Tugas Kelompok, Kajian Aspek Finansial (Part 2) - MUHAMMAD THORIQ FAZA

Diunggah oleh

MUHAMMAD THORIQ FAZAJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tugas Kelompok, Kajian Aspek Finansial (Part 2) - MUHAMMAD THORIQ FAZA

Diunggah oleh

MUHAMMAD THORIQ FAZAHak Cipta:

Format Tersedia

TUGAS

MATA KULIAH ANALISIS DAN PERANCANGAN PERUSAHAAN (IEJ3L2)

Kajian Aspek Finansial (Part 2)

Oleh:

Kelompok 6

TI-44-10

Joshua Antonio Jonathan (1201202379)

Muhammad Sa'id Ridho (1201204013)

Muhammad Thoriq Faza (1201204053)

Mochamad Fadil Fahreza (1201204361)

PROGRAM STUDI S1 TEKNIK INDUSTRI

FAKULTAS REKAYASA INDUSTRI

UNIVERSITAS TELKOM

BANDUNG

2023

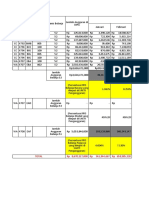

A. Analisis Kriteria Kelayakan Investasi

Tahun 2022 2023 2024 2025 2026 2027

Periode 0 1 2 3 4 5

Cash Out Rp 214,268,912

Cash In Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

Net Cash -Rp 214,268,912 Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

p/f faktor (8%) 1 0.925925926 0.85733882 0.793832241 0.735029853 0.680583197

NPV -Rp 214,268,912 Rp 50,001,025 Rp 80,338,762 Rp 92,796,511 Rp 42,480,465 Rp 111,304,516

NPV Kumulatif -Rp 214,268,912 -Rp 164,267,887 -Rp 83,929,124 Rp 8,867,387 Rp 51,347,852 Rp 162,652,368

IRR>MARR 30% Cash In Rp 376,921,280

NPV>0 Rp 162,652,368 Cash Out Rp 214,268,912

Payback Period 3 BCR>1 2

Interpolasi IRR

Tahun 2022 2023 2024 2025 2026 2027

Net Cash -Rp 214,268,912 Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

p/f faktor (first positive %) 1 0.769230769 0.591715976 0.455166136 0.350127797 0.269329074

NPV -Rp 214,268,912 Rp 41,539,313 Rp 55,448,007 Rp 53,207,500 Rp 20,235,357 Rp 44,046,845

NPV Kumulatif -Rp 214,268,912 -Rp 172,729,599 -Rp 117,281,591 -Rp 64,074,091 -Rp 43,838,734 Rp 208,111

Net Cash -Rp 214,268,912 Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

p/f faktor (first negative %) 1 0.763358779 0.582716625 0.444821851 0.339558665 0.259205088

NPV -214268912.3 Rp 41,222,219 Rp 54,604,704 Rp 51,998,286 Rp 19,624,523 Rp 42,391,139

NPV Kumulatif -Rp 214,268,912 -Rp 173,046,693 -Rp 118,441,989 -Rp 66,443,703 -Rp 46,819,180 -Rp 4,428,041

IRR 30%

Tahun 2022 2023 2024 2025 2026 2027

Cash In Rp0 Rp54,001,107 Rp93,707,132 Rp116,896,879 Rp57,794,204 Rp163,542,851

Cash Out Rp 214,268,912 Rp - Rp - Rp - Rp - Rp -

P/F Faktor (8%) 1 0.925925926 0.85733882 0.793832241 0.735029853 0.680583197

Cash In (PW) Rp 376,921,280

Cash Out (PW) Rp 214,268,912

BCR 2

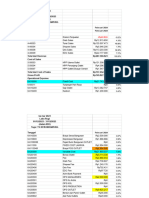

B. Analisis Rasio Keuangan

C.

NPV dengan MARR

Tahun 0 1 2 3 4 5

Cash Outflow Rp 214,268,912 Rp - Rp - Rp - Rp - Rp -

Cash Inflow Rp - Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

Net Cash -Rp 214,268,912 Rp 54,001,107 Rp 93,707,132 Rp 116,896,879 Rp 57,794,204 Rp 163,542,851

p/f factor 30% 1 0.769230769 0.591715976 0.455166136 0.350127797 0.269329074

NPV -Rp 214,268,912 Rp 41,539,313 Rp 55,448,007 Rp 53,207,500 Rp 20,235,357 Rp 44,046,845

NPV Kumulatif -Rp 214,268,912 Rp 41,539,313 Rp 55,448,007 Rp 53,207,500 Rp 20,235,357 Rp 44,046,845

Anda mungkin juga menyukai

- Tugas 1 Analisis Laporan KeuanganDokumen3 halamanTugas 1 Analisis Laporan Keuanganakun membantu100% (4)

- Tugas 1 Analisis Laporan KeuanganDokumen12 halamanTugas 1 Analisis Laporan Keuanganakun membantuBelum ada peringkat

- TK3 CFMDokumen4 halamanTK3 CFMJimmi Tamba100% (1)

- Tugas Rasio MK Maulidiah F (112100000)Dokumen15 halamanTugas Rasio MK Maulidiah F (112100000)MaulidiaftrBelum ada peringkat

- Analisis Keuangan 2Dokumen4 halamanAnalisis Keuangan 2rhendyBelum ada peringkat

- Tahun Laba Setelah Pajak Proceed Faktor Diskonto (8%) Faktor Diskonto (15%) Penyusutan & Amortisasi PV of Proceed (Faktor 1)Dokumen2 halamanTahun Laba Setelah Pajak Proceed Faktor Diskonto (8%) Faktor Diskonto (15%) Penyusutan & Amortisasi PV of Proceed (Faktor 1)REG.A/41921100002/DESI INDRIYANTIBelum ada peringkat

- Tugas 1 Analisis Laporan KeuanganDokumen12 halamanTugas 1 Analisis Laporan Keuanganakun membantuBelum ada peringkat

- UTS SazaliaQN B133200125Dokumen3 halamanUTS SazaliaQN B133200125Andre DwixBelum ada peringkat

- Aplidit Modul 9Dokumen14 halamanAplidit Modul 9Fidia AmeliaBelum ada peringkat

- Perhitungan NPV 2Dokumen2 halamanPerhitungan NPV 2yusep ramdaniBelum ada peringkat

- Analisis Ekotek PLTU 60 MW (AutoRecovered)Dokumen6 halamanAnalisis Ekotek PLTU 60 MW (AutoRecovered)adhie12Belum ada peringkat

- AKM - Kelompok 7Dokumen37 halamanAKM - Kelompok 7Dinda ArdiyaniBelum ada peringkat

- Analisis Laporan Keuangan HMSP 2021-2025 FINALDokumen82 halamanAnalisis Laporan Keuangan HMSP 2021-2025 FINALyobelBelum ada peringkat

- Ltugas AnalisisDokumen9 halamanLtugas AnalisisWafa shifa UrrahmahBelum ada peringkat

- DitanyakanDokumen9 halamanDitanyakanRefa DesiBelum ada peringkat

- Syahla Tugas ALK UpdateDokumen6 halamanSyahla Tugas ALK UpdateSyahla NabilaBelum ada peringkat

- Saskia - 5552230106 - Tugas RasioDokumen7 halamanSaskia - 5552230106 - Tugas Rasiosaskia10Belum ada peringkat

- SKB Mbak DEVIDokumen10 halamanSKB Mbak DEVIAhadi Rizki PratamaBelum ada peringkat

- Tugas Analisa RatioDokumen4 halamanTugas Analisa Ratiorosaliana seftiani deviBelum ada peringkat

- Final Ekonomi Teknik - Jumaing-DikonversiDokumen6 halamanFinal Ekonomi Teknik - Jumaing-DikonversiAndi Annas IndiBelum ada peringkat

- Proforma New SF Toko Rizquna Januari 2024Dokumen6 halamanProforma New SF Toko Rizquna Januari 2024Rizon SyauqiBelum ada peringkat

- AIK Laporan Keuangan ProformaDokumen4 halamanAIK Laporan Keuangan ProformaAgung JulharBelum ada peringkat

- Tarif Masyarakat Rata-RataDokumen20 halamanTarif Masyarakat Rata-RataRefa DesiBelum ada peringkat

- Uas Pak AjisDokumen4 halamanUas Pak Ajisarif_mzBelum ada peringkat

- Arus Kas WASKITA KARYA (PERSERO) TBKDokumen6 halamanArus Kas WASKITA KARYA (PERSERO) TBKDewi Ira SafitriBelum ada peringkat

- UAS - Arif MZ - 216080056 - MK PTRSDokumen25 halamanUAS - Arif MZ - 216080056 - MK PTRSarif_mzBelum ada peringkat

- Tugas 2 - Andi Sedana Yasa - Praktikum AuditDokumen9 halamanTugas 2 - Andi Sedana Yasa - Praktikum AuditNotaris DewirafaldiniBelum ada peringkat

- Final Report Yayasan Putera Sampoerna 2018 10 April 2019SPDOPINIFINAL 6 9Dokumen5 halamanFinal Report Yayasan Putera Sampoerna 2018 10 April 2019SPDOPINIFINAL 6 9Hadi MuttaqinBelum ada peringkat

- Draft KuDokumen2 halamanDraft KuSadli ImranBelum ada peringkat

- AkuntansiDokumen5 halamanAkuntansiTrii WulLandarii127Belum ada peringkat

- Contoh Input RPD Penganggaran SAKTIDokumen5 halamanContoh Input RPD Penganggaran SAKTIAdib El KhillaBelum ada peringkat

- SKB - Tri Puji LestariDokumen22 halamanSKB - Tri Puji LestariAhadi Rizki PratamaBelum ada peringkat

- Kertas Kerja TejaciptaDokumen6 halamanKertas Kerja TejaciptaSbh Kota MojokertoBelum ada peringkat

- Tugas Big PaperDokumen21 halamanTugas Big PaperSuryo NegoroBelum ada peringkat

- Nadya Amalia Maimuna FSA Analisis Komparatif f920139bdd88Dokumen31 halamanNadya Amalia Maimuna FSA Analisis Komparatif f920139bdd88cukongilakesBelum ada peringkat

- Kelompok 4 - Kalbe Farma - Manajemen KeuanganDokumen45 halamanKelompok 4 - Kalbe Farma - Manajemen KeuanganIraa BereBelum ada peringkat

- Kasus 4 AlkDokumen16 halamanKasus 4 AlkShalwa KhaerunnizaBelum ada peringkat

- Investasilaparoskopi FixDokumen3 halamanInvestasilaparoskopi Fixarif_mzBelum ada peringkat

- Rumus Program DCT Berkah Sejahtera DGN Sistem Compound CepatDokumen4 halamanRumus Program DCT Berkah Sejahtera DGN Sistem Compound CepatChahli MawardiBelum ada peringkat

- Analisis Common SizeDokumen4 halamanAnalisis Common SizerioseptiadiBelum ada peringkat

- M. Razhikin Sabah (2110527004) - Simbis Task 7Dokumen8 halamanM. Razhikin Sabah (2110527004) - Simbis Task 7Raziqin SabahBelum ada peringkat

- Analisa Perbandingan NERACADokumen10 halamanAnalisa Perbandingan NERACAKomang DwiarthaBelum ada peringkat

- Common Size Kasus 2Dokumen8 halamanCommon Size Kasus 2Safna Nur HalijahBelum ada peringkat

- Addm - 14-03-2024 185050Dokumen1 halamanAddm - 14-03-2024 185050Anisa MahardikaBelum ada peringkat

- Analisis Neraca Dki JakartaDokumen16 halamanAnalisis Neraca Dki JakartaEndang SjtBelum ada peringkat

- Kuis AlkDokumen20 halamanKuis AlkZeeBelum ada peringkat

- Perhitungan Cicilan Akuntansi PerbankanDokumen9 halamanPerhitungan Cicilan Akuntansi Perbankanstabilo pastelBelum ada peringkat

- Analisis Common SizeDokumen1 halamanAnalisis Common Sizerestu DwiBelum ada peringkat

- PRINT Studi Kelayakan (Hazeland Residence)Dokumen1 halamanPRINT Studi Kelayakan (Hazeland Residence)Suci Syahrani HerdaBelum ada peringkat

- TugasBesar6 D111191005 Juan Daniel TambunanDokumen10 halamanTugasBesar6 D111191005 Juan Daniel TambunanFirstcho Bagus MalvianoBelum ada peringkat

- Tugas Kelompok 2 Analisis Kondisi Keuangan Kota Banda AcehDokumen8 halamanTugas Kelompok 2 Analisis Kondisi Keuangan Kota Banda AcehSela LestariBelum ada peringkat

- Perhitungan Table EDCCASH ExcelDokumen2 halamanPerhitungan Table EDCCASH ExcelSyarif HidayatullohBelum ada peringkat

- Tri Ambar Sari - 7101422127 - Tugas 1 Analisa Informasi KeuanganDokumen10 halamanTri Ambar Sari - 7101422127 - Tugas 1 Analisa Informasi KeuanganTri Ambar SariBelum ada peringkat

- Pinhome Simulasi KPR Yuwono Uripto 2023-09-12Dokumen7 halamanPinhome Simulasi KPR Yuwono Uripto 2023-09-12orangeju1c3Belum ada peringkat

- Analisis Laporan Keuangan Pt. BniDokumen11 halamanAnalisis Laporan Keuangan Pt. BniBagus DwiBelum ada peringkat

- Addm - 07-06-2023 155900Dokumen1 halamanAddm - 07-06-2023 155900Tino HartonoBelum ada peringkat

- Potrait Profit Loss KAG 23 - Google SpreadsheetDokumen4 halamanPotrait Profit Loss KAG 23 - Google Spreadsheetgazkianaufal0Belum ada peringkat

- Menghitung IRRDokumen2 halamanMenghitung IRRAri KaruniaBelum ada peringkat

- Manajemen Keuangan 9Dokumen11 halamanManajemen Keuangan 9tkpkk8 mulyorejoBelum ada peringkat