Perpajakan 2

Diunggah oleh

Imhsym 010 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

23 tayangan2 halamanPrtkm perpajakan 2

Judul Asli

perpajakan 2

Hak Cipta

© © All Rights Reserved

Format Tersedia

XLSX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniPrtkm perpajakan 2

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

23 tayangan2 halamanPerpajakan 2

Diunggah oleh

Imhsym 01Prtkm perpajakan 2

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai XLSX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

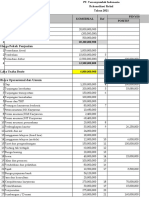

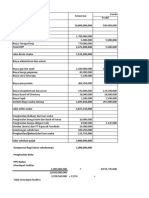

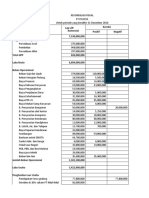

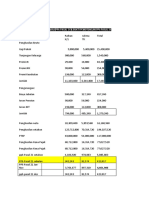

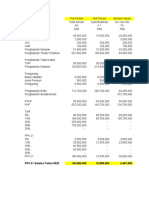

MENGITUNG PPH PASAL 21 ATAS JASA PRODUKSI PEGAWAI TETAP

Keterangan Akbar perdana wicaksana abdurrahman permana yuliawan artanti puspitasari

Gaji pokok setahun 9,000,000 6,200,000 6,200,000 6,200,000 5,000,000 4,200,000 4,200,000

Tunjangan struktural setahun 2,000,000 1,000,000 750,000 500,000

Tunjangan fungsional setahun 500,000 500,000 500,000 500,000 500,000 500,000 500,000

Tunjangan disiplin setahun 180,000 124,000 124,000 124,000 100,000 84,000 84,000

Premi asuransi setahun 360,000 248,000 248,000 248,000 200,000 168,000 168,000

Jasa produksi 13,500,000 7,750,000 12,400,000 9,300,000 10,000,000 8,400,000 5,250,000

Penghasilan bruto setahun 25,540,000 15,822,000 20,222,000 16,872,000 15,800,000 13,352,000 10,202,000

Pengurangan:

1. Biaya jabatan 500,000 403,600 391,100 378,600 290,000 247,600 247,600

2. Iuran pensiun 270,000 186,000 186,000 186,000 150,000 126,000 126,000

Total pengurangan 770,000 589,600 577,100 564,600 440,000 373,600 373,600

Penghasilan neto setahun 135,240,000 89,788,800 86,938,800 84,088,800 64,320,000 54,940,800 54,940,800

PTKP setahun 63,000,000 67,500,000 63,000,000 54,000,000 58,500,000 58,500,000 54,000,000

Penghasilan kena pajak (PKP) 85,740,000 30,038,800 36,338,800 39,388,800 15,820,000 4,840,800 6,190,800

Penghasilan kena pajak (dibulatkan)

PPh Pasal 21 setahun

5% x 2,500,000 1,501,940 1,816,940 1,969,440 791,000 309,540

15% x 5,361,000

25% x

30% x

PPh Pasal 21 atas gaji dan bonus

PPh Pasal 21 atas gaji setahun 7,861,000 1,501,940 1,816,940 1,969,440 791,000 309,540

PPh atas bonus 655,083 125,162 151,412 164,120 65,915 25,795

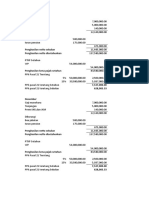

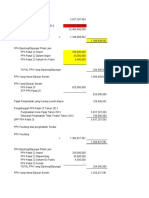

Keterangan andreawan robby wiryawan astria charles

Gaji pokok setahun 5,000,000 5,250,000 5,000,000 5,000,000 10,000,000

Tunjangan struktural setahun 200,000 200,000 4,000,000

Tunjangan fungsional setahun 500,000 500,000 500,000 500,000 500,000

Tunjangan disiplin setahun 100,000 105,000 100,000 100,000 200,000

Premi asuransi setahun 200,000 210,000 200,000 200,000 400,000

Jasa produksi 7,500,000 7,500,000 7,500,000 10,000,000

Penghasilan bruto setahun 13,300,000 6,265,000 13,300,000 13,500,000 25,100,000

Pengurangan:

1. Biaya jabatan 290,000 13,250 290,000 300,000 500,000

2. Iuran pensiun 50,000 157,500 150,000 150,000 300,000

Total pengurangan 440,000 470,750 440,000 450,000 800,000

Penghasilan neto setahun 64,320,000 69,531,000 64,320,000 66,600,000 171,600,000

Penghasilan tidak kena pajak (PTKP) setahun 58,500,000 54,000,000 58,500,000 67,500,000 63,000,000

Penghasilan kena pajak (PKP) 13,320,000 15,531,000 13,320,000 6,600,000 118,600,000

Penghasilan kena pajak (dibulatkan)

PPh Pasal 21 setahun

5% x 666,000 776,550 799,200 396,000 2,500,000

15% x 10,290,000

25% x

30% x

PPh Pasal 21 atas gaji dan bonus

PPh Pasal 21 atas gaji setahun 666,000 776,550 799,200 396,000 12,790,000

PPh atas bonus 55,500 64,713 66,600 33,000 1,065,833

Anda mungkin juga menyukai

- Pembahasan PT Tersenyumlah Ind 2021 RevisiDokumen16 halamanPembahasan PT Tersenyumlah Ind 2021 RevisiMr Muhammad RifkyBelum ada peringkat

- Latihan 1 PPH Pasal 21Dokumen19 halamanLatihan 1 PPH Pasal 21Risma Sugiarti RismaBelum ada peringkat

- Tugas1 PerpajakanDokumen5 halamanTugas1 PerpajakanImhsym 01Belum ada peringkat

- Lita Isna K (220) Raditya Rafif I (221) Zalfa Novia A (222) Lintang R (224) Narendra Kusuma DDokumen77 halamanLita Isna K (220) Raditya Rafif I (221) Zalfa Novia A (222) Lintang R (224) Narendra Kusuma DLintang RahmawatiBelum ada peringkat

- Kelompok 5Dokumen49 halamanKelompok 5Lintang RahmawatiBelum ada peringkat

- Tugas (01-April-2024)Dokumen25 halamanTugas (01-April-2024)Adek Siska MarethaBelum ada peringkat

- Kunci Kasus PerpajakanDokumen51 halamanKunci Kasus PerpajakanRirin Arora YulgaBelum ada peringkat

- Worksheet 1Dokumen6 halamanWorksheet 1rachma fajarBelum ada peringkat

- 1penjelasan Praktikum Perpajakan 2023Dokumen19 halaman1penjelasan Praktikum Perpajakan 2023Davi AbdillahBelum ada peringkat

- 02 - AKT 3F - Alvin Maulana - KASUS 6 + SPTDokumen15 halaman02 - AKT 3F - Alvin Maulana - KASUS 6 + SPTDyah HanifaBelum ada peringkat

- Kertas Kerja Minggu 5Dokumen4 halamanKertas Kerja Minggu 5Gilbert StevanusBelum ada peringkat

- PPH 21 ManoharaDokumen3 halamanPPH 21 ManoharaAkbar SrengsengBelum ada peringkat

- Praktikum PPH Pemotongan Dan Pemungutan 1Dokumen15 halamanPraktikum PPH Pemotongan Dan Pemungutan 1Galuh puspa riniBelum ada peringkat

- 02A - SPT BADAN - Form - 1771 - Per - 19 - 2014'Dokumen13 halaman02A - SPT BADAN - Form - 1771 - Per - 19 - 2014'M.Irvan PratamaBelum ada peringkat

- Lab Pajak-PPh Badan - Kasus 3 - PT YOGYATEX - Selviana Novita Sari - 023001800021Dokumen11 halamanLab Pajak-PPh Badan - Kasus 3 - PT YOGYATEX - Selviana Novita Sari - 023001800021SelvianaBelum ada peringkat

- UntitledDokumen22 halamanUntitledRizka Amalia nabilaBelum ada peringkat

- Neraca SKP 4 (IS)Dokumen9 halamanNeraca SKP 4 (IS)Siti AchmadiBelum ada peringkat

- TGS PajakDokumen6 halamanTGS PajakSannaFantanarosaPanjaitanBelum ada peringkat

- Jawaban Rekonsiliasi Fiskal Perusahaan ManufakturDokumen6 halamanJawaban Rekonsiliasi Fiskal Perusahaan ManufakturMa'watul IzzahBelum ada peringkat

- s12 25Dokumen8 halamans12 25sun kissedBelum ada peringkat

- JWB Hitungan PPH 21Dokumen2 halamanJWB Hitungan PPH 21Elvina SariBelum ada peringkat

- Lembar Jawaban UAS-PRAK. PAJAK 1 - Tiara Desi Arti Suci - Ka13211Dokumen10 halamanLembar Jawaban UAS-PRAK. PAJAK 1 - Tiara Desi Arti Suci - Ka13211FerlinaBelum ada peringkat

- Menghitung Cash FlowDokumen11 halamanMenghitung Cash FlowReza FarishyBelum ada peringkat

- Uts Putri YolandaDokumen5 halamanUts Putri Yolandaum ummrhBelum ada peringkat

- Soal Eval FixDokumen3 halamanSoal Eval FixWiartYTBelum ada peringkat

- Formulir-Spt-1770 NewDokumen14 halamanFormulir-Spt-1770 Newchaing widyaBelum ada peringkat

- Mari BergembiraDokumen39 halamanMari Bergembiramichelle fanuelBelum ada peringkat

- Kelompok 7Dokumen14 halamanKelompok 7Chimon WachiBelum ada peringkat

- PPH Badan Dan SPTDokumen14 halamanPPH Badan Dan SPTpcipm pcipmsebrangulu2plgBelum ada peringkat

- Tabel PPH Pasal 21 Tax Prosedure Hal 24KASDokumen15 halamanTabel PPH Pasal 21 Tax Prosedure Hal 24KASMaria Evy PurwitasariBelum ada peringkat

- SKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 02Dokumen10 halamanSKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 02jungjibang15Belum ada peringkat

- Tugas 4 Pengantar Perpajakan Intan Berliana Aqilah 374209017Dokumen6 halamanTugas 4 Pengantar Perpajakan Intan Berliana Aqilah 374209017Furqon MuhammadBelum ada peringkat

- KorfisDokumen7 halamanKorfisPutri Ramadhani SiswantoBelum ada peringkat

- Aplikasi PjakDokumen7 halamanAplikasi Pjakroyhan bayuBelum ada peringkat

- Keterangan Tahun 1 Tahun 2 Tahun 3 Tahun 4Dokumen3 halamanKeterangan Tahun 1 Tahun 2 Tahun 3 Tahun 4Desta AnggrainiBelum ada peringkat

- Contoh Perhitungan PPH PSL.21Dokumen6 halamanContoh Perhitungan PPH PSL.21YOPIE CHANDRABelum ada peringkat

- Analisis Titik Impas Usaha Planet SportsDokumen8 halamanAnalisis Titik Impas Usaha Planet SportsNugrahainimahardikaBelum ada peringkat

- Kunci Koreksi Fiskal Kasus 6-Revisi 26 Nop 2021Dokumen4 halamanKunci Koreksi Fiskal Kasus 6-Revisi 26 Nop 2021MelianaWijayaBelum ada peringkat

- Perhitungan Gaji Karyawan PT Abc Januari SD Desember 2022Dokumen6 halamanPerhitungan Gaji Karyawan PT Abc Januari SD Desember 2022Muhammad Fuaidil KiromBelum ada peringkat

- PPH Selasa J 7Dokumen3 halamanPPH Selasa J 7Panitia KonserBelum ada peringkat

- PMK 168 Tahun 2023 - Juklak PPH 21 Tahun 2024Dokumen13 halamanPMK 168 Tahun 2023 - Juklak PPH 21 Tahun 2024denny indrayadiBelum ada peringkat

- Kasus SPT Lld-2016Dokumen5 halamanKasus SPT Lld-2016Retno WulandariBelum ada peringkat

- NPV MetaDokumen7 halamanNPV MetaFeri IrwansyahBelum ada peringkat

- SKB 8Dokumen23 halamanSKB 8Deni RahmanBelum ada peringkat

- PPH 21Dokumen11 halamanPPH 21Dimas JokoBelum ada peringkat

- PPH 21 Selama Tahun 2022 140,560,000 15,555,000 4,467,500Dokumen5 halamanPPH 21 Selama Tahun 2022 140,560,000 15,555,000 4,467,500RobyBelum ada peringkat

- Gregorius Arthur - Tugas 4 Perpajakan LanjutanDokumen2 halamanGregorius Arthur - Tugas 4 Perpajakan LanjutanHengkyBelum ada peringkat

- PERTEMUAN KE 2Dokumen6 halamanPERTEMUAN KE 2andre putraBelum ada peringkat

- PPH 21 One Tax PMK-168Dokumen50 halamanPPH 21 One Tax PMK-168Pegy Dwi YulianiBelum ada peringkat

- Proyeksi 5 TahunDokumen5 halamanProyeksi 5 TahunStacia AnastashaBelum ada peringkat

- Jawaban Kasus 2 PPH OPDokumen3 halamanJawaban Kasus 2 PPH OPAlifiany MardhiahBelum ada peringkat

- Katalog Banaran Franchise 1.0Dokumen27 halamanKatalog Banaran Franchise 1.0BenefitoAssetradaZaluchuBelum ada peringkat

- Latihan Soal PPh-21 LainnyaDokumen5 halamanLatihan Soal PPh-21 LainnyaREG.B/40121200006/YAHYA WESIBelum ada peringkat

- Contoh Soal UASDokumen6 halamanContoh Soal UASVina Rahma AuliyaBelum ada peringkat

- Kunci Kuis PotputDokumen5 halamanKunci Kuis PotputBela Canda HandikaBelum ada peringkat

- PPH Pasal 21 Praktika Pajak Yg HitunganDokumen6 halamanPPH Pasal 21 Praktika Pajak Yg HitunganJonathan AlexanderBelum ada peringkat

- Tugas Besar 2 P.Perusahaan - Ryan Nanda Putra - 43120010372Dokumen7 halamanTugas Besar 2 P.Perusahaan - Ryan Nanda Putra - 43120010372Ryan NandaputraBelum ada peringkat

- Latihan Soal PerpajakanDokumen8 halamanLatihan Soal Perpajakan27Siti FebriyantiBelum ada peringkat

- Tax Management. Putrri Zakiyah (22201081219)Dokumen5 halamanTax Management. Putrri Zakiyah (22201081219)Putri ZakiyahBelum ada peringkat

- Praktikum Kasus 2Dokumen8 halamanPraktikum Kasus 2Imhsym 01Belum ada peringkat

- Kel. 4 Resume Materi Kel. 2Dokumen3 halamanKel. 4 Resume Materi Kel. 2Imhsym 01Belum ada peringkat

- AkuntansiDokumen4 halamanAkuntansiImhsym 01Belum ada peringkat

- Ak - Keuangan IIDokumen2 halamanAk - Keuangan IIImhsym 01Belum ada peringkat

- Audit IIDokumen13 halamanAudit IIImhsym 01Belum ada peringkat

- Akuntansi KeuanganDokumen5 halamanAkuntansi KeuanganImhsym 01Belum ada peringkat

- Makalah Ilmu Pengetahuan Alam Dan Teknologi Bagi Kehidupan ManusiaDokumen22 halamanMakalah Ilmu Pengetahuan Alam Dan Teknologi Bagi Kehidupan ManusiaAbdul Samad67% (3)

- Makalah Pengantar Bisnis Kel. 2Dokumen20 halamanMakalah Pengantar Bisnis Kel. 2Imhsym 01Belum ada peringkat

- Fungsi Planning, Organizing, Leading, ControlingDokumen16 halamanFungsi Planning, Organizing, Leading, ControlingImhsym 01Belum ada peringkat

- Fungsi Planning, Organizing, Leading, ControlingDokumen16 halamanFungsi Planning, Organizing, Leading, ControlingImhsym 01Belum ada peringkat

- Akuntansi Manajemen - Mid TesDokumen1 halamanAkuntansi Manajemen - Mid TesImhsym 01Belum ada peringkat

- 2 IKD Hikma SyamDokumen9 halaman2 IKD Hikma SyamImhsym 01Belum ada peringkat

- Makalah 2 IKD - Hikma SyamDokumen13 halamanMakalah 2 IKD - Hikma SyamImhsym 01Belum ada peringkat

- Ikd HikDokumen12 halamanIkd HikImhsym 01Belum ada peringkat

- Makalah 2 IKD - Hikma SyamDokumen13 halamanMakalah 2 IKD - Hikma SyamImhsym 01Belum ada peringkat

- Makalah IKD - Hikma SyamDokumen19 halamanMakalah IKD - Hikma SyamImhsym 01Belum ada peringkat

- DokumenDokumen3 halamanDokumenImhsym 01Belum ada peringkat

- Format KK Prak. Perpajakan - ED10Dokumen43 halamanFormat KK Prak. Perpajakan - ED10Imhsym 01Belum ada peringkat

- Resume 1Dokumen4 halamanResume 1Imhsym 01Belum ada peringkat