)

- Daimler Chrysler: Post Merger News Case AnalysisDokumen10 halamanDaimler Chrysler: Post Merger News Case AnalysisPallavi MishraBelum ada peringkat

- General Motors CompanyDokumen8 halamanGeneral Motors CompanyNeha Soningra100% (1)

- Analysis of Daimler Chrysler StrategyDokumen19 halamanAnalysis of Daimler Chrysler StrategyNaveen RaajBelum ada peringkat

- Daimler Chrysler MergerDokumen49 halamanDaimler Chrysler MergerSamir Saffari100% (1)

- Daimler Benz and ChryslerDokumen2 halamanDaimler Benz and ChryslerAditya JainBelum ada peringkat

- Case Study (General Motors Company)Dokumen21 halamanCase Study (General Motors Company)sidplan67% (3)

- Jai Ganesh-Group 9Dokumen29 halamanJai Ganesh-Group 9jai_g84Belum ada peringkat

- DAIMLER TRUCKS in India Strategic AnalysisDokumen30 halamanDAIMLER TRUCKS in India Strategic Analysisgulrez khanBelum ada peringkat

- Case Study ChryslerDokumen10 halamanCase Study ChryslerShatesh Kumar ChandrahasanBelum ada peringkat

- A Well Managed Company V/s A Poorly Managed CompanyDokumen36 halamanA Well Managed Company V/s A Poorly Managed CompanyShobhit BhatnagarBelum ada peringkat

- Daimler Chrysler MergerDokumen23 halamanDaimler Chrysler MergerAnand Narayan Singh100% (1)

- Daimler WIPDokumen7 halamanDaimler WIPsunil kumarBelum ada peringkat

- Strategy Management - BMWDokumen9 halamanStrategy Management - BMWShyam_Nair_9667Belum ada peringkat

- Swot Daimlerchrysler 1206206011933935 3Dokumen30 halamanSwot Daimlerchrysler 1206206011933935 3adihindBelum ada peringkat

- Negotiating Company Mergers: The Daimler Chrysler Case StudyDokumen12 halamanNegotiating Company Mergers: The Daimler Chrysler Case Studyavinashkatoch100% (1)

- GM ReportDokumen7 halamanGM ReportPiyush GoyalBelum ada peringkat

- ChryslerDokumen9 halamanChryslerladoooshBelum ada peringkat

- Strategy AssignmentDokumen17 halamanStrategy AssignmentprasanthkurupBelum ada peringkat

- General Motors: MKTG205 Marketing Plan Outline Tina Louise Napier American Intercontinental UniversityDokumen6 halamanGeneral Motors: MKTG205 Marketing Plan Outline Tina Louise Napier American Intercontinental UniversityTina NapierBelum ada peringkat

- International Business Strategy: Chrysler in TroubleDokumen6 halamanInternational Business Strategy: Chrysler in TroubleMinting ShenBelum ada peringkat

- Chrysler FiatDokumen12 halamanChrysler FiatTristan HaasBelum ada peringkat

- Research - BMW-StrategyDokumen15 halamanResearch - BMW-StrategyShyam_Nair_9667Belum ada peringkat

- GMDokumen24 halamanGMcool_techBelum ada peringkat

- General Motors Final Marketing PlanDokumen26 halamanGeneral Motors Final Marketing PlanGabriela OldachBelum ada peringkat

- MBA 1 Strategic ManagmentDokumen28 halamanMBA 1 Strategic ManagmentsarathsivadasanBelum ada peringkat

- Chrysler-Fiat Strategic AllianceDokumen37 halamanChrysler-Fiat Strategic AllianceMey Sandrasigaran50% (2)

- DaimlerchryslerDokumen35 halamanDaimlerchryslerVishwajeet Kirdat100% (1)

- The DaimlerChrysler PostDokumen21 halamanThe DaimlerChrysler PostAwaisKhattakBelum ada peringkat

- Daimler-Chrysler Merger FailureDokumen11 halamanDaimler-Chrysler Merger FailureHesty Oktariza100% (18)

- Daimler Chrysler MergerDokumen23 halamanDaimler Chrysler MergerAdnan Ad100% (1)

- General Motors Case Study SolutionDokumen14 halamanGeneral Motors Case Study Solutionumer749100% (4)

- Tammy gm1Dokumen15 halamanTammy gm1cool_techBelum ada peringkat

- General MotorsDokumen8 halamanGeneral MotorsAbhijit Naskar100% (1)

- Competitive Advantage Between Ford and ToyoytaDokumen4 halamanCompetitive Advantage Between Ford and Toyoytaamitiiit31Belum ada peringkat

- Chrysler in Trouble PDFDokumen12 halamanChrysler in Trouble PDFKheirulnizam Abdul RahimBelum ada peringkat

- The DaimlerChrysler Mitsubishi Merger A Study in FDokumen14 halamanThe DaimlerChrysler Mitsubishi Merger A Study in FFairuj TasnimBelum ada peringkat

- General Motors Final Marketing PlanDokumen26 halamanGeneral Motors Final Marketing PlanAkiyama Mio100% (2)

- The Daimler-Chrysler MergerDokumen24 halamanThe Daimler-Chrysler MergerSunil ShettyBelum ada peringkat

- Business Strategies of GMDokumen3 halamanBusiness Strategies of GMFarhad SyedBelum ada peringkat

- General Motors Swot AnalysisDokumen4 halamanGeneral Motors Swot AnalysisSri YantiBelum ada peringkat

- Case Study of General MotorsDokumen9 halamanCase Study of General MotorsOSCAR RENUEL POBLETEBelum ada peringkat

- BMW StrategyDokumen19 halamanBMW Strategycheekyvirgin100% (1)

- Hyundai - A Global Success StoryDokumen5 halamanHyundai - A Global Success StoryHồng Nhung ĐỗBelum ada peringkat

- General Motors: Submitted To Submitted byDokumen25 halamanGeneral Motors: Submitted To Submitted bycool_techBelum ada peringkat

- General Motors Swot AnalysisDokumen3 halamanGeneral Motors Swot AnalysisAnkur Anil Nahata100% (1)

- Courseworks International StrategyDokumen15 halamanCourseworks International StrategySatadru Chakraborty KashyapBelum ada peringkat

- Article 2 (Benz-Chrysler) Are You Modular or Integral Be Sure Your Supply Chain KnowsDokumen11 halamanArticle 2 (Benz-Chrysler) Are You Modular or Integral Be Sure Your Supply Chain KnowsMaryam AsdBelum ada peringkat

- 11 General Motors PDFDokumen25 halaman11 General Motors PDFMikhail MendelevichBelum ada peringkat

- General Motors Marketing ProposalDokumen4 halamanGeneral Motors Marketing ProposalJiashen LimBelum ada peringkat

- General MotorsDokumen6 halamanGeneral Motorsfaria sobnom munaBelum ada peringkat

- Two Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?Dokumen8 halamanTwo Case Studies in Mergers and Acquisitions: Why Some Succeed While Others Fail?HARSHBHATTERBelum ada peringkat

- Acquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Dokumen13 halamanAcquisition and Merger of Kia Motors by Hundai Motors Rev 1.0Tejaswi Monangi100% (1)

- DaimlerDokumen2 halamanDaimlerabhi31kmrBelum ada peringkat

- My Years with General Motors (Review and Analysis of Sloan Jr.'s Book)Dari EverandMy Years with General Motors (Review and Analysis of Sloan Jr.'s Book)Penilaian: 5 dari 5 bintang5/5 (1)

- Transformation Strategy. Sample Plan for SAAB Automobile ABDari EverandTransformation Strategy. Sample Plan for SAAB Automobile ABBelum ada peringkat

- SPF 5189zdsDokumen10 halamanSPF 5189zdsAparna BhardwajBelum ada peringkat

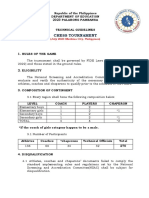

- CHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalDokumen14 halamanCHESS TECHNICAL GUIDELINES FOR PALARO 2023 FinalKaren Joy Dela Torre100% (1)

- 09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SDokumen14 halaman09-01-13 Samaan V Zernik (SC087400) "Non Party" Bank of America Moldawsky Extortionist Notice of Non Opposition SHuman Rights Alert - NGO (RA)Belum ada peringkat

- Sia vs. PeopleDokumen26 halamanSia vs. PeopleoliveBelum ada peringkat

- 005 SPARK v. Quezon City G.R. No. 225442Dokumen28 halaman005 SPARK v. Quezon City G.R. No. 225442Kenneth EsquilloBelum ada peringkat

- Business Studies Form 2Dokumen46 halamanBusiness Studies Form 2Gadaphy OdhiamboBelum ada peringkat

- List of Officers Who Attended Courses at NCRB-2019Dokumen189 halamanList of Officers Who Attended Courses at NCRB-2019Manish Bhardwaj100% (1)

- Double Shot Arcade Basketball System: Assembly InstructionsDokumen28 halamanDouble Shot Arcade Basketball System: Assembly Instructionsمحمد ٦Belum ada peringkat

- 01 - First Law of ThermodynamicsDokumen20 halaman01 - First Law of ThermodynamicsFabio BosioBelum ada peringkat

- Insurance ServicesDokumen25 halamanInsurance Servicesjhansi saiBelum ada peringkat

- Hall 14 FOC Indemnity FormDokumen4 halamanHall 14 FOC Indemnity FormXIVfocBelum ada peringkat

- ASME B31.5-1994 Addend Refrigeration PipingDokumen166 halamanASME B31.5-1994 Addend Refrigeration PipingFRANCISCO TORRES100% (1)

- Directions: Answer The Following Questions. Write Your Final Answer in Simplest Form. 1Dokumen1 halamanDirections: Answer The Following Questions. Write Your Final Answer in Simplest Form. 1chad lowe villarroyaBelum ada peringkat

- Combinepdf PDFDokumen487 halamanCombinepdf PDFpiyushBelum ada peringkat

- Case Report Cirilo Paredes V EspinoDokumen2 halamanCase Report Cirilo Paredes V EspinoJordan ProelBelum ada peringkat

- Sample Balance SheetDokumen22 halamanSample Balance SheetMuhammad MohsinBelum ada peringkat

- Plaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. SolimanDokumen9 halamanPlaintiff-Appellee Vs Vs Defendants-Appellants Claro M. Recto Solicitor General Pompeyo Diaz Solicitor Meliton G. Solimanvienuell ayingBelum ada peringkat

- Topic 2Dokumen5 halamanTopic 2Karl Anthony Tence DionisioBelum ada peringkat

- LT Bill Dec16Dokumen2 halamanLT Bill Dec16nahkbceBelum ada peringkat

- Introduction Business EthicsDokumen24 halamanIntroduction Business EthicsSumit Kumar100% (1)

- Mrunal Updates - Money - Banking - Mrunal PDFDokumen39 halamanMrunal Updates - Money - Banking - Mrunal PDFShivangi ChoudharyBelum ada peringkat

- NISM Series IX Merchant Banking Workbook February 2019 PDFDokumen211 halamanNISM Series IX Merchant Banking Workbook February 2019 PDFBiswajit SarmaBelum ada peringkat

- NSF International / Nonfood Compounds Registration ProgramDokumen1 halamanNSF International / Nonfood Compounds Registration ProgramMichaelBelum ada peringkat

- Eric Adams' Approval Rating Falls To 29% As Voters Sour On NYC FutureDokumen1 halamanEric Adams' Approval Rating Falls To 29% As Voters Sour On NYC FutureRamonita GarciaBelum ada peringkat

- Management of TrustsDokumen4 halamanManagement of Trustsnikhil jkcBelum ada peringkat

- CLP Criminal Procedure - CourtDokumen15 halamanCLP Criminal Procedure - CourtVanila PeishanBelum ada peringkat

- Model Test 15 - 20Dokumen206 halamanModel Test 15 - 20theabhishekdahalBelum ada peringkat

- HIRING OF VEHICLEsDokumen2 halamanHIRING OF VEHICLEsthummadharaniBelum ada peringkat

- Miaa Vs CA Gr155650 20jul2006 DIGESTDokumen2 halamanMiaa Vs CA Gr155650 20jul2006 DIGESTRyla Pasiola100% (1)

- 12-Chemical Hazard CommunicationDokumen9 halaman12-Chemical Hazard CommunicationHalime HalimeBelum ada peringkat