INFO GTK v.2020.2.0

INFO GTK v.2020.2.0

Diunggah oleh

i gede juliawan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan2 halamanHak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

6 tayangan2 halamanINFO GTK v.2020.2.0

INFO GTK v.2020.2.0

Diunggah oleh

i gede juliawanHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

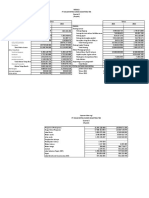

LAPORAN ANALISIS KEUANGAN

NAMA : NI KOMANG AYU WIDIASTUTI

NIM : 2020140252

KELAS : III B2

NO. ABS : 02

Rasio Keuangan PT Unilever Indonesia Tbk Tahun 2021 dan 2021

Rasio Rumus Tahun 2020 Rasio Tahun 2021 Rasio

Rasio Likuiditas

Aset Lancar: Hutang 8.828.360 :

1. Current Ratio 0,743 9.980.912 : 12.739.725 0,783

Lancar 13.357.536

(Aset Liquid + (844.076 + 4.978.160

(590.309 + 5.783.245 +

2. Quick Ratio Piutang) : Hutang + 317.128) : 0,459 0,122

382.519) : 12.739.725

lancar 13.357.536

3. Cash Ratio Kas : Hutang Lancar 844.076 : 13.357.536 0,063 590.309 : 12.739.725 0,046

Rasio Solvabilitas

1. Debt to Total Total Hutang : Total 15.597.264 :

0,760 15.085.142 : 21.645.929 0,697

Asset Asset 20.534.632

2. Debt to Equity Total Hutang : Modal 15.597.264 :

3,159 15.085.142 : 6.560.787 2,299

ratio Sendiri 4.937.368

Laba bersih

3. Time interst

operasional : Beban 2.389.456 : 36.989 64,560 2.226.128 : 9.881 225,294

earned

bunga

4. Total Asset to Total Asset : Modal 20.534.632 :

4,160 21.645.929 : 6.560.787 3,299

Equity Sendiri 4.937.368

5. Fixed Asset to Asset Tetap : Modal 11.706.272 :

2,371 11.665.017 : 6.560.787 1,778

Equity Sendiri 4.937.368

6. Curent Asset Asset Lancar : Modal

8.828.360 : 4.937.368 1,788 9.980.912 : 6.560.787 1,521

to Equity Sendiri

7. Inventory to Persediaan Barang :

2.463.104 : 4.937.368 0,498 2.865.683 : 6.560.787 0,437

Equity Modal Sendiri

8. Receivable to Piutang Dagang :

5.295.288 : 4.937.368 1,072 6.165.764 : 6.560.787 0,940

Equity Modal Sendiri

Rasio Aktivitas

1. Sales to Penjualan : Asset

11.152.919 : 1,263 10.282.521 : 9.980.912 1,030

Liquid Asset Lancar 8.828.360

2. Sales to Penjualan : Piutang

11.152.919 : 2,106 10.282.521 : 6.165.764 1,668

Receivale Dagang 5.295.288

3. Sales to

Penjualan : Persedian 11.152.919 : 4,528 10.282.521 : 2.865.683 3,588

Inventory 2.463.104

4. Sales to Penjualan : Asset

11.152.919 : 1,263 10.282.521 : 9.980.912 1,030

Curent Asset Lancar 8.828.360

5. Sales to Fixed Penjualan : Asset

11.152.919 : 0,953 10.282.521 : 11.665.017 0,881

Asset Tetap 11.706.272

6. Sales to Total Penjualan : Total

11.152.919 : 0,543 10.282.521 : 21.645.929 0,475

Asset Asset 20.534.632

Rasio Profitabilitas

1. Net Profit Laba bersih :

1.862.681 : 0,167 0,157

1.698.080 : 10.282.521

Margin Penjualan 11.152.919

2. Return on Laba Bersih : Total

1.862.681 : 0,091 0,078

1.698.080 : 21.645.929

Investment Aktiva 20.534.632

3. Return on Laba Barsih : Modal

1.862.681 : 4.937.368 0,377 1.698.080 : 6.560.787 0,259

Equity Sendiri

Rasio Pasar

1. Price Earning Harga Persaham :

2 : 49 0,041 2 : 45 0,044

ratio Laba persaham

2. Book Value Modal Sendiri :

4.937.368 : 38.150 129,420 6.560.787 : 38.150 171,973

Per Share Jumlah Saham beredar

Harga Pasar per

3. Market Book

saham : Nilai Buku 2 : 129,420 0,015 2 : 171,973 0,012

value Ratio

per saham

Anda mungkin juga menyukai

- Analisis Rasio Keuangan Sepatu Bata TBK 2019 Dan 2020Dokumen2 halamanAnalisis Rasio Keuangan Sepatu Bata TBK 2019 Dan 2020i gede juliawanBelum ada peringkat

- Presentasi CFINDokumen10 halamanPresentasi CFINDwi Citra Oktara GuciBelum ada peringkat

- Kelompok Minggu IVDokumen14 halamanKelompok Minggu IVmelijapriani06Belum ada peringkat

- Analisis Laporan Keuangan MrezaDokumen18 halamanAnalisis Laporan Keuangan MrezaAmita SariBelum ada peringkat

- Raeykan Albaiti - 220810301037Dokumen3 halamanRaeykan Albaiti - 220810301037raeykanBelum ada peringkat

- Cindy Stacia Pricillia Sirait 190502216 (MNJ KEU)Dokumen25 halamanCindy Stacia Pricillia Sirait 190502216 (MNJ KEU)Cindy StaciaBelum ada peringkat

- Quiz 5-02Dokumen6 halamanQuiz 5-02Ikbal AnsharyBelum ada peringkat

- UTS Manajemen Keuangan MICE 4A 4B - Asterina AnggrainiDokumen3 halamanUTS Manajemen Keuangan MICE 4A 4B - Asterina AnggrainiFarhan SaputraBelum ada peringkat

- Quis 5Dokumen10 halamanQuis 5Irene S. Lestari BarusBelum ada peringkat

- KOPERASIDokumen4 halamanKOPERASIyoga swaraBelum ada peringkat

- Tim 1 - Analisis Common Size - Rasio - TrendDokumen20 halamanTim 1 - Analisis Common Size - Rasio - Trendmelllyyy bukanBelum ada peringkat

- SMGR - Annual Report Halaman 287-292Dokumen17 halamanSMGR - Annual Report Halaman 287-292Shofia AyuBelum ada peringkat

- MK 2 Kelompok 4 Rasio ProfitabilitasDokumen10 halamanMK 2 Kelompok 4 Rasio ProfitabilitasalhaqxyzBelum ada peringkat

- Tugas Pak AndiDokumen26 halamanTugas Pak AndiSahrul FadilaBelum ada peringkat

- Aset Lancar1Dokumen8 halamanAset Lancar1Wardah WardahBelum ada peringkat

- ALK Apit TriyaniDokumen10 halamanALK Apit TriyanivitrimanesBelum ada peringkat

- Akuntansi - Akuntansi Keuangan Menengah IiDokumen3 halamanAkuntansi - Akuntansi Keuangan Menengah IiChandra DwitaraBelum ada peringkat

- Perputaran PiutangDokumen8 halamanPerputaran PiutangArie poenya sonyBelum ada peringkat

- Rasio Kinerja BUSDokumen8 halamanRasio Kinerja BUSAri SusantoBelum ada peringkat

- Bernike Trivena Noveliana - ALKDokumen13 halamanBernike Trivena Noveliana - ALKKabellen VyanBelum ada peringkat

- Analisis Common Size (Neraca) GGMDokumen1 halamanAnalisis Common Size (Neraca) GGMRangga Putra MudaBelum ada peringkat

- Uas PraktikumDokumen7 halamanUas PraktikumIlmiah MufidaBelum ada peringkat

- Kelompok 8 - Laporan Keuangan PT Lampung Jasa UtamaDokumen14 halamanKelompok 8 - Laporan Keuangan PT Lampung Jasa UtamatiarareringBelum ada peringkat

- Tugas MK Kelompok 2Dokumen5 halamanTugas MK Kelompok 2EsterYPBelum ada peringkat

- Laba Rugi BNIDokumen5 halamanLaba Rugi BNIPARLIN LUMBANTORUANBelum ada peringkat

- Calk Lap - Keuangan 2022Dokumen27 halamanCalk Lap - Keuangan 2022Indah SusenaBelum ada peringkat

- NeracaDokumen2 halamanNeracaAlel FarrelBelum ada peringkat

- Post Test Lab 1 KdpplksDokumen4 halamanPost Test Lab 1 KdpplksSaeful LatifBelum ada peringkat

- 11Dokumen10 halaman11WiranataBelum ada peringkat

- Analisis Komparatif MITIDokumen4 halamanAnalisis Komparatif MITIazharazzirol77Belum ada peringkat

- Analisis Laporan Keuangan Kel. 7Dokumen6 halamanAnalisis Laporan Keuangan Kel. 7BERNADETTA DEVINA DWI RATNA SARIBelum ada peringkat

- Analisa Rasio Keuangan Kelompok 9Dokumen14 halamanAnalisa Rasio Keuangan Kelompok 9Rashiif AlBelum ada peringkat

- Selvia Eka Pramesti 200803102053Dokumen11 halamanSelvia Eka Pramesti 200803102053Selvia PramestiBelum ada peringkat

- Primus Automation Division - Kelompok 10 - MKLDokumen32 halamanPrimus Automation Division - Kelompok 10 - MKLtonitoni27Belum ada peringkat

- Analisis Rasio Keuangan TeoriDokumen19 halamanAnalisis Rasio Keuangan TeoriFathia HamidBelum ada peringkat

- Analisis Laporan Keuangan - Rahmat Arif Munawir SaniDokumen2 halamanAnalisis Laporan Keuangan - Rahmat Arif Munawir SaniNasrin Sri MulyatiBelum ada peringkat

- Aulia - Olah Data SiskaDokumen17 halamanAulia - Olah Data SiskaRangga WijayaBelum ada peringkat

- 248595lap Keuangan Konsolidasian Itb TH 2022 Audited 1Dokumen34 halaman248595lap Keuangan Konsolidasian Itb TH 2022 Audited 1Teddy TjBelum ada peringkat

- Unilever 2022Dokumen4 halamanUnilever 2022MUHAMMAD FURQON NURLIANSYAHBelum ada peringkat

- Kel 6 - Analisis Laporan KeuanganDokumen17 halamanKel 6 - Analisis Laporan KeuanganAldi GunawanBelum ada peringkat

- TK2-W8-S12-R6 (1) - Update Cash RatioDokumen12 halamanTK2-W8-S12-R6 (1) - Update Cash Ratioyoufeel socksBelum ada peringkat

- TugasDokumen3 halamanTugasRusdahBelum ada peringkat

- Asgr 2021Dokumen6 halamanAsgr 2021Mohamad Bagus SetiawanBelum ada peringkat

- Aset Aset: Catatan 2b, 3 4 2c, 5 2d, 6Dokumen2 halamanAset Aset: Catatan 2b, 3 4 2c, 5 2d, 6Nurtriany RaisBelum ada peringkat

- Kelompok 6 - BNBRDokumen25 halamanKelompok 6 - BNBRzakyuwais1Belum ada peringkat

- Praktikum Manajemen KeuanganDokumen30 halamanPraktikum Manajemen KeuangankepoBelum ada peringkat

- Keuangan 3oDokumen16 halamanKeuangan 3oobhyn026Belum ada peringkat

- Modul 1 Praktikum AuditDokumen20 halamanModul 1 Praktikum AuditENRIKO HARIS PRATAMA100% (1)

- Analisa Sekuritas - Kelompok 3 - MK 4ADokumen18 halamanAnalisa Sekuritas - Kelompok 3 - MK 4AlutfiemeraldBelum ada peringkat

- Analisis Ratio Dan Laporan Arus KasDokumen6 halamanAnalisis Ratio Dan Laporan Arus KasMuhammad FauziBelum ada peringkat

- b1c118197 Tuty Hajriati Analisa Laporan Keuangan 2017-2019Dokumen21 halamanb1c118197 Tuty Hajriati Analisa Laporan Keuangan 2017-2019Tuty HajriatiBelum ada peringkat

- Kelompok 5 - Anggaran KasDokumen17 halamanKelompok 5 - Anggaran KasChintya BilangBelum ada peringkat

- Ikhtisar Data Keuangan IDDokumen4 halamanIkhtisar Data Keuangan IDinesBelum ada peringkat

- Laporan Posisi KeuanganDokumen9 halamanLaporan Posisi KeuanganNYAIMAN NYAIKBelum ada peringkat

- Halaman 6-9Dokumen5 halamanHalaman 6-9Evi maria sibueaBelum ada peringkat

- Rasio Keuangan PT AstraDokumen5 halamanRasio Keuangan PT AstraPutu AriefBelum ada peringkat

- Laporan Analisis Kel E - Campina Ice CreamDokumen8 halamanLaporan Analisis Kel E - Campina Ice CreamWahyu Adhi Prawira KusumoBelum ada peringkat