Capital Investment 230522

Diunggah oleh

eldaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Investment 230522

Diunggah oleh

eldaHak Cipta:

Format Tersedia

Capital Investment

Usia project 5 tahun

Project initial

Pada tahun 0 $ 10.000.000 net cash outflow

Project operation

tahun 1 $ 1.000.000 Net cash inflow (Total cash inflow- total cash outflow)

tahun 2 $ 1.000.000

tahun 3 $ 3.000.000

tahun 4 $ 8.000.000

tahun 5 $ 5.000.000

Project Disposal

Dana yang masuk dan keluar Ketika project dihentikan net cash in flow $ 800.000

Total yang dikeluarkan tahun ke 0 $ 10.000.000

Total netcash inflow $ 18.800.000

Surplus $ 8.800.000

Discounted Cash Flow (DCF) 20%

Project initial Cash outflow $ 10.000.000 $ 10.000.000

Project operation

Tahun 1 $ 1.000.000 $ 833.333

Tahun 2 $ 1.000.000 $ 694.444

Tahun 3 $ 3.000.000 $ 1.736.111

Tahun 4 $ 8.000.000 $ 3.858.024

Tahun 5 operation $ 5.000.000 $ 2.009.387

Disposal $ 800.000 $ 321.502

Total cash inflow $ 9.452.801

Defisit $ 547.199

===========

Usia project 5 tahun

Project initial

Pada tahun 0 $ 10.000.000 net cash outflow

Project operation

tahun 1 $ 1.000.000 Net cash inflow (Total cash inflow- total cash outflow)

tahun 2 $ 2.000.000

tahun 3 $ 6.000.000

tahun 4 $ 8.000.000

tahun 5 $ 5.000.000

Discounted Cash Flow (DCF) 20%

Project initial Cash outflow $ 10.000.000 $ 10.000.000

Project operation

Tahun 1 $ 1.000.000 $ 833.333

Tahun 2 $ 2.000.000 $ 1.388.888

Tahun 3 $ 6.000.000 $ 3.472.222

Tahun 4 $ 8.000.000 $ 3.858.024

Tahun 5 operation $ 5.000.000 $ 2.009.387

Disposal $ 800.000 $ 321.502

Total penerimaan selama umur proyek $ 11.883.356

Surplus $ 1.883.356

============

Old (i.e., Existing) Machine

Purchase price of machine (7 years ago) $320,000

Accumulated depreciation to date $200,000

Machine removal expenses upon sale $2,000

Commission on sale of old machine 10% of selling price

Current disposal value (selling price) of machine, year 0 $80,000

New Machine Purchase

price of replacement (i.e., new) machine, year 0 $465,000

Machine installation cost $ 5,000

Testing and adjustments of new machine prior to new machine’s use $10,000

Expected life of new machine 4 years Depreciation method (ignore salvage value for tax purposes) SL

Estimated sales (disposal) value of equipment at end of four years $100,000

Salvage value assumed for tax-depreciation purposes $0

Estimated costs related to sale of asset at end of four years $95,000

Other Data

Expected increase in net working capital, year 0 $200,000

Expected reduction in net working capital, end of year 4 $200,000

Increase in annual cash sales because of new machine $1,000,000

Increase in annual cash expenses $733,333

Pretax operating cash-flow increase because of new machine $266,667

Marginal income tax rate (34% 6%) 40%

Corporate headquarters allocation percentage $0.025 per dollar of sales*

Additional pretax cash outlays, year 1 (employee training, etc.) $50,000

Employee pretax relocation expenses, end of year 4 $150,000

Weighted-average cost of capital (WACC) 10.00%

Initial Capital outlay

Data old Machine (OM)

Cash inflow $ 80.000

Removal expense ($ 2.000)

Commission (10%*$80.000) ($ 8.000)

Net cash inflow $ 70.000

Harga perolehan Lama $ 320.000

Accumulated Depre. Expense $ 200.000

Book value $ 120.000

Net cash for sale OM $ 70.000

Loss from sale OM $ 50.000

Tax saving 40%*50.000 $ 20.000

Data New Machine

Price -replacement $ 465.000

Installment Cost $ 5.000

Testing cost $ 10.000

Harga beli $ 480.000

Networking capital $ 200.000

Total $ 680.000

Cash dan tax saving $ 90.000

Initial capital outlay $ 590.000

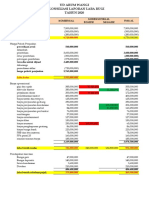

Years

0 1 2 3 4

Project Initiation

Net cost of new machine (a) $ (480.00)

Incremental net working capital $ (200.00)

Sale of old (existing) machine:

Pretax proceeds from sale of old asset (b) 70.00

Tax effect of sale of old machine (c) 20.00

Net initial cash outflow, after tax $ (590.00)

Project Operation

Cash revenues $1,000.00 $1,000.00 $1,000.00 $1,000.00

Operating expenses:

Cash items (d) 783.33 733.33 733.33 733.33

Depreciation (e) 120.00 120.00 120.00 120.00

Total operating expenses 903.33 853.33 853.33 853.33

Pretax operating income 96.67 146.67 146.67 146.67

Income taxes on operating income 38.67 58.67 58.67 58.67

After-tax operating income 58.00 88.00 88.00 88.00

Plus: Noncash expenses 120.00 120.00 120.00 120.00

After-tax cash operating income $ 178.00 $ 208.00 $ 208.00 $ 208.00

Project Disposal

Net working capital released $ 200.00

After-tax proceeds from sale of machine (f) 3.00

After-tax employee relocation expenses (g) (90.00)

Net cash flow, after tax, at project disposal $ 113.00

Net (after-tax) cash flows ($590) $178 $208 $208 $ 321

Anda mungkin juga menyukai

- Soal-Soal Arus KasDokumen12 halamanSoal-Soal Arus KasPratiwi Christianty100% (2)

- Ferdi Muhammad F 1221800103 Kelas H Tugas 1Dokumen4 halamanFerdi Muhammad F 1221800103 Kelas H Tugas 1ferdimuhammad100% (1)

- Contoh SoalDokumen5 halamanContoh SoalNattanon KunkamBelum ada peringkat

- Rekonsiliasi Fiskal...Dokumen5 halamanRekonsiliasi Fiskal...auliaalexta dmkBelum ada peringkat

- Tugas 2 Akuntansi Menengah - Saktio PYDokumen7 halamanTugas 2 Akuntansi Menengah - Saktio PYSaktio Purnomo YudhantoBelum ada peringkat

- SOAL PERPAJAKAN PT PodomoroDokumen5 halamanSOAL PERPAJAKAN PT Podomoroyoga yobellaBelum ada peringkat

- Tugas Individu Bab 18Dokumen5 halamanTugas Individu Bab 18Alya T saabitah Salsabila WibowoBelum ada peringkat

- Arus KasDokumen5 halamanArus KasnauraBelum ada peringkat

- Group6 FINC6001005 Case2Dokumen6 halamanGroup6 FINC6001005 Case2Vernando StevanBelum ada peringkat

- Hansen Mowen Bab 8mmDokumen4 halamanHansen Mowen Bab 8mmDika DiatmikaBelum ada peringkat

- Akuntansi KasusDokumen5 halamanAkuntansi Kasusmarcelgeraldo0Belum ada peringkat

- Kelompok 8Dokumen21 halamanKelompok 8Iskandar SaputraBelum ada peringkat

- Tugas 4 Week 9 Introducing AccountingDokumen7 halamanTugas 4 Week 9 Introducing AccountingLianna WijayaBelum ada peringkat

- Tugas Bab 6-7Dokumen9 halamanTugas Bab 6-7Dillah AsnundBelum ada peringkat

- TP2-W7 ACCT6363039 Acct For BusinessDokumen3 halamanTP2-W7 ACCT6363039 Acct For Businesssuketijo0101Belum ada peringkat

- Nurul Maulidyah Karina - FF - 180421621508 - Tugas 3Dokumen5 halamanNurul Maulidyah Karina - FF - 180421621508 - Tugas 3karinaBelum ada peringkat

- Arus Kas Dan Beberapa Topik Lain Dalam CapitalDokumen24 halamanArus Kas Dan Beberapa Topik Lain Dalam CapitalVelia YolandaBelum ada peringkat

- 16 - 19502030011014 - Mohamad FaisalDokumen7 halaman16 - 19502030011014 - Mohamad FaisalMohamad FaisalBelum ada peringkat

- Akt PemerintahanDokumen5 halamanAkt PemerintahanPutri SariBelum ada peringkat

- SPT DaniswaraDokumen9 halamanSPT DaniswaraAlvin Bagus SumarsonoBelum ada peringkat

- Arus Kas Tugas PresentasiDokumen7 halamanArus Kas Tugas PresentasiJefri PrastyoBelum ada peringkat

- Pengiriman Permen Robert Reid Lady MDokumen15 halamanPengiriman Permen Robert Reid Lady MScribdTranslationsBelum ada peringkat

- Tugas Ke-2 MKDokumen6 halamanTugas Ke-2 MKSalman Ari SaputraBelum ada peringkat

- Ahmad Sauki - 078 - B19 AKT D4 - UpstreamDokumen19 halamanAhmad Sauki - 078 - B19 AKT D4 - Upstreambudi doremiBelum ada peringkat

- TK 4 Kelompok 4Dokumen7 halamanTK 4 Kelompok 4Azhari PambudiBelum ada peringkat

- Rekonsiliasi WP Badan-PembahasanDokumen5 halamanRekonsiliasi WP Badan-Pembahasansunda empireBelum ada peringkat

- Tugas 2 RekaproDokumen4 halamanTugas 2 RekaproNurmaiBelum ada peringkat

- Estimasi Arus KasDokumen3 halamanEstimasi Arus KasAnggaBelum ada peringkat

- K-7 (17 Okt 2022) - Latihan CF Bab VDokumen8 halamanK-7 (17 Okt 2022) - Latihan CF Bab VvannessBelum ada peringkat

- Kelompok 4 Pajak Penghasilan KonsolidasiDokumen22 halamanKelompok 4 Pajak Penghasilan KonsolidasiRidwanBelum ada peringkat

- Spreadsheet Templat KursusDokumen3 halamanSpreadsheet Templat KursusScribdTranslationsBelum ada peringkat

- Bab 12 Estimasi Arus Kas Dan Analisis Risiko NewDokumen47 halamanBab 12 Estimasi Arus Kas Dan Analisis Risiko NewFirman Al-NizzamBelum ada peringkat

- Soal UTS - AKM1Dokumen3 halamanSoal UTS - AKM1Roy PandapotanBelum ada peringkat

- Jawaban Quiz Manajemen KeuanganDokumen6 halamanJawaban Quiz Manajemen KeuanganRIZKA DESTYAWATYBelum ada peringkat

- Soal-Rekonsiliasi Fiskal WP BadanDokumen5 halamanSoal-Rekonsiliasi Fiskal WP Badanannisa apriliaBelum ada peringkat

- Manajemen KeuanganDokumen14 halamanManajemen Keuangantria anikBelum ada peringkat

- Rekonsiliasi WP Badan-Pembahasan NewDokumen5 halamanRekonsiliasi WP Badan-Pembahasan Newsunda empireBelum ada peringkat

- Soal Baldwin, Modern Financial ManagementDokumen6 halamanSoal Baldwin, Modern Financial ManagementEndah DipoyantiBelum ada peringkat

- Akuntansi ManajemenDokumen9 halamanAkuntansi ManajemennadyaanasthasiaBelum ada peringkat

- Workbook - Soal 7 Partijo X Sanio - Mutual HoldingDokumen4 halamanWorkbook - Soal 7 Partijo X Sanio - Mutual HoldingTIMOTHYBelum ada peringkat

- 05akuntansi Manajemen Pertemuan 5Dokumen4 halaman05akuntansi Manajemen Pertemuan 5Devianti PuspitaBelum ada peringkat

- Tugas Manajemen Keuangan DeMello BAB 15Dokumen6 halamanTugas Manajemen Keuangan DeMello BAB 15kikypunkrockstar100% (3)

- Kelompok 1. ALK D'LeonDokumen37 halamanKelompok 1. ALK D'LeonAdhi PrasetyoBelum ada peringkat

- Kelompok 7Dokumen14 halamanKelompok 7Chimon WachiBelum ada peringkat

- 11.3 Fixxxx BGTTTDokumen6 halaman11.3 Fixxxx BGTTTStrawberry PumpkinsBelum ada peringkat

- Primus Automation DivisionDokumen4 halamanPrimus Automation Divisionfarisa25100% (1)

- Kuis Akmen - Kelompok 1 - Ea eDokumen2 halamanKuis Akmen - Kelompok 1 - Ea eLAILY AZMI ADILABelum ada peringkat

- Contoh Soal Manajemen KasDokumen4 halamanContoh Soal Manajemen KasARI SUSANTI100% (1)

- Simulasi Penentuan HargaDokumen10 halamanSimulasi Penentuan HargaEfaldBelum ada peringkat

- 2020 Akc003 4302162201 20201 B 8 2020-12-10Dokumen4 halaman2020 Akc003 4302162201 20201 B 8 2020-12-10Anisa MutmainahBelum ada peringkat

- Soal Laporan Arus Kas 2 - IndirectDokumen4 halamanSoal Laporan Arus Kas 2 - IndirectMarsya ZeinBelum ada peringkat

- Deva Arisanti Rafifah - Tugas Minggu Ke-9 - AM-S1 ManajemenDokumen7 halamanDeva Arisanti Rafifah - Tugas Minggu Ke-9 - AM-S1 ManajemenApes Together Strongs ATSBelum ada peringkat

- Lampiran Laporan Arus KasDokumen3 halamanLampiran Laporan Arus KasBunga ApriliaBelum ada peringkat

- Aspek KEUANGAN/financial SKBDokumen13 halamanAspek KEUANGAN/financial SKBNurul FitriBelum ada peringkat

- Kontrak JK Panjang CH 18Dokumen14 halamanKontrak JK Panjang CH 18NAILA FERIYABelum ada peringkat

- Manajmen Biaya Bab 12, Kel.7Dokumen11 halamanManajmen Biaya Bab 12, Kel.7dilla aming agustiBelum ada peringkat

- Anika Mailina 21919005 Quiz 6Dokumen5 halamanAnika Mailina 21919005 Quiz 6Anika MailinaBelum ada peringkat

- NPV MetaDokumen7 halamanNPV MetaFeri IrwansyahBelum ada peringkat

- Order - All.20220608 20220708Dokumen80 halamanOrder - All.20220608 20220708eldaBelum ada peringkat

- Target Costing - EssayPPtDokumen32 halamanTarget Costing - EssayPPteldaBelum ada peringkat

- Target Costing Europe - En.idDokumen28 halamanTarget Costing Europe - En.ideldaBelum ada peringkat

- Capital Investment DecisionsDokumen20 halamanCapital Investment DecisionseldaBelum ada peringkat

- TargetCosting 18apr22Dokumen16 halamanTargetCosting 18apr22eldaBelum ada peringkat

- Tugas - Manajemen Biaya StrategikDokumen12 halamanTugas - Manajemen Biaya StrategikeldaBelum ada peringkat

- Aktualisasi PancasilaDokumen18 halamanAktualisasi PancasilaeldaBelum ada peringkat

- Modul Praktikum Eviews - HKIDokumen28 halamanModul Praktikum Eviews - HKIeldaBelum ada peringkat

- Kalkulator Komisi Penjualan1Dokumen1 halamanKalkulator Komisi Penjualan1eldaBelum ada peringkat

- Jawaban Modul 11Dokumen5 halamanJawaban Modul 11eldaBelum ada peringkat

- Pengamanan Data Pelanggan Dan Penjualan Menggunakan Implementasi Algoritma KriptografiDokumen7 halamanPengamanan Data Pelanggan Dan Penjualan Menggunakan Implementasi Algoritma KriptografieldaBelum ada peringkat

- Kamus Data SBDDokumen2 halamanKamus Data SBDeldaBelum ada peringkat

- Surat Permintaan Daftar HargaDokumen1 halamanSurat Permintaan Daftar HargaeldaBelum ada peringkat