Chap 1

Diunggah oleh

p4priya0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

104 tayangan19 halamanMarkets, Institutions and Services Second Edition Bharati V. Pathak the Indian financial System, 2e -- Pathak. Financial system is a set of sub systems of financial institutions, markets, instruments and services Intermediates with the flow of funds between savers and borrowers.

Deskripsi Asli:

Hak Cipta

© Attribution Non-Commercial (BY-NC)

Format Tersedia

PPT, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniMarkets, Institutions and Services Second Edition Bharati V. Pathak the Indian financial System, 2e -- Pathak. Financial system is a set of sub systems of financial institutions, markets, instruments and services Intermediates with the flow of funds between savers and borrowers.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

104 tayangan19 halamanChap 1

Diunggah oleh

p4priyaMarkets, Institutions and Services Second Edition Bharati V. Pathak the Indian financial System, 2e -- Pathak. Financial system is a set of sub systems of financial institutions, markets, instruments and services Intermediates with the flow of funds between savers and borrowers.

Hak Cipta:

Attribution Non-Commercial (BY-NC)

Format Tersedia

Unduh sebagai PPT, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 19

The Indian Financial

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

System

Markets, Institutions and

Services

Second Edition

Bharati V. Pathak

The Indian Financial System, 2e -- Pathak

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

1

Financial System: An Introduction

The Indian Financial System, 2e -- Pathak

The Indian Financial System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

The Indian Financial System, 2e -- Pathak

Chapter Objectives

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

To understand the

meaning of financial system

components of the financial system

functions of the financial system

key elements of the financial system

key elements of a well functioning financial

system

bank-based and market-based financial

systems

nature and role of financial institutions and

markets

link between money market and capital

market

link between primary market and secondary

The Indian Financial System, 2e -- Pathak

market

Meaning of the Financial

System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

A set of sub systems of financial

institutions, markets, instruments and

services

Intermediates with the flow of funds

between savers and borrowers.

Facilitates transfer and allocation of scarce

resources efficiently and effectively

The Indian Financial System, 2e -- Pathak

Types of Financial

System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Formal financial system – organized,

institutional and regulated

Informal financial system

Advantages

Low transaction costs

Minimum default risk

Transparency of procedures

Disadvantages

Wide range of interest rates

Higher rates of interest

Unregulated

The Indian Financial System, 2e -- Pathak

Components of the Financial

System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Financial Institutions

Financial Markets

Financial Instruments

Financial Services

The Indian Financial System, 2e -- Pathak

Types of Financial

Institutions

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Banking: creators and purveyors of credit.

Types

Commercial Banks

Cooperative Banks

Non-banking: purveyors of credit

Types

Developmental financial

institutions

Mutual funds

Insurance companies

NBFCs

The Indian Financial System, 2e -- Pathak

Functions of Financial

Institutions

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Provide three transformation services

Liability, asset and size transformation

Maturity transformation

Risk transformation

The Indian Financial System, 2e -- Pathak

Financial Markets

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Types

Money Market – A market for short-term debt

instruments

Capital Market – A market for long-term equity

and debt instruments

Segments

Primary Market – A market for new issues

Secondary Market – A market for trading

outstanding issues

The Indian Financial System, 2e -- Pathak

Link Between Primary and

Secondary Capital Market

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

A buoyant secondary market is

indispensable for the presence of a

vibrant primary market.

The secondary market provides a basis for

the determination of prices of new issues.

Depth of the secondary market depends on

the primary market.

Bunching of new issues affects prices in the

secondary market.

The Indian Financial System, 2e -- Pathak

Financial Instruments

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Types

Primary

Secondary

Distinct Features

Marketable

Tradable

Tailor-made

The Indian Financial System, 2e -- Pathak

Financial Services

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Major Categories

Funds intermediation

Payments mechanism

Provision of liquidity

Risk management

Financial engineering

The Indian Financial System, 2e -- Pathak

Functions of Financial

System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Mobilise and allocate savings

Monitor corporate performance

Provide payment and settlement systems

Optimum allocation of risk bearing and

reduction

Disseminate prize related information

Offer portfolio adjustment facility

Lower the cost of transactions

Promote the process of financial deepening

and broadening

The Indian Financial System, 2e -- Pathak

Key Elements of a Well-

functioning Financial System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

A strong legal and regulatory

environment

Stable money

Sound public finances and public debt

management

A central bank

Sound banking system

Information system

Well-functioning securities market

The Indian Financial System, 2e -- Pathak

Financial System Designs

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Types

Bank-based

Market-based

The Indian Financial System, 2e -- Pathak

Market-based Financial

System

Advantages

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Provide attractive terms to both investors

and borrowers

Facilitate diversification

Allow risk sharing

Allow financing of new technologies

Drawbacks

Prone to instability

Exposure to market risk

Free-rider problem

The Indian Financial System, 2e -- Pathak

Bank-based Financial

System

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Advantages

Close relationships with parties

Provide tailor-made contracts

Efficient inter-temporal risk sharing

No free-rider problem

Drawbacks

Retards innovation and growth

Impedes competition

The Indian Financial System, 2e -- Pathak

Functions of Financial

Markets

Copyright© 2008 Dorling Kindersley India Pvt. Ltd

Enabling economic units to exercise their

time preference

Separation, distribution, diversification and

reduction of risk

Efficient payment mechanism

Providing information

Enhancing liquidity

Providing portfolio management services

The Indian Financial System, 2e -- Pathak

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- List of Registered Independent Sales OrganizationsDokumen53 halamanList of Registered Independent Sales Organizationscdill70100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Sumit Black BookDokumen51 halamanSumit Black BookSuraj BenbansiBelum ada peringkat

- The History and Evolution of Credit and Debit CardsDokumen33 halamanThe History and Evolution of Credit and Debit CardsDeepali Jain87% (15)

- Mobile BankingDokumen2 halamanMobile Bankingp4priyaBelum ada peringkat

- Early History: Banks (That Is With The Government of India Holding A Stake), 31 Private BanksDokumen5 halamanEarly History: Banks (That Is With The Government of India Holding A Stake), 31 Private Banksp4priyaBelum ada peringkat

- Early History: Banks (That Is With The Government of India Holding A Stake), 31 Private BanksDokumen5 halamanEarly History: Banks (That Is With The Government of India Holding A Stake), 31 Private Banksp4priyaBelum ada peringkat

- Entry Into An International BusinessDokumen9 halamanEntry Into An International Businessp4priyaBelum ada peringkat

- Summer Internship ProgramDokumen3 halamanSummer Internship Programamsoni2009Belum ada peringkat

- Statement of AccountDokumen1 halamanStatement of AccountGopal AiranBelum ada peringkat

- IRCTC travel insurance coverDokumen3 halamanIRCTC travel insurance coverAbhinav TayadeBelum ada peringkat

- Assignment Form PDFDokumen2 halamanAssignment Form PDFjoitaBelum ada peringkat

- GL July KoreksiDokumen115 halamanGL July KoreksihartiniBelum ada peringkat

- Executive SummaryDokumen88 halamanExecutive SummaryRashmi Ranjan PanigrahiBelum ada peringkat

- Store-Detail Exact DetailsDokumen17 halamanStore-Detail Exact Detailsgovind_galamBelum ada peringkat

- AudprobDokumen3 halamanAudprobJonalyn MoralesBelum ada peringkat

- AMLA Operating ManualDokumen26 halamanAMLA Operating ManualnatalieBelum ada peringkat

- House BanksDokumen24 halamanHouse BanksNarsimha Reddy YasaBelum ada peringkat

- Security Features of Indian BanknotesDokumen26 halamanSecurity Features of Indian BanknotesRam KrishBelum ada peringkat

- MAS16Dokumen12 halamanMAS16Kyaw Htin Win50% (2)

- DEALER DownloadDokumen4 halamanDEALER DownloadNivedha DeviBelum ada peringkat

- Truth About Imperial RussiaDokumen3 halamanTruth About Imperial RussiaareliabijahBelum ada peringkat

- UPI Swan294 ID Number 5421939 Group Number 17Dokumen12 halamanUPI Swan294 ID Number 5421939 Group Number 17Suyangzi WangBelum ada peringkat

- TFG 2013 Annual ReportDokumen44 halamanTFG 2013 Annual ReportTenGer Financial GroupBelum ada peringkat

- SBM Bank Cash Deposit VoucherDokumen1 halamanSBM Bank Cash Deposit VoucherIrshaad Ally Ashrafi GolapkhanBelum ada peringkat

- Checklist Distribution Agreement SPLDokumen3 halamanChecklist Distribution Agreement SPLLitaBelum ada peringkat

- G.R. No. 174269 - Pantaleon Vs AmEx (2009)Dokumen3 halamanG.R. No. 174269 - Pantaleon Vs AmEx (2009)Sarah Jade LayugBelum ada peringkat

- Agent Name, License No & IRDA URN ListDokumen20 halamanAgent Name, License No & IRDA URN ListHarshad BhirudBelum ada peringkat

- 2020-Jaibb BC JuneDokumen2 halaman2020-Jaibb BC JuneaminulBelum ada peringkat

- Prêt-à-Porter RulesDokumen26 halamanPrêt-à-Porter RulestobymaoBelum ada peringkat

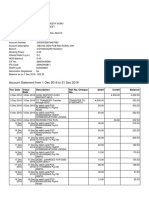

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen2 halamanAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARBelum ada peringkat

- Quiz - ReceivableDokumen2 halamanQuiz - ReceivableAna Mae Hernandez0% (1)

- Zachary Paul Greek ResumeDokumen3 halamanZachary Paul Greek Resumeapi-351871253Belum ada peringkat

- Fraud Through DefalcationDokumen28 halamanFraud Through DefalcationRaj IslamBelum ada peringkat

- Analysis of Audit Report of HindalcoDokumen16 halamanAnalysis of Audit Report of HindalcoYogesh SahaniBelum ada peringkat

- Online BankingDokumen40 halamanOnline BankingIsmail HossainBelum ada peringkat