GEMPI

GEMPI

Diunggah oleh

it sniHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

GEMPI

GEMPI

Diunggah oleh

it sniHak Cipta:

Format Tersedia

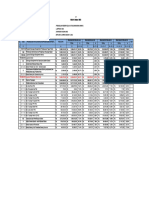

NIK 120%

NPWP 100%

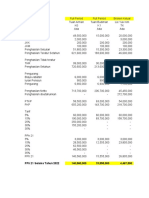

KOP STATUS NPWP DPP PENGHASILAN BRUTO TARIF

21-100-07 100% 50% Rp 60,000,000 Rp 30,000,000 5%

21-100-07 120% 50% Rp 125,000,000 Rp 62,500,000 15%

21-100-07 100% 50% Rp 550,000,000 Rp 275,000,000 25%

21-100-07 100% 50% Rp 5,000,000,000 Rp 2,500,000,000 30%

21-100-07 100% 50% Rp 10,000,000,000 Rp 5,000,000,000 35%

Buatkan rumus Tarifnya sesuai tabel tarif bruto

KOP STATUS NPWP DPP PENGHASILAN BRUTO TARIF

21-100-07 100% 50% Rp 60,000,000 Rp 30,000,000 5%

21-100-07 120% 50% Rp 125,000,000 Rp 62,500,000 15%

21-100-07 100% 50% Rp 550,000,000 Rp 275,000,000 25%

21-100-07 100% 50% Rp 5,000,000,000 Rp 2,500,000,000 30%

21-100-07 100% 50% Rp 10,000,000,000 Rp 5,000,000,000 30%

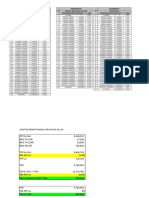

KOP

Kode Pajak Jenis Penerima Penghasilan DPP

21-100-04 Distributor Multi Level Marketing (MLM) 50%

21-100-05 Petugas Dinas Luar Asuransi 50%

21-100-06 Penjaja Barang Dagangan 50%

21-100-07 Tenaga Ahli 50%

21-100-08 Seniman 50%

21-100-09 Bukan Pegawai Lainnya 50%

21-100-11 Mantan Pegawai yang menerima Jasa Produksi 100%

21-100-12 Pegawai yang melakukan penarikan Dana Pensiun 100%

21-100-13 Peserta Kegiatan yang menerima imbalan 100%

TARIF BRUTO

Bruto Tarif

Rp0-Rp60.000.000 5%

>Rp60.000.000 - Rp250.000.000 15%

>Rp250.000.000 - Rp500.000.000 25%

>Rp500.000.000 - Rp5.000.000.000 30%

>Rp5.000.000.000 35%

TABEL BANTU TARIF

0 5%

60000000 15%

250000000 25%

500000000 30%

5,000,000,000 35%

Anda mungkin juga menyukai

- Rumus Excel Cara Menghitung PPH 21 TER Tarif Efektif Rata RataDokumen31 halamanRumus Excel Cara Menghitung PPH 21 TER Tarif Efektif Rata Ratagenbii100% (6)

- PPH 21 One Tax PMK-168Dokumen50 halamanPPH 21 One Tax PMK-168Pegy Dwi YulianiBelum ada peringkat

- Materi Seminar PerpajakanDokumen46 halamanMateri Seminar Perpajakantsaabit.ahnafBelum ada peringkat

- Materi PPH 21 Ter (PMK-168 Tahun 2023) IKPIDokumen61 halamanMateri PPH 21 Ter (PMK-168 Tahun 2023) IKPILuthfi SianturiBelum ada peringkat

- ANC2024010000014Dokumen8 halamanANC2024010000014Joko Triyono Putra JawaBelum ada peringkat

- Kertas Kerja Sosialisasi Instansi Desa 2024Dokumen13 halamanKertas Kerja Sosialisasi Instansi Desa 2024Ricky SyaputraBelum ada peringkat

- UntitledDokumen22 halamanUntitledRizka Amalia nabilaBelum ada peringkat

- Tugas Perpajakan IiDokumen12 halamanTugas Perpajakan IiRegina fortunaBelum ada peringkat

- PPh21 Baru Thun 2024Dokumen11 halamanPPh21 Baru Thun 2024adswa2000Belum ada peringkat

- UntitledDokumen46 halamanUntitledDimas Sopyan PutraBelum ada peringkat

- PMK 168 Tahun 2023 - Juklak PPH 21 Tahun 2024Dokumen13 halamanPMK 168 Tahun 2023 - Juklak PPH 21 Tahun 2024denny indrayadiBelum ada peringkat

- PPH 21 Selama Tahun 2022 140,560,000 15,555,000 4,467,500Dokumen5 halamanPPH 21 Selama Tahun 2022 140,560,000 15,555,000 4,467,500RobyBelum ada peringkat

- Pajak PenghasilanDokumen11 halamanPajak PenghasilanRahma WatiBelum ada peringkat

- Pajak PenghasilanDokumen11 halamanPajak PenghasilanRahma WatiBelum ada peringkat

- Kertas Kerja Kasus 2 KEL 6Dokumen11 halamanKertas Kerja Kasus 2 KEL 6Gustav ElsyahbanaBelum ada peringkat

- Materi Sosialisasi Pajak Ter 2024-HrdDokumen14 halamanMateri Sosialisasi Pajak Ter 2024-Hrddenny indrayadiBelum ada peringkat

- Margin ObatDokumen3 halamanMargin ObatyahyaBelum ada peringkat

- Tabel Tarif Dan TER PPH Pasal 21 Tahun 2024 1Dokumen9 halamanTabel Tarif Dan TER PPH Pasal 21 Tahun 2024 1Alvina TarizkyBelum ada peringkat

- Pedoman Penghitungan PPH Pasal 21 TER - PajakBaliDokumen31 halamanPedoman Penghitungan PPH Pasal 21 TER - PajakBaliEllya Latifah IlyasBelum ada peringkat

- PPH Atas THR Sederhana - Bayu KPP 915Dokumen2 halamanPPH Atas THR Sederhana - Bayu KPP 915lintangBelum ada peringkat

- Contoh Perhitungan PPH 21 (Gaji + THR)Dokumen28 halamanContoh Perhitungan PPH 21 (Gaji + THR)miske_jiang2142Belum ada peringkat

- BJT - Tugas3 - ADBI4330 Adminitrasi Perpajakan - Florida A NumberiDokumen4 halamanBJT - Tugas3 - ADBI4330 Adminitrasi Perpajakan - Florida A NumberiFlorida NumberyBelum ada peringkat

- Rangkuman Ter PPH 21Dokumen9 halamanRangkuman Ter PPH 21sitiBelum ada peringkat

- Simulasi KPRDokumen17 halamanSimulasi KPRnugraha_schevner409Belum ada peringkat

- PPH 21 (Versi Ruu)Dokumen9 halamanPPH 21 (Versi Ruu)ian yanisBelum ada peringkat

- LRA PN - TJK 2023 Okt 01Dokumen2 halamanLRA PN - TJK 2023 Okt 01arinas.ponahanBelum ada peringkat

- Latihan 3 PPH Pasal 21Dokumen12 halamanLatihan 3 PPH Pasal 21Risma Sugiarti RismaBelum ada peringkat

- PPH 21 Pegawai TetapDokumen5 halamanPPH 21 Pegawai Tetaptword katalogBelum ada peringkat

- LN 6 - PPH Pasal 21 Part 2Dokumen17 halamanLN 6 - PPH Pasal 21 Part 2Intan11111111Belum ada peringkat

- Rumus TER PajegDokumen11 halamanRumus TER Pajeganko heroBelum ada peringkat

- Penjelasan PPH 21,22,23,24,25,26, ReviewUASDokumen35 halamanPenjelasan PPH 21,22,23,24,25,26, ReviewUASSabrinahardaBelum ada peringkat

- Analisis Investasi NPV & IRRDokumen13 halamanAnalisis Investasi NPV & IRRAlif SyarifudinBelum ada peringkat

- Format Pajak OPDokumen6 halamanFormat Pajak OPAdek Siska MarethaBelum ada peringkat

- Daftar Gaji RiamaDokumen1 halamanDaftar Gaji Riamatrisna printing92Belum ada peringkat

- PP Nomor 58 Tahun 2023 PPH TERDokumen30 halamanPP Nomor 58 Tahun 2023 PPH TERAdi Kangdra100% (1)

- Jawaban Soal PPN PT AnandaDokumen2 halamanJawaban Soal PPN PT AnandaVidhePerdanaBelum ada peringkat

- SPT PPN - Niska Yuza - 20.05.34.0025Dokumen44 halamanSPT PPN - Niska Yuza - 20.05.34.0025Niska Yuza AfgharinBelum ada peringkat

- PPH Pasal 21 Praktika Pajak Yg HitunganDokumen6 halamanPPH Pasal 21 Praktika Pajak Yg HitunganJonathan AlexanderBelum ada peringkat

- PMK 168 Tahun 2023 Tentang PPH Pasal 21 TERDokumen51 halamanPMK 168 Tahun 2023 Tentang PPH Pasal 21 TERMuhammad RidwanBelum ada peringkat

- Cara Menghitung Persentase ExcelDokumen6 halamanCara Menghitung Persentase Excels8p969cdfgBelum ada peringkat

- PK 2017 Dan KK 2018-Soroja - Rev-FinalDokumen53 halamanPK 2017 Dan KK 2018-Soroja - Rev-FinalDhika Noor PradhanaBelum ada peringkat

- Irr Mmtech NewDokumen1 halamanIrr Mmtech NewDEPO KELAPA BANG WAHYUBelum ada peringkat

- Book 1Dokumen3 halamanBook 1nurullnisahhBelum ada peringkat

- Book1 - Jawaban Praktik PerpajakanDokumen28 halamanBook1 - Jawaban Praktik Perpajakanleni nitasBelum ada peringkat

- Analisa KasDokumen8 halamanAnalisa KasnugrasaktiBelum ada peringkat

- 2408 Soal - Perhitungan PPH 21Dokumen80 halaman2408 Soal - Perhitungan PPH 21Noevan YumaraBelum ada peringkat

- Kunci Kuis PotputDokumen5 halamanKunci Kuis PotputBela Canda HandikaBelum ada peringkat

- Kertas Kerja Perhitungan PPH 21 DesemberDokumen4 halamanKertas Kerja Perhitungan PPH 21 DesemberOrlando HoyarandaBelum ada peringkat

- Perhitungan PPH 21 - M2M22Dokumen1 halamanPerhitungan PPH 21 - M2M22Nuzul ramadhanBelum ada peringkat

- Jawaban Quiz Minggu 7 - Perpajakan LanjutanDokumen9 halamanJawaban Quiz Minggu 7 - Perpajakan LanjutanNatashya PriskilaBelum ada peringkat

- Harga Untuk Katalog Baru (UNTUK AGEN)Dokumen5 halamanHarga Untuk Katalog Baru (UNTUK AGEN)Deen SallBelum ada peringkat

- CBA PerhitunganDokumen11 halamanCBA PerhitunganAfifah MuhtaromiBelum ada peringkat

- NPV MetaDokumen7 halamanNPV MetaFeri IrwansyahBelum ada peringkat

- Praktikum PerpajakanDokumen49 halamanPraktikum PerpajakanDian SuryawatiBelum ada peringkat

- 02A - SPT BADAN - Form - 1771 - Per - 19 - 2014'Dokumen13 halaman02A - SPT BADAN - Form - 1771 - Per - 19 - 2014'M.Irvan PratamaBelum ada peringkat

- FS Dapur Rice BowlDokumen36 halamanFS Dapur Rice Bowlitok.ngi.2023Belum ada peringkat

- Latihan Soal PPh-21 LainnyaDokumen5 halamanLatihan Soal PPh-21 LainnyaREG.B/40121200006/YAHYA WESIBelum ada peringkat

- Suku BungaDokumen16 halamanSuku BungaTriBelum ada peringkat

- Tugas 2 Leo Ivan 7223210009 Manajemen B 22Dokumen1 halamanTugas 2 Leo Ivan 7223210009 Manajemen B 22zakyasdhikaBelum ada peringkat

- Analisis Horizontal Dan VertikalDokumen4 halamanAnalisis Horizontal Dan VertikalRiani OfficialBelum ada peringkat

- reasonDokumen17 halamanreasonit sniBelum ada peringkat

- Modul reportDokumen54 halamanModul reportit sniBelum ada peringkat

- HAK AKSES reportDokumen6 halamanHAK AKSES reportit sniBelum ada peringkat

- Jadwal LogistikDokumen4 halamanJadwal Logistikit sniBelum ada peringkat

- Pelatihan ExcelDokumen7 halamanPelatihan Excelit sniBelum ada peringkat

- COA KIB RevDokumen20 halamanCOA KIB Revit sniBelum ada peringkat