Chapter 5

Diunggah oleh

nadaDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Chapter 5

Diunggah oleh

nadaHak Cipta:

Format Tersedia

Asst.

Nabila & Jerry

CHAPTER 5

ACCOUNTING FOR MERCHANDISING OPERATIONS

Perusahaan berdasarkan jenis usahanya dibedakan menjadi:

1. Perusahaan Jasa (Service Business)

2. Perusahaan Dagang (Merchandising Business)

3. Perusahaan Manufaktur (Manufacturing Business)

Merchandising Business (Perusahaan Dagang)

perusahaan yang menjual produk (barang jadi), akan tetapi perusahaan tidak membuat atau

menghasilkan sendiri produk yang di jualnya melainkan barang yang dijual diperoleh dari

perusahaan lain. Perusahaan dagang yang membeli dan menjual langsung barang daganganya

ke kosumen disebut Retailers. Perusahaan dagang yang menjual barang daganganya ke

retailers disebut Wholesalers.

Sales Revenue/Sales

Sumber pendapatan utama perusahaan dagang adalah penjualan barang dagang atau disebut

sales revenue atau sales

Operating Expenses

Biaya-biaya yang harus dikeluarkan oleh perusahaan, sehubungan dengan operasi atau

kegiatan yang dilakukan oleh perusahaan.

Cost of Goods Sold

Seluruh pengeluaran sampai barang siap dijual.

Cara mengukur pendapatan pada merchandising company

PT. TRISAKTI

Income Statement

For The Year Ended December 31, 20xx

Sales revenue

(-) COGS

xxx

(xxx)

Gross profit

(-) Operating expenses

xxx

(xxx)

Net Income/Net Loss

xxx

ASISTEN AKUNTANSI |CHAPTER 5 ACCOUNTING FOR MERCHANDISING

Asst. Nabila & Jerry

Merchandise Inventory

Persediaan barang dagangan, yang diperdagangkan oleh perusahaan dan merupakan bagian

dari Current Asset

A. Sistem pencatatan inventory

1. Perpetual inventory system:

- Perusahaan tetap mencatat secara detail cost dari setiap pembelian inventory atau

penjualan inventory

- Pencatatan terus-menerus akan menunjukan jumlah inventory yang tersisa,

sehingga dapat diketahui setiap saat

- Perusahaan mencatat pembelian barang dagang sebagai inventory account

- Perusahaan mencatat COGS setiap saat terjadinya penjualan

2. Periodic inventory system:

- Perusahaan tidak secara detail mencatat inventory yang tersisa di setiap periode

- Perusahaan mencatat COGS hanya pada akhir periode akuntansi

- Perusahaan mencatat pembelian barang dagang sebagai purchase account

- Cara mengetahui Flow of costs pada merchandising company yang menggunakan

periodic inventory system

Beginning Inventory

(+) Net Purchased

Cost of goods available for sale (COGAS)

(-) Ending Inventory

Cost of goods sold (COGS)

xxx

xxx

xxx

(xxx)

xxx

B. Freight costs (Biaya angkut)

pengeluaran (expenditure) untuk memindahkan barang dari gudang penjual ke gudang

pembeli. Ada dua terms Free on Board (FOB)

1. FOB shipping point : biaya angkut ditanggung oleh pembeli

2. FOB destination

: biaya angkut ditanggung oleh penjual

*Note: Biaya angkut yang dikeluarkan penjual dicatat sebagai Operating expenses dan biaya

angkut yang dikeluarkan pembeli dianggap sebagai bagian dari Biaya pembelian inventory.

ASISTEN AKUNTANSI |CHAPTER 5 ACCOUNTING FOR MERCHANDISING

Asst. Nabila & Jerry

C. Transaksi di perusahaan dagang yang berhubungan dengan Inventory

D.

E.

a. Transaksi Pembelian

F.

G.

H.

Perpetual System

J.

Membeli

K.

Merchandise Inventory

M.

xxx

L.

Cash/

AP

N.

xxx

barang dagang

S.

Membayar

biaya angkut (FOB

shipping point)

AB. Saat retur

pembelian

T.

AM. Membayar

dalam periode diskon

AN.

BA. Membayar di

luar periode diskon

BB.

BJ.

BK.

BL.

BM.

BN.

BO.

BP.

AC.

Merchandise Inventory

U. Cash

V.

W.

xxx

Cash/AP

AD.

Merchandise

Inventory

AE.

AF.

AG.

xxx

Accounts Payable

AO.

Merchandise

Inventory

AP.

Cash

AQ.

AR.

AS.

AT.

xxx

Accounts Payable

BC.

Cash

BD.

BE.

xxx

I.

O.

Purchase

P. Cash/ AP

X.

Freight in

Y. Cash

AH.

Cash/AP

AI.

Purchase Return and

Allowance

AU.

Accounts Payable

AV.

Purchase Discount

AW.

Cash

BF.

Accounts Payable

BG.

Cash

xxx

xxx

xxx

xxx

xxx

Periodic System

Q.

R.

xxx

Z.

AA.

xxx

AJ.

AK.

AL.

xxx

AX.

AY.

xxx

AZ.

xxx

BH.

BI.

xxx

xxx

xxx

xxx

xxx

xxx

Asst. Nabila & Jerry

BQ.

BR.

b. Transaksi Penjualan

BS.

BT.

BU.

BV. Perpetual System

BX. Menjual barang BY. Cash/AR

CD.

BZ.

Sales

CE.

dagang

CA.

CF.

CB. COGS

CG.

CC.

Merchandise

CH.

Inventory

CO. Membayar

CP. Freight out

CR.

CQ.

Cash

CS.

biaya angkut (FOB

destination)

CX. Saat retur

penjualan

DP. Menerima

pelunasan dalam

periode diskon

EC. Menerima

pelunasan di luar

BW.

xxx

Cash/AR

CJ.

Sales

CK.

CL.

No entry

CM.

x

CN.

xxx

xx

CT.

Freight out

CU.

Cash

xx

DJ.

Sales Return and Allowance

DK.

Cash/AR

DL.

DM.

No entry

CV.

x

CW.

xxx

DN.

x

DO.

xxx

DZ.

x

EA.

x

EB.

xxx

EJ.

x

xx

xxx

xxx

xxx

xxx

DE.

DF.

DG.

DH.

DI.

DT.

DU.

DV.

xxx

xxx

ED.

EF.

EG.

xxx

AR

CI.

xxx

CY. Sales Return and

Allowance

CZ.

Cash/AR

DA.

DB. Merchandise Inventory

DC.

COGS

DD.

DQ. Cash

DR. Sales discount

DS.

AR

Cash

EE.

Periodic System

xxx

xxx

xxx

xxx

xxx

DW. Cash

DX. Sales discount

DY.

AR

EH.

xxx

Cash

EI.

AR

xx

xx

xx

Asst. Nabila & Jerry

periode diskon

EK.

xxx

Asst. Nabila & Jerry

EL.

LATIHAN SOAL

EM.

SOAL1

EN.

Copple Store distributes hardcover books to retail stores and extends credit terms of

5/10, n/30 to all of its customers. At the end of June, Copple Stores inventory consisted of

books purchased for $4,000. During July, the following merchandising transactions occurred.

EO.July 1

Purchased books on account for $3,000 from Bill Publishers,

FOB destination, terms 4/10, n/30. The appropriate party also made a cash

payment of $70 for freight on this date.

EP.

3

Sold books on account to Alpha Store for $4,600. The cost of

books sold was $2,750

EQ.

6

Received $325 credit for books returned to Bill Publishers.

ER.

9

Paid Bill Publishers in full, less discount.

ES.

15

Received payment in full from Alpha store .

ET.

17

Sold books on account to Valerie Books for $2,200. The cost of

the books sold was $1,800.

EU.

20

Purchased books on account for $2,550 from Vree Publishers,

FOB destination, terms 2/15, n/30. The appropriate party also made a cash

paymentof $75 for freight on this date.

EV.

24

Received payment in full from Valerie Books.

EW.

26

Paid Vree Publishers in full, less discount.

EX.

28 Sold books on account to Moulton Bookstore for $2,350. The cost of the

books sold was $1,650

EY.

31

Granted Moulton Bookstore $225 credit for books returned

costing $60.

EZ.

FA. Instructions

FB. Journalize the transactions for the month of July for Copple Store using a perpetual

inventory system.

FC.

FD.

SOAL 2

FE. Pada tanggal 1 Agustus, PT. NAF memiliki persediaan 30 kipas angin yang

memilki harga masing-masing $22. PT NAF menggunakan metode perpetual dalam

pencatatan persediaan. Berikut transaksi yang terjadi selama bulan bulan Agustus

FF.A

G

S

6

FH.

AGS

9

FJ. A

G

FG.

Membeli 100 kipas angin senilai $20 dari PT. CAPLANG, 2/10,

n/30.

FI. Membayar biaya angkut senilai $150 untuk kipas angin yang dibeli dari

PT CAPLANG.

FK.

Mengembalikan 15 kipas angin kepada PT. CAPLANG senilai

$300 karena kipas angina tersebut tidak sesuai dengan pesanan.

Asst. Nabila & Jerry

S

1

0

FL.

AGS

1

1

FN.

AGS

1

3

FP.A

G

S

1

4

FR.

AGS

2

0

FT.A

G

S

2

4

FV.

FW.

FM.

Membayar setengah dari jumlah hutang kepada PT.CAPLANG

FO.

Menjual 40 kipas angin, memiliki nilai perolehan masing masing

$22/ kipas angin dan dijual senilai $30/kipas angin kepada PT.

KELAPA, 3/10 n/30.

FQ.

PT.KELAPA mengembalikan 5 buah kipas angin karena barang

terdapat cacat.

FS.Menjual 10 kipas angin dengan biaya perolehan masing masing

$22/kipas angin dengan harga jual sebesar $32/kipas angin kepada PT.

GADING

FU.

Melunasi sisa hutang atas transaksi kepada PT.CAPLANG

Diminta : Buatlah Jurnal yang dibutuhkan untuk bulan Agustus.

FX.

FY.SOAL 3

FZ.

On October 1, Venus Office Supply had an inventory of 60 staplers at a cost of

55 each. During October, the following transaction accured.

GA.

Oct. 6 Purchased 30 staplers at 45 each from Milan Co., terms 4/10, n/30.

GB.

9 Paid freight of 170 on staplers purchased from Milan Co.

GC.

10 Returned 7 staplers to Milan Co. For 220 credit (including freight)

because they did

GD.

GE.

not meet specifications.

12 Sold 25 staplers costing 55 (including freight) for 70 each to Betha

Co, terms n/30.

Asst. Nabila & Jerry

GF.

14 Granted credit of 70 to Betha Co for the return of 1 stapler that was not

ordered.

GG.

20 Sold 30 staplers costing 55 for 60 each to Alpha Shop , terms n/30.

GH.

GI.Instructions

GJ.

1.Journalize the October transactions under a perpetual inventory system

GK.

2.Journalize the October transactions under a periodic inventory system

GL.

GM.

GN.

GO.

GP.

GQ.

GR.

GS.

SOAL 4

GT.

At the end of Takeshi ATK Corps fiscal year on July 31, 2014. These accounts

appeared in

GU.

its adjusted trial balance

GV.

GW.

Sales Returns and Allowances

32.000

GX.

Freight-in

8.300

GY.

Inventory

30.000

GZ.

Purchase Discounts

10.250

HA.

Purchase Return and Allowances

HB.

Sales Revenue

865.000

HC.

Selling and administration expense

114.000

HD.

Purchases

420.000

HE.

Instructions

HF.

Prepare an Income Statement through gross profit for the year ended July

7.000

31,2015 if Merchandise Inventory on July 31, 2015 is $91.000, and Takeshi ATK

Corp uses a periodic system.

Asst. Nabila & Jerry

HG.

HH.

HI.

HJ.

HK.

HL.

HM.

HN.

HO.

HP.

HQ.

HR.

HS.

HT.

Jawaban

HU.

SOAL 1

HV.

HW.

July

1

IE.

IM.

IV. J

u

l

y

3

PERPETUAL

HX. HY.

IF.

IN.

Inventory

IG.

IO.

A/P

IP.

IW. IX. A/R

JG.

JE.

JF.

JM.

JN.

IY.

Sales

revenue

JO.

JP.

HZ.

3,00

0

IH.3

,

0

0

0

IQ.

IZ. 4

,

6

0

0

JH.4

,

6

0

0

JQ.

IA.

IB. Jul

y

20

IC. Inventory

ID.2,

55

0

IT.

IL. 2,

55

0

IU.

JB. Jul

y

24

JC. Cash

JD.2,

09

0

JI.

JJ.

JK. Sales

discount

JR.

JS.

JT.

IK.

II.

IR.

IJ.

IS.

JA.

A/P

JL.

A/R

11

0*

JU.2,

20

0

Asst. Nabila & Jerry

JV.

JW. JX. COGS

KE.

KF.

KM.

KV.

July

6

JY.

KG.

Inventory

JZ. 2

,

7

5

0

KH.

2,75

0

KN. KO.

KP. KQ.

KW. KX.

A/P

LG.

LF.

Inventory

KZ.

KY. 325

LH.

325

LM.

LV. J

u

l

y

9

LN. LO.

LP.

ME.

MF.

LE.

MM.

MV.

ND.

LW. LX.

A/P

MG.

Inventory

MO.

MN.

Cash

MX.

*(3,000MW.

325 = 2,675)

NF.

**(2,675

NE.

x 4% = 107)

NL.

NU.

July

1

5

NM. NN.

OD.

OE.

OM.

OV.

July

1

7

ON. OO.

PE.

PF.

PM.

PV.

PN. PO.

PW. PX.

NV. NW.

Cash

OF.

A/R

OW. OX.

A/R

PG.

Sales revenue

COGS

LQ.

LZ.

2,67

5

LY.

*

MH.

107*

*

MQ.

1,91

MP.

1

KA. KB.

KC.

*(2,2

00 x 5% =

110)

KD.

KI.

KK.

KL.

KJ.

KS.

July

KR.

26

LA. LB.

LI.

LJ.

LR. LS.

MA. MB.

MJ.

July

MI.

28

KT.

A/P

KU.

2,550

LC.

Inventory

LK.

Cash

LT. (2,550 x 2%

= 51)

LD.

LU.

MC.

MD.

51

LL.

2,499

ML.

2,350

MR. MS.

MK.

A/R

MT.

Sales

revenue

MY.

MZ. NA.

NB.

NG.

NH. NI.

NJ.COGS

NS.

Inventory

NC.

NK.

1,650

NT.

1,650

OB.

OC.

MU.

2,350

NO. NP.

NQ. NR.

NY.

4,60

NX.

0

OH.

4,60

OG.

0

NZ. OA.

OJ.Jul

y

OI.

30

OP. OQ.

OR. OS.

OK.

R&A

OT.

A/R

PA. PB.

PC.

PD.

PK.

Inven

tory

PT.

COGS

QC.

PL.

60

PU.

OZ.

2,20

OY.

0

PH.

2,20

0

PP.

PQ.

PY. PZ.

PI.

PJ.

PR. PS.

QA. QB.

Sales

OL.

225

OU.

225

60

QD.

Asst. Nabila & Jerry

QE.

QF.

1,80

0

QH.

1,80

0

QG.

Inventory

QI.

QJ.

QK.

QL.

QM.

QN.

QO.

QP.

QQ.

QR.

QS.

QT.

QU.

QV.

SOAL 2

QW.

Ags. 7

Inventory (100 X $20) ........................................

2.000

QX.

QY.

10

150

Accounts Payable - PT. CAPLANG

2.000

Inventory ..........................................................

QZ.

RA.

11

300

Accounts Payable PT. CAPLANG ...................

RB.

300

RC.

850

Cash .........................................................

150

12

Inventory .................................................

Accounts Payable PT. CAPLANG.............................

RD.

Inventory*............................................

17

RE.

Cash......................................................

833

RF.

RG.

*[( 2.000-300)x50%] x 2%

14

1,200

Accounts Receivable PT. KELAPA (40 X $30) ...............

RH.

Sales Revenue

1,200

Asst. Nabila & Jerry

RI.

Cost of Goods Sold (40 X $22) ...........................

880

RJ.

RK.

15

150

Sales Returns and Allowances (5 X $30) ..................

RL.

150

RM.

110

Inventory ..................................................

880

Accounts Receivable PT.OMEGA .................

Inventory ..........................................................

RN. Cost

of

$22) .................................

RO.

320

21

(5

26

850

220

Inventory .................................................

Accounts Payable PT.DELTA........................................

RT.

Cash...................................................................

850

RU.

RV.

RW.

RX.

RY.

RZ.

SA.

SB.

SC. SOAL 3

SE.

SF.

SG.

SH.

Sales Revenue .........................................

Cost of Goods Sold (10 X $22) ......................

RR.

220

RS.

Sold

Cash (10 X $32) ....................

RP.

320

RQ.

Goods

110

SD. PERPETUAL

Oct- 06 Inventory

1,350

A/P

1,350

(45 x 30 )

1,350

Oct-06

1,350

PERIODIC

Purchase

A/P

Asst. Nabila & Jerry

SI. Oct-09

SJ.

Inventory

Cash

170

A/P

220

Oct-06

170

170

Freight-in

Cash

220

220

Oct-10 A/P

Purchase R&A

170

SK.

SL.Oct-10

SM.

Inventory

220

SN.

SO.

Oct-12 A/R

1,750

1,750

SP.

Sales Revenue

1,750

1,750

SQ.

(25 x 70 )

SR.

SS.

COGS

1,375

ST.

Inventory

1,375

SU.

(25 x 55 )

SV.

SW.

Oct-14 Sales R&A

70

70

SX.

A/R

70

70

SY.

SZ.

Inventory

55

TA.

COGS

55

TB.

TC.

Oct-20 A/R

1800

1800

TD.

Sales revenue

1800

1800

TE.

(30 x 60 )

TF.

TG.

COGS

1650

TH.

Inventory

1650

TI.

(30 x 55)

TJ.

TK.

TL.

TM.

TN.

TO.

TP.

TQ.

Oct-12 A/R

Sales Revenue

Oct-14

Sales R&A

A/R

Oct-20 A/R

Sales Revenue

Asst. Nabila & Jerry

TR.

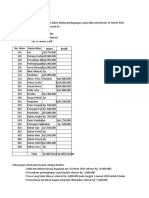

TS.SOAL 4

TT. Takeshi ATK Corp

TU. INCOME STATEMENT

TV. For the Year Ended July 31 , 2015

TW.

TX. Sales revenue

TY.

Sales revenue

TZ.

Less : Sales R&A

(32.000)

UA.

Net Sales

833.000

$865.000

UB. Cost of goods sold

UC.

Inventory , August 1

UD.

Purchases

UE.

Less : Purchase R&A

UF.

Purchase discount

UG.

Net purchases

UH.

Add: Freight in

$30.000

$420.000

$7.000

10.250

(17.250)

402.750

8.300

UI. Cost of goods purchased

411.050

UJ. Cost of goods available for sale

441.050

UK.

UL.

Less : Inventory, July 31

Cost of goods sold

350.050

UM. Gross profit

482.950

UN.

Selling and Administration expense

(114.000)

(91.000)

Asst. Nabila & Jerry

UO. NET INCOME

$368,950

Anda mungkin juga menyukai

- Akuntansi Tugas Kelompok Ke-4Dokumen7 halamanAkuntansi Tugas Kelompok Ke-4Risma Nyazal100% (1)

- Soal Linear ProgamingDokumen9 halamanSoal Linear Progamingkaneki kenBelum ada peringkat

- ASET TETAP & ASET TAKBERWUJUD smt2 Sesi1 Ak Instrumen Keu Imas2019Dokumen49 halamanASET TETAP & ASET TAKBERWUJUD smt2 Sesi1 Ak Instrumen Keu Imas2019sandi217100% (1)

- Latihan Soal Pengantar Akuntansi IDokumen2 halamanLatihan Soal Pengantar Akuntansi IHandia FahrurroziBelum ada peringkat

- Soal Responsi 1Dokumen3 halamanSoal Responsi 1Teopilus ediBelum ada peringkat

- Accounting For Current Liabilities and PayrollDokumen7 halamanAccounting For Current Liabilities and PayrollNurIndah AgusniatyBelum ada peringkat

- Matematika Ekonomi Kel.2Dokumen17 halamanMatematika Ekonomi Kel.2anita febriyantyBelum ada peringkat

- 210 Bab 9 AkuntansiDokumen32 halaman210 Bab 9 AkuntansiHerman AliBelum ada peringkat

- Bab 2Dokumen14 halamanBab 2Nisa100% (1)

- Kasus I Perusahaan Jasa RevDokumen6 halamanKasus I Perusahaan Jasa RevHardiyanto SBelum ada peringkat

- Soal Uts PA 2 AktDokumen2 halamanSoal Uts PA 2 AktFAIZ HIDAYATBelum ada peringkat

- Soal Praktikum AkuntansiDokumen2 halamanSoal Praktikum AkuntansiSmks Handayani ManggarBelum ada peringkat

- Latihan Soal Mata Pelajaran Akuntansi Keuangan Kelas Xi Kas KecilDokumen3 halamanLatihan Soal Mata Pelajaran Akuntansi Keuangan Kelas Xi Kas Kecilimam hasannudinBelum ada peringkat

- Modul PA1-3Dokumen20 halamanModul PA1-3Rezza IrawanBelum ada peringkat

- Uas Akuntansi Semester 1Dokumen8 halamanUas Akuntansi Semester 1Galih LintangBelum ada peringkat

- Deskripsi Data - Tabel Frekuensi, Distribusi Frekuensi, Dan Penyajian GrafikDokumen44 halamanDeskripsi Data - Tabel Frekuensi, Distribusi Frekuensi, Dan Penyajian GrafikRiza AngrelaBelum ada peringkat

- Post Test 7 Akuntansi Dasar 1Dokumen5 halamanPost Test 7 Akuntansi Dasar 1Inu Shiro50% (2)

- Joerdhy Anand 165020062 Isocost Dan IsoquantDokumen23 halamanJoerdhy Anand 165020062 Isocost Dan IsoquantPENDIDIKAN EKONOMI 2016B UNPASBelum ada peringkat

- KelompokDokumen10 halamanKelompokDinda PratiwiBelum ada peringkat

- 05 FLK JFa Xu Qet S9 GF ZEFDJzug QNCVhbuypfk Zod RDokumen16 halaman05 FLK JFa Xu Qet S9 GF ZEFDJzug QNCVhbuypfk Zod Ramanda syaharaBelum ada peringkat

- Tugas 1 - Ekonomi Mikro MadyaDokumen17 halamanTugas 1 - Ekonomi Mikro MadyaIndra SukmawatiBelum ada peringkat

- Ekonomi Mikro Sesi 9Dokumen3 halamanEkonomi Mikro Sesi 9Putri FadilahBelum ada peringkat

- Pengantar Akuntansi IDokumen61 halamanPengantar Akuntansi IdiyahBelum ada peringkat

- Soal Perusahaan Manufaktur PT ABCDokumen2 halamanSoal Perusahaan Manufaktur PT ABCkelas bBelum ada peringkat

- 10a. Lat Persediaan FifoDokumen1 halaman10a. Lat Persediaan FifoFrancesko BernauliBelum ada peringkat

- Soal Bank RekonDokumen4 halamanSoal Bank RekonPutri UtamiBelum ada peringkat

- Materi Akutansi1Dokumen57 halamanMateri Akutansi1Lee KaengBelum ada peringkat

- SosialisasiDokumen24 halamanSosialisasiKiki Praja MahestiBelum ada peringkat

- Latihan L. 2.4Dokumen9 halamanLatihan L. 2.4silvia KartiniBelum ada peringkat

- Latihan Akuntansi Keuangan LanjutanDokumen10 halamanLatihan Akuntansi Keuangan LanjutanNurul Hikmah0% (1)

- Tugas 1Dokumen1 halamanTugas 1Asep GunawanBelum ada peringkat

- Jurnal Pengeluaran KasDokumen2 halamanJurnal Pengeluaran KasAisyah AnggrainiBelum ada peringkat

- Case 1: Tugas Kelompok Ke-2 Week 5/ Sesi 7Dokumen6 halamanCase 1: Tugas Kelompok Ke-2 Week 5/ Sesi 7atika mileniaBelum ada peringkat

- Akutansi Slide 1,2,3,4,5,6,7Dokumen71 halamanAkutansi Slide 1,2,3,4,5,6,7Wina LiaBelum ada peringkat

- Soal Akuntansi 9-10Dokumen3 halamanSoal Akuntansi 9-10Surya Budimansyah100% (1)

- Si327 092173 775 10Dokumen4 halamanSi327 092173 775 10Laurentia NurakBelum ada peringkat

- Lembar Jawaban Hal 2-9 (Jurnal + Ajp + BB + Kertas Kerja + Laporan)Dokumen21 halamanLembar Jawaban Hal 2-9 (Jurnal + Ajp + BB + Kertas Kerja + Laporan)Ilmi Sayyida RahmahBelum ada peringkat

- Tugas Pertemuan 3Dokumen4 halamanTugas Pertemuan 3Addriawan NFBelum ada peringkat

- Soal UTS Dasar Akuntansi (Final)Dokumen2 halamanSoal UTS Dasar Akuntansi (Final)Devinta OksaliaBelum ada peringkat

- SIA Kelompok 6Dokumen20 halamanSIA Kelompok 6Alex SandroBelum ada peringkat

- Perusahaan Dagang.2Dokumen1 halamanPerusahaan Dagang.2Hardianto YoshuaBelum ada peringkat

- Tugas Kelompok TP 1 - AKUTANSI SudahDokumen22 halamanTugas Kelompok TP 1 - AKUTANSI SudahNur Aini P100% (2)

- Jurnal PenyesuaianDokumen5 halamanJurnal PenyesuaianNi PratiwiBelum ada peringkat

- Contoh Soal Salon AyuDokumen2 halamanContoh Soal Salon Ayufajar100% (1)

- Lmos PDFDokumen40 halamanLmos PDFDevi WiliardiBelum ada peringkat

- 1.1 - Konsep Dan Prosedur Akuntansi 2016 Soal 2Dokumen3 halaman1.1 - Konsep Dan Prosedur Akuntansi 2016 Soal 2mirrmirmir100% (3)

- Soal CorporationDokumen10 halamanSoal CorporationAhmad Sultan FauziBelum ada peringkat

- Siska Yuliana Dewi Ali Akt ProfesionalDokumen4 halamanSiska Yuliana Dewi Ali Akt ProfesionalSiskayulianadewBelum ada peringkat

- Akuntansi FirmaDokumen10 halamanAkuntansi FirmaJoan ChandraBelum ada peringkat

- Matematika EkonomiDokumen18 halamanMatematika EkonomiSasi PrabahandariBelum ada peringkat

- CV Aneka Ragam Neraca SaldoDokumen5 halamanCV Aneka Ragam Neraca Saldomeidi claudiaBelum ada peringkat

- Latihan Soal FungsiDokumen3 halamanLatihan Soal Fungsimuhammadabdur rakhmanBelum ada peringkat

- Soal PD Pantang MundurDokumen2 halamanSoal PD Pantang MundurNataca AnggrainaBelum ada peringkat

- Bab 4Dokumen62 halamanBab 4ruthBelum ada peringkat

- Kunci Jawaban Soal Praktik Mandiri ForDokumen18 halamanKunci Jawaban Soal Praktik Mandiri ForToni HermawanBelum ada peringkat

- Amortisasi FixDokumen6 halamanAmortisasi FixAnantha Dharma WijayaBelum ada peringkat

- 46659815Dokumen12 halaman466598150..0 ?Belum ada peringkat

- Perusahaan DagangDokumen16 halamanPerusahaan DagangLazoeardiNurimanBelum ada peringkat

- Jurnal KhususDokumen19 halamanJurnal KhususHazzard RitczBelum ada peringkat

- KB 4 Asset TetapDokumen79 halamanKB 4 Asset TetapMARWANA NURDINBelum ada peringkat