Working Capital Management and Financial Forecasting: Fin3N

Diunggah oleh

iris claire gamad0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

18 tayangan18 halamanJudul Asli

Working-Capital-management-and-financial-Forecasting.pptx

Hak Cipta

© © All Rights Reserved

Format Tersedia

PPTX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

18 tayangan18 halamanWorking Capital Management and Financial Forecasting: Fin3N

Diunggah oleh

iris claire gamadHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PPTX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 18

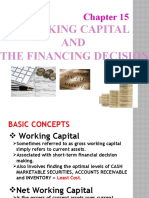

WORKING CAPITAL MANAGEMENT FIN3N

AND FINANCIAL FORECASTING

WORKING CAPITAL MANAGEMENT

Includes both establishing working capital policy and the day-to-day control of cash,

inventories, receivables, accruals, and accounts payable

FORMULAS

Working Capital

Total current assets

Net Working Capital

Current assets – Current liabilities

Net Operating Working Capital

= Current assets – (Current liabilities – Notes Payable)

ROE = Profit Margin x Total Assets Turnover x Equity Multiplier

= (Net Income / Sales) x (Sales / Assets) x (Assets / Equity)

RELAXED INVESTMENT POLICY

- relatively large amounts of cash, marketable securities, and inventories are carried,

and a liberal credit policy results in a high level of receivables.

- lower turnover, lower ROE

RESTRICTED INVESTMENT POLICY

- holdings of cash, marketable securities, inventories, and receivables are

constrained.

- lower level of assets, high total assets turnover ratio, high ROE

- exposes the firm to risks because shortages can lead to work stoppages, uhappy

customers, and serious long-run problems

MODERATE INVESTMENT POLICY

- an investment policy that is between the relaxed and restricted policies.

CURRENT ASSET FINANCING POLICIES

-2 TYPES OF CURRENT ASSETS

O Permanent Current Assets

– current assets that a firm must carry even at trough of its cycles.

O Temporary Currents Assets

– current assets that fluctuate with seasonal or cyclical variations in

sales.

CURRENT ASSET FINANCING POLICIES

o Moderate Approach

o Relatively Aggressive Approach

o Conservative Approach

THE CASH CONVERSION CYCLE (CCC)

The length of time funds are tied up in working capital, or the

length of time between paying for working capital and collecting

cash from the sale of the working capital.

THE CASH CONVERSION CYCLE (CCC)

Inventory Conversion Period

The average time required to convert raw materials into

finished goods and to sell them.

Average Collection Period (ACP or DSO)

The average length of time required to convert the firm’s

receivables into cash, that is, to collect cash following a sale.

Payables Deferral Period

The average length of time between the purchase of

materials and labor and the payment of cash for them.

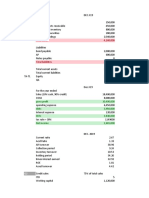

E.G.

ICP + ACP – PDP = CCC

60 + 60 - 40 = 80 days

Annual Sales P1,216,666

COGS P1,013,889

FORMULAS: Inventory

Accounts Receivable

P250,000

P300,000

Accounts Payable P150,000

Inventory conversion period = Inventory/Sales per day

Receivables Collection Period (DSO) = Receivables/Sales/365

Payables Deferral Period = Payables/Cost of Goods Sold/365

INSERT IRIS PPT HERE

The Cash Budget

BANK

LOANS

Anda mungkin juga menyukai

- Financial Accounting and Reporting Study Guide NotesDari EverandFinancial Accounting and Reporting Study Guide NotesPenilaian: 1 dari 5 bintang1/5 (1)

- Brealey6ce Ch20 FinalDokumen36 halamanBrealey6ce Ch20 FinalDylan MadisonBelum ada peringkat

- Cash and Marketable Securities ManagementDokumen5 halamanCash and Marketable Securities ManagementJack HererBelum ada peringkat

- Case Analysis Casa DisenoDokumen7 halamanCase Analysis Casa DisenoLexBelum ada peringkat

- IGCSE Accounting O Level p1 Answers PDFDokumen17 halamanIGCSE Accounting O Level p1 Answers PDFNusaibah AssyifaBelum ada peringkat

- Chapter 4 Working Capital and Cash Flow Management FinmanDokumen38 halamanChapter 4 Working Capital and Cash Flow Management FinmanCris EdrianBelum ada peringkat

- Working Capital ManagementDokumen26 halamanWorking Capital ManagementMrinal KalitaBelum ada peringkat

- Cashflow Forecast Actual SampleDokumen33 halamanCashflow Forecast Actual SampleAchanBelum ada peringkat

- Budgeting and Financial PlanningDokumen11 halamanBudgeting and Financial PlanningMohamed Ali Jamesha100% (1)

- Working Capital ConceptsDokumen42 halamanWorking Capital Conceptsdabloo_3sep86% (7)

- Working Capital Management p1 and 2Dokumen23 halamanWorking Capital Management p1 and 2Emman Lubis50% (2)

- Working Capital MGTDokumen4 halamanWorking Capital MGTLeanne Faustino0% (2)

- Mcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Dokumen4 halamanMcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Angela Dela PeñaBelum ada peringkat

- Session 6 FINANCIAL PLANNING Working Capital ManagementDokumen44 halamanSession 6 FINANCIAL PLANNING Working Capital ManagementXia AlliaBelum ada peringkat

- FM Midterm Chapter4Dokumen13 halamanFM Midterm Chapter4Mayet RoseteBelum ada peringkat

- FinMan-11 25Dokumen92 halamanFinMan-11 25Jessa GalbadorBelum ada peringkat

- Operating and Cash Conversion CyclesDokumen4 halamanOperating and Cash Conversion CyclesChristoper SalvinoBelum ada peringkat

- Working Capital ManagementDokumen58 halamanWorking Capital ManagementRonald MojadoBelum ada peringkat

- Unit 7 Working Capital ManagementDokumen36 halamanUnit 7 Working Capital ManagementNabin JoshiBelum ada peringkat

- Chapter 11 Addressing Working Capital Policies and Management of ShortDokumen2 halamanChapter 11 Addressing Working Capital Policies and Management of ShortElizabethBelum ada peringkat

- F9 Part CDokumen8 halamanF9 Part Cnguyen quynhBelum ada peringkat

- G3-Working Capital Management PDFDokumen8 halamanG3-Working Capital Management PDFJade Berlyn AgcaoiliBelum ada peringkat

- Workingcapitalmanagement 120729142538 Phpapp01Dokumen32 halamanWorkingcapitalmanagement 120729142538 Phpapp01Vikas BansalBelum ada peringkat

- HandoutDokumen7 halamanHandoutSalma AbdullahBelum ada peringkat

- RWJ Chapter 16Dokumen11 halamanRWJ Chapter 16Sohini Mo BanerjeeBelum ada peringkat

- Presentation On Working Capital: by M.P. DeivikaranDokumen71 halamanPresentation On Working Capital: by M.P. Deivikaransweetz_samzBelum ada peringkat

- FINMAN Finals ReviewerDokumen1 halamanFINMAN Finals ReviewerCarol Ferreros PanganBelum ada peringkat

- Report No.07 Labrador TacnaDokumen29 halamanReport No.07 Labrador TacnaCamille EscoteBelum ada peringkat

- Working CapitalDokumen17 halamanWorking CapitalHanuman PrasadBelum ada peringkat

- FIN2004Dokumen79 halamanFIN2004morry123Belum ada peringkat

- FIM - Special Class - 4 - 2020 - OnlineDokumen42 halamanFIM - Special Class - 4 - 2020 - OnlineMd. Abu NaserBelum ada peringkat

- Financial Management II - Chapter 18Dokumen29 halamanFinancial Management II - Chapter 18Herman Agrianto SitorusBelum ada peringkat

- Baf 361 Introduction To Corporate Finance and BankingDokumen33 halamanBaf 361 Introduction To Corporate Finance and BankingRevivalist Arthur - GeomanBelum ada peringkat

- Chapter 2 - Working CapitalDokumen20 halamanChapter 2 - Working Capitalbereket nigussieBelum ada peringkat

- Optimal Working Capital ManagementDokumen71 halamanOptimal Working Capital Managementgodwinggg21Belum ada peringkat

- Session 4 - WCMDokumen68 halamanSession 4 - WCMMayank PatelBelum ada peringkat

- Finman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalDokumen15 halamanFinman Reviewer - Finals Current Assets: Fixed Assets:: Net Working CapitalHoney MuliBelum ada peringkat

- Prof. SB Mishra Working Capital ManagementDokumen25 halamanProf. SB Mishra Working Capital ManagementArun Kumar BansalBelum ada peringkat

- Presentation On Working Capital: BY Sunil Kumar M NDokumen22 halamanPresentation On Working Capital: BY Sunil Kumar M NningegowdaBelum ada peringkat

- Short Term Financial PlanningDokumen7 halamanShort Term Financial PlanningHabib AhmadBelum ada peringkat

- Presentation On Working Capital: by M.P. DeivikaranDokumen71 halamanPresentation On Working Capital: by M.P. DeivikaranHitesh K SutharBelum ada peringkat

- Presentation On Working Capital: by P M NayakDokumen71 halamanPresentation On Working Capital: by P M NayakShivani SharmaBelum ada peringkat

- Working Capital and Financing DecisionDokumen28 halamanWorking Capital and Financing DecisionMarriel Fate CullanoBelum ada peringkat

- PAN African E-Network Project: Working Capital ManagementDokumen89 halamanPAN African E-Network Project: Working Capital ManagementEng Abdulkadir MahamedBelum ada peringkat

- Working Capital ManagementDokumen33 halamanWorking Capital ManagementShweta GoelBelum ada peringkat

- Introduction and Working Capital ManagementDokumen4 halamanIntroduction and Working Capital Managementmh bachooBelum ada peringkat

- Financial Management Theories: Group 9 & 10Dokumen5 halamanFinancial Management Theories: Group 9 & 10Aaron Dale VillanuevaBelum ada peringkat

- Chapter 18 Short Term Finance and PlanningDokumen25 halamanChapter 18 Short Term Finance and Planningtheovester natanBelum ada peringkat

- Management of Working Capital: Ajeet Kumar ThakurDokumen125 halamanManagement of Working Capital: Ajeet Kumar ThakurDilip Kumar YadavBelum ada peringkat

- Working Capital-1 PDFDokumen57 halamanWorking Capital-1 PDFClarenciaAdhemesTantriBelum ada peringkat

- FIN701 Final Exam Cash Conversion CycleDokumen24 halamanFIN701 Final Exam Cash Conversion Cycleankita chauhanBelum ada peringkat

- Working Capital Management 15Dokumen75 halamanWorking Capital Management 15Vany AprilianiBelum ada peringkat

- Working Capital ManagementDokumen24 halamanWorking Capital ManagementAmjad J AliBelum ada peringkat

- Power Point (Working Capital)Dokumen71 halamanPower Point (Working Capital)Varun TayalBelum ada peringkat

- Working Capital ManagementDokumen44 halamanWorking Capital ManagementPhaniraj Lenkalapally100% (1)

- Working Capital ManagementDokumen26 halamanWorking Capital ManagementAshutosh GhadaiBelum ada peringkat

- Working Capital ManagementDokumen37 halamanWorking Capital ManagementalamctcBelum ada peringkat

- Acc 301 Corporate Finance - Lectures Two - ThreeDokumen17 halamanAcc 301 Corporate Finance - Lectures Two - ThreeFolarin EmmanuelBelum ada peringkat

- Working Capital and Current Assets Management: All Rights ReservedDokumen58 halamanWorking Capital and Current Assets Management: All Rights ReservedAndrea RosalBelum ada peringkat

- Manage Working Capital & Cash FlowDokumen10 halamanManage Working Capital & Cash Flowvalentine mutungaBelum ada peringkat

- Working Capital ManagementDokumen6 halamanWorking Capital ManagementJoshua BrazalBelum ada peringkat

- Working Capital ManagementDokumen71 halamanWorking Capital ManagementRachna BajajBelum ada peringkat

- Optimize Working Capital ManagementDokumen4 halamanOptimize Working Capital ManagementAlexandra Nicole IsaacBelum ada peringkat

- The Cash Conversion Playbook: Boosting Profitability in ManufacturingDari EverandThe Cash Conversion Playbook: Boosting Profitability in ManufacturingBelum ada peringkat

- Lecture On Capital Budgeting - Other TopicsDokumen42 halamanLecture On Capital Budgeting - Other Topicsiris claire gamadBelum ada peringkat

- Total Quality ManagementDokumen24 halamanTotal Quality Managementiris claire gamadBelum ada peringkat

- Forex & DerivativesDokumen6 halamanForex & Derivativessarahbee100% (1)

- Capital BudgetingDokumen12 halamanCapital Budgetingjunhe898Belum ada peringkat

- DT1Dokumen5 halamanDT1iris claire gamadBelum ada peringkat

- Budget CycleDokumen42 halamanBudget Cycleiris claire gamadBelum ada peringkat

- Cash Budget ReportDokumen7 halamanCash Budget Reportiris claire gamadBelum ada peringkat

- Finman Report FDokumen12 halamanFinman Report Firis claire gamadBelum ada peringkat

- HI5002 Interactive Tutorial Session 2 Topic 1-Solution.T2.2021Dokumen50 halamanHI5002 Interactive Tutorial Session 2 Topic 1-Solution.T2.2021Boniface KigoBelum ada peringkat

- Intro To Financial ManagementDokumen12 halamanIntro To Financial Managementwei hongBelum ada peringkat

- Arvind MillsDokumen33 halamanArvind MillshasmukhBelum ada peringkat

- Masud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRODokumen4 halamanMasud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRObalal_hossain_1Belum ada peringkat

- Project Report On Cardamom Drying Processing Unit2Dokumen11 halamanProject Report On Cardamom Drying Processing Unit2vikash1905Belum ada peringkat

- Solved ProblemsDokumen24 halamanSolved ProblemsSammir MalhotraBelum ada peringkat

- Working Capital ProjectDokumen100 halamanWorking Capital ProjectJithesh RajinivasBelum ada peringkat

- WCM QuestionsDokumen13 halamanWCM QuestionsjeevikaBelum ada peringkat

- MIRANDA - Post Task 3,4,5 Compilation PDFDokumen9 halamanMIRANDA - Post Task 3,4,5 Compilation PDFSHARMAINE CORPUZ MIRANDABelum ada peringkat

- Fund Flow StatementDokumen16 halamanFund Flow StatementRavi RajputBelum ada peringkat

- Midterm Exam in Treasury ManagementDokumen5 halamanMidterm Exam in Treasury ManagementJoel PangisbanBelum ada peringkat

- Working Capital Management Study for Kamakshi SteelsDokumen90 halamanWorking Capital Management Study for Kamakshi SteelsRakesh Kolasani NaiduBelum ada peringkat

- How To Prepare A Financial Feasibility StudyDokumen35 halamanHow To Prepare A Financial Feasibility StudyN.a. M. Tandayag100% (1)

- Ratio Analysis: Objectives: After Reading This Chapter, You Will Be Able ToDokumen19 halamanRatio Analysis: Objectives: After Reading This Chapter, You Will Be Able ToDanish KhanBelum ada peringkat

- Research Proposal: Effects of Working Capital Management On Sme ProfitabilityDokumen3 halamanResearch Proposal: Effects of Working Capital Management On Sme Profitabilitykashifshaikh760% (1)

- Anil Final ProjectDokumen51 halamanAnil Final ProjectManidipa Bose100% (1)

- 6 Sem Bcom - Management Accounting PDFDokumen71 halaman6 Sem Bcom - Management Accounting PDFaldhhdBelum ada peringkat

- TEST Bank Chapter 22Dokumen19 halamanTEST Bank Chapter 22Rhea llyn BacquialBelum ada peringkat

- Comprehensive Viva of AashiyaDokumen23 halamanComprehensive Viva of AashiyaMegha UikeBelum ada peringkat

- Scrap 5Dokumen14 halamanScrap 5Bryent GawBelum ada peringkat

- II PU Business Studies Passing PackageDokumen14 halamanII PU Business Studies Passing PackageAnjan anjuBelum ada peringkat

- Ratio AnalysisDokumen53 halamanRatio Analysisravi kangneBelum ada peringkat

- Corporate Finance: Financial Statements and Cash FlowDokumen27 halamanCorporate Finance: Financial Statements and Cash FlowIBn RefatBelum ada peringkat

- Chapter 2 Financial AnalysisDokumen26 halamanChapter 2 Financial AnalysisCarl JovianBelum ada peringkat

- Entrepreship JK BOSE BY DR Muzzamil RehmanDokumen29 halamanEntrepreship JK BOSE BY DR Muzzamil RehmanMuzzamil RehmanBelum ada peringkat