Jawab Lat2

Jawab Lat2

Diunggah oleh

Novieta Dwi Fitriaudi0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan2 halamanJudul Asli

JAWAB LAT2

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan2 halamanJawab Lat2

Jawab Lat2

Diunggah oleh

Novieta Dwi FitriaudiHak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

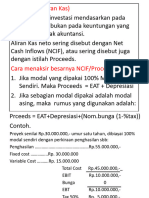

Proyek A :

Penyusutan per tahun = (50.000.000 - 5.000.000) / 4 = Rp. 11.250.000,-

Proceed tahun 1 : 5.000.000 + 11.250.000 = 16.250.000

Proceed tahun 2 : 5.400.000 + 11.250.000 = 16.650.000

Proceed tahun 3 : 6.600.000 + 11.250.000 = 17.850.000

Proceed tahun 4 : 8.000.000 + 11.250.000 + 5.000.000 = 24.250.000

a. Payback Period :

Capital Outlay : 50.000.000

Proceed tahun 1 : 16.250.000 -

33.750.000

Proceed tahun 2 : 16.650.000

17.100.000

Proceed tahun 3 : 17.100.000/17.850.000 x 12 bulan = 11,50

Jadi Payback Period proyek A = 2 tahun, 11 bulan, 15 hari

b. Present Value Proceed (NPV) : DF (10%)

Tahun 1 16.250.000 x 0,909091 = 14.772.727

16.650.000 x 0,826446 = 13.760.331

17.850.000 x 0,751315 = 13.410.969

24.250.000 x 0,683013 = 16.563.076

58.507.103

Present Value Capital Outlay : 50.000.000 -

Net Present Value (NPV) 8.507.103

c. Profitability Index (PI) = PV Proceed/PV Capital Outlay

PI = 58.507.103 / 50.000.000 = 1,17

d. Internal Rate of Return (IRR)

Misal : tingkat bunga = 15%

Present Value Proceed (NPV) : DF (15%)

Tahun 1 16.250.000 x 0,869565 = 14.130.435

16.650.000 x 0,756144 = 12.589.792

17.850.000 x 0,657516 = 11.736.665

24.250.000 x 0,571753 = 13.865.016

52.321.908

Present Value Capital Outlay : 50.000.000

Net Present Value (NPV) 2.321.908

Misal : tingkat bunga = 18%

Present Value Proceed (NPV) : DF (18%)

Tahun 1 16.250.000 x 0,847458 = 13.771.186

16.650.000 x 0,718184 = 11.957.771

17.850.000 x 0,608631 = 10.864.061

24.250.000 x 0,515789 = 12.507.880

49.100.898

Present Value Capital Outlay : 50.000.000

Net Present Value (NPV) (899.102)

I R R = P1 – C1 X P2 – P1

C2 – C1

IRR = 15% - 2.321.908 x ( 18 % - 15 % )

-899.102-2.321.908

= 15% - 69.657,24

- 3.221.010

= 15% + 2,16 %

= 17,16%

Proyek B :

Anda mungkin juga menyukai

- Contoh Kasus IRRDokumen3 halamanContoh Kasus IRRMITSUKI CHANNEL100% (2)

- Contoh Soal Irr Dan NPVDokumen2 halamanContoh Soal Irr Dan NPVSilvia cantik100% (3)

- NPV, IrrDokumen11 halamanNPV, IrrRadhiatunnisa S. SamadBelum ada peringkat

- Tugas Soal Dan JawabanDokumen4 halamanTugas Soal Dan JawabanCynthiaKAyupati86% (7)

- Cara Menghitung Dengan Rumus IRR Yang BenarDokumen9 halamanCara Menghitung Dengan Rumus IRR Yang BenarAdhitya Bagas PratamaBelum ada peringkat

- Contoh Soal Dan Pembahasan Internal Rate of ReturnDokumen10 halamanContoh Soal Dan Pembahasan Internal Rate of ReturnGala Sn50% (2)

- Penganggaran Modal (Capital Budgeting)Dokumen43 halamanPenganggaran Modal (Capital Budgeting)Rio satrioBelum ada peringkat

- Penilaian Keputusan Investasi: Pertemuan 11Dokumen31 halamanPenilaian Keputusan Investasi: Pertemuan 11Muhammad Rizki TrisnantooBelum ada peringkat

- Contoh Soal Metode Capital BudgetingDokumen7 halamanContoh Soal Metode Capital BudgetingIndri UntariBelum ada peringkat

- Soal Latihan Arr Irr PiDokumen6 halamanSoal Latihan Arr Irr Pidwi ist100% (1)

- Contoh Perhitungan NPV Dan Irr-1Dokumen4 halamanContoh Perhitungan NPV Dan Irr-1tuti100% (2)

- Keputusan InvestasiDokumen4 halamanKeputusan InvestasiChamfiah RizmanBelum ada peringkat

- Soal Penilaian Investasi - 1667299091Dokumen3 halamanSoal Penilaian Investasi - 1667299091odiBelum ada peringkat

- Bab 3 Nilai Waktu UangDokumen8 halamanBab 3 Nilai Waktu UangMulyanto PengongBelum ada peringkat

- Perhitungan IRRDokumen21 halamanPerhitungan IRRFITRIA SYAWALINABelum ada peringkat

- 2841815.pdf File-DikonversiDokumen25 halaman2841815.pdf File-DikonversiCau swenBelum ada peringkat

- Contoh Soal Manajemen KeuanganDokumen1 halamanContoh Soal Manajemen KeuanganPutri Bungsu0% (1)

- Poin 5Dokumen5 halamanPoin 5Riana Nur ElistinBelum ada peringkat

- Tugas 2 M.keu Try Rubianto 530019791Dokumen16 halamanTugas 2 M.keu Try Rubianto 530019791Mul YaBelum ada peringkat

- Ttugas AppDokumen6 halamanTtugas AppFlorida Salvi 003Agb'20 MoiBelum ada peringkat

- Metode - Metode Capital BudgetingDokumen18 halamanMetode - Metode Capital BudgetingRima Rohima DesiBelum ada peringkat

- Tugas Sebelum UasDokumen9 halamanTugas Sebelum Uasserly yunitaBelum ada peringkat

- Chapter 9Dokumen20 halamanChapter 9Alika MaulidaBelum ada peringkat

- Bab IDokumen17 halamanBab Ihusnu zhonBelum ada peringkat

- Tugas Manajemen KeuanganDokumen7 halamanTugas Manajemen KeuangantiaraBelum ada peringkat

- 2841815.pdf FileDokumen21 halaman2841815.pdf FileSaputra AgilBelum ada peringkat

- Pertemuan 17Dokumen9 halamanPertemuan 17Nanang RuhiatBelum ada peringkat

- Contoh SoalDokumen16 halamanContoh SoalCandra Setia BaktiBelum ada peringkat

- 11-Aspek Keuangan Lanjutan 2-SkbDokumen39 halaman11-Aspek Keuangan Lanjutan 2-SkbchikaBelum ada peringkat

- Matematika KeuanganDokumen2 halamanMatematika KeuanganStellaBelum ada peringkat

- Latihan Capital BudgetingDokumen4 halamanLatihan Capital BudgetingIqbal AgungBelum ada peringkat

- Kelompok 6 Ekonomi TeknikDokumen12 halamanKelompok 6 Ekonomi TeknikRohdiawanBelum ada peringkat

- Adam Juniarko 20101Mm0058 Jawaban Uas MK Nomer 1Dokumen8 halamanAdam Juniarko 20101Mm0058 Jawaban Uas MK Nomer 1Adam JuniarkoBelum ada peringkat

- Keputusan Investasi-.Dokumen18 halamanKeputusan Investasi-.Muhammad Ghifari RamdhaniBelum ada peringkat

- Latihan Studi KasusDokumen4 halamanLatihan Studi KasusMega JunitaBelum ada peringkat

- Jawaban PG TO NASKAH UJIANDokumen8 halamanJawaban PG TO NASKAH UJIANSonia ZuhraBelum ada peringkat

- Jawaban Tugas Matematika KeuanganDokumen4 halamanJawaban Tugas Matematika KeuanganhaniBelum ada peringkat

- Latihan Bab 14Dokumen4 halamanLatihan Bab 14kamsiah siregarBelum ada peringkat

- Penganggaran InvestasiDokumen19 halamanPenganggaran InvestasiHazinul AsrorBelum ada peringkat

- 11-Aspek Keuangan Lanjutan 4-skbDokumen38 halaman11-Aspek Keuangan Lanjutan 4-skbNiBelum ada peringkat

- Matematika Bisnis Dan Ekonomi - Materi NDokumen15 halamanMatematika Bisnis Dan Ekonomi - Materi NAdLys AbeatLyBelum ada peringkat

- Tugas CH 13 Cash Flow EstimationDokumen5 halamanTugas CH 13 Cash Flow EstimationDhayu Dwi PurnamasariBelum ada peringkat

- Nilai Waktu Terhadap UangDokumen7 halamanNilai Waktu Terhadap UangArtasya Kriscahyani SilalahiBelum ada peringkat

- Akuntansi BiayaDokumen17 halamanAkuntansi BiayaIrwan100% (2)

- Metode - Metode Capital BudgetingDokumen18 halamanMetode - Metode Capital BudgetingRima Rohima DesiBelum ada peringkat

- Pertemuan Ke 16 Anggaran Modal - NPV, Irr, Pi - XDokumen6 halamanPertemuan Ke 16 Anggaran Modal - NPV, Irr, Pi - XAstiniPegiAmeliaBelum ada peringkat

- Uas SKBDokumen4 halamanUas SKBGiobogang BoyoBelum ada peringkat

- Cara Menghitung NPVDokumen9 halamanCara Menghitung NPVArif Imam MahmudBelum ada peringkat

- Average Rate of Return (ARR), Net Present Value, Pert 7 (NPV)Dokumen5 halamanAverage Rate of Return (ARR), Net Present Value, Pert 7 (NPV)Diding Tri RosyantoBelum ada peringkat

- Prakt.13 - Prakt - Analisis Investasi - Noval Mansur AliDokumen2 halamanPrakt.13 - Prakt - Analisis Investasi - Noval Mansur AliNOVAL MANSUR ALIBelum ada peringkat

- Penilaian Investasi (IV) - DikonversiDokumen14 halamanPenilaian Investasi (IV) - DikonversixyourbbyourgurlBelum ada peringkat

- Final Tugas 9 - CFM - FM Anggra Mandala Putra - 55123110024Dokumen6 halamanFinal Tugas 9 - CFM - FM Anggra Mandala Putra - 55123110024fmanggraBelum ada peringkat

- Uas Manajemen FinansialDokumen6 halamanUas Manajemen Finansialsaiful muhammadBelum ada peringkat

- Akuntansi Manajemen - 2Dokumen5 halamanAkuntansi Manajemen - 2Fajri RamadhanBelum ada peringkat

- Tugas 9 - CFM - FM Anggra Mandala Putra - 55123110024Dokumen5 halamanTugas 9 - CFM - FM Anggra Mandala Putra - 55123110024fmanggraBelum ada peringkat

- MKDokumen8 halamanMKNiken UtariBelum ada peringkat

- Analisis FinansialDokumen16 halamanAnalisis FinansialFadhilafanBelum ada peringkat

- Latihan MM-2014 ENENG SITI FATONAHDokumen10 halamanLatihan MM-2014 ENENG SITI FATONAHSiti FatonahBelum ada peringkat