Daily Insight 16162023

Daily Insight 16162023

Diunggah oleh

Muhamad Lukman HakimHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Daily Insight 16162023

Daily Insight 16162023

Diunggah oleh

Muhamad Lukman HakimHak Cipta:

Format Tersedia

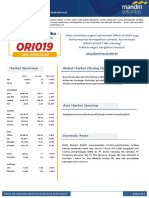

Friday, 16 June 2023

Daily Daily

Sector Last YTD (%) Weekly View

Chg Chg %

MARKET ROUNDUP

Daily Insight

IDXENERGY 2,013.92 (2.51) 3.44% -11.65% Underweight

IDXBASIC 1,125.89 8.16 1.72% -7.42%

IHSG sempat diperdagangkan melemah pada perdagangan kemarin di awal sesi IDXINDUST 1,151.76 (2.18) 1.85% -1.92% Underweight

namun berhasil perlahan naik dia akhir sesi dan berhasil tutup menguat ke level IDXNONCYC 717.84 (0.67) 0.97% 0.18% Overweight

6713 (-0.21%). Optimisme rebound masih terjadi di IHSG yang didorong oleh respon IDXCYCLIC 795.52 5.52 0.70% -6.51% Overweight

para pelaku pasar terkait keputusan The Fed yang tidak melanjutkan trend kenaikan IDXHEALTH 1,562.97 (1.48) 1.85% -0.13% Overweight

suku bunga selain dari dalam negeri adanya rilis data neraca dagang Indonesia yang IDXFINANCE 1,364.90 9.64 1.88% -3.54% Overweight

IDXPROPERT 664.83 7.35 0.05% -6.53% Neutral

kembali surplus namun jauh dibawah perkiraan. Beberapa sector yang mengalami

IDXTECHNO 5,023.90 142.63 -0.09% -2.68% Neutral

penguatan diantara sector energy (+0.75%), sector basic materials (+0.62%) dan

IDXINFRA 808.28 3.90 1.55% -6.95% Neutral

sector infarastrukture (+0.61%). Investor asing tercatat membukukan net sell di pasar IDXTRANS 1,744.59 32.72 2.88% 4.97% Neutral

reguler sebesar Rp235.15 miliar dengan saham-saham yang paling banyak dijual Source(s): IDX & Reli Research

oleh investor asing diantaranya adalah BBCA, TLKM dan PTBA.

ASIA INDEX LAST CHG CHG (%) YTD (%)

NIKKEI 225 33,485.49 (16.9) -0.05% 28.32%

Secara teknikal, IHSG masih akan menguji resistance 6755 untuk dapat melanjutkan TOPIX 2,293.97 (0.6) -0.02% 21.26%

rebound sementara MACD masih menunjukan golden cross. Beberapa saham yang HANGSENG

CSI 300

19,828.92

3,925.50

420.5

61.5

2.17%

1.59%

0.24%

1.39%

memiliki potensi naik untuk perdagangan hari ini yaitu: PTBA, DRMA, BUKA, LPPF, KOSPI 2,608.54 (10.5) -0.40% 16.64%

JPFA, MEDC, AGII, GULA, JSMR, BMRI. SENSEX

KLCI

62,917.63

1,381.73

(310.9)

(3.7)

-0.49%

-0.27%

3.41%

-7.61%

IHSG 6,713.79 14.1 0.21% -2.00%

Sementara itu di bursa AS dari ketiga index utama berhasil ditutup melonjak naik STI 3,242.86 24.7 0.77% -0.26%

dengan penguatan tertinggi terjadi di DJIA +1.26% ditengah ekspektasi dari pelaku EUROPE INDEX LAST CHG CHG (%) YTD (%)

EURO STOXX 4,365.12 (10.9) -0.25% 15.06%

pasar yang dimana isyarat dari The Fed kedepan terkait keputusan suku bunga akan FTSE 100 7,628.26 25.5 0.34% 2.37%

cendrung lebih dovish selain itu data ekonomi AS menunjukan retail sales yang DAX 16,290.12 (20.7) -0.13% 17.00%

CAC40 7,290.91 (37.6) -0.51% 12.62%

mengalami kenaikan 0.3% MoM pada bulan Mei diatas perkiraan dan NY Empire

State Manufacturing Index yang mengalami kenaikan 38 points ke 6.6 di bulan Juni AMERICA INDEX LAST CHG CHG (%) YTD (%)

DJIA 34,408.06 428.7 1.26% 3.80%

selain itu Jobless Claims pada bulan Juni tidak menagalami perubahan. S&P 500 4,425.84 53.3 1.22% 15.27%

NASDAQ 13,782.82 156.3 1.15% 31.69%

NYSE 15,642.70 (25.1) -0.16% 3.02%

MARKET OUTLOOK COMMODITIES LAST CHG CHG (%) YTD (%)

BRENT CRUDE OIL 75.63 2.0 2.73% -12.06%

WTI CRUDE OIL 70.62 2.1 3.02% -12.28%

Dari bursa Asia, pada pagi ini telah diperdagangkan di zona mix, saat laporan ini NATURAL GAS 2.56 0.2 9.33% -42.33%

GOLD 1,971.05 13.8 0.70% 7.70%

ditulis indeks Nikkei 225 melemah (0.49%), sementara index Kospi menguat SILVER 23.96 (0.0) -0.05% -0.92%

(+0.40%). Pada pagi ini para pelaku pasar khususnya di Jepang masih akan COPPER 23.96 (0.0) -0.05% 528.30%

COAL 139.70 3.5 2.61% -61.52%

menunggu keputusan suku bunga yang diperkirakan akn tidak berubah atau tetap di NICKEL 22,975.50 292.0 1.29% -23.56%

-0.1%. CPO (MYR) 3,549.00 90.0 2.60% -14.97%

CURRENCIES LAST CHG CHG (%) YTD (%)

Kemudian dari dalam negeri, IHSG kami perkirakan akan berpotensi cendrung EUR-USD 1.10 0.0 1.03% 2.31%

USD-JPY 140.13 0.1 0.08% 6.86%

menguat ditengah optimisme para pelaku pasar setelah adanya data inflasi yang GBP-USD 1.28 0.0 0.96% 5.71%

semakin membaik dan bank sentral yang lebih bersikap dovish, sementara dari USD-CNY

USD-IDR

7.12

14,902.00

(0.0)

(12.0)

-0.59%

-0.08%

3.23%

-4.27%

dalam negeri para pelaku pasar masih akan menyambut beberapa emiten yang

membagikan dividen setelah RUPS. Kami perkirakan IHSG akan bergerak pada DIVIDEND

TOBA

DIV/SHARE

USD0

CUM DATE

16-Jun-23

EX DATE

19-Jun-23

rentang 6690-6755. JRPT Rp21.00 16-Jun-23 19-Jun-23

DOID Rp0.00 16-Jun-23 19-Jun-23

IHSG Technical PEHA

DSNG

Rp12.37

Rp30.00

16-Jun-23

16-Jun-23

19-Jun-23

19-Jun-23

XAFA Rp25.69 16-Jun-23 19-Jun-23

IMPC Rp33.00 16-Jun-23 19-Jun-23

RUPS SCHEDULE DATE TIME

TIFA TCPI ADCP 16-Jun-23 14:00

SAGE HADE 16-Jun-23 14:00

GGRP BNBR 16-Jun-23 14:00

UFOE PURA 16-Jun-23 13:00

ZBRA RONY BAYU 16-Jun-23 10:00

MTSM MMLP 16-Jun-23 10:00

LPPS BINA 16-Jun-23 10:00

IATA 16-Jun-23 9:30

PTIS PCAR CASS 16-Jun-23 9:00

MTMH KOTA 16-Jun-23 9:00

Right Issue Ratio Price Cum Date

N/A

ECONOMIC CALENDAR DATE

Japan BoJ Interest Rate Decision 16-Jun-23

US Michigan Consumer Sentiment Prel JUN 16-Jun-23

Source: Investing, Tradingview, Barchart, Reli Research

USD / IDR

16,000

your reliable partner | 1

15,500

15,000

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Corporate News USD / IDR

16,000

MIND ID Minta Pencatatan Aset Tambang Nikel Vale Indonesia (INCO) di

15,500

Indonesia. Proses divestasi PT Vale Indonesia Tbk (INCO) sebagai kewajiban

Daily Insight

perpanjangan kontrak karya (KK) menjadi Izin Usaha Pertambangan Khusus( 15,000

IUPK) memasuki babak baru. Setelah adanya kemungkinan Vale Indonesia

14,500

mendivestasikan lebih dari 11% sahamnya ke negara, kini PT Mineral Industri

Indonesia (Persero) atau MIND ID meminta agar aset tambang nikel INCO 14,000

dicatatkan dalam sumber kekayaan negara Indonesia.(Kontan)

Gajah Tunggal (GJTL) Kucurkan Capex US$ 40 Juta-US$ 50 Juta pada Tahun

Ini. PT Gajah Tunggal Tbk (GJTL) berupaya memperkuat kinerjanya pada 2023.

Maka dari itu, GJTL menggelontorkan dana belanja modal atau capital Minyak Mentah WTI (USD/Barrel)

expenditure (capex) sekitar US$ 40 juta-US$ 50 juta pada tahun ini. Finance 85

Director Gajah Tunggal Kisyuwono mengatakan, capex tersebut diprioritaskan 80

untuk peningkatan kualitas mesin-mesin produksi GJTL melalui adopsi teknologi 75

terbaru. Hal ini perlu dilakukan mengingat industri ban terus berkembang 70

mengikuti kemajuan zaman. (Kontan) 65

60

Summarecon Agung (SMRA) Incar Kenaikan Pendapatan Sekitar 10% pada 55

Tahun ini. Emiten properti, PT Summarecon Agung Tbk (SMRA) menargetkan

kenaikan pendapatan dan laba bersih sekitar 10% di tahun 2023. Sebagai

referensi, tahun 2022 SMRA membukukan kinerja keuangan dari sisi pendapatan

tumbuh 2,6% dari Rp 5,57 Triliun menjadi Rp 5,72 Triliun. Perseroan juga berhasil Minyak Mentah Brent (USD/Barrel)

mendapatkan peningkatan laba bersih sebanyak 40% yaitu dari Rp 550 miliar 90

menjadi Rp 772 miliar. . (Kontan) 85

80

Perluas Drop Point, Telefast (TFAS) Siapkan Capex Rp 5 Miliar di 2023. PT

75

Telefast Indonesia Tbk (TFAS), anak usaha PT M Cash Integrasi Tbk (MCAS),

70

menyiapkan Capital expenditure (Capex) atau belanja modal sebesar Rp 5 miliar

65

di tahun ini. Telefast memperluas jaringan drop point logistik yang mencapai

60

hingga lebih dari 9.000 titik. Inovasi dan kolaborasi pun dilakukan Telefast untuk

meningkatkan kinerja, memperkuat daya saing, dan memberikan kemudahan

layanan logistik kepada masyarakat. Telefast bekerja sama dengan mitra 3PL

(third party logistic) dalam beberapa tahun belakangan, antara lain dengan

CPO Malaysia (MYR/Mton)

SiCepat Ekspres, Paxel, Sentral Cargo, Bukalapak dan lainnya.(Kontan)

4,400

4,300

4,200

4,100

4,000

3,900

3,800

Batubara (USD/Mton)

450

400

350

300

250

200

150

100

Emas (USD/t Oz)

2,100

2,000

1,900

your reliable partner | 2

1,800

1,700

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Stock Recommendation

PTBA

Daily Insight

SPECULATIVE BUY

Analisis:

• Berhasil breakout resistance dan membentuk candle

bullish yang kuat, antisipasi jika dapat menutup gap

kembali.

• MACD masih di area golden cross diikuti peningkatan

volume beli.

• Stoploss apabila harga saham kembali turun ke bawah

di level 3600.

• Support : 3250

• Resistance : 3860

• Stoploss : 3600

• Target Price : 4330

DRMA

SPECULATIVE BUY

Analisis:

• Berhasil breakout resistance dan membentuk candle

bullish yang kuat.

• Stochastic berhasil membentuk golden cross.

• Stoploss apabila harga saham kembali turun dan

bertahan kebawah area 1350.

• Support : 1285

• Resistance : 1445

• Stoploss : 1350

• Target Price : 1570

your reliable partner | 3

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Stock Recommendation

BUKA

Daily Insight

SPECULATIVE BUY

Analisis:

• Membentuk candle bullish dan berhasil breakout dari

resistance penting nya, antisipasi jika dapat rebound.

• Stochastic berhasil membentuk golden cross.

• Stoploss apabila harga turun kebawah dan berhasil

bertahan 216.

• Support : 198

• Resistance : 228

• Stoploss : 216

• Target Price : 250

LPPF

SPECULATIVE BUY

Analisis:

• Membentuk candle marubozu bullish dan berhasil

breakout resistance.

• Stochastic dan MACD berhasil membentuk golden

cross.

• Stoploss apabila harga turun kebawah dan berhasil

bertahan di 3580

• Support : 3290

• Resistance : 3900

• Stoploss : 3580

• Target Price : 4600

your reliable partner | 4

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Indicator Explorer

Resistance P rice Suppo rt Weekly Weekly Indicato r Mo ving Average

Daily Insight

Ticker

Fractal 15-Mar-23 Fractal High Lo w Sto chastic RSI B. Band 20 Days 50 Days 200 Days

AALI 13,150 7,950 11,750 13,150 8,075 Neutral Bearish Oversold Lower Bands Under Under Under

ACES 1,030 456 980 1,025 482 Neutral Bearish Oversold Lower Bands Under Under Under

ACST 168 132 154 168 138 Neutral Bearish Oversold Lower Bands Under Under Under

ADHI 730 414 650 700 422 Neutral Bullish Oversold Lower Bands Under Under Under

ADRO 3,380 2,750 3,050 3,380 2,820 Neutral Bearish Neutral Lower Bands Under Under Upper

AGII 2,440 1,910 1,670 2,120 1,985 Neutral Bearish Neutral Middle Bands Under Upper Upper

AKRA 1,065 1,400 975 1,410 1,030 Neutral Bullish Overbought Upper Bands Upper Upper Upper

AMRT 1,845 2,850 1,430 2,900 1,785 Neutral Bullish Overbought Upper Bands Upper Upper Upper

ANTM 2,670 1,855 2,340 2,670 1,865 Neutral Bearish Oversold Lower Bands Under Under Under

ARNA 1,070 1,000 980 1,070 1,015 Neutral Bearish Neutral Middle Bands Under Upper Upper

ASII 7,300 5,775 6,825 7,200 5,875 Neutral Bearish Neutral Lower Bands Under Under Under

ASRI 163 152 149 161 154 Neutral Bearish Neutral Middle Bands Under Under Under

ASSA 2,200 735 1,860 2,170 770 Neutral Bearish Oversold Lower Bands Under Under Under

BBCA 7,575 8,325 7,325 8,475 7,450 Neutral Bullish Neutral Upper Bands Upper Upper Upper

BBNI 9,175 8,800 8,050 9,175 8,925 Neutral Bearish Neutral Middle Bands Under Upper Upper

BBRI 4,530 4,700 4,320 4,770 4,440 Neutral Bullish Neutral Middle Bands Upper Upper Upper

BBTN 1,690 1,175 1,635 1,690 1,225 Neutral Bearish Oversold Lower Bands Under Under Under

BDMN 2,510 2,720 2,320 2,720 2,360 Neutral Bullish Overbought Upper Bands Upper Upper Upper

BEST 113 131 106 135 109 Overbought Bullish Overbought Upper Bands Upper Upper Upper

BFIN 1,160 1,295 1,045 1,315 1,095 Neutral Bearish Neutral Middle Bands Upper Upper Upper

BIRD 1,240 1,685 1,160 1,700 1,195 Neutral Bullish Overbought Upper Bands Upper Upper Upper

BISI 1,880 1,745 1,535 1,880 1,625 Neutral Bullish Neutral Middle Bands Upper Upper Upper

BJBR 1,460 1,320 1,410 1,465 1,340 Neutral Bearish Oversold Lower Bands Under Under Under

BMRI 8,075 10,050 7,750 10,175 8,050 Neutral Bullish Overbought Upper Bands Upper Upper Upper

BNGA 1,070 1,210 995 1,230 1,015 Neutral Bullish Overbought Upper Bands Upper Upper Upper

BNLI 1,300 975 1,130 1,235 1,000 Neutral Bearish Oversold Lower Bands Under Under Under

BRPT 840 765 800 825 785 Neutral Bearish Neutral Lower Bands Under Under Under

BSDE 930 995 880 995 920 Neutral Bullish Neutral Upper Bands Upper Upper Under

BTPN 2,610 2,460 2,490 2,540 2,460 Neutral Bearish Neutral Lower Bands Under Under Under

CPIN 5,175 5,000 4,880 5,175 5,000 Neutral Bearish Neutral Middle Bands Upper Under Under

CTRA 1,010 950 960 1,010 965 Neutral Bearish Neutral Lower Bands Under Under Under

DILD 149 165 139 168 143 Neutral Bearish Overbought Upper Bands Upper Upper Upper

DMAS 175 165 170 175 166 Neutral Bearish Neutral Lower Bands Under Under Under

DOID 615 292 476 615 298 Oversold Bearish Oversold Lower Bands Under Under Under

ERAA 515 482 482 515 496 Neutral Bearish Neutral Lower Bands Under Under Under

ESSA 1,405 980 1,045 1,350 985 Neutral Bearish Neutral Lower Bands Under Under Upper

GGRM 31,200 25,100 30,100 31,200 25,275 Neutral Bearish Oversold Lower Bands Under Under Under

GMFI 83 52 76 83 54 Neutral Bearish Oversold Lower Bands Under Under Under

HMSP 980 1,145 905 1,165 1,065 Neutral Bullish Overbought Upper Bands Upper Upper Upper

HOKI 157 97 143 149 102 Neutral Bearish Oversold Lower Bands Under Under Under

HRUM 11,300 1,530 10,375 11,300 1,580 Neutral Bearish Oversold Lower Bands Under Under Under

ICBP 8,350 9,325 7,750 9,750 8,100 Neutral Bullish Overbought Upper Bands Upper Upper Upper

IMAS 770 1,045 705 1,080 755 Overbought Bullish Overbought Upper Bands Upper Upper Upper

IMJS 424 272 356 368 278 Neutral Bearish Oversold Lower Bands Under Under Under

INCO 8,275 6,150 6,850 8,275 6,175 Neutral Bearish Neutral Lower Bands Under Under Upper

INDF 6,550 6,100 6,325 6,475 6,225 Neutral Bearish Neutral Lower Bands Under Under Under

INDY 2,950 2,140 2,470 2,950 2,210 Neutral Bearish Neutral Lower Bands Under Under Upper

INKP 7,925 7,175 7,200 7,925 7,500 Neutral Bearish Neutral Lower Bands Under Under Under

INTP 10,600 10,250 9,375 11,000 10,000 Overbought Bearish Neutral Middle Bands Upper Under Under

ITMG 33,800 37,900 31,250 38,325 33,075 Neutral Bullish Overbought Upper Bands Upper Upper Upper

JPFA 1,420 1,155 1,370 1,420 1,205 Neutral Bearish Oversold Lower Bands Under Under Under

JRPT 498 492 468 496 474 Overbought Bullish Neutral Upper Bands Upper Upper Upper

JSMR 3,780 3,060 3,660 3,840 3,210 Neutral Bullish Oversold Lower Bands Under Under Under

KLBF 1,660 2,070 1,575 2,120 1,635 Neutral Bullish Overbought Upper Bands Upper Upper Upper

LINK 4,600 2,160 4,380 4,690 2,320 Neutral Bearish Oversold Lower Bands Under Under Under

LPCK 1,465 900 1,065 1,335 915 Oversold Bearish Oversold Lower Bands Under Under Under

LPKR 128 72 114 128 78 Neutral Bearish Oversold Lower Bands Under Under Under

LPPF 5,925 4,950 5,250 5,900 4,970 Neutral Bearish Neutral Lower Bands Under Under Upper

LSIP 1,465 1,005 1,325 1,465 1,020 Neutral Bearish Oversold Lower Bands Under Under Under

MAIN 660 438 595 605 450 Oversold Bullish Oversold Lower Bands Under Under Under

MAPI 910 1,545 820 1,570 865 Neutral Bullish Overbought Upper Bands Upper Upper Upper

MCAS 13,325 5,550 11,800 13,875 6,200 Neutral Bearish Oversold Lower Bands Under Under Under

MEDC 575 930 555 975 565 Neutral Bullish Overbought Upper Bands Upper Upper Upper

META 130 116 108 120 111 Neutral Bullish Neutral Upper Bands Upper Upper Under

3,140 3,000 2,420 3,140 2,800 Overbought Bearish Overbought Middle Bands Upper Upper Upper

your reliable partner | 5

MIKA

MNCN 1,080 590 915 960 620 Neutral Bearish Oversold Lower Bands Under Under Under

MYOR 1,860 2,650 1,600 2,690 1,675 Neutral Bullish Overbought Upper Bands Upper Upper Upper

PBID 1,810 1,555 1,735 1,810 1,570 Neutral Bearish Oversold Lower Bands Under Under Under

PGAS 1,540 1,410 1,335 1,795 1,495 Neutral Bearish Neutral Middle Bands Under Under Upper

PNBN 1,085 1,330 920 1,395 1,035 Neutral Bullish Overbought Upper Bands Upper Upper Upper

Source : Reliance Research

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Indicator Explorer

Resistance P rice Suppo rt Weekly Weekly Indicato r Mo ving Average

Daily Insight

Ticker

Fractal 15-Mar-23 Fractal High Lo w Sto chastic RSI B. Band 20 Days 50 Days 200 Days

PTBA 3,860 3,810 3,560 4,520 3,880 Neutral Bearish Neutral Middle Bands Under Upper Upper

PTPP 940 590 865 925 615 Neutral Bearish Oversold Lower Bands Under Under Under

PWON 560 436 490 520 444 Neutral Bearish Oversold Lower Bands Under Under Under

RALS 735 630 620 710 635 Neutral Bearish Neutral Middle Bands Under Under Under

ROTI 1,295 1,435 1,270 1,480 1,280 Overbought Bullish Overbought Upper Bands Upper Upper Upper

SCMA 258 184 230 236 196 Oversold Bearish Oversold Lower Bands Under Under Under

SGRO 2,360 2,100 2,200 2,360 2,120 Neutral Bearish Neutral Lower Bands Under Under Upper

SIDO 950 850 920 970 855 Neutral Bearish Neutral Lower Bands Under Under Under

SILO 8,975 1,315 950 1,320 1,050 Neutral Bearish Oversold Upper Bands Upper Under Under

SIMP 520 396 472 520 400 Neutral Bearish Oversold Lower Bands Under Under Under

SMBR 520 354 460 515 380 Neutral Bearish Oversold Lower Bands Under Under Under

SMCB 1,700 1,315 1,575 1,590 1,330 Oversold Bullish Oversold Lower Bands Under Under Under

SMGR 6,775 6,175 6,225 6,775 6,425 Neutral Bearish Neutral Middle Bands Under Under Under

SMRA 730 550 665 705 560 Neutral Bearish Oversold Lower Bands Under Under Under

SMDR 3,350 366 2,550 3,350 382 Neutral Bearish Oversold Lower Bands Under Under Under

SSMS 1,180 1,680 1,030 1,720 1,205 Overbought Bullish Overbought Upper Bands Upper Upper Upper

TBIG 3,080 2,100 2,750 2,880 2,170 Oversold Bearish Oversold Lower Bands Under Under Under

TBLA 810 685 765 810 695 Neutral Bearish Oversold Lower Bands Under Under Under

TINS 1,900 1,040 1,615 1,810 1,090 Neutral Bearish Oversold Lower Bands Under Under Under

TKIM 6,775 6,550 6,450 6,825 6,550 Neutral Bearish Neutral Middle Bands Under Under Under

TLKM 4,850 4,010 4,070 4,230 4,060 Neutral Bullish Oversold Middle Bands Under Under Under

TOTL 304 312 296 318 300 Neutral Bullish Overbought Upper Bands Upper Upper Upper

TOWR 1,030 920 940 970 955 Oversold Bearish Neutral Lower Bands Under Under Under

TPIA 9,975 2,220 9,800 9,975 2,250 Neutral Bearish Oversold Lower Bands Under Under Under

ULTJ 1,535 1,470 1,480 1,515 1,480 Neutral Bearish Neutral Lower Bands Under Under Under

UNTR 30,500 27,250 29,200 30,800 27,700 Neutral Bearish Neutral Lower Bands Under Under Upper

UNVR 5,125 4,100 3,370 5,125 4,230 Neutral Bearish Neutral Middle Bands Under Upper Under

WEGE 180 135 170 180 138 Neutral Bearish Oversold Lower Bands Under Under Under

WIKA 960 905 895 950 910 Neutral Bearish Neutral Middle Bands Under Under Under

WOOD 630 398 590 630 422 Neutral Bearish Oversold Lower Bands Under Under Under

WSBP 121 95 95 95 95 Oversold Bearish Oversold Upper Bands Under Under Under

WSKT 560 470 482 535 472 Neutral Bearish Neutral Lower Bands Under Under Under

WTON 214 206 199 214 204 Neutral Bearish Neutral Middle Bands Under Under Under

Source : Reliance Research

your reliable partner | 6

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Indeks LS27

Recommen Current Earnings (Bn Current Price Current P/E Current P/B FY23F FY23F

Ticker TP (IDR) Upside (%) Sector NPM (%) ROA (%) ROE (%)

dation IDR) (IDR) (x) (x) P/E (x) P/B (x)

Daily Insight

AGII Not Rated N/A N/A Basic Materials 70 1,910 54.5 1.6 N/A N/A 3.7% 1% 2%

ESSA Not Rated N/A N/A Basic Materials 2,537 980 9.2 2.1 N/A N/A 29.9% 20% 35%

INCO Not Rated N/A N/A Basic Materials 2,565 6,150 19.3 1.7 N/A N/A 19.3% 6% 7%

MDKA Not Rated N/A N/A Basic Materials 1,070 3,990 75.9 3.1 N/A N/A 1.3% 2% 3%

SMGR BUY 9,700 57% Basic Materials 1,732 6,175 18.3 1.0 19.1 1.4 6.9% 2% 4%

ERAA Not Rated 690 43% Consumer Cyclicals 677 482 7.9 1.1 5.16 0.88 1.9% 4% 10%

AUTO Not Rated N/A N/A Consumer Cyclicals 911 1,690 8.2 0.6 N/A N/A 6.7% 5% 7%

DRMA Not Rated N/A N/A Consumer Cyclicals 252 770 9.0 2.9 N/A N/A 9.5% 10% 20%

VICI Neutral 534 8% Consumer Non Cyclicals 534 496 35.9 4.1 30.3 3.5 73.4% 5% 7%

INDF Not Rated N/A N/A Consumer Non-Cyclicals 4,646 6,100 6.0 0.6 N/A N/A 5.7% 3% 5%

PTRO BUY 5,025 14% Energy 472 4,400 9.4 1.0 8.3 1.0 1.5% 5% 11%

ADRO Not Rated N/A N/A Energy 33,031 2,750 2.4 0.9 N/A N/A 36.7% 22% 34%

AKRA Not Rated N/A N/A Energy 1,509 1,400 15.0 2.3 N/A N/A 4.4% 6% 12%

INDY Not Rated N/A N/A Energy 4,816 2,140 1.7 0.6 N/A N/A 10.8% 9% 27%

MEDC Not Rated N/A N/A Energy 5,706 930 4.0 1.0 N/A N/A 22.2% 6% 24%

ITMG Not Rated N/A N/A Energy 13,611 37,900 2.6 1.4 N/A N/A 34.2% 36% 46%

BBCA Not Rated N/A N/A Financials 28,970 8,325 27.6 4.8 N/A N/A 54.7% 2% 14%

BBRI Not Rated N/A N/A Financials 39,311 4,700 14.0 2.4 N/A N/A 29.0% 2% 13%

BFIN Not Rated N/A N/A Financials 1,310 1,295 12.6 2.4 N/A N/A 41.7% 7% 15%

BRIS Not Rated N/A N/A Financials 3,205 1,520 17.6 2.5 N/A N/A 27.9% 1% 12%

BMRI Not Rated N/A N/A Financials 33,465 10,050 11.9 2.0 N/A N/A 31.2% 2% 14%

KLBF Not Rated N/A N/A Healthcare 2,534 2,070 28.7 4.6 N/A N/A 12.0% 10% 12%

ASSA Not Rated N/A N/A Transportation & Logistic 69 735 13.5 1.0 N/A N/A 1.5% 1% 3%

ASII Not Rated N/A N/A Industrials 32,012 5,775 8.2 1.0 N/A N/A 14.5% 8% 13%

TLKM Not Rated N/A N/A Infrastructures 22,816 4,010 17.7 2.7 N/A N/A 21.0% 8% 16%

JKON Not Rated N/A N/A Infrastructures 106 110 11.4 0.6 N/A N/A 3.9% 2% 4%

DMAS Not Rated N/A N/A Properties & Real Estate 768 165 9.4 1.3 N/A N/A 61.2% 11% 13%

Indicator Explorer Analyst Rating Framework:

The given rating is a basis of technical analysis consideration

▪ Buy : Share price may exceed 10% over the next 12 months

▪ Trading Buy : Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

▪ Speculative Buy : Share price may exceed 20% in a short time horizon, however longer-term outlook remains uncertain

▪ Buy On Weakness : Accumulate stock at indicated support level

▪ Buy If Break : Accumulate stock when share price move above the indicated resistance level

▪ Sell On Strength : Sell stock at indicated resistance level, share price expected to fall in a short time horizon

▪ Neutral : Share price may move within the range of +/- 10% over the next 12 months

▪ Take Profit : Target price has been attained. Look to accumulate at lower levels

▪ Partial Sell : Share price may fall by more than 10% over the next 12 months

Index LS27 Analyst Rating Framework:

The given rating is a basis of fundamental analysis consideration

▪ BUY : Expected return of 2x Risk Free or more within a 12-month period

• NEUTRAL : Expected return between -1.9x and 1.9x Risk Free

• SELL : Expected return of -2x Risk Free or more within a 12-month period

• NON-RATED : Analysts do not express any trading recommendation

Sectoral Weekly View Rating Guidance:

The given rating is a basis of technical analysis consideration

▪ Overweight : Sector may move in bullish (up) trend on daily timeframe for current week, by considering prior 2 (two) to 6 (six) months

your reliable partner | 7

movement

▪ Neutral : Sector may move sideway on daily timeframe for current week, by considering prior 2 (two) to 6 (six) months movement.

▪ Underweight : Sector may move in bearish (down) trend on daily timeframe for current week, by considering prior 2 (two) to 6 (six) months

movement

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Head Office Research Team

Reliance Building Lukman Hakim, Sr. Research Analyst

Soho Westpoint, Kota Kedoya lukman@reliancesekuritas.com

Daily Insight

Jl. Macan Kav 4-5, Kedoya Utara

Kebon Jeruk Ayu Dian, Research Analyst

T. +62 21 2952 0558 ayu.fauzia@reliancesekuritas.com

F. +62 21 2911 9951

Branch Office

Jakarta Bandung Surabaya Medan

Soho Westpoint, Kota Kedoya Jl. PH.H. Mustofa No. 33, Jl. Bangka No. 22 Jl. Teuku Amir Hamzah

Jl. Macan Kav 4-5 Kedoya Utara Kebon Bandung, Jawa Barat 40115 Surabaya 60281 No.48-O

Jeruk T. +62 22 721 8200 T. +62 31 501 1128 Medan 20117

T. +62 21 2952 0558 F. +62 22 721 9603 F. +62 31 503 3196 T. +62 61 6638023

F. +62 21 2911 9951

Pontianak Tasikmalaya Denpasar

Komp. Perkantoran Central Ruko Tasik Indah Plaza No.21 Dewata Square Blok A3

Perdana Blok A2-A3 Jl. KHZ Mustofa No. 345 Jl. Letda Tantular Renon

Jl. Perdana – Kota Pontianak, Tasikmalaya 46121 Denpasar 802361

Kalimantan Barat 78124 T. +62 265 345001 T. +62 361 225099

F. +62 265 345003 F. +62 361 245099

Malang Balikpapan Makassar

Jl. Guntur No. 19 Ruko Puri Blok B No.9 Jl. Monginsidi No. 43 A

Malang 65112 Balikpapan baru Makassar- Sulawesi Selatan

T. +62 341 347 611 Kalimantan Timur T. +62 411 4097507

F. +62 341 347 615 T. +62 542 8708347

IDX Corner & Investment Gallery

Universitas Muhammadiyah Malang Universitas Pesantren Tinggi Universitas Galuh

Jl. Raya Tlogomas 246 Darul Ulum Jl. RE Martadinata No. 150

Malang 65144 Komplek PP Darul Ulum Ciamis 46274

T. +62 341 464318-9 Peterongan, Jombang 61481 T. +62 265 776787

F. +62 341 460435 T. +62 321 873655

F. +62 321 876771

Universitas Surabaya STIESIA Surabaya STIKOM BALI

Jl. Ngagel Jaya Selatan No. 169 Jl. Menur Pumpungan 30 JL. Raya Puputan No. 86,

Surabaya 60294 Surabaya Renon, Denpasar Timur, kota

T. +62 31 2981130 T. +62 31 5947505 Denpasar Bali-80234

F. +62 31 2981131 F. +62 31 5932218 T. +62 361 244445

Universitas 17 Agustus 1945 Universitas Muhammadiyah Universitas Siliwangi

Banyuwangi Sidoarjo Tasikmalaya

Jl. Adi Sucipto 26 Banyuwangi Fakultas Ekonomi Jl. Siliwangi No. 24

JawaTimur Jl. Majapahit 666 B Tasikmalaya 46151

T. +62 333 411248 Sidoarjo, JawaTimur T. +62 265 330634

F. +62 333 419163 T. +62 31 8945444

F. +62 31 8949333

Disclaimer:

your reliable partner | 8

Information, opinions and recommendations contained in this document are presented by PT Reliance Sekuritas Indonesia Tbk. from sources that are considered

reliable and dependable. This document is not an offer, invitation or any kind of representations to decide to buy or sell stock. Investment decisions taken based on this

document is not the responsibility of PT Reliance Sekuritas Indonesia Tbk. PT Reliance Sekuritas Indonesia Tbk. reserves the right to change the contents of this

document at any time without prior notice.

www.reliancesekuritas.com www.relitrade.com www.reliresearch.com reliancesekuritas

Anda mungkin juga menyukai

- INDOBeX FactSheetDokumen6 halamanINDOBeX FactSheetyandaa007Belum ada peringkat

- Daily Insight 07072023Dokumen8 halamanDaily Insight 07072023Muhamad Lukman HakimBelum ada peringkat

- Daily Brief 14022022Dokumen1 halamanDaily Brief 14022022Rizan FauziBelum ada peringkat

- Morning - Update 20220728Dokumen5 halamanMorning - Update 20220728Dini FadhilahBelum ada peringkat

- NH Daily Jan 10 2023 IndonesianDokumen8 halamanNH Daily Jan 10 2023 IndonesianKucing GaulBelum ada peringkat

- Morning - Update 20220708Dokumen4 halamanMorning - Update 20220708ShenShen WidartoBelum ada peringkat

- Fund Update 20220829Dokumen4 halamanFund Update 20220829rizky lazuardiBelum ada peringkat

- Fund Update 20220822Dokumen4 halamanFund Update 20220822rizky lazuardiBelum ada peringkat

- Special Report A-CLUBDokumen10 halamanSpecial Report A-CLUBDONNY SURYANTOBelum ada peringkat

- TP260221Dokumen9 halamanTP260221feelsperfumeryBelum ada peringkat

- Thariq Kemal - Lembar Kerja Manajemen Kredit Dan Analisis Kinerja PerbankanDokumen16 halamanThariq Kemal - Lembar Kerja Manajemen Kredit Dan Analisis Kinerja PerbankanRony Adi NugrahaBelum ada peringkat

- FactsheetDokumen2 halamanFactsheetFendy HendrawanBelum ada peringkat

- Statistik Publik - Januari 2023 v2Dokumen7 halamanStatistik Publik - Januari 2023 v2great scottBelum ada peringkat

- 02 Market Snapshot: Source: BloombergDokumen6 halaman02 Market Snapshot: Source: Bloomberganiesyah widyaningtyasBelum ada peringkat

- Morning - Update 20220801Dokumen4 halamanMorning - Update 20220801Kharisma Al Qua RisbiBelum ada peringkat

- Morning - Update 20230616Dokumen4 halamanMorning - Update 20230616Flx gadgetinBelum ada peringkat

- Bahan Maporina Final-PanitiaDokumen28 halamanBahan Maporina Final-Panitiaheri eko prasetyoBelum ada peringkat

- Daily Research 27 02 2023Dokumen7 halamanDaily Research 27 02 2023ade hexoBelum ada peringkat

- Kinerja BPPDokumen1 halamanKinerja BPPimanBelum ada peringkat

- Daily Research 01 03 2023Dokumen7 halamanDaily Research 01 03 2023Ryhani RahmiBelum ada peringkat

- BNIS Retail Report 061223Dokumen5 halamanBNIS Retail Report 061223Ameliana DamaiyantiBelum ada peringkat

- Bab 4 - Pasar Modal Syariah - ToT Modul PMS Part 2 - Final 211021Dokumen24 halamanBab 4 - Pasar Modal Syariah - ToT Modul PMS Part 2 - Final 211021Zainal AnharBelum ada peringkat

- Catatan Bankir - EOMDokumen14 halamanCatatan Bankir - EOMbprsowanutamaBelum ada peringkat

- FactsheetDokumen2 halamanFactsheetAdit ArmanBelum ada peringkat

- Paparan BPK Saribua SiahaanDokumen34 halamanPaparan BPK Saribua SiahaanTricker ComunyBelum ada peringkat

- Daily Research 17 07 2023Dokumen8 halamanDaily Research 17 07 2023Hendri AdeBelum ada peringkat

- Indonesia Technical Pointer: Mixed in The RangeDokumen9 halamanIndonesia Technical Pointer: Mixed in The RangeEveline AnBelum ada peringkat

- Stock & Bond Market Review-July 10Dokumen3 halamanStock & Bond Market Review-July 10Harris DalimuntheBelum ada peringkat

- MR2021203Dokumen7 halamanMR2021203fathur abrarBelum ada peringkat

- Daily 04012017Dokumen10 halamanDaily 04012017David Nathanael SutyantoBelum ada peringkat

- INDOBeX FactSheetDokumen6 halamanINDOBeX FactSheetadhvikBelum ada peringkat

- Tugas Manajemen TaiDokumen7 halamanTugas Manajemen TaiRaden SunardiBelum ada peringkat

- Sucorinvest Equity Fund FactsheetDokumen1 halamanSucorinvest Equity Fund FactsheetlexoinBelum ada peringkat

- Alk PT - KaiDokumen14 halamanAlk PT - KaiReny PauziahBelum ada peringkat

- Stock & Bond Market Review-July 31Dokumen3 halamanStock & Bond Market Review-July 31Harris DalimuntheBelum ada peringkat

- Tugas Lkpdpekalongan Alfinahmadjulyansyah 2206837050Dokumen3 halamanTugas Lkpdpekalongan Alfinahmadjulyansyah 2206837050Ibrahim MqmoBelum ada peringkat

- Morning Update 20220822Dokumen4 halamanMorning Update 20220822Farid RahmanBelum ada peringkat

- MR 20220908Dokumen6 halamanMR 20220908Rifki AmrullahBelum ada peringkat

- Morning Update 20220902Dokumen4 halamanMorning Update 20220902Opiq PiqhiBelum ada peringkat

- MR20220125Dokumen4 halamanMR20220125watimelawatiBelum ada peringkat

- Pengantar DS-100Dokumen25 halamanPengantar DS-100Fendy Tn100% (1)

- Weekly Report Stocknow - Id 18 - 22 Maret 2024Dokumen8 halamanWeekly Report Stocknow - Id 18 - 22 Maret 2024budivanjBelum ada peringkat

- ZCSGV SGVasd VZXVZXDokumen5 halamanZCSGV SGVasd VZXVZXfathur abrarBelum ada peringkat

- Pernikahan CampuranDokumen4 halamanPernikahan CampuranAbcde FghijkBelum ada peringkat

- Snapshot Perbankan Syariah Indonesia Maret 2020 PDFDokumen6 halamanSnapshot Perbankan Syariah Indonesia Maret 2020 PDFWindi AtrianiBelum ada peringkat

- Indeks Peng-00133Dokumen27 halamanIndeks Peng-00133Fina NisaBelum ada peringkat

- Catatan Bankir - EOMDokumen13 halamanCatatan Bankir - EOMbprsowanutamaBelum ada peringkat

- Indeks Peng 00267Dokumen22 halamanIndeks Peng 00267ardian.syaputraBelum ada peringkat

- Rasyid Slide AssesmentDokumen11 halamanRasyid Slide AssesmentOkta RinaldiBelum ada peringkat

- Snapshot Perbankan Syariah Posisi Desember 2018 - 2Dokumen8 halamanSnapshot Perbankan Syariah Posisi Desember 2018 - 2Cici Aprilia KartiniBelum ada peringkat

- Rakordalbang TW 3 2021 - RevDokumen31 halamanRakordalbang TW 3 2021 - RevMujahidBelum ada peringkat

- Analisis 8 Perusahaan FixDokumen12 halamanAnalisis 8 Perusahaan FixTakezhiBelum ada peringkat

- 01 RPerkembangan Kebijakan JKNDokumen23 halaman01 RPerkembangan Kebijakan JKNm hidayatBelum ada peringkat

- Slide Makalah Analisa Rasio Profitabilitas Dan Rasio LikuditasDokumen24 halamanSlide Makalah Analisa Rasio Profitabilitas Dan Rasio LikuditasHERI ASBOWOBelum ada peringkat

- Accounting Analysis PT SampoernaDokumen19 halamanAccounting Analysis PT SampoernaM Defri AkbarBelum ada peringkat

- Rasio PT Kimia Farma Persero (KAEF) PT Malindo Feedmill (TBK) (MAIN) Rata - Rata Tahun 2021 & 2022 Rata - Rata Tahun 2021 & 2022Dokumen8 halamanRasio PT Kimia Farma Persero (KAEF) PT Malindo Feedmill (TBK) (MAIN) Rata - Rata Tahun 2021 & 2022 Rata - Rata Tahun 2021 & 2022Ni PratiwiBelum ada peringkat

- Fund Fact Sheet Smartlink - Rupiah - Equity - Class - B - Dec - 22 - IdDokumen1 halamanFund Fact Sheet Smartlink - Rupiah - Equity - Class - B - Dec - 22 - IdLancyBelum ada peringkat

- Allianz Alpha Sector Rotation - JANUARI - 2024Dokumen1 halamanAllianz Alpha Sector Rotation - JANUARI - 2024alfarezasetyaBelum ada peringkat

- Daily Insight 05302023Dokumen8 halamanDaily Insight 05302023Muhamad Lukman HakimBelum ada peringkat

- Daily Insight 06052023Dokumen8 halamanDaily Insight 06052023Muhamad Lukman HakimBelum ada peringkat

- Daily Insight 07062023Dokumen8 halamanDaily Insight 07062023Muhamad Lukman HakimBelum ada peringkat

- LS-27 GuideDokumen8 halamanLS-27 GuideMuhamad Lukman HakimBelum ada peringkat