Positive Accounting Theory Slides Written by Craig Deegan and Michaela Rankin

Diunggah oleh

silvia indahsari0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

87 tayangan41 halamanDEEGAN CH7

Judul Asli

ab.az_ch07

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniDEEGAN CH7

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

87 tayangan41 halamanPositive Accounting Theory Slides Written by Craig Deegan and Michaela Rankin

Diunggah oleh

silvia indahsariDEEGAN CH7

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 41

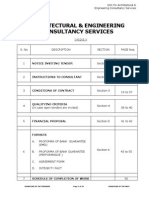

Financial Accounting Theory

Craig Deegan

Chapter 7

Positive accounting theory

Slides written by Craig Deegan and Michaela

Rankin

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-1

Learning objectives

In this chapter you will be introduced to

how a positive theory differs from a normative theory

the origins of Positive Accounting Theory (PAT)

the perceived role of accounting in minimising the

transaction costs of an organisation

how accounting can be used to reduce the costs

associated with various political processes

how particular accounting-based agreements with parties

such as debtholders and managers can provide

incentives for managers to manipulate accounting

numbers

some criticisms of PAT

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-2

Positive compared to normative theories

A positive theory seeks to explain and predict

particular phenomena

Normative theories prescribe how a particular

practice should be undertaken

the prescription might depart from existing practice

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-3

Positive Accounting Theory defined

PAT is concerned with explaining accounting

practice. It is designed to explain and predict

which firms will and which firms will not use a

particular method but it says nothing as to

which method a firm should use. (Watts and

Zimmerman 1986, p. 7)

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-4

Positive accounting theory defined (cont.)

Focuses on relationships between various

individuals and how accounting is used to assist in

the functioning of these relationships

Examples of relationships

owners and managers

managers and the firms debt providers

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-5

Assumptions underlying PAT

All individuals action is driven by self-interest and

individuals will act in an opportunistic manner to

the extent that the actions will increase their wealth

does not incorporate notions of loyalty or morality

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-6

Origins of PAT

Started coming to prominence in mid-1960s

paradigm shift from normative theories

dominant research paradigm in 1970s and 1980s

shift resulted from US reports on business education, and

improved computing facilities enabling large-scale

statistical analysis

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-7

Origins of PATcapital markets research

Development of Efficient Markets Hypothesis

(EMH) by Fama and others

capital markets react in an efficient and unbiased manner

to publicly available information

Ball and Brown (1968) paper was crucial to the

acceptance of the positive research paradigm

investigated stock market reaction to accounting earnings

announcements

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-8

Origins of PATcapital markets research

(cont.)

Price of a security based on beliefs about present

value of future cash flows

Ball and Brown found that earnings

announcements impacted share prices

evidence that historical cost information is useful to the

market

Literature unable to explain why particular

accounting methods selected

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-9

Origins of PATAgency theory

Explained why the selection of particular

accounting methods might matter

Focused on the relationships between principals

and agents

e.g. shareholders and managers

Information asymmetries create much uncertainty

transaction costs and information costs exist

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-10

Agency relationship

Defined by Jensen and Meckling (1976)

a contract under which one or more (principals) engage

another person (the agent) to perform some service on

their behalf which involves delegating some decision-

making authority to the agent

Relies on traditional economics literature

assumptions of self-interest and wealth maximisation

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-11

Price protection

In the absence of contractual mechanisms to

restrict agents potentially opportunistic behaviour

the principal will pay the agent a lower salary

compensates principals for adverse actions

Agents will therefore have incentives to enter

contracts which appear to limit actions detrimental

(yang merusak) to agents

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-12

Agency costs

Monitoring costs

costs of monitoring agents behaviour

e.g. auditing financial statements

Bonding (ikatan) costs

costs involved in agents bonding their behaviour to

expectations of principals

e.g. preparing financial statements

Residual loss

too costly to remove all opportunistic behaviour

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-13

Role of accounting in contracts

Accounting information used to reduce agency

costs

Used as monitoring and bonding mechanisms to

control the efforts of self-interested agents

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-14

Key hypotheses

Three key hypotheses frequently used in PAT

literature to explain and predict support or

opposition to an accounting method

bonus plan hypothesis

debt hypothesis

political cost hypothesis

Research assumes managers will act

opportunistically when selecting methods

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-15

Bonus plan hypothesis

Managers of firms with bonus plans are more likely

to use accounting methods that increase current

period reported income

also called management compensation hypothesis

action increases the present value of bonuses paid to

management

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-16

Debt hypothesis

The higher the firms debt/equity ratio, the more

likely managers use accounting methods that

increase income

also called debt/equity hypothesis

the higher the debt/equity ratio, the closer the firm is to

the constraints in debt covenants

covenant violation results in costs of technical default

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-17

Political cost hypothesis

Large firms rather than small firms are more likely

to use accounting choices that reduce reported

profits

size is a proxy variable for political attention

reduction of reported income is hypothesised to reduce

the possibility that people will argue that the organisation

is exploiting other parties

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-18

Two perspectives adopted by PAT

research

Efficiency perspective

Opportunistic perspective

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-19

Efficiency perspective

Researchers explain how contracting mechanisms

minimise agency costs of the firm

Known as ex ante perspective

mechanisms put in place up front to minimise future

agency and contracting costs

Managers select accounting methods which most

efficiently reflect underlying firm performance

PAT theorists argue that regulation forcing firms to

use a particular accounting method imposes

unwarranted costs

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-20

Opportunistic perspective

Seeks to explain managers actions once contracts

are already in place

Not possible to write complete contracts, so

managers are assumed to opportunistically act to

maximise own wealth

Known as ex post perspective

considers opportunistic actions after the fact

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-21

Owner/manager contracting

Assuming self-interest, owners expect managers

(agent) to undertake activities not always in the

interest of owners (principal)

Managers have access to information not always

available to principals

information asymmetry

further increases managers ability to undertake activities

beneficial to themselves

Costs of divergent behaviour are agency costs

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-22

Owner/manager contracting (cont.)

In the absence of controls to reduce opportunistic

behaviour, agents (managers) expected to

undertake (menjalankan) activities

disadvantageous to the value of the firm

Principals price this into the amounts they are

prepared to pay the manager

Managers may contract themselves not to

consume perks so will receive higher salary

known as bonding

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-23

Methods of rewarding managers

Fixed basissalary independent of performance

manager may not take great risks as does not share in

potential gains

Salary plus remuneration (gaji) is, in part, tied to

firm performance

known as bonus schemes

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-24

Bonus schemes

Remuneration can be tied to (dapat diambilkan

dari)

profits of the firm

sales of the firm

return on assets

All based on output from the accounting system

May also be rewarded in line with market price of

the firms shares

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-25

Accounting-based bonus plans

Any changes in accounting methods will affect the

bonuses paid

may occur as a result of a new accounting standard in

place

Contracts in some circumstances may be based

on the old method in place so changes will not

affect bonuses

Contracts relying on accounting numbers may rely

on floating GAAP

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-26

Incentives to manipulate accounting

numbers

Rewarding managers on the basis of accounting

profits may induce (menyebabkan) them to

manipulate accounting numbers (the opportunistic

perspective)

will affect their rewards

Bonuses based on profits cause short-term rather

than long-term focus

may affect investment in positive NPV projects if returns

not expected to be consistent

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-27

Incentives to manipulate accounting

numbersevidence

Healy (1985) found

managers adopt accounting methods to maximise bonus

if contract rewarded managers after a pre-specified level

of earnings reached

if income not expected to reach pre-specified minimum,

managers shift earnings to future period (take a bath)

Lewellen, Loderer and Martin (1987) found

US managers approaching retirement are less likely to

undertake R&D expenditure if rewards based on

accounting-based performance measures

short-term focus

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-28

Market-based bonus schemes

May be more appropriate to remunerate managers

in terms of market value where accounting

earnings fluctuate greatly

e.g. mining, or high technology R&D firms

Methods include

cash bonus based on share price increases

shares

options to shares

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-29

Market-based bonus schemes (cont.)

Managers have incentives to increase the value of

the firm

Problems include

share price also affected by factors beyond the control of

managers (e.g. general market movements)

only senior managers likely to have a significant impact

on share value

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-30

Choice of accounting versus market-

based bonus schemes

More likely to be based on accounting earnings

where

share returns relatively more sensitive to general market

movements

earnings have a high association with firm-specific

movement in the firms share values

earnings have a less positive association with market-

wide movements in equity values

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-31

Debt contractingagency costs of debt

Agency costs of debt include

excessive dividend payments, which leave fewer assets

to service debt

the organisation may take on additional debt, with new

debtholders competing with original debtholders for

repayment

investment in high-risk projects may not be beneficial to

debt holders as they have a fixed claim

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-32

Use of debt contracts

In the absence of safeguards to protect the

interests of debtholders, it is assumed they will

require the firm to pay higher costs of interest to

compensate

If firms contract not to pay excess dividends, take

on high levels of debt or invest in risky projects,

then they can attract debt at lower cost

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-33

Australian debt contracts

In relation to Australian debt contracts, Cotter

(1998) found

leverage covenants frequently used in bank loan

contracts

leverage most frequently measured as the ratio of total

liabilities to total tangible assets

prior charges covenants typically included in term loan

agreements of larger firms

prior charges covenants defined as a percentage of total

tangible assets

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-34

Australian debt contracts (cont.)

debt to assets, interest coverage and current ratio

clauses frequently in use

interest coverage required to be between 1 and 4

times

current ratio clauses required current assets be

between 1 and 2 times the size of current liabilities

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-35

Debt contractsmanagers incentive to

manipulate

Ex post, the incentive to manipulate numbers

increases as the constraints approach violation

Managers found to manipulate accounting

accruals in the years before and the year after

violation of a debt agreement

Consider HIH

Too costly to stipulate all acceptable accounting

methods in contract so managers always have

some discretionary ability

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-36

Role of external auditors

Auditors arbitrate on the reasonableness of the

accounting method chosen

Demand for financial statement auditing when

management is rewarded on the basis of numbers

generated by the accounting system

the firm has borrowed funds, and accounting-based

covenants are in place to protect the investment of

debtholders

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-37

Political costs

Costs resulting from political attention from

government, lobby groups etc.

Commonly directed at larger firms

indication of market power

May result in increased taxes, increased wage

claims, product boycotts etc.

Firms likely to adopt accounting methods to reduce

profits to lower political scrutiny

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-38

Political actions of individuals

Limited expected pay-off results from the actions

of individuals

Results in formation of interest groups

Information costs shared, ability to investigate

government and business action increases

Given self-interest, representatives of interest

groups predicted to maximise own welfare as

constituents have limited motivation or means to

be fully informed

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-39

Actions of politicians

Politicians know that highly profitable companies

could be unpopular with members of constituency

Politicians could win votes by taking actions

against the companies

argue that in public interest even though in own interest

May rely on reported profits to justify actions

provides incentives for firms to reduce reported profits

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-40

Criticisms of PAT

Does not provide prescription

PAT is not value-free as it asserts assumption that

all action is driven by self-interest

Argued to be too negative and simplistic a

perspective of humankind

Issues have not shown great development

In undertaking large-scale empirical research,

researchers ignore organisational-specific

relationships

Copyright 2006 McGraw-Hill Australia Pty Ltd

PPTs t/a Financial Accounting Theory 2e by Deegan 7-41

Anda mungkin juga menyukai

- The Mechanics of Law Firm Profitability: People, Process, and TechnologyDari EverandThe Mechanics of Law Firm Profitability: People, Process, and TechnologyBelum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 7Dokumen41 halamanFinancial Accounting Theory Craig Deegan Chapter 7Rob26in0978% (9)

- Financial Accounting Theory Craig DeeganDokumen31 halamanFinancial Accounting Theory Craig DeegandhaniismailBelum ada peringkat

- CH 10Dokumen29 halamanCH 10Isnin Nadjama FitriBelum ada peringkat

- Chapter 07Dokumen44 halamanChapter 07Anonymous TFcwyqaBelum ada peringkat

- Financial Accounting TheoryDokumen55 halamanFinancial Accounting TheoryAmiteshBelum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 11Dokumen22 halamanFinancial Accounting Theory Craig Deegan Chapter 11Rob26in09100% (1)

- Financial Accounting Theory Craig Deegan Chapter 8Dokumen47 halamanFinancial Accounting Theory Craig Deegan Chapter 8Rob26in0983% (6)

- DeeganFAT3e PPT Ch10-EdDokumen31 halamanDeeganFAT3e PPT Ch10-EdsourovkhanBelum ada peringkat

- DeeganFAT3e PPT Ch08-EdDokumen51 halamanDeeganFAT3e PPT Ch08-Edwidyaareta100% (1)

- Financial Accounting Theory Craig Deegan Chapter 9Dokumen36 halamanFinancial Accounting Theory Craig Deegan Chapter 9Rob26in09Belum ada peringkat

- DeeganFAT3e PPT Ch09-EdDokumen38 halamanDeeganFAT3e PPT Ch09-EdsourovkhanBelum ada peringkat

- Chapter 01Dokumen31 halamanChapter 01Ahmad N. AlawiBelum ada peringkat

- Financial Accounting Theory 2e by Deegan 2006 Ch05Dokumen41 halamanFinancial Accounting Theory 2e by Deegan 2006 Ch05Hamarr WandayuBelum ada peringkat

- Financial Accounting TheoryDokumen39 halamanFinancial Accounting TheoryAmy SwanBelum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 2Dokumen34 halamanFinancial Accounting Theory Craig Deegan Chapter 2Siti AdawiyahBelum ada peringkat

- Lesson 6 - Positive Accounting TheoryDokumen26 halamanLesson 6 - Positive Accounting TheoryKatty MothaBelum ada peringkat

- Linking Competitive Strat With HR Practice Schuler Jackson 87Dokumen15 halamanLinking Competitive Strat With HR Practice Schuler Jackson 87Karthik ShanklaBelum ada peringkat

- Theories in Accounting: ©2018 John Wiley & Sons Australia LTDDokumen57 halamanTheories in Accounting: ©2018 John Wiley & Sons Australia LTDdickzcaBelum ada peringkat

- Financial Accounting Theory and Earnings ManagementDokumen31 halamanFinancial Accounting Theory and Earnings Managementlucy.gaoBelum ada peringkat

- Table of Content: Acct 2105 Accounting in Organization and Society Assignment - Semester 2,2017Dokumen7 halamanTable of Content: Acct 2105 Accounting in Organization and Society Assignment - Semester 2,2017Chu Ngoc AnhBelum ada peringkat

- Slide bài giảng môn Lý Thuyết kế toánDokumen49 halamanSlide bài giảng môn Lý Thuyết kế toándacminBelum ada peringkat

- Cap Bud - UltDokumen11 halamanCap Bud - UltKhaisarKhaisarBelum ada peringkat

- 07 - Positive Accounting TheoryDokumen15 halaman07 - Positive Accounting TheoryAizzad LoqmanBelum ada peringkat

- Sample Topics For Research Paper About AccountingDokumen7 halamanSample Topics For Research Paper About Accountingaflbmfjse100% (1)

- Lesson 5Dokumen61 halamanLesson 5lakmini pathiranaBelum ada peringkat

- Lesson 5Dokumen67 halamanLesson 5lakmini pathiranaBelum ada peringkat

- Summary Complete Final RevisionDokumen31 halamanSummary Complete Final RevisionOk ayBelum ada peringkat

- The Changing Role of Managerial Accounting in A Dynamic Business EnvironmentDokumen27 halamanThe Changing Role of Managerial Accounting in A Dynamic Business EnvironmentAndrea RobinsonBelum ada peringkat

- Ch01 Horngren IsmDokumen19 halamanCh01 Horngren IsmKiều Thảo AnhBelum ada peringkat

- Earning Management Group AssignmentDokumen7 halamanEarning Management Group AssignmentcikyayaanosuBelum ada peringkat

- Financial Accounting TheoryDokumen67 halamanFinancial Accounting TheoryMohammad Saadman100% (1)

- University of Petroleum and Energy StudiesDokumen7 halamanUniversity of Petroleum and Energy StudiesHrithik SharmaBelum ada peringkat

- CBI Study Guide Module 1 2015 PDFDokumen68 halamanCBI Study Guide Module 1 2015 PDFVMROBelum ada peringkat

- Unit 5Dokumen15 halamanUnit 5EYOB AHMEDBelum ada peringkat

- Module 3.3 - Relevance Valuation ConceptDokumen12 halamanModule 3.3 - Relevance Valuation ConceptGerald RamiloBelum ada peringkat

- 11 Edition: Mcgraw-Hill/IrwinDokumen34 halaman11 Edition: Mcgraw-Hill/IrwinMuhammad SajidBelum ada peringkat

- Final Exam Revision Notes 2012 Financial Accounting Theory Final Exam Revision Notes 2012 Financial Accounting TheoryDokumen19 halamanFinal Exam Revision Notes 2012 Financial Accounting Theory Final Exam Revision Notes 2012 Financial Accounting TheoryShariful IslamBelum ada peringkat

- Group Assignment 4 Earning ManagementDokumen6 halamanGroup Assignment 4 Earning Managementcikyayaanosu0% (1)

- T3 Positive Accounting TheoryDokumen24 halamanT3 Positive Accounting Theorywabdad 2Belum ada peringkat

- Translate Bab 10 Expenses (English)Dokumen2 halamanTranslate Bab 10 Expenses (English)nabilah syifa0% (1)

- ACG 6305 Chapter 1Dokumen17 halamanACG 6305 Chapter 1Rudy Joseph Michaud IIBelum ada peringkat

- ACC3200 - ACF3200 - Week 01 Tutorial SolutionDokumen4 halamanACC3200 - ACF3200 - Week 01 Tutorial Solution朱潇妤Belum ada peringkat

- Islamic Theory AccountingDokumen22 halamanIslamic Theory AccountingNiTholas WeiBelum ada peringkat

- Positive AccountingDokumen10 halamanPositive AccountingDony A. NugrohoBelum ada peringkat

- Contemporary Issues in Accounting MCQ PDFDokumen16 halamanContemporary Issues in Accounting MCQ PDFKamal samaBelum ada peringkat

- Positive Accounting TheoryDokumen47 halamanPositive Accounting TheoryAshraf Uz ZamanBelum ada peringkat

- Strat ManDokumen4 halamanStrat ManThea Condez MecenasBelum ada peringkat

- Positive Accounting TheoryDokumen2 halamanPositive Accounting TheoryGloryo SangkaengBelum ada peringkat

- A Positive Theory of Accounting DiscretionDokumen36 halamanA Positive Theory of Accounting DiscretionElizabeth StephanieBelum ada peringkat

- Sruti Karthikeyan-BV SrutiKarthikeyan C055Dokumen2 halamanSruti Karthikeyan-BV SrutiKarthikeyan C055Saurabh Krishna SinghBelum ada peringkat

- Accounting For Lawyers by Solicitor KatuDokumen45 halamanAccounting For Lawyers by Solicitor KatuFrancisco Hagai GeorgeBelum ada peringkat

- SodapdfDokumen40 halamanSodapdfcommercewaale1Belum ada peringkat

- Anthropological1 - 22Dokumen15 halamanAnthropological1 - 22Maryam Yousefi NejadBelum ada peringkat

- Management Accounting: Information For Creating Value and Managing ResourcesDokumen34 halamanManagement Accounting: Information For Creating Value and Managing ResourcesMuhdTaQiuBelum ada peringkat

- Company Business Process ReengineeringDokumen13 halamanCompany Business Process ReengineeringAldrin ManuelBelum ada peringkat

- Theoretical Framework of The StudyDokumen16 halamanTheoretical Framework of The StudyKurt CaneroBelum ada peringkat

- Marketing Aspect of A Feasib - StudyDokumen14 halamanMarketing Aspect of A Feasib - StudyMariel Tinol0% (1)

- Cash FlowDokumen6 halamanCash Flowsilvia indahsariBelum ada peringkat

- 6 AuditSDMDokumen47 halaman6 AuditSDMmichellee12Belum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 12Dokumen17 halamanFinancial Accounting Theory Craig Deegan Chapter 12Rob26in09100% (3)

- Jawaban Soal Akuntansi Piutang DagangDokumen4 halamanJawaban Soal Akuntansi Piutang Dagangsilvia indahsariBelum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 12Dokumen17 halamanFinancial Accounting Theory Craig Deegan Chapter 12Rob26in09100% (3)

- 6 AuditSDMDokumen47 halaman6 AuditSDMmichellee12Belum ada peringkat

- Financial Accounting Theory Craig Deegan Chapter 11Dokumen22 halamanFinancial Accounting Theory Craig Deegan Chapter 11Rob26in09100% (1)

- Financial Accounting Theory Craig Deegan Chapter 9Dokumen36 halamanFinancial Accounting Theory Craig Deegan Chapter 9Rob26in09Belum ada peringkat

- Lembar Kerja Spreadsheet 2Dokumen2 halamanLembar Kerja Spreadsheet 2silvia indahsariBelum ada peringkat

- Data Roti SalesDokumen2 halamanData Roti Salessilvia indahsariBelum ada peringkat

- PT Dagang Yuk General JournalDokumen5 halamanPT Dagang Yuk General Journalsilvia indahsariBelum ada peringkat

- Monetary Exchange and The Irreducible Cost of Inflation: SciencedirectDokumen12 halamanMonetary Exchange and The Irreducible Cost of Inflation: Sciencedirectsilvia indahsariBelum ada peringkat

- 1 NDA - EIL For GNFCDokumen6 halaman1 NDA - EIL For GNFCraghav joshiBelum ada peringkat

- Respondent NotesDokumen12 halamanRespondent Notesdk0895Belum ada peringkat

- WHITE GOLD MARINE SERVICES Vs PIONEER INSURANCEDokumen5 halamanWHITE GOLD MARINE SERVICES Vs PIONEER INSURANCEYvon BaguioBelum ada peringkat

- Pacana V Pascual-LopezDokumen2 halamanPacana V Pascual-LopezDenise DianeBelum ada peringkat

- Alitalia v. IACDokumen2 halamanAlitalia v. IACTippy Dos SantosBelum ada peringkat

- Important Clauses in Commercial ContractsDokumen12 halamanImportant Clauses in Commercial ContractsUdit NarainBelum ada peringkat

- Manila City's Appeal of Judgment in Land Purchase CaseDokumen8 halamanManila City's Appeal of Judgment in Land Purchase CaseJesus Angelo DiosanaBelum ada peringkat

- PEA vs Amari reclaimed lands caseDokumen21 halamanPEA vs Amari reclaimed lands caseZusmitha SalcedoBelum ada peringkat

- NBCCDokumen56 halamanNBCCriverwilliamsBelum ada peringkat

- SSS Vs MoonwalkDokumen3 halamanSSS Vs MoonwalkMarco BrimonBelum ada peringkat

- Toyota Motor Philippines Corporation vs. Court of Appeals, 216 SCRA 236 (1992)Dokumen7 halamanToyota Motor Philippines Corporation vs. Court of Appeals, 216 SCRA 236 (1992)DNAABelum ada peringkat

- What Is Force MajeureDokumen8 halamanWhat Is Force Majeurelcsyen100% (1)

- Civrev Digested CasesDokumen18 halamanCivrev Digested CaseshannaBelum ada peringkat

- Industrial Management vs. NLRCDokumen5 halamanIndustrial Management vs. NLRCSherwin Anoba CabutijaBelum ada peringkat

- NPT 1020 Imm PDFDokumen216 halamanNPT 1020 Imm PDFNessim Chao BabúnBelum ada peringkat

- NH Code of Admin. RulesDokumen43 halamanNH Code of Admin. Rulesjoeldavis2433Belum ada peringkat

- UP vs. PHILAB PDFDokumen17 halamanUP vs. PHILAB PDFpa0l0sBelum ada peringkat

- SC upholds liquidation of unlawful partnership fundsDokumen6 halamanSC upholds liquidation of unlawful partnership fundsJesa BayonetaBelum ada peringkat

- Pledge - BailmentDokumen3 halamanPledge - BailmentSaurabh SrirupBelum ada peringkat

- Cambridge Standard Terms of School Registration Issue 3 Nov 14Dokumen15 halamanCambridge Standard Terms of School Registration Issue 3 Nov 14nonton youtubeBelum ada peringkat

- 4U Promotions v. 18001 HoldingsDokumen10 halaman4U Promotions v. 18001 HoldingsBillboardBelum ada peringkat

- LLM Previous Year Questions 13.02.2024Dokumen19 halamanLLM Previous Year Questions 13.02.2024HARSHITA SHUKLABelum ada peringkat

- Revisiting The Underlying Philosophical Underpinnings of Philippine Commercial Laws by Cesar Villanueva, Ateneo de Manila Law SchoolDokumen58 halamanRevisiting The Underlying Philosophical Underpinnings of Philippine Commercial Laws by Cesar Villanueva, Ateneo de Manila Law Schoollocusstandi84Belum ada peringkat

- 02 Arco Metal Products v. Samahan NG Mga Manggagawa Sa Arco Metal (2008)Dokumen7 halaman02 Arco Metal Products v. Samahan NG Mga Manggagawa Sa Arco Metal (2008)Kirk BejasaBelum ada peringkat

- Latin PhrasesDokumen6 halamanLatin PhrasesJierah Manahan100% (1)

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Dokumen20 halamanScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderBelum ada peringkat

- Labor Digest 2Dokumen3 halamanLabor Digest 2jemsBelum ada peringkat

- Business in A Borderless WorldDokumen40 halamanBusiness in A Borderless WorldThomas RheeBelum ada peringkat

- 16 Aladdin Hotel Co V BloomDokumen7 halaman16 Aladdin Hotel Co V BloomlabellejolieBelum ada peringkat

- PMP ExamDokumen18 halamanPMP ExamSamir Hegishte50% (2)