RHB Report Ind - Macro - Export Momentum Likely To Decelerate in 2h22 - 20220916 - RHB - Bahasa 3957277133361243963241922a7f92 - 1663514900

Diunggah oleh

AldiJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

RHB Report Ind - Macro - Export Momentum Likely To Decelerate in 2h22 - 20220916 - RHB - Bahasa 3957277133361243963241922a7f92 - 1663514900

Diunggah oleh

AldiHak Cipta:

Format Tersedia

Economics View

16 September 2022

Global Economics & Market Strategy

Indonesia: Momentum Ekspor Akan Melambat Di Semester-II

Senior Economist

Tautan ke laporan asli: https://tinyurl.com/2euxfjcb Barnabas Gan

+65 6320 0804

Kami mempertahankan asumsi kami akan perlambatan momentum barnabas.gan@rhbgroup.com

ekspor di Semester-II yang disebabkan oleh harga komoditas yang

stabil-cenderung-turun seiring dengan melambatnya aktivitas

perdagangan dunia.

Kami tidak merubah outlook pertumbuhan GDP tahun 2022-23

sebesar 5,0% dan 4,1%. Selain itu, melambatnya momentum ekspor

Indonesia konsisten dengan tren ekspor mayoritas negara Asia

lainnya.

Ekspor Indonesia bulan Agustus ’22 melambat ke 30,2% YoY, meski

melebihi asumsi Bloomberg di 19,9%. Kami tidak merubah asumsi

nominal ekspor dan impor tahun 2022 yang masih tumbuh ke 30%

YoY dan 25%.

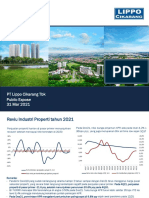

Figure 1: Momentum ekspor kembali naik namun masih Figure 2: Momentum di ekspor komoditas terlihat

dibawah level bulan April ‘22 tertekan sejak awal tahun

Exports Imports Agriculture Manufacturing

15% Refined Oil Crude Oil

40%

10% 35%

30%

MoM SA (3MMA)

MoM SA (3MMA)

5% 25%

20%

0% 15%

10%

5%

-5% 0%

-5%

-10% -10%

-15%

Jul-21

Jul-22

May-21

May-22

Mar-21

Sep-21

Nov-21

Mar-22

Jan-21

Jan-22

-15%

Jul-22

Jul-20

Jul-21

Apr-20

Apr-21

Apr-22

Jan-20

Jan-21

Jan-22

Oct-20

Oct-21

Source: CEIC, RHB Economics & Market Strategy Source: CEIC, RHB Economics & Market Strategy

See important disclosures at the end of this report

Market Dateline / PP 19489/05/2019 (035080) 1

Indonesia Economics View

16 September 2022

Perlambatan pertumbuhan ekspor dalam dua bulan berturut-turut

Kami perkirakan momentum ekspor dapat melambat di Semester-II yang disebabkan oleh stabilnya harga

komoditas ditengah penurunan aktivitas perdagangan dunia. Harga komoditas terus turun dalam dua minggu

pertama di September ’22, seperti CPO (-12,7% YoY), metal1 (-8,1% YoY) dan gas alam (-6,2% YoY), meskipun batubara

tetap di level yang cukup tinggi (+12,6% YoY) seiring dengan harga energi yang masih tinggi. Indonesia juga menurunkan

harga acuan CPO ke USD846,32/ton di bulan September (1H22: USD929,66/ton) seiring dengan penurunan harga CPO

dunia.

Kami tidak merubah estimasi GDP tahun 2022-23 sebesar 5,0% dan 4,1%. Kami menaikkan asumsi laju inflasi dan

inflasi ini tahun 2022 sebesar 6,0% (dari 4,0%) dan 4,0% (dari 3,0%) dan tahun 2023 sebesar 7,0% (dari 2,4%) dan 4,5%

(dari 2,0%) seiring dengan kenaikan harga bahan bakar. Kami juga merubah asumsi BI rate tahun 2023 ke 4,75% (dari

4,50%) dan tidak merubah asumsi tahun 2022 di 4,25% (saat ini 3,75%).

Melambatnya ekspor Indonesia masih sesuai dengan tren mayoritas negara Asia lainnya. Pada bulan Juli ’22,

ekspor Thailand turun 1,4% YoY, sementara ekspor bukan migas Singapura naik 7,0% YoY (vs +29,2% YoY di

Nopember ’21). Kami juga perkirakan momentum ekspor Malaysia akan ikut melambat di Semester-II (Juli ’22: -8,2%

MoM). Lebih detail bisa melihat laporan kami sebelumnya.2 Selain itu, Pemerintah Indonesia dikabarkan sedang mengkaji

penerapan pajak nikel di 2022 untuk meningkatkan kapasitas pengolahan nikel dalam negeri, yang jika diterapkan akan

membatasi tingkat ekspor nikel dari Indonesia.

Impor akan tetap tinggi seiring dengan masuknya modal asing, tingkat konsumsi dan pengiriman barang

setengah jadi. Momentum impor tetap solid di 3,1% MoM (Juli ’22: 3,8%) yang mayoritas didorong oleh impor barang

modal yang naik USD543,9 juta (18,1% MoM), diikuti oleh konsumsi yang naik ke USD202,3 juta (12,2% MoM) dan dan

barang setengah jadi sebesar USD59,2 juta (0,3% MoM). Meski nilai ekspor naik ke level tertinggi di USD27,9 miliar,

pertumbuhan ekspor mulai melambat ke 1,9% MoM (vs Maret ’22: +19,5% MoM). Ekspor bahan bakar mineral mencatat

penurunan terbesar dari semua kategori dengan turun 6,7% MoM (USD368,5 juta).

Ekspor Indonesia melambat dalam dua bulan berturut-turut ke 30,2% YoY di bulan Agustus ’22, meski melebihi

perkiraan Bloomberg di 19,9%. Hal ini berdampak pada surplus neraca dagang sebesar USD5,76 miliar di bulan

Agustus ’22, naik dari surplus USD4,22 miliar di bulan Juli ’22. Ekspor non migas mencatat porsi yang cukup besar dari

total ekspor di USD26,2 miliar (+28,4% YoY), jika dibandingkan dengan ekspor migas sebesar USD1,7 miliar (+64,5%

YoY). Secara kumulatif, ekspor bulan Januari-Agustus ’22 mencapai USD194,6 miliar (+35,4% YoY), sementara ekspor

non migas mencapai USD183,73 miliar (+35,2% YoY). Kami mempertahankan outlook nominal ekspor dan impor yang

akan tumbuh 30% YoY dan 25% YoY di tahun 2022.

1

Metals consist of average prices of copper, nickel, iron ore, zinc, aluminum, lead and tin

2

RHB Bank Berhad, Trade Performance Began to Show Signs of Slowdown, 19 August 2022

2

RHB Bank Berhad, NODX Momentum to Slow In 2H22, 17 August 2022

2

RHB Bank Berhad, Keeping 2022 GDP Forecast at 3.0%, 1 September 2022

See important disclosures at the end of this report

Market Dateline / PP 19489/05/2019 (035080) 2

Indonesia Economics View

16 September 2022

Disclaimer Economics and Market Strategy

This report is prepared for information purposes only by the Economics and Market Strategy division within RHB Bank Berhad and/or its subsidiaries,

related companies and affiliates, as applicable (“RHB”).

All research is based on material compiled from data considered to be reliable at the time of writing, but RHB does not make any representation or

warranty, express or implied, as to its accuracy, completeness or correctness.

Neither this report, nor any opinion expressed herein, should be construed as an offer to sell or a solicitation of an offer to acquire any securities or

financial instruments mentioned herein. RHB (including its officers, directors, associates, connected parties, and/or employees) accepts no liability

whatsoever for any direct or consequential loss arising from the use of this report or its contents. This report may not be reproduced, distributed or

published by any recipient for any purpose without prior consent of RHB and RHB (including its officers, directors, associates, connected parties, and/or

employees) accepts no liability whatsoever for the actions of third parties in this respect.

Recipients are reminded that the financial circumstances surrounding any company or any market covered in the reports may change since the time of

their publication. The contents of this report are also subject to change without any notification.

This report does not purport to be comprehensive or to contain all the information that a prospective investor may need in order to make an investment

decision. The recipient of this report is making its own independent assessment and decisions regarding any securities or financial instruments

referenced herein. Any investment discussed or recommended in this report may be unsuitable for an investor depending on the investor’s specific

investment objectives and financial position. The material in this report is general information intended for recipients who understand the risks of investing

in financial instruments. This report does not take into account whether an investment or course of action and any associated risks are suitable for the

recipient. Any recommendations contained in this report must therefore not be relied upon as investment advice based on the recipient's personal

circumstances. Investors should make their own independent evaluation of the information contained herein, consider their own investment objective,

financial situation and particular needs and seek their own financial, business, legal, tax and other advice regarding the appropriateness of investing in

any securities or the investment strategies discussed or recommended in this report.

RHB (including its respective directors, associates, connected parties and/or employees) may own or have positions in securities or financial instruments

of the company(ies) covered in this research report or any securities or financial instruments related thereto, and may from time to time add to, or

dispose off, or may be materially interested in any such securities or financial instruments. Further, RHB does and seeks to do business with the

company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities

or financial instruments of such company(ies), may sell them or buy them from customers on a principal basis and may also perform or seek to perform

significant banking, advisory or underwriting services for or relating to such company(ies), as well as solicit such banking, advisory or other services

from any entity mentioned in this research report.

RHB (including its respective directors, associates, connected parties and/or employees) do not accept any liability, be it directly, indirectly or

consequential losses, loss of profits or damages that may arise from any reliance based on this report or further communication given in relation to this

report, including where such losses, loss of profits or damages are alleged to have arisen due to the contents of such report or communication being

perceived as defamatory in nature.

KUALA LUMPUR JAKARTA

RHB Investment Bank Bhd PT RHB Sekuritas Indonesia

Level 3A, Tower One, RHB Centre Revenue Tower, 11th Floor, District 8 - SCBD

Jalan Tun Razak Jl. Jendral Sudirman Kav 52-53

Kuala Lumpur 50400 Jakarta 12190

Malaysia Indonesia

Tel : +603 9280 8888 Tel : +6221 509 39 888

Fax : +603 9200 2216 Fax : +6221 509 39 777

SINGAPORE BANGKOK

RHB Bank Berhad (Singapore branch) RHB Securities (Thailand) PCL

90 Cecil Street 10th Floor, Sathorn Square Office Tower

#04-00 RHB Bank Building 98, North Sathorn Road, Silom

Singapore 069531 Bangrak, Bangkok 10500

Thailand

Tel: +66 2088 9999

Fax :+66 2088 9799

See important disclosures at the end of this report

Market Dateline / PP 19489/05/2019 (035080) 3

Anda mungkin juga menyukai

- Form Analisis Rasio Lap Keunagan Kop PLDokumen24 halamanForm Analisis Rasio Lap Keunagan Kop PLMaulana MalikBelum ada peringkat

- Distribusi Kecelakaan Kerja Menurut Area KerjaDokumen2 halamanDistribusi Kecelakaan Kerja Menurut Area KerjaruriBelum ada peringkat

- Buku Absen Siswa PDFDokumen3 halamanBuku Absen Siswa PDFayu ningtiasBelum ada peringkat

- Buku Absen SiswaDokumen3 halamanBuku Absen SiswaAyuTyas100% (1)

- Buku Absen SiswaDokumen4 halamanBuku Absen Siswaayu ningtiasBelum ada peringkat

- Buku Absen SiswaDokumen4 halamanBuku Absen Siswaayu ningtiasBelum ada peringkat

- Buku Absen SiswaDokumen4 halamanBuku Absen Siswaayu ningtiasBelum ada peringkat

- Buku Absen SiswaDokumen3 halamanBuku Absen SiswaArtha DowiBelum ada peringkat

- Buku Absen SiswaDokumen3 halamanBuku Absen SiswaayiBelum ada peringkat

- Buku Absen SiswaDokumen3 halamanBuku Absen Siswayuliana100% (1)

- Buku Absen SiswaDokumen3 halamanBuku Absen Siswafidaagustin842Belum ada peringkat

- Kinerja Lab NewDokumen4 halamanKinerja Lab Newrukiah kuchikiBelum ada peringkat

- Buku Absen SiswaDokumen3 halamanBuku Absen SiswaacoBelum ada peringkat

- Kasubdit - TB Saat Pandemi - Webinar LogistikDokumen33 halamanKasubdit - TB Saat Pandemi - Webinar LogistikAulia PratiwiBelum ada peringkat

- ALUR TPT THP 5Dokumen11 halamanALUR TPT THP 5minien MiniBelum ada peringkat

- Alur TPTDokumen12 halamanAlur TPTTiti YulianaBelum ada peringkat

- Tugas Personal Ke - (2) Minggu 7: Pt. Abc PT - Def Return Probabilitas Return ProbabilitasDokumen3 halamanTugas Personal Ke - (2) Minggu 7: Pt. Abc PT - Def Return Probabilitas Return ProbabilitassallyBelum ada peringkat

- 03 - Paparan KLHK Ujang Solihin Sidik Prinsip PS Berkelanjutan - BRINDokumen15 halaman03 - Paparan KLHK Ujang Solihin Sidik Prinsip PS Berkelanjutan - BRINErik Fitra AdityaBelum ada peringkat

- Development Priorities KCPDokumen1 halamanDevelopment Priorities KCP459973Belum ada peringkat

- Uts LC 0921Dokumen4 halamanUts LC 0921Muhtar RasyidBelum ada peringkat

- Multifinance Outlook 2023-Update1.1-1Dokumen12 halamanMultifinance Outlook 2023-Update1.1-1syabeh qokaBelum ada peringkat

- Materi Microteaching Pengantar PerpajakanDokumen21 halamanMateri Microteaching Pengantar PerpajakanAlberd Boi SamosirBelum ada peringkat

- Kebijakan Program TBC (Pertemuan DPPM 7 Oktober 2021)Dokumen24 halamanKebijakan Program TBC (Pertemuan DPPM 7 Oktober 2021)Yuliana Nina YuanitaBelum ada peringkat

- ANALISIS SENARAI SEMAK KEPERLUAN MURID T5-EditedDokumen31 halamanANALISIS SENARAI SEMAK KEPERLUAN MURID T5-EditedAzlina OmarBelum ada peringkat

- Pembelajaran IPS Abad 21Dokumen35 halamanPembelajaran IPS Abad 21Pratama Auliyadi Saputra100% (2)

- Tugas Ekonomi Makro Ii Winata Pricilla BR SurbaktiDokumen18 halamanTugas Ekonomi Makro Ii Winata Pricilla BR SurbaktiChristy Amelia DamanikBelum ada peringkat

- Pembelajaran Geografi Abad 21Dokumen23 halamanPembelajaran Geografi Abad 21Vitho VithoBelum ada peringkat

- Pe LPCKDokumen14 halamanPe LPCKClips CINEMABelum ada peringkat

- Mambaus Sholihin 2Dokumen12 halamanMambaus Sholihin 2Irvan SafiiBelum ada peringkat

- Panitia Sejarah: Hari: Khamis Masa: 2.30 Petang TARIKH: 27 OKT 2022 Bilik Mesyuarat S.A.I.RDokumen2 halamanPanitia Sejarah: Hari: Khamis Masa: 2.30 Petang TARIKH: 27 OKT 2022 Bilik Mesyuarat S.A.I.RNOOR ASHARITA FATIMAH BINTI AHMAD MoeBelum ada peringkat

- 2H22 - Materi Pubex Live PT Bank Mandiri (Persero) TBKDokumen14 halaman2H22 - Materi Pubex Live PT Bank Mandiri (Persero) TBKL Rsy LeeBelum ada peringkat

- DP-07 Rancangan Pelaksanaan Diklat Daring Dan LuringDokumen45 halamanDP-07 Rancangan Pelaksanaan Diklat Daring Dan LuringMarsi BaniBelum ada peringkat

- Tabel IkmDokumen24 halamanTabel IkmPuskesmas KarangtengahBelum ada peringkat

- Alur Diagnosis TB RO Dan Penguatan Mekanisme Transportasi - 091220-RevDokumen20 halamanAlur Diagnosis TB RO Dan Penguatan Mekanisme Transportasi - 091220-RevDhany NoonaBelum ada peringkat

- Materisosialisasikebijakaneksporjatim 31 Maret 2021Dokumen41 halamanMaterisosialisasikebijakaneksporjatim 31 Maret 2021Game MahenBelum ada peringkat

- Tugas StatistikaDokumen2 halamanTugas StatistikaAbdianor Teknik mesinBelum ada peringkat

- 06-Jadual 5 Bi.2022Dokumen1 halaman06-Jadual 5 Bi.2022Sirajun MuniraBelum ada peringkat

- Paparan EvaluasiDokumen24 halamanPaparan EvaluasiotongBelum ada peringkat

- Hauling Patrol Agustus Subcont 2022-5Dokumen1 halamanHauling Patrol Agustus Subcont 2022-5Azis RoisBelum ada peringkat

- Proposal Teknis Honda - 5!9!2023Dokumen10 halamanProposal Teknis Honda - 5!9!2023mawar melatiBelum ada peringkat

- BI - Perekonomian Riau - Januari 2024Dokumen21 halamanBI - Perekonomian Riau - Januari 2024Herman BoedoyoBelum ada peringkat

- Imunisasi Sapta Mulia JuliDokumen1.181 halamanImunisasi Sapta Mulia JuliRoad AndiBelum ada peringkat

- Buku Absen Siswadocx1Dokumen3 halamanBuku Absen Siswadocx1harinrin23Belum ada peringkat

- BI Prospek Ekonomi DKI - Perspektif MillenialDokumen21 halamanBI Prospek Ekonomi DKI - Perspektif MillenialNazri DiridhoiBelum ada peringkat

- Transisi, Bonus Dan Keragaman DemografiDokumen59 halamanTransisi, Bonus Dan Keragaman DemografiJulius HabibiBelum ada peringkat

- Lporan Imunisasi RUTIN PKM WayDente 2017Dokumen1.098 halamanLporan Imunisasi RUTIN PKM WayDente 2017Benni PMRBelum ada peringkat

- Att2 - Form-Self-Assessment-TKDN - SAMPLE (Only Reference)Dokumen6 halamanAtt2 - Form-Self-Assessment-TKDN - SAMPLE (Only Reference)Henri Purnomo SinagaBelum ada peringkat

- Software 2022Dokumen955 halamanSoftware 2022Dilly OktavianiBelum ada peringkat

- Update Kebijakan Perubahan IK Dan TPT Berdasarkan Surat Edaran - Pelatihan Wasor KabkotaDokumen42 halamanUpdate Kebijakan Perubahan IK Dan TPT Berdasarkan Surat Edaran - Pelatihan Wasor KabkotaYundri PradianBelum ada peringkat

- FA Fenton Growth Chart 0711 Perempuan FINAL-2Dokumen10 halamanFA Fenton Growth Chart 0711 Perempuan FINAL-2Rnch HhBelum ada peringkat

- FA Fenton Growth Chart 0711 Perempuan FINALDokumen10 halamanFA Fenton Growth Chart 0711 Perempuan FINALninaBelum ada peringkat

- 2software Pws Dinkes Kota Ternate THN 2020Dokumen993 halaman2software Pws Dinkes Kota Ternate THN 2020Hasyim Al-MakianyBelum ada peringkat

- Software Pws PKM 2022 - Master PKM LatuhalatDokumen964 halamanSoftware Pws PKM 2022 - Master PKM Latuhalatyustina lettyBelum ada peringkat

- Pmi 2020Dokumen1 halamanPmi 2020Olivia AngelyneBelum ada peringkat

- Performance 1Dokumen17 halamanPerformance 1Widhi WahyudhiBelum ada peringkat

- Software Pws Imunisasi PKM Sarudu 2 2022Dokumen1.092 halamanSoftware Pws Imunisasi PKM Sarudu 2 2022Nur LindaBelum ada peringkat

- Waktu Tunggu Rawat Jalan Okt 2019Dokumen3 halamanWaktu Tunggu Rawat Jalan Okt 2019bahrulBelum ada peringkat

- Gravik Program Hiv 2019Dokumen3 halamanGravik Program Hiv 2019Karlina. amkBelum ada peringkat

- F748e28624 Fab7c59dcbDokumen2 halamanF748e28624 Fab7c59dcbAldiBelum ada peringkat

- Dewi 1Dokumen2 halamanDewi 1AldiBelum ada peringkat

- A6dfea5ca5 1841c0705fDokumen25 halamanA6dfea5ca5 1841c0705fAldiBelum ada peringkat

- Pricelist (Olbren)Dokumen1 halamanPricelist (Olbren)AldiBelum ada peringkat