Akuntansi Perusahaan Dagang

Diunggah oleh

Sarah Dzuriyati SamiyahJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Akuntansi Perusahaan Dagang

Diunggah oleh

Sarah Dzuriyati SamiyahHak Cipta:

Format Tersedia

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

MATERI LAB 6

ACCOUNTING FOR MERCHANDISING COMPANY

Biaya Merchandising Company

Biaya untuk Merchandising Company dibagi menjadi dua kategori, yaitu:

1) Cost of Goods Sold, yakni total biaya barang dagang yang dijual selama periode

tersebut

2) Operating Expense, yakni biaya yang dikeluarkan dalam proses menghasilkan

pendapatan penjualan. Contohnya adalah gaji penjualan dan biaya asuransi

Perbedaan Merchandising Company dan Service Company

Merchandising Company Service Company

Melakukan jasa kepada

Membeli barang untuk dijual

konsumen

Kegiatan Utama kembali tanpa mengubah

bentuk barang

Pendapatan dilaporkan Pendapatan dilaporkan

sebagai Sales Revenue dan sebagai Service revenue dan

terdapat akun tambahan tidak terdapat Cost of Goods

Statement of Profit or

berupa Sales Return and Sold

Loss and Other

Allowances dan Sales

Comprehensive

Discount sebagai contra

Income

account Sales Revenue dan

terdapat akun Cost of Goods

Sold

Terdapat akun tambahan Tidak ada Merchandise

Statement of berupa Merchandise Inventory

Financial Position Inventory pada bagian

current asset

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Sistem Pencatatan Persediaan pada Merchandising Company

a. Perpetual System

Perusahaan mencatat secara detail biaya dari Merchandise Inventory pada saat

terjadinya transaksi pembelian atau penjualan serta transaksi lain yang mempengaruhi

Merchandise Inventory. Cost of Goods Sold dicatat setiap terjadinya transaksi

penjualan.

b. Periodic System

Perusahaan tidak mencatat Merchandise Inventory dan Cost of Goods Sold

secara langsung. Ending Inventory ditentukan dengan perhitungan persediaan secara

fisik (stock opname). Dalam sistem pencatatan periodik, Cost of Goods Sold dihitung

dengan rumus.

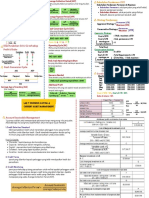

Jurnal pada Merchandising Company

Transaksi Perpetual System Periodic System

Accounts Receivable / Cash Accounts Receivable / Cash

Sales Revenue Sales Revenue

Penjualan

Cost of Goods Sold

Merchandise Inventory

Sales Returns & Allowances Sales Returns & Allowances

Pengembalian Accounts Receivable / Cash Accounts Receivable / Cash

penjualan Merchandise Inventory

Cost of Goods Sold

Sales Pembayaran Freight-Out Freight-Out

Transactions biaya angkut Cash Cash

penjualan

(FOB

destination)

Penerimaan Cash Cash

pembayaran Sales Discounts Sales Discounts

penjualan Accounts Receivable Accounts Receivable

dalam

periode

diskon

Merchandise Inventory Purchases

Pembelian

Accounts Payable / Cash Accounts Payable / Cash

Purchase

Transaction Pengembalian Accounts Payable / Cash Accounts Payable / Cash

Pembelian Purchase Returns &

Merchandise Inventory

Allowances

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Pembayaran Merchandise Inventory Freight-In

biaya angkut Cash Cash

pembelian

(FOB

Shipping

Purchase Point)

Transaction Pembayaran Accounts Payable Accounts Payable

pembelian Cash Cash

dalam Merchandise Inventory Purchase Discount

periode

diskon

Events Perpetual Periodic

Nilai Cost of Goods Sold

Inventory on Merchandise Inventory

Book > No entry

Physical

Count

Nilai Merchandise Inventory

Inventory on Cost of Goods Sold

Book < No entry

Physical

Count

Merchandise Inventory (Ending)

Adjusting Cost of Goods Sold

Entries untuk Purchase Returns & Allowances

memasukkan Purchase Discounts

Adjusting ending No Entry

Merchandise Inventory

and Closing inventory dan

(Beginning)

Entries Cost of

Purchases

Goods Sold

Freigh-In

Menutup Sales Revenue Sales Revenue

akun Other Revenues Other Revenues

temporer Income Summary Income Summary

dengan saldo

kredit

Income Summary Income Summary

Menutup Cost of Goods Sold Cost of Goods Sold

akun Sales Discounts Sales Discounts

temporer

Sales Return & Allowances Sales Returns & Allowances

dengan saldo

debit Freight Out Freight-Out

Other Expenses Other Expenses

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Efek Error dalam Mencatat Merchandising Company

Error dalam Inventory Cost of Goods Sold Net Income Equity

Understates Beginning Inventory Understated Overstated Overstated

Overstates Beginning Inventory Overstated Understated Understated

Understates Ending Inventory Overstated Understated Understated

Overstates Ending Inventory Understated Overstated Overstated

*efek error pada periode yang sama

Single-step Income Statement vs Multiple-step Income Statement

Single-step income statement adalah income statement yang disusun berdasarkan

klasifikasi revenues (mencakup Operating Revenues dan Other Revenues and Gains) dan

expenses (mencakup Cost of Goods Sold, Operating Expenses, and Other Expenses and

Losses). Dinamakan single-step karena step yang dilakukan hanya mengurangi total revenues

dengan total expenses.

Single-step income statement

FATA Company

Income Statement

For the year ended December 31, 2020

Revenues

Net Sales $ 115,000

Interest Revenue $ 750

Gain on Disposal of Plant Assets $ 150

Total Revenues $ 115,900

Expenses

Cost of Goods Sold $ 79,000

Operating Expenses $ 28,500

Interest Expense $ 450

Casualty Loss from Vandalism $ 50

Total Expenses ($ 108,000 )

Net Income $ 7,900

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Multiple-step income statement adalah income statement yang disusun berdasarkan

klasifikasi Operating Activities dan Non-Operating Activities. Hasil akhir perhitugan kegiatan

operasi ditandai dengan “Income from Operations” dan untuk kegiatan non-operasi ditandai

dengan “Other Revenues and Gains” dan “Other Expenses and Losses”.

Multiple-step income statement

FATA Company

Income Statement

For the year ended December 31, 2020

Sales

Sales revenue $ 120,000

Less: Sales Returns and Allowances $ 3,000

Sales Discounts $ 2,000 $ (5,000)

Net Sales $ 115,000

Cost of Goods Sold $ (79,000)

Gross Profit $ 36,000

Operating Expenses

Salaries and Wages Expense $ 16,000

Utilities Expense $ 4,250

Depreciation Expense $ 2,000

Freight-Out $ 1,750

Insurance Expense $ 500

Total operating expenses $ (24,500)

Income From Operations $ 11,500

Other Revenues and Gains

Interest Revenue $ 750

Gains on Disposal of Plant Assets $ 150 $ 900

Other Expenses and Losses

Interest Expense $ 450

Casuality Loss from Vandalism $ 50 $ (500)

Net Income $ 11,900

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Istilah dalam Merchandising Company

• Invoice

Bukti transaksi yang diberikan penjual kepada pembeli yang berasal dari

transaksi non kas (utang).

• Sales Order

Bukti transaksi yang diberikan penjual kepada pembeli yang berasal dari

transaksi kas (lunas).

• Debit Note

Dokumen yang dibuat oleh pembeli dan diberikan kepada penjual karena

adanya pengembalian barang dagang.

• Credit Note

Dokumen yang dibuat oleh penjual dan diberikan kepada pembeli karena

adanya pengembalian barang dagang.

Contoh:

On December 1, DTWM Company had the following account balances:

Cash 600 Accumulated Depreciation - PPE: Building 50

Account Receivable 210 Account Payable 400

Merchandise Inventory (26 units) 130 Notes Payable 340

Supplies 65 Owner's Capital 515

PPE: Building 300

1305 1305

During December, the store completed the following summary transactions

Purchased on account 200 Merchandise at $5 each from Pricillya Co., FOB Shipping

2-Dec

Point, the freight cost is 60. terms 5/10 , n/ EOM

Sold 45 Merchandise to Belinda Co on account (5/10, n.30). The selling price per unit is

5-Dec

$8. the freigt cost was $10 FOB Shipping Point

Purchased 50 Merchandise for $400 from Maria Co., FOB Destination. The freight cost

6-Dec

was $30

7-Dec Returned 6 damaged merchandise to Maria Co.

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Sold 20 Merchandise to Nico Co for $200., FOB Destination the freight cost was

9-Dec

$20

12-Dec Received 5 returned damaged merchandise to Nico CO.

15-Dec Received payment from Belinda Co

31-Dec Based on physical calculation, Inventory is overstated $20

31-Dec Supplies on hand on Dec 31 was $40

31-Dec Depreciation expense for buildings during december was $10

Instructions:

a. Prepare the cost flow assumption table using FIFO method! (2 decimals rounding)

b. Journalize above the transactions using perpetual method and make the necessary

adjusments!

c. Post all the entries to general ledgers!

d. Prepare multiple-step income statement,owners equity statement and balance sheet!

e. Journalize the closing entries!

Answer:

Purchase COGS Balance

Date

Q P T Q P T Q P T

1-Dec 26 5 130

2-Dec 200 5 1060 26 5 130

200 5.3 1060.00

5-Dec 26 5 130 181 5.3 959.30

19 5.3 100.70

6-Dec 50 8 400 181 5.3 959.30

50 8 400.00

7-Dec -6 8 -48 181 5.3 959.30

44 8 352.00

9-Dec 20 5.3 106.00 161 5.3 853.30

44 8 352.00

12-Dec -5 5.3 -26.50 166 5.3 879.80

44 8 352.00

31-Dec 20.00 166 5.3 859.80

44 8 352.00

Total Ending

COGS 330.20 Inventory 1211.80

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

DTWM Company

General Journal

December 2020

JI

Date Account Ref Debit Credit

2-Dec Merchandise Inventory 103 1060.00

Account Payable - Pricillya Co 201 1000.00

Cash 101 60.00

5-Dec Account Receivable - Belinda Co 102 360.00

Sales Revenue 401 360.00

Cost of Goods Sold 501 230.70

Merchandise Inventory 103 230.70

6-Dec Merchandise Inventory 103 400.00

Cash 101 400.00

7-Dec Cash 101 48.00

Merchandise Inventory 103 48.00

9-Dec Cash 101 200.00

Sales Revenue 401 200.00

Freight Out 502 20.00

Cash 101 20.00

Cost of Goods Sold 501 106.00

Merchandise Inventory 103 106.00

12-Dec Sales Return & Allowances 402 50.00

Cash 101 50.00

Merchandise Inventory 103 26.50

Cost of Goods Sold 501 26.50

15-Dec Cash 101 342.00

Sales Discount 403 18.00

Account Receivable - Belinda Co 102 360.00

Adjusting & Correcting Entries

31-Dec Cost of Goods Sold 501 20

Merchandise Inventory 103 20

31-Dec Supplies Expense 503 25

Supplies 104 25

31-Dec Depreciation Expense 504 10

Accumulated Depreciation - PPE: Building 112 10

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Cash 101 Account Payable 201

1-Dec $ 600 2-Dec $ 60 1-Dec $ 400

7-Dec $ 48 6-Dec $ 400 2-Dec $ 1,000

9-Dec $ 200 9-Dec $ 20 Balance $ 1,400

15-Dec $ 342 12-Dec $ 50

Notes Payable 202

Balance $ 660 1-Dec $ 340

Balance $ 340

Account Receivable 102

1-Dec $ 210 15-Dec $ 360 Owners Capital 301

5-Dec $ 360 1-Dec $ 515

Balance $ 210 31-Dec $ 106.80

Balance $ 621.80

Merchandise Inventory 103

1-Dec $ 130.00 5-Dec $ 230.70 Sales Revenue 401

2-Dec $ 1,060.00 7-Dec $ 48.00 31-Dec 560 5-Dec $ 360

6-Dec $ 400.00 9-Dec $ 106.00 9-Dec $ 200

12-Dec $ 26.50 31-Dec $ 20.00 Balance $ -

Balance $ 1,211.80

Cost of Goods Sold 501

Supplies 104 5-Dec $ 230.70 12-Dec $ 26.50

1-Dec $ 65 31-Dec $ 25 9-Dec $ 106.00 31-Dec $ 330.20

Balance $ 40 30-Dec $ 20.00

Balance $ -

PPE: Building 111

1-Dec $ 300 Freight Out 502

Balance $ 300 9-Dec $ 20 31-Dec $ 20

Balance $ -

Accumulated Depreciation - PPE: Building 112

1-Dec $ 50 Sales Return and Allowances 402

31-Dec $ 10 12-Dec $ 50 31-Dec $ 50

Balance $ 60 Balance $ -

Depreciation Expense 504 Supplies Expense 503

31-Dec $ 10 31-Dec $ 10 31-Dec $ 25 31-Dec $ 25

Balance $ - Balance $ -

Sales Discount 403

15-Dec $ 18 31-Dec $ 18

Balance $ -

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

DTWM Company

Income Statement

For the month ended December 2020

Sales

Sales Revenue $ 560

Less: Sales Return and Allowances $ (50)

Sales Discount $ (18)

Net sales $ 492

Cost Of Goods Sold $ 330.20

Gross Profit $ 161.80

Operating Expense

Freight Out $ 20

Supplies Expense $ 25

Depreciation Expense $ 10

Total Operating Expense $ (55)

Income from Operation $ 106.80

Other revenue and gains -

Other expense and losses -

Net Income $ 106.80

DTWM Company

Statement of changes in owners equity

For the month ended Deceber 2020

Owners Equity 1 December 2020 $ 515

Add: Net Income $ 106.80

Less: Drawings -

Owners Equity 31 December 2020 $ 621.80

DTWM Company

Statement of Financial Position

31 December 2020 (in $000)

Assets

Cash $ 660.00

Account Receivable $ 210.00

Merchandise Inventory $ 1,211.80

Supplies $ 40.00

PPE: Building $ 300.00

Accumulated Depreciation - PPE: Building $ (60.00) $ 240.00

Total Assets $ 2,361.80

Liabilities and Equities

Account Payable $ 1,400.00

Notes Payable $ 340.00

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

MATERI PRAKTIKUM PENGANTAR AKUNTANSI FATA 2018

Owners Capital $ 621.80

Total Liabilities and Equities $ 2,361.80

DTWM Company

General Journal

December 2020

Date Account Debit Credit

31-Dec Sales Revenue $ 560

Income Summary $ 560

31-Dec Income Summary $ 453.20

Cost of Goods Sold $ 330.20

Freight Out $ 20

Supplies Expense $ 25

Depreciation Expense $ 10

Sales Return and Allowances $ 50

Sales Discount $ 18

31-Dec Income Summary $ 106.80

Owners Capital $ 106.80

DANENDRA – MARGARETA –TITAN – WINONA FATA 2018

Anda mungkin juga menyukai

- Akuntansi Perusahaan DagangDokumen79 halamanAkuntansi Perusahaan DagangSelviana DiantiBelum ada peringkat

- Contoh Soal Akuntansi - Akuntansi Itu MudahDokumen9 halamanContoh Soal Akuntansi - Akuntansi Itu Mudahqyuzack quantum100% (1)

- AKUNTANSI OPERASI DAGANGDokumen61 halamanAKUNTANSI OPERASI DAGANGDwi Surya Nugraha100% (1)

- Dasar Akuntansi Episode 1 Mrs - CandraDokumen273 halamanDasar Akuntansi Episode 1 Mrs - CandraTri Yuli ManurungBelum ada peringkat

- Topik 5 Akuntansi Untuk SahamDokumen10 halamanTopik 5 Akuntansi Untuk SahamRizkaBelum ada peringkat

- Soal PT MakmurDokumen22 halamanSoal PT MakmurFitrawanBelum ada peringkat

- Pengambilan Keputusan Jangka PendekDokumen9 halamanPengambilan Keputusan Jangka PendekICAmellyshaBelum ada peringkat

- Jurnal PembalikDokumen3 halamanJurnal PembalikAnnisa Nur Al-IslamiBelum ada peringkat

- Kasus 2Dokumen2 halamanKasus 2Hello NewlyBelum ada peringkat

- Tata Cara Mencatat Transaksi Dalam Buku Pembantu PiutangDokumen4 halamanTata Cara Mencatat Transaksi Dalam Buku Pembantu Piutangraja renoBelum ada peringkat

- Akuntansi Perusahaan Dagang (Kuliah)Dokumen26 halamanAkuntansi Perusahaan Dagang (Kuliah)faulaBelum ada peringkat

- Pertemuan 12 Angka Indek Bagian-1Dokumen16 halamanPertemuan 12 Angka Indek Bagian-1Mela CanniliaBelum ada peringkat

- Soal CH 1 Persamaan Dasar AkuntansiDokumen1 halamanSoal CH 1 Persamaan Dasar AkuntansiAchmad Taufik25% (4)

- Persediaan Umi MuawanahDokumen38 halamanPersediaan Umi MuawanahismihartantiBelum ada peringkat

- Tahap Pelaporan Akuntansi An JasaDokumen44 halamanTahap Pelaporan Akuntansi An JasaSitorus Boltok Sian SappuaraBelum ada peringkat

- SOAL PILIHAN GANDA AUDITING 1Dokumen13 halamanSOAL PILIHAN GANDA AUDITING 1ApriliyanaBelum ada peringkat

- EKONOMIDokumen61 halamanEKONOMIDedexsiiJogangdogen Sangaddjeyeghbeuudt Puyeng'gedhieBelum ada peringkat

- Materi Entry Jurnal Perusahaan DagangDokumen15 halamanMateri Entry Jurnal Perusahaan DagangYoesimaBelum ada peringkat

- MANIPULASI LAPORANDokumen1 halamanMANIPULASI LAPORANDwi MaharaniBelum ada peringkat

- PENYESUAIANDokumen13 halamanPENYESUAIANTitis Heri KristiawanBelum ada peringkat

- Rekonsiliasi BankDokumen2 halamanRekonsiliasi BankDewi Ratna NingsihBelum ada peringkat

- Pertemuan 10 Akuntansi Dagang - AJP Dan Neraca Lajur: Universitas Bina Sarana Informatika 2023Dokumen13 halamanPertemuan 10 Akuntansi Dagang - AJP Dan Neraca Lajur: Universitas Bina Sarana Informatika 2023NajdahBelum ada peringkat

- Soal Pilgan Accounting Skills-1&jwbn-1Dokumen18 halamanSoal Pilgan Accounting Skills-1&jwbn-1satrioyuswantoro6Belum ada peringkat

- AKUNTANSI MANAJEMEN 1Dokumen25 halamanAKUNTANSI MANAJEMEN 1Asdi SalloBelum ada peringkat

- Hutang HipotekDokumen5 halamanHutang HipotekBahrul UlumBelum ada peringkat

- Form Jurnal Akuntansi JasaDokumen24 halamanForm Jurnal Akuntansi JasadiengoesBelum ada peringkat

- ANTAX/Mahasiswa se-BaliDokumen13 halamanANTAX/Mahasiswa se-BaliAlit SanjayaaBelum ada peringkat

- SIKLUS AKUNTANSIDokumen2 halamanSIKLUS AKUNTANSIRetno KumalasariBelum ada peringkat

- Kelompok 7 Wesel Bayar Jangka PanjangDokumen35 halamanKelompok 7 Wesel Bayar Jangka Panjangiqbal farisBelum ada peringkat

- Alokasi Bop & Job Order CostDokumen6 halamanAlokasi Bop & Job Order CostSupardiBelum ada peringkat

- NERACA LAJURDokumen3 halamanNERACA LAJURRika SariBelum ada peringkat

- A Latihan PersediaanDokumen4 halamanA Latihan PersediaanNawwafa SBelum ada peringkat

- AUDITDokumen6 halamanAUDITjunabaturanteBelum ada peringkat

- Perpajakan Kelompok 5Dokumen13 halamanPerpajakan Kelompok 5ptvisaempat balijakartaBelum ada peringkat

- AKUNTANSI PERUSAHAAN DAGANGDokumen7 halamanAKUNTANSI PERUSAHAAN DAGANGZahra HawariyahBelum ada peringkat

- DEPRESIASIDokumen2 halamanDEPRESIASIilham yazidBelum ada peringkat

- Persamaan Dasar AkDokumen23 halamanPersamaan Dasar Aknovita45Belum ada peringkat

- Komputer Akuntansi Xi 2 164Dokumen4 halamanKomputer Akuntansi Xi 2 164Aan Wang100% (2)

- Bab 4-5Dokumen22 halamanBab 4-5ChristinaBelum ada peringkat

- SOAL UJIAN AKHIR SEMESTERDokumen6 halamanSOAL UJIAN AKHIR SEMESTERYusron Mubarok100% (1)

- Tugas RemedialDokumen70 halamanTugas RemedialJohanBelum ada peringkat

- Uts Pa PDFDokumen18 halamanUts Pa PDFAzhida Fuada ABelum ada peringkat

- Akuntansi Dasar IIDokumen23 halamanAkuntansi Dasar IIAlfy HaryantoBelum ada peringkat

- Narasi MediaDokumen30 halamanNarasi Media3septiantoBelum ada peringkat

- Harga Perolehan Aktiva Tetap Atau Aset Tetap Lengkap: Ma'rufDokumen13 halamanHarga Perolehan Aktiva Tetap Atau Aset Tetap Lengkap: Ma'rufnova pratamaBelum ada peringkat

- Matematika EkonomiDokumen18 halamanMatematika EkonomiSasi PrabahandariBelum ada peringkat

- Konsep Dasar Aktiva Tetap Berwujud Dan Aktiva Sumber Daya Alam Serta Aktiva Tetap Tidak BerwujudDokumen9 halamanKonsep Dasar Aktiva Tetap Berwujud Dan Aktiva Sumber Daya Alam Serta Aktiva Tetap Tidak Berwujudarif nasiruddinBelum ada peringkat

- Metode Rata-rata Tertimbang ContohDokumen1 halamanMetode Rata-rata Tertimbang ContohYukiDragneelBelum ada peringkat

- Ayat Jurnal PenyesuaianDokumen3 halamanAyat Jurnal PenyesuaianAisa WaBelum ada peringkat

- 2 Manfaat perhitungan fisik persediaanDokumen2 halaman2 Manfaat perhitungan fisik persediaanYuli YatiBelum ada peringkat

- Ekonomi c14Dokumen13 halamanEkonomi c14Ilma N Septiani100% (1)

- Tugas Pengantar Ekonomi Mikro - Pasar Persaingan SempurnaDokumen13 halamanTugas Pengantar Ekonomi Mikro - Pasar Persaingan SempurnaDhea CahyaBelum ada peringkat

- Tugas Akuntansi OkDokumen15 halamanTugas Akuntansi OkAyangBelum ada peringkat

- Latihan Soal Perusahaan DagangDokumen2 halamanLatihan Soal Perusahaan DagangLivia Marsa100% (1)

- Contoh Soal NiaDokumen11 halamanContoh Soal NiaRobi VisualBelum ada peringkat

- Perusahaan Dagang - PPT2Dokumen14 halamanPerusahaan Dagang - PPT2230210018Belum ada peringkat

- Akuntansi Perusahaan DagangDokumen27 halamanAkuntansi Perusahaan DagangDini HardilianiBelum ada peringkat

- Siklus Akuntansi Perusahaan Dagang BaruDokumen59 halamanSiklus Akuntansi Perusahaan Dagang BaruHenSenBelum ada peringkat

- Siklus Akuntansi DagangDokumen30 halamanSiklus Akuntansi DaganglauraBelum ada peringkat

- Pengantar Akuntansi 1Dokumen15 halamanPengantar Akuntansi 1SoelisBelum ada peringkat

- Soal DPT - KamisDokumen1 halamanSoal DPT - KamisSarah Dzuriyati SamiyahBelum ada peringkat

- Papan Tulis Lab 10Dokumen3 halamanPapan Tulis Lab 10Sarah Dzuriyati SamiyahBelum ada peringkat

- Papan Tulis Lab 08Dokumen2 halamanPapan Tulis Lab 08Sarah Dzuriyati SamiyahBelum ada peringkat

- SOAL DISTRIBUSI NORMAL DAN BINOMIALDokumen1 halamanSOAL DISTRIBUSI NORMAL DAN BINOMIALSarah Dzuriyati SamiyahBelum ada peringkat

- Papan Tulis Lab 9Dokumen2 halamanPapan Tulis Lab 9Sarah Dzuriyati SamiyahBelum ada peringkat

- Papan Tulis Lab 7Dokumen2 halamanPapan Tulis Lab 7Sarah Dzuriyati SamiyahBelum ada peringkat

- FINANCIAL-STATEMENTSDokumen5 halamanFINANCIAL-STATEMENTSSarah Dzuriyati SamiyahBelum ada peringkat

- Lab 8 - DPTDokumen9 halamanLab 8 - DPTSarah Dzuriyati SamiyahBelum ada peringkat

- Lab 6 - Adb 2Dokumen5 halamanLab 6 - Adb 2Sarah Dzuriyati SamiyahBelum ada peringkat

- Teori Akbi Lab 5Dokumen1 halamanTeori Akbi Lab 5Sarah Dzuriyati SamiyahBelum ada peringkat

- Modul Materi Eksternal Lab 7Dokumen9 halamanModul Materi Eksternal Lab 7Sarah Dzuriyati SamiyahBelum ada peringkat

- SOAL2Dokumen4 halamanSOAL2Sarah Dzuriyati SamiyahBelum ada peringkat

- Merger Manajemen KeuanganDokumen4 halamanMerger Manajemen KeuanganSarah Dzuriyati SamiyahBelum ada peringkat

- Tugas Mingguan 9Dokumen3 halamanTugas Mingguan 9Sarah Dzuriyati SamiyahBelum ada peringkat

- Lab Ix - Inventory Costing (Variable & Absorption Costing)Dokumen3 halamanLab Ix - Inventory Costing (Variable & Absorption Costing)Sarah Dzuriyati SamiyahBelum ada peringkat

- Lab Ix - Inventory Costing (Variable & Absorption Costing)Dokumen3 halamanLab Ix - Inventory Costing (Variable & Absorption Costing)Sarah Dzuriyati SamiyahBelum ada peringkat