LQ45 Saham 2022 Valuasi dan Kinerja Keuangan

Diunggah oleh

yeremias lusiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

LQ45 Saham 2022 Valuasi dan Kinerja Keuangan

Diunggah oleh

yeremias lusiHak Cipta:

Format Tersedia

www.bnisekuritas.co.

id 31 Agustus 2022

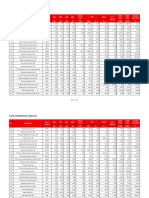

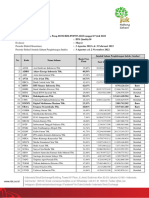

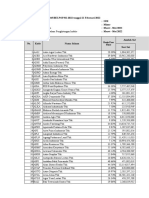

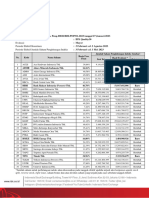

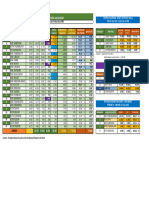

Pergerakan Valuasi Saham LQ45 pada Tahun 2022

30-Dec-21 30-Aug-2022 EPS BVPS PER

No Emiten Kode Saham Market Cap Harga Selisih Harga (% Market Cap

Harga (IDR) PBV PBV 2022 F 2023 F 2022 F 2023 F 2022 F 2023 F

(IDR Trn) (IDR) YTD) (IDR Trn)

1 PT Adaro Energy Tbk ADRO IJ Equity 2,250 1.2 72 3,540 57% 1.45 113.23 0.06 0.04 0.17 0.18 4.18 6.45

2 PT Sumber Alfaria Trijaya Tbk AMRT IJ Equity 1,215 6.2 50 2,030 67% 8.92 84.29 51.11 70.97 252.04 288.59 39.72 28.60

3 PT Aneka Tambang Tbk ANTM IJ Equity 2,250 2.7 54 1,985 -12% 2.14 47.70 169.51 155.56 996.57 1,096.14 11.71 12.76

4 PT Bank Jago Tbk ARTO IJ Equity 16,000 26.9 231 8,175 -49% 13.69 113.27 8.38 27.75 603.93 628.36 975.07 294.61

5 PT Astra International Tbk ASII IJ Equity 5,700 1.4 221 6,900 21% 1.52 279.34 707.59 717.28 4,767.71 5,165.47 9.75 9.62

6 PT Bank Central Asia Tbk BBCA IJ Equity 7,300 4.5 900 8,175 12% 4.96 1,007.77 299.44 339.27 1,814.16 2,002.55 27.30 24.10

7 PT Bank Negara Indonesia Persero Tbk BBNI IJ Equity 6,750 1.0 126 8,425 25% 1.24 157.11 893.05 1,082.60 7,200.67 8,030.07 9.43 7.78

8 PT Bank Rakyat Indonesia Persero Tbk BBRI IJ Equity 4,110 2.2 622 4,260 4% 2.28 645.64 309.33 359.55 2,085.81 2,242.22 13.77 11.85

9 PT Bank Tabungan Negara Persero Tbk BBTN IJ Equity 1,730 0.9 18 1,510 -13% 0.74 15.99 260.72 294.95 2,249.06 2,497.79 5.79 5.12

10 PT BFI Finance Indonesia Tbk BFIN IJ Equity 1,175 2.4 19 1,205 3% 2.22 19.24 94.55 119.00 590.00 606.00 12.74 10.13

11 PT Bank Mandiri Persero Tbk BMRI IJ Equity 7,025 1.7 328 8,650 23% 1.99 403.67 810.50 914.25 4,804.42 5,356.43 10.67 9.46

12 PT Bank Syariah Indonesia Tbk BRIS IJ Equity 1,780 2.9 73 1,520 -15% 2.36 62.52 98.73 125.97 691.35 804.50 15.40 12.07

13 PT Barito Pacific Tbk BRPT IJ Equity 855 3.1 80 840 -2% 2.97 78.75 0.00 0.00 0.02 0.02 28.30 18.86

14 PT Bukalapak.com Tbk BUKA IJ Equity 430 1.9 44 304 -29% 0.97 31.33 25.48 (5.80) 250.17 244.81 11.93 0.00

15 PT Charoen Pokphand Indonesia Tbk CPIN IJ Equity 5,950 4.0 98 5,875 -1% 3.74 96.34 257.88 306.00 1,689.89 1,891.47 22.78 19.20

16 PT Elang Mahkota Teknologi Tbk EMTK IJ Equity 2,280 6.4 140 1,900 -17% 3.54 116.36 28.08 18.82 474.73 494.87 67.68 100.98

17 PT Erajaya Swasembada Tbk ERAA IJ Equity 600 1.6 10 505 -16% 1.25 8.05 77.18 90.43 446.00 508.37 6.54 5.58

18 PT XL Axiata Tbk EXCL IJ Equity 3,170 1.7 34 2,730 (0.14) 1.44 29.28 112.55 143.52 1,972.48 1,931.22 24.26 19.02

19 PT GoTo Gojek Indonesia Tbk* GOTO IJ Equity 338 0.0 0 324 -4% 0.00 383.73 (20.64) (19.11) 109.40 106.82 0.00 0.00

20 PT Hanjaya Mandala Sampoerna Tbk HMSP IJ Equity 965 4.1 112 910 -6% 4.26 105.85 57.21 62.64 245.65 249.31 15.91 14.53

21 PT Harum Energy Tbk HRUM IJ Equity 2,065 4.4 28 1,755 -15% 2.46 23.72 0.02 0.06 0.04 0.06 5.37 1.85

22 PT Indofood CBP Sukses Makmur Tbk ICBP IJ Equity 8,700 3.2 101 8,725 0% 2.81 101.75 600.83 687.85 3,265.46 3,682.12 14.52 12.68

23 PT Vale Indonesia Tbk INCO IJ Equity 4,680 1.5 47 6,125 31% 1.78 60.86 0.03 0.03 0.23 0.25 14.23 15.28

24 PT Indofood Sukses Makmur Tbk INDF IJ Equity 6,325 1.2 56 6,500 3% 1.10 57.07 949.63 1,010.56 6,174.92 6,866.09 6.84 6.43

25 PT Indika Energy Tbk INDY IJ Equity 1,545 0.7 8 2,880 86% 1.03 15.01 0.08 0.03 0.00 0.00 2.46 6.47

26 PT Indah Kiat Pulp & Paper Corp Tbk INKP IJ Equity 7,825 0.6 43 8,375 7% 0.63 45.82 0.00 0.00 0.00 0.00 0.00 0.00

27 PT Indocement Tunggal Prakarsa Tbk INTP IJ Equity 12,100 2.1 45 9,300 -23% 1.76 34.24 399.37 559.40 5,732.29 5,938.38 23.29 16.62

28 PT Indo Tambangraya Megah Tbk ITMG IJ Equity 20,400 1.5 23 39,425 93% 2.02 44.55 0.84 0.57 1.50 1.48 3.15 4.67

29 PT Japfa Comfeed Indonesia Tbk JPFA IJ Equity 1,720 1.7 20 1,570 -9% 1.45 18.41 167.47 203.31 1,171.56 1,304.00 9.37 7.72

30 PT Kalbe Farma Tbk KLBF IJ Equity 1,615 4.1 76 1,630 1% 3.98 76.41 75.59 83.86 459.77 504.68 21.56 19.44

31 PT Merdeka Copper Tbk MDKA IJ Equity 3,795 8.4 89 4,290 13% 8.50 103.44 0.01 0.01 0.05 0.04 57.81 41.29

32 PT Medco Energi Internasional Tbk. MEDC IJ Equity 466 0.8 12 905 94% 1.16 22.75 0.02 0.02 0.04 0.05 3.81 3.59

33 PT Mitra Keluarga Karyasehat Tbk MIKA IJ Equity 2,260 6.2 32 2,620 16% 7.38 37.33 75.46 84.85 407.99 458.75 34.72 30.88

34 PT Media Nusantara Citra Tbk MNCN IJ Equity 900 0.7 14 915 2% 0.69 13.77 201.38 221.28 1,428.81 1,619.58 4.54 4.14

35 PT Perusahaan Gas Negara Tbk PGAS IJ Equity 1,375 0.9 33 1,860 35% 1.15 45.09 0.01 0.01 0.12 0.13 9.64 8.95

36 PT Bukit Asam Tbk PTBA IJ Equity 2,710 1.5 31 4,340 60% 2.22 50.00 985.42 830.29 2,677.65 2,878.03 4.40 5.23

37 PT Semen Indonesia Persero Tbk SMGR IJ Equity 7,250 1.2 43 6,550 -10% 1.09 38.85 457.84 567.10 6,395.69 6,788.99 14.31 11.55

38 PT Tower Bersama Infrastructure Tbk TBIG IJ Equity 2,950 7.0 67 2,890 -2% 6.45 65.48 81.53 82.69 492.96 534.29 35.45 34.95

39 PT Timah Tbk TINS IJ Equity 1,455 1.9 11 1,510 4% 1.60 11.25 282.30 293.40 1,059.40 1,240.00 5.35 5.15

40 PT Telekomunikasi Indonesia Persero Tbk TLKM IJ Equity 4,040 3.8 400 4,480 11% 3.69 443.80 269.11 287.31 1,333.89 1,424.41 16.65 15.59

41 PT Sarana Menara Nusantara Tbk TOWR IJ Equity 1,125 4.9 57 1,220 8% 4.71 62.24 71.44 77.85 282.58 329.95 17.08 15.67

42 PT Chandra Asri Petrochemical Tbk. TPIA IJ Equity 7,325 3.8 158 2,340 -68% 4.68 202.44 0.00 0.00 0.03 0.04 157.65 52.55

43 PT United Tractors Tbk UNTR IJ Equity 22,150 1.2 83 33,325 50% 1.60 124.31 5,052.37 4,462.37 22,443.76 24,617.35 6.60 7.47

44 PT Unilever Indonesia Tbk UNVR IJ Equity 4,110 29.4 157 4,580 11% 38.27 174.73 168.07 173.87 127.18 141.58 27.25 26.34

45 PT Wijaya Karya Persero Tbk WIKA IJ Equity 1,105 0.7 10 1,065 -4% 0.73 9.55 26.04 56.23 1,413.26 1,445.92 40.90 18.94

*based on IPO date

This document is not intended to be an offer, or a satisfaction of an offer, to buy or sell relevant securities (i.e. securities

mentioned herein or of the same issuer and options, warrants or rights to or interest in any such securities). The information

and opinions contained in this document have been compiled from or arrived at in good faith from sources believed to be

reliable. No representation or warranty, expressed or implied, is made by BNI SEKURITAS or any other member of the BNI Group,

including any other member of the BNI Group from whom this document may be received, as to the accuracy or completeness

of the information contained herein. All opinions and estimates in this report constitute our judgment as of this date and are

subject to change without notice.

This report has been prepared by BNI Sekuritas. REQUIRED DISCLOSURES BEGIN ON THE LAST PAGE.

Anda mungkin juga menyukai

- Pergerakan Valuasi Saham LQ45 Tahun 2021 - 030921Dokumen1 halamanPergerakan Valuasi Saham LQ45 Tahun 2021 - 030921indramaBelum ada peringkat

- Pergerakan Valuasi Saham LQ45Dokumen1 halamanPergerakan Valuasi Saham LQ45Kang Na'im Tutur KenconoBelum ada peringkat

- Pergerakan Valuasi Saham LQ45 Tahun 2021 - 061621Dokumen1 halamanPergerakan Valuasi Saham LQ45 Tahun 2021 - 061621indramaBelum ada peringkat

- Reksa Dana Astrodeks - LQ45 - AE A12Dokumen6 halamanReksa Dana Astrodeks - LQ45 - AE A12Indri Liftiany Travelin YunusBelum ada peringkat

- 5 Lamp Peng-00018-Bei Pop - Bisnis-27 - Jan 2023 MinorDokumen2 halaman5 Lamp Peng-00018-Bei Pop - Bisnis-27 - Jan 2023 Minornabiel soheerBelum ada peringkat

- 2 Lamp Peng-00210-BEI POP - LQ45 - Jul 2021 MayorDokumen4 halaman2 Lamp Peng-00210-BEI POP - LQ45 - Jul 2021 MayorRisyep HidayatullahBelum ada peringkat

- 1 Lamp Peng-00210-BEI POP - IDX30 - Jul 2021 MayorDokumen3 halaman1 Lamp Peng-00210-BEI POP - IDX30 - Jul 2021 MayorRisyep HidayatullahBelum ada peringkat

- Data Fundamental PBVu1 PERu10 DERu1 EVEBDu10Dokumen2 halamanData Fundamental PBVu1 PERu10 DERu1 EVEBDu10Wildan MuliawanBelum ada peringkat

- 1 Lamp Peng-00100-BEI POP - IDX30 - Apr 2022 MinorDokumen2 halaman1 Lamp Peng-00100-BEI POP - IDX30 - Apr 2022 MinorRaden AbimanyuBelum ada peringkat

- HASIL INTAN FixDokumen43 halamanHASIL INTAN FixNero AngeloBelum ada peringkat

- Lampiran TabulasiDokumen11 halamanLampiran TabulasiNero AngeloBelum ada peringkat

- LQ45 Konstituen Agustus-JanuariDokumen2 halamanLQ45 Konstituen Agustus-Januaricekbardi cekbardiBelum ada peringkat

- 2 Lamp Peng-00184-BEI POP - LQ45 - Juli 2022 MayorDokumen4 halaman2 Lamp Peng-00184-BEI POP - LQ45 - Juli 2022 MayorAnanta BayuBelum ada peringkat

- 1 Lamp Peng-00018-Bei Pop - Idx30 - Jan 2023 MayorDokumen3 halaman1 Lamp Peng-00018-Bei Pop - Idx30 - Jan 2023 MayorhayoloBelum ada peringkat

- DATA PerusahaanDokumen13 halamanDATA PerusahaantiresmikeBelum ada peringkat

- Fuji Puteri Robia - 4122423110043 - Uas Manajemen Keuangan)Dokumen22 halamanFuji Puteri Robia - 4122423110043 - Uas Manajemen Keuangan)fuji putriBelum ada peringkat

- 2 Lamp Peng-00018-BEI POP - LQ45 - Jan 2023 MayorDokumen4 halaman2 Lamp Peng-00018-BEI POP - LQ45 - Jan 2023 Mayornabiel soheerBelum ada peringkat

- INDEKSINVESTOR33Dokumen1 halamanINDEKSINVESTOR33annisa nurrBelum ada peringkat

- Data Fundamental 1.0.1Dokumen34 halamanData Fundamental 1.0.1Wildan MuliawanBelum ada peringkat

- SahamDokumen8 halamanSahamAngkat Prasetya Abdi NegaraBelum ada peringkat

- 4. Feb 22 - Ags 2022Dokumen3 halaman4. Feb 22 - Ags 2022lz.andhika.auliaBelum ada peringkat

- Saham Saham BluechipDokumen9 halamanSaham Saham BluechipHasyim Al-MakianyBelum ada peringkat

- 5 Lamp Peng-00045 - Srikehati - Feb 2022 MinorDokumen2 halaman5 Lamp Peng-00045 - Srikehati - Feb 2022 Minorannisa nurrBelum ada peringkat

- KAPASITASI PASAR SAHAM INDONESIADokumen18 halamanKAPASITASI PASAR SAHAM INDONESIASiiven ShirokajiBelum ada peringkat

- 5. Ags 22 - Feb 2023Dokumen3 halaman5. Ags 22 - Feb 2023lz.andhika.auliaBelum ada peringkat

- Bab IDokumen10 halamanBab IsenjabutuhmentariBelum ada peringkat

- Investor 33Dokumen50 halamanInvestor 33Aisyah az zahroBelum ada peringkat

- KAPITALISASI PASAR 2013Dokumen32 halamanKAPITALISASI PASAR 2013vinaBelum ada peringkat

- 6 Lamp Peng-00023-BEI POP - SMinfra18 - Jan 2021 - MinorDokumen2 halaman6 Lamp Peng-00023-BEI POP - SMinfra18 - Jan 2021 - MinorIndahkumalaBelum ada peringkat

- Analisis Kinerja PerusahaanDokumen3 halamanAnalisis Kinerja Perusahaanabdul azisBelum ada peringkat

- IDX30-45-80 EVALUASIDokumen10 halamanIDX30-45-80 EVALUASIRisyep Hidayatullah100% (1)

- Kelompok 10 Analisa Laporan KeuangannnDokumen19 halamanKelompok 10 Analisa Laporan KeuangannnZena MatondangBelum ada peringkat

- Kelompok 10 Analisa Laporan Keuangannn (Revisi)Dokumen26 halamanKelompok 10 Analisa Laporan Keuangannn (Revisi)Zena MatondangBelum ada peringkat

- Kelompok 10 Analisa Laporan KeuangannnDokumen26 halamanKelompok 10 Analisa Laporan KeuangannnZena MatondangBelum ada peringkat

- 2023 DataUTS Muhammad Nabil FaidDokumen34 halaman2023 DataUTS Muhammad Nabil Faidnabillfaid101Belum ada peringkat

- Bisnis Indonesia - 28 Juni 2021Dokumen25 halamanBisnis Indonesia - 28 Juni 2021Harsono KusumaBelum ada peringkat

- ISSI EVALUASI MINOR 2022Dokumen20 halamanISSI EVALUASI MINOR 2022annisa nurrBelum ada peringkat

- Lengkap SahamDokumen70 halamanLengkap SahamUlfa ShaenaBelum ada peringkat

- PKH2023Dokumen5 halamanPKH2023Syahroell SyawallBelum ada peringkat

- Rekapitulasi Data Koperasi Per 31 Desember 2021Dokumen1 halamanRekapitulasi Data Koperasi Per 31 Desember 2021Richard ManahaBelum ada peringkat

- 7 Lamp Peng-00018-BEI POP SMinfra18 - Jan 2023 - MinorDokumen2 halaman7 Lamp Peng-00018-BEI POP SMinfra18 - Jan 2023 - MinorRosma Kabatia RitongaBelum ada peringkat

- Evaluasi Indeks JII, JII70, IDX-MES BUMN 17, dan ISSIDokumen24 halamanEvaluasi Indeks JII, JII70, IDX-MES BUMN 17, dan ISSIAnggraieniBelum ada peringkat

- KOMPAS100-2022Dokumen6 halamanKOMPAS100-2022IndahkumalaBelum ada peringkat

- Maulidya Sukma Dewi (195020400111026) Membandingkan Tren SahamDokumen3 halamanMaulidya Sukma Dewi (195020400111026) Membandingkan Tren SahamMAULIDYA SUKMA DEWIBelum ada peringkat

- 6. Feb 23 - Ags 2023Dokumen3 halaman6. Feb 23 - Ags 2023lz.andhika.auliaBelum ada peringkat

- IDX80FASTDokumen5 halamanIDX80FASTmoeslovBelum ada peringkat

- 3. Ags 21 - Feb 2022Dokumen9 halaman3. Ags 21 - Feb 2022lz.andhika.auliaBelum ada peringkat

- Kapitalisasi Pasar 2016Dokumen20 halamanKapitalisasi Pasar 2016vinaBelum ada peringkat

- Revisi Objek PenelitianDokumen11 halamanRevisi Objek PenelitiantiresmikeBelum ada peringkat

- 324, KPD SDM PKH SELINDO, Pendampingan Penyaluran Bansos PKHDokumen5 halaman324, KPD SDM PKH SELINDO, Pendampingan Penyaluran Bansos PKHuwak anepBelum ada peringkat

- 23 ProdJagungDokumen1 halaman23 ProdJagungDwi AriBelum ada peringkat

- Contoh Tabulasi Untuk Data SkripsiDokumen5 halamanContoh Tabulasi Untuk Data Skripsicoconut edensor100% (1)

- KINERJADokumen16 halamanKINERJADicky ArdiBelum ada peringkat

- Bab IDokumen15 halamanBab IsmedizpesorBelum ada peringkat

- Peng-00261 Evaluasi IDX30 LQ45 IDX80 KOMPAS100 PEFINDO25 BISNIS-27 MNC36 SMinfra18Dokumen18 halamanPeng-00261 Evaluasi IDX30 LQ45 IDX80 KOMPAS100 PEFINDO25 BISNIS-27 MNC36 SMinfra18Ageng MargyatnoBelum ada peringkat

- Kinerja Segmen SME 16-06-2021 v1Dokumen76 halamanKinerja Segmen SME 16-06-2021 v1PEJUANG HIJRAHBelum ada peringkat

- Prevalensi Depresi di IndonesiaDokumen70 halamanPrevalensi Depresi di IndonesiaIrha riandi20Belum ada peringkat

- Kinerja Jabar 07072023Dokumen1 halamanKinerja Jabar 07072023Eko wahyudinBelum ada peringkat

- IDX30-EVALUASIDokumen18 halamanIDX30-EVALUASIRosma Kabatia RitongaBelum ada peringkat