Bab 12

Diunggah oleh

tyo48Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bab 12

Diunggah oleh

tyo48Hak Cipta:

Format Tersedia

Chapter Twelve 1

A PowerPoint

Tutorial

to Accompany macroeconomics, 5th ed.

N. Gregory Mankiw

BAB 12

Permintaan Agregat dalam

Perekonomian Terbuka

Chapter Twelve 2

Analisis AD dengan memasukkan

perdagangan dan keuangan internasional.

Model Mundell-Fleming (MF) : versi

perekonomian terbuka dari model IS-LM

Asumsi model MF/IS-LM: tingkat harga

tetap, apa yang menyebabkan fluktuasi jk

pendek dlm AD

Chapter Twelve 3

Asumsi penting model MF: Perekonomian

terbuka kecil dengan modal mobilitas

sempurna.

tingkat bunga ekonomi domestik ditentukan

tingkat bunga dunia *

bisa memusatkan perhatian pada peran kurs.

Chapter Twelve 4

MODEL MUNDELL-FLEMING

Asumsi r = r*

Tingkat bunga dunia tetap secara eksogen

Mis. Jk pendek r naik sedikit, maka pihak

asing akan mulai memberi pinjaman.

Akhirnya bunga domestik kembali menuju

r*.

Chapter Twelve 5

Pasar Barang dan Kurva IS*

Y = C(Y-T) + I(r*) + G + NX(e)

Ekspor neto berhub negative dengan kurs e.

e = jumlah mata uang asing per unit mata

uang domestik. Mis e adalah 9200 rupiah

per dolar US

Chapter Twelve 6

Kurs riil : harga relatif dari barang2 di

dalam dan LN

Kurs nominal : harga relatif dari mata uang

domestik dan asing

Jika e = kurs nominal, maka

Kurs riil = eP/P* (P= harga domestik, P*

harga LN)

Chapter Twelve 7

Asumsi Model MF : tingkat harga dalam

dan LN tetap.

Maka kurs riil proporsional terhadap kurs

nominal.

Misal kurs nominal berapresiasi, barang LN

menjadi lebih murah, maka ekspor turun,

impor naik. (grafik 12.1)

Chapter Twelve 8

Gbr 12.1

NX

Y

Y

E

e

NX

IS

Y=AE

r

Planned Expenditure,

E = C + I + G + NX

Chapter Twelve 9

Ket Gambar 12.1

Kurva IS* miring ke bawah karena kurs

yang lebih tinggi, mengurangi ekspor neto,

menurunkan Y.

kenaikan kurs mengurangi ekspor neto

penurunan NX, menggeser pengeluaran yg

direncanakan ke bawah menurunkan Y

Kurva IS* meringkas hub r dan Y

Chapter Twelve 10

Pasar Uang dan Kurva LM*

M/P = L (r*, Y)

Keseimbangan uang riil M/P sama dengan

permintaan, L(r*, Y)

M var eksogen, dikendalikan bank sentral

Jangka pendek, maka P tetap secara

eksogen

Chapter Twelve 11

Persamaan LM* : menentukan pendapatan

agregat tanpa pertimbangan kurs

Gbr 12.2

e

Income, Output, Y

LM*

Chapter Twelve 12

Merakit Bagian Model

Y = C(Y-T) + I(r*) + G + NX(e) IS*

M/P = L (r*, Y) LM*

Var eksogen : G, T, M, P, r*

Var endogen : Y dan kurs e

Chapter Twelve 13

Gbr 12.3Ekuilibrium menunjukkan kurs dan tingkat

pendapatan di mana pasar barang & pasar uang dalam

ekuilibrium

e

Income, Output, Y

LM*

IS

Chapter Twelve 14

KURS MENGAMBANG (floating

exchange rates)

Kurs dibiarkan berfluktuasi dengan bebas

untuk menanggapi kondisi ekonomi yang

sedang berubah

Chapter Twelve 15

Kebijakan Fiskal Gbr 12.4

Y

e

IS2

IS1

LM

Chapter Twelve 16

Keterangan Gbr 12.4

Peningkatan G atau penurunan T : begitu r

> r*, maka modal LN masuk permintaan

uang meningkat nilai mata uang

domestik naik kurs mata uang domestic

relative mahal terhadap produk asing

mengurangi ekspor neto mengoffset

dampak ekspansioner pendapatan

Chapter Twelve 17

Kebijakan Moneter

Meningkatkan jumlah uang beredar

kenaikan keseimbangan uang riil

menggeser LM*

M naik modal mengalir keluar kurs

mengalami depresiasi ekspor neto

meningkat pendapatan

Jadi meningkatkan pendapatan dan

menurunkan kurs

Chapter Twelve 18

Gbr 12.5.

Y

e

LM2

LM1

IS

Chapter Twelve 19

Kebijakan Perdagangan

Gbr 12.6.

Chapter Twelve 20

Pemberlakuan kuota impor/tariff brg impor

Berarti kenaikan ekspor neto (a)

meningkatkan pengeluaran yang

direncanakan menggeser IS ke kanan

tidak mempengaruhi pendapatan.

Karena tidak mempengaruhi Y, C, I, G,

hambatan perdagangan tidak mempengaruhi

neraca perdagangan.

Jadi pergeseran ekspor neto NX, kenaikan

kurs mengurangi NX dalam jumlah yang

sama

Chapter Twelve 21

KURS TETAP (fixed exchange

rates)

Bank sentral siap membeli atau menjual

mata uang domestic untuk mata uang asing

pada harga yang telah ditetapkan

sebelumnya.

Tujuan : mempertahankan kurs pada tingkat

yang telah diumumkan, jumlah uang yang

beredar menyesuaikan berapapun kurs yang

menjamin kurs ekuilibrium.

Chapter Twelve 22

Gbr 12.7.

Chapter Twelve 23

Kurs ekuilibrium > tingkat tetapnya

pialang akan membeli mata uang asing,

menjualnya pada BI untuk mendapatkan

laba meningkatkan jumlah uang beredar

menggeser LM* ke kanan

menurunkan kurs. Demikian sebaliknya.

Chapter Twelve 24

Kebijakan fiskal Pada Fixed ER

G atau T IS* naik ke kanan. Jumlah

uang beredar ditingkatkan, untuk

mempertahankan kurs, melalui pialang yang

menjual mata uang asing ke bank sentra

LM* ke kanan Y meningkat

Chapter Twelve 25

Gbr 12.8 Kebijakan Fiskal

Chapter Twelve 26

Kebijakan Moneter Pada Fixed ER

Misal meningkatkan jumlah uang beredar,

LM* bgeser tapi bank sentral akan

membuat LM* kembali.

Dengan menyepakati kurs tetap, bank

sentral meningkatkan kontrolnya atas

jumlah uang beredar.

Chapter Twelve 27

Gbr 12.9. Kebijakan moneter

Chapter Twelve 28

Negara bisa mengubah tingkat kurs tetap

Penurunan nilai mata uang : devaluasi

(LM* kekanan)

Kenaikan nilai mata uang : revaluasi (LM*

kekiri)

Chapter Twelve 29

Kebijakan Perdagangan

Gbr 12.10

Chapter Twelve 30

Mengurangi impor/kuota NX bertambah IS*

ke kanan, cenderung menaikkan kurs. Agar kurs

tetap, jumlah uang beredar harus naik LM* ke

kanan.

Jasi ekspor neto meningkat, karena mendorong

ekspansi moneter (bukan apresiasi kurs). Akhirnya

meningkatkan pendapatan agregat.

NX = S I

Pendapatan , tabungan , menunjukkan NX

Chapter Twelve 31

Model MF

Dampak kebijakan (mempengaruhi

pendapatan) tergantung apakah dalam

kondisi kurs mengambang atau kurs tetap.

Kurs mengambang : kebijakan moneter

Kurs tetap : kebijakan fiskal

Chapter Twelve 32

Tabel 12.1. Ringkasan Dampak

Kebijakan

Rezim Kurs

Mengambang Tetap

berdampak pada

Y e NX Y e NX

Kebijakan Fiskal 0 0 0

Ekspansi moneter 0 0 0

Hambatan impor 0 0 0

Chapter Twelve 33

PERBEDAAN TINGKAT BUNGA

Asumsi : tingkat bunga r = r*

Diperluas : sebab dan dampak perbedaan tingkat

bunga internasional

Dengan r = r*, maka mobilitas dana ke luar

masuk.

Kenapa tidak selalu berjalan?

Alasan 1: Resiko Negara / resiko politik

Alasan 2: Ekspektasi kurs

Chapter Twelve 34

Memasukkan perbedaan tingkat bunga dlm model

Mundel Fleming

R = r* + ( = premi tingkat resiko)

Misal kemelut politik, premi resiko naik r bunga

domestik naik ; memiliki 2 dampak :

- Kurva IS* bergeser ke kiri (investasi turun)

-Kurva LM* bergeser ke atas karena permintaan

uang turun pendapatan naik (krn ekspor neto)

Akibatnya: pendapatan naik, mata uang terdepresiasi

Chapter Twelve 35

In the other words

Jadi ekspektasi bahwa mata uang akan

kehilangan nilainya di masa depan

menyebabkan mata uang itu

kehilangan nilainya pada saat ini.

(terdepresiasi)

Chapter Twelve 36

Gbr 12.11.

Chapter Twelve 37

Apa benar pendapatan naik? Kenyataan:

Tidak!

Bank sentral menurunkan jumlah uang

beredar utk mengurangi depresiasi mata

uang

Barang impor yang mahal akan

meningkatkan P

Premi resiko yang naik, permintaan uang

meningkat, LM* bergeser ke kiri

Ketiga perubahan: menggeser LM ke kiri.

Chapter Twelve 38

Jadi kenaikan resiko pada Negara tidak

dikehendaki.

Jangka pendek : - mata uang terdepresiasi

- pendapatan menurun

Jangka panjang: tingkat bunga tinggi

mengurangi investasi, pertumbuhan

ekonomi lebih renda

Chapter Twelve 39

Apakah pilihan kurs mengambang atau tetap?

Jarang kurs yang seutuhnya tetap atau mengambang

Indonesia : nilai tukar mengambang terkendali

Kurs mengambang :

+Kebijakan moneter dapat digunakan utk tujuan lain

misal menstabilkan kesempatan kerja atau harga

Kurs tetap:

+Kepastian perdagangan internasional

+Mendisiplinkan pemegang otoritas moneter negara

Chapter Twelve 40

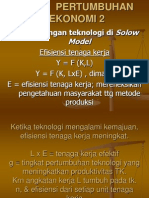

Model MF dengan Perubahan Tingkat Harga

Gbr 12.12 menunjukkan ketika harga turun

Income, Output,Y

Income, Output,Y

IS*

AD

LM* LM*

P

e

Chapter Twelve 41

Gbr 12.12

Harga turun LM* bergeser ke kanan

menurunkan kurs riil pendapatan naik

(gbr a)

AD : hub negatif antara P dan Y (gbr b)

Chapter Twelve 42

Gbr 12.13. Ekuilibrium Jk pendek

dan Jk panjang

Chapter Twelve 43

K : ekuilibrium jk pendek.

Permintaan rendah, tingkat harga turun.

Keseimbangan uang riil LM* bergeser ke

kanan.

Kurs terdepresiasi, ekspor neto naik,

sehingga jangka panjang titik C,

perekonomian alamiah.

Chapter Twelve 44

Chapter Twelve 45

Chapter Twelve 46

Chapter Twelve 47

Introducing

e

Income, Output, Y

LM*

IS*

Equilibrium

exchange rate

Equilibrium Income

Chapter Twelve 48

Assumption 1:

The domestic interest rate is equal to the world interest rate (r = r*).

Assumption 2:

The price level is exogenously fixed since the model is used to analyze

the short run (P). This implies that the nominal exchange rate is

proportional to the real exchange rate.

Assumption 3:

The money supply is also set exogenously by the central bank (M).

Assumption 4:

Our LM* curve will be vertical because the exchange rate does not enter

into our LM* equation.

IS*: Y = C(Y-T) + I(r*) + G + NX(e)

LM*: M/P = L (r*,Y)

Start with these two equations:

Chapter Twelve 49

E

Income, Output, Y

Y=E

Planned Expenditure,

E = C + I + G + NX

r

Income, Output, Y

e

Net Exports, NX

NX(e)

IS*

An increase in the exchange

rate, lowers net exports,

which shifts planned

expenditure downward and

lowers income. The IS*

curve summarizes these

changes in the goods market

equilibrium.

(a)

(b)

(c)

Chapter Twelve 50

r

Income, Output, Y

LM

e

Income, Output, Y

LM*

r = r*

The LM curve and

the world interest

rate together determine

the level of income.

Chapter Twelve 51

e

Income, Output, Y

LM*

IS*

e

Income, Output, Y

LM*

IS*

IS*'

LM*'

When income rises in a small open economy, due to

the fiscal expansion, the interest rate tries to rise but

capital inflows from abroad put downward pressure

on the interest rate.This inflow causes an increase in

the demand for the currency pushing up its value

and thus making domestic goods more expensive

to foreigners (causing a DNX). The DNX offsets

the expansionary fiscal policy and the effect on Y.

When the increase in the money supply puts downward

pressure on the domestic interest rate, capital flows out

as investors seek a higher return elsewhere. The capital

outflow prevents the interest rate from falling. The

outflow also causes the exchange rate to depreciate

making domestic goods less expensive relative to

foreign goods, and stimulates NX. Hence, monetary

policy influences the e rather than r.

+DG, or DT

+De, no DY

+DM

-De, +DY

The Mundell-Fleming Model

Under Floating Exchange Rates

Chapter Twelve 52

e

Income, Output, Y

LM*

IS*

e

Income, Output, Y

LM*

IS*

IS*'

A fiscal expansion shifts IS* to the right. To maintain

the fixed exchange rate, the Fed must increase the

money supply, thus increasing LM* to the right.

Unlike the case with flexible exchange rates, there is no

crowding out effect on NX due to a higher exchange

rate.

If the Fed tried to increase the money supply by

buying bonds from the public, that would put down-

ward pressure on the interest rate. Arbitragers respond

by selling the domestic currency to the central bank,

causing the money supply and the LM curve

to contract to their initial positions.

+DG, or DT + DY

LM*'

+DM no DY

The Mundell-Fleming Model

Under Fixed Exchange Rates

Chapter Twelve 53

Fixed vs. Floating

Exchange Rate Conclusions

Fixed Exchange Rates Floating Exchange Rates

Fiscal Policy is Powerful.

Monetary Policy is Powerless.

Fiscal Policy is Powerless.

Monetary Policy is Powerful.

The Mundell-Fleming model shows that fiscal policy does not influence

aggregate income under floating exchange rates. A fiscal expansion

causes the currency to appreciate, reducing net exports and offsetting

the usual expansionary impact on aggregate demand.

The Mundell Fleming model shows that monetary policy does not

influence aggregate income under fixed exchange rates. Any attempt

to expand the money supply is futile, because the money supply

must adjust to ensure that the exchange rate stays at its announced level.

Hint: (Think of floating money.)

Hint: (Fixed and Fiscal sound alike).

Chapter Twelve 54

Policy in the Mundell-Fleming Model:

A Summary

The Mundell-Fleming model shows that the effect of almost any

economic policy on a small open economy depends on whether the

exchange rate is floating or fixed.

The Mundell-Fleming model shows that the power of monetary and

fiscal policy to influence aggregate demand depends on the exchange

rate regime.

Chapter Twelve 55

The higher return will attract funds from the rest of

the world, driving the US interest rate back down.

And, if the interest rate were below the world

interest rate, domestic residents would lend

abroad to earn a higher return, driving the domestic

interest rate back up. In the end, the domestic

interest rate would equal the world interest rate.

What if the domestic

interest rate were above

the world interest rate?

Chapter Twelve 56

Why doesnt this logic always apply? There are two reasons why interest

rates differ across countries:

1) Country Risk: when investors buy US government bonds, or make

loans to US corporations, they are fairly confident that they will be

repaid with interest. By contrast, in some less developed countries, it

is plausible to fear that political upheaval may lead to a default on loan

repayments. Borrowers in such countries often have to pay higher

interest rates to compensate lenders for this risk.

2) Exchange Rate Expectations: suppose that people expect the French

franc to fall in value relative to the US dollar. Then loans made in francs

will be repaid in a less valuable currency than loans made in dollars. To

compensate for the expected fall in the French currency, the interest rate

in France will be higher than the interest rate in the US.

Chapter Twelve 57

Differentials in the Mundell-Fleming Model

To incorporate interest-rate differentials into the Mundell-Fleming

model, we assume that the interest rate in our small open economy

is determined by the world interest rate plus a risk premium q.

r = r* + q

The risk premium is determined by the perceived political risk of

making loans in a country and the expected change in the real interest

rate. Well take the risk premium q as exogenously determined.

For any given fiscal policy, monetary policy, price level, and risk

premium, these two equations determine the level of income and

exchange rate that equilibrate the goods market and the money market.

IS*: Y = C(Y-T) + I(r* + q) + G + NX(e)

LM*: M/P = L (r* + q,Y)

Chapter Twelve 58

Now suppose that political turmoil causes the countrys risk premium q

to rise. The most direct effect is that the domestic interest rate r rises.

The higher interest rate has two effects:

1) IS* curve shifts to the left, because the higher interest rate reduces

investment.

2) LM* shifts to the right, because the higher interest rate reduces the

demand for money, and this allows a higher level of income for any

given money supply.

These two shifts cause income to rise and thus push down the equilibrium

exchange rate on world markets.

The important implication: expectations of the exchange rate are partially

self-fulfilling. For example, suppose that people come to believe that the

French franc will not be valuable in the future. Investors will place a

larger risk premium on French assets: q will rise in France. This

expectation will drive up French interest rates and will drive down the

value of the French franc. Thus, the expectation that a currency will lose

value in the future causes it to lose value today. The next slide will

demonstrate the mechanics.

Chapter Twelve 59

e

Income, Output, Y

LM*

IS*

LM*'

IS*'

An Increase in the Risk Premium

An increase in the risk premium associated with a country drives up

its interest rate. Because the higher interest rate reduces investment,

the IS* curve shifts to the left. Because it also reduces money

demand, the LM* curve shifts to the right. Income rises, and the

exchange rate depreciates.

Is this really is where

the economy ends

up? In the next slide,

well see that

increases in country

risk are not desirable.

Chapter Twelve 60

There are three reasons why, in practice, such a boom in income

does not occur. First, the central bank might want to avoid the large

depreciation of the domestic currency and, therefore, may respond

by decreasing the money supply M. Second, the depreciation of the

domestic currency may suddenly increase the price of domestic goods,

causing an increase in the overall price level P. Third, when some event

increase the country risk premium q, residents of the country might

respond to the same event by increasing their demand for money (for

any given income and interest rate), because money is often the

safest asset available. All three of these changes would tend to shift

the LM* curve toward the left, which mitigates the fall in the exchange

rate but also tends to depress income.

Chapter Twelve 61

IS*: Y=C(Y-T) + I(r*) + G + NX(e)

LM*: M/P=L (r*,Y)

Recall the two equations of the Mundell-Fleming model:

e

Income, Output,Y

LM*

IS*

LM*'

P

Income, Output,Y

AD

When the price level falls the LM*

curve shifts to the right. The

equilibrium level of income rises.

The second graph displays the

negative relationship between P and

Y, which is summarized by the

aggregate demand curve.

Chapter Twelve 62

Mundell-Fleming Model

Floating exchange rates

Fixed exchange rates

Devaluation

Revaluation

Chapter Twelve 63

Chapter Twelve 64

Anda mungkin juga menyukai

- 6 Mankiw 12Dokumen26 halaman6 Mankiw 12Dhona Tri WibawaBelum ada peringkat

- 6 Mankiw 12Dokumen26 halaman6 Mankiw 12Joko Aconk100% (1)

- Model Mundell-FlemingDokumen7 halamanModel Mundell-FlemingTio Budi SantosoBelum ada peringkat

- Alviatus Salamah - 042111133051 Nisrina Choirunnisa - 042111133061 Hana Celia Tomasoa - 042111133102Dokumen16 halamanAlviatus Salamah - 042111133051 Nisrina Choirunnisa - 042111133061 Hana Celia Tomasoa - 042111133102Alvi AlviBelum ada peringkat

- Makro Mankiw Bab 12Dokumen26 halamanMakro Mankiw Bab 12SekArBelum ada peringkat

- Tinjauan Ulang Model Mundell Fleming dan Rezim KursDokumen15 halamanTinjauan Ulang Model Mundell Fleming dan Rezim KurssandiBelum ada peringkat

- Teori Ekonomi Makro Dari Perekonomian TerbukaDokumen9 halamanTeori Ekonomi Makro Dari Perekonomian TerbukaAndrianto WibisonoBelum ada peringkat

- Febriana Putri L 195020301111038 MakroDokumen5 halamanFebriana Putri L 195020301111038 MakroFebriana Putri LestyadiBelum ada peringkat

- Perekonomian Terbuka Tinjauan Ulang ModeDokumen6 halamanPerekonomian Terbuka Tinjauan Ulang ModeDwi PutriBelum ada peringkat

- 10-11. Mundell Fleming ModelDokumen60 halaman10-11. Mundell Fleming ModelAzhar FathoniBelum ada peringkat

- Ekonomi Internasional Design 13 Mundell FlemingDokumen26 halamanEkonomi Internasional Design 13 Mundell FlemingDwi PutriBelum ada peringkat

- 10 Permintaan AggregatDokumen24 halaman10 Permintaan AggregatMutmainnah RasyidBelum ada peringkat

- NERACA DAN TINGKAT KURSDokumen4 halamanNERACA DAN TINGKAT KURSfai linaBelum ada peringkat

- Mankiw - Perekonomian Terbuka Model Mundell-Fleming Dan Sistem KursDokumen26 halamanMankiw - Perekonomian Terbuka Model Mundell-Fleming Dan Sistem KursDarwin YunusBelum ada peringkat

- Kelompok 2 - TE Makro 1 - Kelas B - Tugas 4Dokumen18 halamanKelompok 2 - TE Makro 1 - Kelas B - Tugas 4Ganang ElangBelum ada peringkat

- Bab 20 MAKROEKONOMI Blanchard Johnson Edisi 6Dokumen28 halamanBab 20 MAKROEKONOMI Blanchard Johnson Edisi 6Muhammad Adhit PutrantoBelum ada peringkat

- MUNDELL-FLEMINGDokumen22 halamanMUNDELL-FLEMINGGanang ElangBelum ada peringkat

- Ekonomi Moneter 2Dokumen29 halamanEkonomi Moneter 2Sthefanie Parera100% (2)

- Teori Ekonomi Makro IiDokumen20 halamanTeori Ekonomi Makro IiEriana KusumaBelum ada peringkat

- Bab 11 Permintaan Agregat Ii Penerapan MDokumen6 halamanBab 11 Permintaan Agregat Ii Penerapan Mkipin avgxBelum ada peringkat

- Kurva Is-LmDokumen26 halamanKurva Is-LmRirin Song HwaBelum ada peringkat

- Mundell FlemingDokumen13 halamanMundell FlemingAlif Al Hamda0% (1)

- FIXED EXCHANGEDokumen6 halamanFIXED EXCHANGEgeraldBelum ada peringkat

- CURRENCY CRISIS - En.idDokumen16 halamanCURRENCY CRISIS - En.idpratiwirahmadaniBelum ada peringkat

- Keseimbangan Di Pasar Barang Dan Pasar UangDokumen23 halamanKeseimbangan Di Pasar Barang Dan Pasar UangGilang Abdi NugrohoBelum ada peringkat

- Rangkuman Emon Chapter 22Dokumen6 halamanRangkuman Emon Chapter 22Farhan NoorBelum ada peringkat

- Kebijakan FiskalDokumen27 halamanKebijakan FiskalSiwi KusumaningtyasBelum ada peringkat

- OPTIMASI PENAWARAN UANGDokumen57 halamanOPTIMASI PENAWARAN UANGtrias tintonBelum ada peringkat

- Bab 13Dokumen46 halamanBab 13tyo48Belum ada peringkat

- Review BLM GabungDokumen4 halamanReview BLM GabungAnggraini Clara SantiBelum ada peringkat

- 24 - Maghfira R Prihamboedi - WEEK 11Dokumen4 halaman24 - Maghfira R Prihamboedi - WEEK 11firaprihamboediBelum ada peringkat

- Adjustment Under FixedDokumen3 halamanAdjustment Under FixedLee EunsangBelum ada peringkat

- MODEL MUNDELL-FLEMINGDokumen10 halamanMODEL MUNDELL-FLEMINGMuhamad Malwa Fatih HuseinBelum ada peringkat

- Makro 10 Penerapan Model IS-LMDokumen6 halamanMakro 10 Penerapan Model IS-LMTio Budi SantosoBelum ada peringkat

- Anton Soleh Hudin - EP E - KUIS 2 P Eko MakroDokumen4 halamanAnton Soleh Hudin - EP E - KUIS 2 P Eko Makroanton.solehudinBelum ada peringkat

- Sesi 7 Kebijakan Fiskal & Moneter Terhadap Keseimbangan Pasar Uang Dan Pasar BarangDokumen14 halamanSesi 7 Kebijakan Fiskal & Moneter Terhadap Keseimbangan Pasar Uang Dan Pasar BarangLeticia AlmaBelum ada peringkat

- TM5-PEREKONOMIAN TERBUKA - Edited PDFDokumen23 halamanTM5-PEREKONOMIAN TERBUKA - Edited PDFahmad khubaibBelum ada peringkat

- Brown and Black Aesthetic Portofolio PresentationDokumen33 halamanBrown and Black Aesthetic Portofolio Presentation4111220078shelsiBelum ada peringkat

- 3. Perekonomian Terbuka brief tanpa kuis (1)Dokumen30 halaman3. Perekonomian Terbuka brief tanpa kuis (1)yutamiadistiaBelum ada peringkat

- BAB 16 DoneDokumen11 halamanBAB 16 DoneBatari Saraswati KarlitaBelum ada peringkat

- Macroeconomics (Rudiger Dornbusch, Stanley Fischer Etc.) (Z-Lib - Org) - 304-340.en - IdDokumen37 halamanMacroeconomics (Rudiger Dornbusch, Stanley Fischer Etc.) (Z-Lib - Org) - 304-340.en - IdFauzan SaukanBelum ada peringkat

- Neraca Pembayaran Dan Kurs Valuta AsingDokumen21 halamanNeraca Pembayaran Dan Kurs Valuta AsingIrsan AbdBelum ada peringkat

- Perekonomian TerbukaDokumen26 halamanPerekonomian TerbukaFatmawati LulukBelum ada peringkat

- Perekonomian TerbukaDokumen21 halamanPerekonomian TerbukaBudiman TeriBelum ada peringkat

- Tugas Makro Resume Bab 18, 19 Dan 20Dokumen8 halamanTugas Makro Resume Bab 18, 19 Dan 20riska putri utami75% (4)

- Epr 16 Kebijakan Fiskal MoneterDokumen14 halamanEpr 16 Kebijakan Fiskal MoneterfajarBelum ada peringkat

- MakroDokumen30 halamanMakroTere HanifahBelum ada peringkat

- Bab 12-Ekonomi MakroDokumen20 halamanBab 12-Ekonomi MakroSuci NingsihBelum ada peringkat

- Model Mundell-Fleming Dan Rezim KursDokumen31 halamanModel Mundell-Fleming Dan Rezim KursEVABelum ada peringkat

- KURVA IS-LMDokumen8 halamanKURVA IS-LMCecepMaulanaMuhamadBelum ada peringkat

- Ekonomi Internasional dan NasionalDokumen9 halamanEkonomi Internasional dan NasionalabighoziBelum ada peringkat

- ISLM-MODELDokumen19 halamanISLM-MODELVirta NisaBelum ada peringkat

- Makro Bab 5 Per TerbukaDokumen23 halamanMakro Bab 5 Per TerbukaJoshua TinambunanBelum ada peringkat

- Jawaban Uas Pengantar Ekonomi Makro 2020Dokumen6 halamanJawaban Uas Pengantar Ekonomi Makro 2020achmad nurdionoBelum ada peringkat

- TEM Kelompok 16Dokumen21 halamanTEM Kelompok 16Marischa Micel PoliiBelum ada peringkat

- Model Mundell Fleming (Open Economy)Dokumen36 halamanModel Mundell Fleming (Open Economy)firdhaBelum ada peringkat

- Permintaan AgregatDokumen27 halamanPermintaan AgregatNatika_IndieLVBelum ada peringkat

- EKONOMI MAKRO II SOAL GENAPDokumen5 halamanEKONOMI MAKRO II SOAL GENAPRzky MNBelum ada peringkat

- IS (Invesment Saving) LM (Liquidity Preference, Money Suply)Dokumen54 halamanIS (Invesment Saving) LM (Liquidity Preference, Money Suply)Razak ArkanantaBelum ada peringkat

- Bab 14 UasDokumen16 halamanBab 14 Uastyo48Belum ada peringkat

- Bab 13Dokumen46 halamanBab 13tyo48Belum ada peringkat

- Bab 10Dokumen60 halamanBab 10tyo48Belum ada peringkat

- Fluktuasi Ekonomi dan Kebijakan Stabilisasi (39Dokumen32 halamanFluktuasi Ekonomi dan Kebijakan Stabilisasi (39tyo48Belum ada peringkat

- Bab 11Dokumen54 halamanBab 11tyo48Belum ada peringkat

- Krisis Asia 1997Dokumen3 halamanKrisis Asia 1997tyo48Belum ada peringkat

- BAB 5 (Solow-2)Dokumen19 halamanBAB 5 (Solow-2)dplarasatiBelum ada peringkat

- Bab 8Dokumen24 halamanBab 8tyo48Belum ada peringkat

- Pasword Gta Sa PCDokumen3 halamanPasword Gta Sa PCjhoni darjudinBelum ada peringkat