Cadangan Jawapan TUTORIAL INVENTORI

Diunggah oleh

NUR AFIQAH IMAN BINTI BADLI SHAHJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cadangan Jawapan TUTORIAL INVENTORI

Diunggah oleh

NUR AFIQAH IMAN BINTI BADLI SHAHHak Cipta:

Format Tersedia

FAKULTI EKONOMI & PENGURUSAN

PUSAT PENGAJIAN PERAKAUNAN

EPPA2013 PERAKAUNAN DAN PELAPORAN KEWANGAN 1

SEMESTER 1 SESI 2021/2022

TUTORIAL 4: INVENTORI (Cadangan jawapan)

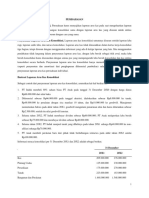

SOALAN 1

Bahagian

a) (i) MDKD – kos pengiraan inventori

KBDJ = (200 X 20) + (500 X 21) + (300 X 22) = 21,100

INVENTORI AKHIR (2,200 – 1,000) – 1,200 UNIT

= (300X22) + (400 X 23) + (500 X 24) = 27,800

INVENTORI AKHIR = KBSDJ - KBDJ

Tarikh KBDJ – inventori dijual

Jun

13 200 x 20 4,000

100 x 21 2,100

15 200 x 21 4,200

22 200 x 21 4,200

100 x 22 2,200

31 200 x 22 4,400

Jumlah 1,000 unit 21,100

Inventori akhir (2,200 – 1,000 = 1,200)

300 x 22 6,600

400 x 23 9,200

500 x 24 12,000

Jumlah 1,200 unit 27,800

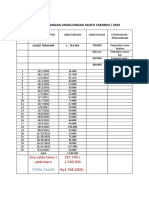

a) (ii) Kaedah Purata Wajaran

Tarikh Unit Kos KBSDJ KBDJ Baki akhir

JUN seunit

1 (baki awal) 200 20 4,000

5 500 21 10,500

13 700 14,500 @ 20.71 300 x 20.71

15 200 x 20.71 200x 2.71

Baki dibawa 200 20.71 4,142

18 600 22 13,200

22 400 23 9,200 300 x 22.12

1200 26,542 @ 22.12

900 x 22.12

Baki dibawa 900 21.12 19,908

29 500 24 12,000

30 1400 31,908 @ 22.79 200 x 22.79 1,200 x 22.79

21,549 27,348

b)

Inventori awal 200 x 20 4,000

Belian 500 x 21 10,500

600 x 22 13,200

400 x 23 9,200

500 x 24 12,000 44,900

Kos barang boleh dijual 48,900 (1)

Jualan 1,000 x35 35,000

Tolak: Untung kasar (30% x 35,000) (10,500)

KBDJ (24,500) (2)

Anggaran inventori 24,400 (3)

Katakan lah, nilai inventori yang boleh diselamatkan dari kebakaran adalah RM10,00.

Oleh itu, kirakan kerugian dari kebakaran.

Kerugian dari kebakaran = 24,400 – 10,000 = 14,400.

Bahagian B (5 markah)

(a) (i) Rugi

Dt Rugi penurunan NBRB 12,000 (82,000 -70,000)

Kt Peruntukan penurunan NBRB 12,000

(a) (ii) KBDJ

Dt Kos barang dijual 12,000 (82,000 -72,000)

Kt Peruntukan penurunan NBRB 12,000

(b)

Dt Peruntukan penurunan NBRB 4,000 (74,000 – 70,000)

Kt Pemulihan kerugian inventori 4,000

SOALAN 2

BAHAGIAN A

1. Kaedah MDKD

Perniagaan Kencana

Jadual Pengiraan Inventori (MDKD)

30 Sept 2019

2019 Unit Kos seunit (RM) Jumlah Kos

15 Sept 1,800 23 41,400

16 Ogos 700 22 15,400

30 Sept 2500 56,800

2. Kaedah Purata Wajaran

Perniagaan Kencana

Jadual Pengiraan Inventori (Purata Wajaran)

30 Sept 2019

2019 Unit Kos seunit (RM) Jumlah Kos

Inventori awal 1,600 18 28,800

5 Julai 2,600 20 52,000

25 Julai 2,400 21 50,400

16 Ogos 1,000 22 22,000

15 September 1,800 23 41,400

9,400 194,600

Purata wajaran 20.70

(194,600/9,400)

Inventori akhir 2,500 20.70 51,750

BAHAGIAN B

a)

i. Dt Rugi penurunan NBRB/KBDJ 35,000

Kt Peruntukan penurunan NBRB 35,000

ii. Dt Peruntukan penurunan NBRB 5,000 (35,000 – 30,000)

Kt Pemulihan kerugian inventori 5,000

b) PKK 31 DISEMBER 2020

Aset semasa:

INVENTORI 615,000

(-) PERUNTUKAN PENURUNAN NILAI (30,000)

NBRB 585,000

c)

i. perbezaan inventori berbanding asset yg lain - Yang dipegang untuk dijual dalam operasi

normal perniagaan, dalam proses pengeluaran untuk dijual, atau dalam bentuk bahan atau

bekalan yang digunakan dalam proses pengeluaran atau pemberian perkhidmatan. Aset yang

lain seperti PPE dipegang bukan untuk tujuan dijual semula

ii. inventori pembarangan terdiri dari barang niaga manakala perkilangan terdiri daripada bahan

mentah, kDP dan barang siap.

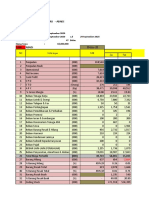

SOALAN 3

a) Sistem inventori berterusan

(i) MDKD

PCK

Jadual Pengiraan Inventori (MDKD)

30 Sept 2019

2019 Unit Kos seunit (RM) Jumlah Kos

29 Sept 500 3.13 1,565

21 Sept 300 3.30 990

30 Sept 800 2,555

(ii) Purata Wajaran

Belian Jualan Baki

Tarikh Unit Kos seunit Unit Kos seunit Unit Kos seunit Jumlah

(RM) (RM) (RM)

Sept 1 600 3.00 1,800

3 500 3.00 100 3.00 300

4 1,500 3.04 1,600 3.04 4,860

8 800 3.20 2,400 3.09 7,420

9 1,300 3.09 1,100 3.09 3,401

11 600 3.09 500 3.09 1,546

13 1,200 3.25 1,700 3.20 5,446

21 700 3.30 2,400 3.23 7,756

23 1,200 3.23 1,200 3.23 3,878

27 900 3.23 300 3.23 969

29 500 3.13 800 3.17 2,534

Inventori

akhir

b) Catatan pelarasan

31/12/2017

Dt KBDJ 3,500

Kt Peruntukan penurunan nilai inventori 3,200 (42,000 – 38,500)

31/12/2018

Dt Peruntukan penurunan nilai inventori 1,500

Kt KBDJ 1,500 [3,500-(48,500-46,500)]

c) Permasalahan penggunaan terendah antara kos dan NBRB

1. A company recognizes decreases in the value of the asset and the charge to expense in the period

in which the loss in utility occurs—not in the period of sale.

2. Application of the rule results in inconsistency because a company may value the inventory at

cost in one year and at net realizable value in the next year.

3. LCNRV values the inventory in the statement of financial position conservatively, but its effect

on the income statement may or may not be conservative. Net income for the year in which a

company takes the loss is definitely lower. Net income of the subsequent period may be higher

than normal if the expected reductions in sales price do not materialize.

d) Maklumat yang perlu didedahkan

1) Accounting policies adopted in measuring inventories, including the cost formula used (weighted-

average, FIFO).

2) Total carrying amount of inventories and the carrying amount in classifications (merchandise,

production supplies, raw materials, work in progress, and finished goods).

3) Carrying amount of inventories carried at fair value less costs to sell.

4) Amount of inventories recognized as an expense during the period.

5) Amount of any write-down of inventories recognized as an expense in the period and the amount

of any reversal of write-downs recognized as a reduction of expense in the period.

6) Circumstances or events that led to the reversal of a write-down of inventories.

7) Carrying amount of inventories pledged as security for liabilities, if any.

Anda mungkin juga menyukai

- Akuntansi Biaya (L4-4, L4-5, S4-7)Dokumen6 halamanAkuntansi Biaya (L4-4, L4-5, S4-7)Leonita Mega Pratiwi100% (2)

- Likuidasi BertahapDokumen4 halamanLikuidasi BertahapRetno100% (1)

- Modul AKL 15 Penyusunan Laporan Keuangan Konsolidasian Dengan Entitas Anak Di Luar NegeriDokumen36 halamanModul AKL 15 Penyusunan Laporan Keuangan Konsolidasian Dengan Entitas Anak Di Luar NegeriPutri Diva ApsariBelum ada peringkat

- Contoh Jalan Beton - Dana DesaDokumen20 halamanContoh Jalan Beton - Dana DesaZidnaPamungkasAlAchirBelum ada peringkat

- Laporan Arus Kas KonsolidasiDokumen10 halamanLaporan Arus Kas KonsolidasiFachzsa ShafiraBelum ada peringkat

- Tugas 1 Akuntansi BiayaDokumen3 halamanTugas 1 Akuntansi Biayaindriana yuni astutiBelum ada peringkat

- Tugas Anggaran PT - Eti-AigatDokumen2 halamanTugas Anggaran PT - Eti-AigatAigat RoflitanBelum ada peringkat

- Skema Prinsip Perakaunan Kedah Kertas 2Dokumen17 halamanSkema Prinsip Perakaunan Kedah Kertas 2Pauziah abu hassanBelum ada peringkat

- Jawaban Uas Akmen 56Dokumen8 halamanJawaban Uas Akmen 56cheesecake.6Belum ada peringkat

- Ja Maret PDFDokumen2 halamanJa Maret PDFMastoha MastohaBelum ada peringkat

- Buku Kas UmumDokumen2 halamanBuku Kas UmumKamis twenty1022Belum ada peringkat

- Laporan Keuangan Lingkuungan Santo YakobusDokumen1 halamanLaporan Keuangan Lingkuungan Santo YakobusFranciska AFBelum ada peringkat

- Uas Manajemen KeuanganDokumen4 halamanUas Manajemen KeuanganwulansiusherengBelum ada peringkat

- Wa Nyai Belanja Modal LuncuranDokumen4 halamanWa Nyai Belanja Modal Luncuranpuskesmascidahuch2Belum ada peringkat

- TarkDokumen128 halamanTarkIrjum BudiBelum ada peringkat

- Paper BudgetingDokumen7 halamanPaper Budgetingzahwa HafizahBelum ada peringkat

- Uasmkii Rachel 322020035Dokumen9 halamanUasmkii Rachel 322020035AntoniusBelum ada peringkat

- Lamp SPH Air MinumDokumen10 halamanLamp SPH Air MinumJual AkunBelum ada peringkat

- Contoh Soal Pertemuan 3-Anggaran PenjualanDokumen6 halamanContoh Soal Pertemuan 3-Anggaran Penjualan23 Lenno GraciaBelum ada peringkat

- Tugas Akuntansi Nadia (11032200050)Dokumen2 halamanTugas Akuntansi Nadia (11032200050)NADIA INBelum ada peringkat

- Book 2Dokumen2 halamanBook 2Abdul MajidBelum ada peringkat

- Jawaban Ujian PPH Badan - Fauzan AkbarDokumen20 halamanJawaban Ujian PPH Badan - Fauzan AkbarFauzan AkbarBelum ada peringkat

- Jawaban Uts PeledakanDokumen9 halamanJawaban Uts PeledakanRezky KSBelum ada peringkat

- Jawaban Departementalisasi BOP Soal No. 1Dokumen1 halamanJawaban Departementalisasi BOP Soal No. 1Azi AvrilBelum ada peringkat

- Soal Hal. 508 (Chapter 10-Hoyle Et Al., 2021)Dokumen10 halamanSoal Hal. 508 (Chapter 10-Hoyle Et Al., 2021)Mutia Rizky Nurul MutifaBelum ada peringkat

- Rab Pindah NSC FixDokumen1 halamanRab Pindah NSC Fixcv hitaindoBelum ada peringkat

- AKL Kelompok 1Dokumen9 halamanAKL Kelompok 1Inka PurbaBelum ada peringkat

- Pelaporan Korporat Tugas 4Dokumen1 halamanPelaporan Korporat Tugas 4SyahputraBelum ada peringkat

- UAS AKM 1 Muhammad Arief PhonnaDokumen4 halamanUAS AKM 1 Muhammad Arief PhonnaArief Pho.naBelum ada peringkat

- Rab 2100.955Dokumen1 halamanRab 2100.955Kementerian Agama Kota PontianakBelum ada peringkat

- Contoh Soal Baf Dan BopDokumen10 halamanContoh Soal Baf Dan BopDio ChandraBelum ada peringkat

- Latihan Rekonsiliasi Fiskal 2022Dokumen8 halamanLatihan Rekonsiliasi Fiskal 2022marinaBelum ada peringkat

- Amelia Ayu Lestari - Laporan Kas KecilDokumen2 halamanAmelia Ayu Lestari - Laporan Kas KecilAcep Rian AmrillahBelum ada peringkat

- Khansa Ananda Triesdianto 2023150022 AKBI (PERSEDIAAN)Dokumen9 halamanKhansa Ananda Triesdianto 2023150022 AKBI (PERSEDIAAN)khansa.triesdiantoBelum ada peringkat

- Uts AnggaranDokumen15 halamanUts AnggaranDyta AisyahBelum ada peringkat

- Uas Praktikum Akm - Fitra Wijayanto 2021011068Dokumen5 halamanUas Praktikum Akm - Fitra Wijayanto 2021011068FITRA WijayantoBelum ada peringkat

- Cadangan Jawapan TUT PENGIKTIRAFAN HASILDokumen10 halamanCadangan Jawapan TUT PENGIKTIRAFAN HASILNUR AFIQAH IMAN BINTI BADLI SHAH0% (1)

- Tugas 1 Oprasional ManagementDokumen9 halamanTugas 1 Oprasional ManagementAde AndrianaBelum ada peringkat

- RAB Pekerjaan Fasad RS Mata Siantar 1Dokumen45 halamanRAB Pekerjaan Fasad RS Mata Siantar 1adeastonoBelum ada peringkat

- 44,470,000 36,752,300 7,717,700 SaldoDokumen1 halaman44,470,000 36,752,300 7,717,700 SaldoAmelia Poetri NadjuaBelum ada peringkat

- Audit Persediaan Menghitung Persediaan AkhirDokumen3 halamanAudit Persediaan Menghitung Persediaan AkhirDwi PutriAningrumBelum ada peringkat

- Forum - Erfan Satria Perdana - 55121110133Dokumen3 halamanForum - Erfan Satria Perdana - 55121110133Erfan SatriaBelum ada peringkat

- Dwi Amalia Rosyidah - Akuntansi B Sore - Kasus Bab 7Dokumen34 halamanDwi Amalia Rosyidah - Akuntansi B Sore - Kasus Bab 7dwi amaliaBelum ada peringkat

- (Financial Accounting Standard) PSAK 25 Dan PSAK 57 - AsinkronDokumen2 halaman(Financial Accounting Standard) PSAK 25 Dan PSAK 57 - Asinkronsiti maesarohBelum ada peringkat

- Akuntansi Menengah ADBI4335Dokumen5 halamanAkuntansi Menengah ADBI4335alfiyahBelum ada peringkat

- Dasar2 Akuntansi Part 2Dokumen13 halamanDasar2 Akuntansi Part 2joe himekaBelum ada peringkat

- NPM 27Dokumen5 halamanNPM 27Ginanjar Ahmad Yulhafizh KmBelum ada peringkat

- Likuidasi PersekutuanDokumen5 halamanLikuidasi Persekutuandinda ardiyaniBelum ada peringkat

- Jawaban KuisDokumen6 halamanJawaban KuisKadek Pranetha PrananjayaBelum ada peringkat

- Tugas Penggganti PresentasiDokumen12 halamanTugas Penggganti PresentasiNur dianaBelum ada peringkat

- Rkas - 69899719 SMK Pgri SempuDokumen2 halamanRkas - 69899719 SMK Pgri SempuSmkpgri Sempu Bisa HebatBelum ada peringkat

- Soal KuisDokumen2 halamanSoal Kuiseliasinaga002Belum ada peringkat

- Ekonomi RekayasaDokumen6 halamanEkonomi RekayasaRido Orid OdirBelum ada peringkat

- Pengakun I UAS 2019 - JawabanDokumen15 halamanPengakun I UAS 2019 - Jawabansepuluh 10Belum ada peringkat

- TM 11Dokumen18 halamanTM 11awa nisrinaBelum ada peringkat

- Kadek Pastika Diana Artha - UAS - PenganggaranDokumen6 halamanKadek Pastika Diana Artha - UAS - PenganggaranPastika DanaBelum ada peringkat

- Minor JalanDokumen7 halamanMinor JalanAndrian MrBelum ada peringkat

- Akuntansi Keuangan LanjutanDokumen6 halamanAkuntansi Keuangan LanjutanReyhan IzzaBelum ada peringkat

- UPM - Prinsip-Prinsip Dasar AkuntansiDokumen2 halamanUPM - Prinsip-Prinsip Dasar AkuntansisyifaawabBelum ada peringkat