Analisa Laporan Keuangan

Diunggah oleh

Dwi Sifah RostiniHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Analisa Laporan Keuangan

Diunggah oleh

Dwi Sifah RostiniHak Cipta:

Format Tersedia

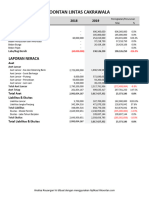

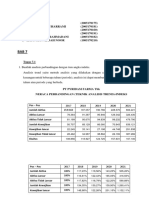

PT.

ABC

NERACA PEMBANDING 31 DESEMBER 2018, 2019

31 Desember Naik/Turun % tase

Ratio

2018 2019 Rp % 2018 2019

a b c d e f f

b-a c/a*100 b/a*100 Masing2 pos/total aktiv

AKTIVA

Aktiva Lancar

Kas 545,500 919,700 374,200 69% 169% 10% 14%

Piutang Dagang 1,324,200 1,612,800 288,600 22% 122% 24% 25%

Piutang Wesel 500,000 250,000 -250,000 -50% 50% 9% 4%

Persediaan 951,200 1,056,500 105,300 11% 111% 17% 16%

Persekot Biaya 46,000 37,000 -9,000 -20% 80% 1% 1%

Jumlah Aktiva Lancar 3,366,900 3,876,000 509,100 32% 532% 61% 60%

Aktiva Tetap

Tanah 200,000 200,000 0 0% 100% 4% 3%

Gedung 1,600,000 2,000,000 400,000 25% 125% 29% 31%

Cadangan Peny. Gedung (225,500) (261,000) -35,500 16% 116% -4% -4%

Alat-Alat kantor 700,000 850,000 150,000 21% 121% 13% 13%

Cadangan Peny. Alat Ktr (153,000) (201,000) -48,000 31% 131% -3% -3%

Jumlah Aktiva Tetap 2,121,500 2,588,000 466,500 94% 594% 39% 40%

Jumlah Aktiva 5,488,400 6,464,000 975,600 125% 1125% 100% 100%

Hutang Modal

Hutang Lancar

Hutang Dagang 655,000 552,200 -102,800 -16% 84% 38% 35%

Hutang Wesel 150,000 125,000 -25,000 -17% 83% 9% 8%

Hutang Gaji 312,000 443,500 131,500 42% 142% 18% 28%

Jumlah Hutang Lancar 1,117,000 1,120,700 3,700 10% 310% 65% 71%

Hutang Jangka Panjang

Hutang Obligasi 3% 2009 600,000 450,000 -150,000 -25% 75% 35% 29%

Jumlah hutang 1,717,000 1,570,700 -146,300 -15% 385% 100% 100%

Modal

Modal saham biasa 2,000,000 2,600,000 600,000 30% 130% 53% 53%

Laba yang ditahan 1,771,400 2,293,300 521,900 29% 129% 47% 47%

Jumlah Modal 3,771,400 4,893,300 1,121,900 59% 259% 100% 100%

Jumlah Hutang + Modal 5,488,400 6,464,000 975,600 44% 644% 200% 200%

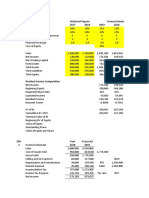

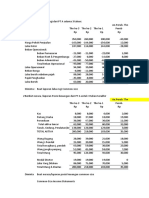

PT. ABC

LAPORAN RUGI LABA PERBANDINGAN

Periode yang berakhir 31 DESEMBER 2018, 2019

31 Desember Naik/Turun

Ratio

2018 2019 Rp %

a b c d e

(b-a) ( c/a)*100 ( b/a)*100

Penjualan Brutto 7,439,200 9,703,000 2,263,800 30% 130%

Return Penjualan 136,100 94,000 -42,100 -31% 69%

Penjualan Netto 7,303,100 9,609,000 2,221,700 61% 199%

Harga Pokok Penjualan

Persediaan Awal 904,600 951,200 46,600 5% 105%

Pembelian Netto 4,792,900 6,029,000 1,236,100 26% 126%

5,697,500 6,980,200 1,282,700 31% 231%

Persediaan Akhir 951,200 1,056,500 105,300 11% 111%

Harga Pokok Penjualan 4,746,300 5,923,700 1,177,400 20% 120%

Laba Kotor 2,556,800 3,685,300 1,044,300 41% 80%

Biaya Penjualan :

Advertensi 182,500 294,700 112,200 61% 161%

Gaji Salesman 456,000 682,300 226,300 50% 150%

Sewa Kantor Penjualan 72,000 90,000 18,000 25% 125%

Biaya Kantor Penjualan 98,450 174,100 75,650 77% 177%

Gaji dan lainya 44,550 85,100 40,550 91% 191%

853,500 1,326,200 472,700 304% 804%

Biaya Administrasi & Umum

Gaji Kantor 626,000 873,000 247,000 39% 139%

Telephone dan Penerangan 72,500 106,000 33,500 46% 146%

Biaya Umum Kantor 140,300 184,700 44,400 32% 132%

Kerugian Piutang 25,000 12,000 -13,000 -52% 48%

863,800 1,175,700 311,900 65% 465%

Jumlah Biaya Operasi 1,717,300 2,501,900 784,600 369% 1269%

Laba Bersih Operasional 839,500 1,183,400 343,900 41% 141%

Biaya lain-lain(bunga) 53,000 28,000 -25,000 -47% 53%

Laba Bersih Sebelum Pajak 786,500 1,155,400 368,900 88% 88%

Deviden

400,000 633,500 233,500 58% 158%

CARA MENCARI PERUBAHAN MODAL KERJA

SUMBER DANA :

LABA BERSIH SEBELUM PAJAK Rp 368,900.00

PENYUSUTAN -Rp 83,500

PENJUALAN SAHAM Rp 600,000

Rp 885,400.00

PENGGUNAAN DATA :

PEMBELIAN ALAT KANTOR Rp 150,000

PEMBELIAN GEDUNG Rp 400,000

MEMBAYAR HUTANG OBLIGASI -Rp 150,000

MEMBAYAR DEVIDEN Rp 233,500

Rp 633,500

KENAIKAN MODAL KERJA Rp 251,900.00

Anda mungkin juga menyukai

- Latihan Analisis Laporan KeuanganDokumen4 halamanLatihan Analisis Laporan KeuangandenisaBelum ada peringkat

- Latihan Analisis Laporan KeuanganDokumen4 halamanLatihan Analisis Laporan KeuangandenisaBelum ada peringkat

- FS Kedai Murah & NikmatDokumen38 halamanFS Kedai Murah & Nikmatitok.ngi.2023Belum ada peringkat

- Tugas Analisis Laporan KeuanganDokumen6 halamanTugas Analisis Laporan KeuanganBella PratamaBelum ada peringkat

- Kelompok 8 - Tugas Analisis Komparatif & TrendDokumen2 halamanKelompok 8 - Tugas Analisis Komparatif & TrendAldi GunawanBelum ada peringkat

- Lisitya Irna para Dela (4AC) Latihan Soal Bab2 No.9,10,11 (Analisis Laporan Keuangan)Dokumen9 halamanLisitya Irna para Dela (4AC) Latihan Soal Bab2 No.9,10,11 (Analisis Laporan Keuangan)Nadia KurniatiBelum ada peringkat

- FS Dapur Rice BowlDokumen36 halamanFS Dapur Rice Bowlitok.ngi.2023Belum ada peringkat

- CVR 2020Dokumen54 halamanCVR 2020CELCIUS IDNBelum ada peringkat

- Jawaban Soal UAS 2019-2020Dokumen7 halamanJawaban Soal UAS 2019-2020Aprita Tri AstutiBelum ada peringkat

- Kertas Kerja Kasus 2Dokumen6 halamanKertas Kerja Kasus 2aci romantiBelum ada peringkat

- Bisplan - Template MENARA SATRIODokumen7 halamanBisplan - Template MENARA SATRIORam AriffBelum ada peringkat

- Contoh Analisa Vertikal Dan Horizontal Perusahaan DagangDokumen2 halamanContoh Analisa Vertikal Dan Horizontal Perusahaan DagangMusadyaBelum ada peringkat

- Jawaban Latihan Soal IAI Jan2024Dokumen22 halamanJawaban Latihan Soal IAI Jan2024riskya3112Belum ada peringkat

- LSIPDokumen21 halamanLSIPdhymas setyawanBelum ada peringkat

- Laporan Laba Rugi PT - DARIAH VARIAH LABORATARIADokumen7 halamanLaporan Laba Rugi PT - DARIAH VARIAH LABORATARIAFernanda EraskaBelum ada peringkat

- Tugas 1 ALK - Najmi Laili - 503200041Dokumen1 halamanTugas 1 ALK - Najmi Laili - 503200041Najmi LailiBelum ada peringkat

- Pertemuan 5 Aspek KeuanganDokumen24 halamanPertemuan 5 Aspek KeuanganPutra LexusBelum ada peringkat

- UntitledDokumen46 halamanUntitledDimas Sopyan PutraBelum ada peringkat

- Nadia Kurniati - 4AC - Analisis Laporan Keuangan - Bab 2 No. 9 - 11Dokumen8 halamanNadia Kurniati - 4AC - Analisis Laporan Keuangan - Bab 2 No. 9 - 11Nadia KurniatiBelum ada peringkat

- Latihan Soal Malam PLP1Dokumen12 halamanLatihan Soal Malam PLP1Jati SasmitoBelum ada peringkat

- Analisa KasDokumen8 halamanAnalisa KasnugrasaktiBelum ada peringkat

- Daftar Agenda Agustus 2023Dokumen150 halamanDaftar Agenda Agustus 2023Hadi SukriBelum ada peringkat

- Catatan Bankir - EOMDokumen13 halamanCatatan Bankir - EOMbprsowanutamaBelum ada peringkat

- Tugas 1Dokumen9 halamanTugas 1Nova Rosa Gita Putri100% (1)

- Pertemuan 6 Aspek Resiko Bisnis Ekonomi Sos Pol Lingkungan Dan YuridisDokumen16 halamanPertemuan 6 Aspek Resiko Bisnis Ekonomi Sos Pol Lingkungan Dan YuridisAndi KamekBelum ada peringkat

- Investasi Dan Modal Kerja BatuDokumen5 halamanInvestasi Dan Modal Kerja BatuAGRISEHAT SUKSESBelum ada peringkat

- Diskusi 7 - Manajemen Risiko Dan Asuransi SyariahDokumen3 halamanDiskusi 7 - Manajemen Risiko Dan Asuransi SyariahgeeBelum ada peringkat

- M.keuangan II Imam Azhari 20011436Dokumen8 halamanM.keuangan II Imam Azhari 20011436Elsa Nabila PutriBelum ada peringkat

- SKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 01Dokumen11 halamanSKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 01jungjibang15Belum ada peringkat

- Irr Mmtech NewDokumen1 halamanIrr Mmtech NewDEPO KELAPA BANG WAHYUBelum ada peringkat

- Business Auto PilotDokumen13 halamanBusiness Auto PilotUli Nasarina MuntheBelum ada peringkat

- Makalah KWUHDokumen3 halamanMakalah KWUHFran SinaBelum ada peringkat

- + Analisis RATIO KeuanganDokumen23 halaman+ Analisis RATIO KeuanganChairul AnamBelum ada peringkat

- Contoh Arus KasDokumen4 halamanContoh Arus KasRafly SoharBelum ada peringkat

- Lab AuditingDokumen13 halamanLab AuditingEdwin Kurniawan HandoyoBelum ada peringkat

- Universitas Jenderal Soedirman Jln. Prof. H.R Boenyamin No 708, Purwokerto 53122 Telp. 0281-637970 Fax. 0281-640268 - WebsiteDokumen4 halamanUniversitas Jenderal Soedirman Jln. Prof. H.R Boenyamin No 708, Purwokerto 53122 Telp. 0281-637970 Fax. 0281-640268 - Websiteahmad marufBelum ada peringkat

- Analisis Horizontal Dan VertikalDokumen4 halamanAnalisis Horizontal Dan VertikalRiani OfficialBelum ada peringkat

- Fahrul BANGKEP T.A 2022Dokumen13 halamanFahrul BANGKEP T.A 2022Fahrul RascalBelum ada peringkat

- Contoh Soal Alk PT ADokumen6 halamanContoh Soal Alk PT Aria susantiBelum ada peringkat

- Latihan Soal - Cost Approach - 2Dokumen40 halamanLatihan Soal - Cost Approach - 2Jati SasmitoBelum ada peringkat

- Perhitungan Esa PratamaDokumen5 halamanPerhitungan Esa PratamaPRIMATAMA KONSULTAMABelum ada peringkat

- Kelompok 8 Audit Kasus 1Dokumen6 halamanKelompok 8 Audit Kasus 1MuntiaBelum ada peringkat

- Rkap PT Jabar Energi - 2019aDokumen30 halamanRkap PT Jabar Energi - 2019aDikdik MegantaraBelum ada peringkat

- Pengantar Manajemen Keuangan 04Dokumen8 halamanPengantar Manajemen Keuangan 04Nova Lina100% (1)

- Bab 7 (Kelompok 3)Dokumen8 halamanBab 7 (Kelompok 3)Nana HernitaBelum ada peringkat

- Tugas Analis Pertemuan 2Dokumen6 halamanTugas Analis Pertemuan 2Mela CanniliaBelum ada peringkat

- Soal - Jawab Appraisal 1 & 2Dokumen2 halamanSoal - Jawab Appraisal 1 & 2Havid AryandikaBelum ada peringkat

- Analisis TrenDokumen5 halamanAnalisis Trensurya kusumaBelum ada peringkat

- JAWABAN Tugas I ANALISIS INF KEUDokumen4 halamanJAWABAN Tugas I ANALISIS INF KEUPutri AngginiBelum ada peringkat

- Jumlah Rata-Rata Kenaikan Harga Tanah (Oleh Arli Kurnia)Dokumen2 halamanJumlah Rata-Rata Kenaikan Harga Tanah (Oleh Arli Kurnia)Bagus Aji IbrahimBelum ada peringkat

- SKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 02Dokumen10 halamanSKB - PERHITUNGAN (Studi Kelayakan Bisnis) - 02jungjibang15Belum ada peringkat

- UntitledDokumen21 halamanUntitledJUMAT KLIWONBelum ada peringkat

- GJTLDokumen21 halamanGJTLNEWS CHANELBelum ada peringkat

- Catatan Bankir - EOMDokumen14 halamanCatatan Bankir - EOMbprsowanutamaBelum ada peringkat

- M.Thomi Irv - Soal Dan Jawaban Ak3-U-DikonversiDokumen3 halamanM.Thomi Irv - Soal Dan Jawaban Ak3-U-DikonversiThomi IrviantoBelum ada peringkat

- Analisis Laporan Keuangan PTDokumen2 halamanAnalisis Laporan Keuangan PTAmalia Ramadhani MentariBelum ada peringkat

- Bank Dan Lembaga Keuangan LainnyaDokumen50 halamanBank Dan Lembaga Keuangan LainnyaDwi Sifah RostiniBelum ada peringkat

- Makalah Etika BisnisDokumen20 halamanMakalah Etika BisnisDwi Sifah RostiniBelum ada peringkat

- Mekanisme Pemotongan Penyetoran Dan Pelaporan PPH 23Dokumen54 halamanMekanisme Pemotongan Penyetoran Dan Pelaporan PPH 23Dwi Sifah RostiniBelum ada peringkat

- Tugas Teori Akuntansi - Kelompok BDokumen17 halamanTugas Teori Akuntansi - Kelompok BDwi Sifah RostiniBelum ada peringkat

- Perubahan Sekutu - PartnerDokumen21 halamanPerubahan Sekutu - PartnerDwi Sifah RostiniBelum ada peringkat

- Kode Etik Advokat IndonesiaDokumen13 halamanKode Etik Advokat IndonesiaDwi Sifah RostiniBelum ada peringkat

- Murabahah - Dwi Sifah RostiniDokumen15 halamanMurabahah - Dwi Sifah RostiniDwi Sifah RostiniBelum ada peringkat

- BudgetingDokumen3 halamanBudgetingDwi Sifah RostiniBelum ada peringkat

- Analisis Efektifitas Dan Kontribusi Pemungutan Pajak RestoranDokumen24 halamanAnalisis Efektifitas Dan Kontribusi Pemungutan Pajak RestoranDwi Sifah RostiniBelum ada peringkat

- Ibadah Zakat - Dwi Sifah RostiniDokumen14 halamanIbadah Zakat - Dwi Sifah RostiniDwi Sifah RostiniBelum ada peringkat

- Peranan Hak Asasi Manusia Dalam NegaraDokumen7 halamanPeranan Hak Asasi Manusia Dalam NegaraDwi Sifah RostiniBelum ada peringkat

- Bab IDokumen20 halamanBab IDwi Sifah RostiniBelum ada peringkat

- Bab IDokumen20 halamanBab IDwi Sifah RostiniBelum ada peringkat

- Bab IDokumen20 halamanBab IDwi Sifah RostiniBelum ada peringkat