Contoh Format Analisis Teknikal

Diunggah oleh

Gloria GlorettaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Contoh Format Analisis Teknikal

Diunggah oleh

Gloria GlorettaHak Cipta:

Format Tersedia

Senin, 17 September 2012

Bahana Beacon

Analisa Teknikal

IDX: 4,257.0 (+2.1%)

Nilai perdagangan: IDR6.4t (+75.4%) Pembelian bersih: IDR1.4t (+182.4%)

PREDIKSI PASAR

Trading range hari ini 4,234 4,309 IHSG berhasil membentuk new all time high pada kisaran 4,157 disertai dengan volume yang sangat tinggi, dengan membentuk gap pada kisaran 4,185 4,205 dan gap kedua pada kisaran 4,100. IHSG terlihat overshoot diatas upper bollinger band, sehingga ada potensi untuk terjadi konsolidasi pada kisaran level ini. MACD golden cross, stochastic menguat.

Support 2 4,183 Support 1 4,231 Index 4,256

RSI

62%

dan

Resistance 1 4,261

Resistance 2 4,285

SAHAM-SAHAM PILIHAN HARI INI

ADRO IDR1,590 Spec BUY

BUY IDR1,600 dengan target IDR1,820 dan cut loss jika tutup dibawah IDR1,360. ADRO mengalami penguatan selama seminggu terakhir, dan pada saat ini berada pada kisaran level resistance pada IDR1,590, BUY jika ADRO dapat ditutup diatas level resistance, dengan target menuju IDR1,820. MACD golden cross, RSI di level 58% dan stochastic menguat.

Support 2 1,500 Support 1 1,540 Price 1,590 Resistance 1 1,610 Resistance 2 1,680

INDY IDR1,650 Trading BUY

BUY IDR1,580 IDR1,650 dengan target IDR1,780 IDR2,075 dan cut loss jika tutup dibawah IDR1,480. INDY membentuk double bottom kecil, yang menandakan tanda reversal, disertai dengan volume yang cukup tinggi, sehingga ada potensi untuk melanjutkan penguatan dengan target menuju IDR1,780 IDR2,075 MACD golden cross, RSI level 42% dan stochastic menguat.

Support 2 1,480 Support 1 1,620 Price 1,650 Resistance 1 1,710

1

Resistance 2 1,780

Pengungkapan: Bahana Securities melakukan dan mencari kerjasama dengan perusahaan yang tercakup dalam laporan penelitiannya. Investor harus mempertimbangkan laporan ini hanya sebagai salah satu faktor dalam membuat keputusan investasi mereka. Silakan lihat disclaimer informasi penting di belakang laporan ini

SIMP IDR1,370 Trading BUY

BUY IDR1,380 dengan target IDRIDR1,470 dan cut loss jika tutup dibawah IDR1,280. SIMP berhasil melalui masa konsolidasi dengan titik konfirmasi pada kisaran IDR1,380, jika menembus level ini maka ada potensi untuk SIMP membentuk new all time high dengan target pertama pada level high dikisaran IDR1,480, volume terlihat meningkat pada saat melalui level MA20. MACD golden cross, RSI level 52% dan Stochastic i.

Support 2 1,320 Support 1 1,350 Price 1,370 Resistance 1 1,380 Resistance 2 1,400

BBNI IDR3,875 Trading BUY

BUY IDR3,825 dengan target IDR4,000 IDR4,100 dan cut loss jika tutup dibawah IDR3,775. BBNI terlihat menembus downtrend channel pada kisaran IDR3,800, ada potensi membentuk pola baru dengan target terdekat menuju IDR4,000 yang merupakan level high pada bulan July, volume masih terlihat normal pada saham ini . MACD sideways, data stochastic menguat.

Support 2 3,800 Support 1 3,850 Price 3,875

RSI

53%

dan

Resistance 1 3,925

Resistance 2 4,000

SGRO IDR2,875 Spec BUY

BUY IDR2,900 dengan target IDR3,150 dan cut loss jika tutup dibawah IDR2,825. SGRO ada potensi untuk membentuk pola reversal, double bottom. Konfirmasi reversal jika dapat ditutup diatas level IDR2,900, disertai dengan volume yang cukup tinggi dengan target menuju iDR3,150, volume terlihat meningkat pada perdagangan hari Jumat dan MACD golden cross. MACD uptrend, RSI di 49% dan Stochastic menguat.

Support 2 2,600 Support 1 2,800 Price 2,875 Resistance 1 2,900 Resistance 2 3,000

PT Bahana Securities Equity Research Bahana Beacon Technical Analysis

Technical Analysis 17 September 2012

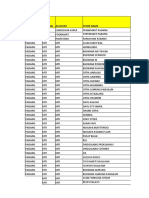

Company Astra Agro Lestari Adaro Energy Adhi Karya Agung Podomoro Land Alam Sutra AKR Corporindo Aneka Tambang Astra International Bakrie Sumatra Plantations Bakrie Telekom Bakrieland Development Bank Bukopin Bank Central Asia Bank Danamon Bank Jabar Banten Bank Mandiri Bank Negara Indonesia Bank Rakyat Indonesia Bank Tabungan Negara Bayan Resourc es Bumi Resourc es Bumi Serpong Damai Borneo Lumbung Energi & Metal BW Plantation Cardig Aero Servic es Charoen Pokphand Ciputra Development Ciputra Property Citra Marga Nursapala Persada Delta Dunia Makmur Garuda Indonesia Gudang Garam Gajah Tunggal Gozc o Plantations Harum Energy Indika Energy Indo Tambangraya Megah Indoc ement Tunggal Prakasa Indofood CBP Sukses Makmur Indofood Sukses Makmur Indomobil Sukses International Indosat Japfa Jasa Marga Kalbe Farma Kawasan Industri Jababeka Lippo Cikarang Lippo Karawac i Medc o Energi International Mitra Adiperkasa Nippon Indosari Corpindo Pelat Timah Nusantara Perusahaan Gas Negara PP London Sumatra Indonesia Bukit Asam Pembangunan Perumahan Ramayana Lestari Sentosa Salim Ivomas Pratama Sampoerna Agro Sarana Menara Nusantara Semen Gresik Summarec on Agung Surya Citra Media Surya Semesta Internusa Telekomunikasi Indonesia Timah Total Bangun Persada Unilever Indonesia United Trac tors Vale Indonesia Wijaya Karya Wintermar Offshore Marine XL Axiata Code AALI ADRO ADHI APLN ASRI AKRA ANTM ASII UNSP BT EL ELTY BBKP BBCA BDMN BJBR BMRI BBNI BBRI BBTN BYAN BUMI BSDE BORN BWPT CASS CPIN CTRA CT RP CMNP DOID GIAA GGRM GJTL GZCO HRUM INDY ITMG INTP ICBP INDF IMAS ISAT JPFA JSMR KLBF KIJA LPCK LPKR MEDC MAPI ROTI NIKL PGAS LSIP PTBA PTPP RALS SIMP SGRO TOWR SMGR SMRA SCMA SSIA T LKM TINS T OTL UNVR UNTR INCO WIKA WINS EXCL 610 7,550 5,700 990 7,600 3,800 7,100 1,240 12,100 740 930 430 1,470 700 2,600 600 465 1,910 205 570 48,150 2,300 175 5,100 1,480 39,250 18,900 6,000 5,350 4,475 4,975 4,100 5,550 4,275 188 3,500 870 1,500 6,650 5,100 177 3,825 2,400 14,950 610 1,040 1,320 2,600 17,300 13,150 1,540 9,850 1,130 8,500 1,460 480 26,000 21,150 2,575 1,050 395 5,950 Support 2 22,200 1,500 790 315 410 3,800 1,340 7,100 94 90 Support 1 22,900 1,540 870 325 465 3,950 1,380 7,200 116 101 50 620 7,750 5,850 1,030 7,800 3,850 7,250 1,270 12,500 820 1,000 470 1,500 810 2,800 660 540 2,025 230 590 48,950 2,350 199 6,050 1,620 39,850 19,600 6,300 5,450 5,400 5,350 4,300 5,700 4,325 199 3,700 920 1,590 6,900 5,250 200 4,000 2,550 15,300 630 1,080 1,350 2,800 19,400 13,600 1,580 10,350 1,230 8,950 1,520 495 27,100 21,650 2,650 1,110 425 6,400 Price 23,000 1,590 930 335 480 4,025 1,390 7,400 135 103 53 620 8,050 6,100 1,090 7,950 3,875 7,400 1,290 12,800 840 1,050 495 1,540 830 2,850 680 600 2,050 250 620 49,050 2,375 220 6,350 1,650 39,900 20,150 6,400 5,500 5,800 5,850 4,350 5,750 4,375 205 3,750 930 1,660 7,100 5,300 205 4,150 2,575 15,650 640 1,120 1,370 2,875 20,300 14,000 1,610 10,650 1,260 9,650 1,550 500 27,800 22,000 2,675 1,140 430 6,700 Resistanc e 1 24,000 1,610 970 335 500 4,100 1,430 7,400 138 120 60 640 8,050 6,100 1,090 8,000 3,925 7,450 1,310 12,800 890 1,050 495 1,540 850 2,925 700 610 2,100 250 630 49,750 2,425 225 6,350 1,710 40,300 20,550 6,850 5,550 6,150 5,950 4,425 5,900 4,425 210 4,000 940 1,700 7,100 5,400 225 4,175 2,650 15,750 650 1,120 1,380 2,900 21,950 14,100 1,620 11,050 1,330 9,750 1,580 510 27,950 22,450 2,750 1,170 445 7,100 Resistanc e 2 25,100 1,680 1,140 340 530 4,200 1,480 7,600 152 139 66 650 8,350 6,450 1,180 8,150 4,000 7,650 1,350 13,000 950 1,090 520 1,610 880 3,025 730 700 2,175 265 670 50,250 2,500 240 6,600 1,780 40,750 22,000 7,400 5,650 6,900 6,550 4,525 6,000 4,525 215 4,300 970 1,870 7,300 5,500 235 4,275 2,725 16,450 680 1,150 1,400 3,000 26,100 14,350 1,700 11,750 1,390 10,500 1,620 520 28,750 23,250 2,900 1,200 460 7,800 Rec ommendation Trading BUY Spec BUY Spec BUY Trading BUY Spec BUY Trading BUY Trading BUY Trading BUY T rading SELL T rading SELL T rading SELL Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY * T rading SELL Trading BUY Trading BUY T rading SELL Trading BUY Spec BUY Trading BUY Trading BUY Trading BUY Trading BUY T rading SELL Trading BUY T rading SELL Trading BUY SELL on Strength Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Spec BUY Trading BUY Trading BUY Trading BUY SELL on Strength Trading BUY Trading BUY Trading BUY * Trading BUY Trading BUY BUY on Weakness Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Trading BUY Spec BUY T rading SELL Trading BUY Spec BUY Trading BUY Trading BUY * Trading BUY Trading BUY T rading SELL Trading BUY Trading BUY Trading BUY T rading SELL Spec BUY

*IN REGARD TO THE ENGAGEMENT LETTER FROM THE COMPANIES, PT. BAHANA SECURITIES WILL NOT PRODUCE THE COMPANIES RATINGS AND TARGET PRICES DURING THE ENGAGEMENT PERIOD TO ENSURE THE OPINIONS GIVEN ARE FAIR AND REASONABLE.

Keterangan Trading BUY Trading SELL BUY on Weakness SELL on Strength

: : : :

Beli setelah konfirmasi penguatan Jual setelah konfirmasi pelemahan Beli saat terjadi pelemahan / beli pada harga support Jual saat terjadi penguatan / jual pada harga resistance

3

PT Bahana Securities Equity Research Bahana Beacon Technical Analysis

Aggregate transactions (%) *

Foreign net transactions (IDRb)*

Sectoral Transaction Finance Mining Infrastructure Trade, Services and Investment Consumer Goods Agriculture Miscellaneous Industry Property Basic Industry and Chemicals

-1 Month 19.9 10.9 17.4 14.7 8.2 3.8 9.7 8.9 6.4

-5 days 18.9 12.4 19.3 14.6 7.7 5.5 10.4 6.3 4.9

Last Day

Sector

-1 Month 579.0 (196.1) 156.8 13.7 566.6 363.1 (602.7) (218.4) 502.3

-5 days 577.3 0.2 369.7 279.3 552.4 191.8 (11.9) 83.8 36.8

Last Day 319.9 293.5 240.5 218.4 154.5 112.9 21.0 19.3 (12.3)

19.9 Infrastructure 17.2 Finance 16.6 Trade, Services & Investment 12.8 Mining 9.8 Miscellanous industry 6.8 Basic industry & Chemicals 6.0 Agriculture 6.0 Property 4.8 Consumer goods

Top 10 foreign BUY 13/9/2012*

Top 10 foreign SELL 13/9/2012*

Company Perusahaan Gas Negara Astra International Bank Mandiri United Tractors Semen Gresik Bank Rakyat Indonesia PT Bukit Asam Adaro Energ Harum Energy AKR Corporindo

Code PGAS ASII BMRI UNTR SMGR BBRI PTBA ADRO HRUM AKRA

Net (IDRb) Company 252.4 Gudang Garam 157.0 Alam Sutera 133.2 Xl Axiata 105.3 PP London Sumatra Indonesia 94.9 Jasa Marga 64.4 Medco Energy 56.1 Citra Marga Nursapala Persada 54.2 Borneo Lumbung Energy & Metal 52.8 Timah 51.9 Gajah Tunggal

Code GGRM ASRI EXCL LSIP JSMR MEDC CMNP BORN TINS GJTL

Net (IDRb) 64.8 11.8 9.6 9.3 9.3 8.0 4.4 4.3 3.2 2.7

Top 19 foreign BUY 10/9/2012 14/9/2012*

Top 10 foreign SELL 10/9/2012 14/9/2012*

Company Perusahaan Gas Negara Astra International Semen Gresik Bank Rakyat Indonesia United Tractors Adaro Energy AKR Corporindo Bank Negara Indonesia Indofood Sukses Makmur Astra Agrol Lestari

Source: IDX.co.id,RTI

Code PGAS ASII SMGR BBRI UNTR ADRO AKRA BBNI INDF AALI

Net (IDRb) Company 667.2 Bank Mandiri 552.8 PP London Sumatra Indonesia 206.9 Gudang Garam 135.5 Telekomunikasi Indonesia 122.1 Jasa Marga 89.6 Xl Axiata 88.7 Indocemen Tunggal Prakasa 68.6 Citra Marga Nursapala Persada 67.1 Medco Energy 65.1 Bank Tabungan Negara

Code BMRI LSIP GGRM TLKM JSMR EXCL INTP CMNP MEDC BBTN

Net (IDRb) 212.0 130.1 80.0 50.9 50.2 46.4 41.2 17.1 15.6 15.6

PT Bahana Securities Equity Research Bahana Beacon Technical Analysis

Research: +62 21 250 5081

Harry Su harry.su@bahana.c o.id Head of Research Strategy, Telc os, Consumer, Aviation ext 3600 direc t: +62 21 250 5735

Teguh Hartanto teguh.hartanto@bahana.co.id Deputy Head of Research Banks, Cement ext 3610

Leonardo Henry Gavaza leonardo@bahana.co.id Researc h Analyst Automotive, Plantations, Metal Mining, Heavy Equipment ext 3608

Natalia Sutanto natalia.sutanto@bahana.c o.id Researc h Analyst Property, Toll Road ext 3601

Irwan Budiarto irwan.budiarto@bahana.co.id Research Analyst Coal, Oil and Gas ext 3606

Arga Samudro arga@bahana.c o.id Ec onomist ext 3602

Chandra Widjanarka chandra.widjanarka@bahana.co.id Tec hnic al Analyst ext 3609

Aditya Eka Prakasa aditya.prakasa@bahana.c o.id Research Analyst Poultry ext 3603

Stifanus Sulistyo stifanus.sulistyo@bahana.co.id Research Analyst Small cap ext 3611

Zefanya Angeline zefanya@bahana.co.id Researc h Associate ext 3612

Anthony Alexander anthony@bahana.c o.id Researc h Analyst Construc tion ext 3613

Salman Fajari Alamsyah salman@bahana.co.id Researc h Assoc iate ext 3605

Made Ayu Wijayati made.ayu@bahana.co.id Researc h Exec utive ext 3607

Giovanni Aristo giovanni@bahana.c o.id Research Assoc iate ext 3604

Nico Laurens nico@bahana.co.id Research Assoc iate ext 3604

Dealing Room: +62 21 250 5508

Yolanda Sondak yolanda@bahana.co.id Head of Equity Sales and Trading ext 2545

Haselinda Rifman haselinda@bahana.co.id Equity Sales ext 2524

Suwardi Widjaja Suwardi@bahana.c o.id Equity Sales ext 2548

Tjokro Wongso tjokro@bahana.c o.id Equity Sales ext 2547

John M. Dasaad dasaad@bahana.c o.id Equity Sales ext 2549

Ashish Agrawal ashish@bahana.c o.id Equity Sales ext 2553

Yohanes Adhi Handoko yohanes@bahana.co.id Manager, Surabaya Branc h ext 7250

Head Office Graha Niaga, 19th Floor Jl. Jend. Sudirman Kav. 58 Jakarta 12190 Indonesia Tel. 62 21 250 5081 Fax. 62 21 522 6049

http://www.bahana.co.id

Surabaya Branch Wisma BII, Ground Floor Jl. Pemuda 60-70 Surabaya 60271 Indonesia Tel. 62 31 535 2788 Fax. 62 31 546 1157

DISCLAIMER The information contained in this report has been taken from sources which we deem reliable. However, none of P.T. Bahana Securities and/or its affiliated companies and/or their respective employees and/or agents makes any representation or warranty (express or implied) or accepts any responsibility or liability as to, or in relation to, the accuracy or completeness of the information and opinions contained in this report or as to any information contained in this report or any other such information or opinions remaining unchanged after the issue thereof. We expressly disclaim any responsibility or liability (express or implied) of P.T. Bahana Securities, its affiliated companies and their respective employees and agents whatsoever and howsoever arising (including, without limitation for any claims, proceedings, action , suits, losses, expenses, damages or costs) which may be brought against or suffered by any person as a results of acting in reliance upon the whole or any part of the contents of this report and neither P.T. Bahana Securities, its affiliated companies or their respective employees or agents accepts liability for any errors, omissions or mis-statements, negligent or otherwise, in the report and any liability in respect of the report or any inaccuracy therein or omission there from which might otherwise arise is hereby expresses disclaimed. The information contained in this report is not be taken as any recommendation made by P.T. Bahana Securities or any other person to enter into any agreement with regard to any investment mentioned in this document. This report is prepared for general circulation. It does not have regards to the specific person who may receive this report. In considering any investments you should make your own independent assessment and seek your own professional financial and legal advice.

PT Bahana Securities Equity Research Bahana Beacon Technical Analysis

IMPORTANT US REGULATORY DISCLOSURES ON SUBJECT COMPANIES This material was produced by Bahana Securities, solely for information purposes and for the use of the recipient. It is not to be reproduced under any circumstances and is not to be copied or made available to any person other than the recipient. It is distributed in the United States of America by Enclave Capital LLC. and elsewhere in the world by Bahana or an authorized affiliate of Bahana (such entities and any other entity, directly or indirectly, controlled by Bahana, the Affiliates). This document does not constitute an offer of, or an invitation by or on behalf of Bahana or its Affiliates or any other company to any person, to buy or sell any security. The information contained herein has been obtained from published information and other sources, which Bahana or its Affiliates consider to be reliable. None of Bahana or its Affiliates accepts any liability or responsibility whatsoever for the accuracy or completeness of any such information. All estimates, expressions of opinion and other subjective judgments contained herein are made as of the date of this document. Emerging securities markets may be subject to risks significantly higher than more established markets. In particular, the political and economic environment, company practices and market prices and volumes may be subject to significant variations. The ability to assess such risks may also be limited due to significantly lower information quantity and quality. By accepting this document, you agree to be bound by all the foregoing provisions. 1. Bahana or its Affiliates may or may not have been beneficial owners of the securities mentioned in this report. 2. Bahana or its Affiliates may have or not managed or co-managed a public offering of the securities mentioned in the report in the past 12 months. 3. Bahana or its Affiliates may have or not received compensation for investment banking services from the issuer of these securities in the past 12 months and do not expect to receive compensation for investment banking services from the issuer of these securities within the next three months. 4. However, one or more of Bahana or its Affiliates may, from time to time, have a long or short position in any of the securities mentioned herein and may buy or sell those securities or options thereon either on their own account or on behalf of their clients. 5. As of the publication of this report Bahana does not make a market in the subject securities. 6. Bahana or its Affiliates may or may not, to the extent permitted by law, act upon or use the above material or the conclusions stated above or the research or analysis on which they are based before the material is published to recipients and from time to time provide investment banking, investment management or other services for or solicit to seek to obtain investment banking, or other securities business from, any entity referred to in this report. Enclave Capital LLC. is distributing this document in the United States of America. Bahana Securities accepts responsibility for its contents. Any US customer wishing to effect transactions in any securities referred to herein or options thereon should do so only by contacting a representative of Enclave Capital LLC.

PT Bahana Securities Equity Research Bahana Beacon Technical Analysis

Anda mungkin juga menyukai

- Trading Saham Untuk Pemula: Lakukan Trading Saham Pertama Anda - Lakukan Trading Pertama Anda Dengan Manajemen Uang Yang LayakDari EverandTrading Saham Untuk Pemula: Lakukan Trading Saham Pertama Anda - Lakukan Trading Pertama Anda Dengan Manajemen Uang Yang LayakPenilaian: 4 dari 5 bintang4/5 (1)

- Materi SPM (Sekolah Pasar Modal)Dokumen90 halamanMateri SPM (Sekolah Pasar Modal)Desta Widia SaktiBelum ada peringkat

- Auditing 3 WTB PT Sugus-1Dokumen21 halamanAuditing 3 WTB PT Sugus-1Ikha Bella78% (23)

- Strategi Memenangkan Perdagangan Opsi Biner: Rahasia Sederhana Menghasilkan Uang Dari Perdagangan Opsi BinerDari EverandStrategi Memenangkan Perdagangan Opsi Biner: Rahasia Sederhana Menghasilkan Uang Dari Perdagangan Opsi BinerPenilaian: 2 dari 5 bintang2/5 (1)

- Penawaran Kerjasama SpbuDokumen18 halamanPenawaran Kerjasama Spbukhohinor koBelum ada peringkat

- 030724-Bahana BeaconDokumen5 halaman030724-Bahana BeaconEsaba SabaBelum ada peringkat

- 122322-Bahana BeaconDokumen5 halaman122322-Bahana BeaconBrainBelum ada peringkat

- 031324-Bahana BeaconDokumen5 halaman031324-Bahana BeaconEsaba SabaBelum ada peringkat

- Analisa & Rekomendasi JUMAT, 30 JULI 2021: ResearchDokumen4 halamanAnalisa & Rekomendasi JUMAT, 30 JULI 2021: ResearchDwi YantoBelum ada peringkat

- 121922-Bahana BeaconDokumen5 halaman121922-Bahana BeaconBrainBelum ada peringkat

- 031524-Bahana BeaconDokumen5 halaman031524-Bahana BeaconEsaba SabaBelum ada peringkat

- Analisa & Rekomendasi SELASA, 27 JULI 2021: ResearchDokumen4 halamanAnalisa & Rekomendasi SELASA, 27 JULI 2021: Researchhendro RukytoBelum ada peringkat

- Teknikal Saham Harian: Analisa & Rekomendasi RABU, 16 JUNI 2021Dokumen4 halamanTeknikal Saham Harian: Analisa & Rekomendasi RABU, 16 JUNI 2021indramaBelum ada peringkat

- BNIS Retail Report 060523Dokumen5 halamanBNIS Retail Report 060523Ameliana DamaiyantiBelum ada peringkat

- 031424-Bahana BeaconDokumen5 halaman031424-Bahana BeaconEsaba SabaBelum ada peringkat

- Analisis Profitabilitas Pada Industri Ba Fda8fb33 PDFDokumen16 halamanAnalisis Profitabilitas Pada Industri Ba Fda8fb33 PDFzf1370Belum ada peringkat

- 040323-Bahana BeaconDokumen5 halaman040323-Bahana BeaconivanBelum ada peringkat

- Bnis Retail Report 122622Dokumen6 halamanBnis Retail Report 122622Eric ZoomBelum ada peringkat

- Kopi Pagi 210723Dokumen4 halamanKopi Pagi 210723ivanBelum ada peringkat

- 031824-Bahana BeaconDokumen5 halaman031824-Bahana BeaconEsaba SabaBelum ada peringkat

- Contoh Format KasDokumen6 halamanContoh Format KasRichie Xavier GoniBelum ada peringkat

- Klik Disini: Global Market HighlightDokumen5 halamanKlik Disini: Global Market HighlightRut Diana Marito SimbolonBelum ada peringkat

- Analisa & Rekomendasi Jumat, 10 Desember 2021: ResearchDokumen4 halamanAnalisa & Rekomendasi Jumat, 10 Desember 2021: ResearchMuhammad Andi PrawiraBelum ada peringkat

- 110823-Bahana BeaconDokumen5 halaman110823-Bahana BeaconEdie Dwi AdhiPrayogoBelum ada peringkat

- Bnis Retail Report 122322Dokumen5 halamanBnis Retail Report 122322Eric ZoomBelum ada peringkat

- BNIS Retail Report 052923Dokumen5 halamanBNIS Retail Report 052923Ameliana DamaiyantiBelum ada peringkat

- BNIS Retail Report 122122Dokumen5 halamanBNIS Retail Report 122122asep cahyo prasetyoBelum ada peringkat

- Partnerhip Proposal SCT Nora Dec 22Dokumen11 halamanPartnerhip Proposal SCT Nora Dec 22Rinnoki SukarbaBelum ada peringkat

- 053123-Bahana Beacon NowDokumen5 halaman053123-Bahana Beacon NowmintadiBelum ada peringkat

- Wirus TubesDokumen15 halamanWirus TubesMukhtar AminBelum ada peringkat

- Klik Disini: Global Market HighlightDokumen6 halamanKlik Disini: Global Market HighlightRut Diana Marito SimbolonBelum ada peringkat

- Coorporate Social ResponsibilityDokumen8 halamanCoorporate Social ResponsibilityandreasrolandBelum ada peringkat

- Bahana BeaconDokumen5 halamanBahana BeaconSopiadi HidayatBelum ada peringkat

- Tugas Statistika Data Set3Dokumen9 halamanTugas Statistika Data Set3Rahma SusantiBelum ada peringkat

- Sharing Session ExcelDokumen23 halamanSharing Session Excelgeraldine melyanaBelum ada peringkat

- Qhuzai UsahawanDokumen11 halamanQhuzai UsahawanAnonymous SDf3NeBelum ada peringkat

- Dak OkDokumen46 halamanDak OkAbdul Jabbar Yusuf SyawaluddinBelum ada peringkat

- Makalah TPAI Tugas 2-RTIDokumen10 halamanMakalah TPAI Tugas 2-RTIMuhammad Ainul RifqiBelum ada peringkat

- Propinsi Channel Account Store NameDokumen30 halamanPropinsi Channel Account Store NameRizky Dhanni Fajri IkepBelum ada peringkat

- Presentasi Motor Smoot 2022 09Dokumen18 halamanPresentasi Motor Smoot 2022 09banggustiBelum ada peringkat

- Analisa & Rekomendasi Selasa, 22 Februari 2022: ResearchDokumen4 halamanAnalisa & Rekomendasi Selasa, 22 Februari 2022: ResearchzulaikaBelum ada peringkat

- BAB 4. SulhadiDokumen17 halamanBAB 4. SulhadijuriskiadiBelum ada peringkat

- Kopi Pagi 310723Dokumen4 halamanKopi Pagi 310723ivanBelum ada peringkat

- New Form Sewa 2023 TW 1Dokumen3 halamanNew Form Sewa 2023 TW 1Ibrahim Rachmad Al-endradno GhozaliBelum ada peringkat

- Chapter 10Dokumen11 halamanChapter 10Danty Christina SitalaksmiBelum ada peringkat

- Makalah Kerja AlfamartDokumen11 halamanMakalah Kerja AlfamartEdo AldiBelum ada peringkat

- Virtual Trading StockbitDokumen11 halamanVirtual Trading StockbitTaruna Putra DirgantaraBelum ada peringkat

- 011023-Bahana BeaconDokumen5 halaman011023-Bahana BeaconivanBelum ada peringkat

- Neraca Lajur Januari 2023Dokumen219 halamanNeraca Lajur Januari 2023soimsonBelum ada peringkat

- Promo SBK Briguna Tahun 2020 (Khusus Payroll Gaji Di BRI)Dokumen1 halamanPromo SBK Briguna Tahun 2020 (Khusus Payroll Gaji Di BRI)diky hendrawanBelum ada peringkat

- Pertemuan 4: Perencanaan Pemeriksaan Dan Perpaduan Proses Audit (Lanjutan)Dokumen9 halamanPertemuan 4: Perencanaan Pemeriksaan Dan Perpaduan Proses Audit (Lanjutan)yunita sariBelum ada peringkat

- Manajemen KeuanganDokumen13 halamanManajemen Keuangandea istiqomahBelum ada peringkat

- Tugas Analisis Laporan KeuanganDokumen8 halamanTugas Analisis Laporan KeuanganMAHFUDBelum ada peringkat

- PL JOSS Januari 2024 Rev 1Dokumen75 halamanPL JOSS Januari 2024 Rev 1bareskrimruciBelum ada peringkat

- Individu Indra Prabowo 212Dokumen19 halamanIndividu Indra Prabowo 212wiidyantzBelum ada peringkat

- Contoh Perhitungan RumusDokumen16 halamanContoh Perhitungan RumusMfaqihBelum ada peringkat

- Tugas Akhir Anggaran PerusahaanDokumen12 halamanTugas Akhir Anggaran PerusahaanImam FaisalBelum ada peringkat

- 6Dokumen402 halaman6wulwulwulwul0% (1)