Analysis of Project Cash Flows

Diunggah oleh

Gaurav AgarwalDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Analysis of Project Cash Flows

Diunggah oleh

Gaurav AgarwalHak Cipta:

Format Tersedia

Financial Management I

10. Analysis of Project Cash Flows

Dr. Suresh suresh.suralkar@gmail.com Phone: 40434399, 25783850

Course Content - Syllabus

Sr Title ICMR Ch. PC Ch. IMP Ch.

1 Introduction to Financial Management

2 Overview of Financial Markets 3 Sources of Long-Term Finance 4 Raising Long-term Finance

1*

2* 10* -

1

2 17 18*

1

20, 21 20, 21, 23

5 Introduction to Risk and Return

6 Time Value of Money 7 Valuation of Securities 8 Cost of Capital 9 Basics of Capital Expenditure Decisions 10 Analysis of Project Cash Flows

4*

3* 5* 11* 18* -

8, 9

6 7 14 11 12*

4, 5

2 3 9 8 10, 11

*Book preference

2 / 23

Analysis of Project Cash Flows

Reference Books 1. Financial Management, Prasanna Chandra, 7th Edition, Chapter 12

2. Financial Management, I. M. Pandey, 9th Edition,

Chapter 10, 11

3 / 23

Syllabus Analysis of Project Cash Flows

1. Cash Flow Estimation 2. Identifying the Relevant Cash Flows 3. Cash Flow Analysis

4. Replacement, cash Flow Estimation Bias

5. Evaluating Projects with Unequal Life 6. Adjusting Cash Flow for Inflation

4 / 23

Introduction: Analysis of Project Cash Flows

It is an analysis of invest inflows and cash inflows. It is most important and most difficult step in capital budgeting. Important because of project viability decisions and difficult because of forecasting error. For example, Alaska pipeline project, initial cost estimate was about $700 million, however final cost was about $7 billion.

Year 0 1 2

15

6

40

7

30

8

20

150 10 Initial Investment

30 50 50 Operating Cash Inflows

50 Terminal Cash Flow

5 / 23

1. Cash Flow Estimation

Following principles are followed while estimating the cash flows of a project Separation Principle Incremental Principle Post-tax Principle Consistency Principle

6 / 23

1. Cash Flow Estimation: Separation Principle

Separation Principle There are two sides of a project viz. investment side (or asset side) and financing side. Cash flows associated with these sides should be separated.

For example, a firm is considering a one-year project that requires an investment of Rs. 1,000 in fixed assets and working capital at time 0. The project is expected to generate a cash inflow of Rs. 1200 at the end of year 1. This is the only cash inflow expected from the project. Project is financed by debt carrying an interest rate of 15% maturing after 1 year.

7 / 23

1. Cash Flow Estimation: Separation Principle

Project

Financing Side Time Cash Flow 0 + 1,000 1 - 1,150 Cost of capital: 15%

Investment Side Time Cash Flow 0 - 1,000 1 + 1,200 Cost of return: 20%

Note that the cash flows on investment side do not show cost of financing (interest in our example). Financing costs are included in the cash flows on the financing side, which reflects in cost of capital. Cost of capital is used as a hurdle rate against which rate of return on investment side is judged. 8 / 23

1. Cash Flow Estimation: Separation Principle

Important point to be noted that the cash flows on investment side should not include financing costs, because they will be reflected in the cost of capital against which the rate of return will be evaluated. Operationally, this means that interest on debt is ignored while computing profits and taxes thereon. Alternatively, if interest is deducted in the process of arriving at profit after tax, an amount equal to interest(1-tax rate) should be added to profit after tax. Note that

9 / 23

1. Cash Flow Estimation: Separation Principle

Profit before interest and tax (1 tax rate) = (Profit before tax + interest) (1 tax rate) = (Profit before tax) (1-tax rate)+ interest(1-tax rate) = Profit after tax + interest(1-tax rate) Thus, whether the tax rate is applied directly to the Profit before interest and tax or whether tax-adjusted interest, which is simply Interest(1-tax rate) is added to the profit after tax, we get the same result.

10 / 23

1. Cash Flow Estimation: Incremental Principle

Incremental Principle Cash flow of a project must be measured in incremental terms. To find a projects incremental cash flows, you have to look at what happens to the cash flows of the firm with the project and without the project. The difference between the two reflects the incremental cash flows attributable to the project. That is

Project cash flow for year t = Cash flow for the firm with the project for year t Cash flow for the firm without the project for year t

11 / 23

1. Cash Flow Estimation: Incremental Principle

While estimating the incremental cash flows of a project, following guidelines must be used. Consider All Incidental Effects: These include some enhancements and some detract effects on profitability. All these effects must be taken into account. Ignore Sunk Costs: A sunk cost refers to an outlay already incurred in the past or already committed irrevocably. Include Opportunity Costs: Opportunity cost is the value of the next best alternative forgone. If a project uses resources already available with the firm, there is a potential for an opportunity cost.

12 / 23

1. Cash Flow Estimation: Incremental Principle

Question the Allocation of Overhead Costs: Costs which are only indirectly related to a project or service are referred to as overhead costs. They include general administrative expenses, managerial salaries, legal expenses, rent and so on. Estimate Working Capital Properly: Working capital (or more precisely, net working capital) is defined as (current assets, loans and advances) (current liabilities and provisions). Outlays on working capital have to be properly considered while project cash flows. Working capital changes over time.

13 / 23

1. Cash Flow Estimation: Post-tax Principle

Post-tax Principle

Cash flows should be measured on an after tax basis.

Average tax rate is the total tax as a proportion of the total income of the business. The marginal tax rate is the tax rate applicable to the income at margin i.e. the next rupee of income. The marginal tax rate is higher than the average tax rate because of various tax incentives.

14 / 23

1. Cash Flow Estimation: Consistency Principle

Consistency Principle Cash flows and the discount rates applied to these cash flows must be consistent with respect to the investor group and inflation. Investor groups are of equity shareholders and lenders. In dealing with inflation, you have two choices. You can use expected inflation in the estimates of future cash flows and apply a nominal discount rate to the same. Else, you can estimate the future cash flows in real terms and apply a real discount rate to the same.

15 / 23

2. Identifying the Relevant Cash Flows

Projects have following components of cash flows

Initial investment

Annual net cash flows Terminal cash flows

16 / 23

2. Identifying the Relevant Cash Flows

Initial investment

This is the net cash outlay in the period in which an asset

is purchased. A major element of the initial investment is gross outlay or original value (OV) of the asset.

17 / 23

2. Identifying the Relevant Cash Flows

Annual net cash flows

An investment is expected to generate annual cash flows

from operations after an initial cash outlay has been made. Cash flows should always be estimated on an after-tax basis.

18 / 23

2. Identifying the Relevant Cash Flows

Terminal cash flows

Last or the terminal year of an investment may have

additional cash flows or salvage value. Salvage value is defined as the market price of an investment at the time of its sale. The cash proceeds net of taxes from the sale of the assets will be treated as cash inflow in the terminal (last) year.

19 / 23

4. Replacement, Cash Flow Estimation Bias

Cash flows for new projects or expansion projects is relatively easy. In such cases, the initial investment, operating cash inflows and terminal cash flows are the after-tax cash flows associated with the proposed project. Estimating the cash flows for a replacement project is somewhat complicated because you have to determine the incremental cash outflows and inflows in relation to the existing project. Biases in cash flow estimation As the cash flows have to be forecasted far into the future, errors occur in estimation. Biases may lead to over stating or under stating of true project profitability. 20 / 23

5. Evaluating Projects with Unequal Life

The choice between projects with different lives should be made by evaluating them for equal periods of time. Example A firm has to choose between two projects X and Y which have different lives.

0 X 120 1 30 2 30 3 30 4 40 NPV, 10% 215.1

60

40

40

129.42

21 / 23

5. Evaluating Projects with Unequal Life

Cash Flows

0

Y1 Y2 Y = Y1 + Y2 X 60 0 60 120

1

40 0 40 30

2

40 60 100 30

3

0 40 40 30

4

0 40 40 30

NPV, 10%

129.42 106.96 236.38 215.10

Correct procedure to compare NPVs of the projects for equal periods of time.

22 / 23

6. Adjusting Cash Flow for Inflation

A common problem which complicates the investment decision making is inflation. The rule is to be consistent in treating inflation in the cash flows and the discount rate. Inflation is a fact of life all over the world. Because the cash flows of a project occur over a long period of time, a firm should be concerned about the inflation on the projects profitability. Capital budgeting results will be biased if the inflation is not correctly factored in the analysis. Nominal rate = (1 + real rate) x (1 + inflation rate) -1

23 / 23

Anda mungkin juga menyukai

- MKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Dokumen9 halamanMKM704 - Finance For Marketers - Lab 4 Solution: MKM704 - DR Page 1 of 9 08/07/2021 at 14:29:50Marziiya RamakdawalaBelum ada peringkat

- Risk AnalysisDokumen28 halamanRisk AnalysisSanchit BatraBelum ada peringkat

- Engineering Procurement & Construction Making India Brick by Brick PDFDokumen96 halamanEngineering Procurement & Construction Making India Brick by Brick PDFEli ThomasBelum ada peringkat

- Projecting Financials & ValuationsDokumen88 halamanProjecting Financials & ValuationsPratik ModyBelum ada peringkat

- Management Accountant Feb 2020Dokumen124 halamanManagement Accountant Feb 2020ABC 123Belum ada peringkat

- Indirect Costs of Contracts: Fred Shelton, JR., CPA, MBA, CVA and Mason Brugh, CPADokumen7 halamanIndirect Costs of Contracts: Fred Shelton, JR., CPA, MBA, CVA and Mason Brugh, CPAGaurav MehraBelum ada peringkat

- DR - Naushad Alam: Capital BudgetingDokumen38 halamanDR - Naushad Alam: Capital BudgetingUrvashi SinghBelum ada peringkat

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDokumen39 halamanFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaBelum ada peringkat

- 8 LMS-Tutorial CFW PDFDokumen6 halaman8 LMS-Tutorial CFW PDFEnriko SagaBelum ada peringkat

- Project Finance: Valuing Unlevered ProjectsDokumen41 halamanProject Finance: Valuing Unlevered ProjectsKelsey GaoBelum ada peringkat

- NPV IRR ExplainedDokumen8 halamanNPV IRR ExplainedkumarnramBelum ada peringkat

- What Is A Gantt ChartDokumen2 halamanWhat Is A Gantt ChartRaaf RifandiBelum ada peringkat

- Indian Broking Industry AnalysisDokumen41 halamanIndian Broking Industry AnalysisacarksBelum ada peringkat

- EstimationDokumen6 halamanEstimationmohit_namanBelum ada peringkat

- © 2010 Financial Management Prepared By: Amyn WahidDokumen66 halaman© 2010 Financial Management Prepared By: Amyn Wahidfatimasal33m100% (1)

- Cash Flow Estimation and Risk AnalysisDokumen24 halamanCash Flow Estimation and Risk AnalysisSahil GuptaBelum ada peringkat

- Chapter I Project CharacteristicsDokumen22 halamanChapter I Project CharacteristicssitirahmainiBelum ada peringkat

- CFADS Calculation & Application PDFDokumen2 halamanCFADS Calculation & Application PDFJORGE PUENTESBelum ada peringkat

- Taha Popatia-Artt Business SchoolDokumen7 halamanTaha Popatia-Artt Business SchooltasleemfcaBelum ada peringkat

- Chapter 6 - Investment Decisions - Capital BudgetingDokumen22 halamanChapter 6 - Investment Decisions - Capital BudgetingBinish JavedBelum ada peringkat

- IRR Vs MIRR Vs NPV (Finatics)Dokumen4 halamanIRR Vs MIRR Vs NPV (Finatics)miranirfanBelum ada peringkat

- EXERCISE - Calculating The Internal Rate of ReturnDokumen5 halamanEXERCISE - Calculating The Internal Rate of ReturnNipun BajajBelum ada peringkat

- Project Appraisal TechniquesDokumen13 halamanProject Appraisal TechniquesAnshuman DuttaBelum ada peringkat

- Session 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceDokumen25 halamanSession 3: Project Unlevered Cost of Capital: N. K. Chidambaran Corporate FinanceSaurabh GuptaBelum ada peringkat

- Unit 5Dokumen15 halamanUnit 5Ramesh Thangavel TBelum ada peringkat

- Evaluating Project Economics and Capital Rationing: Learning ObjectivesDokumen53 halamanEvaluating Project Economics and Capital Rationing: Learning ObjectivesShoniqua JohnsonBelum ada peringkat

- Unit-3 Capital BudgetingDokumen83 halamanUnit-3 Capital BudgetingAashutosh MishraBelum ada peringkat

- The Six Month Roadmap For Ensuring Macroeconomic & Financial System Stability - FINALDokumen85 halamanThe Six Month Roadmap For Ensuring Macroeconomic & Financial System Stability - FINALBat WiseBelum ada peringkat

- Baagpankaj@iimk Ac inDokumen5 halamanBaagpankaj@iimk Ac inPressesIndiaBelum ada peringkat

- Sensitivity and Scenario AnalysisDokumen3 halamanSensitivity and Scenario AnalysisSohail AjmalBelum ada peringkat

- Chapter 6 Financial Estimates and ProjectionsDokumen15 halamanChapter 6 Financial Estimates and ProjectionsKusum Bhandari33% (3)

- Project Management and Quality Control Quality Control: Yarmouk University Yarmouk UniversityDokumen62 halamanProject Management and Quality Control Quality Control: Yarmouk University Yarmouk UniversityLola NurungBelum ada peringkat

- Primal Dual LPPDokumen26 halamanPrimal Dual LPPTech_MXBelum ada peringkat

- 7 LMS-Tutorial Ratios PDFDokumen7 halaman7 LMS-Tutorial Ratios PDFAbubakar IsmailBelum ada peringkat

- iNVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT - PRASSANADokumen136 halamaniNVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT - PRASSANAdalaljinal100% (1)

- Aggregate Supply, Unemployment and InflationDokumen103 halamanAggregate Supply, Unemployment and Inflationapi-3825580Belum ada peringkat

- Break EvenDokumen36 halamanBreak EvenNila ChotaiBelum ada peringkat

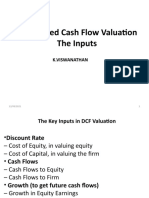

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDokumen47 halamanDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarBelum ada peringkat

- Techniques of Project Appraisal: An Presentation ONDokumen20 halamanTechniques of Project Appraisal: An Presentation ONChandan Lawrence100% (1)

- Black-Sholes Excercise Excel FileDokumen4 halamanBlack-Sholes Excercise Excel Filenelson bolivarBelum ada peringkat

- Corporate FinanceDokumen19 halamanCorporate Financer_m_hanif4308Belum ada peringkat

- Capital Budgeting Techniques PDFDokumen57 halamanCapital Budgeting Techniques PDFMecheal ThomasBelum ada peringkat

- NPVDokumen5 halamanNPVMian UmarBelum ada peringkat

- Forecasting Model - 003Dokumen22 halamanForecasting Model - 003bhution_19Belum ada peringkat

- Infrastructure-Financing-India PWCDokumen138 halamanInfrastructure-Financing-India PWCGosia PłotnickaBelum ada peringkat

- Financial Re-EngineeringDokumen22 halamanFinancial Re-Engineeringmanish_khatri100% (3)

- Monte Carlo Simulation FinalDokumen10 halamanMonte Carlo Simulation FinalAbhishek SinghBelum ada peringkat

- SENSITIVITY ANALYSIS Kk.Dokumen11 halamanSENSITIVITY ANALYSIS Kk.Kunle OketoboBelum ada peringkat

- Project Financing and ManagementDokumen312 halamanProject Financing and Managementsujaysarkar85100% (1)

- Semiconductor ManufDokumen65 halamanSemiconductor ManufDan AdrianBelum ada peringkat

- FM11 CH 12 Mini CaseDokumen14 halamanFM11 CH 12 Mini CaseRahul Rathi100% (1)

- BRAC Linear ProgrammingDokumen37 halamanBRAC Linear ProgrammingMohasena MowmiBelum ada peringkat

- Break Even AnalysisDokumen6 halamanBreak Even AnalysisNafi AhmedBelum ada peringkat

- CH 03 Inventory Management Supply Contracts and Risk PoolingDokumen96 halamanCH 03 Inventory Management Supply Contracts and Risk Poolinggadde bharatBelum ada peringkat

- Project Appraisal MethodsDokumen15 halamanProject Appraisal MethodsAndrew GomezBelum ada peringkat

- Discuss The UNIDO Approach of Social-Cost Benefit AnalysisDokumen3 halamanDiscuss The UNIDO Approach of Social-Cost Benefit AnalysisAmi Tandon100% (1)

- Cash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsDokumen13 halamanCash Flow Estimation and Risk Analysis: Answers To Selected End-Of-Chapter QuestionsRapitse Boitumelo Rapitse0% (1)

- Chapter 6Dokumen52 halamanChapter 6Bhi-ehm GajusanBelum ada peringkat

- CF Chapter 2 NotesDokumen17 halamanCF Chapter 2 NotessdfghjkBelum ada peringkat

- Capital Budgeting (Fulltext)Dokumen105 halamanCapital Budgeting (Fulltext)ttongoona3Belum ada peringkat

- Inflation & UnemploymentDokumen21 halamanInflation & UnemploymentGaurav AgarwalBelum ada peringkat

- Secondary Data Handling in Market ReasearchDokumen26 halamanSecondary Data Handling in Market ReasearchcalmchandanBelum ada peringkat

- Business Research Methods: Errors in Survey ResearchDokumen33 halamanBusiness Research Methods: Errors in Survey ResearchcalmchandanBelum ada peringkat

- Business Research Methods: Qualitative TechniquesDokumen33 halamanBusiness Research Methods: Qualitative TechniquesGaurav AgarwalBelum ada peringkat

- Business Research Methods: Measurement and Scaling: Noncomparative Scaling TechniquesDokumen39 halamanBusiness Research Methods: Measurement and Scaling: Noncomparative Scaling TechniquesGaurav AgarwalBelum ada peringkat

- 3research Design3Dokumen37 halaman3research Design3Gaurav AgarwalBelum ada peringkat

- 4 Definition&approach 4Dokumen23 halaman4 Definition&approach 4Gaurav AgarwalBelum ada peringkat

- Modi Rubber Vs Financial Institution Case PresentationjDokumen27 halamanModi Rubber Vs Financial Institution Case PresentationjGaurav AgarwalBelum ada peringkat

- Risk & Return RSADokumen20 halamanRisk & Return RSAGaurav AgarwalBelum ada peringkat

- 2business Research Methods2Dokumen40 halaman2business Research Methods2Gaurav AgarwalBelum ada peringkat

- Financial Management Case 2: Modi Rubber vs. Financial InstitutionsDokumen28 halamanFinancial Management Case 2: Modi Rubber vs. Financial InstitutionsGaurav Agarwal100% (1)

- 9 Basics of Capital Expenditure DecisionsDokumen37 halaman9 Basics of Capital Expenditure DecisionsHarishYadavBelum ada peringkat

- Internet2: Advanced Network Applications and TechnologiesDokumen10 halamanInternet2: Advanced Network Applications and TechnologiesGaurav AgarwalBelum ada peringkat

- Sources of Long-Term FinanceDokumen17 halamanSources of Long-Term FinanceGaurav AgarwalBelum ada peringkat

- Introduction To Risk and ReturnDokumen59 halamanIntroduction To Risk and ReturnGaurav AgarwalBelum ada peringkat

- 1BRNEA2022002Dokumen64 halaman1BRNEA2022002Nguyễn Xuân ThượngBelum ada peringkat

- HTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankDokumen66 halamanHTTPS:WWW - Studocu.com:row:document:the University of The South Pacific:auditing:solutions Test Bank:40332482:download:solutions Test BankXuân NhiBelum ada peringkat

- Profit Sharing PDFDokumen19 halamanProfit Sharing PDFGadisBelum ada peringkat

- Analysis On Financial Health of HDFC Bank and Icici BankDokumen11 halamanAnalysis On Financial Health of HDFC Bank and Icici Banksaket agarwalBelum ada peringkat

- Tata Group - M&ADokumen24 halamanTata Group - M&Aankur_khushu66100% (1)

- Dissolution of Partnership FirmDokumen5 halamanDissolution of Partnership FirmDark SoulBelum ada peringkat

- Form16 2022 2023Dokumen8 halamanForm16 2022 2023arun poojariBelum ada peringkat

- Parker Economic Regulation Preliminary Literature ReviewDokumen37 halamanParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuBelum ada peringkat

- Firma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableDokumen45 halamanFirma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableBento HartonoBelum ada peringkat

- QUIZ W1 W3 MaterialsDokumen11 halamanQUIZ W1 W3 MaterialsLady BirdBelum ada peringkat

- Quiz 2 For StudentsDokumen4 halamanQuiz 2 For StudentsLorBelum ada peringkat

- Subject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Dokumen4 halamanSubject: Welcome To Hero Fincorp Family Reference Your Used Car Loan Account No. Deo0Uc00100006379290Rimpa SenapatiBelum ada peringkat

- Chapter 2 FACADokumen28 halamanChapter 2 FACAAnshumanSinghBelum ada peringkat

- Greenfield Vs MeerDokumen4 halamanGreenfield Vs MeerTinersBelum ada peringkat

- Excel Drill - CAPM & WACCDokumen8 halamanExcel Drill - CAPM & WACCgjlastimozaBelum ada peringkat

- FranchisorDokumen5 halamanFranchisorNaly YanoBelum ada peringkat

- MhaDokumen35 halamanMhaDhananjay SainiBelum ada peringkat

- LESSONSDokumen151 halamanLESSONSsmile.wonder12Belum ada peringkat

- Finmar - Chapter 12 - 14Dokumen24 halamanFinmar - Chapter 12 - 14AlexanBelum ada peringkat

- Technovision Sales and Services: Vijay 9849985386Dokumen1 halamanTechnovision Sales and Services: Vijay 9849985386financeBelum ada peringkat

- Partnership Agreement (Short Form)Dokumen2 halamanPartnership Agreement (Short Form)Legal Forms91% (11)

- SIP Report OldDokumen27 halamanSIP Report OldAbhishek rajBelum ada peringkat

- Principles of Income and Business TaxationDokumen3 halamanPrinciples of Income and Business TaxationQueen ValleBelum ada peringkat

- Commerce Class 12 Semester2Dokumen31 halamanCommerce Class 12 Semester2Tesmon MathewBelum ada peringkat

- Common Size Financial StatementsDokumen3 halamanCommon Size Financial Statementsirfanabid828Belum ada peringkat

- Ratio Analysis of Shree Cement and Ambuja Cement Project Report 2Dokumen7 halamanRatio Analysis of Shree Cement and Ambuja Cement Project Report 2Dale 08Belum ada peringkat

- Annual-Report-Eng-2017 Ing DiBa PDFDokumen262 halamanAnnual-Report-Eng-2017 Ing DiBa PDFEbalah ZumbabahBelum ada peringkat

- Resident Representative:: International Banking Section - A Introduction To International BankingDokumen3 halamanResident Representative:: International Banking Section - A Introduction To International BankingNimisha BhararaBelum ada peringkat

- FundamentalsOfFinancialManagement Chapter8Dokumen17 halamanFundamentalsOfFinancialManagement Chapter8Adoree RamosBelum ada peringkat

- Meredith WhitneyDokumen13 halamanMeredith WhitneyFortuneBelum ada peringkat