RMK 11

Diunggah oleh

Cari Ilmu0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan5 halamanHak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

12 tayangan5 halamanRMK 11

Diunggah oleh

Cari IlmuHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

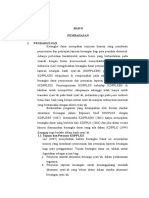

AAOIFI: Organisasi Standar Akuntansi Syariah Internasional

Dibidang akuntansi dikenal beberapa organisasi standar akuntansi skala

internasional. Organisasi Standar akuntansi keuangan internasional dikenal

IASB (International Accounting Standard Board) yang menerbitkan IFRS.

Standar akuntansi sektor publik ada IPSASB (International Public Sector

Accounting Standards Board) yang menerbitkan IPSAS.

Dibidang akuntansi syariah juga ada organisasi standar akuntansi syariah

internasional yang berfungsi untuk penyeragamaan perlakuan akuntansi

lembaga keuangan syariah global. Organisasi standar akuntansi syariah

internasional dikenal AAOIFI.

AAOIFI kepanjangan dari Accounting and Auditing Organizations for Islamic

Financial Institutions merupakan organisasi didirikan pada tahun 1991 dan

berkedudukan di Bahrain. AAOIFI merupakan organisasi non profit yang

konsen pada pengembangan dan penerbitan standar akuntansi bagi industri

keuangan syariah global.

Hingga saat ini AAOIFI telah menerbitkan 90 standar yang terdiri dari 54

standar syariah (sharia standard), 1 Conceptual Framework for Financial

Reporting by Islamic Financial Institutions, 27 standar akuntansi (accounting

standard), 7 standar tatakelola perusahaan (governance standard), dan 2 standar

kode etik (code of ethich).

Standar AAOIFI telah diadopsi oleh bank sentral atau otoritas keuangan

disejumlah negara yang menjalankan keuangan islam baik adopsi secara

penuh (mandatory) atau sebagai dasar pedoman (basis of guidelines). AAOIFI

didukung oleh sejumlah bank sentral, otoritas keuangan, lembaga keuangan,

perusahaan akuntansi dan audit, dan lembaga hukum lebih dari 45 negara

termasuk Indonesia.

Sejumlah negara berbeda-beda dalam mengadopsi standar yang dikeluarkan

oleh AAOIFI. Negara Bahrain, Oman, Pakistan, Sudan, dan Suriah menjadikan

standar syariah dan standar akuntansi AAOIFI sebagai bagian dari peraturan

yang wajib untuk diterapkan (mandatory regulatory). Islamic Development

Bank (IDB) juga mengadopsi secara penuh.

Indonesia dan Malaysia menjadikan standar syariah dan standar akuntansi

AAOIFI sebagai dasar pedoman dalam penyusunan standar syariah dan standar

akuntansi syariah. Sedang Brunei, Dubai International Financial Centre, Mesir,

Perancis, Kuwait, Lebanon, Malaysia, Arab Saudi, Afrika Selatan, Uni Emirat

Arab dan Inggris serta di Afrika dan Asia Tengah hanya menerapkan standar

AAOIFI secara sukarela (voluntary) bagi lembaga keuangan syariah.

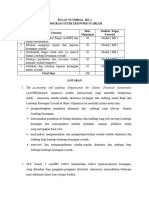

Berikut ini standar yang telah diterbitkan oleh AAOIFI :

Standar Syariah (Sharia Standard)

1. Trading in Currencies 22. Concession Contracts

2. Debit Card, Charge Card and Credit Card 23. Agency

3. Procrastinating Debtor 24. Syndicated Financing

4. Settlement of Debt by Set-Off 25. Combination of Contracts

5. Guarantees 26. Islamic Insurance

6. Conversion of a Conventional Bank to an 27. Indices

Islamic Bank

28. Banking Services

7. Hawalah

29. Stipulations and Ethics of Fatwa in the

8. Murabahah Institutional Framework

9. Ijarah and Ijarah Muntahia Bittamleek 30. Monetization (Tawarruq)

10. Salam and Parallel Salam 31. Controls on Gharar in Financial

Transactions

11. Istisna’a and Parallel Istisna’a

32. Arbitration

12. Sharikah (Musharakah) and Modern

Corporations 33. Waqf

13. Mudarabah 34. Hiring of Persons

14. Documentary Credit 35. Zakah

15. Jua’lah 36. Impact of Contingent Incidents on

Commitments

16. Commercial Papers

37. Credit Agreement

17. Investment Sukuk

38. Online Financial Dealings

18. Possession (Qabd)

39. Mortgage and its Contemporary

19. Loan (Qard)

Applications

20. Commodities in Organised Markets

40. Distribution of Profit in Mudarabah-based

21. Financial Papers (Shares and Bonds) Investments Accounts

41. Islamic Reinsurance 45. Protection of Capital and Investments

42. Financial Rights and How They Are

Exercised and Transferred 46. Al-Wakalah Bi Al-Istithmar (Investment

Agency)

43. Insolvency

47. Rules for Calculating Profit in Financial

Transactions

44. Obtaining and Deploying Liquidity

48. Options to Terminate Due to Breach of

Trust (Trust-Based Options) 52. Options to Reconsider (Cooling-Off

Options, Either-Or Options, and Options to

49. Unilateral and Bilateral Promise Revoke Due to Non-Payment)

50. Irrigation Partnership (Musaqat) 53. Arboun (Earnest Money)

51. Options to Revoke Contracts Due to 54. Revocation of Contracts by Exercise of a

Incomplete Performance Cooling-Off Option

Standar Akuntansi (Accounting Standards)

Financial Accounting Statements (FAS)

Conceptual Framework for Financial FAS 1 – General Presentation and

Reporting by Islamic Financial Disclosure in the Financial Statements

Institutions of Islamic Banks and Financial

Institutions

Financial Accounting Standards

FAS 2 – Murabaha and Murabaha to the FAS 9 – Zakah

Purchase Orderer

FAS 10 – Istisna’a and Parallel Istisna’a

FAS 3 – Mudaraba Financing

FAS 11 – Provisions and Reserves

FAS 4 – Musharaka Financing

FAS 12 – General Presentation and

FAS 7 – Salam and Parallel Salam Disclosure in the Financial Statements

of Islamic Insurance Companies

FAS 8 – Ijarah and Ijarah Muntahia

Bittamleek

FAS 13 – Disclosure of Bases for

Determining and Allocating Surplus or

Standar Tatakelola

Deficit in Islamic Insurance Companies Perusahaan (Governance

FAS 14 – Investment Funds Standard)

1. Shari’ah Supervisory Board:

FAS 15 – Provisions and Reserves in Appointment, Composition and Report

Islamic Insurance Companies

2. Shari’ah Review

FAS 16 – Foreign Currency

Transactions and Foreign Operations 3. Internal Shari’ah Review

FAS 18 – Islamic Financial Services 4. Audit & Governance Committee for

offered by Conventional Financial Islamic Financial Institutions

Institutions 5. Independence of Shari’ah

FAS 19 – Contributions in Islamic Supervisory Board

Insurance Companies 6. Statement on Governance Principles

FAS 20 – Deferred Payment Sale for Islamic Financial Institutions

FAS 21 – Disclosure on Transfer of 7. Corporate Social Responsibility

Assets Conduct and Disclosure for Islamic

Financial Institutions

FAS 22 – Segment Reporting

Standar Kode Etik (Codes of

FAS 23 – Consolidation Ethich)

FAS 24 – Investments in Associates 1. Code of Ethics for Accountants and

Auditors of Islamic Financial

FAS 25 – Investment in Sukuk, shares Institutions

and similar instruments

2. Code of Ethics for the Employees of

FAS 26 – Investment in Real Estate Islamic Financial Institutions

FAS 27 – Investment Accounts

Anda mungkin juga menyukai

- Pendekatan sederhana untuk investasi ekuitas: Panduan pengantar investasi ekuitas untuk memahami apa itu investasi ekuitas, bagaimana cara kerjanya, dan apa strategi utamanyaDari EverandPendekatan sederhana untuk investasi ekuitas: Panduan pengantar investasi ekuitas untuk memahami apa itu investasi ekuitas, bagaimana cara kerjanya, dan apa strategi utamanyaBelum ada peringkat

- Tugas 1 AKSDokumen5 halamanTugas 1 AKSMelda Triaprisa50% (2)

- Tugas Tutorial Ke 1Dokumen4 halamanTugas Tutorial Ke 1Firial AfifahBelum ada peringkat

- Perbankan SyariahDokumen33 halamanPerbankan SyariahsowhereBelum ada peringkat

- Tugas 1 - Akuntansi Keuangan Syariah (Asep Nurrafiq Usmanar 030846903)Dokumen3 halamanTugas 1 - Akuntansi Keuangan Syariah (Asep Nurrafiq Usmanar 030846903)Asep NurrafiqBelum ada peringkat

- Reksadana SyariahDokumen17 halamanReksadana SyariahTiara Ayu PangestiBelum ada peringkat

- Jawaban Tugas 1Dokumen4 halamanJawaban Tugas 1Apep BurhanudinBelum ada peringkat

- Resume KLP 5 Standar Akuntansi SyariahDokumen25 halamanResume KLP 5 Standar Akuntansi SyariahIsma YantiBelum ada peringkat

- AAOIFIDokumen5 halamanAAOIFIReni SoniaBelum ada peringkat

- Aaoifi PDF FreeDokumen15 halamanAaoifi PDF FreeTaufiq HidayatBelum ada peringkat

- CH 2 Kerangka Dasar Penyusunan Dan Penyajian Laporan KeuanganDokumen17 halamanCH 2 Kerangka Dasar Penyusunan Dan Penyajian Laporan KeuanganevaBelum ada peringkat

- Kerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan SyariahDokumen3 halamanKerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan SyariahMaria Yudith Yubellia Ageng Millenia AdhieBelum ada peringkat

- Akuntansi Syariah - Kelompok 5Dokumen22 halamanAkuntansi Syariah - Kelompok 5Hery AriantoBelum ada peringkat

- Bank SyariahDokumen9 halamanBank SyariahKamila HijabStoreBelum ada peringkat

- UTS - Pelaporan Keuangan Syariah - 0117124033 - Ulfa Nurul YasmineDokumen8 halamanUTS - Pelaporan Keuangan Syariah - 0117124033 - Ulfa Nurul YasmineulfanysmnBelum ada peringkat

- Perkembangan Lembaga Keuangan SyariahDokumen26 halamanPerkembangan Lembaga Keuangan SyariahF.Z AjiBelum ada peringkat

- Bab 18 (Teori Akuntansi)Dokumen9 halamanBab 18 (Teori Akuntansi)Gledys Jatitesih GitasmaraBelum ada peringkat

- CPMK3 - Anggun Mita Tri K. - 55519120027Dokumen27 halamanCPMK3 - Anggun Mita Tri K. - 55519120027Anggun Mita Tri KusumawardaniBelum ada peringkat

- TUGAS 1 - Akuntansi Syariah - 041397142 Sari'Atul HidayahDokumen4 halamanTUGAS 1 - Akuntansi Syariah - 041397142 Sari'Atul HidayahSari atul HidayahBelum ada peringkat

- Riva Yani (C1F017040) - Resume Pertanyaan Dan Jawaban Kelompok 5Dokumen7 halamanRiva Yani (C1F017040) - Resume Pertanyaan Dan Jawaban Kelompok 5Riva yaniBelum ada peringkat

- Reksa Dana SyariahDokumen20 halamanReksa Dana SyariahDiana Nadiah AyuBelum ada peringkat

- Bab2 Perkembanganlembagakeuangansyariah 100402011241 Phpapp02Dokumen21 halamanBab2 Perkembanganlembagakeuangansyariah 100402011241 Phpapp02Saori HaraBelum ada peringkat

- Laporan Keuangan SyariahDokumen37 halamanLaporan Keuangan SyariahRanty SunarsihBelum ada peringkat

- Produk Dan Akad LKMSDokumen6 halamanProduk Dan Akad LKMSaan nasrullahBelum ada peringkat

- Materi 3Dokumen36 halamanMateri 3yessyBelum ada peringkat

- Kelompok 5 - PSAK SyariahDokumen65 halamanKelompok 5 - PSAK SyariahIeska Aende AerBelum ada peringkat

- Sesi1 MkiDokumen25 halamanSesi1 MkiAchmad Rofifs RofifBelum ada peringkat

- KDPPLKS Kel 4Dokumen25 halamanKDPPLKS Kel 4AinayaAFBelum ada peringkat

- Reksadana SyariahDokumen17 halamanReksadana SyariahTiara Ayu PangestiBelum ada peringkat

- Akuntansi Syariah Bab 6 & 7Dokumen12 halamanAkuntansi Syariah Bab 6 & 7kikiBelum ada peringkat

- Kel 3 Kerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan SyariahDokumen12 halamanKel 3 Kerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan SyariahMOHAMAD IKSAN ABIDINBelum ada peringkat

- Bab 5 - KDPPLKSDokumen36 halamanBab 5 - KDPPLKSSena ChairunnisaBelum ada peringkat

- Sesi4-5 PmisDokumen27 halamanSesi4-5 PmisRifaldy MajidBelum ada peringkat

- Peranan Aaoifi Dalam Akuntansi SyariahDokumen13 halamanPeranan Aaoifi Dalam Akuntansi SyariahHerlina HumairahBelum ada peringkat

- 7 +norma+ (102-119) en IdDokumen20 halaman7 +norma+ (102-119) en IdM Helmi MulyadiBelum ada peringkat

- Tugas-3 AkBSDokumen4 halamanTugas-3 AkBSYouana RizkyBelum ada peringkat

- Akuntansi Koperasi SyariahDokumen17 halamanAkuntansi Koperasi SyariahFitriyatus Sabilah12Belum ada peringkat

- Ak. Syariah 2Dokumen4 halamanAk. Syariah 2HannaBelum ada peringkat

- Sukma Indrianti 172 MPS - Manajemen PerbankanDokumen6 halamanSukma Indrianti 172 MPS - Manajemen PerbankanIrsandhyBelum ada peringkat

- Makalah Presentasi PelaporanDokumen35 halamanMakalah Presentasi PelaporanAnnisa InsaniBelum ada peringkat

- Makalah Kelompok 5 Manajemen KeuanganDokumen12 halamanMakalah Kelompok 5 Manajemen Keuanganputrinurdiana026Belum ada peringkat

- Laporan Posisi Keuangan Laporan Laba-Rugi Komprehensif Laporan Arus Kas Dan Laporan Perubahan EkuitasDokumen18 halamanLaporan Posisi Keuangan Laporan Laba-Rugi Komprehensif Laporan Arus Kas Dan Laporan Perubahan EkuitasIsmi OktaviaBelum ada peringkat

- TMK Ekma4482Dokumen5 halamanTMK Ekma4482Ardi WalukowBelum ada peringkat

- Quiz Managemen, Muhammad Luvi 201941166Dokumen7 halamanQuiz Managemen, Muhammad Luvi 201941166Muhammad LuviBelum ada peringkat

- Uts Manajemen InvestasiDokumen3 halamanUts Manajemen Investasisalmanhizbullah531Belum ada peringkat

- Aliya Hasna Mahira - 210421622032 - Aksyar Tugas 1Dokumen2 halamanAliya Hasna Mahira - 210421622032 - Aksyar Tugas 1ALIYA HASNABelum ada peringkat

- Friska Alehanda Nainggolan - 01170009 - Tugas MakalahDokumen36 halamanFriska Alehanda Nainggolan - 01170009 - Tugas MakalahFRISKA ALEHANDABelum ada peringkat

- Lembaga Keuangan Syariah Bank-Asuransi Syariah-Pasar Modal SyariahDokumen10 halamanLembaga Keuangan Syariah Bank-Asuransi Syariah-Pasar Modal SyariahTulasmi, SEIBelum ada peringkat

- PLK Sesi 5-1. Bank SyariahDokumen21 halamanPLK Sesi 5-1. Bank SyariahZ MaghfirahBelum ada peringkat

- Pendapatan Non HalalDokumen21 halamanPendapatan Non HalalhandikaBelum ada peringkat

- LLKS Xi Bab I GasalDokumen4 halamanLLKS Xi Bab I GasalYURAIDA BETELGUESE100% (1)

- Makalah (Mentahan)Dokumen18 halamanMakalah (Mentahan)alvin kurniawatiBelum ada peringkat

- UK 1.8 Merencanakan Manajemen Resiko OperasionalDokumen28 halamanUK 1.8 Merencanakan Manajemen Resiko OperasionalImam NimaxBelum ada peringkat

- Rangkuman Praktik-Praktik SyariahDokumen9 halamanRangkuman Praktik-Praktik SyariahFalyciaBelum ada peringkat

- Makalah Kerangka Dasar Penyajian Dan Penyusunan Laporan Keuangan SyariahDokumen5 halamanMakalah Kerangka Dasar Penyajian Dan Penyusunan Laporan Keuangan SyariahAyu Dian SetyaniBelum ada peringkat

- Kel. 5 Akuntansi SyariahDokumen14 halamanKel. 5 Akuntansi SyariahamirBelum ada peringkat

- Makalah Kelompok 3 - ApsDokumen29 halamanMakalah Kelompok 3 - Apsevelyn.maddiezBelum ada peringkat

- MAKALAH AKUNTANSI PERBANKAN SYARIAH Akuntansi Transaksi Pembiayaan MudharabahDokumen12 halamanMAKALAH AKUNTANSI PERBANKAN SYARIAH Akuntansi Transaksi Pembiayaan Mudharabahvira damanikBelum ada peringkat

- Akuntansi Syariah Kelompok 12Dokumen18 halamanAkuntansi Syariah Kelompok 12Ahmad HernandaBelum ada peringkat

- Akuntansi Keuangan SyariahDokumen2 halamanAkuntansi Keuangan Syariahha diBelum ada peringkat

- Formulir 1721-IIIDokumen2 halamanFormulir 1721-IIICari IlmuBelum ada peringkat

- AKL II Sesi 6 Debril-1700012136Dokumen12 halamanAKL II Sesi 6 Debril-1700012136Cari IlmuBelum ada peringkat

- Tugas Pratikum Pajak CBDokumen2 halamanTugas Pratikum Pajak CBCari IlmuBelum ada peringkat

- AKL 2 C SesiDokumen3 halamanAKL 2 C SesiCari IlmuBelum ada peringkat

- Ta 10Dokumen2 halamanTa 10Cari IlmuBelum ada peringkat

- RMK 14Dokumen3 halamanRMK 14Cari IlmuBelum ada peringkat

- RMK 10Dokumen2 halamanRMK 10Cari IlmuBelum ada peringkat

- Book2Cash Out 29-1 AprilDokumen7 halamanBook2Cash Out 29-1 AprilCari IlmuBelum ada peringkat

- Etika Bisnis Dan ProfesiDokumen4 halamanEtika Bisnis Dan ProfesiCari IlmuBelum ada peringkat