Tugas Kelompok Ke-3 (Minggu 8/ Sesi 14)

Diunggah oleh

flavour sugaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tugas Kelompok Ke-3 (Minggu 8/ Sesi 14)

Diunggah oleh

flavour sugaHak Cipta:

Format Tersedia

Tugas Kelompok ke-3

(Minggu 8/ Sesi 14)

Nama Nim

Vircella Marvika Aurelia 2402004625

Desti Yolanda Sari 2401997500

Cleri Valencia 2502095706

Monika Yunita Sari 2301955024

Wanda Nathalia 2502046641

Tugas Kelompok ke-3

ACCT6329 – Intermediate Accounting I

ESSAY

1. Pada perusahaan dagang dan manufaktur apakah terdapat perbedaan dalam

penghitungan nilai inventory? Jelaskan perbedaannya.

2. Jelaskan apa saja karakteristik suatu aset diklasifikasikan ke Property, Plant and

Equipment.

KASUS

Soal 1

Berikut ini adalah trial balance Amanda Co per 31 Desember:

Cash $190,000 Work in process $200,000

Equipment (net) 1,100,000 Account receivable (net) 400,000

Prepaid 41,000 Patents 110,000

insurance

Raw materials 335,000 Finished goods 170,000

ACCT6329 – Intermediate Accounting I

Siapkan bagian aset lancar pada laporan posisi keuangan 31 Desember.

Soal 2

Marco Co menggunakan sistem persediaan perpetual. Persediaan awalnya terdiri dari 50unit

dengan harga €34/unit. Selama Juni, perusahaan membeli 150unit masing-masing seharga

€34 secara kredit, lalu mengembalikan 6 unit, dan menjual 125unit dengan harga masing-

masing €50. Buatlah jurnal transaksi di Bulan Juni.

Soal 3

Dewan direksi Potter Corporation sedang mempertimbangkan apakah harus melakukan

Perubahan metode inventory dari FIFO menjadi dasar LIFO. Informasi berikut tersedia.

Sales 20,000 units @50

ACCT6329 – Intermediate Accounting I

Inventory, January 1 6,000 units @20

Purchases 6,000 units @22

10,000 units @25

7,000 units @30

Inventory, December 9,000 units @ ?

31

Operating expenses $200,000

Diminta:

Siapkan income statement dengan metode FIFO dan LIFO yang akan digunakan sebagai

pembanding.

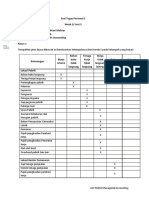

Perpetual Inventory System with FIFO Method

Pembelian Harga Pokok Penjualan Persediaan

Tgl Total Total

Unit Harga Total Harga Unit Harga Harga Unit Harga Harga

1-Jan 6,000 20 120,000

6,000 22 132,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000

7,000 30 210,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000

7,000 30 210,000

31-Dec 6,000 20 120,000 7,000 30 210,000

6,000 22 132,000 2,000 25 50,000

8,000 25 200,000

Total 23,000 592,000 20,000 - 452,000 9,000 260,000

Income Statement FIFO

Sales Revenue 1,000,000

COGS

Inventory, 1 Jan 120,000

Purchase 592,000

COGS Available 712,000

ACCT6329 – Intermediate Accounting I

Inventory, 31 Des 260,000

COGS 452,000

Gross Profit 548,000

Operating Expenses 200,000

Net Income 348,000

Purchase Inventory Dec 31

Unit Harga Total Unit Harga Total

6,000 22 132,000 7,000 30 210,000

10,000 25 250,000 2,000 25 50,000

7,000 30 210,000 0

592,000 260,000

Perpetual Inventory System with LIFO Method

Pembelian Harga Pokok Penjualan Persediaan

Tgl Total Total

Unit Harga Harga Unit Harga Harga Unit Harga Total Harga

1-Jan 6,000 20 120,000

6,000 22 132,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000

7,000 30 210,000 6,000 20 120,000

6,000 22 132,000

10,000 25 250,000

7,000 30 210,000

31-Dec 7,000 30 210,000 6,000 20 120,000

10,000 25 250,000 3,000 22 66,000

3,000 50 150,000

Total 23,000 592,000 20,000 - 610,000 9,000 186,000

Purchase Inventory Dec 31

Unit Harga Total Unit Harga Total

ACCT6329 – Intermediate Accounting I

6,000 22 132,000 6,000 20 120,000

10,000 25 250,000 3,000 22 66,000

7,000 30 210,000 0

592,000 186,000

Income Statement LIFO

Sales Revenue 1,000,000

COGS

Inventory, 1 Jan 120,000

Purchase 592,000

COGS Available 712,000

Inventory, 31 Des 186,000

COGS 526,000

Gross Profit 474,000

Operating Expenses 200,000

Net Income 274,000

Soal 4

Berikut ini beberapa transaksi yang terjadi selama tahun 2020. Asumsikan bahwa penyusutan

10% per tahun dibebankan pada semua mesin dan 5% per tahun pada bangunan, dengan

metode garis lurus, tanpa perkiraan nilai sisa. Penyusutan dibebankan selama setahun penuh

atas semua aset tetap yang diperoleh selama tahun berjalan, dan tidak ada penyusutan yang

dibebankan pada aset tetap yang dilepas selama tahun tersebut.

Diminta:

Siapkan jurnal untuk transaksi di atas. (Dibulatkan ke dolar terdekat).

30 Jan

Sebuah bangunan seharga $ 112.000 pada tahun 2003 dirobohkan untuk memberi ruang bagi

gedung baru. Kontraktor perusak dibayar $ 5.100 dan diizinkan untuk menyimpan semua

bahan yang diselamatkan.

ACCT6329 – Intermediate Accounting I

30-Jan Disposal (demolition) of old building --> capitalize

Annual depreciation for building = 5% x (Cost - Residual Value) = 5%x ($ 112,000 - $ 0) = $ 5,600

Depreciation for 2003 (full depreciation applied for plant asset acquired during the year) $ 5,600

Depreciation for 2004 to 2019 (16 years x $ 5,600) = 89,600

Depreciation for 2020 = N/A (no depreciation applied for plant asset disposed during the year) 0

Accummulated depreciation for 2003 to 2020 $ 95,200

Cash paid for demolition $ 5,100

Original building cost $ 112,000

Total building cost $ 117,100

General Journal

Date Account Titles and Explanation Ref. Debit Credit

Jan 30 Accummulated Depreciation - Building 95,200

Loss on disposal of building 21,900

Building 117,100

(To record dispotision of building)

10 Mar

Mesin yang dibeli pada tahun 2013 seharga $ 16.000 dijual seharga $ 2.900 tunai, f.o.b.

pabrik pembeli. Pengangkutan sebesar $ 300 dibayarkan atas penjualan mesin ini.

10-Mar Dipsosal (sale) of Machinery --> capitalize

Annual depreciation for machinery = 10% x (Cost - Residual Value) = 10% x ($ 16,000 - $ 0) = $ 1,600

Depreciation for 2013 (full depreciation applied for plant asset acquired during the year) $ 1,600

Depreciation for 2014 to 2019 (6 years x $ 1,600) = 9,600

Depreciation for 2020 = N/A (no depreciation applied for plant asset disposed during the year) 0

Accummulated depreciation for 2013 to 2020 $ 11,200

Cash received from sale $ 2,900

Freight cost (fob destination) $ 300

Original machinery cost $ 16,000

General Journal

Date Account Titles and Explanation Ref. Debit Credit

Mar 10 Cash 2,900

Accummulated Depreciation - Machinery 11,200

Loss on disposal of equipment 2,200

Machinery 16,000

Freight cost 300

(To record disposition of machinery)

20 Mar

Roda gigi rusak pada mesin yang harganya $ 9.000 pada tahun 2015. Roda gigi tersebut

diganti dengan biaya $ 3.000. Penggantian tidak memperpanjang masa pakai mesin.

ACCT6329 – Intermediate Accounting I

20-Mar Replacement part of machinery --> capitalize

Annual depreciation for machinary = 10% x (Cost - Residual Value) = 10% x ($ 9,000 - $ 0) = $ 900

Depreciation for 2015 (full depreciation applied for plant asset acquired during the year) $ 900

Depreciation for 2016 to 2019 (4 years x $ 900) = 3,600

Depreciation Januari - Februari 2020 (2 x $ 900) 1,800

Accummulated depreciation for 2015 to 2020 $ 6,300

Cash paid for gears repair $ 3,000

Original machinery cost $ 9,000

General Journal

Date Account Titles and Explanation Ref. Debit Credit

Mar 20 Machinery (gears) 3,000

Accummulated Depreciation - Machinery 6,300

Loss on disposal of equipment 2,700

Machinery (gears) 9,000

Cash 3,000

(To record replacement of gears)

23 June

Salah satu bangunan dicat ulang dengan biaya $ 6.900. Bangunan tersebut belum dicat sejak

dibangun pada 2016.

General Journal

Date Account Titles and Explanation Ref. Debit Credit

Jun 23 Repair and Maintenance Expense 6,900

Cash 6,900

(To record building painting expense)

---oOo---

ACCT6329 – Intermediate Accounting I

Anda mungkin juga menyukai

- Tugas Personal Ke-1 (Minggu 2/ Sesi 3) : EssayDokumen4 halamanTugas Personal Ke-1 (Minggu 2/ Sesi 3) : Essayfenny fauzi0% (1)

- Tugas Personal 1Dokumen4 halamanTugas Personal 1Riry OktaviaBelum ada peringkat

- Tugas Kelompok 1 Week 3Dokumen2 halamanTugas Kelompok 1 Week 3Celent Ng0% (1)

- Analisis Biaya Overhead dan Margin Pada Perusahaan Pembuat Mesin RotiDokumen4 halamanAnalisis Biaya Overhead dan Margin Pada Perusahaan Pembuat Mesin RotiShilda Rus0% (2)

- Tugas Kelompok Ke-3 Sesi 12Dokumen3 halamanTugas Kelompok Ke-3 Sesi 12fenny fauziBelum ada peringkat

- TP2 - Managerial AccountingDokumen4 halamanTP2 - Managerial AccountingIca0% (1)

- TK 2 Managerial Acc Team 8-FinishDokumen14 halamanTK 2 Managerial Acc Team 8-Finishbagas helmiBelum ada peringkat

- Tugas Kelompok Ke-1 Week 3: Team 4Dokumen6 halamanTugas Kelompok Ke-1 Week 3: Team 4Ai Suminar100% (1)

- Cendra Kurnia Turnip - Tugas Personal 1 Finc6193Dokumen10 halamanCendra Kurnia Turnip - Tugas Personal 1 Finc6193CENDRA KURNIA TURNIPBelum ada peringkat

- Activity-Based Costing dan Budget ProduksiDokumen7 halamanActivity-Based Costing dan Budget ProduksimawanBelum ada peringkat

- HPP DEPARTEMEN B DAN TDokumen5 halamanHPP DEPARTEMEN B DAN TliissylviaBelum ada peringkat

- INVESTASI SAHAMDokumen4 halamanINVESTASI SAHAMFirda YantiBelum ada peringkat

- TP1-W2-S3 - Sandra Andriani MDokumen4 halamanTP1-W2-S3 - Sandra Andriani MSandra AndrianiBelum ada peringkat

- Tugas Kelompok ke-2: TVM, Saham, ObligasiDokumen4 halamanTugas Kelompok ke-2: TVM, Saham, ObligasiGaruda Gajayana0% (1)

- ACCT6332-Personal Assignment Managerial AkuntansiDokumen4 halamanACCT6332-Personal Assignment Managerial AkuntansiThania SeptiyaniBelum ada peringkat

- Tugas Personal Ke-2 Minggu 7: Muhamad Fakhri Khusaini 2502157282 EssayDokumen6 halamanTugas Personal Ke-2 Minggu 7: Muhamad Fakhri Khusaini 2502157282 EssayFahriiBelum ada peringkat

- 1811 Acct6174 Dlba TK3-W8-S12-R2 Team99Dokumen5 halaman1811 Acct6174 Dlba TK3-W8-S12-R2 Team99ChandriansyaBelum ada peringkat

- TK1 W3 S4 R1 TEAM4 HasilDokumen4 halamanTK1 W3 S4 R1 TEAM4 HasilrinaBelum ada peringkat

- Tugas Kelompok 2 - Intermediate Accounting IDokumen6 halamanTugas Kelompok 2 - Intermediate Accounting IEvelyn Purnama Sari100% (1)

- Tugas Kelompok Ke-3 (Minggu 8/ Sesi 14)Dokumen11 halamanTugas Kelompok Ke-3 (Minggu 8/ Sesi 14)flavour sugaBelum ada peringkat

- 1911 Acct6334 Tifa TK3-W8-S14-R0 Team5Dokumen11 halaman1911 Acct6334 Tifa TK3-W8-S14-R0 Team5Clara MargarethaBelum ada peringkat

- LGFA ACCT6130039 CostAccounting-QuestionDokumen9 halamanLGFA ACCT6130039 CostAccounting-QuestionDiaz Hesron Deo SimorangkirBelum ada peringkat

- TUGAS KELOMPOK 3 Akuntan 1Dokumen4 halamanTUGAS KELOMPOK 3 Akuntan 1rinaBelum ada peringkat

- Introduction To Money and Capital Market TP1 Kinkin 12 SeptDokumen6 halamanIntroduction To Money and Capital Market TP1 Kinkin 12 SeptshintaBelum ada peringkat

- FM-BINUS-AA-FPU-579/R3Dokumen3 halamanFM-BINUS-AA-FPU-579/R3Lan WanyamaBelum ada peringkat

- 25 Oktober 2021 TK3 Managerial AccDokumen4 halaman25 Oktober 2021 TK3 Managerial Accblancor7770% (1)

- FIFO-DEPT-ADokumen9 halamanFIFO-DEPT-AAde irma Nur fadhilah100% (1)

- TP3 W8 S12 Team3Dokumen9 halamanTP3 W8 S12 Team3CENDRA KURNIA TURNIPBelum ada peringkat

- Analisis Investasi SahamDokumen2 halamanAnalisis Investasi SahamSasaBelum ada peringkat

- TP1contohDokumen3 halamanTP1contohfenny fauzi0% (1)

- Tugas Personal 2 - Diaz Hesron Deo Simorangkir - 2602202526Dokumen3 halamanTugas Personal 2 - Diaz Hesron Deo Simorangkir - 2602202526Diaz Hesron Deo SimorangkirBelum ada peringkat

- Tugas Kelompok Ke-3 (Minggu 8/ Sesi 14) : EssayDokumen2 halamanTugas Kelompok Ke-3 (Minggu 8/ Sesi 14) : Essayfenny fauziBelum ada peringkat

- Tugas Personal Ke-2 Week 7: Soal 1Dokumen5 halamanTugas Personal Ke-2 Week 7: Soal 1fajar reymizardBelum ada peringkat

- TP2-W7-S11 - MEILY TRI WULANDARI - 2502029212 (Sudah Di Koreksi Pak Koko)Dokumen7 halamanTP2-W7-S11 - MEILY TRI WULANDARI - 2502029212 (Sudah Di Koreksi Pak Koko)Meily Tri WulandariBelum ada peringkat

- Tugas Kelompok 2 - Jawaban EssayDokumen4 halamanTugas Kelompok 2 - Jawaban Essaysaiful0% (1)

- Clara 20210518141340 - Tugas Kelompok 2 FINC6193Dokumen7 halamanClara 20210518141340 - Tugas Kelompok 2 FINC6193Clara BataraBelum ada peringkat

- PT A MENINGKATKAN PENJUALANDokumen5 halamanPT A MENINGKATKAN PENJUALANMeily Tri WulandariBelum ada peringkat

- Optimized Titles for Investment Accounting CasesDokumen5 halamanOptimized Titles for Investment Accounting CasesSayang MeilyBelum ada peringkat

- Tugas Personal Ke-1 (Minggu 2) : 2301964451 - Thania SeptiyaniDokumen4 halamanTugas Personal Ke-1 (Minggu 2) : 2301964451 - Thania SeptiyaniThania Septiyani100% (1)

- Corporate 123Dokumen6 halamanCorporate 123liissylviaBelum ada peringkat

- Tugas Kelompok 1 - Intermediate Accounting IDokumen6 halamanTugas Kelompok 1 - Intermediate Accounting IEvelyn Purnama SariBelum ada peringkat

- Audit Personal 2Dokumen1 halamanAudit Personal 2viviBelum ada peringkat

- Cendra K.turnip Lampiran Session6Dokumen1 halamanCendra K.turnip Lampiran Session6CENDRA KURNIA TURNIPBelum ada peringkat

- Tugas Kelompok Ke-2 Week 4: Team 4Dokumen5 halamanTugas Kelompok Ke-2 Week 4: Team 4Ai SuminarBelum ada peringkat

- Tugas Kelompok 1Dokumen2 halamanTugas Kelompok 1Amelia MarisaBelum ada peringkat

- Tugas Kelompok 3Dokumen2 halamanTugas Kelompok 3Zanitra AminBelum ada peringkat

- Inter Acc 2 TP1 RevDokumen3 halamanInter Acc 2 TP1 RevNur Febiana ArumBelum ada peringkat

- 1911 Acct6332 Lofa TK4-W10-S15-R0 Team5Dokumen3 halaman1911 Acct6332 Lofa TK4-W10-S15-R0 Team5Eka AdjieBelum ada peringkat

- 27 September 2021 TK2 Managerial AccDokumen4 halaman27 September 2021 TK2 Managerial Accblancor777Belum ada peringkat

- (Taxation) 20190313103111 - TP2-W7-S11Dokumen3 halaman(Taxation) 20190313103111 - TP2-W7-S11MUTIABelum ada peringkat

- Tugas Personal 2Dokumen3 halamanTugas Personal 2Diaz Hesron Deo SimorangkirBelum ada peringkat

- FCF ANALYSISDokumen7 halamanFCF ANALYSISflavour sugaBelum ada peringkat

- Pemahaman Analisa Objek Pajak PPH Pasal 22,23,26Dokumen1 halamanPemahaman Analisa Objek Pajak PPH Pasal 22,23,26Rajin Belajar Biar SuksesBelum ada peringkat

- Tugas Kelompok Ke-3 Minggu 8/sesi 12Dokumen3 halamanTugas Kelompok Ke-3 Minggu 8/sesi 12Elfrida Yudika PBelum ada peringkat

- TP1 AccDokumen4 halamanTP1 AccIca0% (1)

- REKONFISKALDokumen2 halamanREKONFISKALShilda Rus0% (1)

- Nomor 6Dokumen2 halamanNomor 6Habib SamudraBelum ada peringkat

- TK3 IntermediateAccountingI Kelompok5Dokumen9 halamanTK3 IntermediateAccountingI Kelompok5ali akbarBelum ada peringkat

- Bab 7Dokumen24 halamanBab 7Vanesa KaurongBelum ada peringkat

- AKUNDokumen12 halamanAKUNVanesa KaurongBelum ada peringkat

- REKONFISKALDokumen2 halamanREKONFISKALDhory Boystar Metalizer'sBelum ada peringkat

- Tugas Kelompok 1Dokumen2 halamanTugas Kelompok 1flavour sugaBelum ada peringkat

- 2112 Taxn6040039 Tufa TK1-W3-S4-R0 Team2Dokumen5 halaman2112 Taxn6040039 Tufa TK1-W3-S4-R0 Team2flavour sugaBelum ada peringkat

- TK3 No 4 - WandaDokumen4 halamanTK3 No 4 - Wandaflavour sugaBelum ada peringkat

- REKONSILIASIDokumen4 halamanREKONSILIASIflavour sugaBelum ada peringkat

- Tugas Kelompok Ke-3 (Minggu 8/ Sesi 14)Dokumen11 halamanTugas Kelompok Ke-3 (Minggu 8/ Sesi 14)flavour sugaBelum ada peringkat

- REKONSILIASIDokumen4 halamanREKONSILIASIflavour sugaBelum ada peringkat

- REKONSILIASIDokumen4 halamanREKONSILIASIflavour sugaBelum ada peringkat

- TP1 W2 S3 R2Dokumen1 halamanTP1 W2 S3 R2Debora BudiBelum ada peringkat

- Pem-05001197 WPJ.30 KP.0103 2022Dokumen1 halamanPem-05001197 WPJ.30 KP.0103 2022flavour sugaBelum ada peringkat

- No 1799641Dokumen2 halamanNo 1799641flavour sugaBelum ada peringkat

- Implementasi Good GovernanceDokumen85 halamanImplementasi Good Governanceflavour sugaBelum ada peringkat

- Tugas Kelompok Ke-2 (Minggu 5/ Sesi 7) : P (RP) Q (Unit) TFC (RP) TVC (RP) TC (RP) TR (RP) MR (RP) MC (RP)Dokumen1 halamanTugas Kelompok Ke-2 (Minggu 5/ Sesi 7) : P (RP) Q (Unit) TFC (RP) TVC (RP) TC (RP) TR (RP) MR (RP) MC (RP)Jimmi TambaBelum ada peringkat

- REKONSILIASIDokumen4 halamanREKONSILIASIflavour sugaBelum ada peringkat

- Penundaan PemeriksaanDokumen3 halamanPenundaan Pemeriksaanflavour sugaBelum ada peringkat

- Tugas Kelompok Ke-2 (Minggu 5/ Sesi 7) : P (RP) Q (Unit) TFC (RP) TVC (RP) TC (RP) TR (RP) MR (RP) MC (RP)Dokumen1 halamanTugas Kelompok Ke-2 (Minggu 5/ Sesi 7) : P (RP) Q (Unit) TFC (RP) TVC (RP) TC (RP) TR (RP) MR (RP) MC (RP)Jimmi TambaBelum ada peringkat

- Tugas Kelompok Minggu 5Dokumen2 halamanTugas Kelompok Minggu 5flavour sugaBelum ada peringkat

- Jurnal Akuntansi Sektor PublikDokumen2 halamanJurnal Akuntansi Sektor Publikflavour sugaBelum ada peringkat

- Renpam Pilkada 2009Dokumen17 halamanRenpam Pilkada 2009flavour sugaBelum ada peringkat

- FCF ANALYSISDokumen7 halamanFCF ANALYSISflavour sugaBelum ada peringkat

- Tanggal: JurnalDokumen22 halamanTanggal: Jurnalflavour sugaBelum ada peringkat