Kerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan

Diunggah oleh

FreeDoeJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Kerangka Dasar Penyusunan Dan Penyajian Laporan Keuangan

Diunggah oleh

FreeDoeHak Cipta:

Format Tersedia

KERANGKA DASAR PENYUSUNAN DAN PENYAJIAN

LAPORAN KEUANGAN

(L. Suparwoto: 0815 6854 333)

Hasil Akuntansi keuangan: laporan keuangan - bertujuan umum

(general purposes financial statement)

Pengguna atau pemakai utama laporan keuangan: pihak ekternal

seperti

- Investor / calon (pemegang saham)

- Kreditor / calon (termasuk pemegang obligasi)

- karyawan

- pemerintah

Masing-masing kelompok mempunyai kepentingan berbeda (antar

masing-masing kelompok pemakai dan manajemen terdapat

benturan kepentingan) akan tetapi diberi informasi yang sama

(general purposes financial statement)

Agar tujuan tersebut tercapai maka laporan keuangan disusun

mengikuti GAAP (Generally Accepted Accounting Principles):

STANDAR AKUNTANSI KEUANGAN, yang terdiri atas

1. PSAK (emiten)

2. PSAK Etap (Entitas tanpa akuntabilitas publik)

3. PSAK Syariah

4. PSAK sektor publik atau pemerintahan

5. PSAK UMKM

Standar akuntansi keuangan yang berlaku sekarang konvergen

dengan IFRS (International Financial Reporting Standar)

Tujuan umum laporan keuangan

Tujuan kwalitatif laporan keuangan

1. Kwalitas fundamental /dasar): Relevan (relevance)

a. Predictive value

b. Confirmatory value

2. Faithfull representation

a. Lengkap (completeness): menyajikan semua informasi yang

material

b. Netral (neutrality): tidak memihak pada salah satu kelompok

c. Bebas dari kesalahan / bias (freedom form bias)

Kwalitas laporan keuangan meningkat:

1. Mempunyai daya banding (comparibility)

a. Dengan laporan keuangan periode sebelumnya perusahaan

yang sama. konsisten (consistence) kebijakan

akuntansi yang sama dengan kebijakan akuntansi periode

sebelumnya

b. Dengan laporan keuangan perusahaan lain (satu industri dan

satu kelompok ukuran) untuk periode yang sama. Kendala:

adanya beberapa metode akuntansi

2. Verifiabilitas (verifiability) diverifikasi atau diuji

kebenarannya berdasar data pendukung. Laporan keuangan

diaudit oleh auditor independen audited financial statement

3. Disajikan tepat waktu (timelines) tidak lebih dari 3 bulan

4. Dapat dipahami (oleh pengguna) Understandability

NB

Tujuan kwalitatif menurut standard lama

1. Tujuan kwalitatif primer

a. Relevant (ce)

b. Reliable

2. Tujuan kwalitatif skundair

Basic Elements (10 6)

a. Asset. A resource controlled by the entity as a result of past

events and from which future economic benefits are

expected to flow to the entity

b. Liability. A present obligation of the entity arising from past

events, the settlement of which is expected a result in an

outflow from the entity of resources embodying economics

benefits.

c. Equity. The residual interest in the assets of the entity after

deducting all its liabilities.

d. Income. Increases in economic benefits during the

accounting period in the form of inflows or enhancements of

assets or decreases of liabilities that result in increases in

equity, other than those relating to contributions from

equity participants.

e. Expenses. Decreases in economic benefits during the

accounting period in the form of outflows or depletions of

asset or incurrence of liabilities that result in decreases in

equity, other than those relating to distributions to equity

participants.

f. Cash flows (arus kas)

A, b, and c describes amount of resources and claim to resources

at a moment in time disajikan di dalam laporan posisi keuangan

pada akhir periode. disajikan di dalam laporan posisi keuangan

D and e describes transactions, events, and circumstances that

affect a company during a period of time disajikan di dalam

Laporan laba-rugi komprehensif (comprehensive income). Unsur

laporan laba-rugi komprihensif:

- Laba-rugi

- Laba-rugi komprihensif lain-lain (OCI = Other Comprehensive

Income).

Penyajian 2 alternatif

1) Dalam 2 laporan

o Laporan laba rugi terakhir: laba atau rugi bersih

Pendapatan

HPP dan biaya

Laba (rugi) bersih

o Laporan laba rugi komprihensif lain

Laba bersih

Laba komprihensif lain

Laba komprihensif

2) Dalam satu laporan: Laporan laba rugi komprihensif, yang

isinya:

i. Pendapatan (1)

ii. HPP dan biaya (2)

iii. Laba atau rugi bersih(3=1-2)

iv. Laba atau rugi komprihensif lain (4)

v. Laba atau rugi komprihensif (5=3+4)

F describes cash inflows and cash outflows a company during a

period of time disajikan di dalam laporan arus kas. Isi laporan

aruskas

1. Arus kas aktivitas operasi

2. Arus kas aktivitas investasi

3. Arus kas aktivitas pendanaan

4. Kenaikan atau penurunan kas (1+2+3)

5. Kas pada awal periode

6. Kas pada akhir periode = (4+5)

Asumsi dasar = Basic assumption = basic

concepts

1) Economic Entity Assumption. that economic activity can be

identified with a particular unit of accountability (a company

keeps its activity separate and distinct from its owners and any

other business unit), does not necessarily refer to a legal entity.

2) Going Concern Assumption = perusahaan hidup terus =

continuity of activity. the company will have a long life.

Implications cost principle. only when liquidation appears

imminent is the assumption inapplicable.

3) Monetary Unit Assumption

Money is the common denominator of economic activity and

provides an appropriate basis for accounting measurement and

analysis.

The monetary unit is the most effective means of expressing to

interested parties changes in capital and exchanges of goods or

services.

The monetary unit is relevant, simple, universally available,

understandable, and useful.

Accounting generally ignores price level changes (mengasumsikan

nilai uang tetap, mengabaikan inflasi / deflasi))

4) Periodicity Assumption

To measure the results of a company’s activity accurately, we

would need to wait until it liquidates, decision makers, however,

can-not wait that long for such information.

Users need to know a company’s performance and economic

status on a timely basis so that they can evaluate and compare

companies , and take appropriation action companies must

report information periodically.

Implies that a company can divide its economic activities into

artificial time period, that is vary, but the most common are

monthly, quarterly, and yearly.

The shorter the time period, the more difficult (the less realiable,

the most relevant) it is to determine the proper income for the

period. provides an interesting example of the trade-off

between relevance and faithful representation in preparing

financial data.

5) Accrual basis of accounting means that transactions that

change a company’s financial statements are recorded in the

period in which the events occur. financial statement prepared

on the accrual basis inform users not only of past transactions

involving the payment and receipt of cash but also of obligations

to pay cash in the future and of resources that represent cash to

be received in the future.

6) Basic Principle of Accounting

a. Measurement principle

i. Cost principle.

Cost?

Kebaikan cost principle -> reliable?

Kos mencerminkan fair value?

1. Pada tanggal transaksi: ya

2. Dengan berjalannya waktu nilai wajar dapat

berfluktuasi

ii. Fair value principle (PSAK 68)

b. Revenue recognition principle

Revenue is to be recognized when it is probable (51%-90%)

that future economic benefit will flow to the company and

reliable measurement of revenue is possible. Terpenuhinya

kedua syarat tsb dapat berbeda antara perusahaan yag satu

dengan yang lain, seperti:

i. At time of sale: terjadinya pemindahan kepemilikan

dari penjual ke pembali

ii. During production kontrak jangka panjang dg

metode % penyelesaian

iii. At end of production

iv. Upon receipt of cash: misalnya kemungkinan

terjadinya retur tinggi; penjualan angsuran.

c. Expense recognition principle matching principle: biaya

diakui di dalam periode (di mana) pendapatan terkait

dengan biaya tersebut diakui.

Tergantung jenis biaya (2)

i. Product cost (BBB, BTKL, BOP: inventoriable cost)

matching (diakui sebagai biaya pada

saat/periode produk terjual, sebelumnya disajikan

sebagai sediaan

ii. Period costs langsung dibebankan ke laba-rugi di

dalam periode terjadinya biaya

d. Full disclosure principle

Semua informasi yang material harus diungkapkan

Informasi yang material?

Kwantitatif / kwalitatif?

Pengungkapan

di mana: di dalam laporan keuangan itu sendiri ( di

dalam kurung; catatan kaki, dsb) atau di dalam CALK

bagaimana/ cara

7) Constraints (keterbatasan)

a. Cost constraint

b. Materiality constraint.

Anda mungkin juga menyukai

- Analisa Laporan KeuanganDokumen7 halamanAnalisa Laporan KeuanganKelinting KuningBelum ada peringkat

- Tugas ZahirDokumen6 halamanTugas ZahirEva Nur DianaBelum ada peringkat

- Kerangka KonseptualDokumen5 halamanKerangka KonseptualSarah GamesarBelum ada peringkat

- Konsep Dasar Laporan KeuanganDokumen25 halamanKonsep Dasar Laporan KeuanganWarno SuwarnoBelum ada peringkat

- LAPORAN KEUANGAN (Send)Dokumen12 halamanLAPORAN KEUANGAN (Send)Dwie DwikaBelum ada peringkat

- Ringkasan Subramanyan Bab 2Dokumen20 halamanRingkasan Subramanyan Bab 2Della Amelia100% (1)

- Menjawab Tugas Halaman 102Dokumen2 halamanMenjawab Tugas Halaman 102Nabilla PutriBelum ada peringkat

- Rangkuman Bahan Ujian Komprehensif AkuntansiDokumen7 halamanRangkuman Bahan Ujian Komprehensif AkuntansiBobby BintaraBelum ada peringkat

- Ringkasan AKM CH 2 - SalmaDokumen5 halamanRingkasan AKM CH 2 - Salmael-salmaBelum ada peringkat

- Teori Akuntansi (Laba)Dokumen6 halamanTeori Akuntansi (Laba)Fahri HimawanBelum ada peringkat

- Kerangka Konseptual AkuntansiDokumen7 halamanKerangka Konseptual AkuntansiHenrikus Hendriko RajagukgukBelum ada peringkat

- Contoh Income StatementDokumen19 halamanContoh Income StatementFITRA PEBRI ANSHORBelum ada peringkat

- Bab 1 AKM 1 Pertanyaan Dan JawabanDokumen6 halamanBab 1 AKM 1 Pertanyaan Dan JawabanDina Nihlatun NavisahBelum ada peringkat

- Jawaban SakDokumen18 halamanJawaban SakAgnesBelum ada peringkat

- Makalah Kel 1 Ak KeuDokumen16 halamanMakalah Kel 1 Ak Keust.faisyahputriBelum ada peringkat

- Resume Kelompok 1Dokumen6 halamanResume Kelompok 1Ping PingBelum ada peringkat

- Nama: Moch Romadhon NBI: 1221900035 Kelas: UUDokumen3 halamanNama: Moch Romadhon NBI: 1221900035 Kelas: UUTmr RomadhonBelum ada peringkat

- Tugas CF - Adinda Fajri LubisDokumen5 halamanTugas CF - Adinda Fajri LubisDinda LubisBelum ada peringkat

- Kerangka Dasar Penyusunan Laporan Keuangan. Tugas PRDokumen23 halamanKerangka Dasar Penyusunan Laporan Keuangan. Tugas PRHangga Pradana YudhistyraBelum ada peringkat

- RMK Analisis Laporan Keuangan PrintDokumen13 halamanRMK Analisis Laporan Keuangan PrintDanarristya Nanda KurniaBelum ada peringkat

- Kerangka Konseptual IndonesiaDokumen8 halamanKerangka Konseptual IndonesiaYakti Pradhana100% (1)

- Kelompok 6Dokumen14 halamanKelompok 6Arya PahleviBelum ada peringkat

- Kuis Teori AkuntansiDokumen6 halamanKuis Teori AkuntansiAwanda PutraBelum ada peringkat

- Pelaporan Korporat Conceptual Framework.Dokumen15 halamanPelaporan Korporat Conceptual Framework.Halimah Bakry100% (1)

- TAK RMK 11 Kelompok 2Dokumen14 halamanTAK RMK 11 Kelompok 2Ratna PradnyaBelum ada peringkat

- A. Relevansi Konsep Laba: Akuntansi Nilai Saat IniDokumen5 halamanA. Relevansi Konsep Laba: Akuntansi Nilai Saat IniAlif MaulanaBelum ada peringkat

- Jawaban Soal Bab IiDokumen7 halamanJawaban Soal Bab IiVivi Narulita100% (1)

- Bab 6 Dan Bab 7. Teori AkuntansiDokumen27 halamanBab 6 Dan Bab 7. Teori AkuntansiAulia Maharani J100% (1)

- Laporan KeuanganDokumen24 halamanLaporan KeuanganRamadhan MuhardiBelum ada peringkat

- BAB VI Konsep BiayaDokumen14 halamanBAB VI Konsep BiayaFathia HamidBelum ada peringkat

- HubunganDokumen7 halamanHubunganIndah PermataBelum ada peringkat

- Kerangka Konseptual Sak IfrsDokumen30 halamanKerangka Konseptual Sak IfrsIrma CakeBelum ada peringkat

- Teori Akuntansi (LABA)Dokumen7 halamanTeori Akuntansi (LABA)diahnurlailiBelum ada peringkat

- Modul Akm1aDokumen56 halamanModul Akm1aHans Surya Candra DiwiryaBelum ada peringkat

- Teori AkuntansiDokumen8 halamanTeori AkuntansiayundaBelum ada peringkat

- Akuntansi KeuanganDokumen10 halamanAkuntansi KeuanganMohammad Farisan AuzanBelum ada peringkat

- Tugas Bab 10 Bryan SaudaleDokumen15 halamanTugas Bab 10 Bryan SaudaleBryan SaudaleBelum ada peringkat

- Laporan KeuanganDokumen9 halamanLaporan KeuanganSyaifulloh IrsyandiBelum ada peringkat

- Laporan Keuangan PKKDokumen8 halamanLaporan Keuangan PKKSinta Yuliani100% (7)

- Tugas Sesi 2Dokumen3 halamanTugas Sesi 2nadia safitriBelum ada peringkat

- Konsep Teori AkuntansiDokumen14 halamanKonsep Teori Akuntansidavidwijaya1986Belum ada peringkat

- Akuntansi Keuangan Menengah I RangkumanDokumen128 halamanAkuntansi Keuangan Menengah I Rangkumannabilah hasna kamilaBelum ada peringkat

- Laporan Laba RugiDokumen7 halamanLaporan Laba RugiNuraisyah dwiyantiBelum ada peringkat

- Jawaban KisiDokumen7 halamanJawaban KisiLala IsnainiBelum ada peringkat

- RMK Chapter 2-Akuntansi Keuangan MenengahDokumen4 halamanRMK Chapter 2-Akuntansi Keuangan MenengahArintaBelum ada peringkat

- Teori Presentasi Kelompok 4Dokumen14 halamanTeori Presentasi Kelompok 4ReningsihBelum ada peringkat

- Naufal Ghiffari Eka Kusuma - 20809334053 - Tugas UMKM SAKDokumen6 halamanNaufal Ghiffari Eka Kusuma - 20809334053 - Tugas UMKM SAKDwi Surya NugrahaBelum ada peringkat

- Adinda Rahma Yulianti - 042011333104 - Kelas L - Minggu 2Dokumen4 halamanAdinda Rahma Yulianti - 042011333104 - Kelas L - Minggu 2adinda rahmaBelum ada peringkat

- Kerangka Konseptual Pelaporan Keuangan (KKPK)Dokumen4 halamanKerangka Konseptual Pelaporan Keuangan (KKPK)adinda rahma100% (1)

- Selly Rinda Hariono - 0045 - Aks C PDFDokumen4 halamanSelly Rinda Hariono - 0045 - Aks C PDFMega Dwi LestariBelum ada peringkat

- Tugas Individu Teori Akuntansi (Pertemuan 1)Dokumen4 halamanTugas Individu Teori Akuntansi (Pertemuan 1)diona puspitasariBelum ada peringkat

- Modul AKM1 PDFDokumen58 halamanModul AKM1 PDFmiftachus sBelum ada peringkat

- Bagian DanielDokumen8 halamanBagian DanielSri PramitaBelum ada peringkat

- TUGAS-Pelaporan Korporasi NewDokumen13 halamanTUGAS-Pelaporan Korporasi NewRia OctavianiBelum ada peringkat

- Akuntansi 6Dokumen7 halamanAkuntansi 6nomor1.scribdBelum ada peringkat

- UAS Teori Akuntansi 5A1-5A5 2019Dokumen6 halamanUAS Teori Akuntansi 5A1-5A5 2019Praditya Sukma RamadhanBelum ada peringkat

- SFAC No 5 & 6Dokumen7 halamanSFAC No 5 & 6INDRA_gita100% (3)

- Pendekatan sederhana untuk perdagangan obligasi: Panduan pengantar investasi obligasi dan manajemen portofolionyaDari EverandPendekatan sederhana untuk perdagangan obligasi: Panduan pengantar investasi obligasi dan manajemen portofolionyaBelum ada peringkat

- Pendekatan sederhana untuk investasi ekuitas: Panduan pengantar investasi ekuitas untuk memahami apa itu investasi ekuitas, bagaimana cara kerjanya, dan apa strategi utamanyaDari EverandPendekatan sederhana untuk investasi ekuitas: Panduan pengantar investasi ekuitas untuk memahami apa itu investasi ekuitas, bagaimana cara kerjanya, dan apa strategi utamanyaBelum ada peringkat

- Reksadana dibuat sederhana: Panduan pengantar reksa dana dan strategi investasi yang paling efektif dalam manajemen asetDari EverandReksadana dibuat sederhana: Panduan pengantar reksa dana dan strategi investasi yang paling efektif dalam manajemen asetBelum ada peringkat

- Tantangan Dalam Membangun IntegrasiDokumen3 halamanTantangan Dalam Membangun IntegrasiFreeDoeBelum ada peringkat

- Proposal Magang Pt. Mercedes-BenzDokumen11 halamanProposal Magang Pt. Mercedes-BenzFreeDoeBelum ada peringkat

- PT. KaoDokumen7 halamanPT. KaoFreeDoeBelum ada peringkat

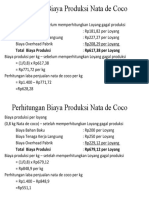

- Perhitungan Biaya Produksi Nata de CocoDokumen2 halamanPerhitungan Biaya Produksi Nata de CocoFreeDoeBelum ada peringkat

- Laporan KewirausahaanDokumen8 halamanLaporan KewirausahaanFreeDoeBelum ada peringkat

- Audit Kelompok 7Dokumen11 halamanAudit Kelompok 7FreeDoeBelum ada peringkat