Legal Aspects of Business

Diunggah oleh

MH0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan4 halamanLegal Aspects of Business

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniLegal Aspects of Business

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

9 tayangan4 halamanLegal Aspects of Business

Diunggah oleh

MHLegal Aspects of Business

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 4

Regulatory Instruments

Submitted by

Anuj Garg 15P187

Deep Desai 15P197

Moksha Hegde 15P214

Pankaj Kaushal 15P217

Rahul Talari 15P227

RBI Policy Guidelines (2014)

(on Issuance and Operation of Pre-paid Payment Instruments

in India)

Purpose

To provide a framework for the regulation and

supervision of persons operating payment systems

involved in the issuance of Pre-paid Payment Instruments

in the country

To ensure development of this segment of the payment

and settlement systems in a prudent and customer

friendly manner

To lay down the basic eligibility criteria and the

conditions for operations of payment systems

Statutory Guidelines issued by Reserve Bank of India

under Section 18 read with Section 10(2) of Payment &

Settlement Systems Act, 2007 (Act 51 of 2007)

Classification

Key Highlights of RBI Policy

Guidelines

The circular defines different kinds of payment instruments that one may create

Semi-Closed System Payment Instrument, Non Banking Finance Companies (NBFC) and

companies incorporated in India are eligible to apply for license to issue these

instruments

A company (that which is not a bank or a NBFC) seeking RBIs authorization should

have a minimum paid-up capital of INR 5 crores and a minimum positive net worth of

INR 1 crores at all times

The circular specifies anti-fraud mechanisms/standards and the level of customer due

diligence required based on the quantum of transactions involved

KYC norms and Anti Money Laundering norms, as relevant, will apply to pre-paid

instruments

These regulations do not cover any cross border transaction and do not extend to any

foreign exchange pre-paid instruments allowed by RBI under Foreign Exchange

Management Act

Amendment in Policy Guidelines

Issue of multiple PPIs by banks from fully-KYC compliant bank accounts for

dependents / family members

The guidelines highlighted that the following types of semi closed pre-paid

payment instruments can be issued on carrying out Customer Due

Diligence as detailed below: Upto Rs.10,000/- by accepting minimum details of the customer provided the amount

outstanding at any point of time does not exceed Rs 10,000/- and the total value of reloads

during any given month also does not exceed Rs 10,000/-. These can be issued only in

electronic form;

from Rs.10,001/- to Rs.50,000/- by accepting any officially valid document defined under

Rule 2(d) of the PML Rules 2005, as amended from time to time. Such PPIs can be issued only

in electronic form and should be non-reloadable in nature

Upto Rs.50,000/- with full KYC and can be reloadable in nature. The balance in the PPI should

not exceed Rs.50,000/- at any point of time

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Ffa12efmq A Low ResDokumen34 halamanFfa12efmq A Low ResAdi StănescuBelum ada peringkat

- BS ADFREE 15.12.2019 @IAS4IndiaDokumen12 halamanBS ADFREE 15.12.2019 @IAS4Indiakowsalya mathiBelum ada peringkat

- IMSDokumen1 halamanIMSHarsh TuliBelum ada peringkat

- Anti ChresisDokumen21 halamanAnti ChresisKaren Sheila B. Mangusan - DegayBelum ada peringkat

- MODAUD1 UNIT 3 - Audit of ReceivablesDokumen11 halamanMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokBelum ada peringkat

- Dubai DatabaseDokumen1.830 halamanDubai DatabaseMIan Muzamil100% (1)

- Iso 20022 Payment Guide: Messages: Pain.001.001.03 Pain.002.001.03Dokumen41 halamanIso 20022 Payment Guide: Messages: Pain.001.001.03 Pain.002.001.03sri_vas4u100% (1)

- EPG REST Integration v.1.3.1Dokumen37 halamanEPG REST Integration v.1.3.1Sain S - iRoid0% (1)

- CAS 560 Subsequent EventsDokumen11 halamanCAS 560 Subsequent EventszelcomeiaukBelum ada peringkat

- Audit Program For InventoriesDokumen2 halamanAudit Program For InventoriesRex Munda Duhaylungsod71% (7)

- Guingon Vs Del MonteDokumen2 halamanGuingon Vs Del MonteMan2x SalomonBelum ada peringkat

- Questions PDFDokumen6 halamanQuestions PDFManjunath ABelum ada peringkat

- ImpsDokumen3 halamanImpsMubarak N MoideenBelum ada peringkat

- Bonds: Formulas & ExamplesDokumen12 halamanBonds: Formulas & ExamplesAayush sunejaBelum ada peringkat

- Post Office Saving SchemesDokumen2 halamanPost Office Saving SchemesanandsethiBelum ada peringkat

- M3M Corner Walk BrochureDokumen14 halamanM3M Corner Walk BrochureharshBelum ada peringkat

- MCB 11Dokumen157 halamanMCB 11ubshahidBelum ada peringkat

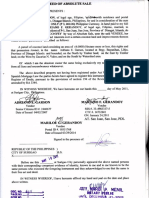

- Deed of Absolute SaleDokumen1 halamanDeed of Absolute SaleMariano GerandoyBelum ada peringkat

- SHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedDokumen3 halamanSHERMAN FURAYI - 2022-04-23 - 2022-05-23 - StampedshermanBelum ada peringkat

- Accounting Grade 10 Lesson and TasksDokumen4 halamanAccounting Grade 10 Lesson and Tasksnashi04Belum ada peringkat

- National Bank of PakistanDokumen44 halamanNational Bank of Pakistanmadnansajid8765Belum ada peringkat

- Prucash PremierDokumen14 halamanPrucash PremierJaboh LabohBelum ada peringkat

- Emerging Trend in CRMDokumen3 halamanEmerging Trend in CRMPrabhjeet Singh GillBelum ada peringkat

- Chapter 24Dokumen32 halamanChapter 24Nuts420Belum ada peringkat

- Sports Law ProjectDokumen14 halamanSports Law ProjectShubh DixitBelum ada peringkat

- Financial System of ColombiaDokumen14 halamanFinancial System of ColombiaSantiago Aguirre CastiblancoBelum ada peringkat

- ISIN ListDokumen32 halamanISIN ListMirza Haseeb Ahsan100% (1)

- Summary of Your Banking Relationship: Savings & InvestmentsDokumen3 halamanSummary of Your Banking Relationship: Savings & InvestmentsJeffreyBelum ada peringkat

- List of All SWIFT-ISO MessagesDokumen47 halamanList of All SWIFT-ISO Messagessanjayjogs50% (2)

- 87493v16n4 High ResDokumen9 halaman87493v16n4 High ResErlene CompraBelum ada peringkat