Audit Principles

Diunggah oleh

Jhayanti Nithyananda Kalyani0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

37 tayangan34 halamanShareholders should have the right to participate in key corporate governance decisions. An annual audit should be conducted by an independent, competent and qualified, auditor. External auditors should be accountable to the shareholders and exercise due professional care.

Deskripsi Asli:

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniShareholders should have the right to participate in key corporate governance decisions. An annual audit should be conducted by an independent, competent and qualified, auditor. External auditors should be accountable to the shareholders and exercise due professional care.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

37 tayangan34 halamanAudit Principles

Diunggah oleh

Jhayanti Nithyananda KalyaniShareholders should have the right to participate in key corporate governance decisions. An annual audit should be conducted by an independent, competent and qualified, auditor. External auditors should be accountable to the shareholders and exercise due professional care.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 34

Perusahaan Indonesia berskala nasional yang termotivasi

untuk mengembangkan bisnisnya di tingkat ASEAN

hendak melakukan IPO. Perusahaan saat ini sedang

mempertimbangkan restrukturisasi organisasi terkait

dengan fungsi audit internal agar fungsinya efektif dan

efektif sekaligus sesuai dengan kriteria ASEAN Corporate

Governance Scorecard. Terdapat tiga pilihan yang

dipikirkan, yaitu:

A. Fungsi audit internal di bawah CFO (chief financial

officer)

B. Fungsi audit internal di bawah masing-masing manajer

di kantor cabang dan kantor perwakilan.

C. Fungsi audit internal di bawah komite audit.

Pilihan manakah yang Anda, sebagai konsultan CG,

rekomendasikan untuk digunakan. Jelaskan kelebihan dari

pilihan Anda, dan jelaskan kekurangan-kekurangan dari

dua pilihan lainnya yang tidak Anda rekomendasikan.

(2) Shareholders should have the

opportunity to ask questions to the

board, including questions relating to

the annual external audit, to place

items on the agenda of general

meetings, and to propose

resolutions, subject to reasonable

limitations.

OECD Principle II (C)

Shareholders should have the

right to participate in key

corporate governance decisions,

such as the right to nominate,

appoint and remove directors in

an individual basis and also the

right to appoint external auditor.

ICGN 8.3.2 Shareholder

participation in governance

An annual audit should be conducted

by an independent, competent and

qualified, auditor in order to provide an

external and objective assurance to the

board and shareholders that the

financial statements fairly represent

the financial position and performance

of the company in all material respects.

OECD Principle V (C)

External auditors should be

accountable to the shareholders

and owe a duty to the company

to exercise due professional care

in the conduct of the audit.

OECD Principle V (D)

The auditors should observe highquality auditing and ethical standards.

To limit the possible risk of possible

conflicts of interest, non-audit services

and fees paid to auditors for non-audit

services should be both approved in

advance by the audit committee and

disclosed in the Annual Report.

ICGN 6.5 Ethical standards

(Audit)

(D) The board should fulfill certain key

functions, including:

7. Ensuring the integrity of the corporations

accounting and financial reporting systems,

including the independent audit, and that

appropriate systems of control are in place,

in particular, systems for risk management,

financial and operational control, and

compliance with the law and relevant

standards.

OECD PRINCIPLE VI: The

Responsibilities of the Board

(2) When committees of the board are established, their mandate,

composition and working procedures should be well defined and disclosed

by the board.

While the use of committees may improve the work of the board they may

also raise questions about the collective responsibility of the board and of

individual board members. In order to evaluate the merits of board

committees it is therefore important that the market receives a full and

clear picture of their purpose, duties and composition. Such information is

particularly important in an increasing number of jurisdictions where boards

are establishing independent Audit Committees with powers to oversee the

relationship with the external auditor and to act in many cases

independently. Other such

committees include those dealing with nomination and compensation. The

accountability of the rest of the board and the board as a whole should be

clear. Disclosure should not extend to committees set up to deal with, for

example, confidential commercial transactions

OECD PRINCIPLE VI (E)

C.3.1. The board should satisfy

itself that at least one member of

the Audit Committee has recent

and relevant financial experience.

UK CODE (JUNE 2010)

As many of the key responsibilities of the

Audit Committee are accounting-related,

such as oversight of financial reporting and

audits, it is important to have someone

specifically with accounting expertise, not

just general financial expertise.

UK CODE (JUNE 2010)

C.3.6 The Audit Committee should have primary

responsibility for making a recommendation on

the appointment, reappointment and removal of

the external auditor. If the board does not accept

the Audit Committees recommendation, it should

include in the Annual Report, and in any papers

recommending appointment or re- appointment, a

statement from the Audit Committee explaining

the recommendation and should set out reasons

why the board has taken a different position.

UK CODE (JUNE 2010)

(F) In order to fulfill their responsibilities, board members should

have access to accurate, relevant and timely information.

Board members require relevant information on a timely basis in

order to support their decision-making. Non-executive board

members do not typically have the same access to information

as key managers within the company. The contributions of nonexecutive board members to the company can be enhanced by

providing access to certain key managers within the company

such as, for example, the company secretary and the internal

auditor, and recourse to independent external advice at the

expense of the company. In order to fulfil their responsibilities,

board members should ensure that they obtain

accurate, relevant and timely information.

OECD PRINCIPLE VI

Ensuring the integrity of the essential reporting

and monitoring systems will require the board

to set and enforce clear lines of responsibility

and accountability throughout the

organization. The board will also need to

ensure that there is appropriate oversight by

senior management. One way of doing this is

through an internal audit system directly

reporting to the board.

OECD PRINCIPLE VI (D)

Companies often disclose that they have an internal audit

but, in practice, it is not uncommon for it to exist more in

form than in substance. For example, the in-house internal

audit may be assigned to someone with other operational

responsibilities. As internal audit is unregulated, unlike

external audit, there are firms providing outsourced

internal audit services which are not properly qualified to

do so. Making the identity of the head of internal audit or

the external service provider public would provide some

level of safeguard that the internal audit is substantive.

OECD PRINCIPLE VI (D)

In some jurisdictions it is considered

good practice for the internal auditors to

report to an independent Audit

Committee of the board or an equivalent

body which is also responsible for

managing the relationship with the

external auditor, thereby allowing a

coordinated response by the board.

OECD PRINCIPLE VI (D)

(7)

(VI.D.7.9) Does the internal

auditors have direct and

unfettered access to the board of

directors and its independent

Audit Committee?

WORLDBANK PRINCIPLE 6

companies should consider a second

reporting line from the internal audit function to

the board or relevant committee. Under the

ASX Principles it is also recommended that the

Audit Committee have access to internal audit

without the presence of management, and that

the audit committee should recommend to the

board the appointment and dismissal of a chief

internal audit executive."

ASX Principles on CG

The members of these key board committees

should be solely non-executive directors, and

in the case of the audit and remuneration

committees, solely independent directors. All

members of the nominations committee

should be independent from management

and at least a majority should be independent

from dominant owners.

ICGN 2.4.4 Composition

of board committees

Did the chairman of the Audit

Committee attend the most

recent AGM?

A.3.12

Are the auditors seeking

appointment/re-appointment

clearly identified?

B.2.4

Where the same audit firm is

engaged for both audit and non-audit

services

Are the non-audit fees disclosed?

D.5.2

Where the same audit firm is

engaged for both audit and non-audit

services

Does the non-audit fee exceed the

audit fees?

D.5.3

Does the Audit Committee comprise

entirely of non-executive directors/

commissioners with a majority of

independent

directors/commissioners?

E.2.22

Is the chairman of the Audit

Committee an independent

director/commissioner?

E.2.23 (default)

Does the company disclose the

terms of reference/governance

structure/charter of the Audit

Committee?

E.2.24

Does the Annual Report

disclose the profile or

qualifications of the Audit

Committee members?

E.2.25

Does at least one of the

independent directors/

commissioners of the (audit)

committee have accounting

expertise (accounting

qualification or experience)?

E.2.26

Did the Audit Committee

meet at least four times

during the year?

E.2.27

Is the attendance of members

at Audit Committee meetings

disclosed?

E.2.28

Does the Audit Committee

have primary responsibility

for recommendation on the

appointment, and removal of

the external auditor?

E.2.29

Does the company have a

separate internal audit

function?

E.3.16

Is the head of internal audit

identified or, if outsourced, is

the name of the external firm

disclosed?

E.3.17

Does the appointment and

removal of the internal

auditor require the approval

of the Audit Committee?

E.3.18 (default)

TERIMAKASIH

Anda mungkin juga menyukai

- GCU CHP Flowchart PDFDokumen1 halamanGCU CHP Flowchart PDFJhayanti Nithyananda KalyaniBelum ada peringkat

- Soal Audit Chapter 7-13Dokumen6 halamanSoal Audit Chapter 7-13Jhayanti Nithyananda KalyaniBelum ada peringkat

- Sas 110Dokumen23 halamanSas 110Jhayanti Nithyananda KalyaniBelum ada peringkat

- DCUBS Research Paper Series 13Dokumen33 halamanDCUBS Research Paper Series 13Jhayanti Nithyananda KalyaniBelum ada peringkat

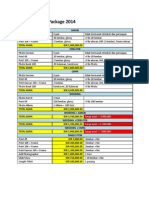

- Vphotography Package 2014: Harga Awal - 3.900.000 Harga Awal - 5.700.000 Harga Awal - 7.400.000Dokumen1 halamanVphotography Package 2014: Harga Awal - 3.900.000 Harga Awal - 5.700.000 Harga Awal - 7.400.000Jhayanti Nithyananda KalyaniBelum ada peringkat

- Branch Node City Node City Distance NodeDokumen3 halamanBranch Node City Node City Distance NodeJhayanti Nithyananda KalyaniBelum ada peringkat

- Sony: Betting It All On Blu-Ray SynopsisDokumen4 halamanSony: Betting It All On Blu-Ray SynopsisJhayanti Nithyananda KalyaniBelum ada peringkat

- Objective Function Z X + X + X + X + X + X + X + X + X: Branch Node City Node City Distance Node Network FlowDokumen3 halamanObjective Function Z X + X + X + X + X + X + X + X + X: Branch Node City Node City Distance Node Network FlowJhayanti Nithyananda KalyaniBelum ada peringkat

- Pertemuan 7Dokumen2 halamanPertemuan 7Jhayanti Nithyananda KalyaniBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Nyamango Site Meeting 9 ReportDokumen18 halamanNyamango Site Meeting 9 ReportMbayo David GodfreyBelum ada peringkat

- HPCL CSR Social Audit ReportDokumen56 halamanHPCL CSR Social Audit Reportllr_ka_happaBelum ada peringkat

- 2001 Ford F150 ManualDokumen296 halaman2001 Ford F150 Manualerjenkins1100% (2)

- For ClosureDokumen18 halamanFor Closuremau_cajipeBelum ada peringkat

- Household: Ucsp11/12Hsoiii-20Dokumen2 halamanHousehold: Ucsp11/12Hsoiii-20Igorota SheanneBelum ada peringkat

- Sample Interview Questions For Planning EngineersDokumen16 halamanSample Interview Questions For Planning EngineersPooja PawarBelum ada peringkat

- Jota - EtchDokumen3 halamanJota - EtchRidwan BaharumBelum ada peringkat

- ProspDokumen146 halamanProspRajdeep BharatiBelum ada peringkat

- Pontevedra 1 Ok Action PlanDokumen5 halamanPontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- Work Site Inspection Checklist 1Dokumen13 halamanWork Site Inspection Checklist 1syed hassanBelum ada peringkat

- MPT EnglishDokumen5 halamanMPT Englishkhadijaamir435Belum ada peringkat

- Chapter 1 4Dokumen76 halamanChapter 1 4Sean Suing100% (1)

- Ariba Collaborative Sourcing ProfessionalDokumen2 halamanAriba Collaborative Sourcing Professionalericofx530Belum ada peringkat

- Contigency Plan On Class SuspensionDokumen4 halamanContigency Plan On Class SuspensionAnjaneth Balingit-PerezBelum ada peringkat

- Beamng DxdiagDokumen22 halamanBeamng Dxdiagsilvioluismoraes1Belum ada peringkat

- Mindray PM 9000 User ID10240 PDFDokumen378 halamanMindray PM 9000 User ID10240 PDFJuan FernandoBelum ada peringkat

- Uh 60 ManualDokumen241 halamanUh 60 ManualAnonymous ddjwf1dqpBelum ada peringkat

- Nse 2Dokumen5 halamanNse 2dhaval gohelBelum ada peringkat

- Chestionar 2Dokumen5 halamanChestionar 2Alex AndruBelum ada peringkat

- ASHRAE Elearning Course List - Order FormDokumen4 halamanASHRAE Elearning Course List - Order Formsaquib715Belum ada peringkat

- Induction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesDokumen21 halamanInduction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesSpoiala DragosBelum ada peringkat

- Ose Sample QuotationDokumen37 halamanOse Sample Quotationrj medelBelum ada peringkat

- Interbond 2340UPC: Universal Pipe CoatingDokumen4 halamanInterbond 2340UPC: Universal Pipe Coatingnoto.sugiartoBelum ada peringkat

- Trading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankDokumen49 halamanTrading Journal TDA Branded.v3.5 - W - Total - Transaction - Cost - BlankChristyann LojaBelum ada peringkat

- USDA List of Active Licensees and RegistrantsDokumen972 halamanUSDA List of Active Licensees and Registrantswamu885Belum ada peringkat

- KiSoft Sort & Pack Work Station (User Manual)Dokumen41 halamanKiSoft Sort & Pack Work Station (User Manual)Matthew RookeBelum ada peringkat

- MOS - Steel StructureDokumen15 halamanMOS - Steel StructuredennisBelum ada peringkat

- Pautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosDokumen11 halamanPautas Anatómicas para La Inserción de Minitornillos: Sitios PalatinosValery V JaureguiBelum ada peringkat

- Yarn HairinessDokumen9 halamanYarn HairinessGhandi AhmadBelum ada peringkat

- Ice 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisDokumen15 halamanIce 3101: Modern Control THEORY (3 1 0 4) : State Space AnalysisBipin KrishnaBelum ada peringkat