Bab 8 Akuntansi Untuk Piutang Usaha

Diunggah oleh

nizwirHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bab 8 Akuntansi Untuk Piutang Usaha

Diunggah oleh

nizwirHak Cipta:

Format Tersedia

Chapter 8

Receivables

Accounting, 21

st

Edition

Warren Reeve Fess

PowerPoint Presentation by Douglas Cloud

Professor Emeritus of Accounting

Pepperdine University

Copyright 2004 South-Western, a division

of Thomson Learning. All rights reserved.

Task Force Image Gallery clip art included in this

electronic presentation is used with the permission of

NVTech Inc.

Classification of Receivables

Accounts ReceivablePiutang Usaha: timbul

karena penjualan barang atau jasa secara

kredit, biasanya umurnya jangka pendek

Notes ReceivableWesel Tagih,didasarkan

pada suatu surat promes dari debitur.

Other Receivables contoh: interest

receivable, taxes receivable, and receivables

from officers and employees.

Acctg.

Info

Collections

Invoice

Acctg.

Info.

Accounting

Goods

or

services

Sales

Separating the Receivable Functions

Credit

Info.

Credit

Approval

Seringkali suatu

perusahaan menjual

piutangnya kepada pihak

lain. Tansaksi ini disebut

factoring of Receivable

ACCOUNT RECEIVABLE

Saat timbul

Saat Pelunasan

Saat tak tertagih

Saat timbul

Penjualan kredit/Sales

meminjamkan uang tunai/Cash

Jurnal

Account Receivable

Cash/Sale

Piutang Tak Tertagih/

Uncollectible Account/

Bad-Debt Account /

Doubtfull Account/

Uncollectible Account

Piutang tak tertagih

Metode Penghapusan Piutang tak tertagih

1.Metode Cadangan ( Allowance Method)

2.Metode Langsung ( Direct Write-off)

Metode ini sesuai dengan matching principle.

Setiap akhir periode akan dibentuk suatu cadangan

atas piutang yang kemungkinan tidak tertagih

berdasarkan Estimasi.

Jurnal yang akan dibuat untuk mencatat pembentukan

cadangan :

Uncollectible Accounts Expense

Allowance for Uncllectible Accounts

Pada saat benar-benar terdapat piutang yang tak

tertagih maka akan di jurnal:

Allowance for Uncollectible Accounts

Accounts Receivable.

The Allowance Method

Metode Cadangan

The Allowance Method

Dec. 31 Uncollectible Accounts Expense 4 000 00

Allowance for Uncollectible Accounts 4 000 00

31 Des, dari saldo Piutang $ 105,000

diestimasikan terdapat piutang yang

kemungkinan tak tertagih sebesar $4,000

Adjusting Entry

Jumlah piutang yang mungkin bisa

tertagih $101,000 ($105,000 $4,000),

disebut net realizable value (NRV).

The Allowance Method

The adjusting entry

reduces receivables to

the NRV and matches

uncollectible expenses

with revenues.

Receivables

on the

Balance Sheet

Assets

Current assets:

Cash $119,500

Notes receivable 250,000

Accounts receivable $445,000

Less : allowance for

Uncollectible accounts 15,000 430,000

Interest receivable 14,500

Merchandise inventory 714,000

Crabtree Co. Balance Sheet

December 31, 2006

Highlighted items are receivables

Jurnal

Penyesuaian

dibuat untuk

membentuk

cadangan

Allowance

for

Doubtful

Accounts

The Allowance Method

Pada saat piutang

benar-benar

dihapus maka

akan mengurangi

cadangan

The Allowance Method

On January 21, diketahui

terdapat piutang yang benar2

tidak tertagih sebesar $610

Jan. 21 Allowance for Uncollectible Accounts 610 00

Accounts ReceivableJohn Parker 610 00

To write off the uncollectible

account.

The Allowance Method

On June 10, the written-off

account is collected.

Jun. 10 Accounts ReceivableJohn Parker 610 00

To reinstate the account

written off on Jan. 21.

Apabila piutang yang

sebelumnya sudah dihapus

ternyata dapat ditagih

kembali

Allowance for Uncollectible Accounts 610 00

The Allowance Method

Saat cash diterima dari

pelunasan piutang

Jun. 10 Cash 610 00

Accounts ReceivableJohn Parker 610 00

To record collection on

account.

The Allowance Method

Menghitung Estimasi Beban Piutang Tak

Tertagih

1. Berdasarkan penjualan (percentage of sales).

Penjualan yang dimaksud adalah penjualan

kredit. Contoh Credit sales th berjalan

$300,000 dan estimasi piutang tak tertagih

ditetapkan 1%. Maka jumlah Uncollectible

Accounts Expense = $3,000.

Dalam menghitung besarnya estimasi atas piutang

tak tertagih bisa dihitung dengan 2 dasar yaitu:

The Allowance Method

Dec. 31 Uncollectible Accounts Expense 3 000 00

Allowance for Uncollectible Accounts 3 000 00

Adjusting Entry

Based on a Percentage of Sales

The Allowance Method

The ABC company, Credit Sales selama

tahun berjalan $100,000. saldo A/R

$30,500. Saldo allowance for doubtful

accounts $350 (Cr.). Diestimasikan 3%

dari Credit Sales tidak tertagih

Percentage of Credit Sales

Jurnal Penyesuaian yang harus dibuat?

Percentage of Credit Sales

Bad Debt Expense 3,000

Allowance for Doubtful Accounts .. 3,000

To record estimated uncollectible

accounts for the year.

The ABC company, Credit Sales selama

tahun berjalan $100,000. saldo A/R

$30,500. Saldo allowance for doubtful

accounts $350 (Cr.). Diestimasikan 3%

dari Credit Sales tidak tertagih

Percentage of Credit Sales

Allowance for Doubtful Accounts

Balance 350

Adjusting 3,000

Dec. 31, Bal. 3,350

2. Berdasarkan Analisa Saldo Piutang

Besarnya cadangan piutang tat tertagih dihitung

erdasarkan saldo piutang. Maka hasil

perhitungan harus memperhatikan saldo

Cadangan sebelumnya.

Contoh: Saldo piutang $ 100,000. Cadangan

Piutang tak tertagih awal $ 200. apabila

ditetapkan besarnya cadangan th ini adl 1%,

maka Beban piutang taktertagih yang harus

dicatat sebesar $ 800 ((1%x100,000)-200)

Dec. 31 Uncollectible Accounts Expense 800 00

Allowance for Uncollectible Accounts 800 00

Adjusting Entry

Based on an Analysis of Receivables

The Allowance Method

Percentage of Accounts

Receivable

Bad Debt Expense.. 1,175

Allowance for Doubtful Accounts. 1,175

To record estimated uncollectible

accounts for the year.

What is the entry to record estimated bad debts?

($30,500 x .05) - $350

The ABC company, Credit Sales selama

tahun berjalan $100,000. saldo A/R

$30,500. Saldo allowance for doubtful

accounts $350 (Cr.). Diestimasikan 5%

dari Saldo A/R tidak tertagih

Percentage of Accounts

Receivable

Allowance for Doubtful Accounts

Balance 350

Adjusting 1,175

Dec. 31, Bal. 1,525

Allowance for Doubtful Accounts

Adjusting 1,875

Dec. 31, Bal. 1,525

Balance 350

Apa pengaruhnya

kalo saldo Allowance

adalah Debit $350?

Percentage of Accounts

Receivable

AGING SKEDULE

Not Days Past Due

Past over

Customer Balance Due 1-30 31-60 61-90 91-180 181-365 365

Ashby & Co. $ 150 $ 150

B. T. Barr 610 $ 350 $260

Brock Co. 470 $ 470

Saxon Woods 160 160

Total $86,300 $75,000 $4,000 $3,100 $1,900 $1,200 $800 $300

Total accounts receivable

shown by age.

2% 5% 10% 20% 30% 50% 80%

Uncollectibles

PERCENT

% ditentukan berdasarkan

pengalaman tahun2 sebelumnya

Daftar Umur Piutang dan % Estimasi piutang tak

tertagih

Not Days Past Due

Past over

Customer Balance Due 1-30 31-60 61-90 91-180 181-365 365

Ashby & Co. $ 150 $ 150

B. T. Barr 610 $ 350 $260

Brock Co. 470 $ 470

Saxon Woods 160 160

Total $86,300 $75,000 $4,000 $3,100 $1,900 $1,200 $800 $300

2% 5% 10% 20% 30% 50% 80%

Uncollectibles

PERCENT

AMOUNT

$3,390 = $1,500 $200 $310 $380 $360 $400 $240

Accounts Receivable Aging and Uncollectibles

Not Days Past Due

Past over

Customer Balance Due 1-30 31-60 61-90 91-180 181-365 365

Ashby & Co. $ 150 $ 150

B. T. Barr 610 $ 350 $260

Brock Co. 470 $ 470

Saxon Woods 160 160

Total $86,300 $75,000 $4,000 $3,100 $1,900 $1,200 $800 $300

Year-End Adjustment for Uncollectibles

General Ledger

Accounts Receivable

86,300

A

Allowance for Doubtful Accts.

510

Uncollectible Accts. Expense

Accounts receivable $86,300

Less allowance for

doubtful accounts 3,390

Net realizable value $82,910

Balance Sheet

A

Balances before adjustment

A

Year-end adjustment:

$3,390 $510 = $2,880

B

2,880

B

2,880

B

Balance after adjustment C

3,390 C

Metode ini dianggap tidak sesuai dengan

matching principle

Piutang akan di hapuskan pada saat

benar-benar tidak tertagih

Jurnal:

Uncollectible Accounts Expense xx

Accounts Receivable xx

The Direct Write-Off Method

Metode Penghapusan langsung

The Direct Write-Off Method

On May 10, Diketahui Piutang Kepada

Ny. A sebesar $420, terbukti tidak

dapat ditagih

May 10 Uncollectible Accounts Expense 420 00

Accounts ReceivableD. L. Ross 420 00

To write off an uncollectible

account.

Seandainya piutang yang sudah dihapus

ternyata dapat ditagih kembali

Nov. 1 Accounts ReceivableD. L. Ross 420 00

Uncollectible Accounts Expense 420 00

To reinstate account written

off on May 10.

The Direct Write-Off Method

1

st

Entry

Mencatat penerimaan kas atas

pelunasan piutang

Nov. 1 Cash 420 00

Accounts ReceivableD. L. Ross 420 00

To record collection on

account.

The Direct Write-Off Method

2

nd

Entry

Notes Receivable

$_____________

Fresno, California______________20___ March 16 06

________________ _AFTER DATE _______ PROMISE TO PAY TO Ninety days

We

THE ORDER OF ____________________________________________ Judson Company

_________________________________________________DOLLARS

Two thousand five hundred 00/100---------------------------

PAYABLE AT ______________________________________________

City National Bank

VALUE RECEIVED WITH INTEREST AT ____ 10%

2,500.00

NO. _______ DUE___________________ 14 June 14, 2006

TREASURER, WILLIARD COMPANY

H. B. Lane

Payee

Maker

Nilai nominal (principal/Face Ammount)

Tanggal notes

Nama Penerima Notes (payee) dan TTd

Pembuat Notes (Maker)

Tempat Pembayaran

Tgl Jatuh tempo/umur notes

Tingkat Bunga/th, jika ada

Surat sanggup membayar yang berisi

informasi mengenai:

Notes Receivable

Notes Receivable

Dicatat sebesar Nilai Nominal

Dua jenis Notes Rec:

Interest-bearing: berbunga

Non-interest-bearing: tidak berbunga

Tanggal suatu hutang harus

dilunasi disebut tanggal Jatuh

Tempo (Due Date)

Notes tgl 16 maret jatuh

tempo 90 hari. Kapan Tgl

Jatuh temponya?

Notes Receivable

Total days in note 90 days

Number of days in March 31

Issue date of note March 16

Remaining days in March 15 days

75 days

Number of days in April 30 days

45 days

Number of days in May 31 days

Residual days in June 14 days

Jawab: June 14

Notes Receivable

Notes Receivable

Jumlah yang harus

dibayarkan/diterima pada tgl

jatuh tempo disebut

maturity value.

Notes Receivable

Maturity value untuk :

*Interest Bearing = Nominal + Bunga

*Non Interest Bearing = Nominal

Saat Timbulnya Notes

Saat Jatuh Tempo

Penyesuaian atas Bunga terhutang

Pendiskontoan Notes

Saat Jatuh tempo atas Notes yg

didiskontokan

Jurnal yang diperlukan

Notes Receivable

21 Nov 2006 Diterima Notes dari Wan

Abu $6,000, 12%, 30-day atas

penjualan barang dagangan

Notes Receivable

Accounting for Notes Receivable

Nov. 21 Notes Receivable 6 000 00

Sales 6 000 00

Received 30-day, 12% note

dated November 21, 2006.

21 Nov 2006 Diterima Notes dari Wan

Abu $6,000, 12%, 30-day atas

penjualan barang dagangan

21 Dec, saat jatuh tempo maka

perusahaan akan menerima pelunasan

sebesar $6,060 ($6,000 plus $60 interest).

Dec. 21 Cash 6 060 00

Notes Receivable 6 000 00

Received principal and interest

on matured note.

Interest Revenue 60 00

Accounting for Notes Receivable

Nominal + Interest = Maturity Value

$6,000 + $60.00 = $6,060.00

Nominal x Tingkat Bunga x umur = Interest

$6,000 x 12% x 30/360 = $60.00

Interest Calculation

Nilai Jatuh tempo

Notes Receivable

Apabila pada Tgl Jatuhtempo debitur tidak bisa

melunasi maka wesel tsb dinamakan dishonored

note receivable.

Dec. 21 Accounts ReceivableBunn Co. 6 060 00

Notes Receivable 6 000 00

To record dishonored note and

interest.

Interest Revenue 60 00

Dishonor of Notes Receivable

Diterima wesel tgl 1 Desember 2006 atas

pelunasan piutang dari Tn. X, $4000, 90-day,

12%

Dec. 1 Notes Receivable 4 000 00

Accounts ReceivableCrawford

Company 4 000 00

Received note in settlement of

account.

Accounting for Notes Receivable

Pada akhir periode perlu dibuat

penyesuaian atas bunga

Dec. 31 Interest Receivable 40 00

Interest Revenue 40 00

Adjusting entry for accrued

interest.

Accounting for Notes Receivable

On March 1, 2004, $4,120 is received for

the note ($4,000) and interest ($120).

Mar. 1 Cash 4 120 00

Notes Receivable 4 000 00

Interest Receivable 40 00

Interest Revenue 80 00

Received payment on note and

interest.

$4,000 x

0.12 x

60/360

Accounting for Notes Receivable

Discount Rate: tarif diskon atas penjualan

N/R

Discount Period: periode antara tgl

penjualan tgl jatuh tempo

Discounting Notes Receivable

Formulas for Discounting

Notes

Face Ammount = xxxx

Interest = FA x % = xx +

Maturity Value = xxxx

Discount= % Disc x MV x disc period = xx -

Proceed = xxx

Example: Discounting

The original note is a 3-month, $1,000 note at

14% interest. What is the journal entry if the

note was discounted after one month at 16%?

Interest = $1,000 x .14 x 3/12 = $ 35.00

Maturity value = $1,000 + $35 = $1,035.00

Discount = $1,035 x .16 x 2/12 = $ 27.60

Proceeds = $1,035 - $27.60 = $1,007.40

Cash. 1,007.40

Interest Revenue... 7.40

Note Receivable... 1,000.00

Jurnal

Cash. 1,007.40

Interest Revenue... 7.40

Note Receivable... 1,000.00

Apabila Saat jatuh tempo tidak

tertagih

Account Receivable . 1,035.00

Cash.............................................1,035.00

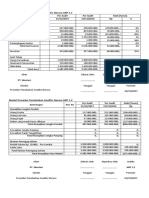

Financial

Analysis and

Interpretation

Accounts Receivable Turnover

Net sales

Average accounts receivable

Accounts Receivable Turnover

2006 2005

Net sales on account $36,000,000 $32,500,000

Accounts receivable (net):

Beginning of year $ 1,080,000 $1,050,000

End of year 1,220,000 1,080,000

Total $2,300,000 $2,130,000

Average $1,150,000 $1,115,000

Accounts receivable turnover 31.3 times 29.1 times

$36,000,000

$1,150,000

$32,500,000

$1,115,000

Use: To assess the efficiency

in collecting receivables

and in the management

of credit.

Number of Days Sales in Receivables

Accounts receivable, end of year

Average daily sales on account

$1,220,000

($36,000,000 365 days)

=12.4 days

Use: To assess the efficiency in collecting

receivables and in the management of credit.

Accounts receivable, end of year

Average daily sales

The End

Chapter 8

Anda mungkin juga menyukai

- Kinerja Keuangan Dan Kinerja Non KeuanganDokumen14 halamanKinerja Keuangan Dan Kinerja Non KeuanganVhivi NurdianaBelum ada peringkat

- Tugas3 AdeAndriWahyudin 382031052Dokumen4 halamanTugas3 AdeAndriWahyudin 382031052Ade Andri Wahyudin100% (1)

- Makalah Sistem Akuntansi UtangDokumen25 halamanMakalah Sistem Akuntansi UtangHandika PutraBelum ada peringkat

- Laporan New BLKDokumen52 halamanLaporan New BLKZainal AbidinBelum ada peringkat

- Bab Xii Biaya ModalDokumen16 halamanBab Xii Biaya ModalElizabeth LisaBelum ada peringkat

- Contoh Soal AdvanceDokumen1 halamanContoh Soal AdvanceAngela KurniawanBelum ada peringkat

- Akuntansi PerbankanDokumen2 halamanAkuntansi PerbankanVivi NovitaBelum ada peringkat

- Makalah Bab 10-Analisis Laporan Kinerja KeuanganDokumen23 halamanMakalah Bab 10-Analisis Laporan Kinerja Keuangannabila putriBelum ada peringkat

- Makalah Akuntansi Keuangan Lanjutan 1 ObligasiDokumen21 halamanMakalah Akuntansi Keuangan Lanjutan 1 Obligasiriska ika100% (1)

- Kasus Skandal Akuntansi Pada WorldcomDokumen3 halamanKasus Skandal Akuntansi Pada WorldcomIkhwallAfifBelum ada peringkat

- BAB 6 D E P O S I T O.bukuDokumen18 halamanBAB 6 D E P O S I T O.bukuvia safitriBelum ada peringkat

- Tugas Transaksi GiroDokumen2 halamanTugas Transaksi GiroYOVITA IRAWATI 23.05.52.6001Belum ada peringkat

- DiskusiDokumen2 halamanDiskusiandienfiddinieBelum ada peringkat

- Ina018 - Manajemen Keuangan Ii - Modul-Sesi 7 - Review Bab I - ViDokumen4 halamanIna018 - Manajemen Keuangan Ii - Modul-Sesi 7 - Review Bab I - Viyordan kalosBelum ada peringkat

- Dunkin Donuts Report: Oleh: Marvel Krent - 2006596573 Sistem Informasi 2020 Manajemen BisnisDokumen10 halamanDunkin Donuts Report: Oleh: Marvel Krent - 2006596573 Sistem Informasi 2020 Manajemen BisnisGarthic FamgamesBelum ada peringkat

- Pendekatan Utama Untuk Menilai Saham Biasa Menggunakan Analisis Keamanan Fundamental MeliputiDokumen6 halamanPendekatan Utama Untuk Menilai Saham Biasa Menggunakan Analisis Keamanan Fundamental MeliputiZidnie IlmaanBelum ada peringkat

- 6.penilaian SahamDokumen22 halaman6.penilaian SahamMufidmuyBelum ada peringkat

- Tugas Minggu 15 MUHAMMAD JIHAD 18233069Dokumen5 halamanTugas Minggu 15 MUHAMMAD JIHAD 18233069Rizky Dhanni Fajri IkepBelum ada peringkat

- BLK - Bank Umum Berdasar SyariahDokumen17 halamanBLK - Bank Umum Berdasar Syariah3H Akuntansi S1Belum ada peringkat

- PAI 7 WarrenDokumen62 halamanPAI 7 WarrenFaisalBelum ada peringkat

- Biaya ModalDokumen15 halamanBiaya ModalAmelia RismaBelum ada peringkat

- AkuntansiDokumen18 halamanAkuntansiIr Fhanjuel Jr.Belum ada peringkat

- aNGGARAN KAS DAN PIUTANGDokumen47 halamanaNGGARAN KAS DAN PIUTANGSoekartono Machmoed100% (1)

- Anggaran PiutangDokumen26 halamanAnggaran PiutangKartika RetnoningsihBelum ada peringkat

- Soal 1: Pertemuan 6 Asistensi Akuntansi Keuangan Menengah 3 MG. Fitria Harjanti, SE., M.SC (Kelas F, G, H)Dokumen1 halamanSoal 1: Pertemuan 6 Asistensi Akuntansi Keuangan Menengah 3 MG. Fitria Harjanti, SE., M.SC (Kelas F, G, H)AndroBelum ada peringkat

- Kelompok 3 Biaya-Modal-Manajemen-KeuanganDokumen28 halamanKelompok 3 Biaya-Modal-Manajemen-Keuangannhurul 21140% (1)

- MODUL AK2 Versi ABSS 2019 (Update 30-08-2019) (139-215)Dokumen77 halamanMODUL AK2 Versi ABSS 2019 (Update 30-08-2019) (139-215)Fitria ChoirunnisaBelum ada peringkat

- Akuntansi Laporan Keuangan Perusahaan DagangDokumen6 halamanAkuntansi Laporan Keuangan Perusahaan DagangWiwi NetBelum ada peringkat

- Soal 2 Akuntansi Aktiva Tetap (Disposal)Dokumen1 halamanSoal 2 Akuntansi Aktiva Tetap (Disposal)Fikri Taehyun SonExoBelum ada peringkat

- 1298 - Soal Quis I BsiDokumen2 halaman1298 - Soal Quis I BsiHane DiarBelum ada peringkat

- Manajemen Kewajiban LancarDokumen13 halamanManajemen Kewajiban LancarArik TogeBelum ada peringkat

- Kelompok 4 - Kesimpulan Tugas Minggu 4 Dan Minggu 7Dokumen5 halamanKelompok 4 - Kesimpulan Tugas Minggu 4 Dan Minggu 7KGGGGBelum ada peringkat

- Akuntansi Manajemen1Dokumen86 halamanAkuntansi Manajemen1Maria Evy PurwitasariBelum ada peringkat

- Nilai Waktu UangDokumen1 halamanNilai Waktu UangMega SeafoodBelum ada peringkat

- Penghimpunan Dana Penyaluran DanaDokumen10 halamanPenghimpunan Dana Penyaluran Danahanifah ajengBelum ada peringkat

- Ceacilia Eva (MCD)Dokumen10 halamanCeacilia Eva (MCD)Gio Namja ElfBelum ada peringkat

- SoalDokumen4 halamanSoalFahira Amanda Putri100% (1)

- Analisis Laporan KeuanganDokumen14 halamanAnalisis Laporan KeuanganPutri Suci Novianti IIBelum ada peringkat

- Aisah Salma R - KKP Pelaksanaan Audit Piutang Usaha Dan PenjualanDokumen26 halamanAisah Salma R - KKP Pelaksanaan Audit Piutang Usaha Dan PenjualanaisyahBelum ada peringkat

- PT Bintang JayaDokumen6 halamanPT Bintang JayaAgn Karang TangisBelum ada peringkat

- Kertas Kerja Pemeriksaan Audit PDFDokumen6 halamanKertas Kerja Pemeriksaan Audit PDFPajar YantoBelum ada peringkat

- Bahan Ajar BudgetingDokumen5 halamanBahan Ajar BudgetingMuhammad IlhamBelum ada peringkat

- Akun Perbankan 4Dokumen24 halamanAkun Perbankan 4Berliana Syaivera AnggraeniBelum ada peringkat

- Transletan Soal Akm Bab 14Dokumen3 halamanTransletan Soal Akm Bab 14yaniBelum ada peringkat

- D - Kel 6 - CASE STUDY 1Dokumen10 halamanD - Kel 6 - CASE STUDY 1Luki ChocsBelum ada peringkat

- Etika Bisnis Fix 221-234Dokumen8 halamanEtika Bisnis Fix 221-234Eka Maisa YudistiraBelum ada peringkat

- Keputusan Bauran Produk - Penetapan HargaDokumen3 halamanKeputusan Bauran Produk - Penetapan HargaElsa Sabrina Agustia Putri AkuntansiBelum ada peringkat

- Soal - Responsi Pertemuan 10 Genap 2019 2020Dokumen4 halamanSoal - Responsi Pertemuan 10 Genap 2019 2020Rahel Elysabet LitasiaBelum ada peringkat

- Latihan Installment SalesDokumen2 halamanLatihan Installment SalesCatur Aji PamungkasBelum ada peringkat

- Faktor Yang Mempengaruhi Pemahaman Pelaku Umkm Dalam Menyusun Laporan Keuangan Berdasarkan Sak Emkm Di BekasiDokumen88 halamanFaktor Yang Mempengaruhi Pemahaman Pelaku Umkm Dalam Menyusun Laporan Keuangan Berdasarkan Sak Emkm Di BekasiAzhaar ayuBelum ada peringkat

- Materi Workshop Zahir Hari KeduaDokumen12 halamanMateri Workshop Zahir Hari KeduaNovia Asih Rizki0% (1)

- Analisis Laporan Keuangan PT Jasa Marga TBKDokumen12 halamanAnalisis Laporan Keuangan PT Jasa Marga TBKAry Huda S0% (2)

- MompreneurDokumen15 halamanMompreneurWulan Permata100% (1)

- SOAL LATIHAN DAN TUGAS AK2 Pertemuan 4 Sekuritas Dilutif PDFDokumen7 halamanSOAL LATIHAN DAN TUGAS AK2 Pertemuan 4 Sekuritas Dilutif PDFanon_136248592Belum ada peringkat

- Kelompok 4 - Materi Manajemen KeuanganDokumen14 halamanKelompok 4 - Materi Manajemen KeuanganNur Aisyah AminiBelum ada peringkat

- Pt. HM Sampoerna TBKDokumen10 halamanPt. HM Sampoerna TBKVita IstatBelum ada peringkat

- Dasar2 AK - Chapter 8 (AR)Dokumen61 halamanDasar2 AK - Chapter 8 (AR)Lifa AnatasyaBelum ada peringkat

- Bab 8 Piutang Pengantar Ak.Dokumen45 halamanBab 8 Piutang Pengantar Ak.Lestari AgustinaBelum ada peringkat

- Bab 8 PiutangDokumen47 halamanBab 8 Piutangnandyking19Belum ada peringkat