Small Cap Stocks Info: Thursday, 10 February 2022

Diunggah oleh

Aditiya Kelana0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

5 tayangan5 halamanJudul Asli

Untitled

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

5 tayangan5 halamanSmall Cap Stocks Info: Thursday, 10 February 2022

Diunggah oleh

Aditiya KelanaHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

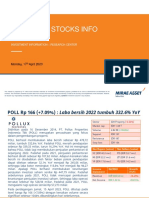

SMALL CAP STOCKS INFO

Thursday, 10th February 2022

INVESTMENT INFORMATION

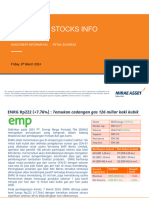

CPRO Rp 104 (+20.93%) : Target penjualan 2022 +10%

Sector IDX Noncyclical (+0.01%)

Market cap IDR 6.20 T

Didirikan pada 30 April 1980, PT. Central Proteina Prima, Tbk (CPRO) Volume 2.24 B (+1194%)

merupakan perusahaan yang fokus pada bisnis produsen dan

Support IDR 97

pengolahan produk udang, produk-produk akuakultur, pakan,

probiotik untuk pasar domestik maupun internasional, termasuk ke Resistance IDR 112

negara-negara Asia, Australia, Eropa hingga Amerika. Stop loss IDR 92

CPRO menargetkan pertumbuhan penjualan 2022 mencapai 5%

hingga 10% seiring dengan membaiknya potensi pasar. Adapun Net Buyers (value) Net Sellers (value)

perseroan menargetkan total penjualan di sepanjang 2022 MG (IDR 8.4 bn) CP (IDR 3.25 bn)

mencapai Rp 8,5 triliun, dengan jumlah EBITDA sebesar Rp 1 triliun ZP (IDR 4.62 bn) YP (IDR 3.3 bn)

dan laba bersih diyakini bisa mencapai Rp 500 miliar. Demi

KK (IDR 4.06 bn) RF (IDR 2.77 bn)

mendukung peningkatan penjualan, perseroan menganggarkan

capex sebesar Rp 320 miliar pada tahun ini. Sebagian besar alokasi

digunakan untuk membangun fasilitas produksi baru, termasuk Income Q3/2021 Growth

pabrik pakan hewan kesayangan, pabrik makanan beku dan fasilitas Statement (YoY)

pembenuran udang. Sementara sisi capex lainnya akan Revenue IDR 6.0 tn 7.1%

dianggarkan untuk memelihara fasilitas produksi eksisting. Net Income IDR 2.1 tn 3187%

Pada perdagangan Rabu, 9 Februari 2022, CPRO ditutup pada level

harga Rp 104 (+20.93%) dengan kenaikan volume secara signifikan

sekitar 1194% dibandingkan hari sebelumnya.

1 | Small Cap Stocks Info | 10/02/2022 Mirae Asset Sekuritas Indonesia

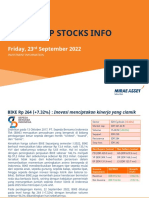

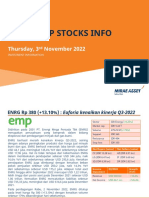

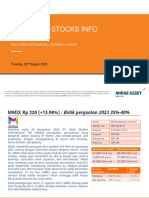

DEPO Rp 520 (+6.56%) : Target laba bersih 2022 +27%

Sector IDX Cyclical (-0.91%)

Market cap IDR 3.53 T

Didirikan pada 3 Januari 1996, PT. Caturkarda Depo Bangunan Tbk Volume 14.70 M (+22.6%)

(DEPO) merupakan perusahaan yang bergerak dibidang

Support IDR 505

supermarket dan/atau ritel bahan bangunan.

Resistance IDR 535

DEPO menargetkan pertumbuhan kinerja laba bersih mencapai

25% hingga 27% pada tahun 2022. Perseroan optimis bahwa bisnis Stop loss IDR 498

perusahaan building material sedang bergerak menuju arah

membaik seiring pertumbuhan ekonomi nasional yang semakin Net Buyers (value) Net Sellers (value)

kondusif dari pandemi COVID-19. Apalagi rumah hunian tidak ZP (IDR 1.25 bn) XC (IDR 571.3 mn)

hanya dibangun oleh pengembang swasta saja, melainkan oleh AK (IDR 982.4 mn) FZ (IDR 569 mn)

pemerintah dalam hal ini kementerian PUPR. Terlebih lagi adanya

MG (IDR 202.2 mn) SH (IDR 376.91 mn)

program sejuta rumah dari pemerintah mengingat backlog

mencapai 9 juta. Di sisi lain, perseroan juga optimis bahwa kenaikan

kinerja tersebut terdorong oleh pengoperasian gerai baru. Dengan Income M7/2021 Growth

demikian, maka DEPO akan terus mencatatkan peningkatan Statement (YoY)

pengunjung di setiap gerainya. Adapun DEPO berencana Revenue IDR 1.17 tn -4.1%

menambahkan tiga gerai baru pada 2022. Net Income IDR 49.01 bn +4.6%

Pada perdagangan Rabu, 9 Februari 2022, DEPO ditutup pada level

harga Rp 520 (+6,56%) dengan kenaikan volume sebesar 22.6%

dibandingkan hari sebelumnya.

2 | Small Cap Stocks Info | 10/02/2022 Mirae Asset Sekuritas Indonesia

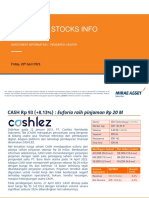

NOBU Rp 700 (+5.26%) : Rencana Rights Issue

Sector IDX Finance (+0.55%)

Market cap IDR 3.22 T

Didirikan pada 1989, PT. Bank Nationalnobu Tbk Volume 5.22 M (+138%)

(NOBU) merupakan perusahaan yang bergerak dalam bidang jasa

Support IDR 670

perbankan umum.

Resistance IDR 755

NOBU berencana melaksanakan rights issue dengan menerbitkan

sebanyak-banyaknya 500 juta saham baru atau setara dengan 9,8% Stop loss IDR 655

dari modal ditempatkan dan disetor penuh setelah PMHMETD II.

Perusahaan akan menyampaikan pernyataan pendaftaran dalam Net Buyers (value) Net Sellers (value)

rangka PMHMETD II kepada OJK segera setelah disetujui oleh PD (IDR 372.1 mn) OD (IDR 1 bn)

RUPSLB yang akan diselenggarakan pada tanggal 9 Maret 2022. TP (IDR 295.8 mn) IF (IDR 147.7 mn)

Adapun dana rights issue tersebut akan digunakan menyesuaikan

NI (IDR 267.9 mn) MG (IDR 131.1 mn)

urutan prioritas utama, yakni pembelian gedung dan selanjutnya

untuk modal kerja perusahaan berupa penyaluran kredit kepada

nasabah. Adapun PT Star Pacific Tbk (LPLI) dan James Tjahaja Income Q3/2021 Growth

Riady, selaku pemegang saham perseroan, bertindak pembeli siaga Statement (YoY)

pada rights issue tersebut. Net Interest IDR 702.2 bn +20.1%

Income

Pada perdagangan Rabu, 9 Februari 2022, NOBU ditutup pada level

harga Rp 700 (+5,26%) dengan kenaikan volume secara signifikan Net Income IDR 46 bn -7.07%

sebesar 138% dibandingkan hari sebelumnya.

3 | Small Cap Stocks Info | 10/02/2022 Mirae Asset Sekuritas Indonesia

Disclaimer

This report is published by Mirae Asset Sekuritas Indonesia, a broker-dealer registered in the Republic of Indonesia and a

member of the Indonesia Stock Exchange. Information and opinions contained herein have been compiled in good faith and

from sources believed to be reliable, but such information has not been independently verified and Mirae Asset Sekuritas

Indonesia makes no guarantee, representation or warranty, express or implied, as to the fairness, accuracy, completeness or

correctness of the information and opinions contained herein or of any translation into English from the Indonesian language. In

case of an English translation of a report prepared in the Indonesian language, the original Indonesian language report may

have been made available to investors in advance of this report. The intended recipients of this report are sophisticated

institutional investors who have substantial knowledge of the local business environment, its common practices, laws and

accounting principles and no person whose receipt or use of this report would violate any laws and regulations or subject Mirae

Asset Sekuritas Indonesia and its affiliates to registration or licensing requirements in any jurisdiction shall receive or make any

use hereof. This report is for general information purposes only and it is not and shall not be construed as an offer or a

solicitation of an offer to effect transactions in any securities or other financial instruments. The report does not

constitute investment advice to any person and such person shall not be treated as a client of Mirae Asset Sekuritas Indonesia by

virtue of receiving this report. This report does not take into account the particular investment objectives, financial situations, or

needs of individual clients. The report is not to be relied upon in substitution for the exercise of independent judgment.

Information and opinions contained herein are as of the date hereof and are subject to change without notice. The price and

value of the investments referred to in this report and the income from them may depreciate or appreciate, and investors may

incur losses on investments. Past performance is not a guide to future performance. Future returns are not guaranteed, and a

loss of original capital may occur. Mirae Asset Sekuritas Indonesia, its affiliates and their directors, officers, employees and agents

do not accept any liability for any loss arising out of the use hereof. Mirae Asset Sekuritas Indonesia may have issued other

reports that are inconsistent with, and reach different conclusions from, the opinions presented in this report. The reports may

reflect different assumptions, views and analytical methods of the analysts who prepared them. Mirae Asset Sekuritas Indonesia

may make investment decisions that are inconsistent with the opinions and views expressed in this research report. Mirae Asset

Sekuritas Indonesia, its affiliates and their directors, officers, employees and agents may have long or short positions in any of

the subject securities at any time and may make a purchase or sale, or offer to make a purchase or sale, of any such securities or

other financial instruments from time to time in the open market or otherwise, in each case either as principals or agents. Mirae

Asset Sekuritas Indonesia and its affiliates may have had, or may be expecting to enter into, business relationships with the

subject companies to provide investment banking, market-making or other financial services as are permitted under applicable

laws and regulations. No part of this document may be copied or reproduced in any manner or form or redistributed or

published, in whole or in part, without the prior written consent of Mirae Asset Sekuritas Indonesia.

4 | Small Cap Stocks Info | 10/02/2022 Mirae Asset Sekuritas Indonesia

Anda mungkin juga menyukai

- Small Cap Stocks Info - 8 July 2022Dokumen5 halamanSmall Cap Stocks Info - 8 July 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 13 July 2022Dokumen5 halamanSmall Cap Stocks Info - 13 July 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 10 June 2022Dokumen5 halamanSmall Cap Stocks Info - 10 June 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 5 September 2022Dokumen5 halamanSmall Cap Stocks Info - 5 September 2022Ira KusumawatiBelum ada peringkat

- Small Cap Stocks Info - 11 October 2022Dokumen5 halamanSmall Cap Stocks Info - 11 October 2022wahyu agung yuwonoBelum ada peringkat

- Small Cap Stocks Info - 25 October 2022Dokumen5 halamanSmall Cap Stocks Info - 25 October 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 8 April 2022Dokumen5 halamanSmall Cap Stocks Info - 8 April 2022yohan pramonoBelum ada peringkat

- Small Cap Stocks Info - 20 May 2022Dokumen5 halamanSmall Cap Stocks Info - 20 May 2022wahyu agung yuwonoBelum ada peringkat

- Small Cap Stocks Info - 11 July 2022Dokumen5 halamanSmall Cap Stocks Info - 11 July 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 8 June 2022Dokumen5 halamanSmall Cap Stocks Info - 8 June 2022rogandaganesha70Belum ada peringkat

- Small Cap Stocks Info - 14 March 2022Dokumen5 halamanSmall Cap Stocks Info - 14 March 2022Aditiya KelanaBelum ada peringkat

- Small Cap Stocks Info - 14 November 2022Dokumen5 halamanSmall Cap Stocks Info - 14 November 2022reza_sBelum ada peringkat

- Small Cap Stocks Info - 3 August 2022Dokumen5 halamanSmall Cap Stocks Info - 3 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 1 August 2022Dokumen5 halamanSmall Cap Stocks Info - 1 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 9 November 2022Dokumen5 halamanSmall Cap Stocks Info - 9 November 2022MfdfandiBelum ada peringkat

- Small Cap Stocks Info - 4 July 2022Dokumen5 halamanSmall Cap Stocks Info - 4 July 2022DianeDianeBelum ada peringkat

- Small Cap Stocks Info - 9 March 2022Dokumen5 halamanSmall Cap Stocks Info - 9 March 2022Hardy Young HostelBelum ada peringkat

- Small Cap Stocks Info - 4 October 2022Dokumen5 halamanSmall Cap Stocks Info - 4 October 2022dannydzurizalBelum ada peringkat

- Small Cap Stocks Info - 31 October 2022Dokumen5 halamanSmall Cap Stocks Info - 31 October 2022MfdfandiBelum ada peringkat

- Smal Capital Stock Part 2Dokumen5 halamanSmal Capital Stock Part 2Suryanto Bekti NugrohoBelum ada peringkat

- Small Cap Stocks Info - 29 August 2022Dokumen5 halamanSmall Cap Stocks Info - 29 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 12 October 2022Dokumen5 halamanSmall Cap Stocks Info - 12 October 2022wahyu agung yuwonoBelum ada peringkat

- Small Cap Stocks Info - 16 November 2022Dokumen5 halamanSmall Cap Stocks Info - 16 November 2022MfdfandiBelum ada peringkat

- Small Cap Stocks Info - 23 September 2022Dokumen5 halamanSmall Cap Stocks Info - 23 September 2022Sandi S.T.Belum ada peringkat

- Small Cap Stocks Info - 9 February 2023Dokumen5 halamanSmall Cap Stocks Info - 9 February 2023minnie storeBelum ada peringkat

- Small Cap Stocks Info - 22 August 2022Dokumen5 halamanSmall Cap Stocks Info - 22 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 28 April 2023Dokumen5 halamanSmall Cap Stocks Info - 28 April 2023Suryanto Bekti NugrohoBelum ada peringkat

- Small Cap Stocks Info - 29 December 2022Dokumen5 halamanSmall Cap Stocks Info - 29 December 2022Su BarkahBelum ada peringkat

- Small Cap Stocks Info - 3 November 2022Dokumen5 halamanSmall Cap Stocks Info - 3 November 2022MfdfandiBelum ada peringkat

- Small Cap Stocks Info - 29 June 2022Dokumen5 halamanSmall Cap Stocks Info - 29 June 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 12 August 2022Dokumen5 halamanSmall Cap Stocks Info - 12 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 20 October 2022Dokumen5 halamanSmall Cap Stocks Info - 20 October 2022Ahmad NurfitrianBelum ada peringkat

- Small Cap Stocks Info - 21 February 2023Dokumen5 halamanSmall Cap Stocks Info - 21 February 2023reza_sBelum ada peringkat

- Small Cap Stocks Info - 8 August 2023Dokumen5 halamanSmall Cap Stocks Info - 8 August 2023nopaBelum ada peringkat

- Small Cap Stocks Info - 13 April 2022Dokumen5 halamanSmall Cap Stocks Info - 13 April 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 24 June 2022Dokumen5 halamanSmall Cap Stocks Info - 24 June 2022KPH BaliBelum ada peringkat

- Small Cap Stocks Info - 13 October 2022Dokumen5 halamanSmall Cap Stocks Info - 13 October 2022dannydzurizalBelum ada peringkat

- 9 May 2023 Stocks InfoDokumen5 halaman9 May 2023 Stocks Infobabi reroll0Belum ada peringkat

- Small Cap Stocks Info - 24 January 2024Dokumen5 halamanSmall Cap Stocks Info - 24 January 2024Kknz 13Belum ada peringkat

- Small Cap Stocks Info - 11 November 2022Dokumen5 halamanSmall Cap Stocks Info - 11 November 2022Ira KusumawatiBelum ada peringkat

- Small Cap Stocks Info - 23 May 2022Dokumen5 halamanSmall Cap Stocks Info - 23 May 2022AndripgaBelum ada peringkat

- Small Cap Stocks Info - 23 May 2023Dokumen5 halamanSmall Cap Stocks Info - 23 May 2023EdiBelum ada peringkat

- Small Cap Stocks Info - 11 April 2023Dokumen5 halamanSmall Cap Stocks Info - 11 April 2023Daud Ryan Steven SilitongaBelum ada peringkat

- Small Cap Stocks Info - 22 December 2022Dokumen5 halamanSmall Cap Stocks Info - 22 December 2022EdiBelum ada peringkat

- Small Cap Stocks Info - 26 August 2022Dokumen5 halamanSmall Cap Stocks Info - 26 August 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 27 October 2022Dokumen5 halamanSmall Cap Stocks Info - 27 October 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 7 October 2022Dokumen5 halamanSmall Cap Stocks Info - 7 October 2022mario heskiaBelum ada peringkat

- Small Cap Stocks Info - 31 March 2023Dokumen5 halamanSmall Cap Stocks Info - 31 March 2023deliBelum ada peringkat

- Small Cap Stocks Info - 8 March 2024Dokumen5 halamanSmall Cap Stocks Info - 8 March 2024KazeaBelum ada peringkat

- UntitledSmal Capital Stock Part 3Dokumen5 halamanUntitledSmal Capital Stock Part 3Suryanto Bekti NugrohoBelum ada peringkat

- Small Cap Stocks Info - 2 May 2023Dokumen5 halamanSmall Cap Stocks Info - 2 May 2023Daud Ryan Steven SilitongaBelum ada peringkat

- Small Cap Stocks Info - 24 October 2022Dokumen5 halamanSmall Cap Stocks Info - 24 October 2022Hendi PrihatnaBelum ada peringkat

- Small Cap Stocks Info - 16 June 2023Dokumen5 halamanSmall Cap Stocks Info - 16 June 2023Rikma DendaBelum ada peringkat

- Small Cap Stocks Info - 4 December 2023Dokumen5 halamanSmall Cap Stocks Info - 4 December 2023zoelkar nainBelum ada peringkat

- Small Cap Stocks Info - 1 March 2024Dokumen5 halamanSmall Cap Stocks Info - 1 March 2024dopaminee12Belum ada peringkat

- Small Cap Stocks Info - 22 August 2023Dokumen5 halamanSmall Cap Stocks Info - 22 August 2023deliBelum ada peringkat

- Small Cap Stocks Info - 4 January 2023Dokumen5 halamanSmall Cap Stocks Info - 4 January 2023Yanuar Firman HadiatnaBelum ada peringkat

- Small Cap Stocks Info - 28 February 2024Dokumen5 halamanSmall Cap Stocks Info - 28 February 2024mbahjo1Belum ada peringkat

- Small Cap - Stocks Info - 25 January 2024 OkeDokumen5 halamanSmall Cap - Stocks Info - 25 January 2024 OkeOberlin SimanjuntakBelum ada peringkat

- Pendekatan sederhana untuk perdagangan obligasi: Panduan pengantar investasi obligasi dan manajemen portofolionyaDari EverandPendekatan sederhana untuk perdagangan obligasi: Panduan pengantar investasi obligasi dan manajemen portofolionyaBelum ada peringkat