ch02 1

Diunggah oleh

Farooq AzamDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ch02 1

Diunggah oleh

Farooq AzamHak Cipta:

Format Tersedia

Copyright 2009 John Wiley & Sons, nc.

Project Management

SeIecting Projects

StrategicaIIy

Ch # Ch #- -2 2

ProbIems With MuItipIe Projects

. Delays in one project delays others

because of common resource needs

or technological dependencies

2. nefficient use of resources

3. Bottlenecks in resource availability

Ch # Ch #- -3 3

Project ResuIts

30 Percent canceled

Over half 90 percent over budget

Over half 220 percent late

Ch # Ch #- -4 4

haIIenges

aking sure projects closely tied to

goals and strategy

How to handle growing number of

projects

How to make projects successful

Ch # Ch #- -5 5

Project Management Maturity

Project management maturity refers to

mastery of skills required to manage

project competently

Number of ways to measure

ost organizations do not do well

Ch # Ch #- -6 6

Project SeIection and riteria of

hoice

Project selection.

Evaluating

Choosing

mplementing

Same process as other business decisions

Projects that are consistent with the strategic

goals of the organization should be selected

Ch # Ch #- -7 7

ampIes of Project SeIection

manufacturing firm chooses which

machine to adopt in a process

TV station selects which comedy show to

run

construction firm selects the best subset of

potential projects

hospital finds the best mix of beds for a

new wing

Ch # Ch #- -8 8

%ypes of ompanies

Companies considering projects fall into

two broad categories:

. Companies whose core business is completing

projects

2. Companies whose core business is something

else

They can also be broken down as:

. Companies looking at projects to do for others

2. Companies looking at projects to do for

themselves

Ch # Ch #- -9 9

Project ompanies

ust select which projects they will bid on

Generally based on.

Their expertise

Resource they have availability

Their chance of winning bid

Preparing a bid is expensive

They do not want to waste that effort on bids

where they are unlikely to be successful

Ch # Ch #- -10 10

on-Project ompanies

ust decide which potential projects

they will pursue

vailable capital is the major constraint

Profitability is often the major criteria

ust evaluate approaches when there

is more than one project that can

accomplish a goal

Ch # Ch #- -11 11

ModeIs

odels are used to select projects

ll models simplify reality

That is, they only look at the key

variables involved in a decision

The more variables included in a

model, the more complex it becomes

Simpler models usually work better

Ch # Ch #- -12 12

%ypes of ModeIs

Stochastic/Probabilistic odel

model that includes the probabilities of events

occurring within the model. n other words, the

same inputs might yield different outputs at

different runs.

Deterministic odel

model that does not include probabilities. Given

the same inputs, the outputs will always be the

same.

Ch # Ch #- -13 13

riteria For Project SeIection

ModeIs

Companies only want to undertake successful

projects

Projects that fail waste resources and hurt

profitability and competitiveness

Projects that succeed improve profitability and

competitiveness

t is not possible to know ahead of time if a project

will succeed or fail

n fact, there is a continuum of possible results from

total success through absolute failure

Ch # Ch #- -14 14

riteria (ontinued)

Companies need a way of weeding out the

bad projects while keeping the good ones

No model can predict with absolute certainty

What we want is a model with a "good batting

average

Ch # Ch #- -15 15

ModeI riteria

Realism

Capability

Flexibility

Easy to use

nexpensive

Easy to implement

Ch # Ch #- -16 16

ReaIism

Needs to include all objectives of the firm

Needs to include the firms expertise as well

as its limitations

Needs to report results in a fashion that

allows different projects to be compared, e.g.

how do we compare a project to lower

production cost and one to raise market

share

Ch # Ch #- -17 17

apabiIity

odel needs to be sophisticated

enough to deal with all projects

Varying resource requirements

Varying time periods

Varying probabilities of success

Needs to be able to select the optimum

projects among all contenders

Ch # Ch #- -18 18

FIeibiIity

Needs to be able to work with all

projects

Needs to be updated as the firm and its

environment evolves

Ch # Ch #- -19 19

asy to Use

Needs to be quick to gather the data

and easy to use and understand

Easy to be able to "fit the project in the

model

Ch # Ch #- -20 20

nepensive

Do not want the model to eat up all the

savings that result from using the

model

Expenses include the cost of writing

and maintaining the model

lso includes the expense of gathering

the data needed by the model

Ch # Ch #- -21 21

asy to mpIement

This is less of an issue with modern

spreadsheets

However, a model to be used to

evaluate all the firm's projects should

be centrally maintained

Ch # Ch #- -22 22

%he ature of Project SeIection ModeIs

odels turn inputs into outputs

anagers decide on the values for the inputs

and evaluate the outputs

The inputs never fully describe the situation

The outputs never fully describe the

expected results

odels are tools

anagers are the decision makers

Ch # Ch #- -23 23

ifferent Factors Affecting

Outcome

any factors affect the outcome of a project

Some are one-time factors

The cost of an item

Others are reoccurring

aintenance

Not all factors are equally important

Critical factors on one project may be trivial

on another project

Ch # Ch #- -24 24

Predictors of Project Success

Expected profitability

Technological opportunity

Development risk

ppropriateness of the project for the

organization

Ch # Ch #- -25 25

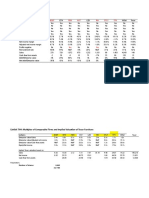

tabIe_02_01

Project vaIuation Factors

Ch # Ch #- -26 26

%ypes of Project SeIection ModeIs

Nonnumeric models

Numeric models

Ch # Ch #- -27 27

onnumeric ModeIs

odels that do not return a numeric

value for a project that can be

compared with other projects

These are really not "models but rather

justifications for projects

Just because they are not true models

does not make them all "bad

Ch # Ch #- -28 28

%ypes of onnumeric ModeIs

Sacred Cow

project, often suggested by top management,

that has taken on a life of its own. t continues, not

due to any justification, but "just because.

Operating Necessity

project that is required in order to protect lives

or property or to keep the company in operation.

Competitive Necessity

project that is required in order to maintain the

company's position in the marketplace.

Ch # Ch #- -29 29

%ypes of onnumeric ModeIs ontinued

Product Line Extension

Often, projects to expand a product line are

evaluated on how well the new product meshes

with the existing product line rather than on

overall benefits.

Comparative Benefit

Projects are subjectively rank ordered based on

their perceived benefit to the company.

Ch # Ch #- -30 30

umeric ModeIs

odels that return a numeric value for

a project that can be easily compared

with other projects

Two major categories:

. Profit/profitability

2. Scoring

Ch # Ch #- -31 31

Profit/ProfitabiIity ModeIs

odels that look at costs and revenues

Payback period

Discounted cash flow (NPV)

nternal rate of return (RR)

Profitability index

NPV and RR are more common

Ch # Ch #- -32 32

Payback Period

The length of time until the original

investment has been repaid by the

project

shorter payback period is better

Ch # Ch #- -33 33

Payback Period ampIe

4

000 , 25 $

000 , 100 $

Period Payback

Flow Cash Annual

Cost Project

Period Payback

Ch # Ch #- -34 34

Payback Period rawbacks

. Does not consider time value of

money

2. ore difficult to use when cash flows

change over time

3. Less meaningful over longer periods

of time (due to time value of money)

4. gnores cash flows beyond payback

period

Ch # Ch #- -35 35

iscounted ash FIow

The value of a stream of cash inflows and

outflows in today's dollars

lso known as net present value (NPV) or

just discounting

Widely used to evaluate projects

ncludes the time value of money

ncludes all inflows and outflows, not just the

ones through payback point

Ch # Ch #- -36 36

iscounted ash FIow ontinued

Requires a percentage to use to reduce

future cash flows

This is known as the discount rate or

hurdle rate or cutoff rate

There will usually be one overall

discount rate for the company

Ch # Ch #- -37 37

PV FormuIa

n

t

t

t

k

F

A

1

0

1

(project) NPV

0

nitial cash investment

F

t

The cash flow in time period t (negative for

outflows)

k The discount rate

n The number of years of life

Ch # Ch #- -38 38

PV FormuIa %erms

project is acceptable if NPV is positive

higher NPV is better

The higher the discount rate, the lower the

NPV

Ch # Ch #- -39 39

PV FormuIa ncIuding nfIation

0

1

NPV (project)

1

n

t

t

t

t

F

A

k p

p

t

Predicted rate of inflation during period t

Ch # Ch #- -40 40

PV ampIe

project requires $00,000 investment with a

net cash inflow of $25,000 per year for a

period of eight years, a required rate of

return of 5% and an inflation rate of 3%

per year.

Ch # Ch #- -41 41

PV ampIe

939 , 1 $

03 . 0 15 . 0 1

000 , 25 $

000 , 100 $ (project) NPV

8

1

t

t

Ch # Ch #- -42 42

tabIe_02_02

PV ampIe

Ch # Ch #- -43 43

nternaI Rate of Return (RR)

The discount rate (k) that causes the NPV to

be equal to zero

The higher the RR, the better

While it is technically possible for a series to have

multiple RR's, this is not a practical issue

Finding the RR requires a financial

calculator or computer

RR can also be found by trial and error

n Excel "=RR(Series,Guess)

Ch # Ch #- -44 44

ProfitabiIity nde

a.k.a. Benefit cost ratio

NPV of all future cash flows divided by

initial cash investment

Ratios greater than .0 are good

Ch # Ch #- -45 45

Advantages of ProfitabiIity ModeIs

Easy to use and understand

Based on accounting data and

forecasts

Familiar and well understood

Give a go/no-go indication

Can be modified to include risk

Ch # Ch #- -46 46

isadvantages of ProfitabiIity

ModeIs

gnore non-monetary factors

Some ignore time value of money

Discounting models (NPV, RR) are

biased to the short-term

Payback models ignore cash flow after

payback

Sensitive to error in data

Ch # Ch #- -47 47

Scoring ModeIs

&nweighted factor model

Weighted factor model

Ch # Ch #- -48 48

Unweighted Factor ModeIs

Each factor is weighted the same

Easy to compute

Just total or average the scores

Ch # Ch #- -49 49

Unweighted 0-1 Factor ModeI ampIe

Figure 2-2

Ch # Ch #- -50 50

Unweighted Factor Scoring ModeI

Give a score (point) to each criterion

and sum them up

Select the project with the highest total

score

Generally a five-point scale is used

Ch # Ch #- -51 51

Unweighted Factor Scoring ModeI

ampIe

Criterion: estimated annual profits

Score Performance level

5 bove $,00,000

4 $750,00 to $,00,000

3 $500,00 to $750,000

2 $200,000 to $500,000

Less than $200,000

Ch # Ch #- -52 52

Unweighted Factor Scoring ModeI

ampIe

Criterion: no decrease in quality of the final product

Score Performance level

The quality of the final product is

5 significantly and visibly improved

4 significantly improved but not visible to buyer

3 not significantly changed

2 significantly lowered but not visible to buyer

significantly and visibly lowered

Ch # Ch #- -53 53

Weighted Factor (Scoring) ModeI

Each factor is weighted relative to its

importance

Weighting allows important factors to stand out

good way to include non-numeric data in

the analysis

Factors need to sum to one

ll weights must be set up so higher values

mean more desirable

Small differences in totals are not meaningful

Ch # Ch #- -54 54

Weighted Factor ModeI

1

n

i if f

f

S s w

S

i

Total score of the i

th

project

s

ij

Score of the i

th

project on the j

th

criterion

w

j

Weight of the j

th

criterion

0 1 and 1

f f

f

w w A A

Ch # Ch #- -55 55

Weighted Factor ModeI ampIe

AutomobiIe SeIection

Table

Ch # Ch #- -56 56

Weighted Factor ModeI ampIe

AutomobiIe SeIection

Table B

Ch # Ch #- -57 57

Weighted Factor ModeI ampIe

AutomobiIe SeIection

Figure

Ch # Ch #- -58 58

Weighted Factor ModeI ampIe

AutomobiIe SeIection

Figure B

Ch # Ch #- -59 59

Advantages of Scoring ModeIs

ultiple criteria can be used

Simple and easy to understand

Direct reflection of managerial policy

Easily altered to accommodate

changes

Weights of criteria

Easy sensitivity analysis

Ch # Ch #- -60 60

isadvantages of Scoring ModeIs

Scores may not directly represent the

value or utility

Elements are assumed to be

independent

&nweighted models assume equal

importance of all criteria

Ch # Ch #- -61 61

AnaIysis Under Uncertainty-%he

Management of Risk

Everything to do with projects is risky

Some projects, like R&D, are more risky than

others, like construction

Risks include.

The timing of the project and its associated cash

flow

Risk regarding the outcome of the project

Risk about the side effects

Ch # Ch #- -62 62

Uncertainty

. Pro forma financial statements, break-

even charts

2. Risk analysis

3. Simulation (requires detailed

probability information)

Ch # Ch #- -63 63

omments on the nformation Base for

SeIection

database must be created and

maintained to furnish input data

ccounting data

easurements

&ncertain information

Ch # Ch #- -64 64

Accounting ata

. Cost and revenue are linear

2. Cost-revenue data derived using

standard cost standardized revenue

assumptions

3. Costs may include overhead

Ch # Ch #- -65 65

Measurements

. Subjective versus objective

2. Quantitative versus qualitative

3. Reliable versus unreliable

4. Valid versus invalid

Ch # Ch #- -66 66

Uncertain nformation

ust estimate inputs for risk analysis

These inputs cannot be known exactly

nputs must be adjusted over time

Ch # Ch #- -67 67

Project PortfoIio Process (PPP)

Links projects directly to the goals and

strategy of the organization

eans for monitoring and controlling

projects

Ch # Ch #- -68 68

Project PortfoIio Process (PPP)

dentify non-projects

Prioritize the available projects

Limit the number of projects

dentify the projects that best fit the

organization's strategy

Eliminate projects that incur high cost/risk

Keep from overloading the resource

availability

Balance resources with needs

Ch # Ch #- -69 69

PPP Steps

. Establish a project council

2. dentify project categories and criteria

3. Collect project data

4. ssess resource availability

5. Reduce the project and criteria set

6. Prioritize the projects within categories

7. Select projects to be funded and held in reserve

8. mplement the process

Ch # Ch #- -70 70

Step 1: stabIish a Project ounciI

Senior management

The project managers of major projects

The head of the Project anagement Office

Particularly relevant general managers

Those who can identify key opportunities and

risks facing the organization

nyone who can derail the PPP later on

Ch # Ch #- -71 71

Step 2: dentify Project ategories and

riteria

. Derivative projects: incrementally different in

product and process from existing offerings

2. Platform projects: major departures from existing

offerings (ex: a new model of automobile, a new

type of insurance plan)

3. Breakthrough projects: newer technology than

platform projects (ex: use of fiber optic cables for

data transmission, hybrid automobiles)

4. R&D projects: develop new technologies

Ch # Ch #- -72 72

fig_02_10

Ch # Ch #- -73 73

Step 3: oIIect Project ata

ssemble the data

&pdate previous data

Document assumptions

Screen out weaker projects

The fewer projects that need to be

compared and analyzed, the easier the

work

Ch # Ch #- -74 74

Step 4: Assess Resource AvaiIabiIity

ssess both internal and external

resources

ssess labor conservatively

Timing is particularly important

Ch # Ch #- -75 75

Step 5: Reduce the Project and riteria

Set

Organization's goals

Have competence

arket for offering

How risky

Potential partner

Right resources

Good fit

&se strengths

Synergistic with

other projects

Dominated by

another

Has slipped in

desirability

Ch # Ch #- -76 76

Step 6: Prioritize the Projects Within

ategories

pply the scores and criterion weights

Consider in terms of benefits first,

resource costs second

Summarize the returns from the

projects

Ch # Ch #- -77 77

Step 7: SeIect the Projects to be

Funded and HeId in Reserve

Determine the mix of projects across

the categories

Leave some resources free for new

opportunities

llocate the categorized projects in

rank order

Ch # Ch #- -78 78

fig_02_11

Ch # Ch #- -79 79

Step 8: mpIement the Process

Communicate results

Repeat regularly

mprove process

Ch # Ch #- -80 80

Project ProposaIs

The project proposal is essentially a project

bid

Putting together a project proposal requires a

detailed analysis of the project

Project proposals can take weeks or months

to complete

more detailed analysis may result in not

bidding on the project

Ch # Ch #- -81 81

Project ProposaI ontents

Cover letter

Executive summary

The technical approach

The implementation plan

The plan for logistic support and

administration

Past experience

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- DO - 163 - S2015 - DupaDokumen12 halamanDO - 163 - S2015 - DupaRay Ramilo100% (1)

- Teuer B DataDokumen41 halamanTeuer B DataAishwary Gupta100% (1)

- Berkshire PartnersDokumen2 halamanBerkshire PartnersAlex TovBelum ada peringkat

- Hatch Final ReportDokumen47 halamanHatch Final ReportJennifer UrsuaBelum ada peringkat

- Capital Budgeting Techniques: Multiple Choice QuestionsDokumen10 halamanCapital Budgeting Techniques: Multiple Choice QuestionsRod100% (1)

- Krugman 4 eDokumen7 halamanKrugman 4 eAlexandra80% (5)

- Short Fall in Stock MArketsDokumen6 halamanShort Fall in Stock MArketsFarooq AzamBelum ada peringkat

- Five Steps To Solving EuropeDokumen4 halamanFive Steps To Solving EuropeFarooq AzamBelum ada peringkat

- Strategic Management 11Dokumen4 halamanStrategic Management 11Farooq AzamBelum ada peringkat

- Business LettersDokumen4 halamanBusiness LettersFarooq AzamBelum ada peringkat

- Introduction To Sustainability AccountingDokumen8 halamanIntroduction To Sustainability AccountingAnonymous UhgThoBelum ada peringkat

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Dokumen24 halamanKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- Fundamentals of Trade FinanceDokumen9 halamanFundamentals of Trade FinanceMohammed SuhaleBelum ada peringkat

- Franchise ConsignmentDokumen2 halamanFranchise ConsignmentClarissa Atillano FababairBelum ada peringkat

- Delta Project and Repco AnalysisDokumen9 halamanDelta Project and Repco AnalysisvarunjajooBelum ada peringkat

- Economic Roundtable ReleaseDokumen1 halamanEconomic Roundtable Releaseapi-25991145Belum ada peringkat

- Investment Project (Mock Trading)Dokumen9 halamanInvestment Project (Mock Trading)sanaBelum ada peringkat

- GonzalesDokumen2 halamanGonzalesPrecious Gonzales100% (1)

- What Is A Financial Intermediary (Final)Dokumen6 halamanWhat Is A Financial Intermediary (Final)Mark PlancaBelum ada peringkat

- SJCBA Prospectus 2010-12-04nov09Dokumen17 halamanSJCBA Prospectus 2010-12-04nov09tyrone21Belum ada peringkat

- WRD 27e SE PPT Ch16Dokumen24 halamanWRD 27e SE PPT Ch16Hằng Nga Nguyễn ThịBelum ada peringkat

- EquityDokumen126 halamanEquityChristopherBelum ada peringkat

- Company Profile - 6A GROUP 5Dokumen26 halamanCompany Profile - 6A GROUP 5PUTERI SIDROTUL NABIHAH SAARANIBelum ada peringkat

- Case For L.CDokumen17 halamanCase For L.CChu Minh LanBelum ada peringkat

- Sanction Letter MitaBrickDokumen15 halamanSanction Letter MitaBricktarique2009Belum ada peringkat

- Form 43Dokumen1 halamanForm 43ShobhnaBelum ada peringkat

- CheatsheetDokumen2 halamanCheatsheetSafi NurulBelum ada peringkat

- APC 2017 English Information On The DayDokumen17 halamanAPC 2017 English Information On The DaySafwaan DanielsBelum ada peringkat

- Final Exam Review 2 - LSM 1003 - HCT - ..Dokumen12 halamanFinal Exam Review 2 - LSM 1003 - HCT - ..Roqaia AlwanBelum ada peringkat

- ICAP TRsDokumen45 halamanICAP TRsSyed Azhar Abbas0% (1)

- Basics of Engineering Economy, 1e: CHAPTER 12 Solutions ManualDokumen15 halamanBasics of Engineering Economy, 1e: CHAPTER 12 Solutions Manualttufan1Belum ada peringkat

- Kausar AlamDokumen1 halamanKausar AlamVenu Gopal RaoBelum ada peringkat

- Affidavit of Loss - Lavina AksakjsDokumen1 halamanAffidavit of Loss - Lavina AksakjsAnjo AlbaBelum ada peringkat

- Accounts PayableDokumen29 halamanAccounts PayableDiane RoallosBelum ada peringkat