Ifrs-8 Operating Segments

Diunggah oleh

niichauhan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

103 tayangan8 halamanIFRS 8

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniIFRS 8

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

103 tayangan8 halamanIfrs-8 Operating Segments

Diunggah oleh

niichauhanIFRS 8

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 8

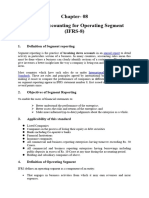

IFRS 8 Operating Segments requires particular

classes of entities (essentially those with publicly

traded securities) to disclose information about

their operating segments, products and services,

the geographical areas in which they operate,

and their major customers. Information is based

on internal management reports, both in the

identification

of

operating

segments

and

measurement of disclosed segment information.

IFRS 8 was issued in November 2006 and applies

to annual periods beginning on or after 1 January

2009.

IFRS 8 applies to the separate or individual financial

statements of an entity (and to the consolidated financial

statements of a group with a parent):

whose debt or equity instruments are traded in a public

market or

that files, or is in the process of filing, its (consolidated)

financial statements with a securities commission or

other regulatory organization for the purpose of issuing

any class of instruments in a public market.

However, when both separate and consolidated financial

statements for the parent are presented in a single

financial report, segment information need be presented

only on the basis of the consolidated financial statements.

Operating segments

IFRS 8 defines an operating segment as follows. An

operating segment is a component of an entity:

that engages in business activities from which it

may earn revenues and incur expenses (including

revenues and expenses relating to transactions with

other components of the same entity)

whose operating results are reviewed regularly by

the entity's chief operating decision maker to make

decisions about resources to be allocated to the

segment and assess its performance and

for which discrete financial information is available

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments. Reportable

segments are operating segments or aggregations of operating

segments that meet specified criteria:

its reported revenue, from both external customers and

intersegment sales or transfers, is 10 per cent or more of the

combined revenue, internal and external, of all operating

segments, or

the absolute measure of its reported profit or loss is 10 per

cent or more of the greater, in absolute amount, of (i) the

combined reported profit of all operating segments that did not

report a loss and (ii) the combined reported loss of all

operating segments that reported a loss, or

its assets are 10 per cent or more of the combined assets of all

operating segments.

Two or more operating segments may be aggregated

into a single operating segment if aggregation is

consistent with the core principles of the standard,

the segments have similar economic characteristics

and are similar in various prescribed respects.

If the total external revenue reported by operating

segments constitutes less than 75 per cent of the

entity's revenue, additional operating segments

must be identified as reportable segments (even if

they do not meet the quantitative thresholds set out

above) until at least 75 per cent of the entity's

revenue is included in reportable segments.

Required disclosures include:

general information about how the entity identified its operating

segments and the types of products and services from which each

operating segment derives its revenues.

judgements made by management in applying the aggregation

criteria to allow two or more operating segments to be aggregated.

information about the profit or loss for each reportable segment,

including certain specified revenues and expenses such as revenue

from external customers and from transactions with other

segments, interest revenue and expense, depreciation and

amortisation, income tax expense or income and material non-cash

items.

a measure of total assets and total liabilities for each reportable

segment, and the amount of investments in associates and joint

ventures and the amounts of additions to certain non-current assets

('capital expenditure').

an explanation of the measurements of segment profit or loss, segment

assets and segment liabilities, including certain minimum disclosures, e.g.

how transactions between segments are measured, the nature of

measurement differences between segment information and other

information included in the financial statements, and asymmetrical

allocations to reportable segments.

reconciliations of the totals of segment revenues, reported segment profit

or loss, segment assets, segment liabilities and other material items to

corresponding items in the entity's financial statements.

some entity-wide disclosures that are required even when an entity has

only one reportable segment, including information about each product

and service or groups of products and services.

analyses of revenues and certain non-current assets by geographical area

with an expanded requirement to disclose revenues/assets by individual

foreign country (if material), irrespective of the identification of operating

segments.

information about transactions with major customers.

Anda mungkin juga menyukai

- Pfrs 8 Operating SegmentsDokumen2 halamanPfrs 8 Operating SegmentsJimuel ImbuidoBelum ada peringkat

- 9 - Segment ReportingDokumen4 halaman9 - Segment ReportingCathBelum ada peringkat

- Ifrs 8Dokumen3 halamanIfrs 8Samantha IslamBelum ada peringkat

- #6 PFRS 8Dokumen2 halaman#6 PFRS 8Shara Joy B. ParaynoBelum ada peringkat

- IFRS 8 Operating SegmentsDokumen18 halamanIFRS 8 Operating SegmentsrgnrgyBelum ada peringkat

- Ifrs 8Dokumen11 halamanIfrs 8TasminBelum ada peringkat

- PFRS 8-Operating SegmentsDokumen20 halamanPFRS 8-Operating Segmentsrena chavezBelum ada peringkat

- Operating SegmentDokumen6 halamanOperating SegmentsubupooBelum ada peringkat

- Chapter-08-Ideas On Operating SegmentsDokumen12 halamanChapter-08-Ideas On Operating Segmentsmdrifathossain835Belum ada peringkat

- Far 3 (Final Topics) - Ma'Am JannaDokumen68 halamanFar 3 (Final Topics) - Ma'Am JannaAndrea FernandoBelum ada peringkat

- Segment Reporting: Meaning, Terminology, Need and DisclosuresDokumen5 halamanSegment Reporting: Meaning, Terminology, Need and DisclosuresIMRAN ALAMBelum ada peringkat

- Ifrs 8Dokumen3 halamanIfrs 8kadermaho456Belum ada peringkat

- PFRS 8 - Operating SegmentsDokumen13 halamanPFRS 8 - Operating SegmentsYassi CurtisBelum ada peringkat

- Kings College of The PhilippinesDokumen6 halamanKings College of The PhilippinesIzza Mae Rivera KarimBelum ada peringkat

- Operating Segments PDFDokumen4 halamanOperating Segments PDFAvi MartinezBelum ada peringkat

- Operating Segments: International Financial Reporting Standard 8Dokumen9 halamanOperating Segments: International Financial Reporting Standard 8Imran MustafaBelum ada peringkat

- PAS 8 Operating SegmentsDokumen4 halamanPAS 8 Operating SegmentsAlex OngBelum ada peringkat

- FA Vol.3 Operating SegmentsDokumen7 halamanFA Vol.3 Operating SegmentsRyan SanitaBelum ada peringkat

- ACTIVITY 8 - Intermediate AccountingDokumen2 halamanACTIVITY 8 - Intermediate AccountingMicky BernalBelum ada peringkat

- Ifrs 8: Operating SegmentsDokumen15 halamanIfrs 8: Operating SegmentsAABelum ada peringkat

- Ifrs 8: Operating SegmentsDokumen15 halamanIfrs 8: Operating SegmentsMohammad BaratBelum ada peringkat

- As-17 Segment Reporting: Segment Revenue: SR - Includes ExcludesDokumen5 halamanAs-17 Segment Reporting: Segment Revenue: SR - Includes ExcludesRajesh BhatiaBelum ada peringkat

- IFRS8Dokumen11 halamanIFRS8Elaine MateoBelum ada peringkat

- IFRS 8 Operating SegmentsDokumen6 halamanIFRS 8 Operating SegmentsPratima SeedheeyanBelum ada peringkat

- IAS 14 Segment Reporting SummaryDokumen2 halamanIAS 14 Segment Reporting Summarylinda_nardoBelum ada peringkat

- Segment Reporting - As17Dokumen41 halamanSegment Reporting - As17nikitsharmaBelum ada peringkat

- Operating Segments: International Financial Reporting Standard 8Dokumen10 halamanOperating Segments: International Financial Reporting Standard 8Tanvir PrantoBelum ada peringkat

- Segment Reporting-As17: Ca. Pankaj AgrwalDokumen41 halamanSegment Reporting-As17: Ca. Pankaj AgrwalV ArvindBelum ada peringkat

- Ca - Bharat Bhushan B-Com, ACA: Presented byDokumen23 halamanCa - Bharat Bhushan B-Com, ACA: Presented byEshetieBelum ada peringkat

- 8.0 NFRS 8 - SetPasswordDokumen8 halaman8.0 NFRS 8 - SetPasswordDhruba AdhikariBelum ada peringkat

- Segment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)Dokumen32 halamanSegment Reporting-As17: Compiled By: - AKHIL KOHLI (MBA - Marketing) MANJU (MBA - Finance)AmolBelum ada peringkat

- DipIFR-Session31 d08 Operating SegmentsDokumen0 halamanDipIFR-Session31 d08 Operating SegmentsFahmi AbdullaBelum ada peringkat

- SECTION 5Dokumen15 halamanSECTION 5Abata BageyuBelum ada peringkat

- Ifrs 8 Segment InformationDokumen6 halamanIfrs 8 Segment InformationMovies OnlyBelum ada peringkat

- Operating SegmentDokumen15 halamanOperating SegmentSrabon BaruaBelum ada peringkat

- Interim Financial ReportDokumen30 halamanInterim Financial ReportVIRGIL KIT AUGUSTIN ABANILLABelum ada peringkat

- PFRS 8 - Operating SegmentsDokumen11 halamanPFRS 8 - Operating SegmentseiraBelum ada peringkat

- Ias 14Dokumen5 halamanIas 14Khalida UtamiBelum ada peringkat

- Operating SegmentsDokumen10 halamanOperating SegmentsUdit JindalBelum ada peringkat

- Adv - Chap 8Dokumen7 halamanAdv - Chap 8Melody LisaBelum ada peringkat

- Assignment:2 International Financial Reporting Standards (7,8,17,32)Dokumen26 halamanAssignment:2 International Financial Reporting Standards (7,8,17,32)Pue DasBelum ada peringkat

- IFRS-8-Operating-SegmentsDokumen15 halamanIFRS-8-Operating-SegmentsNichole Angel LeiBelum ada peringkat

- Welcome To The Presentation On: IFRS 8 - Operating SegmentsDokumen21 halamanWelcome To The Presentation On: IFRS 8 - Operating SegmentsMaruf MahadiBelum ada peringkat

- Understand Operating Segments with this Accounting GuideDokumen3 halamanUnderstand Operating Segments with this Accounting GuideChinchin Ilagan DatayloBelum ada peringkat

- Ifrs 8 Operating Segments: BackgroundDokumen4 halamanIfrs 8 Operating Segments: Backgroundmusic niBelum ada peringkat

- Module 6 - Operating SegmentsDokumen3 halamanModule 6 - Operating SegmentsChristine Joyce BascoBelum ada peringkat

- Operating Segment: Intermediate Accounting 3Dokumen51 halamanOperating Segment: Intermediate Accounting 3Trisha Mae AlburoBelum ada peringkat

- Operating Segments PDFDokumen12 halamanOperating Segments PDFZahidBelum ada peringkat

- Chapter 37 IntaccDokumen23 halamanChapter 37 IntaccShiela DimaculanganBelum ada peringkat

- Segment ReportingDokumen4 halamanSegment ReportingAlex FungBelum ada peringkat

- Accounting Standard 17Dokumen8 halamanAccounting Standard 17Aram SivaBelum ada peringkat

- Chapter Eight: Segment and Interim ReportingDokumen30 halamanChapter Eight: Segment and Interim ReportingsoozboozBelum ada peringkat

- 07 Segment ReportingDokumen5 halaman07 Segment ReportingHaris IshaqBelum ada peringkat

- 07 Segment Reporting 1Dokumen4 halaman07 Segment Reporting 1Irtiza AbbasBelum ada peringkat

- FARAP-4519Dokumen4 halamanFARAP-4519Accounting StuffBelum ada peringkat

- Chapter 8Dokumen7 halamanChapter 8suleymantesfaye10Belum ada peringkat

- Akl2 SEGMENT AND INTERIM FINANCIAL REPORTING (8-9) .Dokumen27 halamanAkl2 SEGMENT AND INTERIM FINANCIAL REPORTING (8-9) .Nanda Latifa PutriBelum ada peringkat

- Operating Segment Reporting Key Financial DataDokumen19 halamanOperating Segment Reporting Key Financial DataRainBelum ada peringkat

- A31 Finals Pt1Dokumen6 halamanA31 Finals Pt1dre thegreatBelum ada peringkat

- Macros 2010Dokumen8 halamanMacros 2010Parthiban RajendranBelum ada peringkat

- BT S 2014 PDFDokumen10 halamanBT S 2014 PDFniichauhanBelum ada peringkat

- FileSharing Windows2Dokumen32 halamanFileSharing Windows2hazimBelum ada peringkat

- Role of WomenDokumen18 halamanRole of WomenniichauhanBelum ada peringkat

- Rma S15Dokumen3 halamanRma S15niichauhanBelum ada peringkat

- IFRS 2 Share Based PaymentsDokumen14 halamanIFRS 2 Share Based Paymentsniichauhan100% (1)

- Ppt. 4Dokumen10 halamanPpt. 4niichauhanBelum ada peringkat

- Role of WomenDokumen18 halamanRole of WomenniichauhanBelum ada peringkat

- Implication of Vinay and DarbelnetDokumen22 halamanImplication of Vinay and DarbelnetniichauhanBelum ada peringkat

- Asignmnt of Keil5Dokumen8 halamanAsignmnt of Keil5niichauhanBelum ada peringkat

- Data Collection Methods Explained: Primary, Secondary Sources & TechniquesDokumen31 halamanData Collection Methods Explained: Primary, Secondary Sources & TechniquesniichauhanBelum ada peringkat

- Explore the history and significance of the Great Wall of ChinaDokumen11 halamanExplore the history and significance of the Great Wall of ChinaniichauhanBelum ada peringkat

- PTCL Annual Report by UsmanDokumen66 halamanPTCL Annual Report by Usmanusmanfarooquf100% (6)

- حَدَّثَنَا يَحْيَى بْنُ أَيُّوبَ وَقُتَيْب 7snvIOjux8jy5u8gze - M8tHtIOLux Tv6Mcgze7P7vHL7ubuxyDF8NPy مَاعِيلُDokumen2 halamanحَدَّثَنَا يَحْيَى بْنُ أَيُّوبَ وَقُتَيْب 7snvIOjux8jy5u8gze - M8tHtIOLux Tv6Mcgze7P7vHL7ubuxyDF8NPy مَاعِيلُniichauhanBelum ada peringkat

- Earnings and Cash Flow Volatility's Impact on Firm ValueDokumen45 halamanEarnings and Cash Flow Volatility's Impact on Firm ValuePaavo PõldBelum ada peringkat

- Application Form For Admission To Post-Graduate Courses: University of Veterinary and Animal Sciences, LahoreDokumen2 halamanApplication Form For Admission To Post-Graduate Courses: University of Veterinary and Animal Sciences, LahoreniichauhanBelum ada peringkat

- Case Questions Thomas Green Power, Office Politics and A Career in CrisisDokumen1 halamanCase Questions Thomas Green Power, Office Politics and A Career in CrisisAyesha Bilal0% (1)

- KHankins RiskMgmt01-06 PDFDokumen36 halamanKHankins RiskMgmt01-06 PDFniichauhanBelum ada peringkat

- Lums Cases Bibliography FinalDokumen154 halamanLums Cases Bibliography FinalRiffi NaziBelum ada peringkat

- Regression ExcelDokumen5 halamanRegression ExcelniichauhanBelum ada peringkat

- Case Study Summary 2Dokumen2 halamanCase Study Summary 2niichauhanBelum ada peringkat

- LGDokumen1 halamanLGniichauhanBelum ada peringkat

- Hydrography: The Key To Well-Managed Seas and WaterwaysDokumen69 halamanHydrography: The Key To Well-Managed Seas and Waterwayscharles IkeBelum ada peringkat

- United States Court of Appeals, Fourth CircuitDokumen22 halamanUnited States Court of Appeals, Fourth CircuitScribd Government DocsBelum ada peringkat

- MBA Capstone Module GuideDokumen25 halamanMBA Capstone Module GuideGennelyn Grace PenaredondoBelum ada peringkat

- Intern Ship Final Report Henok MindaDokumen43 halamanIntern Ship Final Report Henok Mindalemma tseggaBelum ada peringkat

- March 3, 2014Dokumen10 halamanMarch 3, 2014The Delphos HeraldBelum ada peringkat

- Airline Operation - Alpha Hawks AirportDokumen9 halamanAirline Operation - Alpha Hawks Airportrose ann liolioBelum ada peringkat

- CVP Analysis in Management AccountingDokumen30 halamanCVP Analysis in Management AccountinggurgurgurgurBelum ada peringkat

- Wires and Cables: Dobaindustrial@ethionet - EtDokumen2 halamanWires and Cables: Dobaindustrial@ethionet - EtCE CERTIFICATEBelum ada peringkat

- B001 Postal Manual PDFDokumen282 halamanB001 Postal Manual PDFlyndengeorge100% (1)

- Class 3-C Has A SecretttttDokumen397 halamanClass 3-C Has A SecretttttTangaka boboBelum ada peringkat

- Valve SheetDokumen23 halamanValve SheetAris KancilBelum ada peringkat

- Tata Securities BranchesDokumen6 halamanTata Securities BranchesrakeyyshBelum ada peringkat

- Montaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Dokumen6 halamanMontaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Ebbe DyBelum ada peringkat

- Export-Import Fertilizer ContractDokumen36 halamanExport-Import Fertilizer ContractNga LaBelum ada peringkat

- Variety July 19 2017Dokumen130 halamanVariety July 19 2017jcramirezfigueroaBelum ada peringkat

- Psu Form 111Dokumen2 halamanPsu Form 111Ronnie Valladores Jr.Belum ada peringkat

- GST English6 2021 2022Dokumen13 halamanGST English6 2021 2022Mariz Bernal HumarangBelum ada peringkat

- Pakistan Money MarketDokumen2 halamanPakistan Money MarketOvais AdenwallaBelum ada peringkat

- Understanding Cultural Awareness Ebook PDFDokumen63 halamanUnderstanding Cultural Awareness Ebook PDFLaros Yudha100% (1)

- Syntel Placement Paper 2 - Freshers ChoiceDokumen3 halamanSyntel Placement Paper 2 - Freshers ChoicefresherschoiceBelum ada peringkat

- American Bible Society Vs City of Manila 101 Phil 386Dokumen13 halamanAmerican Bible Society Vs City of Manila 101 Phil 386Leomar Despi LadongaBelum ada peringkat

- Ca NR 06 en PDFDokumen251 halamanCa NR 06 en PDFZafeer Saqib AzeemiBelum ada peringkat

- Essential Rabbi Nachman meditation and personal prayerDokumen9 halamanEssential Rabbi Nachman meditation and personal prayerrm_pi5282Belum ada peringkat

- Definition of Internal Order: Business of The Company (Orders With Revenues)Dokumen6 halamanDefinition of Internal Order: Business of The Company (Orders With Revenues)MelanieBelum ada peringkat

- Static pile load test using kentledge stackDokumen2 halamanStatic pile load test using kentledge stackHassan Abdullah100% (1)

- The First, First ResponderDokumen26 halamanThe First, First ResponderJose Enrique Patron GonzalezBelum ada peringkat

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDokumen50 halamanThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- The Christian WalkDokumen4 halamanThe Christian Walkapi-3805388Belum ada peringkat

- Mission Youth PPT (Ramban) 06-11-2021Dokumen46 halamanMission Youth PPT (Ramban) 06-11-2021BAWANI SINGHBelum ada peringkat

- Anthropology Paper 1 Pyq AnalysisDokumen6 halamanAnthropology Paper 1 Pyq AnalysisRimita Saha100% (1)