Nike Analysis

Diunggah oleh

riz4winDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Nike Analysis

Diunggah oleh

riz4winHak Cipta:

Format Tersedia

Founded 1962 Bowerman & Knight Blue Ribbon > Nike > Nike Simply Number ONE!

Presence in 120 Countries

Key Internal Factor Strengths Most dominant player in global market (50% market share),in footwear >$84. Jordan (2nd Largest), 10.8% of US shoe market. 75% for Basketball, 86.5% for >$100. Revenue Increase 2.9% in 2009. 25,000 Retail Accounts in USA and more than 27000 outside US. Internet based customization through web site www.nikebiz. Nike has five wholly owned subsidiaries. Weaknesses Net Income Reduce 21% in 2009 Allmost 99% Manufacturing Outsourced out side USA Sales are heavily concentrated in the youth and young adult market 12 to 24 year old age bracket. Totals

Weight 0.12 0.12 0.07 0.07 0.11 0.1 0.07 0.1 0.12 0.12 1

Rating 3 4 3 3 4 4 3 1 1 2

WS 0.36 0.48 0.21 0.21 0.44 0.4 0.21 0.1 0.12 0.24 2.77

Key External Factor Opportunity Making shoes for 35+ and under 12 age braket Younger consumers are less price sensitive. Growing Market WTO (Outsourcing, Other Markets) Internet, Altering Sales Model (18% growth expected by 2012) Threat Foreign exchange rate fluctuations. After age 40 consumers do not pay more than $35 to $40. Strong Competition Addidass strong in (Europe & China) Beijing 2008 games. Global Recession Totals

Weight 0.1 0.1 0.11 0.1 0.1

Rating 1 4 3 3 3

WS 0.1 0.4 0.33 0.3 0.3

0.08 0.09 0.12 0.07 0.13 1

2 2 3 2 2

0.16 0.18 0.36 0.14 0.26 2.53

Competitive Profile Matrix (CPM)

Nike

Critical Success Factors Weight Rating score

Adidas

Rating score Rating

Puma

score

Advertising Product Quality Price competitiveness Management Financial Position Customer Loyalty Global Expansion Market Share Technology

0.14 0.14 0.11 0.08 0.07 0.12 0.07 0.13 0.14

1.00

4 3 3 4 4 4 4 4 3

0.56 0.42 0.33 0.32 0.28 0.48 0.28 0.52 0.42

3.61

4 3 3 2 2 3 3 3 2

0.56 0.42 0.33 0.16 0.14 0.36 0.21 0.39 0.28

2.85

3 2 2 2 2 2 3 2 2

0.42 0.28 0.22 0.16 0.14 0.24 0.21 0.26 0.28

2.21

Total

Matching Stage

Strength

Weakness

Opportunity

Threats

1. Most dominant player in global market (50% market share),in footwear >$84. StrengthLargest), 10.8% of US shoe 2. Jordan (2nd 10.8% of US shoe market. market. 3. 75% for Basketball, 86.5% for >$100. 4. Revenue Increase 2.9% ease 2.9% in Incrin 2009. 5. 2009 Retail Accounts in USA and more 25,000 than 27000 outside USA. 6. Internet based customization through web site www.nikebiz.com. 7. Nike has five wholly owned subsidiaries.

Weakness

1. Net Income Reduce 21% in 2009. 2. Allmost 99% Manufacturing Outsourced out side USA. Weakness 3. sales are heavily concentrated in the youth and young adult market 12 to 24 year old age bracket.

Opportunity

1. Making shoes for 35+ and under 12 age bracket. 2. Younger consumers are less price sensitive. 3. Growing Market. 4. WTO (Outsourcing, Other Market). 5. Internet, Altering Sales Model (18% growth expected by 2012).

Opportunity

Threats

1. Foreign exchange rate fluctuations. 2. After age 40 consumers do not pay more than $35 to $40. 3. Strong Competition.

4.

strong in (Europe & China) Beijing 2008 games. 5. Global Recession.

Threats

1. S7,O5 increase marketing and sales through internet.

2. W3,O1 make specific products for children and older people.

3. S1,S3,W3,W4 develop low price quality products.

4. W1,W2,T1 the USA shodown to almost almost 50% sales USA which will exchange risk.

outsourcing out side uld be cut 50% because comes from reduce foreign

Internal Strategic Position

Sr. No. 1 2 Financial Position (FP) Rating

External Strategic Position

Sr. No.

Return on Investment declined by 26% Stronge Leverage Position i.e. 3% Liquidity ratio increased by 11% Working Capital ratio is 71% of total assets Inventory was Turned over by 8 times only Earnings Per Share declined by 19 % Price to Earning Ratio showing increase of 24% Cash Flow from operations decreased by 10.3%

Competitive Position (CP) Rating

Stability Position (SP) Technological Changes: e.g. If Nike has Shox, Adidas has Adidas 1 and Reebok has 1 Pump 2 created by NASA

2

Rating

-4

7 6 6 5 4

6 4

42

Sr. No.

Avg Rate of Inflation: 2007: 2.8%, 2008: 3.8%, 2009: -0.4% Demand Variability: a surging demand was witnessed for performance athletic 3 apparels and footwear due to the increasing number of athletes and the growing health awareness

4

-3 -2 -3 -3 -3

-2 -2

-22

Rating

Price Range of Competing Products

Barriers To Entry Into Market: Threat of new entrants based on first-mover advantage is minimal:

6 7 8

6 7 8

Competitive Pressure: Highly saturated and challenging industry:

Ease of Exit From Market

Risk Involved In Business

Industry Position (IP)

Sr. No.

1 Nike

is enjoying more than 50% market share

-1

Growth Potential : Global sports footwear: 1 * 46.8% volume growth from 05-10 and 2.1% from 09-10 * 46.7% value growth from 05-10 and 3.3% from 09-10

2

manufacture wherever they can produce high quality product at the lowest possible price. If prices rise, and products can be made more 2 cheaply elsewhere (to the same or better specification), Nike will move production. In the apparel marketplace, Nike is a pioneer in product lifecycle management 3 (PLM). The company traces much of its PLM success to a major focus on process reengineering.

4 Customer

-2

Profit Potential: Sports Footwear and apperal industry is highly profitable industry

-3

Financial Stability: Players are financialy stronge Extent Leveraged: use of financial leverage is high in others. i.e adidas debt ratio 50% Resource Utilization Productivity, Capacity Utilization

Loyalty

-2 -3 -1

4 3 3

Capacity Utilization: outsourced all production operations like Nike does and hence have the flexibility of increasing or decreasing capacity at will. Technological Know How: e.g. Nike + iPod Sport Kit, Many Nike shoes use 6 a cushioning technology called "AIR.", Nike Shox technology, Hyperfuse construction delivers Superior breathability Control Over Suppliers: NIKE can better plan with its material vendors; control excessive overtime. Hold lean manufacturing 7 processes to ensure cost control and improve labor standards required materials delivered on-time during the production process;

5

-2

-14

25

(Book Illustration for better understanding)

Selection Stage

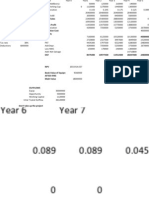

1 2 3 4 5

Key Factors Opportunities Making shoes for 35+ and under 12 age braket. Younger consumers are less price sensitive. Growing Market WTO (Outsourcing, Other Market). Internet, Altering Sales Model (18% growth expected by 2012) Threats Foreign exchange rate fluctuations. After age 40 consumers do not pay more than $35 to $40 Strong Competition. Adidas strong in (Europe & China) Beijing 2008 games. Global Recession. Strengths Most dominant player in global market (50% market share),in footwear >$84. Jordan (2nd Largest), 10.8% of US shoe market. 75% for Basketball, 86.5% for >$100. Revenue Increase 2.9% in 2009. 25,000 Retail Accounts in USA and more than 27000 outside USA. Internet based customization through web site www.nikebiz.com. Nike has five wholly owned subsidiaries. Weaknesses Net Income Reduce 21% in 2009. Allmost 99% Manufacturing Outsourced out side USA. sales are heavily concentrated in the youth and young adult market 12 to 24 year old age bracket.

weight 0.1 0.1 0.11 0.1 0.1

S7,O5 increase marketing and sales through internet. AS 4 4

TAS

S1,S3,W3,W 4 develope low price quality products. AS -

TAS

W3,O1 make specific products for children and older peaple. AS 2 2

TAS

0.4 0.4

3 3

0.3 0.3

0.2 0.2

1 2 3 4 5

0.08 0.09 0.12 0.07 0.13 1

3 3 3 0.27 0.36 0.39 4 4 4

0.36 0.48 0.52

2 2 2

0.18 0.24 0.26

1 2 3 4 5 6 7

0.12 0.12 0.07 0.07 0.11 0.1 0.07

4 4 4 4 4 -

0.48 0.48 0.28

1 1 1 2 3 -

0.12 0.12 0.07

1 2 2 3 2 -

0.12 0.24 0.14

0.44 0.4

0.22 0.3

0.33 0.2

1 2 3

0.1 0.12 0.12 1

1 1 1

0.1 0.12 0.12 4.24

4 4 1

0.4 0.48 0.12 3.79

3 1 4

0.3 0.12 0.48 3.01

Conclusion

FP Average

5.25

IP Average

3.571

CP Average

-2

SP Average

-2.75

Directional Vector Co ordinates: X axis: Y axis: 1.571 2.5

Anda mungkin juga menyukai

- Group-13 Case 12Dokumen80 halamanGroup-13 Case 12Abu HorayraBelum ada peringkat

- Course Syllabus F21Dokumen9 halamanCourse Syllabus F21dhwaniBelum ada peringkat

- Textile Mill Scheduling and Lockbox OptimizationDokumen6 halamanTextile Mill Scheduling and Lockbox OptimizationCharlotte Ellen0% (1)

- Obscurity: Undesirability: P/E: Screening CriteriaDokumen21 halamanObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnBelum ada peringkat

- Ejercicio 7.5Dokumen6 halamanEjercicio 7.5Enrique M.Belum ada peringkat

- NikeDokumen6 halamanNikeAbhinav SrivastavaBelum ada peringkat

- Jun18l1-Ep04 QDokumen18 halamanJun18l1-Ep04 QjuanBelum ada peringkat

- MENG 6502 Financial ratios analysisDokumen6 halamanMENG 6502 Financial ratios analysisruss jhingoorieBelum ada peringkat

- Shimano 3Dokumen14 halamanShimano 3Tigist AlemayehuBelum ada peringkat

- The Body Shop Plc 2001: Historical Financial AnalysisDokumen13 halamanThe Body Shop Plc 2001: Historical Financial AnalysisNaman Nepal100% (1)

- Case Study - Nike IncDokumen6 halamanCase Study - Nike Inc80starboy80Belum ada peringkat

- Does IT Payoff Strategies of Two Banking GiantsDokumen10 halamanDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Belum ada peringkat

- Ocean Carriers - Case (Final)Dokumen18 halamanOcean Carriers - Case (Final)Namit LalBelum ada peringkat

- Fonderia di Torino Case PresentationDokumen1 halamanFonderia di Torino Case Presentationpoo_granger5229Belum ada peringkat

- Ocean Carriers FinalDokumen5 halamanOcean Carriers FinalsaaaruuuBelum ada peringkat

- Sample Final Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkDokumen2 halamanSample Final Instructions: Answer All Questions. To Receive Any Credit You MUST Show Your WorkRick Cortez0% (1)

- AOL.com (Review and Analysis of Swisher's Book)Dari EverandAOL.com (Review and Analysis of Swisher's Book)Belum ada peringkat

- Case 2: Nike, Inc. - 2009 Case Notes Prepared By: Dr. Mernoush Banton Case Author: Randy HarrisDokumen6 halamanCase 2: Nike, Inc. - 2009 Case Notes Prepared By: Dr. Mernoush Banton Case Author: Randy HarrisNaeem ShreimBelum ada peringkat

- ACC 250 Exam 1 Flashcards - QuizletDokumen4 halamanACC 250 Exam 1 Flashcards - QuizletIslam SamirBelum ada peringkat

- Policy and investment guidelines for financial objectivesDokumen5 halamanPolicy and investment guidelines for financial objectivesavi dotto100% (1)

- Beta Management QuestionsDokumen1 halamanBeta Management QuestionsbjhhjBelum ada peringkat

- ACC406 - Chapter - 13 - Relevant - Costing - IIDokumen20 halamanACC406 - Chapter - 13 - Relevant - Costing - IIkaylatolentino4Belum ada peringkat

- Nike Equity ManagementDokumen11 halamanNike Equity ManagementVikrant KumarBelum ada peringkat

- Apollo Tyres - Group 12Dokumen5 halamanApollo Tyres - Group 12Pallav PrakashBelum ada peringkat

- Zespri Final AlternativeDokumen46 halamanZespri Final Alternativeapi-58835638100% (1)

- Rosario FinalDokumen13 halamanRosario FinalDiksha_Singh_6639Belum ada peringkat

- Case Analysis of NikeDokumen6 halamanCase Analysis of NikeZackyBelum ada peringkat

- Nike Case AnalysisDokumen9 halamanNike Case AnalysistimbulmanaluBelum ada peringkat

- Case 3 - Starbucks - Assignment QuestionsDokumen3 halamanCase 3 - Starbucks - Assignment QuestionsShaarang BeganiBelum ada peringkat

- A Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDDokumen11 halamanA Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDarcherselevators100% (1)

- MIT Sloan School of ManagementDokumen3 halamanMIT Sloan School of Managementebrahimnejad64Belum ada peringkat

- Takeover Bid and Shareholder Value PDFDokumen9 halamanTakeover Bid and Shareholder Value PDFworld ProjectBelum ada peringkat

- World Wide Paper CompanyDokumen2 halamanWorld Wide Paper CompanyAshwinKumarBelum ada peringkat

- CH 13Dokumen11 halamanCH 13Rachel LeachonBelum ada peringkat

- F&C International Outline Answers ValuationDokumen6 halamanF&C International Outline Answers ValuationnurBelum ada peringkat

- Case QuestionsDokumen9 halamanCase QuestionsFami FamzBelum ada peringkat

- Valuation Final ProjectDokumen31 halamanValuation Final ProjectsidchorariaBelum ada peringkat

- Integrative Case 10 1 Projected Financial Statements For StarbucDokumen2 halamanIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyBelum ada peringkat

- Tutorial 5 PDFDokumen2 halamanTutorial 5 PDFBarakaBelum ada peringkat

- Gainesville Machine Tools Corp financial projections and analysisDokumen2 halamanGainesville Machine Tools Corp financial projections and analysisAbhinav Singh100% (1)

- Porters 5 forces analysis of the Kiwi fruit industryDokumen2 halamanPorters 5 forces analysis of the Kiwi fruit industryPiyush Agarwal33% (3)

- Completed Chapter 5 Mini Case Working Papers FA14Dokumen12 halamanCompleted Chapter 5 Mini Case Working Papers FA14ZachLoving75% (4)

- Corning Convertible Preferred Stock PDFDokumen6 halamanCorning Convertible Preferred Stock PDFperwezBelum ada peringkat

- Buffett CaseDokumen15 halamanBuffett CaseElizabeth MillerBelum ada peringkat

- Bethesda Mining CompanyDokumen2 halamanBethesda Mining CompanyShivam BhasinBelum ada peringkat

- This Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)Dokumen52 halamanThis Spreadsheet Supports Analysis of The Case, "American Greetings" (Case 43)mehar noorBelum ada peringkat

- Titanium Dioxide and Super Project Prof. Joshy JacobDokumen3 halamanTitanium Dioxide and Super Project Prof. Joshy JacobSIDDHARTH SINGHBelum ada peringkat

- Nintendo Wii Marketing PlanDokumen13 halamanNintendo Wii Marketing PlanAzlan PspBelum ada peringkat

- Swati Anand - FRMcaseDokumen5 halamanSwati Anand - FRMcaseBhavin MohiteBelum ada peringkat

- CM FinanceforUndergradsDokumen5 halamanCM FinanceforUndergradsChaucer19Belum ada peringkat

- Hitungan Kuis 6 Bethesda Mining CompanyDokumen6 halamanHitungan Kuis 6 Bethesda Mining Companyrica100% (1)

- 1 - Nike Cost of CapitalDokumen8 halaman1 - Nike Cost of CapitalJayzie LiBelum ada peringkat

- Nike Inc - Cost of Capital - Syndicate 10Dokumen16 halamanNike Inc - Cost of Capital - Syndicate 10Anthony KwoBelum ada peringkat

- Teletech CorporationDokumen7 halamanTeletech CorporationNeetha Mohan0% (1)

- LoeaDokumen21 halamanLoeahddankerBelum ada peringkat

- Krispy Kreme's Financial DeclineDokumen3 halamanKrispy Kreme's Financial Declineleo147258963100% (2)

- Gamification in Consumer Research A Clear and Concise ReferenceDari EverandGamification in Consumer Research A Clear and Concise ReferenceBelum ada peringkat

- Case 02 NikeDokumen20 halamanCase 02 NikeKad SaadBelum ada peringkat

- NikeDokumen23 halamanNikeEugene SmithBelum ada peringkat

- Comparison Between Nike and AdidasDokumen14 halamanComparison Between Nike and AdidasSombis2011Belum ada peringkat

- Case 2: Nike, Inc. - 2009 Case Notes Prepared By: Dr. Mernoush Banton Case Author: Randy HarrisDokumen7 halamanCase 2: Nike, Inc. - 2009 Case Notes Prepared By: Dr. Mernoush Banton Case Author: Randy HarrisNaeem ShreimBelum ada peringkat

- Curriculm VitateDokumen3 halamanCurriculm Vitateriz4winBelum ada peringkat

- Creating Value Through Required ReturnDokumen74 halamanCreating Value Through Required Returnriz4winBelum ada peringkat

- Equity Ownership and Fin PerformanceDokumen7 halamanEquity Ownership and Fin PerformancePinal ShahBelum ada peringkat

- Saima Ahsan Final Report of Mba HRMDokumen103 halamanSaima Ahsan Final Report of Mba HRMriz4winBelum ada peringkat

- Front Page For AssignmnetsDokumen1 halamanFront Page For Assignmnetsriz4winBelum ada peringkat

- Candidate Application FormDokumen2 halamanCandidate Application FormPardeep KumarBelum ada peringkat

- Chevron-Ecuador Risk Analysis Report May2011Dokumen18 halamanChevron-Ecuador Risk Analysis Report May2011riz4winBelum ada peringkat

- 1558056Dokumen23 halaman1558056riz4winBelum ada peringkat

- Keyman Insurance Policy-White PaperDokumen12 halamanKeyman Insurance Policy-White PaperbeingviswaBelum ada peringkat

- Bond Accounting LectureDokumen25 halamanBond Accounting LectureAhsan ImranBelum ada peringkat

- Buss Law AsinmentDokumen27 halamanBuss Law AsinmentAnupam Kumar ChaudharyBelum ada peringkat

- Modified Pag-Ibig Ii Enrollment FormDokumen2 halamanModified Pag-Ibig Ii Enrollment FormRaineBelum ada peringkat

- LK Juni 2017 Unaudited PDFDokumen210 halamanLK Juni 2017 Unaudited PDFnandiwardhana aryagunaBelum ada peringkat

- Business Cycle Unemployment and Inflation 2Dokumen22 halamanBusiness Cycle Unemployment and Inflation 2GeloBelum ada peringkat

- Batas Pambansa BLGDokumen2 halamanBatas Pambansa BLGKevin Joe CuraBelum ada peringkat

- Instructions for Excel templatesDokumen4 halamanInstructions for Excel templatespcsriBelum ada peringkat

- Cost - Management Accounting - A - B - Vineet SwarupDokumen3 halamanCost - Management Accounting - A - B - Vineet SwarupAbhishek RaghavBelum ada peringkat

- Pag-IBIG Provident Benefits Claim FormDokumen2 halamanPag-IBIG Provident Benefits Claim FormCarlo Beltran Valerio0% (2)

- Pinto Pm2 Ch03Dokumen22 halamanPinto Pm2 Ch03Focus ArthamediaBelum ada peringkat

- AnswersDokumen7 halamanAnswersQueen ValleBelum ada peringkat

- Real StripsDokumen64 halamanReal StripsNitesh KumarBelum ada peringkat

- Merchandising OperationsDokumen39 halamanMerchandising OperationsRyan Jeffrey Padua Curbano50% (2)

- Cement Industry's Crucial Role in Nepal's Economic Growth and DevelopmentDokumen22 halamanCement Industry's Crucial Role in Nepal's Economic Growth and DevelopmentManoj Bharadwaj Subedi100% (1)

- Homework Chapter 2: ExerciseDokumen6 halamanHomework Chapter 2: ExerciseDiệu QuỳnhBelum ada peringkat

- New Hair Streamer Marketing PlanDokumen24 halamanNew Hair Streamer Marketing PlanTANGI85Belum ada peringkat

- Memorandum of Association of TRADE ORGANIZATIONDokumen8 halamanMemorandum of Association of TRADE ORGANIZATIONSyed Zahid ImtiazBelum ada peringkat

- Financial Statement (FS) AnalysisDokumen41 halamanFinancial Statement (FS) AnalysisJasy Nupt GilloBelum ada peringkat

- Adampak AR 09Dokumen74 halamanAdampak AR 09diffsoftBelum ada peringkat

- Pre Mid Sem Family Law NotesDokumen11 halamanPre Mid Sem Family Law NoteshaloXDBelum ada peringkat

- Asm 2670Dokumen3 halamanAsm 2670Pushkar MittalBelum ada peringkat

- Tanduay Trend AnalysisDokumen17 halamanTanduay Trend AnalysisDiane Isogon LorenzoBelum ada peringkat

- Stocks and BondsDokumen28 halamanStocks and BondsPrincess Macariola100% (1)

- Dumy The 14th Surana and Surana National Corporate LawDokumen23 halamanDumy The 14th Surana and Surana National Corporate Lawkarti_am100% (1)

- Sbi Project of HRDokumen41 halamanSbi Project of HRDev YadavBelum ada peringkat

- EntrepDokumen4 halamanEntrepBOBOKOBelum ada peringkat

- Inflation's Causes and CostsDokumen55 halamanInflation's Causes and CostsSimantoPreeom100% (1)

- A-4 Purple Form Farewell Grant ApplicationDokumen2 halamanA-4 Purple Form Farewell Grant Applicationabubakar younasBelum ada peringkat